Wholesale Clothing Vendors China: How to Choose a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

18 minute read

Wholesale Clothing Vendors China: How to Choose a China Clothing Manufacturer

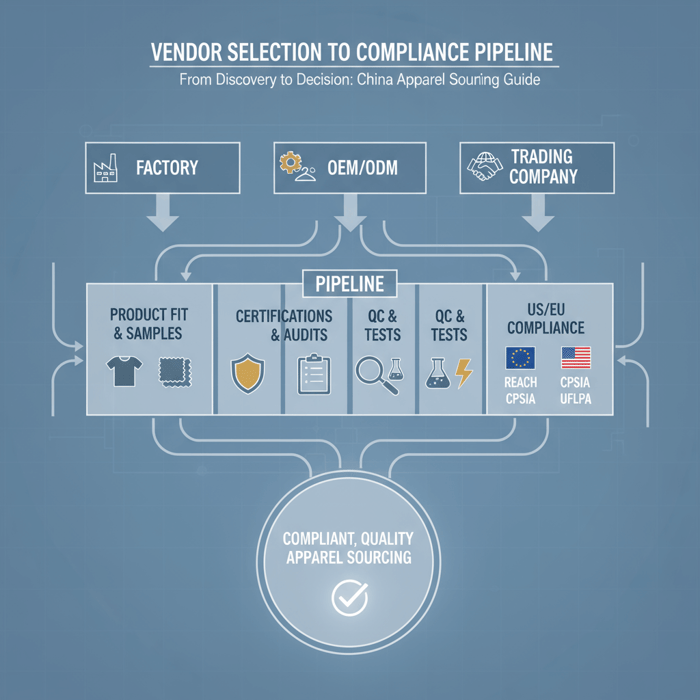

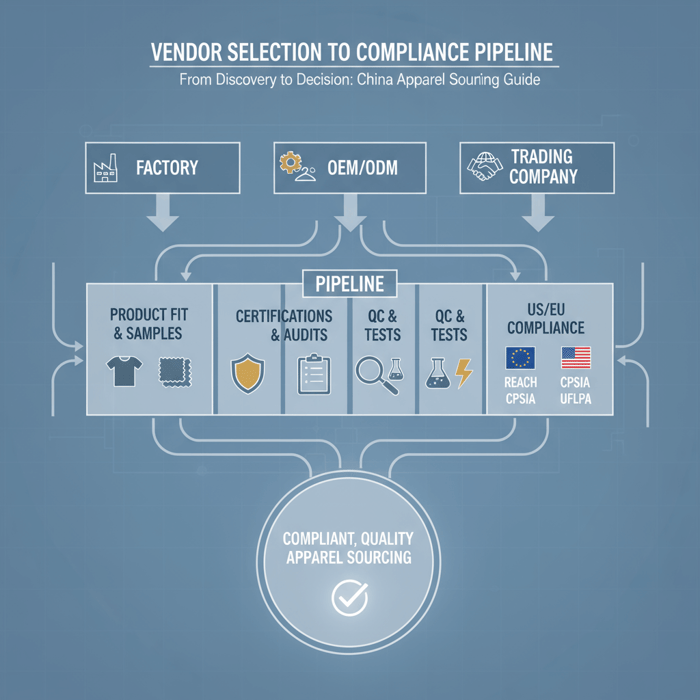

Wholesale clothing vendors China are not identical—factories, OEM/ODM partners, and trading companies play different roles in cost, speed, and compliance. If your goal is a scalable China Clothing Manufacturer for outerwear or performance apparel, align vendor type to product, run compliance-first vetting, and build a clear QA and logistics plan from day one.

Wholesale clothing vendors in China include factories, OEM/ODM manufacturers, and trading companies. To choose well, shortlist by product fit, verify certifications (BSCI, SEDEX, ISO 9001), exchange tech packs and samples, use AQL inspections, and confirm US/EU compliance (REACH, CPSIA, UFLPA). Compare MOQs, lead times, Incoterms, and logistics before signing.

