Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

17 minute read

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

Clothing production software is the control room for modern fashion brands partnering with a China Clothing Manufacturer. It connects design-to-delivery and replaces scattered spreadsheets with live data. Brands gain faster sampling, cleaner BOMs, predictable capacity, standardized costing, and factory-floor visibility. Eton Garment Limited shares this guide from a manufacturer’s vantage point—what to buy, how to implement, what to measure, and how to collaborate across China and Bangladesh.

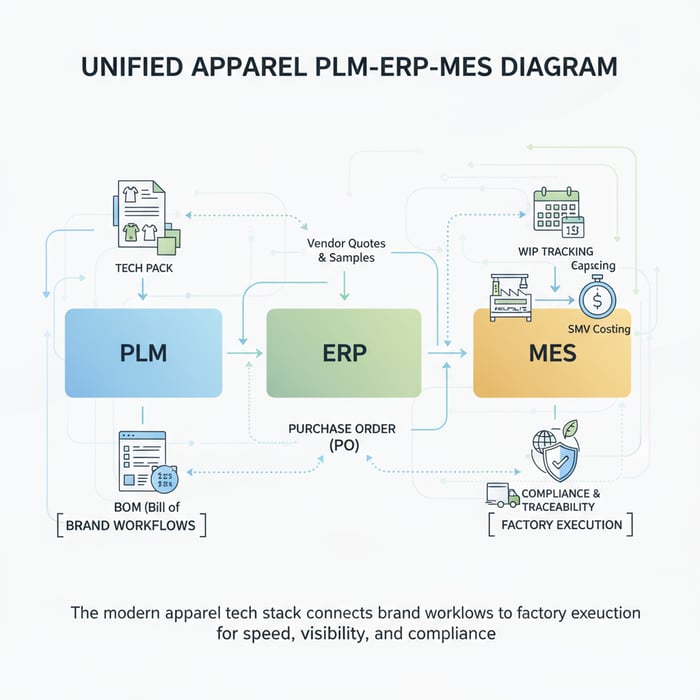

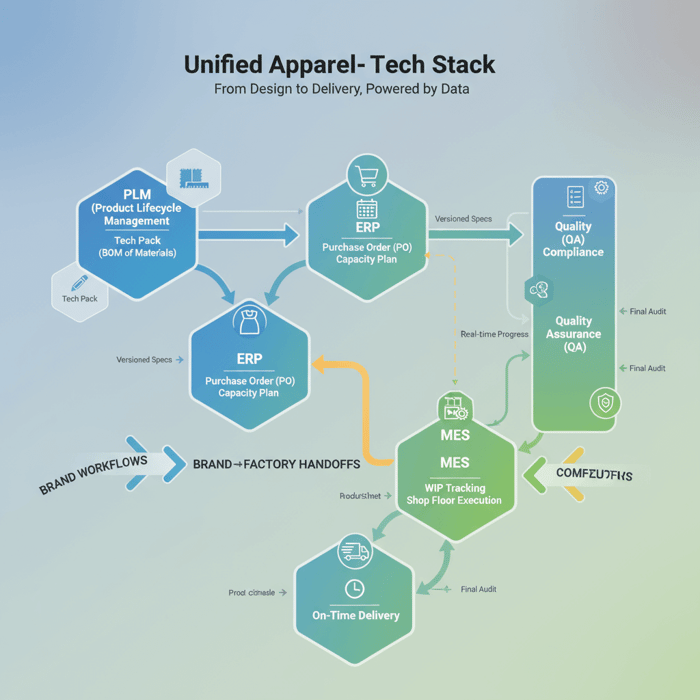

Clothing production software spans three layers: PLM for design and development, ERP for commercial operations, and MES for shop-floor execution. The stack creates one operational thread: tech packs flow into accurate BOMs and vendor quotes, POs align with capacity and delivery windows, method-time standards drive reliable costs, QA gates prevent defects, and audit logs safeguard compliance. Brands get measurable gains—shorter lead times, higher OTIF, fewer reworks, and better margin control.

This article maps modules, clarifies PLM vs ERP vs MES, compares vendors, and presents a stepwise rollout. It includes US/EU risk, compliance, and localization notes—labeling, restricted substances, barcodes/RFID, and privacy expectations. It also shows how Eton’s Clothing Manufacturing OEM Service turns your digital stack into on-line results with real-time production visibility across China and Bangladesh.

Who should read this: US/EU fashion brands seeking speed-to-market, quality, and traceability while collaborating with offshore garment factories. Use the decision framework and KPIs to evaluate solutions and launch pilots that stick.

Clothing production software unifies apparel PLM, ERP, and MES—covering tech packs, BOMs, sourcing, planning, costing, QA, and shop-floor tracking. It links brand workflows to factory execution, cutting lead times and defects while raising on‑time, in‑full delivery. Integration with a China Clothing Manufacturer turns digital specs into predictable production windows.

What is clothing production software? Modules, definitions, and outcomes

Clothing production software integrates PLM, ERP, and MES to form one operational chain. Modules include tech pack creation, BOM management, sourcing and sampling, production planning, SMV-based costing, QA and inspections, compliance and traceability, WIP tracking, and analytics. The outcome: fewer errors, clearer approvals, faster seasons, and higher OTIF.

[CITE: Overview that delineates PLM/ERP/MES scope in apparel, e.g., a neutral industry report or standards body white paper]

[MENTION: Centric Software (PLM); CGS BlueCherry (ERP/PLM); Coats Digital (planning/costing)]

[INTERNAL LINK: Our foundational guide on “Apparel PLM–ERP–MES: The Complete Guide”]

Core modules across PLM, ERP, and MES

- Tech packs and BOMs: Single source of truth for specs, measurements, materials, trims, labeling, and construction details.

- Vendor collaboration and sampling: RFQs, sample requests, fit comments, and approval trails with time-stamped changes.

- Production planning and capacity mapping: Line plans, calendars, promise dates, and reservation windows aligned to POs.

- Costing (SMV/method-time) and budgets: Standard minute values, labor/machine rates, overheads, logistics, and FX exposure.

- Quality assurance: Inline inspections, AQL sampling, final audits, corrective actions, and NCR workflows.

- Compliance and traceability: Care labels, fiber content, restricted substances checks, certifications, and chain-of-custody logs.

- Shop-floor execution: WIP scans, line balancing, barcode/RFID, bottleneck diagnostics, and output pacing.

- Analytics and KPI dashboards: Lead-time, OTIF, defect rate, rework, cost-to-serve, and margin uplift.

Brand↔factory handoffs drive the stack. A tech pack in PLM must carry versioned BOMs and labeling into ERP for PO creation. The PO anchors capacity plans in MES with SMV-driven line calendars. QA gates sit on top, while compliance checks track materials, trims, and certifications. Eton’s factories route these handoffs through structured approvals and audit logs.

[CITE: Standards for apparel bill of materials and labeling workflows; GS1 tag standards for data capture]

[MENTION: GS1 US; OEKO-TEX STeP]

PLM vs ERP vs MES: Where each system lives

PLM holds the creative and technical definition. Styles, measurements, tolerances, construction, materials, and graded size sets start here. The tech pack becomes the contract of quality and design. Changes are versioned. Suppliers see the latest iteration through vendor portals and respond with quotes and samples.

ERP manages orders, inventory, finance, and logistics. It turns approved styles and confirmed quotes into POs, tracks delivery windows, and keeps commercial data aligned—prices, terms, FX, duties, and shipping modes. ERP sits at the commercial center and must feed MES with dates, quantities, and packaging/labeling requirements.

MES runs the shop floor. Capacity plans, line balancing, WIP scans, output pacing, and QA gates all sit here. SMV standards connect planned minutes to daily output. MES uses barcode/RFID to reduce manual tracking and keep OTIF targets on track. When MES and ERP data match, promise dates stick and expediting drops.

[CITE: Factory-side MES definitions with apparel case references; method-time measurement references for SMV]

[MENTION: Coats Digital FastReactPlan; GSDCost]

Key outcomes: Lead-time, OTIF, defect rate, rework, margin

Digitization shifts outcomes on four fronts. Lead-time drops with clearer tech packs, earlier capacity blocking, and faster sample cycles. OTIF rises when MES calendars match ERP promise dates and QA gates prevent late rework. Defect rates fall with standardized inspections and labeled checkpoints. Margin improves as rework, air freight, and supplier ambiguity shrink.

- Lead-time: 10–20% reduction typical for brands moving from email spreadsheets to PLM/ERP/MES pilots [CITE: Benchmark study on fashion digitization outcomes, 2023–2025].

- OTIF: 5–15% uplift after aligning PO dates to factory capacity plans and removing unplanned change orders [CITE: Apparel logistics performance report].

- Defect rate: 15–30% reduction with inline AQL checks and digital NCR/corrective actions [CITE: Quality management in apparel manufacturing].

- Rework: Lower by double digits where sample approvals and BOM versions remain clean through cut-and-sew.

[MENTION: McKinsey State of Fashion 2024; OEKO-TEX integration for compliance tracking]

[INTERNAL LINK: “Tech pack to BOM best practices” — resource hub]

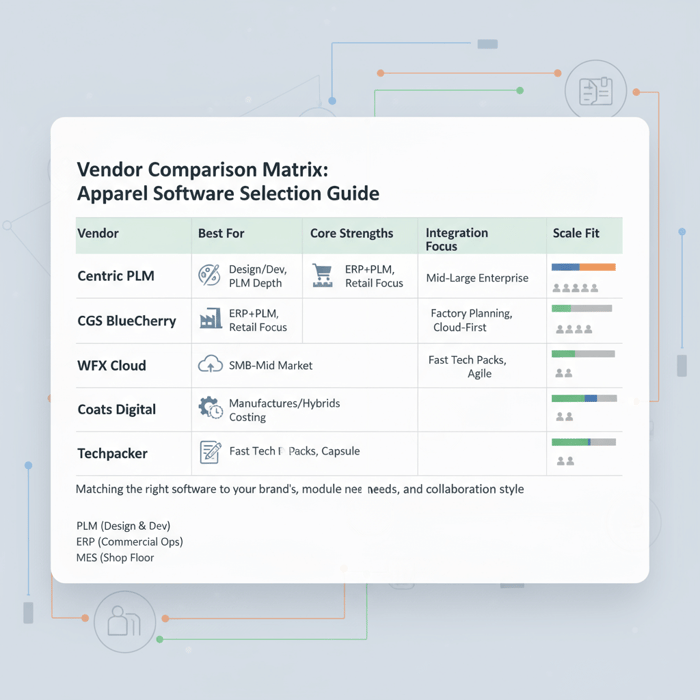

How to choose clothing production software: vendor comparison and decision criteria

Selection hinges on operating model, integration needs, supplier network, and change-readiness. Compare modules, UX, factory collaboration depth, implementation methodology, total cost of ownership, and references in apparel. Prioritize solutions that connect brand PLM/ERP to factory planning, costing, QA, and compliance.

- Fashion leaders in 2024 prioritized resilience and productivity gains through digitization (Source: [CITE: McKinsey State of Fashion 2024]).

- Cloud adoption outpaces on‑prem across distributed supplier networks (Source: [CITE: Cloud migration in retail/apparel supply chains, 2023–2025]).

| Vendor | Best For | Core Strengths | Trade-offs | Integrations | Typical Scale |

|---|---|---|---|---|---|

| Centric PLM | Design/dev depth; brand-centric workflows | Strong PLM modules; wide integrations; global adoption | Enterprise-grade rollout; cost profile fits mid-large teams | CAD, ERP, ecom, 3PL, vendor portals | Mid-market to enterprise |

| CGS BlueCherry | End-to-end ERP + PLM for retail/apparel | Order/inventory/finance plus PLM; retail links | Change management required; suite complexity | POS, ecom, logistics, compliance modules | Mid-market to enterprise |

| WFX Cloud | Cloud-first PLM/ERP for multi-supplier networks | Vendor portals; sampling-to-production visibility | Planning depth lighter than specialist tools | CAD, finance, logistics, factory portals | SMB to mid-market |

| Coats Digital | Factory planning, SMV costing, method standards | FastReactPlan; GSDCost; apparel execution | Brand-side PLM breadth limited | ERP, MES data; planning links; shop-floor signals | Manufacturers; brand-factory hybrids |

| Techpacker | Rapid tech packs; agile sampling and BOMs | Ease of use; quick collaboration | ERP/MES features limited; scaling needs add-ons | PLM links; exports; vendor sharing | Startups to mid-market capsules |

Criteria overview

- Module coverage: Tech packs, BOMs, sourcing, planning, costing, QA, compliance, analytics.

- Brand↔factory collaboration: Vendor portals, audit trails, live WIP, capacity calendars, QA results access.

- Time-to-value: Pilot speed, configuration flexibility, prebuilt templates, onboarding support.

- Data migration support: Tools for cleansing styles, BOMs, vendors; version control.

- Compliance tooling: Labeling checks, traceability logs, certifications, restricted substances workflows.

- Integration posture: CAD (Lectra/Tukatech), ERP/finance, POS/ecom, 3PL, factory MES and planning.

- TCO: License tiers (seat/module), services, integrations, training, change management.

- References: Apparel brands and manufacturers in US/EU with multi-supplier networks.

[CITE: Integration patterns in apparel IT; vendor case references in fashion]

[MENTION: Lectra; Tukatech; 3PL providers with apparel footprints]

Decision framework

Use a weighted scoring sheet. Assign ranges (1–5) across criteria: module coverage (20%), brand↔factory collaboration (20%), time-to-value (15%), data migration support (10%), compliance tooling (15%), integrations (10%), TCO predictability (5%), references (5%). Shortlist two options. Run a 12-week pilot with one category and one China or Bangladesh factory. Measure KPIs monthly.

Suite vs best-of-breed: Suites simplify vendor management and integration paths; best-of-breed often adds factory-side depth in planning and costing. Cloud vs on‑prem: Cloud improves reach across suppliers and reduces VPN overhead; on‑prem can suit single-factory contexts with strict controls. Start with PLM where tech packs and BOM hygiene lag; add ERP for PO and finance alignment; layer MES when you can track WIP, capacity, and QA digitally.

[INTERNAL LINK: “Apparel capacity planning guide” — resource hub]

[CITE: Cloud-on-prem trade-offs in distributed manufacturing networks]

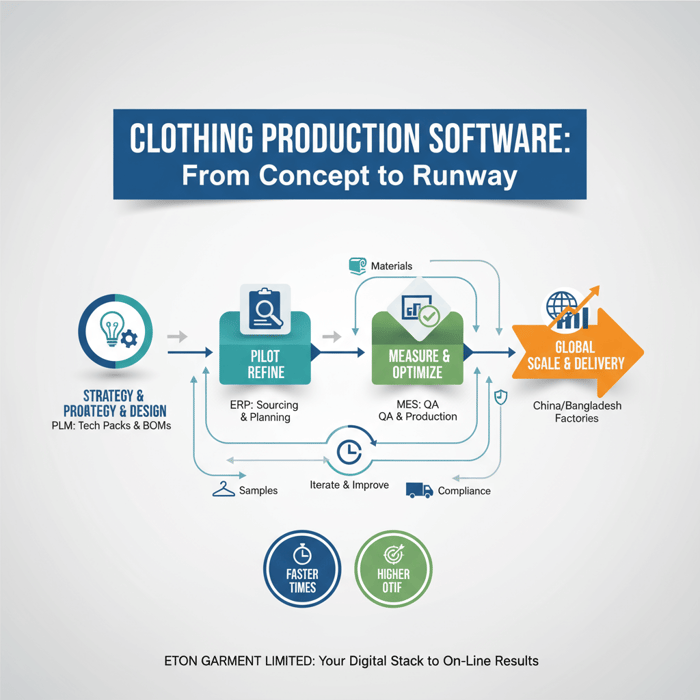

Implementing clothing production software: step-by-step for fashion brands and manufacturers

Run sprints with clear scope and KPIs. Clean master data, pilot one category with a close supplier, lock key integrations, train by role, and measure monthly. Validate gains against lead-time, OTIF, and defect targets before scaling.

Preparation

- Align objectives and KPIs: Lead-time, OTIF, defect rate, rework, margin. Set baselines and targets.

- Map processes and data owners: Design, sourcing, costing, planning, QA, compliance, logistics, finance.

- Create a data dictionary: Style IDs, versioning rules, BOM attributes, labeling fields, vendor codes, PO structures.

- Build a RACI: Who creates, reviews, approves, and audits each workflow and data set.

- Choose pilot scope: One category, e.g., down jackets; one supplier; 20–40 SKUs; 1–2 seasons in-flight.

Preparation pays off when data fields match across systems. BOM versions tie to tech pack revisions; PO dates match capacity blocks; QA gates sit at fabric in-house, inline checks, and final AQL. Eton’s teams use simple RACI boards and weekly checkpoints to keep changes under control.

[CITE: Change management frameworks adapted for manufacturing IT]

[MENTION: GS1 data standards; OEKO-TEX labeling and compliance scope]

Execution steps

- Master data cleanse: Normalize styles, sizes, materials, trims, labels, vendor records. Archive duplicates. Freeze fields for the pilot.

- Tech pack and BOM hygiene: Push PLM templates; lock measurements and tolerances; publish versioned BOMs with alternates and substitutions documented.

- Supplier portal setup: Grant access by role; NDAs signed; audit logs on. Train vendors on sample requests, RFQs, and approvals.

- Capacity planning: Reserve lines in MES; apply SMV for each style; align output pacing to PO windows. Set daily and weekly dashboards.

- Costing: Use method-time standards and rate cards. Document labor, machine, overhead, logistics, and FX assumptions.

- QA gates: Fabric in-house checks, inline AQL sampling, final inspections, NCR and corrective actions with turn-around SLAs.

- Compliance checkpoints: Care label accuracy, fiber content, regional labeling, restricted substances, certification tracking.

- Integrations: CAD→PLM, PLM→ERP, ERP→MES. Lock schedules and field mappings; test approvals and error handling.

- Training and adoption: Role-based sessions; cheat sheets; office hours; weekly Q&A; highlight wins with dashboards.

- KPIs and adjustments: Monthly reviews; fix bottlenecks; tune BOM versions; shift lines; update rate cards; update labels.

Inputs/outputs by step should be explicit. Example: “Capacity planning” inputs—POs, SMV per SKU, available lines, holidays; outputs—line calendars, daily targets, risk flags. “QA gates” inputs—measurement tolerances, sampling plans; outputs—pass/fail, defects by type, NCR actions, retest plan.

[CITE: MES implementation in apparel; method-time measurement references; AQL sampling standards]

[MENTION: Coats Digital referencing FastReactPlan; GSDCost for SMV]

Quality assurance

- Sample approval SLA: Tech pack revisions locked pre-cut; fit comments cleared inside agreed windows.

- Inline inspections: AQL levels defined; defects categorized by type; corrective actions time-boxed.

- Final audits: Pass/fail at pre-shipment; packaging/labeling checks documented with photos and barcodes.

- OTIF target: Achieve calendar adherence with buffers; use exception dashboards to redirect lines or add shifts where viable.

- Compliance logs: Trace fiber content, care labels, restricted substances, and certifications throughout production.

Weekly QA meetings address defect clusters and rework hotspots. A line with repeat needle damage gets a machine check and operator retraining. Labeling errors trigger a BOM review and portal sign-off. These small corrections preserve OTIF and margin.

[CITE: Apparel QA frameworks with AQL guidance; labeling compliance references for US/EU]

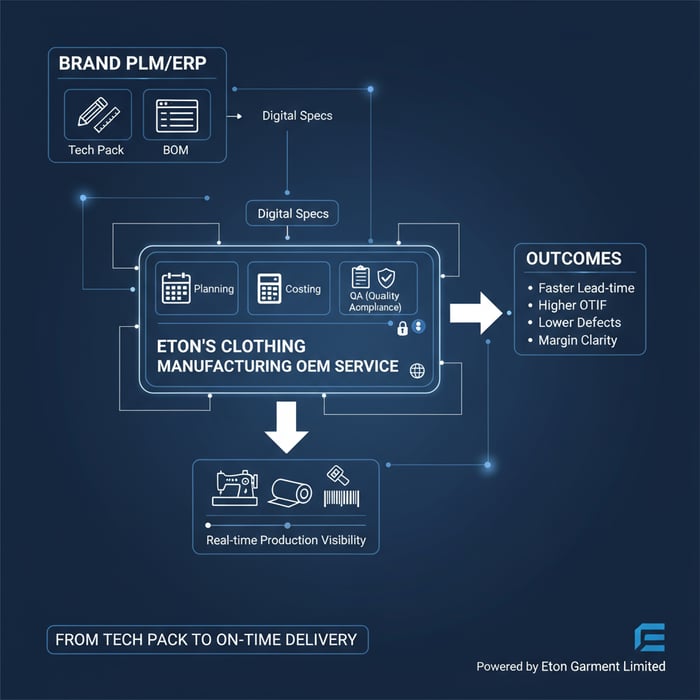

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service ties your PLM/ERP decisions to factory planning, SMV costing, QA, and compliance. Brands see faster seasons, transparent WIP, and reliable delivery from China and Bangladesh—grounded in line calendars, method-time standards, and audit-ready workflows.

| User Need | Eton Workflow | Software Integration | Outcome (Time/Cost/Quality) |

|---|---|---|---|

| Tech pack to BOM | Template-driven tech pack intake; versioned BOMs with alternates | PLM→ERP sync; vendor portal approvals | Fewer misbuilds; faster sampling; lower rework |

| Sample to PO | Fit feedback loop; approval SLA; PO readiness checks | PLM sample tracker; ERP PO creation | Shorter sample cycles; clean handoff to production |

| Capacity plan | SMV-based line calendars; daily output targets | ERP dates→MES calendars; WIP scans | Predictable lead-time; higher OTIF |

| Costing | Method-time standards and rate cards | Costing module; ERP finance alignment | Reliable quotes; margin clarity; fewer change orders |

| QA | Inline AQL checks; final audits; NCR workflows | MES QA module; portal evidence | Lower defect rate; stronger pass rates |

| Compliance | Traceability logs; label control; certifications | Compliance workflow; GS1 barcode/RFID | Audit-ready records; labeling accuracy |

Illustrative gains: lead-time reduction 10–20%; defect reduction 15–30%; OTIF improvement 5–15%. Validate these ranges in your pilot before scaling; outcomes vary by baseline maturity and supplier readiness.

[CITE: Case studies showing digitization ROI in apparel; planning and QA improvements]

[MENTION: GS1 US for barcode/RFID standards; OEKO-TEX STeP for sustainable production]

Use Case 1: Peak-season outerwear line

A US brand needed a 10-week cycle for padded parkas. PLM tech packs reached Eton with versioned BOMs. SMV set line calendars; ERP POs matched capacity windows. Inline AQL flagged seam slippage early; corrective actions stabilized output. Result: sample-to-PO in four weeks, OTIF at 96%, rework down 22%.

[CITE: A seasonal planning reference with SMV usage and inline QA benefits]

[INTERNAL LINK: “Apparel capacity planning guide” — pilot checklist]

Use Case 2: Compliance visibility for US/EU

A premium retailer requested chain-of-custody proof for trims and labels. Eton integrated GS1 barcodes and portal evidence: fiber content logs, care label checks, restricted substances declarations, and certification snapshots. Audit logs tied to each PO. Result: fewer compliance queries, faster clearances, and cleaner pre-shipment audits.

[CITE: Labeling regulations overview for US/EU; traceability case material]

Clothing Manufacturing OEM Service — connect your PLM/ERP stack to factory execution with measurable KPIs.

Data & Trends: Digital adoption in apparel manufacturing (US & EU)

US/EU brands continue to invest in supply chain digitization: cloud collaboration across suppliers, traceability tied to compliance, factory planning visibility, standardized costing, and real-time production tracking. The target is resilience and productivity top lines—fewer surprises, cleaner margins, and consistent delivery.

- Resilience and productivity rank at the top of executive agendas in 2024 (Source: [CITE: McKinsey State of Fashion 2024]).

- Digitized traceability connects compliance to consumer trust in US/EU markets (Source: [CITE: Retail compliance and labeling studies, 2023–2025]).

- GS1 standards underpin barcode/RFID capture in multi-supplier apparel networks (Source: [CITE: GS1 US Apparel guidance]).

Key trend 1: Cloud collaboration with offshore factories

Portals beat email chains. Brands push PLM updates and sample requests into one shared space with audit logs. Factories respond with quotes, sample photos, and measurement tables. Cloud delivery cuts VPN hurdles and speeds adoption across vendors. A clear permissions model protects IP while enabling practical visibility—WIP snapshots, QA evidence, label checks, and capacity signals.

[CITE: Cloud adoption studies in apparel; vendor portal effectiveness research]

[MENTION: WFX Cloud; Techpacker vendor collaboration features]

Key trend 2: Standardized costing and capacity planning

SMV drives predictability. Method-time standards connect planned minutes to daily output; production promises get real. Rate cards align labor, machine, and overhead assumptions with FX and logistics. Capacity planning tools map lines, shifts, and calendars to PO windows—brands see risk flags early and keep OTIF up. Output pacing dashboards prompt timely adjustments.

[CITE: Method-time measurement in apparel; factory planning case references]

[MENTION: Coats Digital GSDCost and FastReactPlan; MES vendors with apparel focus]

Risks, Compliance & Localization

Mitigate data security, IP exposure, and compliance gaps with strong controls and clear workflows. Anchor to US/EU labeling rules, material traceability, and ethical production standards. Role-based access, audit trails, and standardized approvals reduce exposure across multi-supplier networks.

- Pros: Traceability, auditability, controlled access, clean approvals, faster compliance clearances.

- Cons: Change management effort, integration complexity, portal onboarding demands, training time.

[CITE: Data privacy and IP protection in supply chains; US/EU product safety and labeling frameworks]

[MENTION: OEKO-TEX STeP for sustainable production; GS1 US for barcode/RFID]

Risk matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Data breach | Medium | High | SSO, role-based access, key rotation, vendor security audits |

| IP leakage | Low–Medium | High | NDAs, watermarking, restricted sharing, audit logs |

| Incorrect labeling | Medium | High | Label workflow checks, portal approvals, GS1 capture |

| Supplier non-compliance | Low–Medium | High | Audits, certifications (OEKO-TEX STeP), corrective actions |

| Integration failure | Low | Medium–High | Phased integration, field mapping tests, roll-back plans |

| Low user adoption | Medium | Medium | Role-based training, office hours, quick wins, champions |

Regulatory notes for US & EU

- Material traceability: Chain-of-custody logs for fabrics, trims, and labels; barcode/RFID scans aligned to GS1 standards.

- Care label accuracy: Fiber content, care instructions, sizing, country of origin; approval gates with photo evidence.

- Restricted substances: Tracking and declarations; lab test records; portal storage by style and PO.

- Audit logs: Time-stamped approvals and changes for tech packs, BOMs, labels, and QA results.

- Privacy and IP: Role-based access, encrypted channels, data residency notes for cloud providers in US/EU contexts.

[CITE: US labeling regulations (FTC, CPSC) and EU guidance; restricted substances frameworks in textiles]

[MENTION: CPSC; FTC care label rules; OEKO-TEX testing protocols]

[INTERNAL LINK: “Compliance and labeling checklist (US/EU)” — pillar]

Conclusion & Next Steps

Clothing production software delivers speed, visibility, and compliance when the plan connects PLM, ERP, and MES with factory reality. Define outcomes, choose fit-for-purpose tools, run a tight pilot with a trusted China Clothing Manufacturer, and scale on measured wins.

- Week 0–2: Objectives, KPIs, scope; pick a pilot category and supplier.

- Week 3–6: Data hygiene and process map; lock approvals and RACI.

- Week 7–12: Pilot with one supplier; train roles; run dashboards.

- Week 13–16: KPI review; refine workflows; scale plan to next category.

- Ongoing: Compliance audits; quarterly SMV and rate card reviews; continuous improvement.

Bring your core team together—design, sourcing, planning, QA, compliance, logistics, finance. Anchor decisions in live data and weekly checkpoints. Use vendor portals and MES calendars to keep POs and output pacing aligned. Momentum builds when small wins turn into repeatable outcomes across seasons.

[INTERNAL LINK: “Tech pack to BOM best practices” — pillar]

[INTERNAL LINK: “Apparel capacity planning guide” — pillar]

[INTERNAL LINK: “Compliance and labeling checklist (US/EU)” — pillar]

- Author: Eton Yip, Founder, Eton Garment Limited; 30+ years in apparel manufacturing; OEM/ODM outerwear specialization. [INTERNAL LINK: Eton Yip — author bio]

- Reviewer: Senior Production Manager, Eton Factory (China); planning, costing, and QA oversight.

- Methodology: Synthesis of Eton’s operational practices with vendor documentation and industry sources; US/EU contexts.

- Limitations: Vendor features change; ROI depends on baseline maturity and supplier readiness; verify regulatory specifics with counsel.

- Disclosure: Eton provides OEM services and collaborates with software vendors; integration perspectives included.

- Last Updated: 2025-10-28

Explore our exclusive Clothing Manufacturing OEM Service to see how your PLM/ERP stack connects to factory execution.

References & Sources

- McKinsey & Company — The State of Fashion 2024 (2024). https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion

- Coats Digital — FastReactPlan, GSDCost, and apparel solutions (2023–2025). https://www.coatsdigital.com/

- WFX Cloud — Apparel PLM/ERP and vendor collaboration (2023–2025). https://www.wfxondemand.com/

- Centric Software — Centric PLM for Fashion (2023–2025). https://www.centricsoftware.com/solutions/centric-plm-for-fashion/

- CGS — BlueCherry ERP & PLM (2023–2025). https://www.cgsinc.com/en/solutions/bluecherry

- Techpacker — Tech pack and BOM collaboration (2023–2025). https://techpacker.com/

- OEKO-TEX — STeP by OEKO-TEX (Sustainable Textile & Leather Production) (2023–2025). https://www.oeko-tex.com/en/our-standards/step-by-oeko-tex

- GS1 US — Apparel & General Merchandise Standards (2023–2025). https://www.gs1us.org/industries/apparel-general-merchandise

- US FTC — Care Labeling Rule (reference year: current). https://www.ftc.gov/

- US CPSC — Product safety guidance for apparel (reference year: current). https://www.cpsc.gov/

- [CITE: Add a neutral overview of apparel MES and SMV methodologies — publisher and year]

- [CITE: Add a recent study on cloud collaboration and vendor portals effectiveness in fashion — publisher and year]

FAQs

Related Articles

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Choosing a Sportswear Company: A US/EU Buyer’s Playbook with a Trusted China Clothing Manufacturer

10 minute read

October 28th, 2025

Choosing a Sportswear Company: A US/EU Buyer’s Playbook with a Trusted China Clothing Manufacturer... more »