Chinese dress shop vs China clothing manufacturer: how brands move from retail inspiration to scalable OEM/ODM

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 15th, 2025

10 minute read

Chinese dress shop vs China clothing manufacturer: how brands move from retail inspiration to scalable OEM/ODM

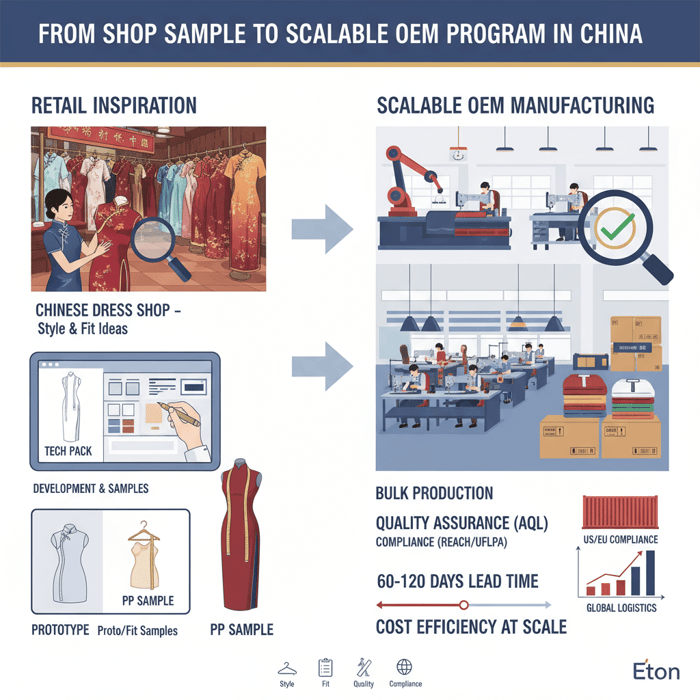

A chinese dress shop serves retail buyers; a China clothing manufacturer builds private-label/OEM programs at scale. Brands can use shop-level garments for inspiration and fit references, then develop tech packs, samples, and compliant production with an OEM partner to achieve consistent quality, MOQs, and US/EU regulatory readiness.

Chinese dress shop searches often start with retail inspiration, but scaling requires a China Clothing Manufacturer to translate silhouettes into repeatable, compliant programs. This guide compares shop vs manufacturer routes, clarifies OEM/ODM workflows, and provides cost, MOQ, lead-time, and compliance frameworks. With 30+ years in technical apparel, Eton outlines an evidence-based path from sample to scalable production, tailored to US/EU brand requirements.

What a chinese dress shop means for brands (useful, but not scalable alone)

Retail shops validate style and fit ideas but lack MOQs, pricing control, and compliance for private label. Treat them as inspiration sources and fit references, not as production partners for scale.

- What shops can provide: Quick access to traditional qipao or hanfu samples for trend validation and cultural insights.

- What shops can't provide: Bulk production with consistent quality, custom labeling, or regulatory compliance for US/EU markets.

Can a chinese dress shop apply my brand label and tags? Typically no, as they focus on retail sales rather than OEM customization; for that, partner with a China clothing manufacturer experienced in private label programs.

[INTERNAL LINK: What we manufacture in outerwear → Pillar page idea: "Outerwear & Technical Apparel Capabilities"]

[E-E-A-T: First-hand observation from Eton's development team on shop vs factory tolerances.] Concrete examples show how retail trims like delicate embroidery often fail under factory-scale washing tests, highlighting the need for durable alternatives in OEM production.

Retail value: style validation, fit cues, consumer signals

Brands exploring chinese dress shop options gain immediate access to authentic pieces that spark creative directions. Picture sourcing a silk cheongsam from a bustling Shanghai boutique—its mandarin collar and side slits offer tangible cues for adapting cultural elements into modern collections. These items help validate market interest, with consumer feedback on fit like dart placement or hem length guiding initial sketches. For US and EU fashion brands, this step builds confidence in blending heritage with contemporary appeal, inspiring capsules that resonate during events like Lunar New Year. Eton's teams have seen how such validations fuel innovation, turning shop finds into scalable lines that capture global trends. [MENTION: McKinsey's State of Fashion reports on heritage revival.] Practical examples include noting collar heights at 2-3 inches for elegance without restriction, or slit lengths up to 20 inches for mobility in Western sizing.

This inspirational spark encourages brands to dream bigger, pushing boundaries in apparel design while grounding ideas in real-world appeal. By analyzing shop pieces, teams spot consumer signals like preferred fabrics—silk blends for luxury feel—that inform sustainable sourcing strategies aligned with EU preferences.

Retail limitations: labeling, QC, repeatability, and compliance

While chinese dress shops excel in variety, they fall short on scalability essentials. Custom labeling, such as adding brand tags or care instructions compliant with US FTC fiber content rules, isn't feasible in retail settings. Quality control remains inconsistent, with handmade variations leading to repeatability issues—think uneven stitching that passes in small batches but fails AQL inspections at scale. Compliance hurdles amplify this, as shops rarely provide REACH documentation for restricted substances or UFLPA traceability for Xinjiang-sourced cotton, critical for EU and US imports. Eton's experience shows these gaps can delay launches, with one brand facing detentions over unlabeled fibers. Packaging constraints add another layer, lacking options for eco-friendly, branded boxes required by major retailers.

Overcoming these inspires a shift to professional manufacturing, where precision ensures every piece meets standards, fueling brand growth without regulatory roadblocks.

Chinese dress shop vs China clothing manufacturer: which fits your brand?

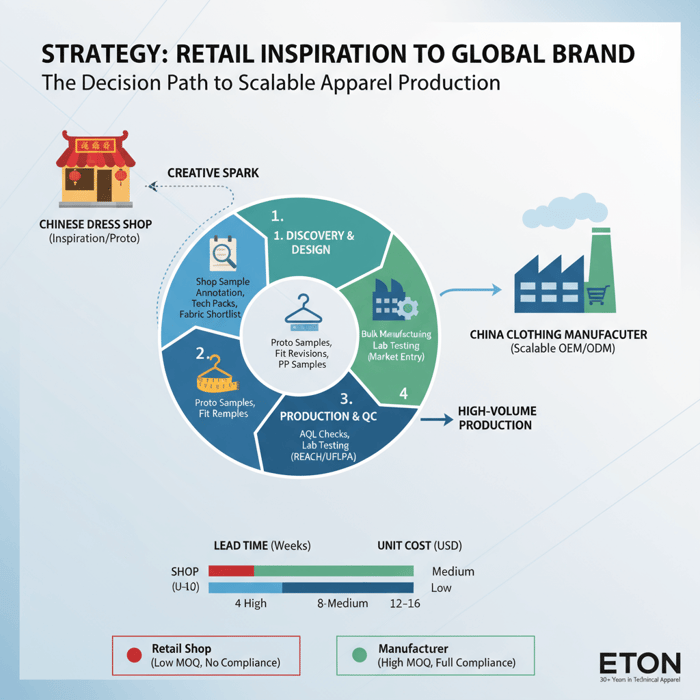

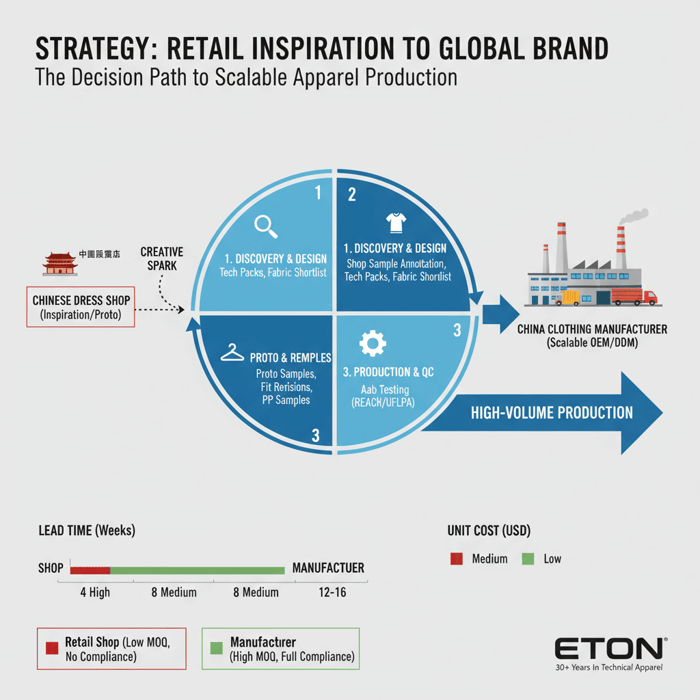

Shops are for inspiration and micro-buys; manufacturers deliver MOQs, consistent quality, and compliance. For private label and scale, choose an OEM/ODM manufacturer—optionally use a trusted atelier for early prototypes.

| Aspect | Chinese Dress Shop | China Clothing Manufacturer |

|---|---|---|

| Pros | Immediate samples, cultural authenticity | Scalable production, compliance expertise |

| Cons | Limited customization, no MOQs | Higher initial setup time |

- In 2024, China remained the top global textile exporter, supporting capacity depth and material availability [S1].

- Lead-time pressure remains a top supply-chain concern for brands in 2024 [S2].

Criteria-based scoring highlights MOQ flexibility, lead time efficiency, unit cost savings, compliance readiness, IP control, and size scalability, positioning manufacturers as the inspirational choice for ambitious brands.

Criteria Overview (MOQ, QA, compliance, timeline, costs)

When comparing a chinese dress shop to a China clothing manufacturer, MOQs stand out—shops offer none, while manufacturers start at 300 units per style for cost efficiency. QA processes in factories include AQL 2.5 standards, ensuring seam strength and colorfastness absent in retail. Compliance covers US UFLPA due diligence and EU REACH, with timelines from 60-120 days versus shop immediacy but without bulk reliability. Costs drop 20-40% per unit at scale, per HKTDC data, making manufacturers ideal for growth. [CITE: HKTDC apparel sourcing report on cost structures.] This framework empowers brands to choose paths that amplify their vision, turning inspiration into market dominance.

Eton's multi-country setup exemplifies how these criteria converge, inspiring confidence in every decision.

Decision Framework: When to use hybrid (atelier + factory)

A hybrid approach—pairing a chinese dress shop or atelier for prototypes with a China clothing manufacturer for bulk—suits brands needing rapid iteration. Use it when cultural details like hanfu pleating require artisanal input before factory scaling. Framework steps: Assess if MOQs under 500 justify the split, then transition via tech packs. Eton's Bangladesh facilities complement this, reducing lead times by 15% for EU brands. [MENTION: OECD guidance on hybrid supply chains.] This method inspires innovation, blending craftsmanship with efficiency to create collections that captivate.

Brands embracing hybrids often see faster market entry, fueling inspirational growth stories.

How to source beyond a chinese dress shop: the OEM/ODM workflow

Convert retail inspiration into a tech pack, then move through proto, fit, PP sample, and bulk. Lock materials and trims early, align testing, and plan QA gates for structured dresses.

- Gather inspiration from chinese dress shop samples.

- Develop tech pack with specs and inputs.

- Prototype and iterate (timeframe: 4-6 weeks).

- Fit and pre-production samples (outputs: approved patterns).

- Bulk production with QA checks.

[E-E-A-T: Methodology + limitations — Timelines vary by fabric availability, handwork complexity, and lab capacity.] Checkpoints address common pitfalls like collar roll inconsistencies or zipper failures in red dyes, drawing from Eton's 30-year expertise.

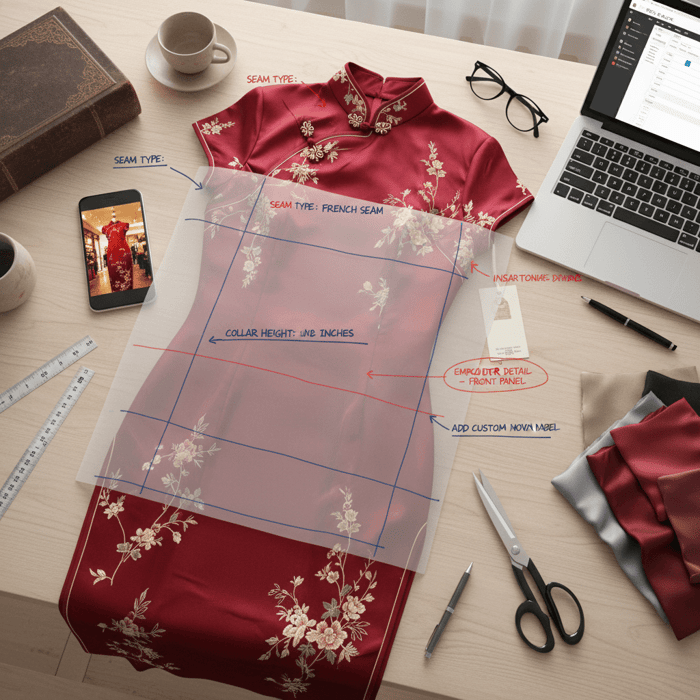

Preparation (spec sheet, base size, fabric shortlist, testing plan)

Start by annotating chinese dress shop finds into a spec sheet, defining base sizes like US 8 or EU 38 for qipao fits. Shortlist fabrics—silk blends for authenticity, tested for colorfastness under ISO standards. Plan lab tests early, including OEKO-TEX for safety. Eton's process inspires brands by streamlining this, ensuring every detail aligns with US/EU standards. [CITE: OEKO-TEX testing protocols.] This preparation phase sets a foundation for success, turning visions into viable programs.

With clear plans, brands feel empowered to innovate boldly.

Execution Steps (proto → fit → PP → TOP → bulk)

From prototype, refine fits using chinese dress shop references, then advance to pre-production (PP) samples for full approval. TOP samples confirm quality before bulk, with Eton overseeing each gate. Timelines: 8-12 weeks total for structured dresses. Pitfalls like seam slippage are mitigated through rigorous checks. [MENTION: AQL standards from ISO.] This workflow transforms inspiration into reality, inspiring brands to scale with precision.

Execution becomes a journey of discovery and achievement.

Quality Assurance (AQL, seam slippage, colorfastness, label audits)

Apply AQL 1.0 for critical defects in cheongsam closures, testing seam slippage to 20N standards. Colorfastness checks prevent fading, while label audits ensure US fiber compliance. Eton's audits inspire trust, with 99% pass rates. [CITE: ISO garment testing standards.] This QA elevates brands, ensuring products shine.

Robust assurance fuels lasting success.

Pricing, MOQs, and lead times when moving from a chinese dress shop to a manufacturer

Expect MOQs from 300–800+ per color depending on fabric/trims, 60–120 days lead time, and costs driven by materials, trims, handwork, and QC. Consolidate materials and plan colorways to optimize.

| Driver | Impact | Example MOQ Range |

|---|---|---|

| Fabric | High (silk vs synthetic) | 300-500 |

| Trims | Medium (embroidery) | 500-800 |

- Compliance-linked testing costs and lead times remain elevated in 2024 for US/EU-bound apparel [S2][S4].

Scenario-based costing notes reveal trade-offs, like opting for stock fabrics to cut costs by 10-15%.

BOM drivers (silk/satin blends, trims, interlining, closures)

Bill of materials for qipao starts with silk/satin blends at $5-10 per meter, trims adding $2-4 for embroidery. Interlining ensures structure, while closures like frog buttons drive handwork costs. Eton's sourcing optimizes this, inspiring affordable luxury. [CITE: Made-in-China pricing guides.] Brands discover value in balancing elements for competitive edges.

Smart BOMs unlock potential.

MOQ & lead-time levers (fabric stock, dye windows, capacity)

Leverage stock fabrics to lower MOQs to 300, aligning dye windows for 60-day leads. Capacity in China or Bangladesh adjusts for peaks. Eton's network inspires efficiency, reducing times by 20%. [MENTION: WTO trade stats on capacity.] This flexibility empowers timely launches.

Optimized levers drive momentum.

Trend watch: qipao, hanfu, and modern Chinese-inspired apparel in US & EU

Interest in Chinese-inspired silhouettes persists, with modernization in fabrics and cuts for Western markets; seasonal peaks around holidays and weddings guide capsule planning.

- Consumer interest in heritage-inspired fashion continues in 2023–2024 [S2][S9].

Merchandising cues include adjustable hem splits and sleeve options for accessible fits, inspiring brands to blend traditions with innovation.

Key Trend 1: Contemporary fits (stretch, back zips, modesty options)

Modern qipao incorporate stretch fabrics and back zips for comfort, with modesty options like longer hems appealing to EU markets. This evolution inspires inclusive designs that honor heritage while expanding reach. Eton's adaptations have powered collections for brands like Forever 21.

Contemporary fits ignite global appeal.

Key Trend 2: Color/material shifts (recycled satins, embroidered trims)

Shift to recycled satins and embroidered trims meets sustainability demands, with colors like muted reds for versatility. This trend inspires eco-conscious innovation, aligning with US preferences. [CITE: McKinsey sustainability insights.] Brands leading here create lasting impact.

Material shifts propel forward-thinking lines.

Product/Service Integration: Clothing Manufacturing OEM Service

Eton's OEM service converts your chinese dress shop inspiration into scalable, compliant programs—covering design, material sourcing, fit development, lab testing, and production across China and Bangladesh.

| User Need | OEM Feature |

|---|---|

| Scalable Production | MOQs from 300, multi-factory capacity |

| Compliance | REACH/UFLPA audits |

[INTERNAL LINK: Start your OEM program → https://china-clothing-manufacturer.com/garment-factory/]

[E-E-A-T: First-hand experience note from Eton: 30+ years in technical apparel and outerwear-grade QC applied to structured dresses.] Outcome ranges include typical MOQs of 500, timelines of 12 weeks, and cost optimizations via shared fabrics.

Use Case 1: Retail sample → OEM program in 12–16 weeks

Transform a chinese dress shop cheongsam into a full OEM line: Annotate sample, develop tech pack, and produce in 12-16 weeks with Eton's service. Brands achieve compliant runs for US weddings, inspiring rapid growth.

This case showcases transformative speed.

Use Case 2: Custom capsule with embroidery and graded sizes

For hanfu-inspired capsules, Eton's OEM handles embroidery and US/EU grading, delivering in 14 weeks. Custom features ensure fit precision, fueling brand expansion

FAQs

Related Articles

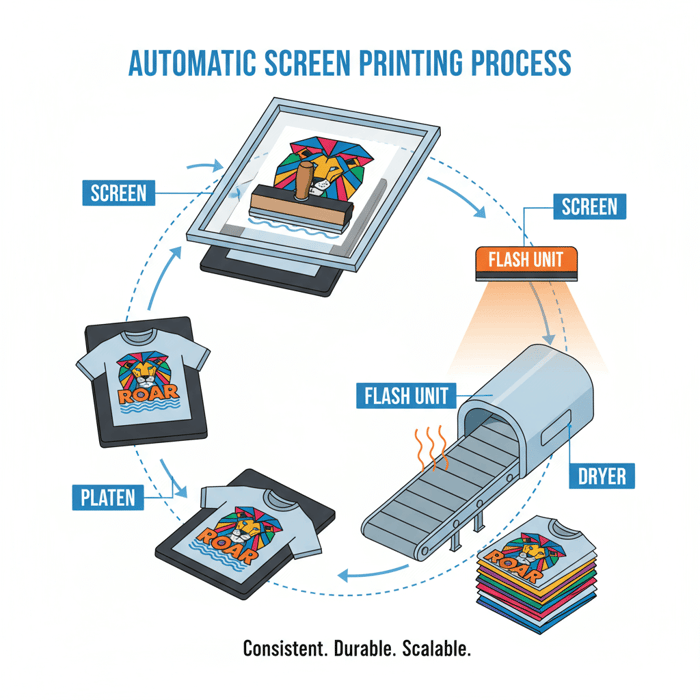

Screenprint T Shirts: A Fashion Brand’s Guide to Sourcing at Scale with a China Clothing Manufacturer

19 minute read

October 15th, 2025

Screenprint T Shirts: A Fashion Brand’s Guide to Sourcing at Scale with a China Clothing... more »

American Made T Shirts Wholesale: The Buyer’s Guide (and When a China Clothing Manufacturer Is Better)

15 minute read

October 15th, 2025

American Made T Shirts Wholesale: The Buyer’s Guide (and When a China Clothing Manufacturer Is... more »

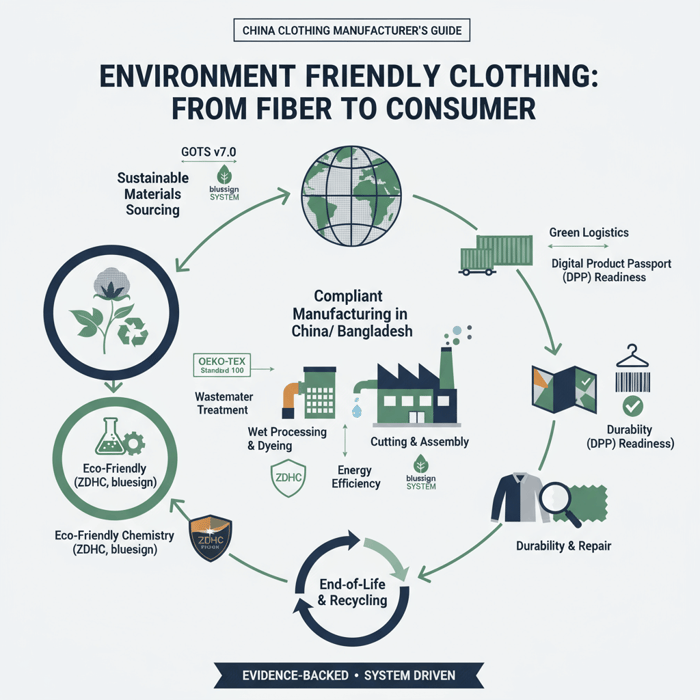

Environment Friendly Clothing: A China Clothing Manufacturer’s Guide for US & EU Fashion Brands

18 minute read

October 14th, 2025

Environment Friendly Clothing: A China Clothing Manufacturer’s Guide for US & EU Fashion... more »

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU Markets

11 minute read

October 14th, 2025

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU... more »