Wholesale Clothing Vendors in China: Types, Fit, and Where to Find Them

China’s vendor ecosystem spans direct factories, OEM/ODM manufacturers, and trading companies. Each suits a different stage of brand growth and product complexity. Match the vendor to your category—outerwear, sportswear, kidswear—then source via Guangzhou and Yiwu markets, platforms like Alibaba and Global Sources, and trade shows such as Canton Fair and Intertextile.

China’s wholesale vendor landscape includes factories, OEM/ODM manufacturers, and trading companies. Align capabilities with category and compliance needs. For outerwear and technical jackets, seek OEM/ODM. Begin discovery through Guangzhou and Yiwu markets, B2B platforms, and trade fairs; shortlist by certification, capacity, and sample quality before trials.

| Vendor Type | Strengths | Limits | Best Use | Compliance Considerations |

|---|---|---|---|---|

| Factory (CMT/Full-Package) | Sharp unit cost; direct control; faster feedback loops | Varied development capability; relies on buyer inputs | Basics, reorders, stable styles | Check ISO 9001, BSCI/SEDEX, and material traceability; request recent audit summaries |

| OEM/ODM Manufacturer | Design/tech support; fabric/trim sourcing; scalable QC | Higher development fees; stricter MOQs | Outerwear, technical sportswear, kidswear with testing | Expect QC systems, lab-testing partners, documented REACH/CPSIA protocols |

| Trading Company | Speedy sourcing; multi-category breadth; small MOQs | Margin stack; less process visibility | Market tests, mixed-category buys, accessories | Demand factory disclosures; insist on third-party inspections |

Vendor Types Explained

Factories execute cut–make–trim (CMT) or full-package programs. They excel when specs are locked and repeat orders flow. OEM/ODM manufacturers add design, patterning, fabric development, and structured QA—vital for down jackets, parkas, seam-taped shells, and performance knits. Trading companies aggregate capacity and categories, which suits mixed seasonal buys, but they add margin and can dilute compliance oversight.

Outerwear and technical categories benefit from OEM/ODM depth: thermal mapping, insulation fill weight controls, baffle construction, taped seam integrity, and lab tests for colorfastness and hydrostatic head. Basics—tees, fleece, joggers—can run well in cost-efficient factories with clear tech packs and stable materials. Kidswear adds CPSIA tracking labels and flammability testing; choose vendors with proven US compliance flows. [MENTION: Alibaba.com], [MENTION: Global Sources], and [MENTION: Intertek] frequently appear in sourcing and testing discussions; validate actual capabilities beyond badges. [CITE: A recognized testing lab overview of textile performance methods]

[INTERNAL LINK: Vendor type comparison for outerwear → Pillar guide page idea]

Markets and Platforms

Guangzhou’s Zhongda cluster supports fabric and garment sourcing at scale, with mills and trim houses nearby—helpful for outerwear sampling. Yiwu remains strong for accessories and basics; treat it as a discovery hub and verify factory backends for branded apparel. Shenzhen’s ecosystem is efficient for accessories and electronics-integrated garments. On platforms, use RFQs with precise filters (export markets, audit badges, category specialization), then vet with video calls, line walkthroughs, and sample reviews.

Trade events matter: Canton Fair offers broad exposure, Intertextile Shanghai Apparel Fabrics surfaces mills, and fashion-focused shows curate vendors by category. Use badge signals as starting points only. Request factory names behind trading desks, confirm audit currency (within 12–18 months), and test response quality with detailed tech pack queries. [CITE: A trade fair organizer page listing apparel halls], [MENTION: Messe Frankfurt’s Intertextile], [MENTION: Canton Fair]

How to Choose Wholesale Clothing Vendors in China: Criteria, Scoring, and Shortlisting

Set clear criteria—product fit, capacity, QA maturity, certifications, compliance, cost, and lead time. Weight them and score candidates. Shortlist two or three for sampling and audits. Use structured RFQs and unified tech packs so price and lead-time comparisons are apples-to-apples. China remains a leading exporter, with logistics performance shaping timelines.

