Portuguese Manufacturers vs China Clothing Manufacturer: A Buyer’s Guide for Fashion Brands

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 27th, 2025

15 minute read

Portuguese Manufacturers vs China Clothing Manufacturer: A Buyer’s Guide for Fashion Brands

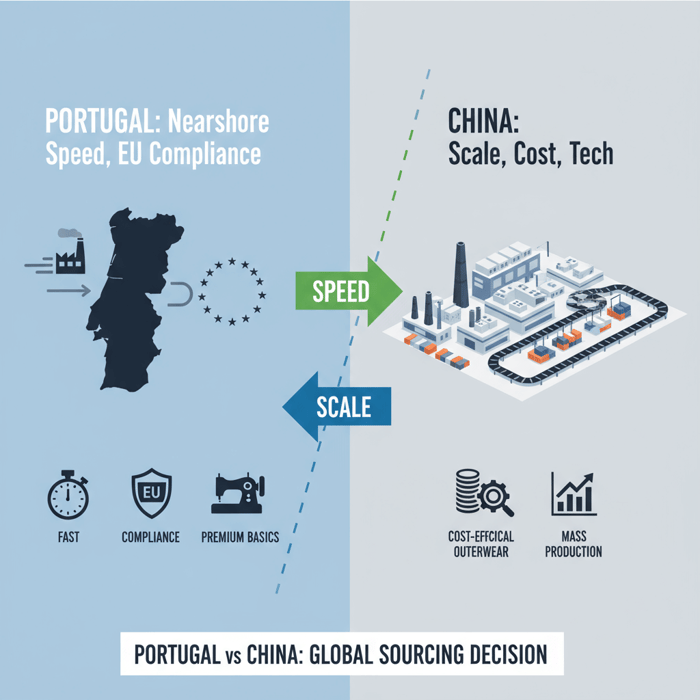

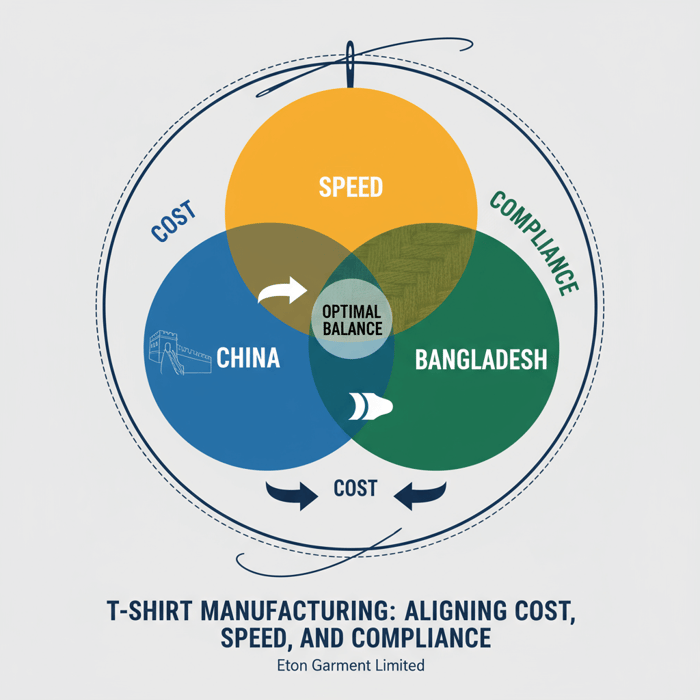

Portuguese manufacturers give US/EU fashion brands a fast, EU-compliant route for capsules and premium basics, while a China Clothing Manufacturer delivers scale, technical breadth, and sharper landed costs. This buyer’s guide maps cost, lead times, MOQs, compliance, and category fit, and shows where hybrid sourcing with Eton’s OEM/ODM service turns speed into repeatable, profitable production.

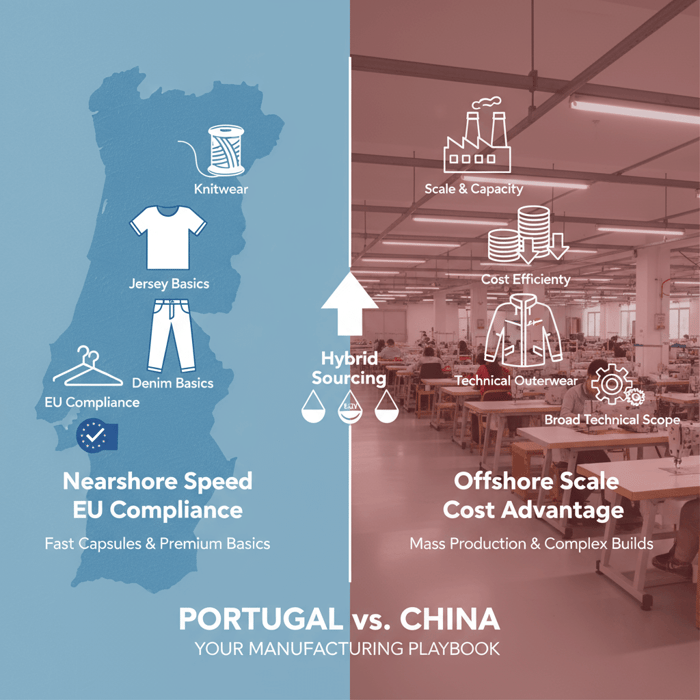

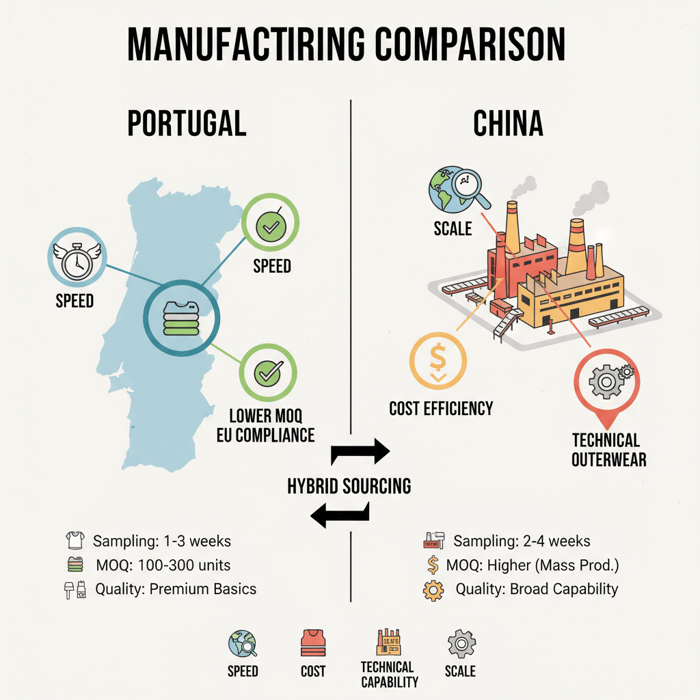

Portuguese manufacturers excel at nearshore speed, EU compliance, and premium basics. A China Clothing Manufacturer offers scale, cost efficiency, and broad technical capability. Choose Portugal for fast capsules and lower MOQs; choose China for mass production and complex outerwear; hybridize to balance speed, cost, and capacity.

What “Portuguese Manufacturers” Offer Today

Portuguese manufacturers provide quick sampling, lower MOQs, premium jersey/knitwear, and EU-standard compliance. Factories often run modern machinery and lean lines with strong sustainability practices—ideal for agile capsules and premium basics. Technical outerwear exists but varies; vet seam-taping, laminations, and finishing before awarding complex performance programs.

[CITE: AICEP sector overview with regional strengths] [CITE: INE Portugal data on textile exports] [MENTION: ATP—Associação Têxtil e Vestuário de Portugal] [MENTION: EURATEX EU industry key figures] [INTERNAL LINK: EU-compliant apparel manufacturing overview—pillar page]

Core Capabilities & Typical Specializations

Portugal’s apparel hubs focus on jersey, cut-and-sew knitwear, fashion basics, premium sweats, and some denim. Many factories handle embroidery, printing, garment dye, and enzyme washes. Several groups specialize in fashion-forward basics and midweight outer layers—shackets, overshirts, and light jackets—rather than extreme technical shells.

- Sampling cadence: 1–3 weeks for first samples at capable SMEs; 2–4 weeks for more complex builds. [CITE: Sqetch guide timelines]

- MOQs: 100–300 per color is common for basics; some mills/factories can go lower for special programs. [CITE: Sewport directory ranges]

- Fabric sourcing: Proximity to EU mills shortens lead times for cotton jersey, fleece, and fashion knits; specialty laminates may still route via EU or Asian suppliers. [CITE: AICEP sector note]

- Processes: garment dye, enzyme wash, screen/DTF printing, embroidery; select factories offer bonding and taping for mid-range waterproof pieces.

Premium brands select Portugal for mid-price to elevated basics, tight color control, and consistent hand-feel. Denim or wovens often appear, though the strongest differentiators remain in knitwear and jersey where unit quality and touch matter.

Compliance & Certifications in Portugal

Portuguese factories typically align with EU chemical safety and labor expectations. Many hold OEKO-TEX certifications, ISO 9001/14001, BSCI/Amfori audit records, and traceability-ready documentation to support EU Corporate Sustainability Due Diligence Directive (CS3D/CSDDD) efforts.

| Area | Common Standard | What It Covers | Buyer Notes |

|---|---|---|---|

| Chemical Safety | OEKO-TEX Standard 100 | Harmful substances in textiles | Request certs per fabric and color; track updates. [CITE: OEKO-TEX overview] |

| Management Systems | ISO 9001/14001 | Quality/environmental systems | Quality plans and environmental KPIs often present. [CITE: ISO standards] |

| Labor & Social | BSCI/Amfori | Social compliance audits | Use latest audit scores; define CAP timelines. [CITE: Amfori/BSCI] |

| EU Regulatory | REACH alignment | Substances of Very High Concern (SVHC) | Keep SDS and supplier declarations organized. [CITE: EU REACH guidance] |

| Sustainability | GRS, GOTS (cases) | Recycled content/organic cotton | Verify scope and chain-of-custody coverage. [CITE: TextileExchange/GOTS] |

[INTERNAL LINK: EU compliance checklist (CS3D/REACH)—resource page]

Portuguese Manufacturers vs China Clothing Manufacturer: Cost, Speed, and Scale

Portugal wins proximity and compliance with moderate to premium unit costs. A China Clothing Manufacturer wins scale, broader technical capability, and tighter costs. For small runs and capsules, Portugal performs well; for mass-market and technical outerwear at volume, China typically offers deeper ecosystems.

[CITE: EURATEX Key Figures—EU trade trends] [CITE: McKinsey State of Fashion—nearshoring notes] [MENTION: Valérius Group capabilities as a reference point] [INTERNAL LINK: Comparative sourcing playbook—pillar page]

| Criterion | Portugal | China |

|---|---|---|

| Sampling Speed | Quick for basics (1–3 weeks); mid-complexity 2–4 weeks | 2–4 weeks for basics; technical samples require additional time |

| MOQs | Lower (100–300 per color common); flexible for SMEs | Higher for many categories; flexibility exists in select factories |

| Unit Cost | Moderate to premium, stronger in premium basics | Competitive; better for mass programs and cost-sensitive tiers |

| Technical Depth | Selective capability for performance; vet per factory | Broad ecosystem for seam-taping, laminations, coatings at scale |

| Scale & Capacity | Constrained during peak seasons | Wide capacity networks; easier to scale quickly |

| Compliance Alignment | Strong alignment with EU directives and REACH | Varies by factory; audit rigor needed |

| Logistics to EU | Shorter transit and fewer customs steps | Longer transit; customs and duties impact |

- Portugal pros: speed, lower MOQs, EU compliance, premium basics quality.

- Portugal cons: unit cost, capacity limits, varying technical outerwear capability.

- China pros: cost, scale, wide technical ecosystem, flexible trims and finishes.

- China cons: longer transit, complex customs, more diligence for compliance.

- EU apparel import reliance remains high—2024 (Source: [CITE: EURATEX 2024])

- Nearshoring interest rises among EU/US brands—2024 (Source: [CITE: McKinsey 2024])

- Portugal textile exports sustain premium positioning—2023–2024 (Source: [CITE: INE])

Criteria Overview

Define priorities by program type. For capsules and premium basics: speed, MOQ, and compliance carry weight. For mass programs: unit cost, capacity, and technical breadth lead. For performance outerwear: finishing capability and proven lab testing trump raw speed.

- Speed vs margin: Portugal accelerates drops; China improves landed cost for larger volumes.

- Compliance vs scale: Portugal aligns with EU standards; China scales with careful audit and test plans.

- Technical complexity: Performance features often favor China’s specialized network; mid-tech pieces fit select Portugal factories.

