Clothing Manufacturers for Startups from Development to Production: How to Choose the Right China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 27th, 2025

20 minute read

Clothing Manufacturers for Startups from Development to Production: How to Choose the Right China Clothing Manufacturer

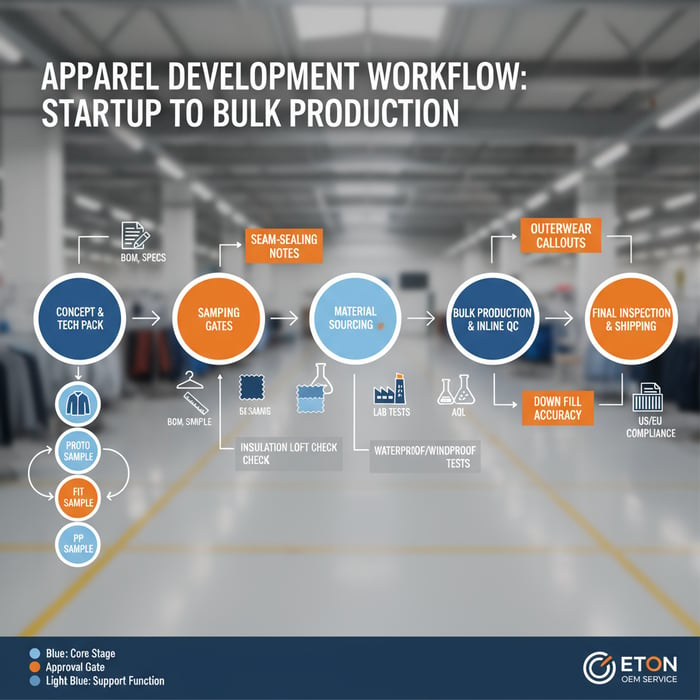

Clothing manufacturers for startups from development to production guide a brand from concept to market with tech pack support, sampling, material sourcing, production planning, quality control, and compliance. A China Clothing Manufacturer with proven OEM and ODM capability gives startups range, speed, and technical depth, especially in outerwear and performance apparel.

Clothing manufacturers for startups from development to production deliver tech pack support, samples, material sourcing, bulk production, QC, and US/EU compliance under one accountable partner. Vet OEM/ODM capability, MOQs, lead times, lab testing, and audit credentials. For outerwear and technical apparel, favor factories with seam-sealing, insulation handling, and strong testing programs.

Eton builds outerwear and technical apparel at scale across China and Bangladesh. The team translates startup concepts into factory-ready specs, runs sample gates, sources proven materials, and manages compliance for US/EU retail. The following blueprint brings the end-to-end workflow to life with decision matrices, cost levers, QC tools, and regional guidance—grounded in factory practice and aligned with startup realities.

What “clothing manufacturers for startups from development to production” really means

End-to-end service spans concept to delivery: tech pack creation, material sourcing and testing, sample gates, production scheduling, inline QC, final inspection, and compliance. The partner holds accountability for timelines, quality, and documentation while flexing MOQs and capacity for startup launches in US/EU markets.

This phrase describes a single vendor or network capable of carrying the load from the first sketch to cartons on a pallet. In practice, it means disciplined information flow, time-boxed sample gates, and a clear path for approvals. For outerwear and technical apparel, it includes machinery and methods that are beyond basic cut-and-sew, such as seam-sealing, down/insulation handling, engineered interlinings, heat-welded components, and verified fabric performance. Startups gain speed and fewer handoffs when the factory handles tech pack refinement, sources testable fabrics, and schedules pilot runs before bulk.

- Stage 1: Concept and tech pack — sketches, measurement charts, BOM, construction notes, tolerances, test plans.

- Stage 2: Sampling gates — proto for design validation, fit for size and pattern accuracy, PP for production readiness.

- Stage 3: Material sourcing and testing — mills and trim vendors, lab tests for US/EU compliance, performance validation.

- Stage 4: Bulk production and inline QC — line setup, operator training, AQL checkpoints, sealed standards.

- Stage 5: Final inspection and compliance docs — TOP sample approval, packing/label checks, test reports, audit evidence.

[CITE: A manufacturing operations guide that defines development-to-production stages in apparel] [MENTION: ISO 9001 for process discipline] [INTERNAL LINK: Our foundational guide on tech pack structure and BOM for startups]

Do startups need both proto and pre-production samples? Yes. Proto confirms the concept matches the spec and helps catch design issues. PP confirms the factory can build to the signed standards on production lines, with correct materials, labels, and tolerances, minimizing risk in bulk.

OEM vs ODM: What startups should choose

OEM means the brand owns the design. The factory builds according to the brand’s tech pack and standards. OEM fits startups with a strong point of view, clear specifications, and a market plan that depends on differentiation.

