Where to Buy Hanfu (Retail & Wholesale) — A China Clothing Manufacturer’s Guide

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 14th, 2025

12 minute read

Table of Contents

- Where to Buy Hanfu: Retail vs Wholesale

- Where to Buy Hanfu Online: Store Reviews and Quality Checklist

- Where to Buy Hanfu in Bulk for Brands: China Clothing Manufacturer Options

- Compliance & Risk for US/EU: Labeling, REACH, Import

- Trends & Market: Hanfu Demand and Brand Integration

- Validate Quality Before Bulk Orders: Practical QC Methodology

- Minimal‑Risk Capsule Test: 30–60 Day Plan

- Sourcing Workflow for Brands: Retail Benchmarking to OEM Readiness

- Partner with Eton: Clothing Manufacturing OEM Service

- Next Steps

- References & Sources

- FAQs

Where to Buy Hanfu (Retail & Wholesale) — A China Clothing Manufacturer’s Guide

Where to buy hanfu starts with choosing your path: retail sampling or wholesale/OEM. A China Clothing Manufacturer like Eton can help you move from inspired retail picks to compliant, scalable production for US/EU markets. This guide maps both routes, adds QC and compliance steps, and shows how brands turn heritage silhouettes into modern collections.

To buy hanfu, start with trusted specialty stores online and validate quality through fabric, seams, and verified reviews. For brands, source hanfu in bulk via vetted China clothing manufacturers offering OEM/ODM with defined MOQs, fit grading, and US/EU compliance. Compare retail vs wholesale on control, cost, and lead times. [CITE: Wikipedia Hanfu overview] [CITE: FTC Textile Labeling rules] [CITE: EU Regulation No 1007/2011]

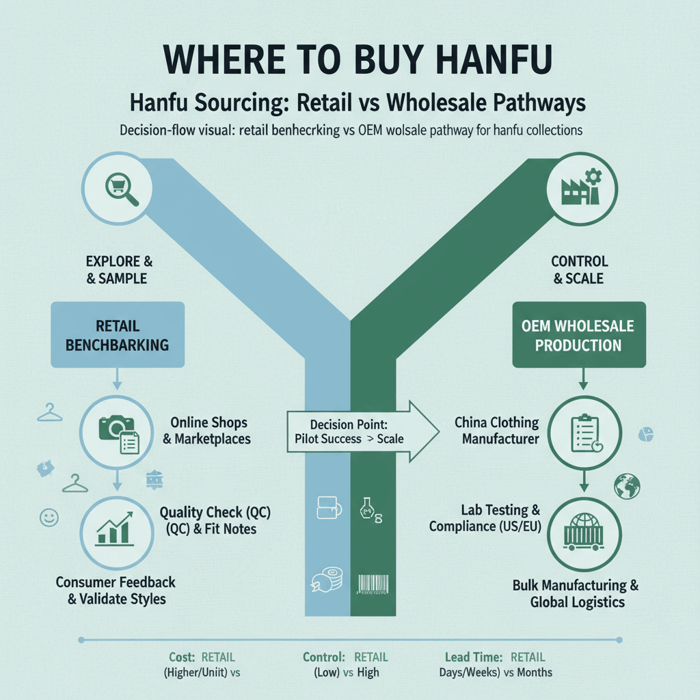

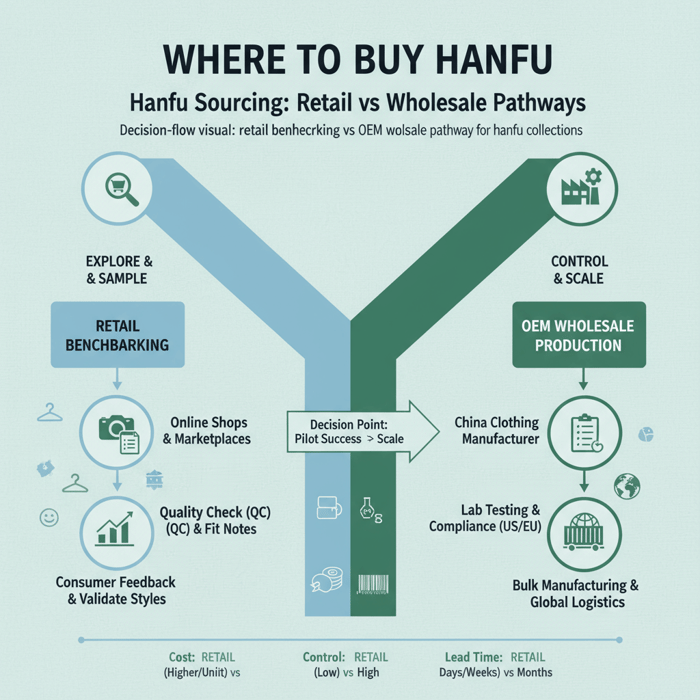

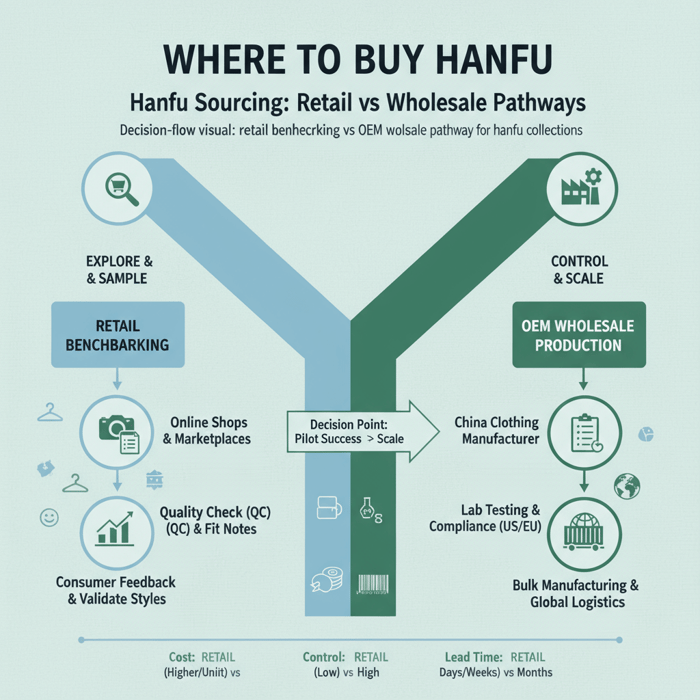

Where to Buy Hanfu: Retail vs Wholesale

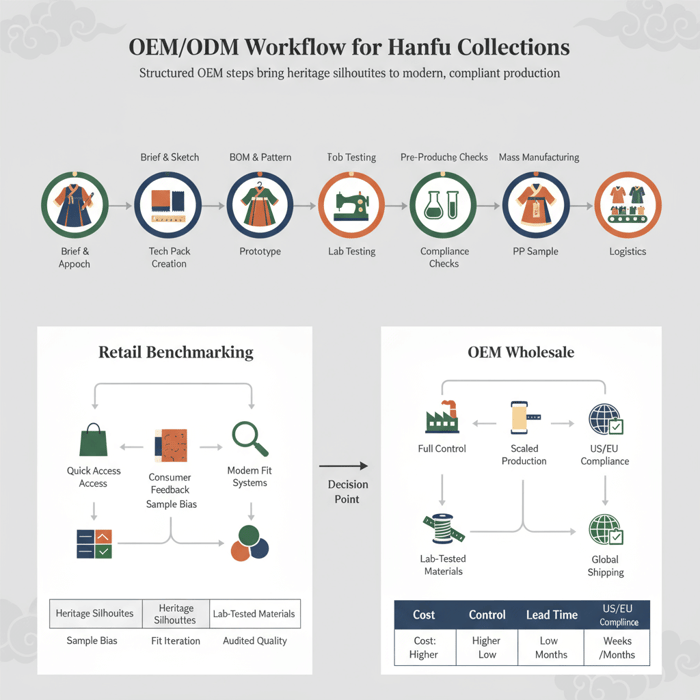

Retail buying suits exploration and consumer testing, while wholesale/OEM serves brands ready to scale with full control over fabrics, trims, fit grading, and compliance. Use retail for benchmarking and samples, then step into OEM for consistency, margins, and certifications across US/EU markets.

Hanfu refers to traditional clothing of the Han Chinese, distinct from qipao/cheongsam which emerged later with different cuts and construction. Retail helps teams understand silhouette families (ruqun, aoqun, mamianqun), accessories, and price bands, while wholesale/OEM unlocks pattern development, BOM control, and lab-tested materials aligned to regulatory standards. [CITE: Wikipedia Hanfu definition] [MENTION: Newhanfu editorial guides] [MENTION: YesStyle marketplace trends] [INTERNAL LINK: Our foundational guide on heritage apparel silhouettes]

- Retail pros: quick access, low commitment, live consumer feedback.

- Retail cons: limited control, inconsistent sizing, variable materials.

- Wholesale pros: fabric/fit control, margin stability, compliance alignment.

- Wholesale cons: MOQs, longer timelines, development investment.

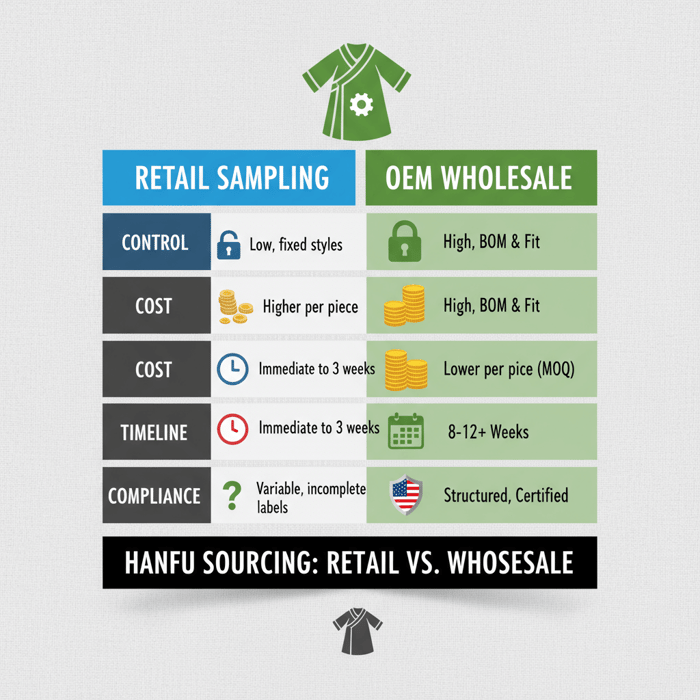

| Attribute | Retail Sampling | Wholesale/OEM |

|---|---|---|

| Unit Cost | Higher per piece; limited discounts | Lower per piece at MOQ+; negotiated |

| Control | Low (fixed styles, materials) | High (BOM, trims, fit grading) |

| Lead Time | Immediate or 1–3 weeks | 8–12+ weeks (dev + production) |

| QC Consistency | Variable across shops | Process-based and auditable |

| Compliance | Mixed; labels may be incomplete | Structured for US/EU standards |

| Risk | Low cash risk; sample bias | Higher commitment; higher control |

Retail Path: Explore, Sample, Validate

Use retail shops to understand silhouette appeal, comfort, and accessory packaging. Document fit notes, seam quality, fabric drape, and colorfastness. Capture consumer feedback on sleeve length, skirt fullness, waist ties, and ease of movement. Build a reference library of photos and tech notes to guide OEM design later. [MENTION: Newhanfu shop roundups] [MENTION: Hanfu Culture editorial reviews] [INTERNAL LINK: Our retail benchmarking checklist]

Wholesale Path: Control, Scale, Comply

When a capsule gains traction, OEM/ODM delivers repeatable quality. Define BOMs (silk, tencel, polyester brocade), trims (frog closures, ribbons), size grading, and stitch standards. Plan lab testing for colorfastness, pH, restricted substances, and labeling. Align accessory packs and packaging to US/EU rules and prepare carton marking and HTS codes for import. [CITE: ECHA REACH restricted substances guidance] [CITE: US CBP apparel importing overview] [INTERNAL LINK: Compare garment factory options]

Where to Buy Hanfu Online: Store Reviews and Quality Checklist

Prioritize specialty hanfu shops and reputable marketplaces with clear materials, accurate sizing, and transparent returns. Validate fabric type, seam construction, trims, and accessories. Avoid listings with vague materials, one-size claims, or stock photos unrelated to the garment.

When screening shops, look for high-resolution product photos, fabric descriptions (mulberry silk, brocade blends), seam close-ups, and standardized size charts. Cross-check customer reviews for fit notes and color bleed. For US/EU sampling, retain packaging and labels to examine fiber content declarations and care instructions. [MENTION: YesStyle hanfu categories] [MENTION: Etsy seller policies] [CITE: EU Textile Regulation No 1007/2011 labeling rules] [INTERNAL LINK: Fabric sourcing for traditional garments]

Store Types: Specialty Hanfu, Marketplaces, Fashion Retailers

Specialty hanfu stores often curate heritage-consistent silhouettes with better fabric transparency. Marketplaces carry broad options but require stricter vetting for authenticity and materials. Fashion retailers may offer hanfu-inspired pieces with contemporary fits, which can help benchmark appeal and price anchors. Use a balanced mix for samples and style research. [CITE: iiMedia Hanfu Industry Report (2023)] [MENTION: Culture Trip regional retail notes]

| Type | Pros | Cons |

|---|---|---|

| Specialty Hanfu Shops | Better silhouette fidelity; fabric details; community feedback | Limited returns to US/EU; smaller size runs |

| Marketplaces (Etsy/AliExpress) | Broad range; quick shipping options | Mixed authenticity; variable QC; supplier turnover |

| Global Fashion Retailers | Easy purchase; familiar policies | Hanfu-inspired; less heritage accuracy |

Quality Checklist: Fabrics, Stitching, Fit & Accessories

- Fabric: verify silk type, brocade composition, lining breathability; check weight/drape.

- Stitching: clean topstitching; consistent seam allowances; bar tacks at stress points.

- Fit: sleeve length, skirt fullness, waist ties; check movement comfort.

- Color: inspect colorfastness with a damp cloth rub test; check dye odor.

- Trims & Accessories: frog closures, ribbons, belts; secure attachment and finishing.

- Labels: fiber content disclosures; care symbols; origin; safety notes.

- Policies: returns, exchanges, shipping lead times, and duties to US/EU.

Where to Buy Hanfu in Bulk for Brands: China Clothing Manufacturer Options

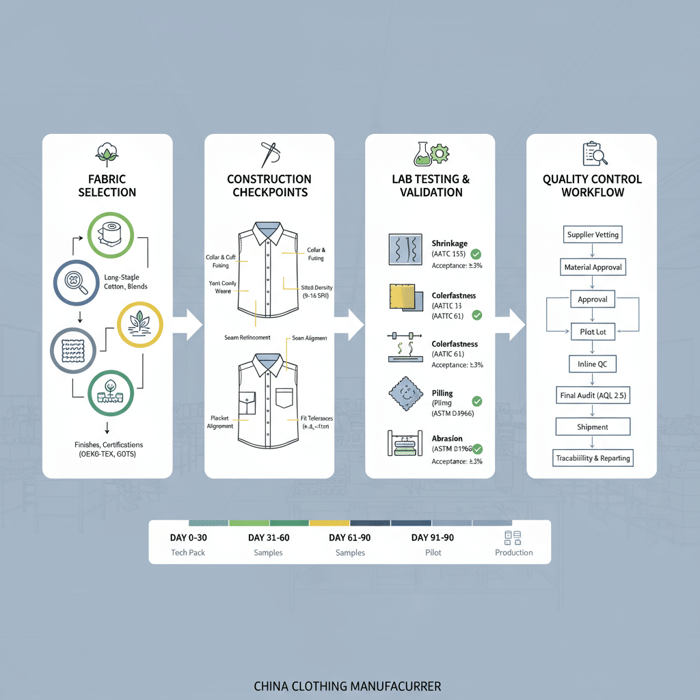

For bulk purchases, partner with experienced China clothing manufacturers offering OEM/ODM. Define BOMs, fabric specs, trims, size grading, and lab testing. Expect MOQs, 8–12+ week timelines, and certification ready documentation for US/EU compliance.

An OEM/ODM partner builds repeatability: pattern blocks, grading rules, stitch specs, and packaging standards. Eton’s process layers heritage silhouettes onto modern fit systems, then validates with wear testing and lab reports for colorfastness, restricted substances, and labeling. MOQs vary by fabric and style complexity; timelines extend with embellishments or custom weaves. [MENTION: McKinsey State of Fashion] [CITE: ECHA azo dyes restriction overview] [INTERNAL LINK: Our production playbook]

OEM/ODM Workflow — Steps

- Brief & Sketch: define silhouette families, fabrics, trims, and price band.

- BOM & Pattern: create tech packs, pattern blocks, and grading rules.

- Prototype: sew development samples; iterate on fit and construction.

- Lab Testing: run colorfastness, pH, and restricted substances checks.

- PP Sample: approve pre‑production sample with final labels and packaging.

- Production: confirm QC plan; line‑set; first article inspection.

- Logistics: book shipments; prepare HTS classification; file compliance docs.

MOQs, Lead Times, and Cost Drivers

- MOQs: 300–800+ units per style; lower with fabric stock, higher with custom brocades.

- Lead Times: 8–12+ weeks; add time for custom weaving, embroidery, or dye lab holds.

- Cost Drivers: fabric quality, yardage, trims, multi‑piece sets, accessory packaging, compliance testing.

| Category | Typical MOQ | Avg. Timeline | Notes |

|---|---|---|---|

| Ruqun (top + skirt) | 400–600 | 8–10 weeks | Solid fabrics speed production; printed motifs add time. |

| Mamianqun (pleated skirt) | 500–800 | 10–12 weeks | Complex pleating and trims drive labor minutes. |

| Hanfu sets (multi‑piece) | 600–900 | 10–14 weeks | Accessory packs and packaging increase QC steps. |

- Restricted azo dyes — EU REACH Annex XVII (Compliance: required) [CITE: ECHA Annex XVII]

- US fiber content labeling — FTC Textile Rules (Compliance: required) [CITE: FTC Textile Rules]

- HTS 61–62 classification — US CBP apparel (Import: required) [CITE: US CBP HTS Chapters 61–62]

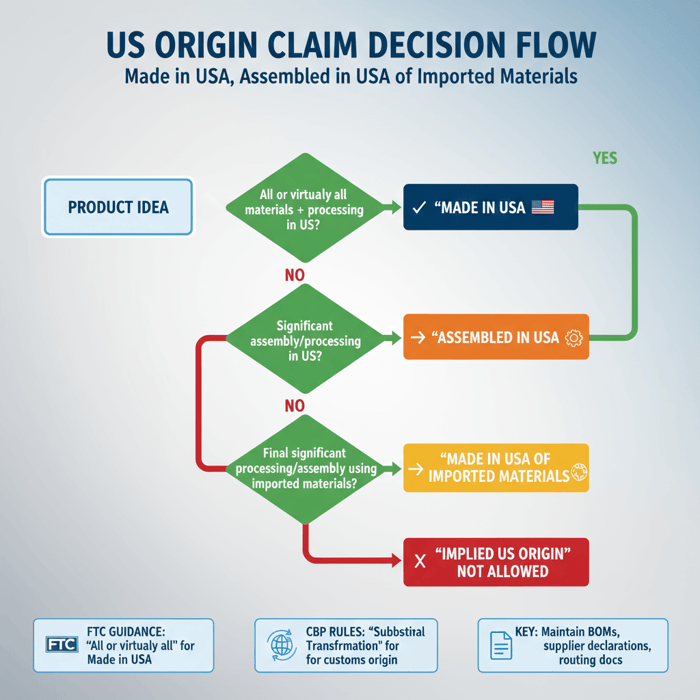

Compliance & Risk for US/EU: Labeling, REACH, Import

Compliance requires accurate fiber labeling, care instructions, origin marking, and chemical safety. US teams follow FTC Textile Rules and CBP import protocols; EU teams follow Regulation No 1007/2011 and REACH for restricted substances, including azo dyes.

US: FTC Labeling and CBP Import

- Labels: fiber content by percentage, RN/ID where applicable, care instructions, and country of origin. [CITE: FTC Textile Labeling rules]

- Import: classify under HTS Chapters 61–62 with correct duty rates; maintain invoices, packing lists, and COO documents. [CITE: US CBP apparel import guide]

- Testing: pursue colorfastness and flammability checks when required; retain lab reports. [CITE: AATCC colorfastness standards overview]

EU: Textile Regulation and REACH

- Labels: fiber names standardized under 1007/2011; language rules per destination country. [CITE: EU Textile Regulation No 1007/2011]

- Chemicals: comply with REACH Annex XVII restrictions (azo dyes, nickel release in accessories). [CITE: ECHA REACH guidance]

- Documentation: technical files and supplier declarations; retain updates for audits. [CITE: EU Commission guidance on product compliance]

Trends & Market: Hanfu Demand and Brand Integration

Hanfu interest has grown through cultural communities and social media. US/EU brands fold hanfu elements—sleeve shapes, pleating, braided closures—into contemporary pieces while keeping heritage lines for special capsules.

Recent reports and search interest show rising awareness outside Asia, with younger consumers citing culture and craftsmanship. Brands succeed when they respect silhouette grammar and choose modern materials that carry drape and luster without inflating costs. [CITE: iiMedia Hanfu Industry Report (2023)] [CITE: Google Trends regional interest] [MENTION: Vogue Business features on heritage apparel]

Demographics and Channels

- Core: Gen Z and young millennials with culture‑driven fashion values.

- Channels: specialty e‑commerce, marketplaces, social storefronts, community events.

- Price Bands: entry sets for sampling; premium silk capsules for brand drops.

Integrating Hanfu Aesthetics into Contemporary Lines

- Sleeves: wide or curved cuffs adapted to daily wear.

- Skirts: pleated structures with modern waistbands for fit stability.

- Closures: frog buttons or tie belts combined with hidden zips for ease.

- Materials: silk-touch blends, tencel, breathable linings for comfort and care.

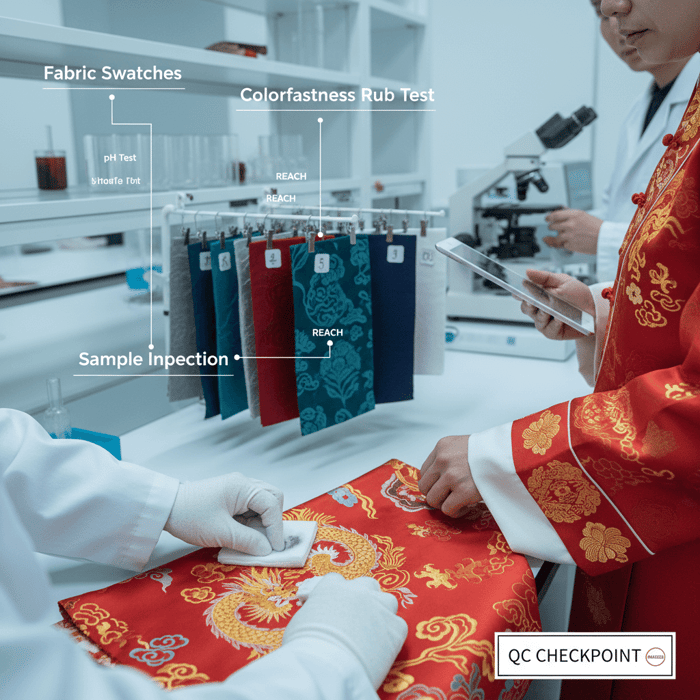

Validate Quality Before Bulk Orders: Practical QC Methodology

Run a layered QC plan: review construction on PP samples, lab‑test high‑risk materials, and audit trims and accessories. Document results in a central tech file and lock approved standards before production.

Lab Tests and Certifications

- Colorfastness to washing/rubbing; perspiration tests for dark colors. [CITE: AATCC test methods]

- pH and formaldehyde checks for skin comfort and safety. [CITE: OEKO‑TEX Standard 100 overview]

- REACH Annex XVII restricted substances screening. [CITE: ECHA Annex XVII]

Fit Grading and Sampling Plan

- Build size sets across US/EU ranges; test movement and drape for each silhouette.

- Use wear tests to evaluate waist tie security, sleeve reach, and skirt flow.

- Approve PP samples alongside labels, packaging, and accessory inclusion.

Minimal‑Risk Capsule Test: 30–60 Day Plan

Pilot a micro‑capsule with tight SKU count and controlled materials. Use retail benchmarks and one OEM style per silhouette to minimize complexity while gathering measurable feedback.

Steps for a Fast Pilot

- Pick 2–3 silhouettes (e.g., ruqun, mamianqun, jacket layer).

- Source retail samples; record fit, fabric, and pricing insights.

- Kick off OEM dev for one style; approve PP sample quickly.

- Launch preorders or limited drop; track sell‑through and returns.

- Survey customers for fit notes and movement comfort.

- Decide scale‑up based on margins, feedback, and QC outcomes.

Metrics and Feedback Loop

- Sell‑through in 14–21 days; return rate; reasons cited.

- Fit satisfaction scores; alteration requests.

- Material feedback: drape, handfeel, wrinkle resistance, care ease.

Sourcing Workflow for Brands: Retail Benchmarking to OEM Readiness

Move from retail benchmarking to OEM readiness with a simple workflow: define silhouette intent, lock BOMs, validate fit, and codify compliance before production.

Retail Benchmarking Checklist

- Capture silhouettes, fabric weights, trim types, and price anchors.

- Note seam types, finishing quality, and accessory packaging.

- Evaluate shop policies and label completeness for US/EU samples.

OEM Readiness Checklist

- Tech packs with measurements, tolerances, stitch specs, and trims.

- Lab test plan: colorfastness, REACH, fiber content labeling.

- Logistics: HTS codes, carton marking, routing, and timelines.

Partner with Eton: Clothing Manufacturing OEM Service

Eton Garment Limited blends traditional hanfu silhouettes with modern pattern systems and compliance discipline. The team produces outerwear and heritage‑inspired apparel at scale with audited quality and US/EU labeling alignment. Textile From Day One.

Eton’s Approach to Hanfu‑Inspired Production

We adapt wide sleeves, pleated skirts, and braided trims to fit‑stable blocks, breathable linings, and durable stitch programs. Our supply chain spans China and Bangladesh, with lab partners for REACH checks and colorfastness. Long‑term retail brand experience shortens the cycle from concept to compliant delivery. [INTERNAL LINK: Our manufacturing capabilities overview] [MENTION: Liverpool F.C. licensing apparel] [MENTION: Forever 21 vendor partnerships]

Start a Project

Explore our Clothing Manufacturing OEM Service and build a capsule aligned to your market. Begin with a single silhouette, PP approval, and a 30–60 day pilot before scaling. Clothing Manufacturing OEM Service. [INTERNAL LINK: Contact our team] [INTERNAL LINK: {{author_name}} - {{author_title}} {{author_bio_url}}]

Next Steps

Decide your path: retail for learning, OEM for control. Use the checklists above to select samples, build tech packs, and confirm compliance. When ready, brief Eton for a PP‑backed pilot so your hanfu capsule moves from inspiration to production without surprises.

References & Sources

- [CITE: Wikipedia — Hanfu overview (2024) — cultural definition and garment components]

- [CITE: FTC — Textile Fiber Products Identification Act & Rules (2023) — US labeling requirements]

- [CITE: EU — Regulation No 1007/2011 on textile fibre names and related labeling (consolidated 2023)]

- [CITE: ECHA — REACH Annex XVII restricted substances guidance (2024)]

- [CITE: US CBP — Importing Apparel HTS Chapters 61–62 overview (2023)]

- [CITE: iiMedia Research — Hanfu Industry Report (2023) — market insights]

- [CITE: AATCC — Colorfastness Test Methods (2022–2024) — lab standards]

- [CITE: OEKO‑TEX — Standard 100 overview (2024) — harmful substance thresholds]

- [CITE: EU Commission — Product compliance and labeling guidance (2024)]

- [CITE: Google Trends — Hanfu search interest in US/EU (2020–2025)]

- [CITE: McKinsey — State of Fashion (2024) — heritage and craft trends]

- [CITE: Vogue Business — Coverage on traditional clothing influences in contemporary fashion (2023–2024)]

FAQs

Where to buy hanfu retail for small brands?

How to buy hanfu wholesale from China manufacturers?

What is the minimum order quantity (MOQ) for hanfu?

How long does hanfu production take from China?

What are the compliance requirements for hanfu in the US?

What are the compliance requirements for hanfu in the EU?

How to verify hanfu quality before bulk orders?

What are the key differences between OEM and ODM for hanfu?

How to choose a reliable China clothing manufacturer for hanfu?

What are the cost factors for hanfu production?

What fabric types are common for hanfu?

How to integrate hanfu elements into contemporary fashion?

Related Articles

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU Markets

11 minute read

October 14th, 2025

Polo Manufacturers: Top China Clothing Manufacturer Options for Fashion Brands in US & EU... more »

Affordable American-Made Clothing vs China Clothing Manufacturer: A Practical Sourcing Guide for Fashion Brands

12 minute read

October 14th, 2025

Affordable American-Made Clothing vs China Clothing Manufacturer: A Practical Sourcing Guide for Fashion... more »

Shirt High Quality Guide with a China Clothing Manufacturer: Build Premium Shirts that Last

15 minute read

October 14th, 2025

Shirt High Quality Guide with a China Clothing Manufacturer: Build Premium Shirts that Last Shirt high... more »

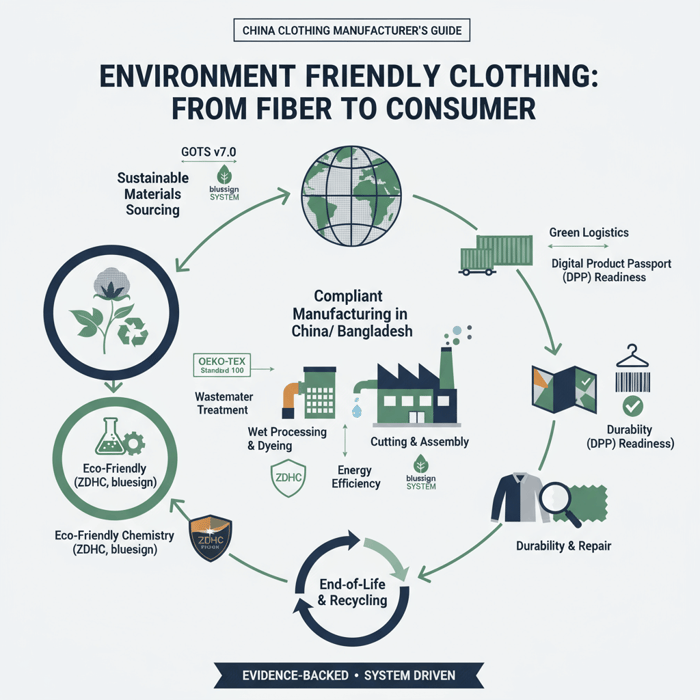

Environment Friendly Clothing: A China Clothing Manufacturer’s Guide for US & EU Fashion Brands

18 minute read

October 14th, 2025

Environment Friendly Clothing: A China Clothing Manufacturer’s Guide for US & EU Fashion... more »