Where to Get Cheap Material: A China Clothing Manufacturer’s Sourcing Playbook for Fashion Brands

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

9 minute read

Where to Get Cheap Material: A China Clothing Manufacturer’s Sourcing Playbook for Fashion Brands

Where to get cheap material is the question every US/EU fashion brand asks a China Clothing Manufacturer when margins feel tight. Cheap fabric in bulk is possible without losing quality if you treat price as one factor among traceability, QC, MOQ for fabric, and lead time. This playbook distills 30+ years of factory-side sourcing at Eton Garment Limited into steps that cut unit cost and risk together.

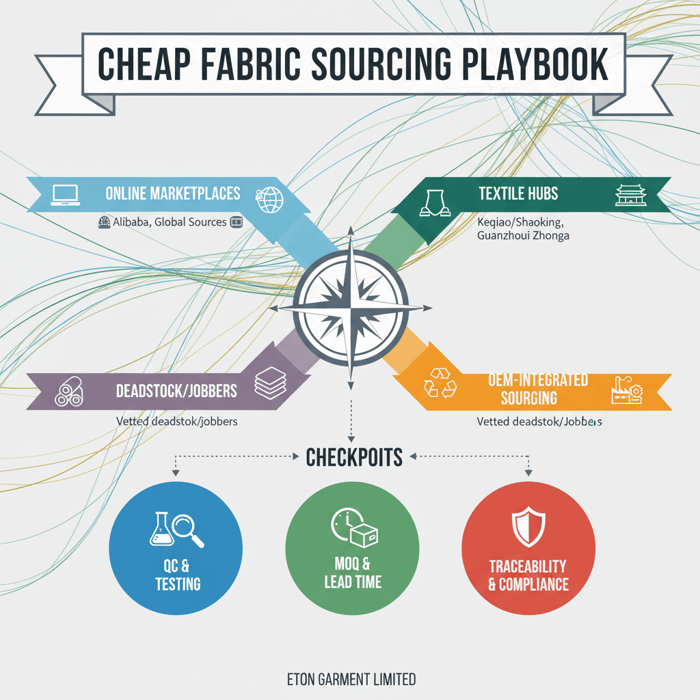

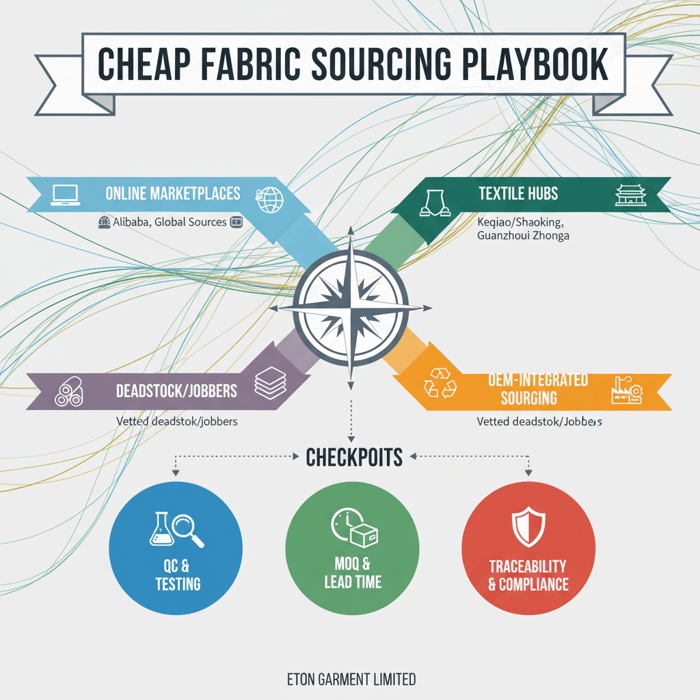

Cheap material comes from four reliable paths: online fabric wholesalers, offline China textile hubs (Keqiao/Shaoxing, Guangzhou Zhongda), vetted deadstock/jobbers, and OEM fabric sourcing via a manufacturing partner. Match price with MOQ, QC testing, and compliance (UFLPA, EU ESPR) to avoid false savings.

