American Made T Shirts Wholesale: The Buyer’s Guide (and When a China Clothing Manufacturer Is Better)

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 15th, 2025

15 minute read

American Made T Shirts Wholesale: The Buyer’s Guide (and When a China Clothing Manufacturer Is Better)

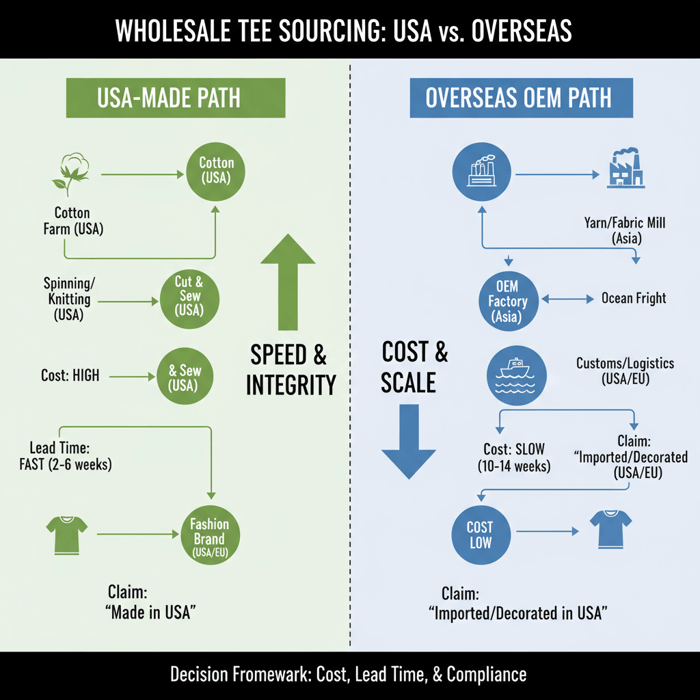

American made t shirts wholesale sourcing gives US/EU fashion brands proximity, claim integrity, and faster logistics, while a seasoned China Clothing Manufacturer can extend capacity, color depth, and cost control when domestic options tighten. This buyer’s guide brings clarity on “Made in USA” rules, supplier selection, landed-cost modeling, and hybrid paths. It reflects three decades of hands-on apparel manufacturing across OEM and ODM programs at Eton Garment Limited—Textile From Day One.

American made t shirts wholesale refers to U.S.-cut-and-sewn blank tees offered in bulk. Confirm FTC-compliant origin claims, compare supplier MOQs, prices, and lead times, then pressure-test capacity, fabric specs, and embellishment. Use a clear decision framework to weigh domestic versus overseas OEM based on cost, assortment breadth, and timelines.

What “American Made T Shirts Wholesale” Really Means (and Compliance Basics)

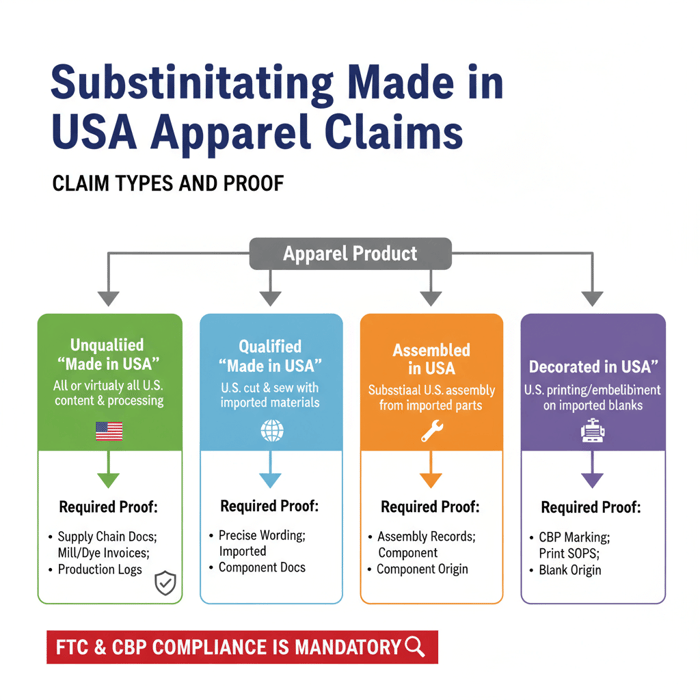

“American made t shirts wholesale” often implies U.S.-cut-and-sewn blank tees available in bulk with B2B terms. To lawfully claim “Made in USA,” apparel must meet the FTC’s “all or virtually all” standard and brands must substantiate the claim with robust documentation. If inputs are imported, consider qualified wording such as “Made in USA with imported fabric” and align CBP country-of-origin marking for any imported components.

Claim types and when to use them

- Unqualified “Made in USA”: All or virtually all significant parts and processing are of U.S. origin; only negligible foreign content acceptable. Requires supply chain proof. [CITE: eCFR, 16 CFR Part 323 — FTC Made in USA Labeling Rule]

- Qualified “Made in USA” (with imported materials): Cut-and-sew in the U.S. with imported yarn/fabric; wording must be precise and non-misleading. [CITE: FTC guidance on qualified claims]

- “Assembled in USA”: Substantial assembly in the U.S. from imported parts; not interchangeable with “Made in USA.” [CITE: FTC policy statements]

- “Decorated in USA on imported blanks”: Printing or embellishment occurs domestically; blank bodies are imported; do not misrepresent final origin. [CITE: CBP origin marking guidance]

- FTC enforcement of “Made in USA” claims is active — brands must substantiate unqualified claims (2024) [CITE: FTC press releases and Part 323 updates].

FTC “Made in USA” Rule for Apparel

The FTC’s Made in USA Labeling Rule codifies the “all or virtually all” benchmark: finished goods described as “Made in USA” must contain no more than negligible foreign content, and the finishing work must occur domestically. For tees, that typically means U.S.-origin yarn-to-fabric-to-cut-and-sew or near-complete domestic transformation. The claim must match the evidence: bills of materials, mill and dye house invoices, production logs, and QC records. [CITE: eCFR 16 CFR Part 323] [MENTION: FTC Bureau of Consumer Protection; National Advertising Division]

Examples help: a tee knit from U.S.-grown cotton, dyed, cut, and sewn in the U.S. is a strong candidate for an unqualified claim. A tee cut and sewn in the U.S. from imported fabric fits a qualified claim like “Made in USA with imported fabric.” Brands should maintain a claims file and refresh it when suppliers, mills, or processes change. [INTERNAL LINK: Compliance-ready labeling guide — editorial resource]

CBP Origin & Marking Intersections

CBP governs origin marking on imported goods. If blanks or fabrics are imported, they must be marked with the country of origin as determined by substantial transformation rules. When blending domestic finishing with imported components, your labeling and marketing must not imply U.S. origin beyond what the FTC allows. The CBP import paperwork, tariff classification, and marking practices should align with your retail label and care tag. [CITE: CBP Informed Compliance Publication — Marking of Country of Origin] [MENTION: U.S. Customs and Border Protection; International Trade Commission]

EU Labeling Notes for US/EU Brands

EU markets generally require care labeling (fiber content, care symbols, size, and producer/importer details) and accurate claims (e.g., “organic” must be substantiated across the chain-of-custody). Country-of-origin claims in the EU must not mislead; certain members have national specifics. For brands exporting from the U.S. to the EU, keep a technical file (fiber certificates, lab tests, safety standards like REACH compliance). Seek local counsel for market-specific rules. [CITE: European Commission consumer product labeling overview] [MENTION: CEN standards; REACH]

Best American-Made Wholesale Tee Suppliers: Comparison + How to Choose

To choose well, score suppliers across claim substantiation, fabric options, assortment depth, embellishment readiness, capacity, sustainability, and service. Validate with samples, shrinkage tests, print adhesion checks, and PO-level terms. Use the matrix below to shortlist two to three partners for pilot orders of american made wholesale t-shirts.

| Supplier | Typical Claim | Fabrics | Colors/Sizes | MOQ | Lead Time | Sustainability | Notes |

|---|---|---|---|---|---|---|---|

| Royal Apparel | Made in USA and qualified variants | Carded, ringspun, blends, organic | Wide core, seasonal expansions | Case packs; programs vary | 2–6 weeks in-stock; 6–10 weeks make-to-order | Organic lines, OEKO-TEX on select items | Wholesale portal; pricing often behind login [CITE: site check] |

| Los Angeles Apparel | Made in USA | Heavyweight cotton, fashion-forward cuts | Strong color palette; fashion fits | By style/color; contact sales | 3–8 weeks typical | Local production; CA labor compliance notes | Good brand story; verify scale and claims file |

| Bayside Apparel | Made in USA; union-made options | Cotton, poly-cotton | Core colors; broad basics | Case pack standards | 2–6 weeks typical | Union programs | Legacy manufacturer; confirm embellishment specs |

| US Blanks | Made in USA | Premium knits; ringspun | Premium fits; curated range | Program-based | 4–10 weeks | Local production focus | Fit quality; check color/size breadth |

| All USA Clothing (wholesale) | Aggregated USA-made | Varies by brand | Wide via aggregation | Varies | Varies | Brand-dependent | Retailer/aggregator; not a manufacturer |

- USA-made programs: stronger claim integrity, proximity, easier replenishment logistics; watch MOQs, unit costs, and color/size limits.

- Aggregators: fast access to many usa made blank t shirts; less control over manufacturing details and QC frameworks.

Scoring Criteria Explained

Weight criteria by launch risk, margin, and brand values. Common weightings: claim substantiation (25%), assortment depth — styles/colors/sizes (20%), fabric and handfeel quality (15%), embellishment readiness (10%), capacity/lead-time reliability (20%), sustainability and certifications (5%), and service terms (5%). Calibrate for private label usa t-shirts that need consistent colorfastness, shrinkage control, and print compatibility. [MENTION: AATCC standards; ISO colorfastness] [INTERNAL LINK: Supplier scoring worksheet — downloadable resource]

Sampling & Validation Protocol

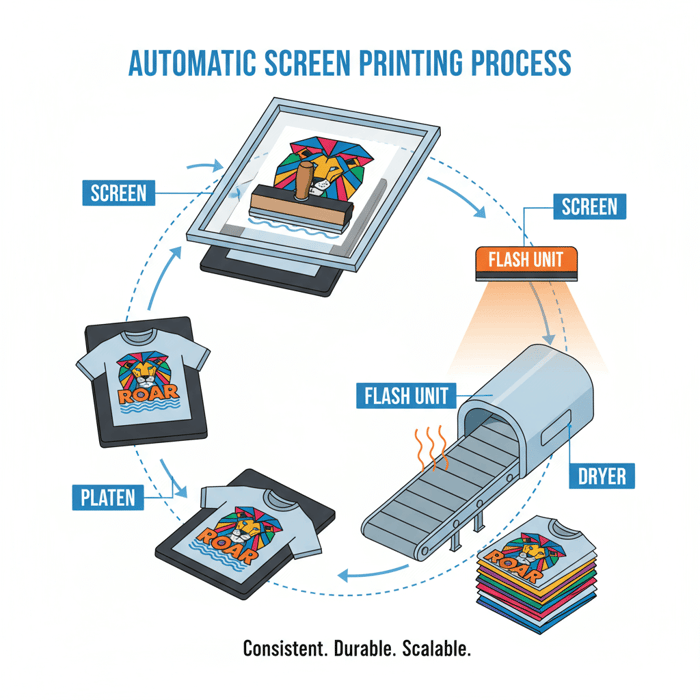

Order color/size representative samples; test shrinkage (wash/dry cycles at standard conditions; target shrinkage ≤4–6% depending on fabric), pilling (Martindale or random tumble; record grades), and colorfastness (to washing, perspiration, light). Screen and DTG print trials validate ink adhesion; verify heat transfer temperatures against fabric. Log measurements (tolerance ±0.5–1.0” by point), stitch density, and seam strength. Run small pilots with AQL levels (e.g., 2.5) before scaling. [CITE: AATCC test methods; ISO 105 series] [MENTION: AATCC; ASTM D4157]

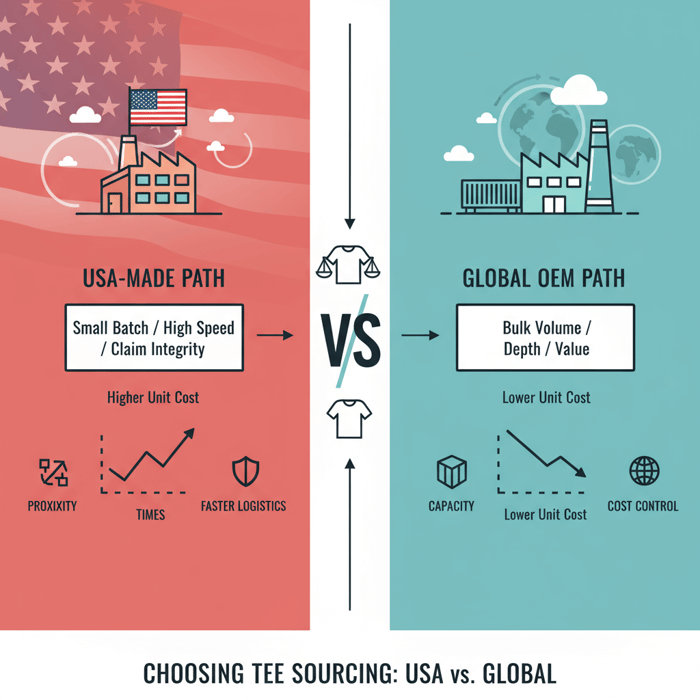

USA vs Overseas: Pricing, MOQs, and Lead Times for Wholesale T-Shirts

Domestic tees often win on speed and simpler logistics; overseas OEM offers lower unit costs, broader color/size matrices, and scalable capacity. Map your forecast (units/styles/colors) to MOQs and build a landed-cost model before committing. This section includes usa vs china t-shirt manufacturing comparisons with realistic ranges.

| Dimension | USA-Made Program | China OEM | Bangladesh OEM |

|---|---|---|---|

| Typical Unit Price (blank) | USD $6–$12+; organic/recycled higher [CITE: supplier price bands] | USD $2.20–$5.50; spec-dependent [CITE: OEM quotes & market ranges] | USD $2.00–$4.50; large runs [CITE: OEM quotes & market ranges] |

| MOQ | Case packs per color/size; 144–1,000+ units per style | 500–3,000+ per color; size runs required | 1,000–5,000+ per color; optimized at scale |

| Lead Time (blank bodies) | 2–10 weeks; faster with in-stock | 6–12 weeks production + transit | 8–14 weeks production + transit |

| Color/Size Depth | Good core; seasonal expansions | Deep at scale; custom dyes | Deep at scale; cost-efficient |

| Customization | Relabeling, limited custom fabrics | Full OEM: fabric, dye, spec | Full OEM: fabric, dye, spec |

| Freight & Duties | Domestic freight; minimal duties | Ocean/air + duties; tariffs vary | Ocean/air + duties; GSP if applicable |

| Risk Profile | Lower freight risk; capacity bottlenecks possible | Longer chain; robust QC needed | Longer chain; robust QC needed |

- Domestic labor costs are higher than typical overseas CMT rates; wage benchmarks for U.S. sewing operators rose versus 2021 (2024) [CITE: BLS OEWS — Sewing Machine Operators].

Building a Landed Cost Model

Break down cost by: fabric/yarn, CMT, trims/labels, embellishment (DTG/screen/heat transfer), packing, freight, duties/tariffs, QC, and expected rejects. Add overheads (artwork, tech packs, compliance, lab tests). For decorated in usa on imported blanks, model blank costs and domestic print costs separately. Compare unit economics against MSRP and margin targets. [CITE: Trade tariff schedules; carrier rate indices] [MENTION: CBP; ICC Incoterms]

Lead-Time Drivers and Buffers

Lead times hinge on fabric knitting/dye queues, seasonal demand, capacity allocation, and logistics. USA-made restocks move faster with domestic freight. OEM timelines depend on mill schedules, dye capacity, and port conditions. Build buffers: sample sign-offs, PP approvals, fabric lab dips, and print tests. Create calendar gates and book capacity early for peak seasons. [CITE: Port performance reports; logistics advisories] [MENTION: PIERS data; major ocean carriers]

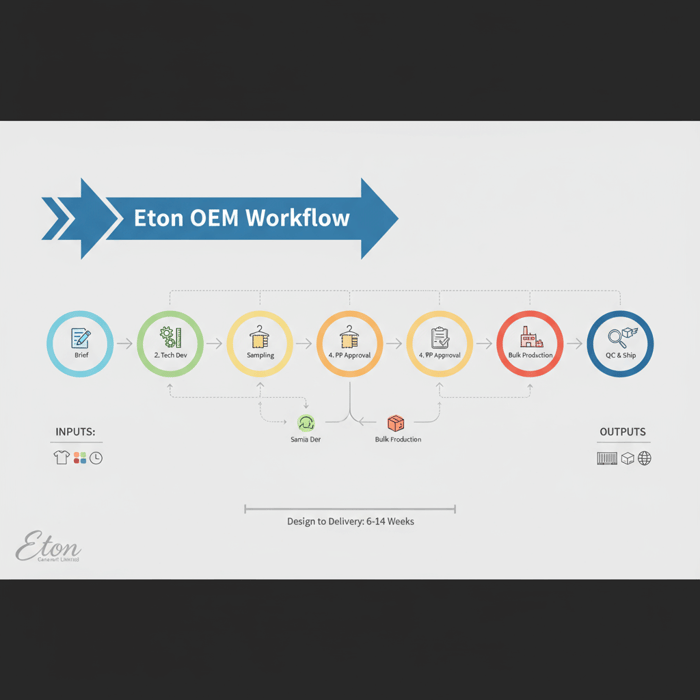

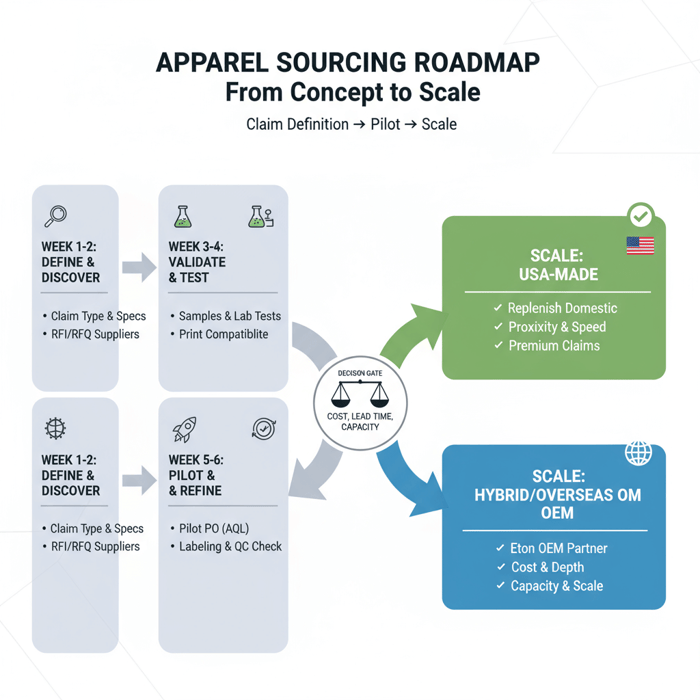

How to Source American-Made Wholesale Tees: Step-by-Step

Follow a structured workflow: define your claim, spec, and volume forecast; run an RFI/RFQ; validate samples and compliance; pilot; then scale. Bake QC gates and replenishment plans into your calendar to protect timelines for wholesale made in usa apparel.

- Define claim type, spec, and volume forecast — Choose “Made in USA,” qualified, or “Decorated in USA on imported blanks.” Document BOM and evidence.

- RFI/RFQ using a criteria matrix — Request proof of origin, fabric specs, capacity, MOQs, price tiers, and embellishment terms.

- Samples + lab/fit tests — Wash/shrinkage, colorfastness, pilling, print adhesion; log measurements and tolerances.

- Contracting — SLAs, QC gates, AQL levels, claims language, replenishment terms, and penalties for missed timelines.

- Pilot run — Validate real-world QC, embellishment outcomes, and packing/label compliance; confirm carton markings.

- Scale-up & replenishment — Book capacity blocks, align color buys, and set reorder cadences.

Specs That Matter (Fabric weight, shrinkage, fits)

Set fabric weights by market: 150–180 gsm for lightweight basics; 180–220 gsm for classic tees; 220–260 gsm for heavyweight. Convert oz/yd² to gsm consistently in tech packs. Specify ringspun vs carded cotton (handfeel, strength, printability), yarn count, knit structure, and finishing (enzyme wash, silicon softener). Define fit blocks and tolerances; pre-wash measures for shrinkage planning on private label usa t-shirts. [CITE: Textile engineering references] [MENTION: Cotton Incorporated; ASTM standards]

QC & Testing Plan

Adopt AQL 2.5 or 4.0 by product tier. Test colorfastness to washing and perspiration (AATCC TM 61, TM 15), dimensional change (AATCC TM 135), pilling (ASTM D3511/D4970), and seam strength (ASTM D1683). For printing: screen inks cure tests, DTG wash durability, heat transfer temperature/time windows. Keep QC logs and defect paretos to tighten repeatability on us made blanks for printing. [CITE: AATCC/ASTM test methods] [MENTION: SGS; Intertek]

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

When U.S. suppliers cannot meet cost, color/size depth, or capacity, Eton’s Clothing Manufacturing OEM Service delivers scalable programs with rigorous QC, ethical compliance, and technical development. Consider hybrid models that combine imported bodies with U.S. embellishment to balance claim integrity, speed, and margin.

| Need | Eton Capability | Outcome |

|---|---|---|

| Large color/size matrix | Fabric mill network + dye capacity | Depth at scale with consistent shade control |

| Tighter budgets | Optimized BOM + efficient CMT | Lower unit costs with protected quality |

| Technical specs | Patterning + lab tests; functional finishing | Performance fit/finish and reliable shrinkage |

| Fast market drops | Parallel sampling/production | Shorter calendars from brief to bulk |

Explore the Clothing Manufacturing OEM Service at Eton’s garment factory to build custom tee programs or hybrid models that keep claims and economics aligned across US & EU. [INTERNAL LINK: Eton garment factory and OEM services — https://china-clothing-manufacturer.com/garment-factory/]

When to Switch or Split Production

Trigger points: volume step-ups that outstrip domestic capacity, missed restocks risking retail calendars, and margin compression from material/finishing upgrades. Split production when basics run overseas efficiently while premium or time-sensitive capsules stay domestic. Keep claim clarity by product family and maintain separate claims files. [CITE: Retail calendar case studies] [MENTION: NRF seasonal calendars]

Hybrid Model Playbook

Use imported blank bodies with U.S. printing/finishing for speed and margin balance. Wording: “Decorated in USA on imported blanks” or “Printed in USA using imported garments.” Ensure CBP origin marking on imported bodies and align care labels. Keep embellishment SOPs and lab tests in your claims file to validate durability. [CITE: FTC marketing guide; CBP marking rules]

Risks, Compliance & Localization

Mitigate risk by maintaining a claims file (BOMs, invoices, process maps), QC logs, and contracts with supplier attestations. Add EU label specifics for exports and state-level notes where applicable. For union made t shirts wholesale or organic cotton usa t-shirts wholesale, track certification scopes and chain-of-custody documents.

- Pros (USA-made): proximity, simpler logistics, stronger claim controls.

- Cons (USA-made): higher unit costs, limited assortment breadth at scale.

- Pros (overseas): scale, deeper color/size matrices, cost advantages.

- Cons (overseas): longer lead times, duties/tariffs, complex QC management.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Claim non-compliance | Medium | High | Maintain claims file; legal review; supplier attestations |

| Shrinkage beyond spec | Medium | Medium | Lab tests; pre-wash measures; adjust size specs |

| Color variance across lots | Medium | Medium | Shade band approvals; lot tracking; mill capacity booking |

| Capacity bottlenecks | Medium | High | Early bookings; dual-supplier strategy; buffer weeks |

| Freight delays | Medium | High | Flexible routing; domestic embellishment; air freight contingency |

Regulatory Notes for US & EU

US: The FTC’s Made in USA Rule governs claims; CBP handles origin marking for imports. CA-specific rules under SB62 address wage and manufacturer liability. EU: observe REACH chemical safety, fiber content labeling, and market-specific care labeling standards. For OEKO-TEX Standard 100 and GOTS claims, retain lab and scope certificates that match product runs. [CITE: eCFR Part 323; CBP origin marking; CA SB62; OEKO-TEX; GOTS] [MENTION: California DIR; European Commission]

Data & Trends: Demand for USA-Made Basics and Domestic Capacity

Consumer interest in domestic and responsibly made basics remains resilient, yet domestic cut-and-sew capacity is finite and labor costs trend upward. Balance values with viable unit economics and calendar realities when scoping wholesale programs for made in usa t-shirt suppliers.

- U.S. sewing machine operator wages increased versus 2021 baseline (2024) [CITE: BLS OEWS].

- Domestic textile investment has pockets of growth, but capacity remains uneven by region [CITE: NCTO industry report].

Key Trend 1: Capacity Constraints

Domestic mills and cut-and-sew shops prioritize existing accounts and peak seasons. Color lab dips, dye schedules, and knitting queues exert real lead-time pressure. Brands succeed by booking capacity early, standardizing fabrics, and aligning calendars to retail drops. [MENTION: NCTO; regional textile councils] [CITE: Industry capacity briefings]

Key Trend 2: Value-Driven Demand

Story-driven products—union programs, organic cotton usa t-shirts wholesale, and recycled blends—hold share with specific audiences. Maintain transparency: publish claim types, share lab results, and explain embellishment methods. Use clear labels and origin wording to sustain trust while scaling assortment. [CITE: Consumer surveys on domestic preference] [MENTION: Sustainable Apparel Coalition; Higg indices]

Conclusion & Next Steps

Decide with evidence: confirm your origin claim, score suppliers against your launch risks and margins, pilot with robust QC, and compare USA-made versus overseas programs with a landed-cost and lead-time model. Where capacity, color depth, or budgets stretch domestic limits, partner with a China Clothing Manufacturer for scale and keep claims transparent by product line.

- Week 1–2: Define claims/specs; send RFI to made in usa t-shirt suppliers.

- Week 3–4: Sampling and tests; validate print compatibility.

- Week 5–6: Pilot PO with AQL and clear labeling.

- Week 7+: Scale domestically or split using hybrid or overseas OEM.

Start a detailed OEM brief with Eton’s garment factory to scope costs, color depth, and timelines for wholesale programs. [INTERNAL LINK: China Clothing Manufacturer home — https://china-clothing-manufacturer.com/] [INTERNAL LINK: OEM vs ODM guide — editorial resource]

Author: Eton Garment Technical Team (30+ years in apparel manufacturing, OEM/ODM outerwear and performance wear). Reviewer: Compliance Lead, Eton Garment Limited. Methodology: Knowledge base + competitor pattern analysis; primary-source regulations (FTC/CBP); industry data (BLS/NCTO); first-hand OEM experience. Limitations: No live SERP crawl; statistics needing exact figures are marked via [CITE]; regulatory notes are high-level and not legal advice. Disclosure: Eton provides overseas OEM manufacturing services.

- FTC — Made in USA Labeling Rule (16 CFR Part 323) (2024). https://www.ecfr.gov

- CBP — Informed Compliance Publication: Marking of Country of Origin (latest rev.). https://www.cbp.gov

- California DIR — Garment Worker Protection (SB62) and Labor Code Updates (2022–2024). https://www.dir.ca.gov

- OEKO-TEX — Standard 100: 2024 Updates. https://www.oeko-tex.com

- GOTS — Global Organic Textile Standard v7.0 (2023). https://global-standard.org

- BLS — Occupational Employment and Wage Statistics: Sewing Machine Operators, May 2024. https://www.bls.gov

- NCTO — State of the U.S. Textile Industry 2024. https://www.ncto.org

- AATCC — Test Methods (Colorfastness, Shrinkage). https://www.aatcc.org

- ASTM — Textile Test Methods (Seam Strength, Pilling). https://www.astm.org

- European Commission — Consumer Product & Textile Labeling Guidance. https://commission.europa.eu

FAQs

What is the Made in USA labeling rule for apparel, and how does it apply to American made t shirts wholesale?

When should brands use qualified Made in USA claims with imported fabric for wholesale t-shirts?

What does Decorated in USA on imported blanks mean for t-shirt labeling and marketing?

How does CBP origin marking for t-shirts interact with Made in USA claims?

Who are the leading USA-made wholesale tee suppliers, and how should brands compare them?

What should brands know about private label usa t-shirts and consistent quality?

How do USA vs China t-shirt manufacturing programs compare on price, choice, and timelines?

What is a realistic MOQ for wholesale t-shirts, and how does it vary by supplier type?

What lead time should brands expect for USA-made tees compared to imported OEM programs?

How do you build a landed cost model for t-shirts to compare USA and overseas programs?

What is the AATCC shrinkage test for tees, and what targets should brands set?

What AQL levels should be used for apparel QC in wholesale t-shirt programs?

What is the difference between ringspun vs carded cotton for t-shirts, and how does it affect printability?

How should brands specify fabric weight gsm vs oz/yd² for tees to ensure consistency?

How does a hybrid model—imported blanks with U.S. printing—balance cost, speed, and claims?

Grouped: What do OEKO-TEX Standard 100 and GOTS certification mean for tees, and when should each be used?

What should brands know about SB62 California garment manufacturing compliance for wholesale tees?

What REACH compliance considerations apply to apparel exports to the EU, including wholesale t-shirts?

Related Articles

Screenprint T Shirts: A Fashion Brand’s Guide to Sourcing at Scale with a China Clothing Manufacturer

19 minute read

October 15th, 2025

Screenprint T Shirts: A Fashion Brand’s Guide to Sourcing at Scale with a China Clothing... more »

Chinese dress shop vs China clothing manufacturer: how brands move from retail inspiration to scalable OEM/ODM

10 minute read

October 15th, 2025

Chinese dress shop vs China clothing manufacturer: how brands move from retail inspiration to scalable... more »

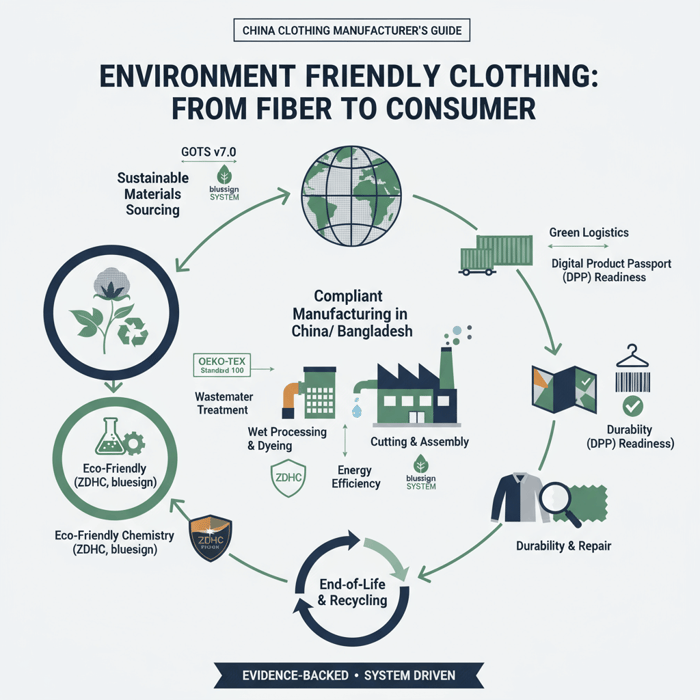

Environment Friendly Clothing: A China Clothing Manufacturer’s Guide for US & EU Fashion Brands

18 minute read

October 14th, 2025

Environment Friendly Clothing: A China Clothing Manufacturer’s Guide for US & EU Fashion... more »

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU Markets

11 minute read

October 14th, 2025

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU... more »