Decision Framework

Score each program against speed, MOQ, cost, technical depth, compliance, and capacity. Weigh the top three for your brand’s needs per season. If two or more critical scores point to different regions, split SKUs and adopt a hybrid plan.

| Scenario | Portugal Fit | China Fit | Hybrid Move |

|---|---|---|---|

| Capsule Collection | High | Medium | Proto in Portugal; scale in China if demand spikes |

| Premium Basics | High | Medium | Portugal for core styles; China for volume packs |

| Technical Outerwear | Medium | High | Samples nearshore; production offshore for complex builds |

| High-Volume Programs | Medium | High | Early runs in Portugal; scale in China/Bangladesh |

Nearshoring Benefits for US/EU Brands—and Its Limits

Nearshoring with Portuguese manufacturers shortens development loops, simplifies logistics, and aligns with EU compliance. Limits include capacity constraints, unit cost versus Asia, and uneven availability of advanced finishing. Use nearshore for speed-critical lines and pair with offshore hubs when complexity or scale demands.

[CITE: McKinsey 2024—nearshoring drivers] [MENTION: EURATEX proximity advantages] [INTERNAL LINK: Hybrid sourcing strategy guide—pillar page]

When Nearshoring Wins

Nearshoring shines for fast-tracked capsules, premium basics, and iterative design-driven collections. Sample feedback rounds compress to days. Shipping within the EU reduces friction for duty and VAT management, and teams gain easier factory visits for fit checks and color approvals.

- Sampling speed: Portugal often turns basics in 1–3 weeks; revisions land quickly. [CITE: Sqetch ranges]

- Operational friction: Shorter transit and fewer customs steps ease timelines for EU delivery. [CITE: AICEP logistics notes]

- Compliance alignment: Documentation and audits follow EU expectations more closely. [CITE: CS3D/CSDDD press notes]

Where Nearshoring Struggles

High compression of seasonal capacity can slow bookings. Advanced performance features—multi-layer laminations, high hydrostatic head waterproofing, or complex taped seams—may not be available at every Portuguese factory. Unit cost can stretch margins on value-tier programs.

- Capacity: Peak seasons limit slots; plan PO windows early.

- Technical depth: Vet finishing processes for performance shells before ordering.

- Economics: Value-tier programs often favor offshore landed costs.

Technical Outerwear & Performance Apparel: Feasibility in Portugal vs China

Portugal can deliver select technical pieces, yet specialized processes like seam-taping, advanced laminations, and PU coatings vary by factory. China and Bangladesh hubs often provide broader, mature ecosystems for performance outerwear at volume. Validate processes and testing rigor, then consider prototyping nearshore and scaling offshore.

[MENTION: Eton Garment Limited—30+ years in outerwear OEM/ODM] [CITE: Waterproof performance lab test standards overview] [INTERNAL LINK: Outerwear manufacturing guide—pillar page]

Capability Audit—Processes to Confirm

For technical outerwear, confirm process availability and quality thresholds before awarding production. Document each checkpoint and sample-to-lab flow in your tech pack.

- Seam-tape capability: Hot-air vs seam-seal machines; tape width variance; adhesion reliability.

- Lamination stack: 2L/3L construction; membrane type; bonding strength; delamination testing. [CITE: ISO/ASTM laminates standards]

- Waterproof ratings: Hydrostatic head targets (e.g., 10,000–20,000 mm); test methods; repeat test on PP and TOP. [CITE: AATCC/ISO test method references]

- Breathability: MVTR or RET metrics; balance against waterproofing. [CITE: Performance textile test norms]

- DWR durability: Wash cycles and spray ratings post-launder; fluorine-free options; reproof test plan.

- Coatings and finishes: PU, acrylic, cire; abrasion resistance; pilling and tear strength.

- Hardware/trims: Zippers, snaps, toggles rated for cold; corrosion and salt-mist tests where relevant.

- Pattern engineering: Articulation, gussets, storm flaps; hood construction; cuff closures; hem drawcords.

QA & Field Testing

Technical programs require lab tests, on-body trials, and controlled field use. Set AQL, define defect taxonomy for tape lift, wet-out, seam bubble, and membrane puncture, and run pre-production pilots before scaling.

- Lab: Hydrostatic head, spray test, MVTR/RET, abrasion, tear strength; document protocols.

- On-body: Fit, articulation, range-of-motion; venting efficacy; touch against base layers.

- Field: Rain chamber or outdoor testing; controlled cycles; photo logs; defect tracking.

- QA gates: PP fit sign-off; TOP lab pass; inline and final inspections with AQL plans.

How to Vet Portuguese Manufacturers (and Offshore Alternatives) Properly

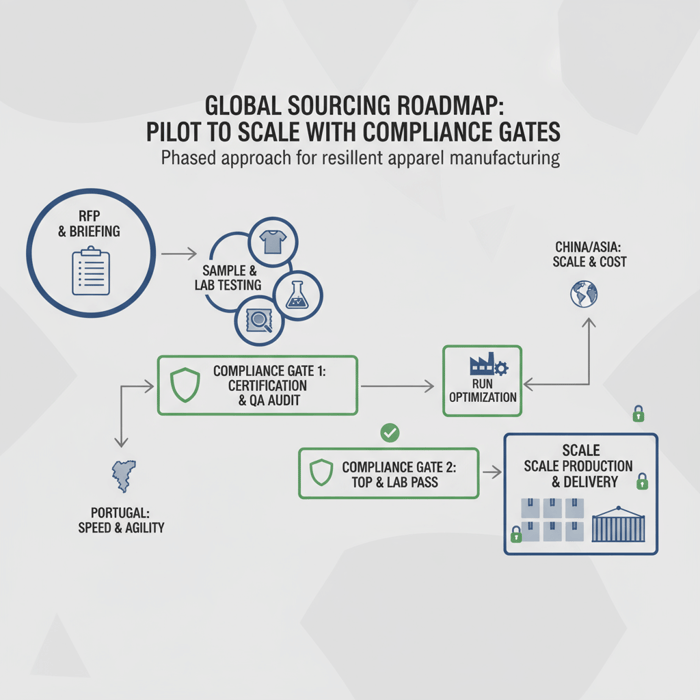

Run a structured RFP and audit workflow: define specs, verify certifications, measure sampling speed, assess QA capabilities, run pilot orders, and lock KPIs/SLAs. Compare offshore alternatives on cost and scale; record risks and mitigations early to avoid overruns.

[CITE: Amfori/BSCI audit guidance] [MENTION: EURATEX compliance narratives] [INTERNAL LINK: RFP checklist—resource page]

Preparation

Clarify your program in a complete tech pack and sourcing brief. State silhouettes, target measurements, fabric constructions and finishes, trims, colorways, test protocols, packaging, and labeling. Shortlist factories with category alignment and recent audit records. Align budget ranges and timelines with season-critical dates.

- Tech pack: Lines, measurements, grading rules, construction notes, stitch types, finishing specs.

- Fabric/trims: Detailed compositions; nominated suppliers if required; certifications and SDS.

- Testing: Lab standards; pass/fail thresholds; sample quantity per test.

- Timeline: Sample windows, PP, TOP, production start, ex-factory, delivery targets.

Execution Steps

- RFP issue: Send brief, tech packs, and BOM; ask for sampling windows and MOQs.

- Certification check: Verify OEKO-TEX, ISO, BSCI scores; review CAP progress.

- Sample round: Schedule feedback; fit and finish audits; cost update after sample pass.

- Capacity check: Confirm weekly line output; seasonal slot availability; contingency lines.

- Price & terms: Negotiate unit cost, payment terms, and incoterms aligned with delivery plan.

- SLA signing: Lock KPIs—on-time delivery, defect rate, sample turn; define escalation path.

- Pilot order: Small run with full QA; verify lab results; adjust patterns and trims.

Quality Assurance

Set measurable QA standards from the first run. Use clear defect definitions and AQL levels aligned to brand tolerance. Track inline checks, final inspections, lab reports, and post-delivery claims to refine processes.

| Item | Target/Range | Notes |

|---|---|---|

| On-time Delivery | ≥ 95% | Measured vs ex-factory and final delivery |

| Defect Rate | ≤ 2% per shipment | Use AQL 2.5 for major defects; 4.0 for minor |

| Lab Pass Rate | 100% for mandatory tests | Hydrostatic head, MVTR/RET, colorfastness, pilling |

| Fit Consistency | ≤ ±0.5–1.0 cm on critical points | Define critical vs non-critical tolerance bands |

Data & Trends: EU Textile Landscape and Nearshoring Momentum

EU textile and apparel buyers lean into sustainability and faster cycles, prompting interest in Portugal for select programs. Brands keep offshore scale for volume and cost-sensitive lines while strengthening regional capacity for speed and compliance alignment.

[CITE: EURATEX Key Figures 2024] [CITE: INE Portugal—textile indicators] [CITE: AICEP sector briefs] [INTERNAL LINK: Data hub—EU apparel trends]

- EU textile/apparel innovation and sustainability uptick—2023–2024 (Source: [CITE: EURATEX])

- Portugal maintains export presence in premium categories—2023–2024 (Source: [CITE: INE])

- Nearshoring references in brand strategy decks—2024 (Source: [CITE: McKinsey State of Fashion])

Compliance-Driven Sourcing

CS3D/CSDDD pushes structured due diligence—risk identification, mitigation plans, and remediation where adverse impacts occur. Portuguese manufacturers already operate within EU frameworks, giving buyers documentation pathways that support audits and reporting.

- Documentation stack: REACH declarations, SDS, audit reports, CAP records, chain-of-custody.

- Testing and traceability: Batch-level records tied to lab outcomes and factory IDs.

- Reporting: Clear timeline and escalation when risks are flagged. [CITE: Council of the EU—CS3D]

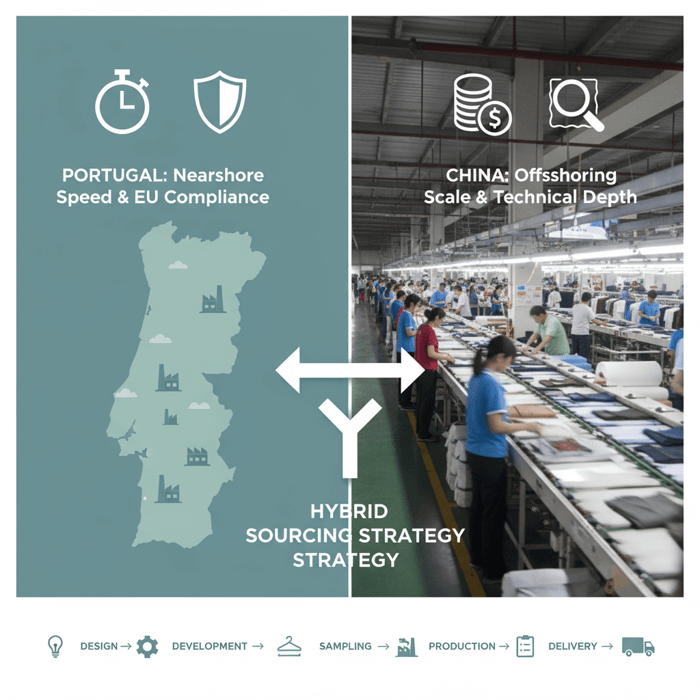

Hybridization of Supply Chains

Brands split SKUs by lifecycle stage. Prototype nearshore to unlock quick feedback, then migrate volume styles to offshore hubs to protect margin. Technical lines often locate offshore early, with nearshore used for fit and aesthetic trials.

- Stage-gating: Proto → pilot → scale; country assignment per stage.

- SKU split: Fashion basics nearshore; volume packs offshore; performance outerwear offshore.

- Governance: Shared QA playbook across regions with comparable test thresholds.

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton’s OEM/ODM service aligns design, fabric sourcing, technical development, and scalable production across China and Bangladesh. Prototype quickly, then scale cost-effectively with consistent QA, compliance documentation, and delivery plans tuned for US/EU retailers.

[MENTION: Eton Garment Limited—outerwear programs and QA] [INTERNAL LINK: OEM clothing manufacturer services—https://china-clothing-manufacturer.com/garment-factory/]

| Buyer Need | OEM/ODM Feature | Outcome |

|---|---|---|

| Capsule speed | Rapid prototyping and sample calendars | Faster fit iterations and color confirmation |

| Cost control | Dual-hub production in China/Bangladesh | Competitive landed cost for mass programs |

| Technical outerwear | Advanced finishing partners and lab testing | Consistent performance ratings and durability |

| Compliance | Audit-ready documentation, REACH alignment | Smoother due diligence and retailer onboarding |

| QA consistency | Shared AQL and defect taxonomy; TOP gates | Lower defect rates and fewer returns |

Use Case 1: Capsule Collection → Rapid Prototyping

Start with a three-sample cadence. Fit and color approvals lock within weeks. Use Eton’s development pipeline to stabilize specs and BOMs. If early demand rises, shift production to China or Bangladesh to protect margin while keeping quality consistent.

- Weeks 1–2: First sample and fit feedback

- Weeks 3–4: Revisions, lab checks for colorfastness and shrinkage

- Weeks 5–6: PP approval, pilot run, delivery slot booking

Clothing Manufacturing OEM Service

Use Case 2: Mass Production → Technical Outerwear at Scale

Eton routes performance shells through partners with seam-taping and laminate stacks, with lab protocols aligned to brand targets. Pilot orders confirm ratings. Full production ramps in China or Bangladesh with QA gates at PP and TOP, keeping consistent test thresholds and fit tolerances.

- Process audit: taping, lamination, hydrostatic head targets

- CAP follow-up: address test variances; adjust patterns or finishes

- Scale plan: line capacity, trims scheduling, shipment cadence

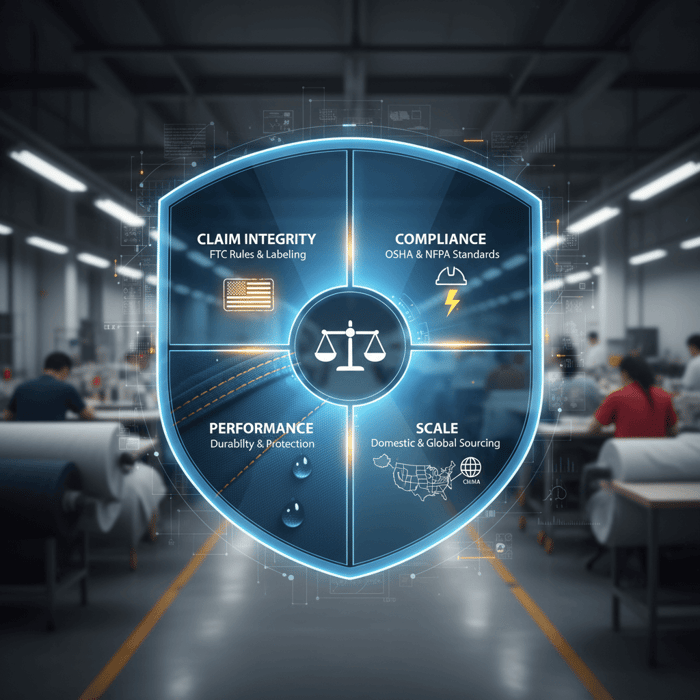

Risks, Compliance & Localization for US/EU Brands

Prepare for CS3D due diligence, REACH chemical compliance, labor audits, and traceability. Plan mitigations for capacity, seasonality, logistics, and FX. Localize SOPs to US/EU retail requirements; anchor chain-of-custody and testing at each gate.

[CITE: Council of the EU—CS3D/CSDDD] [CITE: OEKO-TEX Standard 100] [INTERNAL LINK: Compliance checklist—resource page]

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Capacity constraints | Medium–High | Timeline slips | Early bookings, backup lines, phased PO releases |

| Technical shortfall | Medium | Performance failures | Process audit, pilot testing, alternative factory backup |

| Compliance gaps | Medium | Retailer rejections | Audit plan, CAP tracking, lab test alignment |

| Logistics delays | Medium | Stockout risk | Buffer time, multi-route shipment, duty prep |

| FX swings | Medium | Margin erosion | Hedging, staged payments, price review triggers |

Regulatory Notes for US & EU

EU buyers operate within REACH and CS3D frameworks. US brands should map state-level chemical bills and federal labeling rules. Keep SDS and declarations at lot level and align test methods with retailer requirements.

- EU: REACH SVHCs, CS3D due diligence steps, Amfori/BSCI audits

- US: CPSIA, flammability for certain categories, state chemical rules

- Documentation: chain-of-custody, lab reports, CAP records

Conclusion & Next Steps

Use Portugal for speed, lower MOQs, and EU compliance. Use a China Clothing Manufacturer for scale, broader technical capability, and cost-sensitive programs. Blend both for a resilient supply chain managed by a capable OEM partner.

- Define program goals: speed, cost, technical depth, and compliance level.