ODM means the factory owns the base design. The brand customizes details such as colors, trims, labels, and minor construction changes. ODM fits startups seeking speed, lower development cost, and proven base patterns. For outerwear, ODM libraries can include down jackets, parkas, softshells, and rainwear with pre-tested seam constructions and insulation packages.

[CITE: A sourcing handbook explaining OEM vs ODM in apparel] [MENTION: Techpacker’s guidance on tech pack depth] [INTERNAL LINK: Our resource on ODM capsule selection and customization]

Sample Gates: Proto, Fit, PP, and TOP

Proto confirms silhouette, major construction, and design intent. Fit checks measurements on a live model or form, validates grading logic, and locks tolerances per size. PP (pre-production) is built with final materials and trims after sealing the spec; it confirms line readiness. TOP (top-of-production) is pulled from the first bulk cartons; it serves as the benchmark for ongoing QC and shipping.

Each gate needs a dated checklist and a single source of truth: spec version, change log, test reports, and sign-off. For technical styles, include seam-sealing evidence, insulation weights and warmth targets, and weatherproof tests. Maintain a digital trail of deviations and approvals so changes never drift across emails without control.

[CITE: Apparel quality management standard outlining sample gate definitions] [MENTION: AATCC test methods for fabric performance] [INTERNAL LINK: Pilot run playbook — from PP sample to line setup]

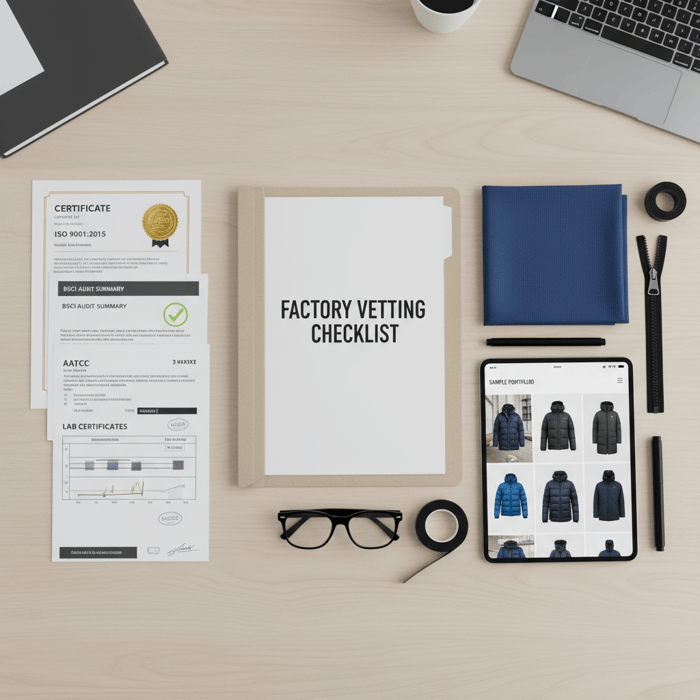

How to evaluate a China clothing manufacturer for startup success

Vetting focuses on capability, capacity, MOQs, lead times, compliance, lab testing, communication, transparency, and cost structure. Request audit reports, lab certificates, category portfolios, and a pilot run plan. For outerwear, ask for seam-sealing equipment lists and proof of down/insulation handling.

A good partner has range, discipline, and clear evidence. Startups benefit from factories that show billable transparency, flexible MOQs, and realistic calendars backed by supply chain access. Ask for a structured onboarding path with milestones and weekly touchpoints. Clarify cost drivers and testing fees in writing and check how the factory manages lab scheduling and re-tests. Strong teams provide sample calendars, tolerance tables, AQL plans, and a plan for pilot runs that fit startup volumes.

| Criteria | Why it matters | Evidence to request |

|---|---|---|

| Category capability (outerwear/technical) | Complex builds need specialized machines and trained operators. | Machine lists (seam-sealing, heat-weld), sample photos, buyer references. |

| Capacity and calendar | Timelines depend on available lines and seasonal load. | Monthly capacity sheet, booking calendar, pilot plan for startup volumes. |

| MOQ flexibility | Startup ranges are smaller; mills and trims set hard floors. | Fabric/trim MOQ sheets, consolidation options, deadstock access. |

| Compliance | US/EU markets require audits and chemical controls. | BSCI/SEDEX, ISO 9001 certificates, OEKO-TEX, past audit summaries. |

| Lab testing | REACH, RSL, performance and safety need documented results. | Lab reports, RSL matrix, testing calendar, corrective action logs. |

| QC plan and AQL | Defect rates drop when checkpoints are defined. | AQL tables, inline inspection forms, TOP sample protocol. |

| Cost structure | Transparent pricing reduces disputes and rework. | Quote breakdowns by fabric/trim/labor/overheads/testing. |

[CITE: A recognized audit framework summary for apparel factories] [MENTION: amfori BSCI and SEDEX standards] [INTERNAL LINK: Factory capability checklist — detailed version]

- Define category scope and performance needs.

- Request machinery and process evidence.

- Check compliance certificates and audit history.

- Study sample quality and finish details.

- Confirm MOQ floors from mills and trims.

- Map the sample calendar and pilot run plan.

- Agree on QC checkpoints, AQL, and TOP protocol.

What documents prove a factory’s compliance? BSCI/SEDEX audit summaries, ISO 9001 certifications, OEKO-TEX Standard 100 for materials, lab test reports, corrective action plans, and signed policy documents for chemical control, worker safety, and environmental practice.

Capability and capacity

Outerwear calls for specialized tools and trained teams. Look for seam-sealing stations, tape application knowledge, heat-weld machinery, specialized presser feet for heavy materials, down-proof fabric handling, and accurate fill allocation methods. Ask how the factory sets lines, trains operators, and protects standards with sealed samples and work instructions. Capacity matters when booking lines in peak months. Ask for monthly caps and a calendar that shows open windows for your sizes and colors. A strong factory estimates operator learning curves and reserves time for rework buffers.

[CITE: A technical apparel manufacturing handbook with machinery requirements] [MENTION: AATCC, ASTM test methods for water resistance and seam integrity] [INTERNAL LINK: Our outerwear manufacturer page with machinery profiles]

Compliance and certifications

ISO 9001 signals process discipline. BSCI and SEDEX address social standards. OEKO-TEX Standard 100 validates material safety. For US, align with FTC textile and care labels and CPSIA for children’s products. For EU, align with REACH and your buyer’s restricted substances list. Ask for current certificates, lab reports, and a material traceability plan. Confirm who pays for testing and how failed tests are handled. Align your product plan with a compliance calendar to avoid late surprises.

[CITE: FTC labeling rules overview] [MENTION: ECHA REACH and OEKO-TEX Standard 100] [INTERNAL LINK: Compliance and sustainability practices — policy overview]

The startup garment development workflow: tech packs to samples

Build a complete tech pack, plan sample gates, lock standards, and run change control. Document everything. Timelines vary by category and testing scope. Outerwear adds steps for seam-sealing, insulation, and weatherproof performance. A disciplined workflow trims rework and compresses launch calendars.

Start with a spec that factories trust. Include sketches, graded measurement charts, construction drawings, stitch types, seam allowances, tolerance ranges by measurement, BOM with material codes, care labels, packaging requirements, and test plans. Define how you will assess samples and how you will record feedback. Move from proto to fit to PP with clear sign-offs and sealed standards. Keep a change log and a single spec version in circulation; do not scatter updates across emails and attachments. For technical styles, note seam tape widths, seam types, membrane or coating specifications, and down/insulation composition and weight per size.

- Draft the tech pack — inputs: sketches and market intent; outputs: spec sheets, graded measurements, BOM, construction drawings, and test plan.

- Source materials and book lab tests — inputs: BOM and performance targets; outputs: mill quotes, MOQ floors, test reports, and corrective actions.

- Build proto — inputs: draft tech pack; outputs: silhouette confirmation and construction feedback.

- Run fit sample and grading — inputs: measurement charts and model notes; outputs: size set approvals and sealed tolerances.

- Approve PP and line setup — inputs: final spec, BOM, labels, and packaging; outputs: production readiness and operator instructions.

[CITE: Tech pack best practices guide with construction artwork examples] [MENTION: Techpacker for spec organization and version control] [INTERNAL LINK: Tech pack template — download and guide]

Build a tech pack that factories trust

Factories move fast with clean specs. Use precise tolerances by measurement type. Mark seam types with illustrations. List stitch counts and seam allowances. Add BOM entries with vendor codes, color names, Pantone references, and care label content. Note zipper types, slider bodies, pocket bags, interlinings, and any tapes. For outerwear, specify insulation type and grams per square meter by size, lining combinations, seam tape widths, and waterproof ratings from lab tests. Add pack-out diagrams and carton count targets to protect downstream logistics.

[CITE: A sewing construction reference with stitch and seam type definitions] [MENTION: ASTM standards for zipper performance] [INTERNAL LINK: Construction artwork gallery — examples for outerwear]

Sampling standards and change control

Sampling needs a scoreboard. Proto feedback fixes silhouette and major construction. Fit checks measurements and grading across sizes. PP locks final materials and on-line build. TOP guards shipping standards. Log every decision, including small tweaks. Use a single document hub. Assign a change owner with dates and reasons. If the brand changes a pocket or stitch, revise the tech pack, update BOM codes, and re-issue the spec. Tie every change to risk notes, cost impacts, and calendar impacts.

[CITE: A product development governance framework adapted to apparel] [MENTION: ISO 9001 change management clauses as applied in manufacturing] [INTERNAL LINK: Sample gate scorecards — downloadable forms]

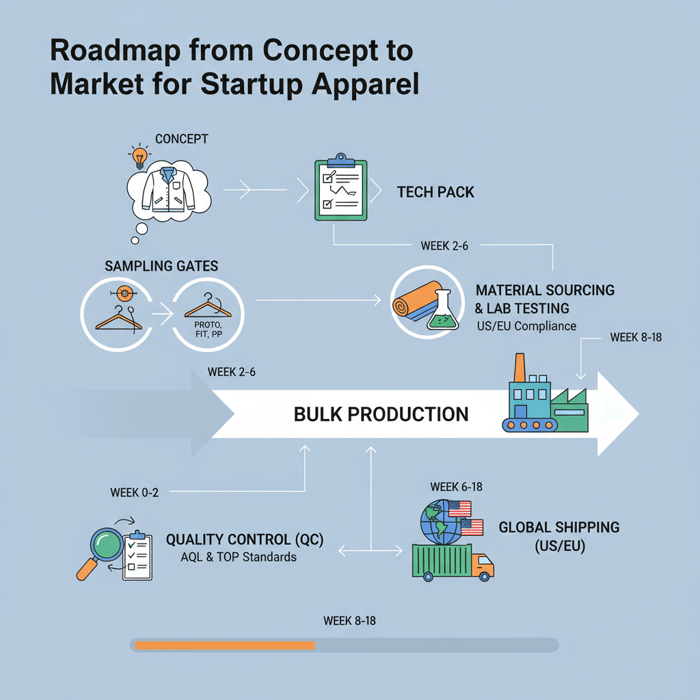

From development to production: timeline, MOQ, and cost control for startups

Expect development in 8–12 weeks and production in 6–10 weeks for mainstream apparel; outerwear and technical apparel add weeks for material lead times and testing. MOQs depend on mill and trim floors; cost drivers include materials, trims, labor, complexity, testing, and shipping. Smart design lowers cost without dulling brand identity.

Timelines change with seasonality, holidays, and lab queues. A working rule: plan buffers for fabric lead times and test retries. Startup ranges often run across smaller size sets and limited colors, which reduces material consumption but can increase unit cost at mills with high MOQ floors. Use color consolidation and shared trims to lower exposure. Book lab testing early and align with PP to avoid post-line surprises. Weigh air vs sea on landed cost and calendar impacts for US/EU delivery windows.

- Speed-to-market remained a priority for brands — 2024 [CITE: A current industry report on apparel sourcing speed trends]

- Material costs contribute the largest share of outerwear unit cost — 2023–2025 [CITE: A cost breakdown analysis for outerwear]

- Lab testing can add 1–3 weeks per cycle — 2024 [CITE: A lab throughput study covering textile compliance protocols]

| Cost driver | Impact | Tactics |

|---|---|---|

| Fabric | Largest cost share in outerwear and performance styles. | Consolidate colors; choose mill programs with lower floors; confirm test pass rates early. |

| Trims | Zippers, snaps, seam tapes, labels add up. | Standardize trim families across styles; bulk-buy where possible; validate supply reliability. |

| Labor and complexity | Seam count, operations, and special machines add cost. | Reduce seam changes; group operations; simplify panels where the design still holds. |

| Testing | RSL, performance, and safety tests add fees and time. | Align tests with buyer requirements; avoid redundant re-tests; book labs early. |

| Shipping | Air boosts speed and cost; sea lowers cost and adds weeks. | Mix modes; shift urgent colors to air; bulk of the range on sea. |

[CITE: A materials economics report for apparel] [MENTION: McKinsey State of Fashion 2024] [INTERNAL LINK: Calendar planning worksheet for startups]

MOQs by category and sourcing constraints

MOQ floors derive from mills and trims even when factories can cut small batches. Typical woven outerwear fabrics run 800–1,200 meters per color at many mills; knit basics can run lower on program fabrics. Seam tapes and specialized trims may carry minimums, especially for custom colors. Startup teams can use shared colors across styles and common trims to meet floors while building cohesive capsules. Ask mills for program fabrics with pre-dyed colors and test histories to lower risk.

[CITE: A mill MOQ program document] [MENTION: OEKO-TEX program fabrics with certified color libraries] [INTERNAL LINK: MOQ planning guide — fabric and trim consolidation]

Cost control levers

Design for the price while protecting the silhouette. Trim seam counts where they add cost without character. Choose fabric programs with pre-tested specs to avoid retesting fees. Consolidate zippers and snaps to a single supplier across styles. Batch sampling to cut courier and rework costs. Make shipping a portfolio decision: urgent launch colors by air, deeper volumes by sea. Track real landed costs in USD and EUR to compare scenarios that affect US/EU deliveries.

[CITE: A buyer-side case study on design-to-cost] [MENTION: A brand’s published sustainability and cost transparency report] [INTERNAL LINK: Trim consolidation library and preferred vendors]

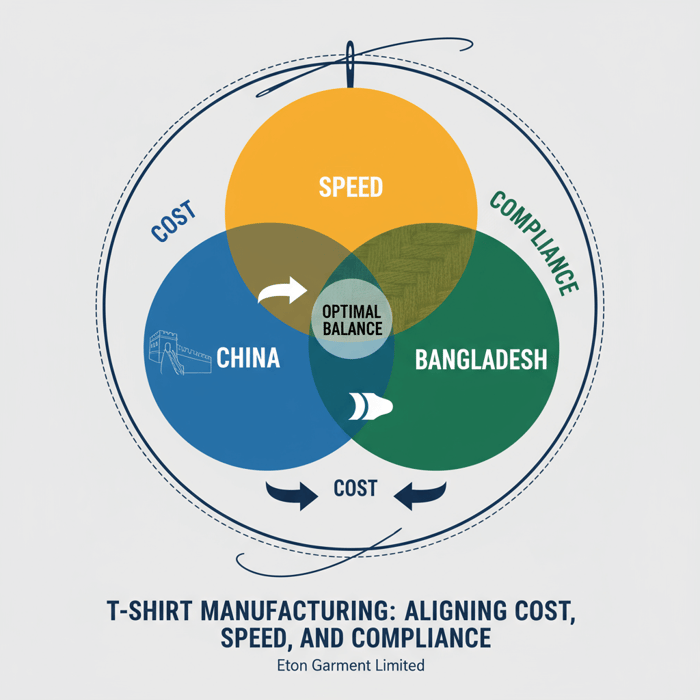

China vs Bangladesh vs US/EU: which clothing manufacturers for startups fit best?

China offers broad capability, technical depth, and speed for complex builds; Bangladesh offers cost efficiency and large-volume capacity; US/EU offer proximity, lower cross-border friction, and faster feedback for small runs. Choose the region based on category complexity, MOQs, budget, launch timing, and compliance burden.

Startups gain when the region fits the product. Outerwear and technical apparel lean toward China for machinery and experience, with Bangladesh as a strong choice for volume basics or select outerwear programs with pre-defined methods. US/EU shops fit small runs and premium positioning where proximity and lower compliance friction outweigh cost. Pair region strengths with your calendar. For US/EU launches, time peak seasons with the region’s holidays and lab capacity.

| Criteria | China | Bangladesh | US/EU |

|---|---|---|---|

| Technical complexity | High — seam-sealing, down handling, engineered builds. | Medium — strong on basics; select technical capabilities. | Medium — varies; strong boutique prototyping. |

| MOQ flexibility | Medium — good programs exist; mills set floors. | Low to medium — better at larger volumes. | High — small batches; higher unit cost. |

| Cost | Medium — balanced with technical depth. | Low — strong for cost-sensitive ranges. | High — premium cost; proximity lifts responsiveness. |

| Lead time | Medium to fast — strong supply chain access. | Medium — volume planning needed. | Fast locally; slower if materials import. |

| Compliance burden | Managed — broad experience with US/EU standards. | Managed — strong buyer programs; confirm audits. | Lower friction — domestic proximity aids oversight. |

[CITE: A recent sourcing trends report comparing regions] [MENTION: McKinsey State of Fashion 2024] [INTERNAL LINK: Region selection matrix — interactive tool]

Criteria overview

Pick by product category, target price point, and calendar. Complex jackets and performance wear need machinery lists and tested processes. Fashion basics with volume targets use mills and trims with favorable floors. Premium small-batch ranges gain from proximity and face-to-face development. Consider buyer audits and social standards programs; request certificates and last audit dates. Map material lead times and testing windows for US and EU requirements.

[CITE: A region capability guide with machinery and audit density] [MENTION: SEDEX and BSCI audit distributions by region] [INTERNAL LINK: Capability matrix — outerwear and knit]

Decision framework

Score regions on a 1–5 scale for your category, MOQ needs, budget band, and launch timing. Weight scores by what matters most for your range. Startups building technical outerwear often score China highest for capability and lab access. Startups pushing basic volume at aggressive price points often score Bangladesh highest. Startups seeking small-batch premium runs with direct oversight score US/EU highest for proximity.

Build a short list and request pilot run plans. Ask for cost breakdowns, test calendars, and operator training protocols. Align your scoring with risk appetite and cash flow. Use your PP and TOP gates to lock standards and reduce surprises.

[CITE: A decision analysis framework applied in apparel sourcing] [MENTION: Gartner-style sourcing decision matrices adapted to apparel] [INTERNAL LINK: Weighted scoring template — download]

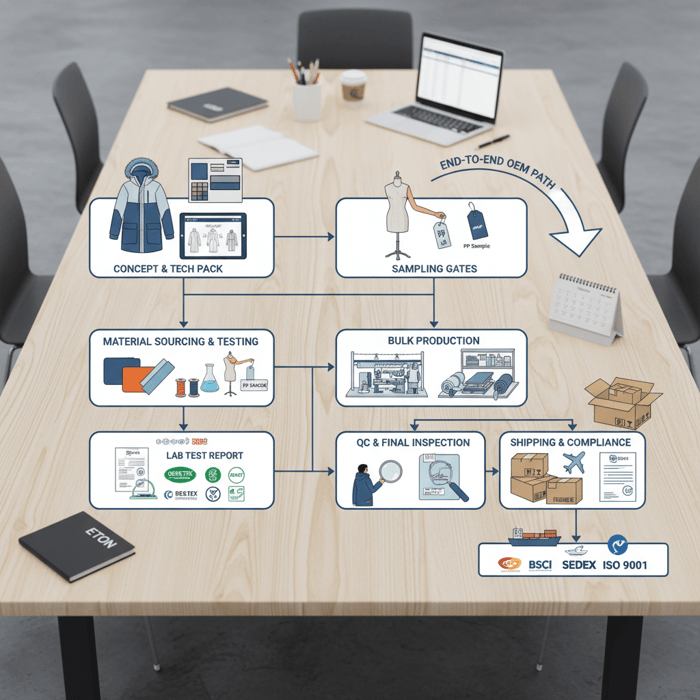

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton’s Clothing Manufacturing OEM Service compresses development-to-production for outerwear and technical apparel. The team supports tech packs, runs sampling gates, sources fabrics and trims, and manages QC with AQL checkpoints and TOP standards. With bases in China and Bangladesh, Eton aligns US/EU compliance and moves from idea to bulk through one accountable path.

| Need | Feature | Outcome | Typical range |

|---|---|---|---|

| Tech pack support | Spec refinement, construction artwork, BOM alignment. | Factory-ready specs and fewer reworks. | 1–2 weeks |

| Sampling gates | Proto, fit, PP, TOP with sealed standards. | Predictable approvals and build quality. | 4–6 weeks total |

| Fabric sourcing and testing | Mill access, lab booking, test reports. | US/EU compliance with documented results. | 2–4 weeks testing |

| Outerwear machinery and methods | Seam-sealing, down handling, heat-weld capacity. | Technical builds on live lines. | As scheduled |

| QC and AQL | Inline checkpoints, final inspection, TOP standards. | Lower defects and cleaner shipments. | Per batch |

| Compliance | Audit credentials, lab tests, label checks. | US/EU retail readiness. | Aligned with buyer timelines |

See the OEM workflow and start a pilot run: Clothing Manufacturing OEM Service. “Textile From Day One.” has guided Eton’s work across three decades, building jackets, parkas, padded coats, and technical sportswear for global brands.

[CITE: An operations case study for end-to-end apparel OEM] [MENTION: Liverpool F.C., Forever 21, Babyshop — partnerships cited in brand materials] [INTERNAL LINK: Eton Garment Limited — capabilities overview]

Use Case 1: Outerwear capsule

A startup builds a four-style winter capsule: down jacket, parka, softshell, and rain shell. Eton aligns spec refinement, sources down-proof fabrics with tested membranes, and sets seam tape standards. Proto confirms silhouettes; fit locks grading; PP runs line setup with final materials. A TOP from the first cartons anchors ongoing QC. Unit costs align with fabric programs and shared trims across styles. Launch dates fit US/EU windows with sea shipments for volume and air on hero colors.

[CITE: A down and weatherproof testing protocol pack] [MENTION: AATCC water resistance tests and fill power standards] [INTERNAL LINK: Outerwear capsule planning tool]

Use Case 2: Technical sportswear

A startup needs stretch, breathability, and durable construction. Eton sources performance knits and tests moisture management. Proto validates paneling and stretch; fit confirms movement. PP ensures line repeatability across sizes. AQL checks focus on seam integrity and stress areas. Zippers and snaps standardize across styles to lower unit cost. TOP confirms packaging and labels for US/EU rules. The range ships with a split mode: urgent colors by air and the rest by sea.

[CITE: A performance knit testing suite for moisture and stretch] [MENTION: ASTM seam strength methods] [INTERNAL LINK: Sportswear methods — seam stress mapping]

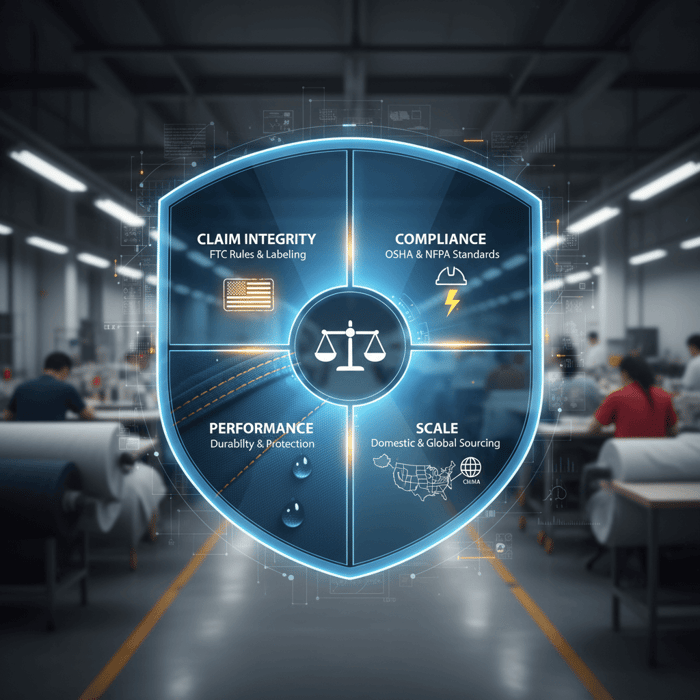

Risks, compliance, and localization for US and EU

Plan for labeling rules, restricted substances, ethical audits, and safety testing. Document materials and tests early. Use a risk matrix and region notes. Confirm regulations with legal and buyer compliance teams; requirements evolve.

US labeling covers fiber content, care, and origin under FTC rules; CPSIA applies to children’s products. EU chemical controls run under REACH; buyers often require OEKO-TEX certifications for materials. Build a compliance file per style: materials list, lab reports, label content, audit credentials, corrective actions, and packing compliance. Trace materials and trims back to vendors and maintain lot numbers on file.

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Material test failure | Medium | High | Book tests early; use program fabrics; pre-screen RSL. |

| MOQ shortfall | Medium | Medium | Consolidate colors; share trims; access deadstock if viable. |

| Sampling delays | Medium | Medium | Fixed calendars; weekly checkpoints; sealed standards. |

| Production defects | Low to medium | High | AQL inline checks; operator training; TOP approvals. |

| Shipping and customs | Medium | Medium | Split modes; document labels; buyer compliance file ready. |

[CITE: A compliance handbook for textile labeling and chemical safety] [MENTION: FTC guidance and ECHA REACH overview] [INTERNAL LINK: Sustainability and compliance policy page]

Regulatory notes for US and EU

US: follow FTC Textile, Wool, and Care Labeling rules. CPSIA applies if products target children; test and document accordingly. EU: align with REACH and buyer RSLs; OEKO-TEX Standard 100 helps validate materials. Label fiber content, care, and origin per market rules. Keep test reports on file and confirm lot traceability. Update your compliance file when materials or suppliers change.

[CITE: FTC textile and care labeling rules] [MENTION: OEKO-TEX Standard 100 program] [INTERNAL LINK: Labeling checklist — US/EU formats]

Conclusion and next steps

Match your region to your product and calendar. Build a tech pack that factories trust. Run sample gates with sealed standards. Anchor compliance early with test bookings and labeling. Use MOQs and cost levers to protect budgets. Pilot with a factory that shows evidence and discipline in outerwear and technical apparel.

- Week 0–2: Finalize tech pack and BOM; open lab bookings.

- Week 2–6: Proto and fit; grade size set; log changes.

- Week 6–8: PP sample sign-off; line setup; work instructions.

- Week 8–18: Bulk production; QC checkpoints; TOP approvals; shipping plan.

See how Eton’s OEM service aligns with this plan: Clothing Manufacturing OEM Service. For outerwear machinery and methods, visit [INTERNAL LINK: Outerwear manufacturer — capability details].

Author: Eton Yip, Founder, Eton Garment Limited — 30+ years in apparel manufacturing, outerwear and technical apparel specialist. Reviewer: Head of Quality, Eton Garment Limited (Factory QA lead).

Methodology: Factory workflows and compliance practices across China and Bangladesh, cross-checked against current industry guidance and standards. Limitations: timelines and MOQs vary by category, materials, seasonality, and lab throughput; regulations change and differ by product type. Confirm requirements with legal and buyer teams. Disclosure: This article integrates Eton’s OEM service.

[INTERNAL LINK: Eton Yip — founder bio and operations background]

- Shopify — How to Find a Clothing Manufacturer (2024). https://www.shopify.com/blog/clothing-manufacturers

- Sewport — How to Find a Clothing Manufacturer (2023). https://sewport.com/blog/how-to-find-a-clothing-manufacturer

- Techpacker — How to Find Clothing Manufacturers (2023). https://techpacker.com/blog/design/how-to-find-clothing-manufacturers/

- McKinsey & Company — The State of Fashion 2024 (2024). https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion

- ISO — ISO 9001:2015 Quality Management Systems (2015). https://www.iso.org/standard/62085.html

- amfori — BSCI Overview (2024). https://www.amfori.org/

- FTC — Textile, Wool, and Fur Labeling (2024). https://www.ftc.gov/business-guidance/textile-wool-fur

- ECHA — REACH Regulation (2024). https://echa.europa.eu/regulations/reach

- OEKO-TEX — STANDARD 100 (2024). https://www.oeko-tex.com/en/our-standards/standard-100

FAQs

Related Articles

Tshirt Manufacturers: How to Choose a China Clothing Manufacturer for Quality, Cost, and Speed

17 minute read

October 27th, 2025

Tshirt Manufacturers: How to Choose a China Clothing Manufacturer for Quality, Cost, and Speed Tshirt... more »

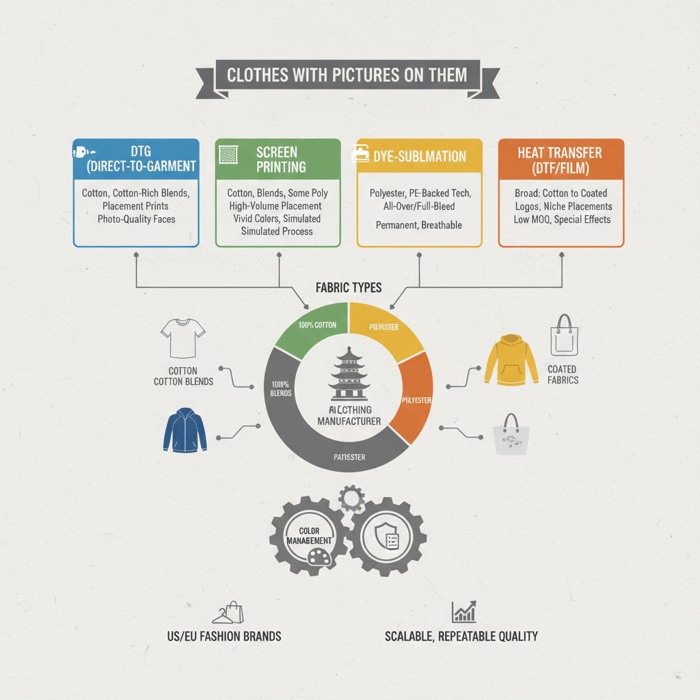

Clothes with Pictures on Them: A Fashion Brand’s Manufacturing Guide with a China Clothing Manufacturer

17 minute read

October 27th, 2025

Clothes with Pictures on Them: A Fashion Brand’s Manufacturing Guide with a China Clothing Manufacturer... more »

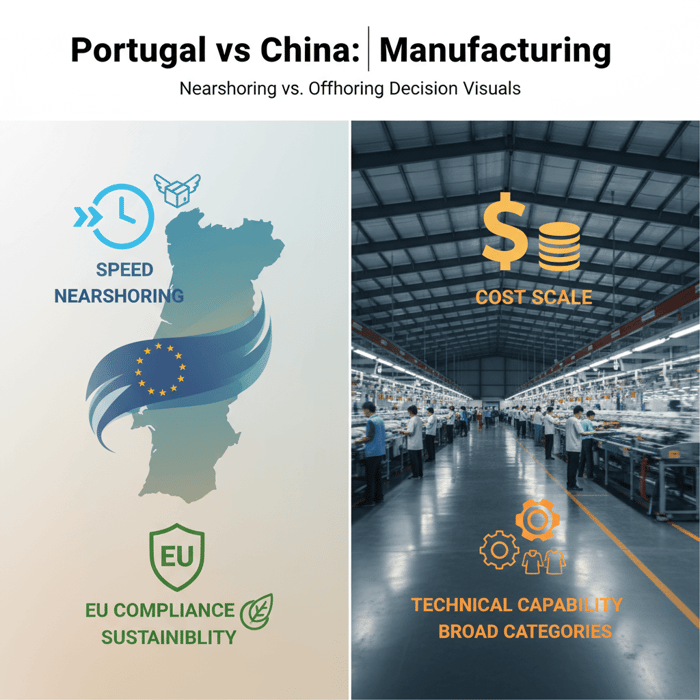

Portuguese Manufacturers vs China Clothing Manufacturer: A Buyer’s Guide for Fashion Brands

15 minute read

October 27th, 2025

Portuguese Manufacturers vs China Clothing Manufacturer: A Buyer’s Guide for Fashion Brands Portuguese... more »

american made workwear: Standards, Sourcing, and Global Alternatives with a China Clothing Manufacturer

17 minute read

October 27th, 2025

american made workwear: Standards, Sourcing, and Global Alternatives with a China Clothing Manufacturer... more »