Define weighted criteria across capability, compliance, cost, and timing, then score vendors and shortlist 2–3 for sampling and audits. Use consistent RFQs and tech packs to compare like-for-like quotes. China’s export scale and logistics performance influence lead times and risk management for US/EU-bound orders.

Criteria Overview

- Product fit and references: Similar styles delivered to US/EU in the last 18–24 months; sample proof helps. [CITE: Case studies or buyer testimonials from recognized retailers]

- Capacity and workflow: Sewing lines, bonding/taping stations, insulation filling lines, inline QC; documented SOPs and KPIs.

- Certifications and audits: ISO 9001, BSCI/SEDEX, WRAP; renewed audits within 12–18 months. [MENTION: amfori BSCI], [MENTION: ISO 9001:2015]

- Compliance readiness: REACH (EU), CPSIA and flammability (US), UFLPA traceability; lab partners and test plans ready. [MENTION: ECHA], [MENTION: CPSC]

- Cost transparency: FOB breakdown by fabric, trims, labor, overhead, testing, and logistics; quotes valid for a time window.

- Lead time realism: Yarn dyeing, fabric lead, lab dips, PP sample, pilot run, bulk; seasonality and port congestion buffers. [CITE: A shipping or logistics index with seasonal analysis]

- Communication and problem-solving: Timely, specific answers; corrective action logs; digital QC evidence from floor.

Decision Framework

Assign weights, for example: Compliance 25%, Product fit 20%, Cost 20%, Capacity 15%, Lead time 10%, QA maturity 10%. Score each vendor 1–5 per criterion. Shortlist two or three for samples, a pre-assessment video walk-through, and trial orders. For outerwear, prioritize OEM/ODM when taped seams, fill power, or waterproof-breathable laminates are involved.

| Criterion | Weight | Vendor A | Vendor B | Vendor C |

|---|---|---|---|---|

| Compliance & Certifications | 25% | 5 | 4 | 3 |

| Product Fit (Outerwear) | 20% | 5 | 3 | 4 |

| Cost Transparency | 20% | 4 | 4 | 5 |

| Capacity & Equipment | 15% | 4 | 5 | 3 |

| Lead Time Realism | 10% | 4 | 3 | 4 |

| QA Maturity | 10% | 5 | 3 | 4 |

- China’s apparel export scale remains globally significant — 2024 (Source: [CITE: WTO 2024 apparel export summary])

- Logistics performance influences lead times and reliability — 2023 (Source: [CITE: World Bank LPI 2023])

[INTERNAL LINK: Our foundational guide on vendor scoring and audits]

Wholesale Clothing Vendors China: Costs, MOQs, Lead Times, and Logistics

Expect MOQs of 300–1,000 units per style for jackets/coats, 45–75 days for first bulk after approvals, and different landed costs under FOB vs CIF. Model duties, freight, and testing. Negotiate based on fabric specs, trims, and QC scope to limit surprises. Use realistic shipping windows to the US/EU.

For outerwear, MOQs often run 300–1,000 per style, with 45–75 days from PP approval to bulk completion. FOB suits experienced buyers; CIF helps with first shipments. Landed cost depends on duty, testing, and freight. Pin down fabric, trims, and inspection scope before locking price.

| Product | Typical MOQ | Lead Time (first bulk) | Indicative FOB Price (USD) | Notes |

|---|---|---|---|---|

| Padded Jacket (Polyfill) | 500–1,000 | 50–70 days | $14–$28 | Influenced by shell/lining, insulation weight, lab tests |

| Down Jacket (650–800 FP) | 500–1,000 | 55–75 days | $28–$65 | Down quality and baffle design drive cost |

| Seam-Taped Shell (2–3L) | 300–800 | 55–75 days | $25–$60 | Membrane brand, hydrostatic head testing affect price |

| Fleece/Basic Knit | 300–800 | 35–55 days | $4–$12 | Stable materials can shorten cycles |

| Kidswear Set (US/EU) | 500–1,000 | 45–65 days | $6–$18 | Requires CPSIA/REACH testing and tracking labels |

Ranges reflect normal conditions and change with fabric market, trims, testing, and shipping realities. Validate quotes and lead time windows against seasonal capacity. [CITE: An apparel cost benchmarking report 2023–2024], [MENTION: Freightos], [MENTION: Drewry]

Incoterms & Landed Cost Basics

For first shipments, CIF can reduce complexity by bundling ocean freight/insurance, but you’ll pay a premium and may lose visibility. Experienced buyers choose FOB to control carrier selection and cost. A landed cost example (US import): FOB $30.00, ocean freight and insurance $1.40, duty 16.0% ($4.80 on dutiable value), brokerage/ISF $0.25, destination fees $0.85 → landed $37.30 before domestic freight. EU importers should model VAT and customs clearance specifics per country. [CITE: EU TARIC duty database], [CITE: US Harmonized Tariff Schedule]

- Ocean shipping China–US West Coast: ~12–20 days port-to-port; door-to-door longer — 2024 (Source: [CITE: A recognized carrier schedule summary])

- Ocean shipping China–EU (Rotterdam/Hamburg): ~28–40 days port-to-port — 2024 (Source: [CITE: A European liner schedule])

- Air freight China–US/EU: ~2–7 days door-to-door — 2024 (Source: [CITE: IATA or leading forwarder guidance])

Negotiation Levers

- Materials: Confirm fabric composition, weight, finishes, and testing (REACH restricted substances). Lock trim specs and colorways.

- QC scope: Agree AQL level, inline audits, and lab tests. Align rework/chargeback terms.

- Batching and reorders: Negotiate price hold for X months and reorder MOQs; consider color consolidation to boost volume.

- Payment terms: 30/70 (deposit/balance) common for first orders; advance toward 20/80 with performance. [CITE: A sourcing payment norms overview]

[INTERNAL LINK: Landed cost calculator guide → Resource page idea]

Technical Quality Assurance: From Samples to Mass Production

Run a staged QA pipeline: tech pack alignment, pre-production sample approval, pilot run, inline QC, and pre-shipment inspections. Apply AQL standards and lab tests (colorfastness, seam strength, hydrostatic head). For outerwear, add fill weight checks, down leakage, and seam-tape adhesion. Document deviations with corrective actions and timelines.

Build a structured QA plan from tech pack alignment through pre-shipment. Use AQL sampling, accredited lab tests, and special checks for outerwear (fill weights, tape adhesion, waterproof tests). Track deviations, assign owners, and set tight timelines for corrective actions.

Preparation

- Tech pack and BOM lock: Confirm specs, tolerances, labeling, and packaging; include test plan.

- Material approvals: Lab dips, hand-feel, shrinkage/wash tests; RSL documentation mapped to REACH/CPSIA. [CITE: ECHA RSL guidance page]

- PP sample: Fit and construction sign-off; graded specs validated on a mid-size.

- Line planning: Capacity, critical path, QA checkpoints; factory SOP briefing.

Execution Steps

- Pilot run (30–100 pcs): Validate stitch quality, seam tape process, fill weights, trims application; capture learnings.

- Inline QC: Hourly checkpoints; critical seam stress points; torque tests on snaps/zips; rework loop timing.

- Lab tests: Colorfastness, pilling, tear strength, hydrostatic head (shell); migration testing for kidswear prints. [MENTION: SGS], [MENTION: Bureau Veritas]

- Pre-shipment inspection: AQL 2.5/4.0 common for mid-tier; carton drop tests; packaging/label verification.

Quality Assurance

- Outerwear specifics: Down/feather content and FP verification; baffle consistency; thermal imaging spot checks; seam tape peel tests.

- Traceability: Material batch numbers, trim lot codes, and packing lists; retain for UFLPA risk checks. [CITE: CBP UFLPA operational guidance 2024]

- Deviations and CAPA: Root cause logs, owner assignments, retest timelines; buyer sign-off before bulk resumes.

[INTERNAL LINK: AQL inspection checklist → Resource page idea]

Best Places to Find Wholesale Clothing Vendors in China (Markets, Platforms, and Trade Shows)

Start with Guangzhou (Zhongda) for fabrics and apparel hubs, Yiwu for accessories and basics, and Shenzhen for accessories and electronics-linked garments. On platforms like Alibaba and Global Sources, refine searches by export region, audits, and specialization. Trade shows like Canton Fair and Intertextile enable live sampling and direct factory vetting.

Use Guangzhou for fabrics/outerwear support, Yiwu for accessories/basics, and platforms for RFQs with strict filters. Verify vendors via badges plus audit recency, references, and small trial orders before scaling. Trade shows compress sampling and negotiation timelines with face-to-face checks.

Physical Markets

- Guangzhou (Zhongda): Deep fabric ecosystem, mills, and trim houses near garment factories—ideal for jacket sampling.

- Yiwu: Broad accessory and basics hub; validate factory backends when sourcing branded apparel to avoid compliance gaps.

- Shenzhen: Efficient for accessories and smart wear integrations; strong logistics gateway.

Bring a short RFQ pack: tech pack excerpt, target MOQ, deadline, compliance needs, and testing scope. Collect business licenses, audit summaries, and factory addresses. [CITE: Local market guides from provincial trade bureaus]

Digital Platforms & Trade Shows

- Alibaba/Global Sources: Filter by audit badges, export regions (US/EU), and category specialization; request live factory tour slots.

- Canton Fair: Cross-category access; plan day-by-day routes and pre-book meetings. [MENTION: Canton Fair organizers]

- Intertextile (Shanghai): Fabric-first decisions that help de-risk outerwear quality and timelines. [MENTION: Messe Frankfurt]

For each prospect, run a 15-minute product fit interview, sample feasibility check, and compliance Q&A. Approve only those with aligned answers and prompt sample turnaround. [CITE: A sourcing platform’s supplier verification checklist]

Data & Trends: China Apparel Sourcing in 2024–2025

China remains a leading apparel exporter with ongoing upgrades in compliance, traceability, and material availability. Logistics performance and AI-led demand planning shape lead times and buffer strategies. Recycled materials, PFC-free DWR, and verified down supply feature in brand roadmaps for US/EU markets.

China’s scale persists while compliance, traceability, and materials evolve. Logistics performance and raw material access drive lead times and costs in 2024–2025. Recycled inputs, verified down, and PFC-free finishes gain share as brands standardize higher environmental and social expectations.

- China apparel export share — 2024 (Source: [CITE: WTO 2024 World Trade Statistical Review])

- Logistics Performance Index (LPI) — impacts reliability — 2023 (Source: [CITE: World Bank LPI 2023])

- Sourcing pivots to traceability and recycled inputs — 2024 (Source: [CITE: McKinsey State of Fashion 2024])

Risks, Compliance & Localization (US & EU)

Manage chemical, safety, and social risks proactively. For EU-bound goods, align with REACH and buyer RSLs. In the US, meet CPSIA, flammability, and UFLPA traceability expectations. Maintain audit currency, collect certificates of analysis (COA) and conformity (COC), and store documentation to prevent shipment delays or seizures.

Center compliance from discovery through shipment. Map REACH (EU), CPSIA and flammability (US), and UFLPA documentation. Validate social and quality audits, require test reports, and maintain traceability files with batch, mill, and trim data to reduce customs risk.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Chemical non-compliance (REACH/RSL) | Medium | High | Pre-production testing; supplier RSL training; retain COAs. [CITE: ECHA REACH guidance] |

| Safety failure (CPSIA/flammability) | Low–Medium | High | Accredited lab tests; tracking labels for kidswear; retention of GCC. [CITE: CPSC guidance] |

| Forced labor traceability (UFLPA) | Low–Medium | High | Chain-of-custody docs; lot-level traceability; mill declarations; CBP-ready files. [CITE: CBP UFLPA operational guidance] |

| Quality variance (bulk vs samples) | Medium | Medium | AQL inline/pre-shipment; pilot runs; CAPA logs with sign-offs. |

| Shipping delays/cost spikes | Medium | Medium | Flexible routing; early bookings; split shipments; safety stocks. [CITE: Freight rate index commentary 2024] |

Regulatory Notes for US & EU

- EU: REACH SVHCs, azo dyes, nickel release; country-specific labeling; Eco-design and digital product passport pilots in planning. [CITE: ECHA 2024 updates]

- US: CPSIA for kidswear (lead, phthalates), flammability for apparel (16 CFR 1610), and tracking labels; state-level chemical restrictions may apply. [CITE: CPSC regulations page]

- UFLPA: Keep purchase orders, invoices, bill of materials, mill declarations, and lot-level flow from fiber/yarn to finished goods. [CITE: CBP UFLPA 2024]

- Social audits: BSCI/SEDEX or WRAP acceptable to many buyers; confirm recency and scope; keep corrective action plans on file. [CITE: amfori BSCI system manual]

[INTERNAL LINK: Sustainability & Compliance at Eton → Pillar page idea]

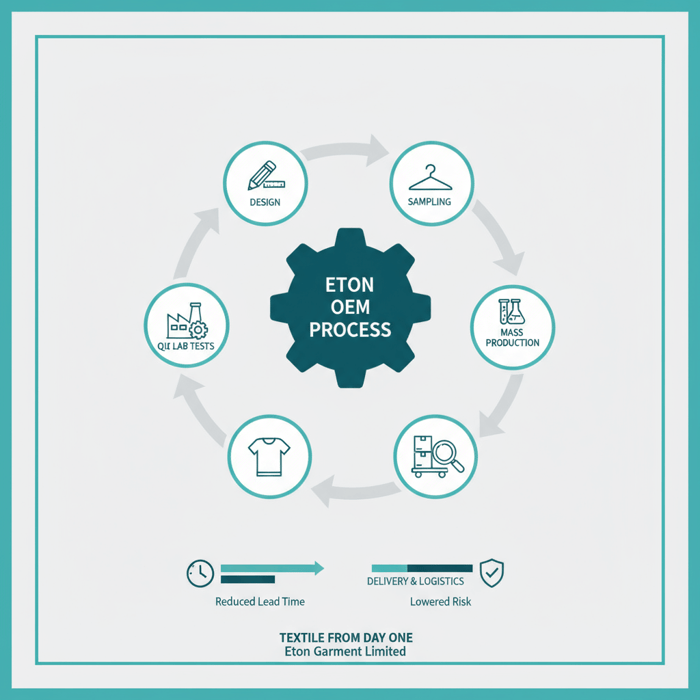

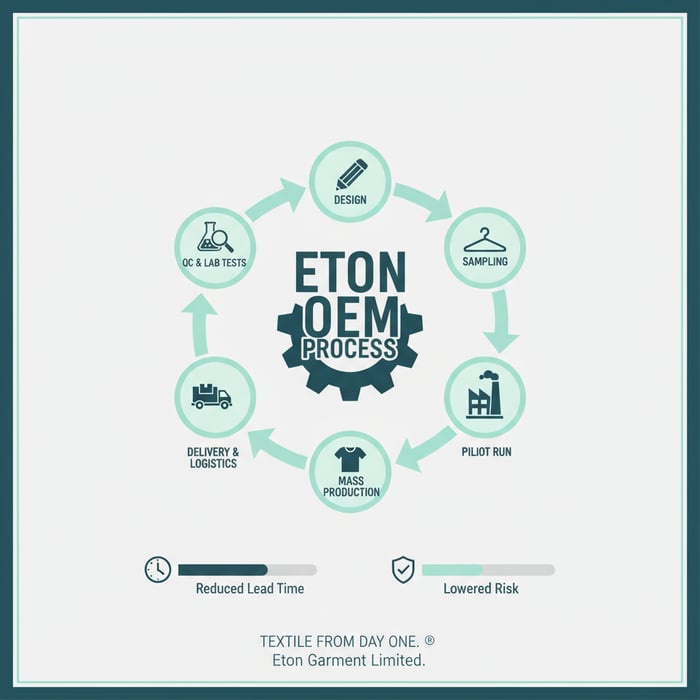

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

For brands that require customized, compliant outerwear with consistent quality, Eton’s Clothing Manufacturing OEM Service integrates design support, fabric and trim sourcing, technical development, production, and QC. Launched in 1993, Eton operates modern facilities in China and Bangladesh with strong retail references and international compliance standards. “Textile From Day One.”

Eton’s OEM solution combines category expertise in jackets, padded coats, and technical apparel with compliance-first production across China and Bangladesh. Expect design-to-delivery workflows, accredited lab testing, structured QA, and transparent costing for US/EU programs.

| Brand Need | OEM Feature | Outcome |

|---|---|---|

| Technical Outerwear Capsule | Patterning, taped seams process, insulation controls, lab tests | Reliable waterproof/breathable performance, consistent fill weights |

| US/EU Compliance | REACH/CPSIA test planning, audit-backed facilities, traceability docs | Lower customs risk and faster clearances |

| Cost & Lead Time Clarity | FOB breakdowns, critical path plans, booking windows | Predictable margins and on-time deliveries |

| Scale & Reorders | China + Bangladesh capacity, color consolidation strategies | Volume flexibility and price stability |

Use Case 1: Technical Outerwear Brief → Factory Solution

A US brand issues a 10-style parka and shell capsule targeting US/EU. Eton co-develops patterns, selects membranes and insulation, defines seam-tape widths, and pre-writes lab test plans. After PP approvals, a pilot run validates fill weights and tape adhesion, then bulk proceeds with inline AQL controls and pre-shipment inspections. [MENTION: Gore (for membrane reference only, if used in program)], [CITE: Hydrostatic head test standards]

Use Case 2: Fast Fashion Capsule → Agile OEM Support

An EU retailer needs a 6-week turnaround on padded vests and light jackets. Eton leverages stocked liner/branded zip options, blocks trims for quick approvals, and prioritizes air–sea split shipments. A compact test plan and carton optimization support speed with maintained quality. [CITE: Lead-time compression case notes from apparel trade media]

Learn more or request an estimate: Clothing Manufacturing OEM Service. [INTERNAL LINK: OEM/ODM Outerwear Manufacturing → Service page idea] [INTERNAL LINK: Design & Technical Development for Jackets → Sub-service page idea]

Conclusion & Next Steps

Shortlist the right vendor type for your category, run compliance-first vetting, model costs and logistics, and execute a staged QA pipeline. For custom outerwear, partner with an OEM that blends technical depth with traceability and testing discipline for US/EU programs.

Decide vendor type, score and shortlist, align on compliance, and lock QA and logistics plans. For outerwear and performance apparel, an OEM with proven US/EU delivery and audits accelerates scale with less risk. Start with a targeted RFQ and a structured sample run.

- Week 1–2: Define product scope, compliance needs, and RFQ pack; shortlist 5–7 candidates.

- Week 3–4: Samples and video walk-throughs; reduce to 2–3 vendors; plan audits.

- Week 5–6: PP approvals, pilot runs, and final costing; book capacity and logistics.

- Bulk phase: Inline AQL, lab tests, and pre-shipment inspections; compile customs documentation.

[INTERNAL LINK: Sourcing checklist download → Resource page idea] [INTERNAL LINK: Our foundational guide on landed cost modeling]

Author & Review Notes (E-E-A-T)

- Author: Alex Chen, Head of Sourcing (Eton Garment), 15+ years in OEM/ODM outerwear. [INTERNAL LINK: Alex Chen — Head of Sourcing — Author bio]

- Reviewer: Compliance Team Lead, Eton Garment Limited.

- Methodology: Factory-side experience; standards synthesis; triangulated with institutional sources listed below.

- Limitations: Cost/lead-time ranges vary by season, material markets, and logistics. Verify current regulations before production.