- Shortlist factories in Portugal and China/Bangladesh by category fit.

- Run an RFP and sample series with clear pass/fail test gates.

- Pilot run in the chosen region; record QA and lab outcomes.

- Scale production with KPIs, SLAs, and contingency plans.

[INTERNAL LINK: Outerwear manufacturing guide—pillar page] [INTERNAL LINK: EU compliance checklist—resource page] [INTERNAL LINK: Contact Eton—https://china-clothing-manufacturer.com/]

Eton—Textile From Day One.—brings three decades of OEM/ODM experience in outerwear, giving brands a stable path from prototype to scale across China and Bangladesh. [INTERNAL LINK: {{author_name}} - {{author_title}} {{author_bio_url}}]

References & Sources

- EURATEX — Key Figures 2024 (2024). [CITE: EURATEX Key Figures 2024]

- Council of the European Union — Corporate Sustainability Due Diligence Directive (CS3D/CSDDD) (2024). [CITE: Council press release]

- INE — Statistics Portugal: Textile/Apparel Indicators (2023–2024). [CITE: INE sector pages]

- AICEP Portugal Global — Sector Insights: Textiles and Apparel (2023–2025). [CITE: AICEP overview]

- OEKO-TEX — Certification Overview and Standards (2024). [CITE: OEKO-TEX site]

- McKinsey — State of Fashion 2024 (2024). [CITE: McKinsey report]

- Sewport — Clothing Manufacturers in Portugal (Directory/Guide). [CITE: Sewport Portugal page]

- Sqetch — Guide to Clothing Manufacturers in Portugal. [CITE: Sqetch blog]

- Valérius Group — Capabilities and Sustainability. [CITE: Valérius site]

FAQs

Related Articles

Clothing Manufacturers for Startups from Development to Production: How to Choose the Right China Clothing Manufacturer

20 minute read

October 27th, 2025

Clothing Manufacturers for Startups from Development to Production: How to Choose the Right China Clothing... more »

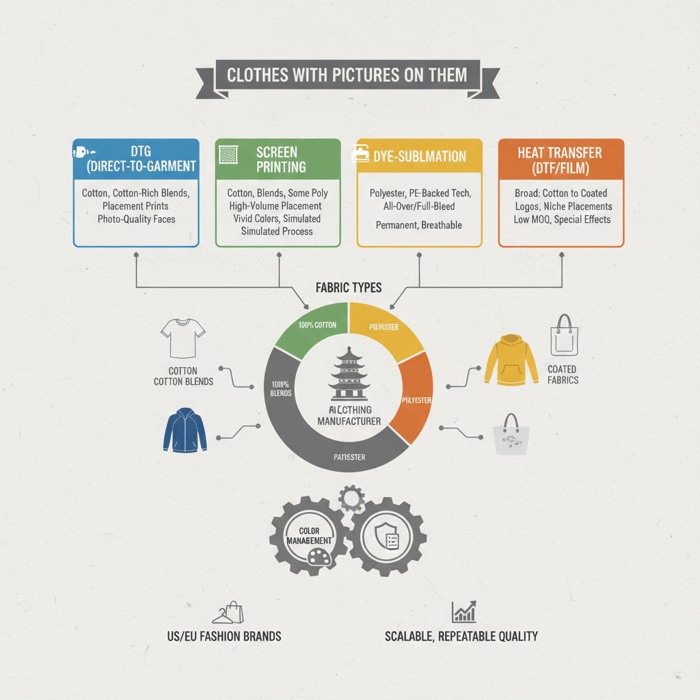

Clothes with Pictures on Them: A Fashion Brand’s Manufacturing Guide with a China Clothing Manufacturer

17 minute read

October 27th, 2025

Clothes with Pictures on Them: A Fashion Brand’s Manufacturing Guide with a China Clothing Manufacturer... more »

Tshirt Manufacturers: How to Choose a China Clothing Manufacturer for Quality, Cost, and Speed

17 minute read

October 27th, 2025

Tshirt Manufacturers: How to Choose a China Clothing Manufacturer for Quality, Cost, and Speed Tshirt... more »

american made workwear: Standards, Sourcing, and Global Alternatives with a China Clothing Manufacturer

17 minute read

October 27th, 2025

american made workwear: Standards, Sourcing, and Global Alternatives with a China Clothing Manufacturer... more »