Where to get cheap material is a commercial decision wrapped in compliance and quality. Brands that link fiber price, finish, MOQ, tests, and Incoterms lower real costs and protect sell-through. Eton’s factory network in China and Bangladesh buys daily from mills and trading companies; these insights reflect what holds up under production pressure.

What “Cheap Material” Really Means for Fashion Brands

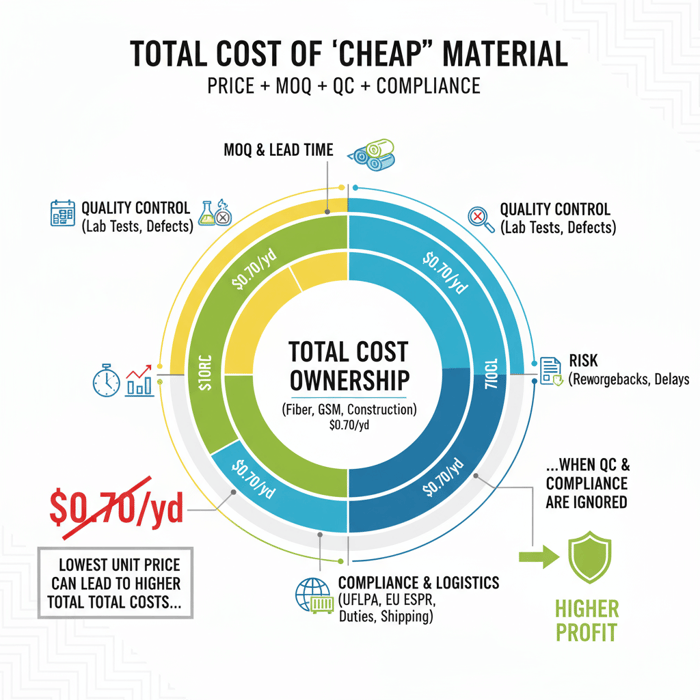

Cheap material should be framed as risk-adjusted value: unit price plus QC, lead time, MOQs, defect rates, logistics, duties, and compliance. The lowest price per yard can become expensive after color bleeding, shrinkage, or shipment detention under UFLPA or EU rules.

Think in total cost of ownership. A rock-bottom polyester at $0.70/yd looks attractive until lab results fail, causing rework, chargebacks, and lost time-to-market. A slightly higher-priced mill-run at $0.95/yd with OEKO-TEX and documented chain-of-custody can out-earn through fewer defects and smoother customs.

- Unit price and fiber: polyester, recycled poly, poly-cotton blends, cotton, nylon, spandex content

- Construction: GSM, denier, weave/knit type, finishes, coatings

- MOQ: price breaks at 1,000–3,000 meters; partial dye lots raise cost

- Lead time: greige availability, dye calendars, finishing queues

- QC and testing: AATCC, ISO, ASTM methods; third-party lab fees and timing

- Traceability: UFLPA compliance textiles, Better Cotton claims, recycled content verification

- Logistics and duties: Incoterms, HS codes, tariff rates, port congestion

[CITE: A recent WTO or OECD report quantifying textile input cost components] [MENTION: Textile Exchange; OEKO-TEX Association] [INTERNAL LINK: Apparel Landed Cost Calculator]

Cost Drivers and Trade-offs

Fiber type sets the floor. Polyester and polyester blends often deliver better price bands than cotton, especially when mills run continuous dye schedules. Finishes like waterproof coatings add process steps and yield loss; cost rises if small lots require machine clean-downs. Shrinkage above tolerance forces pattern changes and extra sampling cycles. A five-day delay in lab test turnaround pushes dye calendars out, extending lead time and risking missed windows at retail.

[CITE: Mill cost drivers overview from a recognized trade body] [MENTION: H&M Group sourcing notes; Inditex supply chain transparency reports]

MOQ, Lead Time, and Quality Tiers

MOQ unlocks price ladders. Mills quote higher at 500 meters when a standard piece-dye run is 1,200 meters. Lead time tightens when fabric matches a mill’s running program; custom colors or finishes add setup days. Quality tiers matter: first-grade runs deliver consistent handfeel and shade bands; second-grade or “seconds” cut unit cost yet spike defect rates in production. Cheap material is viable when MOQ aligns with price breaks and the test plan matches wear and care claims.

[CITE: Incoterms and MOQ economics from ICC or industry paper] [MENTION: ICC Incoterms; AATCC standards]

Where to Get Cheap Material in Bulk: Online vs. Offline vs. Deadstock

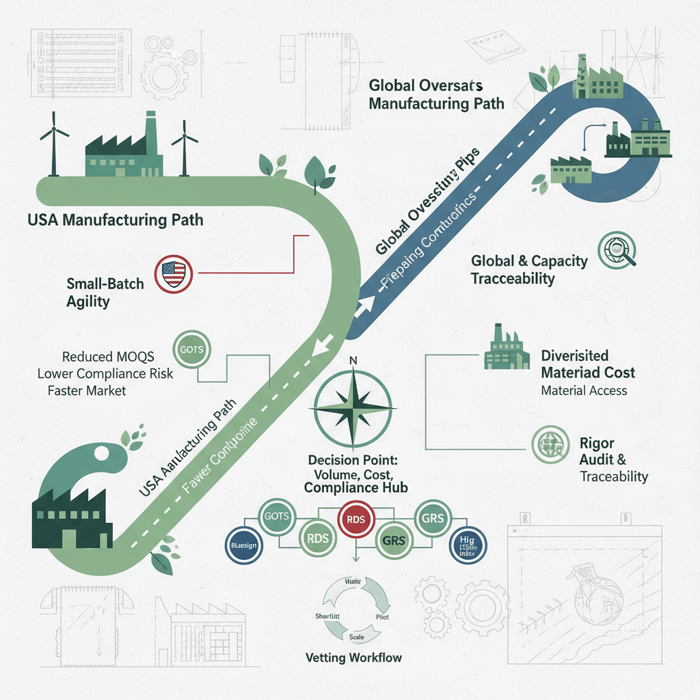

The dominant bulk sources are online B2B marketplaces, offline textile hubs in China, and deadstock/jobbers. Each has different price bands, MOQs, verification ease, and scaling potential. OEM-integrated sourcing adds production alignment and compliance documentation.

| Source type | Typical MOQ | Lead time | Price band | QC/testing ease | Scalability | Compliance traceability |

|---|---|---|---|---|---|---|

| B2B marketplaces (Alibaba fabric suppliers, Made-in-China, Global Sources) | 300–3,000 m | 7–30 days ex-stock; 25–60 days made-to-order | Low to mid | Moderate—requires lab testing and sample verification | Varies—traders vs. mills | Mixed—request chain-of-custody and certifications |

| Keqiao/Shaoxing (China textile hubs Keqiao) | 500–5,000 m | Same-week for ex-stock; 20–45 days for custom | Low to mid | High—on-site sampling and mill access | High—dense mill ecosystem | High when buying direct from mills with documentation |

| Guangzhou Zhongda Fabric Market | 300–3,000 m | Same-week for market stock; 25–45 days custom | Low to mid | Moderate—1:1 inspection possible | Moderate—market vendors vary | Mixed—verify supplier chain |

| Deadstock/jobbers | 100–1,000 m per SKU | Immediate for available rolls | Low | Low—past test records rare; retest required | Low—continuity risk | Low—traceability gaps; extra diligence |

| OEM-integrated sourcing | Aligned to garment PO (variable) | Compressed through calendar coordination | Mid with reduced total cost | High—factory-grade QC funnel | High—repeatable and scalable | High—centralized documentation |

[CITE: Keqiao Textile City overview; Guangzhou market government bureau page] [MENTION: Alibaba.com; Global Sources] [INTERNAL LINK: China Textile Hubs Guide]

Online B2B Marketplaces

Alibaba, Made-in-China, and Global Sources offer breadth and speed for discovery. Verified profiles, audit badges, and transaction history help filter suppliers. Screen for mill-backed listings when scaling. Request swatches, lab dips, and third-party test reports up front. Push for OEKO-TEX Standard 100, recycled content documentation, and fiber origin declarations for UFLPA checks.

[CITE: Marketplace verification criteria from platform help centers] [MENTION: OEKO-TEX; SGS/Bureau Veritas testing labs]

Offline Hubs in China: Keqiao/Shaoxing, Guangzhou Zhongda

Keqiao hosts thousands of mills and traders, especially for woven polyester, blends, and technical fabrics. Sampling is fast and face-to-face QC reduces surprises. Guangzhou Zhongda offers breadth for fashion knits and market-driven stock. Immediate touch-tests, shade checks, and roll-end inspection raise confidence before lab work. On-site visits support chain-of-custody validation.

[CITE: Official Keqiao hub stats; local trade bureau reports] [MENTION: BGMEA for regional cross-comparison; China National Textile and Apparel Council]

Deadstock & Jobbers: Cheap but Can You Scale?

Deadstock fabric sourcing captures mill overruns and roll ends at steep discounts. It suits capsules and small runs. Verification is the hurdle: confirm fiber content with lab tests, inspect for shade variation, and check prior QC records. Stock continuity is limited; plan colorways to adapt or restrict the range to avoid mid-season stockouts.

[CITE: Textile waste and overproduction studies from reputable NGOs] [MENTION: Fashion for Good; Circular fashion initiatives]

How to Get Cheap Material Without Sacrificing Quality

Use a sampling-to-bulk QC funnel: define specs, run lab dips, conduct tests, trial garments, then lock a Golden Sample. Cheap runs demand tougher gatekeeping and documented approvals at each stage.

- Define specs: fiber, GSM/denier, weave/knit, finishes, performance targets.

- Request swatches and lab dips: control shade bands; assess handfeel and drape.

- Run tests: colorfastness, shrinkage, tensile, seam slippage, pilling, hydrostatic head if applicable.

- Pilot production: 20–50 pieces through real cutting, sewing, wash/wear checks.

- Approve Golden Sample: sign-off with labeled retains, seal lot shade ranges.

Document inputs and outputs per gate. Store lab reports with batch numbers. Track shade windows against production rolls to catch out-of-tolerance bands early.

[CITE: AATCC and ISO method references for colorfastness and shrinkage] [MENTION: AATCC; ASTM International] [INTERNAL LINK: Fabric Testing Toolkit]

Essential Fabric Tests

Colorfastness to laundering (ISO 105-C06) reveals dye stability. Dimensional change testing identifies shrinkage that affects pattern grading. Tensile strength (ASTM D5034) and seam slippage protect against split seams in high-stress areas. Pilling resistance evaluates surface durability. Hydrostatic head matters for outerwear with waterproof claims. Failures show as shade bleed, torque twist, seam bursts, or rapid abrasion wear.

[CITE: ISO 105 series; ASTM D5034 details] [MENTION: Intertek; TUV Rheinland]

Golden Sample and Pilot Runs

A Golden Sample approved after a pilot run captures real sewing behavior, needle heat impact, wash performance, and color migration across panels. It establishes an anchor for incoming rolls, downstream inspection checkpoints, and claim language. Cheap material becomes safe when a pilot finds latent defects before full-scale production.

[CITE: QC program case study from a recognized apparel auditor] [MENTION: SGS; Bureau Veritas]

Best Places to Get Cheap Material: Decision Framework for US/EU Brands

Select source types using a simple score: price, MOQ, lead time, QC ease, compliance traceability, and scalability. Weight criteria by market window and product claims to reveal low-cost winners.

| Channel | Price | MOQ Fit | Lead Time | QC Ease | Traceability | Scale |

|---|---|---|---|---|---|---|

| Marketplaces | 4 | 4 | 3 | 3 | 2 | 3 |

| Keqiao/Shaoxing | 4 | 4 | 4 | 5 | 4 | 5 |

| Guangzhou Zhongda | 4 | 4 | 4 | 4 | 3 | 3 |

| Deadstock/jobbers | 5 | 5 | 5 | 2 | 1 | 1 |

| OEM-integrated sourcing | 3 | 5 | 4 | 5 | 5 | 5 |

- China remains top exporter of textiles/clothing — 2024 (Source: [CITE: WTO World Trade Statistical Review 2024])

- Brands prioritize resilience and sustainability amid cost pressure — 2024 (Source: [CITE: McKinsey State of Fashion 2024])

[MENTION: WTO; McKinsey & Company] [INTERNAL LINK: Keqiao/Shaoxing Sourcing Deep Dive]

Criteria Overview

Price gets points when quotes hold through production and match shade consistency. MOQ fit matters when price breaks align to PO volumes. Lead time scores rise with greige availability and dye calendar predictability. QC ease depends on transparent sampling and lab records. Traceability climbs with documented fiber origin and certifications. Scale favors mill-backed continuity and OEM calendar control.

[CITE: Supply reliability studies; chain-of-custody guidance from Better Cotton] [MENTION: Better Cotton; Textile Exchange]

Decision Framework

Assign weights per collection. A fast-fashion drop prioritizes lead time and MOQ fit. A performance outerwear line prioritizes QC and traceability. Sum weighted scores to select the sourcing path. Review twice per season as price bands and hub activity shift.

[CITE: Seasonal procurement planning references] [INTERNAL LINK: Our foundational guide on vendor scorecards]

Costs, Negotiation, and Incoterms for Cheap Fabric

Lower spend by aligning MOQs with price breaks, bundling seasonal demand, clarifying specs early, and using Incoterms strategically. Negotiate with side-by-side alternatives and lab test readiness.

- MOQ alignment: Move from 800 m to 1,200 m to access dye-run pricing.

- Bundling: Aggregate colors with similar base cloth to reduce setup.

- Specs clarity: Lock GSM, finish, and tests in the RFQ to avoid padding.

- Seasonality: Book dye capacity ahead of peak calendars.

- Payment terms: Offer deposits that match mill cash cycles for price relief.

| Term | Seller responsibility | Buyer responsibility | Risk transfer | Cost impact |

|---|---|---|---|---|

| EXW | Minimal; goods at seller’s premises | All transport, export, and import steps | At seller’s door | Lower quote; higher buyer logistics |

| FOB | Export clearance; delivery onboard | Ocean freight, insurance, import | When onboard vessel | Balanced; clearer cost split |

| CIF | Ocean freight and insurance | Import clearance and local logistics | Destination port | Higher quote; simpler buyer transport |

[CITE: ICC Incoterms 2020] [MENTION: ICC; Freightos Baltic Index for rate checks] [INTERNAL LINK: Negotiation email/RFQ templates]

Price Drivers and Timing

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

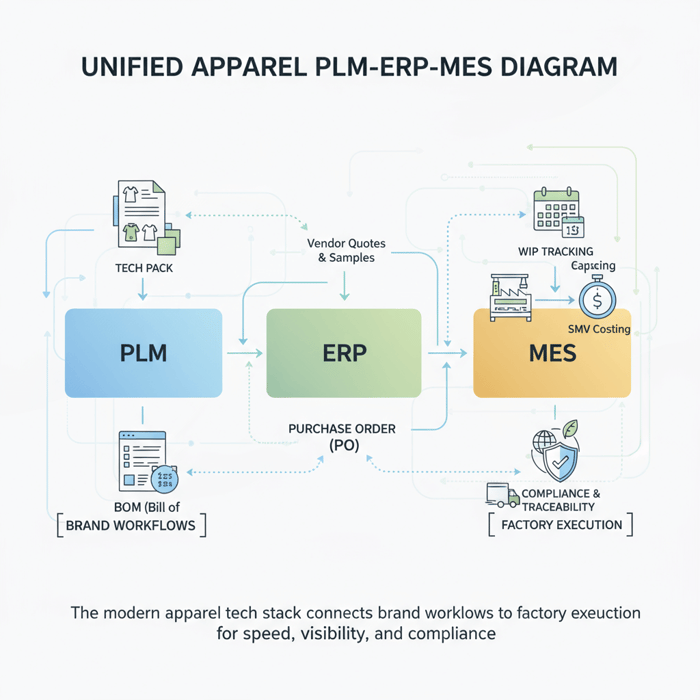

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »