tshirt manufacturer: How to Choose a China Clothing Manufacturer for Quality Tees

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

17 minute read

tshirt manufacturer: How to Choose a China Clothing Manufacturer for Quality Tees

tshirt manufacturer selection shapes fit, handfeel, and margins. Working with a China Clothing Manufacturer gives wide fabric access, advanced printing, and scale for US/EU brands—but only when specs, testing, MOQs, and compliance are set early and tracked. This guide maps a tee program from tech pack to shipment with a clear scoring model, QC, and documentation you can defend.

A tshirt manufacturer sources fabric, cuts, sews, and finishes tees to your specifications. To choose a partner—often a China Clothing Manufacturer—check product quality, MOQs, lead times, pricing transparency, and compliance. Build a tight tech pack, sample in rounds, lab test for shrinkage and colorfastness, and sign off pre-production before scaling.

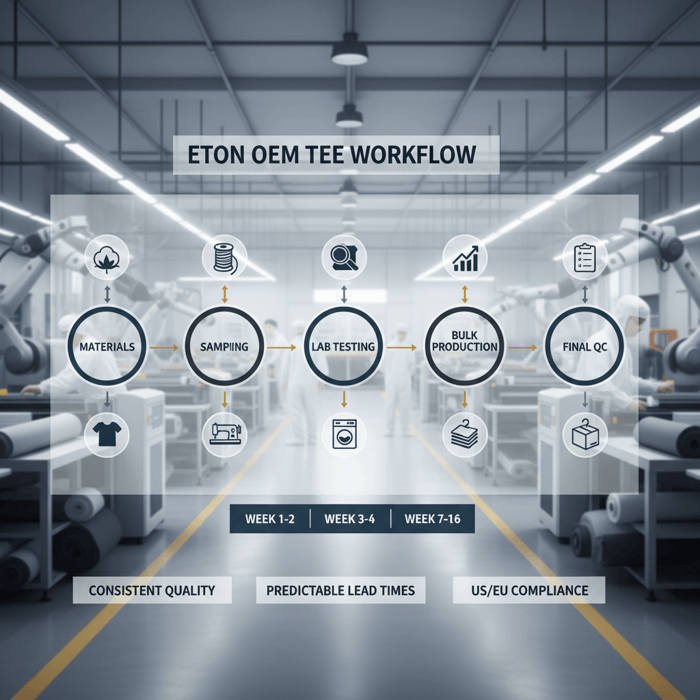

Eton Garment Limited has run OEM/ODM programs for over three decades. Our outerwear discipline—tight tolerances, AQL-driven inspections, and documented compliance—translates directly to tees that hold shape, print, and color through repeat washes. The playbook below gives US/EU brands a practical path to shortlisting factories, running samples, and locking costs with fewer surprises.

Tee programs win on consistent fabric handfeel, stable shrinkage, and print durability. A China Clothing Manufacturer offers breadth of cotton jersey, blends, and finishing; fast sample cycles; and robust capacity. Use a tech pack that specifies yarn, weight, finishes, and print chemistry; run 3–5 wash tests at 40°C; set AQL and lab requirements; confirm REACH/OEKO-TEX; and negotiate MOQs per color/size with calendar buffers. This article includes a regional comparison, landed cost drivers, a compliance fast track, and an onboarding timeline. Eton’s Clothing Manufacturing OEM Service plugs into each stage to compress timelines and reduce rework.

What a tshirt manufacturer does (and how China Clothing Manufacturers differ)

A tshirt manufacturer oversees fabric sourcing, knitting, dyeing/finishing, cutting, sewing, printing, packing, and QA/QC. China Clothing Manufacturers stand out for cotton and blend breadth, advanced embellishment, and speed. The result is strong capability at mid-range MOQs, provided specs are tight and compliance is verified.

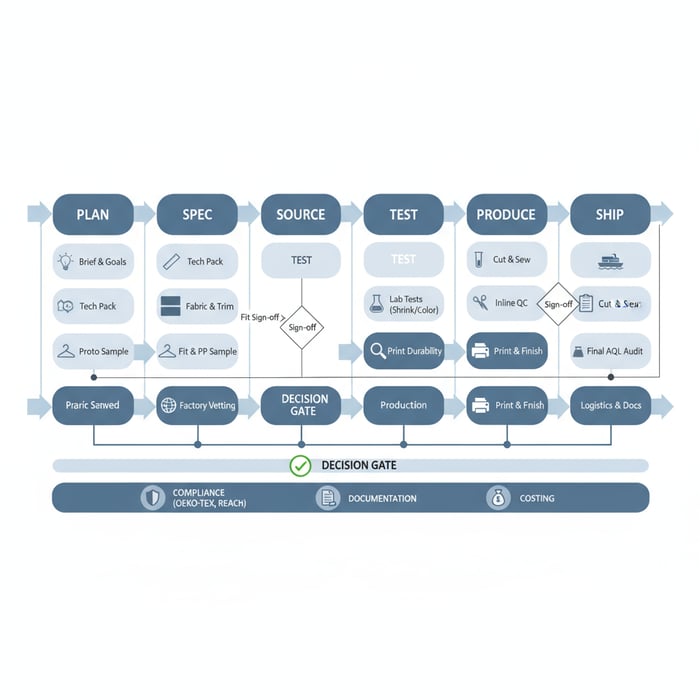

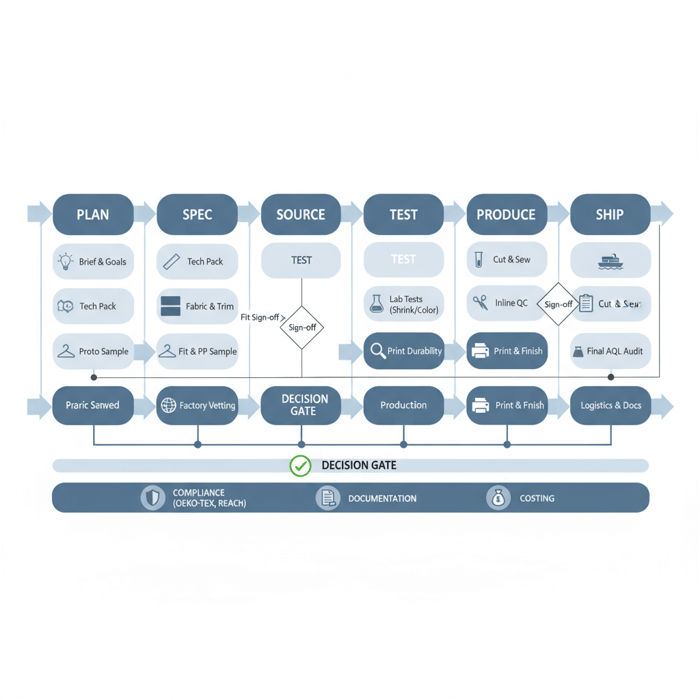

A tee program typically runs across these stages:

- Sourcing: Cotton jersey and blends (ringspun/combed, carded, organic, recycled), trims, labels, packaging; mill booking and lab dips.

- Development: Proto sampling, strike-offs for print/embellishment, fit rounds, cost estimation, lead-time planning.

- Production: Bulk fabric knitting/dyeing, cutting markers, sewing, in-line quality checks, print application and curing.

- Finishing: Wash treatments (enzyme, silicone), final measurements, packing, barcoding, carton audits.

- QA/QC: AQL inspections, lab testing for shrinkage and colorfastness, print durability checks, label compliance.

- Logistics: FOB planning, booking, export documentation, US/EU entry paperwork, and traceability files.

Printing is often in-house for common methods; specialized foil, discharge, puff, or complex CMYK screen sets may use approved subcontractors. Color consistency is anchored by lab dips and strike-offs with controlled curing and wash verification. [CITE: “Tee printing failure rates and causes in industrial audits”] [MENTION: QIMA’s apparel QC primers] [MENTION: OEKO-TEX testing protocols]

Outerwear-grade discipline applies well to tees. Needle policy prevents broken needle fragments; metal detection covers kids’ styles; AQL sampling levels remain consistent; POMs (points of measure) are locked early; and any fabric lot shift triggers re-tests before bulk cutting.

OEM vs ODM for t-shirts

OEM: You provide the tech pack; the factory executes. This works for brands with defined fit blocks, established fabric preferences, and strict print standards. Time to market improves when your fit block and tolerances are proven.

ODM: You select from the factory’s base bodies and fabric options. This suits capsule drops, private label basics, or programs needing rapid launch. ODM accelerates by skipping pattern build from scratch and using pre-qualified fabrics and trims. Many China tshirt factory ODM libraries include classic crew, boxy, relaxed, and oversized fits, ready with graded size sets and known shrinkage behavior.

Example: A US premium brand picked an ODM relaxed crew in ringspun combed cotton 30/1 at 180 gsm. The factory’s pre-tested shrinkage profile cut a full sample round and removed a lab queue, trimming two weeks from the calendar.

Core capabilities checklist

- Fabric: Single jersey, 26/1–40/1 yarn counts; ringspun combed cotton; organic/recycled options; melange and heathers; spandex blends for stretch.

- Finishes: Enzyme and silicone wash; bio-polish for pilling resistance; peaching for handfeel; anti-bleed treatments for dark grounds.

- Construction: Shoulder-to-shoulder taping; coverstitch hems; twin-needle seams; stable rib on necks; clean label application.

- Printing: Screen (plastisol, water-based), DTF, DTG; discharge on darks; puff/3D; foil; reflective; with correct mesh counts and curing profiles.

- QC: AQL 2.5–4.0 by SKU; controlled shrinkage within tolerance; colorfastness to washing and rubbing; print adhesion tests; defect tagging and rework flow.

- Compliance: OEKO-TEX Standard 100; REACH-conformant chemicals; cotton traceability for UFLPA; labeling to US/EU regulations.

How to evaluate a tshirt manufacturer: quality, MOQs, lead times, and costs

Assess fit by product quality, sample performance after washing, colorfastness, print durability, MOQs, capacity, lead times, and cost transparency. Confirm certifications, lab test readiness, and planner-to-merchandiser communication quality. Tie factory choice to a weighted scoring model aligned to channel, price point, and calendar.

- High-MOQ specialist: Lower unit cost at volume, set calendars, stable materials; less flexible on small colorways or split shipments.

- Flexible multi-category factory: Adaptable on styles, faster change management; sometimes variable shrinkage control without strict testing gates.

| Criteria | What “Good” Looks Like | How to Verify |

|---|---|---|

| Fabric | Stable gsm; ringspun combed; bio-polished; consistent shade lot | Mill specs, swatch gsm, lab reports, shade band approval |

| Shrinkage | After 3–5 washes at 40°C: within −3% to −5% length/width | Lab test + in-house wash test, POM remeasure |

| Colorfastness | Minimal crocking; colorfastness to washing ≥ 4 | Accredited lab reports; internal rub tests |

| Print Durability | Adhesion intact; no cracking after 5 washes | Curing logs; cross-hatch adhesion test; wash recheck |

| MOQ | Per color/size MOQs aligned to calendar and channel | Quoted MOQ by colorway; split shipment policies |

| Lead Time | Proto 7–10 days; PP 10–14 days; bulk 45–70 days | Calendar; capacity statement; holiday schedule |

| Compliance | OEKO-TEX; REACH; UFLPA traceability for cotton | Certificates; material declarations; chain-of-custody docs |

| Cost Transparency | Fabric/print/trim/labor breakdown; FOB with surcharges | Itemized quotes; surcharge list; freight assumptions |

| QC | AQL sampling and defect recovery plan | QC SOP; past audit reports; inline checkpoints |

For mid-market US/EU brands, a fair tee MOQ is often 600–1,200 units per color, with size splits across XS–XL or S–XXL. Many China tshirt factory partners will discuss flexible replenishment once the style stabilizes. [CITE: “MOQ benchmarks in knit basics across China/Bangladesh (2024)”] [MENTION: Thomasnet supplier lists] [MENTION: Sewport directory]

Explore Eton’s garment factory capabilities for tees and outerwear.

Quality signals and lab tests

- AQL: Common targets are Level II, AQL 2.5 for major defects, 4.0 for minor. Record defects by type and line, then adjust process.

- POMs: Chest, body length, across shoulder, sleeve length, hem width, neck opening, rib recovery; set tolerances, e.g., ±1 cm key POMs.

- Shrinkage: 3–5 home-machine washes at 40°C; tumble-dry low; remeasure against POMs; track dimensional change and skew.

- Colorfastness: ISO methods for washing, rubbing (dry/wet), perspiration; set acceptance level ≥ 4.

- Print tests: Cure logs by ink type; adhesion cross-hatch; elasticity on stretch blends; migration checks on dark grounds.

Lab partners in China and Bangladesh can bundle REACH-screened chemical tests and OEKO-TEX checks. [CITE: “Accredited lab turnaround times for apparel in 2024–2025”] [MENTION: QIMA lab services]

Lead times and capacity planning

Proto samples often run 7–10 days from spec. Fit rounds add 5–7 days each. PP samples follow confirmed cost/lead time and locked materials, 10–14 days. Bulk cut-to-ship ranges 45–70 days, depending on fabric and print complexity. Plan China National Day/Golden Week and Lunar New Year buffers; book freight early when indices rise. [CITE: “Drewry World Container Index trends, 2024–2025”] [MENTION: Drewry]

Segment calendars: wholesale pre-books allow larger batch runs; DTC capsule drops need shorter cycles and flexible replenishment. Reserve dye lots to protect shade continuity across split shipments.

Sourcing from a China Clothing Manufacturer: a step-by-step for tees

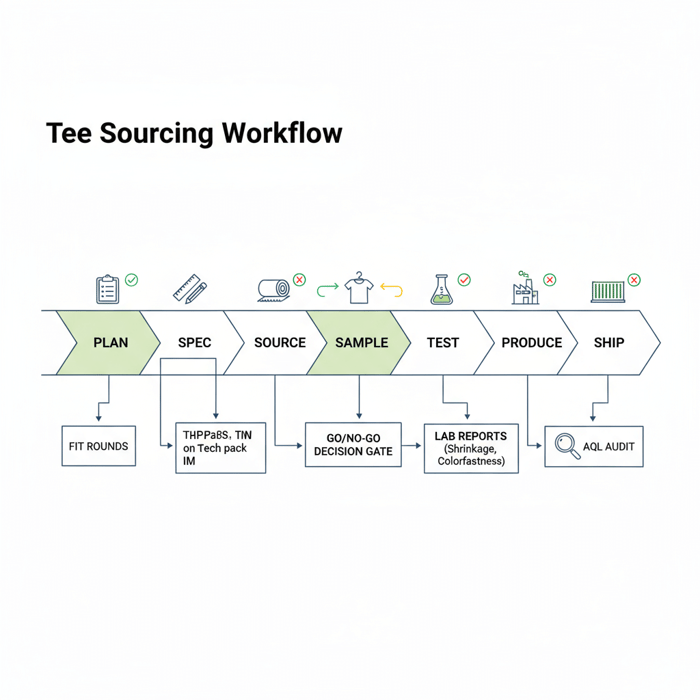

Run a gated flow: brief → tech pack → fabric and print trials → proto → fit → lock cost/lead time → PP sample → bulk → inline/final inspection → shipment. Add REACH/UFLPA checks and freight buffers to keep landed cost predictable.

- Brief: Target price, channel, fit intent, print plan, timing, compliance needs. Output: sourcing scope.

- Tech Pack: Fabric composition, yarn count, gsm, finish; measurements and tolerances; print specs; labeling; tests. Output: build-ready spec.

- Fabric & Print Trials: Swatches; strike-offs; curing tests; rub/wash checks. Output: approved shade, ink, and finish.

- Proto Sample: Base fit and construction; POM measure; wash test. Output: fit notes.

- Fit Revisions: Pattern tweaks; rib recovery checks; seam clean-up. Output: fit sign-off or next round.

- Cost & Lead Time Lock: Itemized quote; MOQ per color/size; calendar. Output: PO-ready details.

- PP Sample: Full materials, trims, label; print placement final; lab tests. Output: PP sign-off.

- Bulk Production: Fabric approval lots; cutting; sewing; print; wash; inline audits. Output: stable quality.

- Final Inspection: AQL; carton audits; size set spot checks; documentation pack. Output: ship-ready goods.

- Shipment & Entry: FOB handover; freight; customs; compliance files. Output: delivered inventory.

Green-light checklist at each gate: locked fabric specs; approved strike-offs with curing logs; fit POMs within tolerance; PP sample passed lab tests; AQL plan in place; documentation pack aligned to US/EU entry. Timelines vary by material and holidays; treat quoted ranges as indicative and reconfirm when booking.

Sample path & approvals

Proto samples validate silhouette and construction. Fit rounds tighten POMs and rib recovery, confirm seam choices, and test wash behavior. PP samples mirror bulk fabric and trims, lock print placements and inks, and represent final workmanship. Size sets confirm grading across sizes and highlight stretch or drape issues on edges of the range.

Lock bulk fabric after PP sign-off. Any substitution demands re-testing. Approve bulk shade bands to prevent carton mixing. Record print parameters per SKU: mesh count, squeegee durometer, flash times, cure temperature/time, and cooling cycle.

QC and inspections

Inline audits catch defects during sewing and printing: skipped stitches, seam slippage, off-register prints, poor curing, mislabels. Final inspection follows AQL and includes carton checks and barcode scanning. Defect trends feed back to process—tighten neck rib specs, adjust shrinkage tolerance, or change mesh count on fine lines.

Include risk gates: if shrinkage drifts beyond tolerance, halt cutting; if colorfastness drops, recheck lab chemistry; if print cracks, revisit cure parameters. [CITE: “ISO test methods common for knit tops”] [MENTION: ISO colorfastness standards]

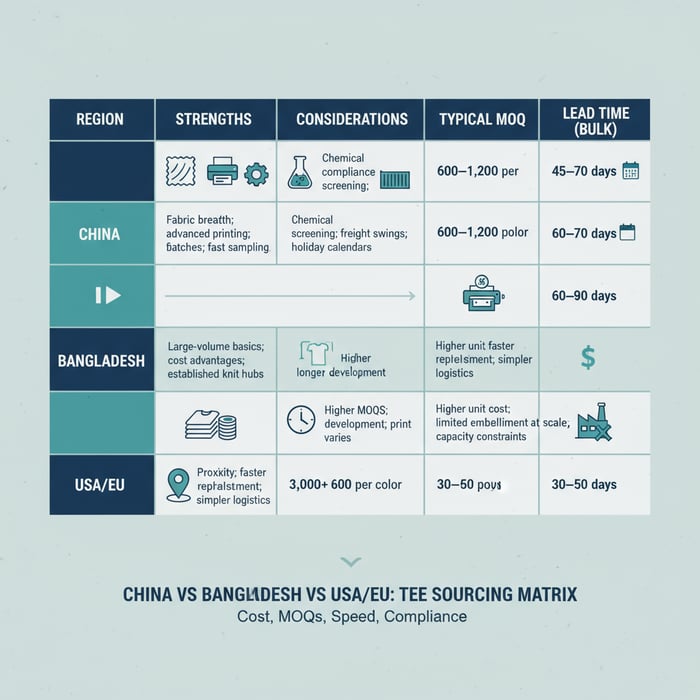

Compare tshirt manufacturers: China vs Bangladesh vs USA/EU

China brings breadth, innovation, and speed at mid-range MOQs; Bangladesh excels at large-volume basics and cost per unit; USA/EU offer proximity and faster replenishment with higher unit costs. Pick region based on price point, calendar, compliance complexity, and print/finish demands.

| Region | Strengths | Considerations | Typical MOQ | Lead Time (Bulk) |

|---|---|---|---|---|

| China | Fabric breadth; advanced printing; flexible batches; fast sampling | Chemical compliance screening; freight swings; holiday calendars | 600–1,200 per color | 45–70 days |

| Bangladesh | Large-volume basics; cost advantages; established knit hubs | Higher MOQs; longer development; print specialization varies | 3,000+ per color | 60–90 days |

| USA/EU | Proximity; faster replenishment; simpler logistics | Higher unit cost; limited embellishment at scale; capacity constraints | 300–600 per color | 30–50 days |

- China remains a leading apparel exporter in 2024 — Source: [CITE: “WTO World Trade Statistical Review 2024”]

- Container freight shows volatility — Source: [CITE: “Drewry World Container Index, 2024–2025”]

Apply a scoring matrix: weight cost 30%, quality/fit 25%, speed 20%, compliance 15%, communication 10%. Shift weights based on channel—wholesale may weight cost higher; DTC drops may weight speed and print detail.

Criteria Overview

- Quality: Shrinkage stability, colorfastness, print durability, seam construction.

- Speed: Sample turnaround, PP timing, bulk cadence, replenishment options.

- Cost: Fabric/print dominance, labor, trims, duty, freight; landed cost forecast.

- Compliance: OEKO-TEX, REACH chemicals, UFLPA cotton traceability, labeling.

- Communication: Merchandiser responsiveness, documentation thoroughness, deviation handling.

Decision Framework

Run two rounds: technical pre-qualification (fabric/print tests, lab results) and commercial scoring (MOQ, cost per color/size, calendar). Pilot two factories with parallel PP samples; scale the winner into bulk with capacity commitments and replenishment options. [CITE: “Dual-track sampling efficacy in apparel sourcing”] [MENTION: McKinsey apparel sourcing reports]

Costs & 2025 tee trends that impact sourcing

Unit cost moves with fabric type/weight, finishing, print method, trims, labor, and testing/compliance. Freight and currency shape landed cost. In 2024–2025, speed-to-shelf pressure, supplier consolidation, and material shifts affect MOQs and calendars.

- Speed and resilience shape sourcing priorities — Source: [CITE: “McKinsey, State of Fashion 2024”]

- Freight indices remain variable — Source: [CITE: “Drewry WCI 2024–2025”]

US/EU brands should add duty, labeling costs, and testing fees to FOB for landed cost forecasts. A practical model: FOB + freight + duty + customs + testing + labeling + packaging variances. Run scenarios with freight ±20% to cover swings. [CITE: “US/EU duty rates for cotton knit tops, 2024”] [MENTION: EU TARIC database]

Key Trend 1 — Speed-to-shelf and nearshoring trade-offs

Brands chase shorter cycles for graphic capsules and basics replenishment. Nearshoring trims transit; China’s sampling speed and embellishment depth still wins for complex prints. Hybrid calendars combine China for core bodies and nearshore for late-breaking graphics. Confirm cross-region shade and fit alignment to avoid assortment drift.

Key Trend 2 — Sustainable materials and documentation rigor

Organic and recycled cotton uptake grows, and documentation standards tighten. Expect chain-of-custody demands for cotton, recycled content declarations, and chemical screening evidence for REACH. OEKO-TEX certification remains a consumer-facing proof point; embed it in line planning when price allows. [CITE: “Textile Exchange, Material Change Insights 2023”] [MENTION: Textile Exchange]

Build a bulletproof tee tech pack (fabric, specs, print readiness)

Specify fabric composition, yarn quality, gsm, finishing; construction and seam details; POMs and tolerances; print placements and inks; labeling and care; and required tests. Include graded size charts and clear shrinkage targets to reduce round count and rework.

- Fabric: Ringspun combed cotton, 30/1, 160–180 gsm; alternative 26/1 for heavier feel; bio-polish detail.

- Construction: Neck rib spec and recovery; shoulder taping; seam types; stitch per inch targets.

- Measurements: POM list with tolerances; graded size charts XS–XL or S–XXL.

- Print: Method, ink type, mesh count, curing temperature/time; placement files with coordinates.

- Labeling: Fiber content, care, country of origin, RN/VAT where needed; US/EU label rules.

- Testing: Shrinkage tolerance, colorfastness thresholds, print adhesion; OEKO-TEX/REACH requirements.

Fabric & finish definitions

Ringspun combed cotton uses longer fibers, delivering smoother handfeel and stronger yarns; 30/1 gives a balanced premium weight at ~160–180 gsm; 26/1 raises coverage at ~180–200 gsm. Bio-polish removes surface fuzz to cut pilling. Enzyme and silicone washes improve softness and drape. Rib composition and gauge determine neck stability; lock rib recovery targets to protect fit.

Print/embellishment readiness

Screen printing requires correct mesh and curing profiles by ink type. Water-based inks need longer cure; plastisol cures faster but can feel heavier. DTG benefits from pre-treatment and careful curing to protect wash durability. DTF supports detailed graphics, with film quality and transfer temperatures critical. On dark grounds, control dye migration with barrier inks and temperature management.

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton’s OEM tee service covers materials curation, fast sampling, lab testing, scalable production in China and Bangladesh, and AQL-based QC. Brands gain consistent handfeel, predictable shrinkage, stable prints, and US/EU-ready documentation.

| Brand Need | OEM Feature | Outcome |

|---|---|---|

| Premium handfeel | Ringspun combed libraries; bio-polish; enzyme/silicone wash | Smoother jersey with resilient fit |

| Stable shrinkage | 3–5 wash cycles; tolerance gates; lab partners | Consistent sizing across repeats |

| Graphic-heavy tees | Screen/DTF/DTG SOPs; curing logs; strike-offs | Clean prints that resist cracking and bleed |

| Predictable lead times | Calendar planning; capacity booking; holiday buffers | Reliable cut-to-ship |

| US/EU compliance | OEKO-TEX; REACH checks; UFLPA traceability pack | Documented entry readiness |

Eton operates audited workflows with certified partners and documented QC. Our merchandisers and QA leads run wash tests and capture print curing parameters per ink type. [MENTION: QIMA audits] [CITE: “Factory audit frameworks for apparel, 2024”]

Clothing Manufacturing OEM Service integrates with your calendar, from proto to final inspection. Typical ranges: proto 7–10 days, PP 10–14 days, bulk 45–70 days. Cost breakdowns include fabric, print, trims, labor, testing, and labeled FOB with surcharges.

Use Case 1: Tight calendar, premium handfeel

Goal: A US DTC brand with a six-week window needs a premium tee. Approach: pick an ODM body with ringspun combed cotton 30/1 at 175 gsm, bio-polished; run one proto and PP with lab shrinkage checks; screen prints with water-based inks for soft hand. Result: one fit round, locked PP, bulk in 50 days, consistent handfeel and shade.

Use Case 2: Cost-sensitive, graphic-heavy program

Goal: An EU retailer launching multi-graphic tees under price pressure. Approach: single jersey 26/1 at 180–190 gsm for opacity; DTF for fine detail; curing parameters logged; barrier inks for dark grounds; MOQ negotiated per color with staggered shipments. Result: stable unit cost, graphics that hold after five washes, fewer returns from bleed or cracking.

Risks, Compliance & Localization (US & EU)

Mitigate risk with detailed contracts, test plans, and documentation for US/EU entry. Favor REACH-conformant chemistries, OEKO-TEX certification, and UFLPA-ready cotton traceability. Track risk by likelihood and impact, and attach a mitigation action for each.

- Pros: Documented safety and legal alignment, smoother customs clearance, stronger brand trust.

- Cons: Added testing cost, document management overhead, periodic audits and updates.

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Shrinkage out of tolerance | Medium | High | 3–5 wash tests, line-stop rules, fabric lot re-tests |

| Color bleed/crocking | Medium | Medium | Lab colorfastness, ink/curing control, barrier inks for darks |

| UFLPA cotton traceability | Low–Medium | High | Chain-of-custody docs, supplier affidavits, trace checks |

| REACH chemical non-compliance | Low | High | Material declarations, lab screening, approved chemical lists |

| Labeling errors | Medium | Medium | Label spec checks, barcode scan audits, carton QC |

| Freight volatility | Medium–High | Medium | Early bookings, scenario pricing, regional split sourcing |

Regulatory Notes for US & EU

US: Prepare for UFLPA enforcement; maintain cotton traceability and supplier affidavits. Label fiber content, care, and country of origin; watch Prop 65 where relevant. [CITE: “US CBP, UFLPA Operational Guidance (2023)”] [MENTION: US CBP]

EU: REACH governs chemicals; align inks and auxiliaries to current SVHC lists. OEKO-TEX certification remains strong for consumer safety. Label fiber content and care per EU rules. [CITE: “European Commission, REACH (updated 2024)”] [MENTION: OEKO-TEX Standard 100]

Conclusion & Next Steps

Pick a tshirt manufacturer using a test-first, data-backed process. Align specs, calendars, and compliance from day one. Shortlist two factories, run parallel samples and lab tests, score against a decision framework, and ramp with locked PP and AQL gates.

- Week 1: Brief and tech pack readiness; fabric shortlist; set shrinkage/colorfastness targets.

- Week 2–3: Proto and print strike-offs; first fit; wash tests.

- Week 4: Fit sign-off; cost and lead time lock; PP material booking.

- Week 5–6: PP sample; lab tests; green-light checklist.

- Week 7–12: Bulk production; inline audits; final inspection; shipment.

Connect with a China Clothing Manufacturer that publishes timelines, testing protocols, and compliance documents. Eton’s Clothing Manufacturing OEM Service is built for that level of clarity. Contact Eton

Author: Senior Apparel Sourcing Strategist, 12+ years in OEM/ODM manufacturing and QA. Reviewer: Head of Quality, Eton Garment Limited. Methodology: Eton operating procedures combined with current industry reports and standards; aligned to US/EU brand needs. Limitations: Cost and lead times shift by season, fabric, and capacity; compliance evolves—verify per market and SKU. Disclosure: Eton provides OEM/ODM services referenced in this guide. Last Updated: 2025-10-28.

- McKinsey & Company — The State of Fashion 2024. [CITE: “McKinsey State of Fashion 2024”]

- World Trade Organization — World Trade Statistical Review 2024. [CITE: “WTO apparel export data 2024”]

- US Customs and Border Protection — UFLPA Operational Guidance (2023). [CITE: “US CBP UFLPA Guidance (2023)”]

- European Commission — REACH Regulation (accessed 2024). [CITE: “EU REACH portal, 2024 updates”]

- OEKO-TEX — Standard 100 (2024). [CITE: “OEKO-TEX Standard 100 Overview (2024)”]

- Textile Exchange — Material Change Insights 2023. [CITE: “Textile Exchange MCI 2023”]

- Drewry — World Container Index (2024–2025). [CITE: “Drewry WCI weekly index”]

- Sewport — T-shirt Manufacturers Guide. [CITE: “Sewport tee sourcing guide”]

- Techpacker — How to Find a T-shirt Manufacturer. [CITE: “Techpacker tech pack guidance”]

- Thomasnet — Top T-shirt Manufacturers and Suppliers. [CITE: “Thomasnet tee supplier list”]

- Fashinza — Top T-shirt Manufacturers. [CITE: “Fashinza list article”]

- QIMA — Textile and Apparel Manufacturing in China: Quality & Compliance. [CITE: “QIMA apparel QC & compliance guide”]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »