Top Online Clothes in China: A Fashion Brand Guide to Choosing Platforms vs a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

15 minute read

Top Online Clothes in China: A Fashion Brand Guide to Choosing Platforms vs a China Clothing Manufacturer

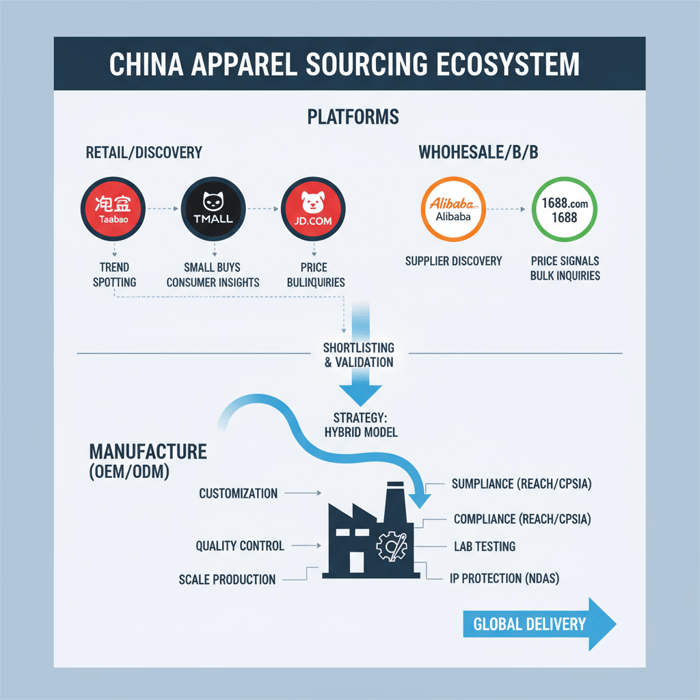

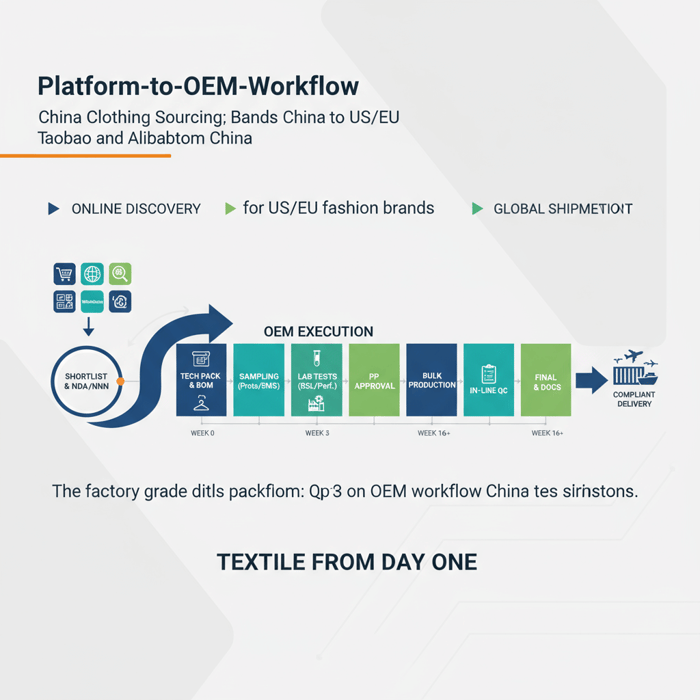

top online clothes in China means two paths for US/EU fashion brands: platforms for discovery and test buys, and a China Clothing Manufacturer for OEM/ODM that meets quality, compliance, and scale. Use platforms to scout and shortlist, then shift to factory-grade development to hit specs, pass audits, and ship on time.

For brands searching “top online clothes in China,” use Taobao/Tmall/JD for trend checks and small buys, and Alibaba/1688 for wholesale discovery. For consistent quality and US/EU compliance, route shortlisted items to a vetted China Clothing Manufacturer for OEM/ODM with lab testing, QA, and documentation aligned to export markets.

Eton Garment Limited brings three decades of outerwear manufacturing to this guide. Our teams operate in China and Bangladesh with OEM/ODM scope across jackets, parkas, padded coats, and technical sportswear. The goal: help US/EU brands decide when to use platforms, when to engage a factory, and how to bridge both to deliver reliable, compliant product lines.

[INTERNAL LINK: Our foundational guide on platform-to-factory sourcing — pillar page idea] [INTERNAL LINK: Eton Garment Limited — About page] [INTERNAL LINK: Author bio — Alex Chen, Apparel Sourcing Lead]

Top Online Clothes in China: Platforms, Use Cases, and Pitfalls

Chinese platforms split into retail (Taobao, Tmall, JD) and wholesale/B2B (Alibaba, 1688). Retail helps with trend discovery and test buys; wholesale aids supplier discovery and pricing signals. Common pitfalls: variable quality, limited compliance readiness, IP exposure, and inconsistent repeatability. Use platforms to research and initiate, then validate through manufacturer-grade due diligence.

Platform taxonomy linked to brand goals helps teams set expectations. Retail sites skew to trend and speed but seldom publish testing or compliance documents. Wholesale directories and marketplaces present supplier breadth and low prices yet vary in factory depth, documentation, and export-readiness. A hybrid workflow—platform discovery feeding an OEM/ODM partner—covers both speed and rigor.

Retail Platforms (Taobao, Tmall, JD): When and How

Taobao, Tmall, and JD serve consumer purchases in China. These platforms excel for trend scouting, silhouette confirmation, fabric hand-feel checks via samples, and quick, small orders for internal wear testing. Branded storefronts on Tmall and JD can reflect stronger merchandising and customer feedback loops. Retail listings rarely include lab test reports, restricted substance compliance, or factory social audits. Expect style churn and limited repeatability across seasons, as sellers optimize for fast-moving consumer demand rather than brand-grade continuity.

- Use cases: trend validation, wear-tests, competitor benchmarking, BOM idea gathering.

- Do: compare reviews and returns data; order size runs to confirm grading; record shrinkage, colorfastness, and seam strength in internal tests.

- Don’t: assume export compliance or stable supply; avoid copying proprietary designs to minimize IP exposure.

[MENTION: Alibaba Group’s Tmall and Taobao marketplace reports] [MENTION: JD.com retail operations] [CITE: Platform market share breakdown from an industry analytics firm]

Wholesale Platforms (Alibaba, 1688): Supplier Discovery

Alibaba targets global buyers with English-language listings, trade assurance options, and basic supplier verification tiers. 1688 targets domestic wholesale buyers in China; listings run in Chinese, unit costs often read lower, and MOQs can vary widely. Brands seeking export-ready OEM/ODM still need hard validation: ownership of factory assets, lab testing track record, AQL practices, and compliance documentation.

- Alibaba: global outreach, RFQs, messaging translation, escrow-like services; mixed depth in actual factory ownership.

- 1688: domestic pricing signals and vast supplier pool; language and payment friction; frequent trading companies.

- Next steps: move shortlists into NDAs/NNNs, request factory audits, confirm export documentation, and run sample + lab test gates.

PAA: Is 1688 better than Alibaba for domestic wholesale apparel in China? For Chinese-language buyers with local payment channels, 1688 offers breadth and pricing signals; for export-oriented OEM/ODM, Alibaba simplifies communication and contract paths. Both require external validation. [CITE: Comparative marketplace analysis] [MENTION: Trade assurance policy overview] [INTERNAL LINK: Platform-to-factory sourcing checklist]

China Clothing Manufacturer vs Online Sellers: What Brands Should Choose

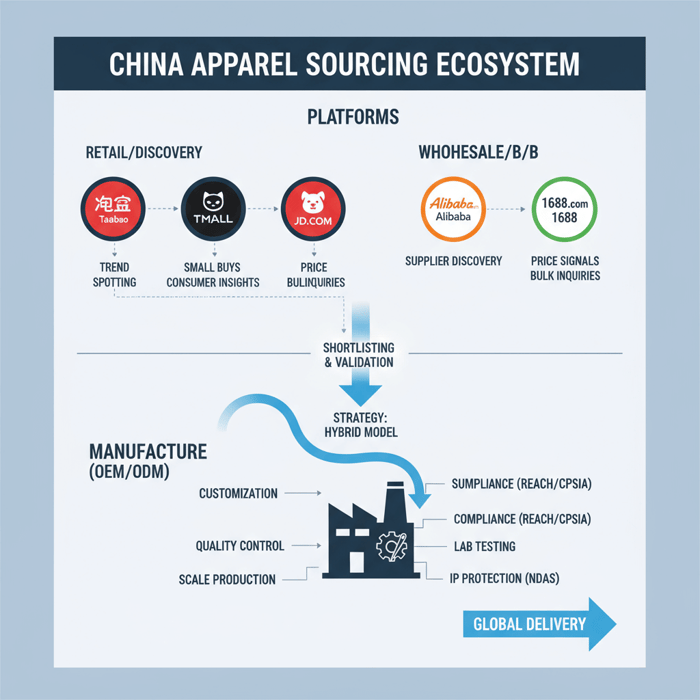

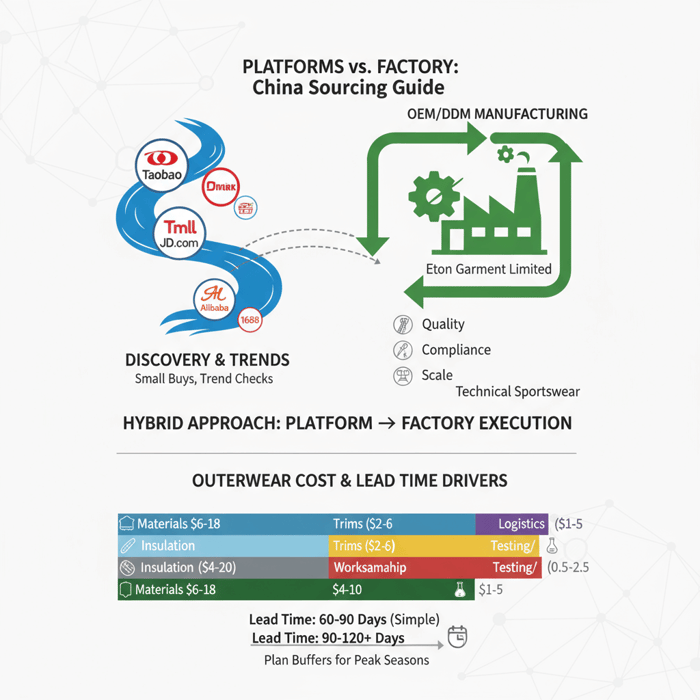

Online sellers enable quick buys and experiments. A China clothing manufacturer unlocks OEM/ODM with design precision, performance testing, compliance documentation, and scale. Many brands win with a hybrid model: platform discovery, manufacturer execution. Score options on quality, compliance, scalability, IP safeguards, timeline control, and total cost.

| Dimension | Online Sellers (Retail/Wholesale) | China Clothing Manufacturer (OEM/ODM) |

|---|---|---|

| Speed to test | Fast; buy in days | Sampling in 2–4 weeks typical |

| Repeatability | Variable; style churn | Controlled via tech packs and SOPs |

| Compliance | Rarely documented | Plan-based (REACH, CPSIA, Prop 65) |

| Quality control | Listing claims only | In-line + final AQL inspections |

| IP protection | Low; catalog resale risk | NDAs/NNNs; custom molds/patterns |

| Scale | Limited or inconsistent | Capacity planning across lines |

| Total cost | Low ticket, hidden rework | Transparent BOM + testing |

- Asia remains central for many apparel categories in 2024–2025 (Source: [CITE: McKinsey “State of Fashion 2024”]).

Criteria Overview: Quality, Compliance, Cost, Speed, IP, Scalability

Quality: brand-grade outerwear needs controlled stitch density, seam sealing accuracy, insulation fill balance, and tolerances supported by PP/TOP approvals. Compliance: US/EU require restricted substance controls, labeling, and at times PPE standards for rainwear or workwear. Cost: OEM prices reflect fabric/trim grades, insulation type, workmanship, testing, and logistics. Speed: retail buys ship fast in small volumes; OEM runs require calendars with material booking and test gates. IP: trading hubs risk duplication; manufacturers can lock patterns, molds, and branding. Scalability: OEM/ODM enables multi-plant planning, seasonal buffers, and rolling forecasts.

[MENTION: SGS, Intertek, Bureau Veritas for testing] [MENTION: RDS, bluesign, Oeko‑Tex for material compliance] [CITE: PPE and rainwear standards overview for EU/US]

Decision Framework: Online, Manufacturer, Hybrid

- Online-first: micro-batches for DTC learning, dropship pilots, influencer capsules; low commitment; low compliance readiness.

- Manufacturer-first: new core lines, private label with technical specs, retailer programs, or categories with safety/regulatory exposure.

- Hybrid: scan platforms for silhouettes and fabric ideas, then brief a China clothing manufacturer to build custom, compliant variants.

Weighting example for outerwear: compliance 25%, quality 25%, scalability 20%, cost 15%, lead time 10%, IP 5%. Score each path and choose the model that clears your retailer onboarding and seasonal delivery windows. [CITE: Retail onboarding checklist reference] [INTERNAL LINK: Weighted scoring worksheet for supplier selection]

Costs, MOQs, and Lead Times for Top Online Clothes in China (OEM Perspective)

OEM outerwear costs hinge on fabric and trims, insulation type (down or synthetic), workmanship complexity, and testing. Typical MOQs range from 300–1,000 units per style per color; lead times span 60–120+ days based on material availability and seasonality. Wholesale online prices run lower but rarely include compliance, testing, or stable repeatability.

| Component | Typical Range (USD/pc) | Notes |

|---|---|---|

| Shell & lining fabrics | $6–$18 | Recycled nylons/polyesters, PU/PFAS-free DWR options change costs |

| Insulation | $4–$20 | 90/10 down vs synthetic loft; RDS-certified down adds premiums |

| Trims & accessories | $2–$6 | Waterproof zippers, seam tapes, snaps, reflective prints |

| Workmanship | $4–$10 | Panels, seam sealing, quilting density, bartacks, QC overhead |

| Testing & compliance | $0.50–$2.50 | RSL/REACH, AATCC/ISO performance, down cleanline/IDFL |

| Packaging & logistics | $1–$5 | Carton specs, poly alternatives, freight volatility |

[CITE: Benchmark cost studies for outerwear BOMs] [MENTION: IDFL for down testing] [MENTION: AATCC and ISO test method catalogs]

- China apparel e-commerce continues to grow, while B2B wholesale remains significant for global buyers (Source: [CITE: Statista apparel e-commerce overview, 2023–2025]).

MOQ & Lead-Time Levers

- Fabrics: greige availability, dyeing capacity, and lab dips add 2–4 weeks; PFAS-free DWR or special membranes may extend by 1–3 weeks.

- Insulation: down allocation and fill power tolerances; synthetic fiber supply during winter peaks; reserve capacity early.

- Testing: chemical RSL tests in 5–10 days; performance tests 5–12 days; plan parallel testing during sample rounds.

- Calendars: for FW seasons, book materials 12–16 weeks ahead; allow buffers for holiday closures and port congestion.

Reference lead times: 60–90 days for simple padded jackets; 90–120+ days for seam‑sealed parkas with specialty trims. Consolidation across styles trims freight and carton costs. [CITE: Seasonal logistics advisories] [MENTION: Freightos index or similar freight benchmarks]

Cost Drivers: Materials, Insulation, Workmanship, QA, Compliance

Materials: recycled content, special coatings, and PFC/PFAS-free requirements elevate fabric costs. Insulation: goose vs duck, 700+ fill power vs mid-grade, synthetic loft weight, quilting density. Workmanship: seam sealing, multi-panel construction, 3D hoods, articulated sleeves, reinforcement overlays. QA: more in-line checks cut rework; PP/TOP sample iterations add upfront cost yet reduce claims. Compliance: RSL testing, down traceability (RDS), and documentation for US/EU raise predictability and lower recall exposure.

[MENTION: The Microfiber Consortium on fiber shedding] [CITE: PFAS regulatory updates for US states and EU proposals] [INTERNAL LINK: Outerwear technical playbook — Eton resource]

Sourcing Workflow: From Online Discovery to Factory-Grade OEM Execution

Start with platform research and a shortlist. Move to factory validation, NDAs/NNNs, tech packs, sampling, lab tests, and pilot production. Use in-line QC and final AQL inspection. Close with compliant documentation, shipping, and a post‑production audit. This sequence reduces risk on quality, compliance, and timelines.

Preparation: Brief, Tech Packs, BOM, Testing Plan

- Scope: define user scenario, target temp range, retail price, channels, calendar.

- Tech pack: measurements, graded spec, construction notes, stitch counts, seam tape map, artworks, labeling, packaging.

- BOM: fabric specs (denier, membrane, DWR), trims, insulation standards, zipper models, color standards.

- Compliance plan: RSL mapping (REACH, CPSIA, Prop 65), performance tests (AATCC 127 hydrostatic head, AATCC 22 spray, ASTM E96 MVTR, ISO 11092 Ret), down standards (RDS, EN 12934), labeling (EU 1007/2011, US FTC).

[CITE: OECD Due Diligence Guidance for Garment & Footwear] [MENTION: ZDHC MRSL, Higg FEM] [INTERNAL LINK: Template tech pack download]

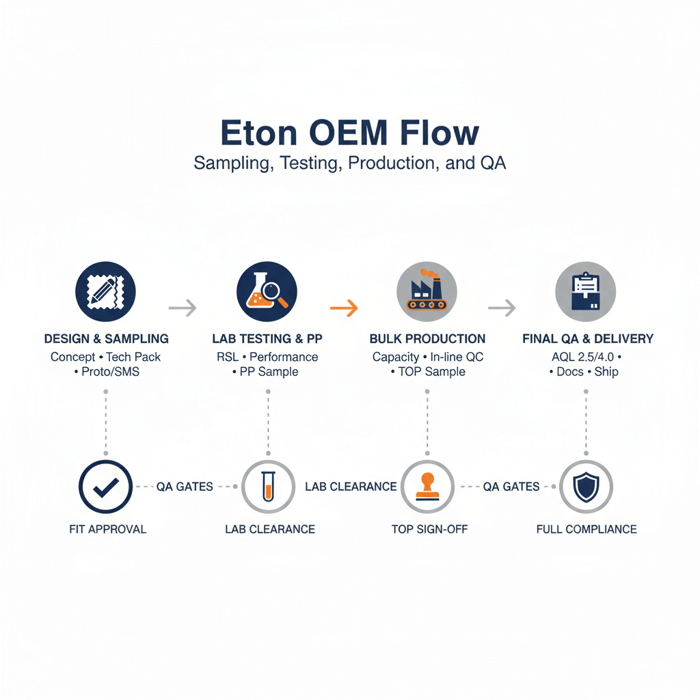

Execution: Sampling → Lab Tests → PP → Bulk → QC → Docs

- Proto samples: fit, silhouette, and construction feasibility.

- SMS: sales-ready samples with near‑final trims for buyer feedback.

- Lab tests: chemical RSL, fabric performance, zipper/fastener cycles, down cleanliness and fill-power (IDFL/IDFB).

- PP sample: signed standard for bulk; lock key trims and workmanship notes.

- Bulk production: capacity booking, line pilot, in-line QC with defect tagging.

- TOP sample: from bulk line, confirm finish and packing.

- Final inspection: AQL 2.5/4.0 per brand SOP; carton checks; metal needle detection if needed.

- Docs: test reports, COO, packing lists, invoices, HTS/TARIC codes, FTA or preference evidence if applicable.

[MENTION: AQL practice per ANSI/ASQ Z1.4 / ISO 2859] [CITE: Labeling guidance FTC and EU 1007/2011] [INTERNAL LINK: QC checklist for outerwear]

Quality Assurance: AQL, In‑line, Sealing, Outerwear Checks

- Fit and grading: verify across size runs; confirm sleeve and body ease with layering.

- Seam sealing: tape width, adhesion, cross‑seam treatments; shower test with controlled pressure/time.

- Thermal: CLO targets for insulation weight/placement; quilting consistency; cold spots review.

- Function: zipper runs, snap pull tests, cuff/hood adjusters, pocket bag strength, reflective visibility.

- Appearance: color matching to standards, panel shading, puckering, stitch density, cleanliness.

[MENTION: ASTM D4966/ISO 12947 Martindale; AATCC 61 colorfastness; ASTM D1683 seam strength] [CITE: Rainwear standard EN 343 and cold protective EN 342 where applicable]

Data & Trends: China’s Online Apparel and Global Sourcing Context

China’s online apparel market scales while brands weigh nearshoring for proximity against Asia’s depth in technical outerwear. For jackets, parkas, and sportswear, supply clusters in China maintain material options, testing expertise, and line capacity. Use data to frame volume allocation, then verify plant-level capabilities and compliance.

- China remains a top apparel exporter in 2024 (Source: [CITE: WTO World Trade Statistical Review 2024]).

- Technical outerwear sourcing retains Asia weight in brand portfolios (Source: [CITE: McKinsey “State of Fashion 2024”]).

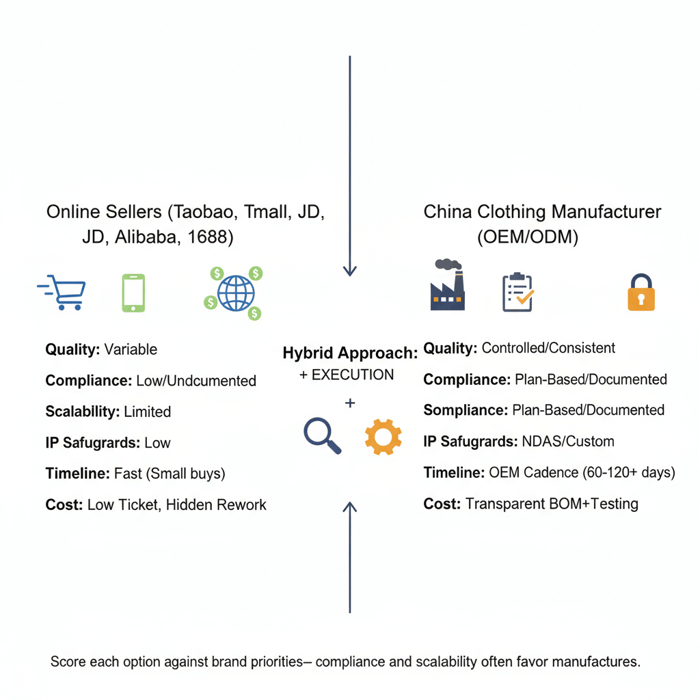

Key Trend 1: Platform Discovery + OEM Execution

Teams use Taobao/Tmall/JD for trend cues and competitor reads, then filter Alibaba/1688 leads for potential factory partners. Shortlists move into NDAs/NNNs, factory audits, and sample rounds. The result: faster market sensing without giving up on compliance or repeatability. [CITE: Case studies on hybrid sourcing models] [MENTION: Canton Fair and CHIC trade show ecosystems]

Key Trend 2: Compliance and ESG as Differentiators

US/EU buyers request RSL alignment, ZDHC MRSL conformance, Oeko‑Tex or bluesign materials, social audits (amfori BSCI, SMETA, SLCP), and Higg Facility scores. PFAS restrictions grow in both markets; recycled inputs and traceable down gain share. Factories with testing playbooks and audit readiness secure multi‑season commitments. [CITE: PFAS phase-out timelines in EU/US] [MENTION: Textile Exchange, Higg, ZDHC]

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton converts platform insights into compliant, high‑quality outerwear at scale. The Clothing Manufacturing OEM Service covers design translation, material sourcing, sampling, lab tests, pilot runs, QA, and final delivery across China and Bangladesh. Core categories: down jackets, parkas, padded coats, and performance sportswear.

| Brand Need | OEM Feature | Outcome |

|---|---|---|

| Trend to private label line | Design translation, tech pack build, fit rounds | Retail-ready silhouettes with repeatability |

| Technical rain parka | Seam sealing, hydrostatic/breathability tests | Pass EN 343-style performance targets |

| Down capsule | RDS down, fill calibration, IDFL testing | Balanced warmth, traceability, cleanline |

| Retailer onboarding | RSL plan, third‑party lab bookings, AQL SOPs | Compliance pack for US/EU intake |

Explore the Clothing Manufacturing OEM Service: Eton Garment Limited — Clothing Manufacturing OEM Service. Programs start with scoping and a sample calendar mapped to your launch date. [INTERNAL LINK: Outerwear category overview] [MENTION: RDS, Oeko‑Tex, bluesign, Higg]

Use Case 1: Trend Discovery → OEM Parka Line

A EU retailer spots a clean fishtail parka trend on Tmall. Eton builds a tech pack with PFAS‑free DWR, 2‑layer shell, quilted liner, and taped key seams. Samples pass AATCC 127 and AATCC 22 targets. RSL testing clears REACH Annex XVII. Bulk delivers in 100 days with AQL 2.5, securing a reorder slot. [CITE: REACH Annex XVII overview] [INTERNAL LINK: Case portfolio — parkas]

Use Case 2: Technical Sportswear → Performance Testing & Scale

A US brand needs a lightweight running shell with high MVTR. Eton sources a recycled ripstop with PU membrane, confirms ASTM E96 results, and enforces ISO 11092 Ret thresholds. The line uses reflective tape validated for wash durability and a bonded visor hood. The first drop ships DDP to a 3PL with testing and care label packs attached. [CITE: ASTM E96 and ISO 11092 references] [MENTION: 3M reflective material guidance]

Risks, Compliance & Localization for US/EU

US/EU brands should plan compliance at design lock: restricted substances (REACH, CPSIA, Prop 65), performance tests for outerwear, labeling, and social/environmental audits. Build a risk matrix, assign mitigations, and request lab reports from accredited bodies. Record everything in a compliance pack per style.

- Pros of early compliance: fewer red tags, smoother retailer onboarding, lower returns/claims.

- Cons of late compliance: rework, shipment holds, margin loss, reputational hits.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| RSL failure | Medium | High | Pre‑shipment chemical testing; ZDHC MRSL materials; supplier RSL training |

| Performance misses | Medium | Medium–High | Lab tests at SMS/PP; PP sign‑off with method references |

| IP leakage | Medium | Medium | Chinese/English NNN, watermark tech packs, staged disclosure |

| Capacity shortfall | Low–Medium | High | Multi‑factory planning; peak season buffers; early bookings |

| Social audit fail | Low–Medium | High | Pre‑audit with SMETA/BSCI/SLCP readiness; CAP tracking |

Regulatory Notes for US/EU

- US: CPSIA (lead, phthalates for kids), labeling per FTC; Prop 65 requires warnings if substances exceed thresholds; flammability CFR 1610 for certain textiles.

- EU: REACH Annex XVII/SVHC checks; EU Textile Regulation 1007/2011 for fiber labeling; EN 343 for rainwear; PPE Regulation (EU) 2016/425 where applicable.

- Materials & ESG: Oeko‑Tex Standard 100, bluesign, RDS for down, GRS/RCS for recycled claims, Higg FEM for facility reporting.

- Docs: test reports from accredited labs (SGS, Intertek, BV), DoC/technical file for PPE items, care labels aligned to ISO symbols.

[CITE: CPSIA guidance — CPSC] [CITE: EU Textile Regulation 1007/2011] [MENTION: amfori BSCI, Sedex SMETA, SLCP, SA8000] [INTERNAL LINK: Compliance pack template — Eton]

Conclusion & Next Steps

Use platforms for discovery and small tests, then partner with a China clothing manufacturer for OEM/ODM. The hybrid approach gives speed and rigor: trend input from online, technical development and compliance from the factory. Follow the workflow gates, apply the decision framework, and lock your seasonal calendar.

- Week 0–2: platform research; shortlist; sign NNN; share brief.

- Week 2–6: proto/SMS; lab dips; initial RSL tests; fit round.

- Week 6–9: PP sample; performance tests; booking of long‑lead materials.

- Week 9–14: bulk; in‑line QC; TOP; final AQL; compliance pack.

- Week 14–16: freight; customs; DC intake; market launch.

Explore how Eton’s Clothing Manufacturing OEM Service translates “top online clothes in China” into brand‑grade product lines: Clothing Manufacturing OEM Service. Textile From Day One.

Author & Review Notes (E‑E‑A‑T)

Author: Alex Chen, Apparel Sourcing Lead, 12+ years in China OEM/ODM, outerwear specialization. Reviewer: Maria Lopez, QA & Compliance Manager (US/EU regulations). Methodology: platform taxonomy review; OEM outerwear process mapping; Eton factory workflows; synthesis of public industry sources. Limitations: market data updates rapidly; validate retailer‑specific requirements. Disclosure: Eton Garment Limited offers OEM/ODM services aligned to guidance herein. [INTERNAL LINK: Alex Chen — Author profile URL]

References & Sources

- McKinsey & Company — The State of Fashion 2024 (2024). [CITE: McKinsey State of Fashion 2024]

- Statista — China apparel e‑commerce market size and forecasts (2023–2025). [CITE: Statista apparel e‑commerce China]

- World Trade Organization — World Trade Statistical Review 2024 (2024). [CITE: WTO 2024 apparel exports]

- OECD — Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector (latest). [CITE: OECD guidance]

- SGS — Textile and apparel testing service pages. [CITE: SGS testing catalog]

- Intertek — Performance and chemical testing for apparel. [CITE: Intertek testing overview]

- Bureau Veritas — Softlines testing standards. [CITE: BV softlines testing]

- IDFL — Down and feather testing methods. [CITE: IDFL resources]

- AATCC — Test methods (AATCC 22, 127, 61). [CITE: AATCC methods]

- ISO — ISO 11092 and related apparel performance standards. [CITE: ISO standards]

- CPSC — CPSIA guidance and resources. [CITE: CPSC]

- European Commission — EU Textile Regulation 1007/2011, REACH info. [CITE: EU REACH and Textile Regulation]

- ZDHC — MRSL conformance program. [CITE: ZDHC MRSL]

- Textile Exchange — RDS, GRS, RCS details. [CITE: Textile Exchange]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »