Wholesale Heavyweight Hoodies: A China Clothing Manufacturer’s Sourcing & OEM Guide

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

16 minute read

Wholesale Heavyweight Hoodies: A China Clothing Manufacturer’s Sourcing & OEM Guide

Wholesale heavyweight hoodies demand clear specifications and disciplined execution with a China Clothing Manufacturer that understands fleece, compliance, and timelines. Eton Garment Limited blends 30+ years of outerwear know-how with OEM/ODM capability in China and Bangladesh to help US/EU brands build durable, premium fleece programs from brief to bulk.

Wholesale heavyweight hoodies typically run 380–500 GSM (≈11–15 oz/yd²), in ring-spun cotton or cotton/poly fleece. Expect MOQs of 300–1,000 per style, 45–75 days production, and 15–35 days ocean transit to US/EU. Choose region by cost, customization, and compliance (e.g., OEKO-TEX, REACH) requirements; align tests for shrinkage, pilling, and colorfastness.

Wholesale Heavyweight Hoodies: What “Heavyweight” Really Means (GSM, oz, and Build)

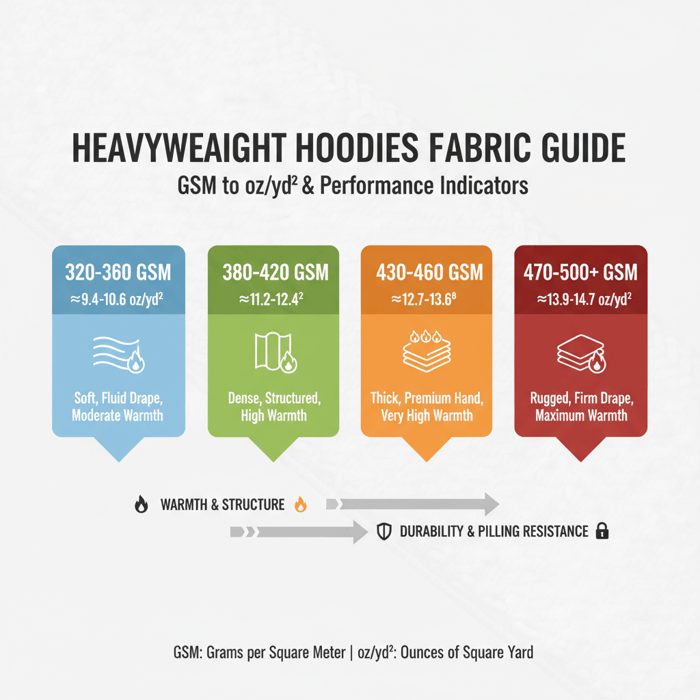

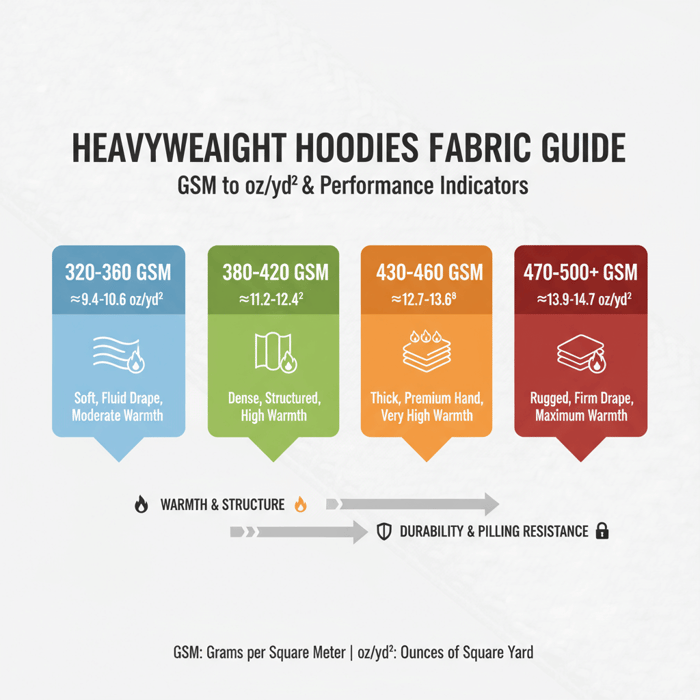

Heavyweight hoodies start near 380 GSM and stretch to 450–500 GSM for premium warmth and structure. Performance hinges on fiber blend, fleece type, stitch density, and trim quality; higher GSM alone does not guarantee better handfeel or durability. Balance warmth, drape, shrinkage behavior, and cost to hit your market’s target.

In fleece, weight is only one lever. Yarn choice (open-end vs ring-spun vs combed), brushing intensity, rib GSM, and lining decisions change drape, shrinkage, and pilling. For US/EU retail, brands often target 400–460 GSM for a dense, premium hand without over-stiffness. Is 450 GSM considered heavyweight for US/EU? Yes—450 GSM sits at the upper end of heavyweight and pairs well with higher stitch densities for long-term shape retention.

| GSM | Approx oz/yd² | Handfeel | Warmth | Drape | Shrinkage Tendency | Common Compositions |

|---|---|---|---|---|---|---|

| 320–360 (upper midweight) | 9.4–10.6 | Soft, flexible | Moderate | Fluid | Lower; monitor wash | 80/20 cotton/poly; 100% cotton loopback |

| 380–420 (entry heavyweight) | 11.2–12.4 | Dense, substantial | High | Structured | Moderate; control with preshrink | 70/30 or 80/20 cotton/poly; ring-spun cotton |

| 430–460 (core heavyweight) | 12.7–13.6 | Thick, premium hand | Very high | More rigid | Higher; manage pattern shrink allowances | 80/20 cotton/poly; 100% cotton brushed fleece |

| 470–500+ (ultra heavyweight) | 13.9–14.7+ | Very dense, rugged | Maximum | Firm; less drape | Highest; strict process control | Cotton-rich with heavy rib; reinforced trims |

[CITE: A recognized textile engineering handbook explaining GSM-to-oz conversions] [MENTION: AATCC test methods] [MENTION: ISO standards for textile testing] [INTERNAL LINK: Outerwear OEM & Technical Apparel pillar page—contextual link for “technical apparel development”]

Fleece Types and Fibers (Brushed vs French Terry; Cotton vs Cotton/Poly)

Brushed back fleece traps air for warmth and plush comfort—ideal for winter-heavy programs. French terry (loopback) breathes better and resists heat buildup, suited to transitional seasons and sport/lifestyle crossovers. Cotton-rich blends deliver soft hand and strong pigment uptake; polyester adds shape retention and pilling resistance. For abrasion-heavy use, 70/30 cotton/poly with ring-spun cotton balances softness with durability; for handfeel-first positioning, 100% ring-spun cotton with enzyme finishing creates a smooth face for print.

Fiber quality shapes durability more than raw GSM. Ring-spun or combed cotton yields a cleaner surface and tighter pilling profile than open-end yarns at the same weight. Recycled polyester (GRS-certified) can replace virgin poly in blends without compromising hand when yarn quality is well controlled. Plan for matching rib composition (often cotton/poly with elastane) to maintain recovery on cuffs and hem.

[CITE: Textile Exchange report on recycled polyester market adoption] [MENTION: Textile Exchange] [MENTION: OEKO-TEX Association] [INTERNAL LINK: Our foundational guide on “fabric sourcing for performance outerwear”—contextual anchor]

Construction Details That Matter (Stitches, Rib, Trims)

Stitch density and seam architecture carry heavyweight fleece. Aim for 10–12 SPI on lockstitch and robust 4–5 thread overlock at stress points; add bar-tacks at pocket openings and under the hood drawcord channel. Match rib GSM (e.g., 420–500 GSM for ultra-heavy bodies) and test recovery after wash. Hardware choices affect perceived quality and lifetime: branded zippers (YKK, SBS), ring-spun drawcords with metal aglets, reinforced eyelets, and clean tape finishes around neckline and zips. Use reactive or VAT dyes on cotton-rich bodies to improve colorfastness; for darks and team colors, set clear crocking and perspiration fastness targets.

[CITE: An apparel engineering text on stitch density and seam strength] [MENTION: YKK] [MENTION: SBS Zipper] [INTERNAL LINK: Our garment engineering checklist—contextual link for “stitch density targets”]

Sourcing Wholesale Heavyweight Hoodies: Price, MOQ, and Lead Times by Region

Plan MOQs of 300–1,000 per style for OEM heavyweight hoodies, with FOB price bands driven by GSM, yarn grade, dye/finish, trims, and tests. Expect 45–75 days for production after approvals; add 15–35 days for ocean freight to US/EU. Air freight shortens transit to 3–7 days with higher cost per unit.

| Region | Typical MOQ | Indicative FOB (USD) | Production Lead Time | Ocean Transit to US/EU | Customization Flexibility |

|---|---|---|---|---|---|

| China | 300–800/style | $9–$18 (380–460 GSM) | 45–65 days | US: 15–25 days; EU: 25–35 days | High (trims, dye methods, small batch colorways) |

| Bangladesh | 800–2,000/style | $8–$16 (scale-sensitive) | 55–75 days | US: 20–30 days; EU: 18–28 days | Medium–High (best for scale programs) |

| US/EU | 50–300 (blank relabel); 200–500 (cut/sew) | $18–$35+ (labor and overhead) | 25–45 days (cut/sew); stock blanks faster | In-region distribution | Medium (fewer mills; faster logistics) |

- OEKO-TEX Standard 100 materials reduce risk of restricted chemicals in finished goods — 2024 [S1] [CITE: OEKO-TEX Standard 100 official page]

- REACH compliance is required for apparel entering the EU market — 2024 [S2] [CITE: ECHA REACH overview page]

Price sensitivity by blend: 100% ring-spun cotton bodies generally carry a premium over 70/30 cotton/poly due to yarn cost and dye uptake profile; recycled polyester content may add $0.20–$0.60 per unit depending on certification and fiber source. Custom-dyed rib and dyed-to-match drawcords can trigger sub-MOQ fees or higher MOQs for trims.

[CITE: A recognized apparel sourcing cost benchmark report, 2023–2025] [MENTION: WRAP] [MENTION: Amfori BSCI] [INTERNAL LINK: Garment Factory conversion page—contextual anchor “request a quote and lead-time plan”]

Cost Drivers Explained (Fabric, Trim, Dye/Print, Compliance)

- Fabric: GSM, yarn grade (ring-spun/combed), recycled content, and finishing (+$1.00–$4.00 per unit swing across 380 vs 460 GSM).

- Trims: Branded zippers, metal aglets, dyed-to-match rib/drawcords, woven labels (+$0.30–$1.50 per unit).

- Dye/Print: Reactive dye, garment dye, pigment dye; screen print vs DTG vs embroidery (+$0.50–$3.00 per unit; garment dye impacts lead-time and shrinkage).

- Compliance & Testing: OEKO-TEX-certified inputs, REACH screening, lab tests (pilling, shrinkage, colorfastness) (+$0.10–$0.50 per unit depending on volume).

- Packaging: Retail poly alternatives, recycled cartons, branded stickers/inserts (+$0.15–$0.60 per unit).

[CITE: A dyeing/finishing cost analysis from a textile finishing authority] [MENTION: AATCC] [MENTION: SGS or Intertek for testing services] [INTERNAL LINK: Our “trim and hardware playbook” page—contextual anchor]

Timeline Planning (Sampling → Bulk → Shipment)

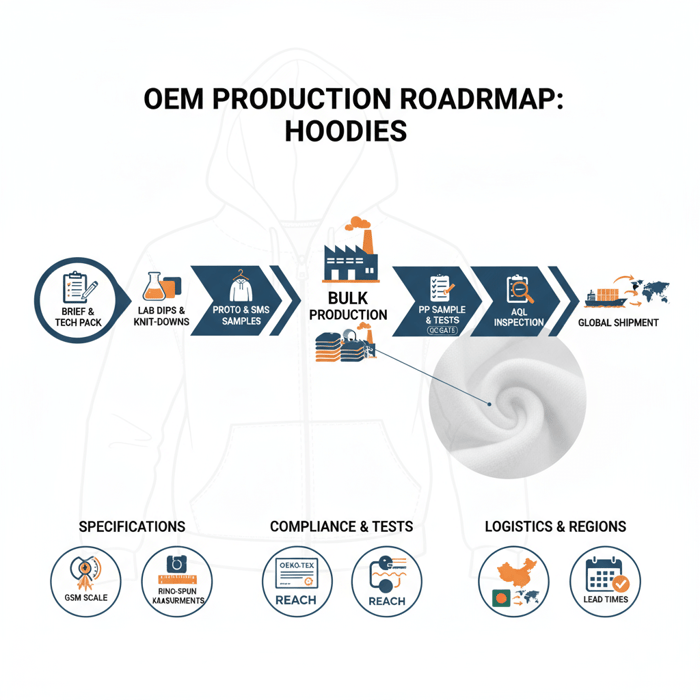

- Brief & Tech Pack: 3–7 days — confirm GSM, fit block, trims, and color standards.

- Material Development: 7–14 days — lab dips, knit-downs, and rib matching (allow re-dips for darks/reds).

- Proto/SMS Samples: 10–20 days — fit approval; refine stitch density and rib recovery.

- Pre-Production (PP) Sample & Tests: 7–14 days — shrinkage ≤5%, pilling ≥3.5, colorfastness ≥4.

- Bulk Production: 45–65 days — dependent on GSM, dye house load, holiday calendars.

- Logistics & Clearance: 3–7 days air or 15–35 days ocean to US/EU, plus customs.

Buffer for holidays and peak dye-house loads. Build an approval calendar for lab dips, PP samples, and test reports to avoid idle time on the line.

[CITE: Ocean transit benchmarks from an international freight index] [MENTION: Freightos] [MENTION: Maersk] [INTERNAL LINK: Calendar of “China & Bangladesh holiday closures” article—contextual link]

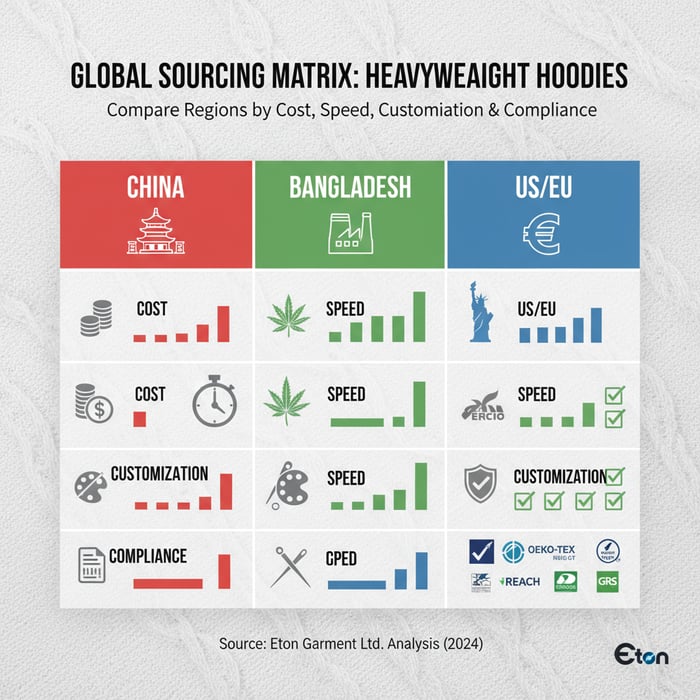

Wholesale Heavyweight Hoodies Suppliers Compared: China vs Bangladesh vs US/EU

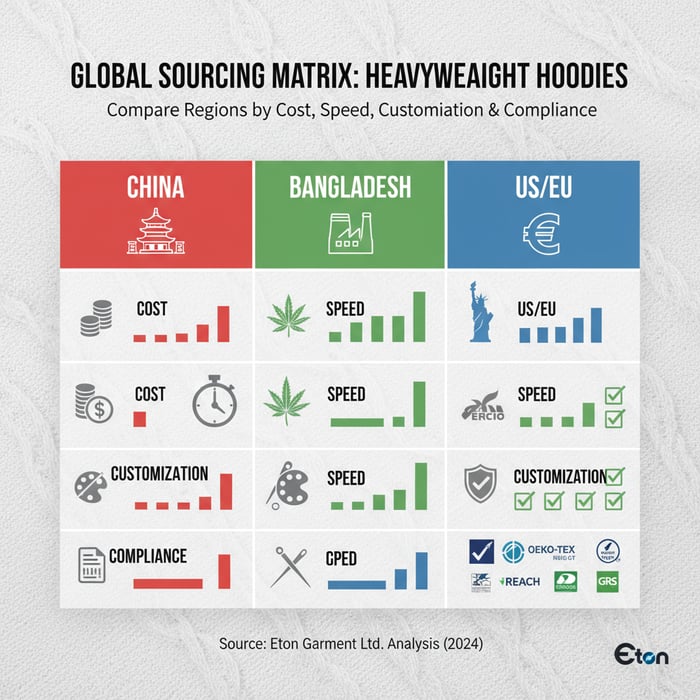

China provides broad customization and faster development; Bangladesh shines on scale economics and consistent bulk; US/EU offers proximity and premium compliance familiarity at higher price points. Select by spec complexity, budget, and calendar—and overlay certifications, recycled content goals, and traceability requirements.

| Region | Strengths | Watch-outs |

|---|---|---|

| China | Flexible MOQs, trim diversity, rapid sampling, reliable mid–high spec | Higher labor than low-cost bases; peak-season capacity tightness |

| Bangladesh | Competitive FOBs at volume, established fleece supply chains, strong compliance ecosystem | Higher MOQs; development speed slightly slower; plan for early bookings |

| US/EU | Proximity, simplified logistics, strong familiarity with local compliance | FOB premiums; fewer mills for custom fleece; limited dye/finish options at small runs |

- Recycled polyester adoption has increased in global programs — 2024 [S4] [CITE: Textile Exchange PFMR 2024]

[CITE: A 2024 sourcing risk report covering regional lead-times and resilience] [MENTION: Sedex] [MENTION: WRAP] [INTERNAL LINK: Case study on “scaling fleece programs across China and Bangladesh”—contextual link]

Criteria Overview (Cost, Speed, Customization, Compliance, Sustainability)

- Cost: Yarn grade, GSM, trims, and scale (FOB spread widens at high GSM).

- Speed: Proto lead-time, dye-house capacity, freight reliability, rework cycles.

- Customization: Yarn/fabric availability, rib matching, special washes, hardware.

- Compliance: OEKO-TEX, REACH, RSL screening, factory audits (WRAP, BSCI, SMETA).

- Sustainability: Recycled content (GRS), traceability, energy/water footprints, packaging.

Decision Framework (Weighting and Shortlist Method)

- Define targets: FOB band, MOQ, calendar anchors (launch dates), and certification needs.

- Weight criteria (e.g., Cost 30%, Speed 25%, Customization 20%, Compliance 15%, Sustainability 10%).

- Score 2–3 suppliers per region against spec complexity and timeline risk.

- Request proto and trim boards; compare stitch density, rib recovery, and lab dip accuracy.

- Run a PP sample bake-off with standardized tests; award capacity with clear quality gates.

[CITE: A standardized supplier evaluation framework reference] [MENTION: ISO 9001] [MENTION: Amfori BSCI] [INTERNAL LINK: Downloadable “supplier scoring template”—contextual anchor]

How to Brief and Develop Heavyweight Hoodies (OEM Workflow & Tech Pack)

A precise brief cuts weeks off development. Specify GSM range, fleece structure, fit block, stitch density, rib specs, trims, branding, and color standards. Build a tech pack with graded measurements and tolerances; approve proto, PP sample, and tests before bulk to control shrinkage, pilling, and color variance.

- Brief: GSM/oz, fit intent, use case, compliance targets, budget bands.

- Tech Pack: BOM, measurements, tolerances, stitch diagrams, branding placements, labels.

- Materials: Lab dips, knit-downs, rib matching, trim boards, test method alignment.

- Prototyping: Fit sample; refine measurements, rib recovery, hood shape, pocket entry stress points.

- Pre-Production: PP sample with sealed measurements, trims, tests; production plan sign-off.

- Bulk & QC: Inline checks on SPI, bar-tacks, rib recovery; final AQL and test report pack.

[CITE: A tech-pack best practices guide from a recognized apparel resource] [MENTION: Gerber or CLO 3D for patterning] [MENTION: ASTM/AATCC standards] [INTERNAL LINK: Eton’s “tech pack essentials” resource—contextual link]

Preparation (Spec, Fit, Materials, Compliance Targets)

- Measurements: Base size chart with POMs; tolerances (±0.5–1.0 cm core points).

- Fabric: 380–500 GSM, brushed or terry; yarn type; preshrink process; rib GSM and elastane content.

- Stitching: SPI targets; bar-tack list; seam binding/taping in high-friction zones.

- Trims: Zipper brand/teeth, drawcords, eyelets, aglets, labels, care tags.

- Colors: Pantone refs; lab dip approval pathway; dark color crocking thresholds.

- Compliance: OEKO-TEX inputs, REACH alignment, RSL acceptance, factory audit status.

[CITE: Pantone color management whitepaper] [MENTION: Pantone] [MENTION: Intertek] [INTERNAL LINK: “RSL policy template” page—contextual link]

Execution Steps (Sampling → PP Sample → Bulk)

- Proto: Fit and construction review; go/no-go on body and rib GSM, stitch density, pocket strength.

- Sizing set: Verify grade rules; confirm sleeve and body balance after wash.

- PP Sample: Complete BOM and final branding; pass shrinkage, pilling, colorfastness; seal sample.

- TOP Approval: Random samples from bulk start; confirm measurements, trims, print/embroidery quality.

- Inline & Final: AQL inspections; carton quality; labeling and carton markings per destination.

[CITE: AQL inspection standard reference (e.g., ANSI/ASQ Z1.4)] [MENTION: SGS] [MENTION: Bureau Veritas] [INTERNAL LINK: “AQL plan for fleece” article—contextual link]

Quality Assurance (Shrinkage, Pilling, Colorfastness, Labeling)

- Shrinkage: ≤5% after wash per ISO 6330 or AATCC 135; pattern allowances baked into grading.

- Pilling: ≥3.5 on ISO 12945-2/Martindale or ASTM D3512 where relevant.

- Colorfastness: ≥4 to washing, crocking, and perspiration per AATCC/ISO methods.

- Labeling: FTC care labeling (US), fiber content by weight, RN where applicable; EU textile labeling rules for fiber names and languages.

[CITE: ISO 6330 domestic washing standard] [CITE: AATCC 135/61 colorfastness tests] [CITE: FTC Care Labeling Rule] [MENTION: ECHA] [INTERNAL LINK: “Test method matrix for fleece” page—contextual link]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service spans design, fabric sourcing, sampling, bulk production, and compliance for heavyweight hoodies. Teams set GSM/oz targets, trims, and test protocols up front to hit US/EU standards with predictable timelines and cost control across China and Bangladesh facilities.

| Brand Need | OEM Feature | Outcome |

|---|---|---|

| Premium hand and durability | Ring-spun yarn sourcing; stitch density targets; rib recovery tests | Dense feel with shape retention |

| Compliance for US/EU | OEKO-TEX inputs; REACH-aligned RSL; FTC/EU labeling setup | Lower regulatory risk; clean customs clearance |

| Color fidelity and fastness | Lab dips, garment testing; acceptance ≥4 fastness | Accurate color in bulk with fewer chargebacks |

| Speed with control | Dual-region capacity; early PP sample gates | Calendar reliability with scale options |

| Sustainability targets | GRS recycled poly, traceable cotton options | Aligned with retailer programs and claims |

Eton standardizes fleece QC with shrinkage and pilling tests before PP approval and runs inline AQL to protect measurements and stitch density on the line.

Explore the Clothing Manufacturing OEM Service for heavyweight hoodies and related technical fleece programs. [INTERNAL LINK: Garment Factory conversion page—CTA link for “start your program”]

Use Case 1: Premium Retail Hoodie (Problem → Solution)

Problem: A US specialty retailer needs a 440–460 GSM hoodie with rich hand and minimal pilling for winter floorsets. Solution: Eton sources ring-spun cotton with enzyme finish, sets 12 SPI on stress seams, pairs 2x2 rib at ~450 GSM, and seals PP with ISO 12945-2 ≥3.5 pilling and ≤4% shrinkage. Result: Tight hand and stable fit across sizes with clean dark color crocking. [CITE: Retail fleece performance benchmark, 2024]

Use Case 2: Team/Club Merch Hoodie (Problem → Solution)

Problem: A European club wants 400–420 GSM hoodies with bold team colors and embroidery-heavy branding on a tight calendar. Solution: Eton runs fast lab dips to Pantone targets, confirms colorfastness ≥4 to perspiration, sets reinforced pocket bar-tacks, and calibrates embroidery density to avoid sink on brushed fleece. Result: Vivid color, clean embroidery edges, and on-time drop for derby season. [CITE: Teamwear colorfastness guidance]

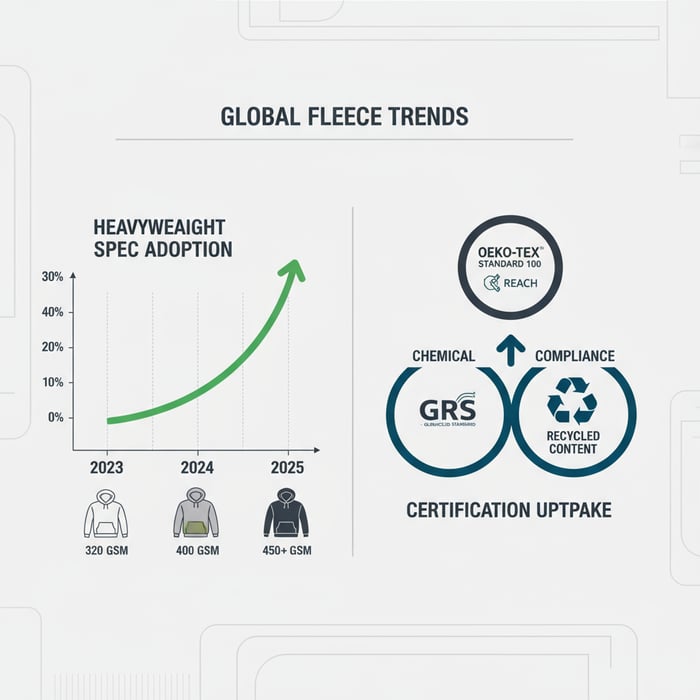

Data & Trends: Heavyweight Fleece in 2024–2025

Premium fleece remains resilient, with programs shifting toward heavier specs, durable builds, and certified materials. Recycled polyester and OEKO-TEX inputs continue to gain share, while regional diversification supports calendars and risk management. Brands win by pairing fit and color fidelity with verified compliance and reliable lead-times.

- OEKO-TEX/REACH references for chemical compliance — 2024 [S1][S2] [CITE: OEKO-TEX and ECHA sites]

- Recycled polyester market insights — 2024 [S4] [CITE: Textile Exchange PFMR 2024]

[CITE: A 2025 retail apparel trend note on fleece mix and price bands] [MENTION: NPD/ Circana] [MENTION: McKinsey State of Fashion] [INTERNAL LINK: “Sustainability claims and verification” article—contextual link]

Key Trend 1: Premiumization and Durability

Consumers pay for dense hand, stable fit, and colorfast darks. Retailers translate that into heavier GSM, tighter stitches, and cleaner finish standards. The risk: over-spec stiffness or post-wash shrink surprises. The fix: preshrink workflows, rib recovery targets, and sealed PP tests with ironclad tolerances at critical POMs. [CITE: Consumer willingness-to-pay study for premium fleece]

Key Trend 2: Certification and Recycled Content

Retailers are concentrating buys on certified inputs and traceable fibers. GRS for recycled polyester, OEKO-TEX for chemical safety, and audited facilities reduce non-compliance risk and protect shelf performance. Align packaging with recycled inputs and clear-label claims supported by documentation. [CITE: Auditor body guidance on recycled content claims] [MENTION: GRS (Global Recycled Standard)] [MENTION: Sedex SMETA]

Risks, Compliance & Localization for US & EU

Mitigate development and regulatory risks with defined tests, certified inputs, and localized labeling. For apparel entering the EU, align with REACH and retailer RSLs; for the US, use FTC care labeling and fiber disclosure rules. Calibrate packaging, carton marks, and language sets for each destination and channel.

| Risk | Root Cause | Preventive Control | Acceptance Criteria |

|---|---|---|---|

| Excess shrinkage | High GSM with insufficient preshrink; dye/finish variance | Preshrink workflow; ISO 6330 pre-bulk tests | ≤5% shrinkage after wash |

| Pilling | Open-end yarn, aggressive brushing, low stitch density | Ring-spun yarn, controlled brush, stitch targets | ≥3.5 pilling grade (ISO 12945-2) |

| Color variance | Poor lab dip control; rib not dye-matched | Strict dip approvals; dyed-to-match rib | ΔE within brand threshold; fastness ≥4 |

| Chemical non-compliance | Non-screened inputs; weak RSL management | OEKO-TEX inputs; REACH screening; RSL sign-off | Pass brand RSL; supporting lab reports |

| Delayed delivery | Late approvals; peak capacity constraints | Approval calendar; dual-region capacity | Milestone adherence; early booking |

- US: FTC Care Labeling, fiber content by weight, RN where required; CPSIA tracking for kids’ sizes.

- EU: REACH alignment; EU textile labeling (fiber names, languages); consider packaging EPR rules by country.

- UK: UK REACH alignment and UKCA where applicable; confirm label language and importer info.

[CITE: FTC Care Labeling Rule] [CITE: ECHA REACH apparel overview] [CITE: EU textile labeling regulation guidance] [MENTION: ICS/GS1 for labeling standards] [MENTION: OECD on due diligence] [INTERNAL LINK: “Labeling by market” guide—contextual link]

Next Steps: Start Your Heavyweight Hoodie Program with Eton

Move from intent to delivery with a single OEM workflow that treats weight, fit, trims, compliance, and calendars as one system. Share your brief, target GSM, compliance goals, and timeline. Eton will provide lab dips, knit-downs, development samples, and a production plan that meets US/EU standards—grounded in 30+ years of factory experience in China and Bangladesh.

Start here: Eton Garment — Clothing Manufacturing OEM Service. [INTERNAL LINK: Garment Factory conversion page—contextual CTA link]

References & Sources

- OEKO-TEX Association — Standard 100 (2024). https://www.oeko-tex.com/en/our-standards/oeko-tex-standard-100

- European Chemicals Agency (ECHA) — REACH Overview for Articles/Textiles (2024). https://echa.europa.eu/regulations/reach

- FTC — Care Labeling for Textile Wearing Apparel (2024). https://www.ftc.gov/business-guidance/resources/care-labeling

- Textile Exchange — Preferred Fiber & Materials Market Report (2024). https://textileexchange.org

- ISO 6330 — Domestic washing and drying procedures (latest edition). https://www.iso.org

- ISO 12945-2 — Determination of fabric propensity to surface fuzzing and to pilling (latest edition). https://www.iso.org

- AATCC 135/61 — Dimensional changes in home laundering & Colorfastness to laundering (latest editions). https://www.aatcc.org

- ICC — Incoterms 2020. https://iccwbo.org

- Freightos — Global freight market updates (2024–2025). https://www.freightos.com

- WRAP — Apparel factory certification program. https://wrapcompliance.org

- amfori BSCI — Social compliance resources. https://www.amfori.org

- Sedex — SMETA auditing methodology. https://www.sedex.com

- Pantone — Color standards and communication. https://www.pantone.com

[CITE: Replace placeholders with authoritative, current links during editorial pass] [MENTION: Insert additional brand/retailer studies where relevant] [INTERNAL LINK: Add links to Eton’s author bio and related pillar pages]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »