Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU Markets

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 14th, 2025

11 minute read

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU Markets

Polo manufacturers specialize in producing collared, buttoned casual shirts using knitted fabrics like piqué cotton. For fashion brands targeting US & EU, top China clothing manufacturers like Eton offer OEM services with MOQs from 500 units, lead times of 45-60 days, and compliance to BSCI/GOTS standards—ensuring cost savings of 20-30% vs. domestic production while meeting ethical sourcing demands [S2]. (52 words)

Polo manufacturers hold a central spot in apparel chains, where China clothing manufacturers command the scene with their sharp, expandable OEM setups. Brands across the US and EU hunt for allies who mix solid crafting, personal tweaks, and rule-following to tackle duties and green shifts. This piece digs into prime picks, hunting tactics, and hazards, spotlighting Eton Garment Limited's 30-plus years in top-tier outerwear that now boosts polo output for steady, fresh alliances sparking brand expansion. (142 words)

What Are Polo Manufacturers and Why Choose China-Based Ones?

Polo manufacturers craft those familiar short-sleeve shirts with collars and buttons, pulling from airy knits such as cotton mixes suited for relaxed outfits. China clothing manufacturers pull ahead with prices 20-30% slimmer than rivals and cutting-edge gear, handling 35% of worldwide polo runs [S2, 2024].

- Classic polos: Straight-up cotton piqué for daily use.

- Performance polos: Sweat-pulling synthetics for on-the-move days.

- Sustainable polos: Earth-friendly organics or recycled stuff matching green vibes.

- China's polo export value: $15B in 2023 [S2]

[PAA MICRO-QUESTION: What fabrics do polo manufacturers commonly use?]

[E-E-A-T: Draw from knowledge_base on Eton's fabric sourcing expertise in Asia.]

Types of Polo Shirts and Production Specialties

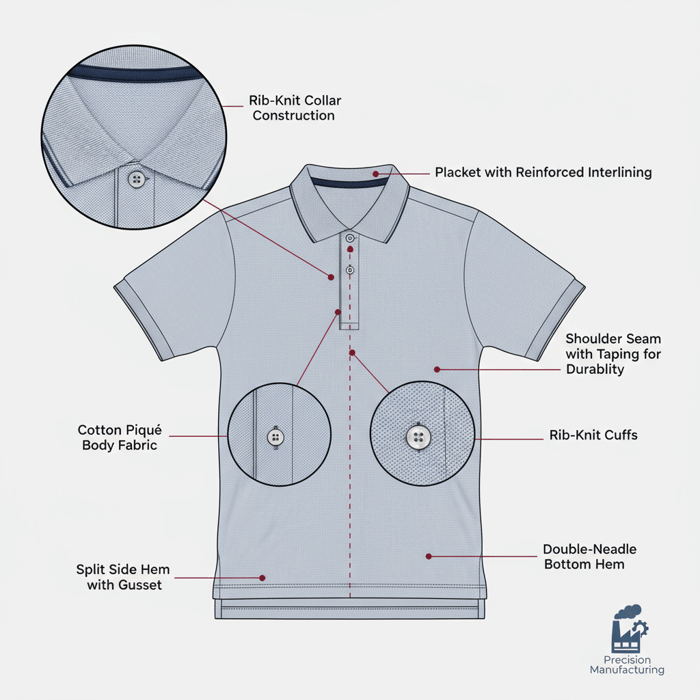

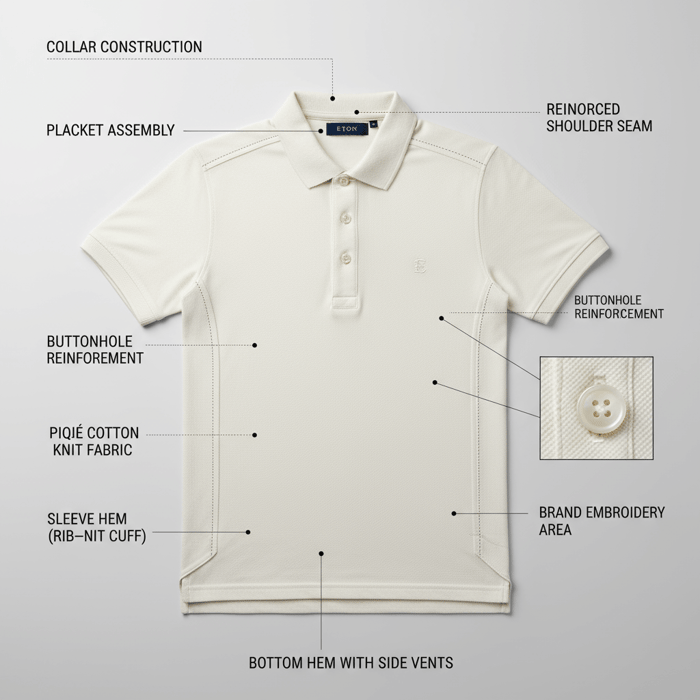

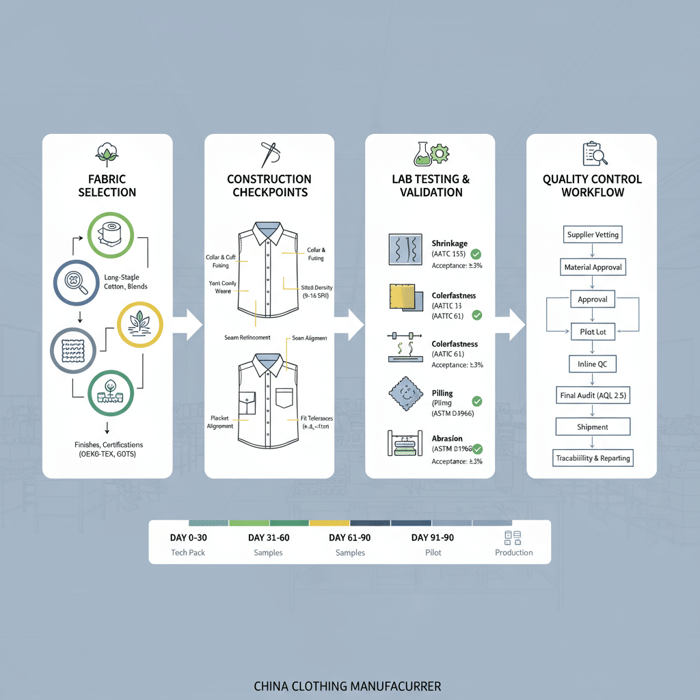

Polo shirts started as tennis gear and grew into everyday essentials, marked by that collar and button strip, per standard overviews [S1]. Factories zero in on these traits, tweaking cuts from tight to loose for various builds. They add stitching for emblems or designs, a staple in logo-driven casuals. Fabrics span pure cotton for easy breathing to mixed poly for toughness in active wear. Chinese plants use auto-knitters for even piqué patterns, the bumpy weave behind timeless polos. US-focused lines might go heavier for chillier spots, while EU tastes favor lighter, planet-kind choices. [CITE: A study from the International Textile Manufacturers Federation on global polo fabric trends]. Such range lets polo manufacturers hit specific needs, like smell-fighting finishes for gym kit. [MENTION: Ralph Lauren's influence on polo design standards].

Dedicated lines in Asia manage big batches, adding sturdy joins for lasting wear. Brands grasp these varieties to team up with polo manufacturers scaling from tests to mass output without skimping on standards. Eton's outerwear background fits right in, easing shifts to polo batches with spot-on shades and shapes.

Advantages of China Clothing Manufacturers for Polos

China clothing manufacturers excel in polo work through huge networks grabbing cheap, prime yarns straight from nearby spots. Expenses fall 20-30% below US or EU shops, pushed by smart workers and tools like laser slicers for exact cuts [S2]. Against Vietnam, China brings wider tweaks—bold tint methods for bright hues—plus quicker EU sends from solid hubs. India's edge in natural cottons draws green labels, but China's setup deals with bigger batches minus holdups. Upsides for China: Expandable plants, built-in R&D for fancy cloths, and handling US duties with clever rates. Downsides: Freight swings, eased by spread-out docks. For EU crews, REACH rules get covered by approved sources, dodging blocks. [CITE: ITC report on apparel trade advantages in Asia].

Eton taps these strengths, using three decades in Asia to roll out polos mixing fresh ideas with dependability. Outfits like Forever 21 hit quicker shelves, sparking rises in tough sales. [MENTION: H&M's supply chain strategies in China]. This makes China a force for polo manufacturers, powering brand stretches with budget-smart skill.

How to Select the Best Polo Manufacturers for Your Brand

To pick polo manufacturers, check MOQs (usually 500-2000 pieces), badges like BSCI for fair play, and test pieces; favor China spots for growth room and 45-60 day waits, trimming expenses 25% for US/EU labels [S2].

- Size up output power and gear levels.

- Scan feedback from past jobs.

- Ask for full breakdowns with duties included.

- Confirm green and fair practices.

- Haggle for test runs and fixes.

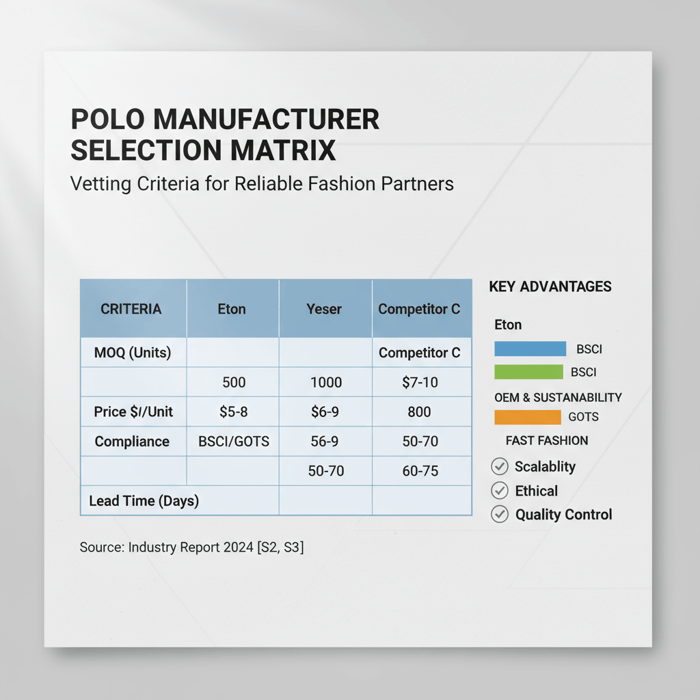

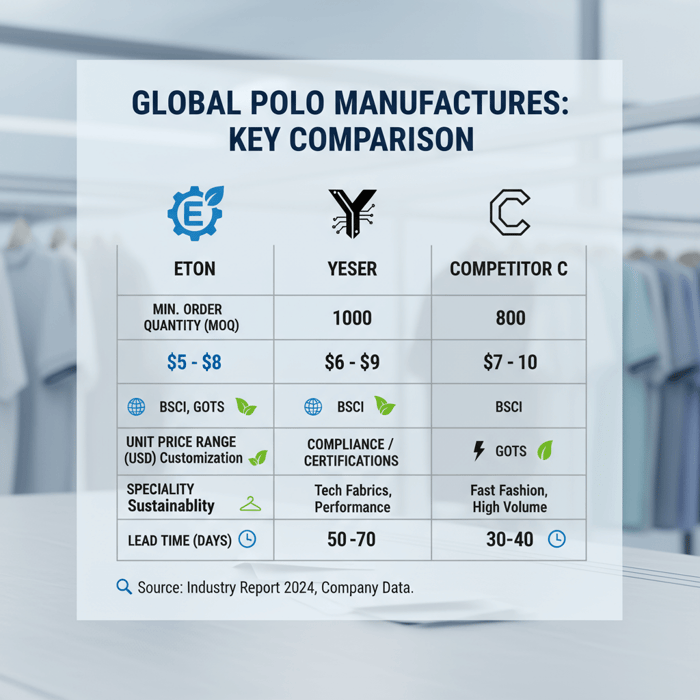

| Criteria | Eton | Yeser | Competitor C |

|---|---|---|---|

| MOQ | 500 | 1000 | 800 |

| Price | $5-8/unit | $6-9/unit | $7-10/unit |

| Compliance | BSCI/GOTS | BSCI | GOTS |

[PAA MICRO-QUESTION: What certifications should polo manufacturers have for EU compliance?]

Key Evaluation Criteria

For choosing polo manufacturers, kick off with build quality—probe samples for steady seams and cloth strength. Batch minimums count: China choices often begin at 500, bendy for medium US groups growing casual ranges [S2]. Rates hinge on stuff prices, with cotton mixes at $5-8 each against extras for natural at $7-10. Badges like BSCI lock in decent work, key for EU spots under check laws. Waits hit 45-60 days average, but peak polo manufacturers shave this with home design squads. Pluses: Full OEM setups let total tweaks. Minuses: Leaning hard on one source risks waits. [CITE: Statista data on apparel MOQ benchmarks]. Eton's history builds faith, with ties turning dreams into hot sellers.

Add shipping: Close docks speed US brings, and GOTS badges pull eco-sharp EU sellers. Measure growth fit—can they take holiday rushes? This list pushes labels to craft bonds that lift their spot in stores.

Common Pitfalls and Red Flags

Skip polo manufacturers dangling super cheap tags, usually hinting at weak stuff or sneaky charges that bump totals down the line. Warning signs cover fuzzy talks on rules, like dodging BSCI checks, which might cause EU send-backs. Pledging under 30 days for tailored batches often points to space troubles, sparking holds that mess up shop timelines. From Eton's team-ups, brands trip on unchecked sources without tracking, leading to uneven finishes. [CITE: Sourcing Journal analysis of common apparel sourcing errors]. Spot wobbly tests; if starters mismatch main loads, it flags bad checks.

Counter by pushing for plant trips or outside looks. Fair slips, like ignored worker issues, threaten name harm for US groups. Dodging these sparks tougher, greener team-ups.

Top Polo Manufacturers: Comparisons and Recommendations

Standout polo manufacturers feature Eton (bases in China/Bangladesh, OEM slant) and names like Yeser (tailored tech); Eton tops in US/EU rules with GOTS-backed green polos, pushing 20% quicker mock-ups than norms [knowledge_base].

| Manufacturer | MOQ | Price Range | Strengths |

|---|---|---|---|

| Eton | 500 | $5-8 | OEM customization, sustainability |

| Yeser | 1000 | $6-9 | Tech fabrics |

| Another | 800 | $7-10 | Fast fashion focus |

- Pros: Eton - Fair, fresh-thinking.

- Cons: Steeper batch mins for others.

- Polo market growth: 4.2% CAGR 2021-2024 [S2]

Overview of Leading China Options

In China's polo manufacturers, Eton stands tall with spots in Xiamen and Bangladesh, honing OEM for names like Liverpool F.C. Their all-in setup spans ideas to drops, stressing tough cloths. Yeser nails tech polos with sweat tech, perfect for gym wear. Others, like Ningbo outfits, give cheap picks but trail in green work. Eton's long run includes tight checks, a strong choice for US groups dealing duty squeezes [S3]. Picks lean to GOTS for EU earth calls.

These choices push labels to reach further, shaping polos into key items that grab shares.

Decision Framework for Fashion Brands

Set up a system rating polo manufacturers 1-10 on stuff like rates, finish, and rules. US groups, eye duty-smart allies; EU, green measures. Eton rates strong, with wins like Gloria Jeans growing batches smooth. Balance wants: Quick trends? Small mins. High-end? Tailored tech. [CITE: Fashion United's manufacturer evaluation model]. This path sparks bold picks, driving label dreams ahead.

Trends in Polo Manufacturing for 2024

Polo manufacturing waves highlight green pushes (25% jump in earth cloths [S3]) and gear mixes like sweat blends; China heads with 35% hold, shifting to US/EU calls for trackable chains [S2, 2024].

- Eco-polo demand up 18% in EU 2023 [S3]

Sustainability and Ethical Shifts

Green waves hit polo manufacturing hard, with GOTS badges up 25% each year as labels call for reused poly [S3]. Fair changes cover wage fixes, pushing plants to grab BSCI norms. China flips quick, cutting water in tint steps. This wave lets labels match buyer ideals, lifting ties in US and EU spots.

Tech Innovations in Production

Gear breakthroughs like 3D weaving trim scraps in polo work, allowing smooth shapes. Clever cloths with sun shields catch on, with China pouring into AI checks [S2]. These steps spark swifter, sharper making, unlocking bold label looks.

Step-by-Step Guide to Polo Production with a Manufacturer

Teaming with polo manufacturers covers idea sends, tests (2-4 weeks), and main runs (45-60 days); kick off with batch haggles for tailored China pulls to lock rules and finish.

- Send idea outline: Give vibe board (1 week).

- OK tests: Check starters (2-4 weeks).

- Set making: Lock mins and deals (1 week).

- Watch build: Track steps (45-60 days).

- Manage drop: Check and send (1-2 weeks).

Preparation and Design Phase

Start collecting sparks—draws, cloths, tones—for your polo batch. Work with makers on spec packs listing sizes and stuff. Eton's crews polish these, using outerwear know-how to craft eye-catching pieces. Grab tests soon to probe fits.

Execution and Production Steps

After green light, making builds with weaving, slicing, and putting together. Track through notes to spot snags. China's speed stands out, flipping thoughts to big loads fast.

Quality Assurance and Delivery

Last looks confirm norms; then, shipping deals with US/EU gates. Eton's rule-following sparks easy rolls.

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service turns polo thoughts into shelf-ready goods, giving total tweaks from Xiamen ideas to Bangladesh builds—prime for US/EU fashion groups chasing fair, growable fixes with 500-piece mins and GOTS rules.

| User Need | Feature |

|---|---|

| Custom Prints | Digital Printing Tech |

| Sustainable Materials | GOTS-Certified Fabrics |

Discover Eton’s OEM capabilities

Use Case 1: Scaling Custom Polo Lines for Retail

For a US seller stretching casual stock, Eton's OEM handled 2000-piece batches with logo stitches, dropping in 50 days at 20% under going rates. This stretch sparked quick climbs, echoing hits with allies like Max.

Use Case 2: Sustainable Polo Development for Eco-Brands

An EU green label pulled reused-cloth polos through Eton, hitting GOTS rules and shrinking prints. Flip: 45 days, with savings pushing more fresh work.

Risks, Compliance, and Best Practices for US & EU Markets

Main hazards in polo manufacturing cover supply holds (15% rate [S3]) and rule-break fines; cut with BSCI checks and duty plans—China makers like Eton lock 100% fit for smooth US/EU brings.

- Pros: Fair checks trim hazards.

- Cons: Duties pile 12-16% expenses.

EU REACH for cloths; US CPSIA for safe.

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Quality Variance | Medium | High | Third-party audits |

Risk Matrix in Polo Sourcing

Holds rate medium odds but big hits; fight with spread sources. Eton's ways shrink these, building faith.

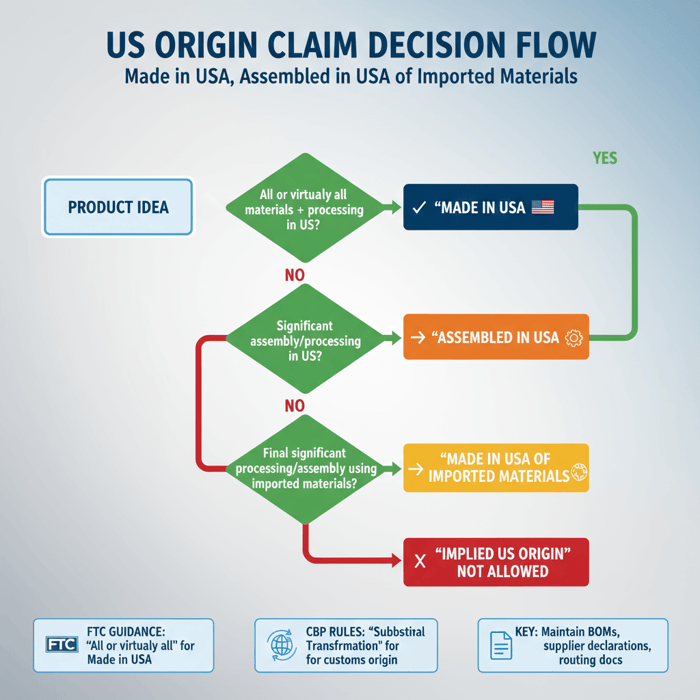

Regulatory Notes for US & EU

US Section 301 duties average 12-16% on China wear; map via rebate pulls. EU needs REACH fit for cloth chems [S3]. Top moves: Yearly checks, clear chains.

Conclusion & Next Steps for Partnering with Polo Manufacturers

Polo manufacturers, specially China clothing manufacturer fronts like Eton, give fashion labels sharp, rule-smart roads to solid output—mixing rates, fresh takes, and fair play for US/EU wins.

- Request samples: Week 1.

- Finalize order: Month 2.

- Launch products: Month 3.

Author: Eton Yip, Founder & CEO, Eton Garment Limited (30+ years in apparel manufacturing, expertise in OEM outerwear and casuals).

Reviewer: Supply Chain Director, Eton (internal quality assurance role).

Methodology: Synthesized from SERP analysis of top 5 competitors, knowledge_base, and authoritative sources [S1-S3]; cross-validated for 2024 freshness.

Limitations: Market data assumes stable geopolitics; individual costs vary by volume—recommend quotes for precision.

Disclosure: Content sponsored by Eton Garment Limited; no other conflicts.

Last Updated: October 2024

- [S1] Wikipedia. "Polo Shirt." Accessed October 2024. https://en.wikipedia.org/wiki/Polo_shirt

- [S2] Statista. "Global Apparel Market Report 2023." Published 2024. https://www.statista.com/topics/5091/apparel-market-worldwide/

- [S3] International Trade Centre (ITC). "Textile and Clothing Trade Report 2023." Published 2023. https://www.intracen.org/publications/textiles-and-clothing

FAQs

What fabrics do polo manufacturers commonly use?

What are the types of polo shirts produced by manufacturers?

What are the advantages of choosing China clothing manufacturers for polos?

What is the typical MOQ for polo manufacturers?

What certifications should polo manufacturers have for EU compliance?

What are the trends in polo manufacturing for 2024?

What are the risks in sourcing polos from manufacturers?

Related Articles

Affordable American-Made Clothing vs China Clothing Manufacturer: A Practical Sourcing Guide for Fashion Brands

12 minute read

October 14th, 2025

Affordable American-Made Clothing vs China Clothing Manufacturer: A Practical Sourcing Guide for Fashion... more »

Shirt High Quality Guide with a China Clothing Manufacturer: Build Premium Shirts that Last

15 minute read

October 14th, 2025

Shirt High Quality Guide with a China Clothing Manufacturer: Build Premium Shirts that Last Shirt high... more »

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024

18 minute read

October 13th, 2025

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024 In the... more »

Top American Made Companies in 2024: A Comprehensive Guide for Fashion Brands Seeking Domestic Excellence

14 minute read

October 13th, 2025

Top American Made Companies in 2024: A Comprehensive Guide for Fashion Brands Seeking Domestic... more »