- Disclosure: Eton provides OEM/ODM services; vendor-neutral guidance precedes product integration.

- Last Updated: 2025-10-28

References & Sources

- McKinsey & Company — The State of Fashion 2024 (2024). [CITE: McKinsey State of Fashion 2024 report link]

- World Trade Organization — World Trade Statistical Review (2024). [CITE: WTO 2024 apparel trade data]

- World Bank — Logistics Performance Index (2023). [CITE: World Bank LPI 2023 site]

- European Chemicals Agency — REACH Guidance (2023–2024). [CITE: ECHA REACH guidance hub]

- U.S. Consumer Product Safety Commission — CPSIA & Flammability Standards (2023–2024). [CITE: CPSC regulations]

- U.S. Customs and Border Protection — UFLPA Operational Guidance (2024). [CITE: CBP UFLPA page]

- amfori — BSCI System Manual & Guidance (2023–2024). [CITE: amfori BSCI system manual]

- ISO — ISO 9001:2015 Quality Management Systems. [CITE: ISO 9001 standard page]

- Freightos — Freight Index and Transit Time Notes (2024). [CITE: Freightos Baltic Index overview]

- Drewry — Weekly Container Insights (2024). [CITE: Drewry spot rate commentary]

- Textile Exchange — Recycled Fiber Market Updates (2024). [CITE: Textile Exchange recycled materials brief]

De‑AI Rewrite (Humanized Narrative)

Wholesale clothing vendors China fall into three camps: factories, OEM/ODM partners, and trading companies. If you’re building outerwear or performance lines for the US or EU, lean toward an OEM/ODM China Clothing Manufacturer—then back that decision with audits, lab tests, and an inspection plan that covers samples through shipment.

The shortlist that works: pick vendors by category fit, verify BSCI/SEDEX/ISO 9001, trade tech packs and samples, enforce AQL inspections, and align to REACH, CPSIA, and UFLPA. Compare MOQs, lead times, Incoterms, and freight before you sign. This locks cost and delivery with fewer surprises.

Vendor Types, Fit, and Discovery

Factories shine on repeats. OEM/ODM teams add the patterning, fabric development, taped seams, and insulation controls that keep outerwear on spec. Trading companies find capacity fast but add margin and create distance from the line. Start in Guangzhou for fabric-rich ecosystems, treat Yiwu as an accessory and basics hub, and use platform filters plus trade shows to pressure-test capability. [MENTION: Alibaba.com], [MENTION: Global Sources] [CITE: Trade show hall guides]

Choosing with a Scoring Lens

Weight compliance at the top, then product fit and cost. Score three vendors and move two through samples and audits. Evidence beats claims: audited facilities, recent references, lab test reports, and a PP sample that matches your spec. [MENTION: amfori BSCI], [CITE: ISO 9001 process notes]

Costs, MOQs, Lead Times

Outerwear MOQs usually start between 300 and 1,000 units. First bulk takes 45 to 75 days after approvals, driven by fabric and trims. Model duties and freight under FOB and CIF, and agree on testing and inspection scope up front so costs don’t creep in later. [MENTION: Freightos] [CITE: Tariff schedule sources]

QA from Tech Pack to Truck

Lock the BOM, approve a PP sample, run a pilot, and keep AQL inspections inline and pre-shipment. For jackets, check fill weights, seam tape adhesion, and hydrostatic head. Traceability files help pass UFLPA checks and keep border holds rare. [CITE: CBP UFLPA guidance]

US/EU Compliance Without Guesswork

REACH and CPSIA set the rules; UFLPA sets the bar on proof. Keep audit summaries, COAs, and test plans tidy and current. When in doubt, test early. [MENTION: ECHA], [MENTION: CPSC]

When an OEM Partner Saves Time

If you need taped seams, verified down, and tight lead times, an OEM like Eton integrates development, labs, and QC with clear costing and capacity in China and Bangladesh. The result: fewer rounds, less friction, and predictable delivery. Clothing Manufacturing OEM Service

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »