T-Shirt Distribution Companies: How to Choose (and When a China Clothing Manufacturer Is Better)

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 16th, 2025

14 minute read

T-Shirt Distribution Companies: How to Choose (and When a China Clothing Manufacturer Is Better)

t shirt distribution companies give brands fast access to blank and branded tees, while a China Clothing Manufacturer unlocks cost and customization at scale. Growth teams in the US and EU need speed, predictability, and compliance. This article delivers a decision framework, cost signals, and a migration playbook built from factory-floor experience.

t shirt distribution companies are the fastest route for replenishment and small-to-mid runs. As volumes rise and specs tighten, OEM/ODM with a China Clothing Manufacturer reduces unit costs, opens fabric/trim control, and improves margin. This guide compares sourcing models, maps total cost of ownership, outlines compliance for UFLPA/REACH, and provides a dual-sourcing path into Eton’s Clothing Manufacturing OEM Service.

t shirt distribution companies stock and ship wholesale tees with low MOQs and quick dispatch. Choose by inventory depth, brand fit, price breaks, integrations, and US/EU compliance. Shift to a China Clothing Manufacturer when volume, customization, and margin goals outgrow distributor limits—often beyond 10–20k units per season or when custom fabrics and trims are required.

What T-Shirt Distribution Companies Do (and What They Don’t)

Distributors aggregate inventory from multiple brands, publish live catalogs, and ship quickly. They are effective for decorators, merch drops, and retail restocks. They rarely build from tech packs, run custom fabrics, or manage deep trim programs, which limits control of shrinkage, color continuity, and brand-specific spec.

Pros

- Speed: same-day or 1–3 day shipping within the US/EU for common SKUs.

- Low risk: buy against demand; minimal inventory exposure versus OEM.

- Catalog breadth: multiple brands, fabrics, and colors in one portal.

- Low MOQ: often 1 case per size/color, with tiered price breaks.

- Integrations: EDI, API, and ERP connectors at larger distributors.

Cons

- Limited customization: restricted fabric, dye, trims, and care label options.

- Volatile stock: peak-season outages and color/size gaps are common.

- Higher unit costs at volume: price advantage erodes above mid-scale buys.

- Fragmented quality: cross-brand tolerances vary in shrinkage and shade.

- Compliance opacity: traceability and UFLPA/REACH documentation vary by vendor.

Core Services & Integrations

Leading distributors run real-time catalogs with SKU metadata, brand filters, fabrics (ringspun cotton, combed, CVC, triblend), and printable surfaces (DTG, screen, DTF). Inventory feeds often support CSV, API, and EDI. Enterprise buyers look for ERP integrations (NetSuite, Microsoft Dynamics, SAP), cart plugins, ASN support, and order status webhooks. Many offer mixed-cart consolidation, drop-ship to DCs or stores, and staged release windows for seasonal promotions.

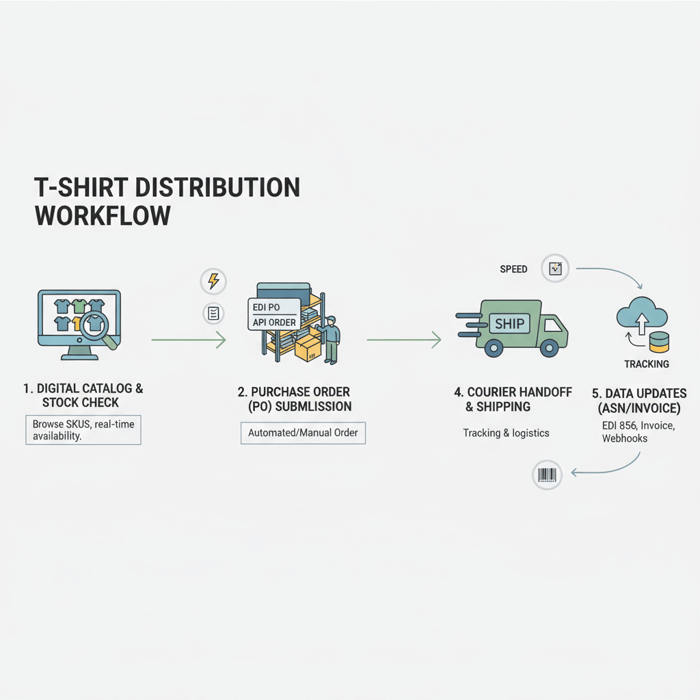

Operationally, a typical flow is: SKU selection → availability check → PO/EDI submission → pick/pack → courier handoff → EDI 856/ASN + invoice. SLA targets depend on cut-off times and warehouse region. In the US, multi-node distribution (East/Central/West) reduces freight time and cost; in the EU, cross-border VAT rules and IOSS/EORI handling can separate leaders from general wholesalers [CITE: EU VAT/IOSS guidance for cross-border B2B apparel]. For repeat buys, some distributors support blanket POs and scheduled releases to balance inventory risk.

For data-driven teams, must-haves include: inventory feed freshness ≤15 minutes; backorder policies; substitution logic; carton pack standards; GS1 labeling; and compliance document access (fiber content, care, country of origin, and any Oeko-Tex/GRS claims). Enterprise teams ask for SOC 2 or similar attestations for data handling where APIs touch customer data [CITE: recognized security framework overview].

Where Distributors Fall Short

When brands need custom patterns, collar specs, lab-dyed fabrics, or branded trims, distributors cannot support full tech-pack execution. Color continuity across replenishments also suffers because dye lots differ by brand and season. For tight brand fits or unique silhouettes, sizing blocks in stock tees may not align with target body measurements. At volumes beyond 10–20k units per season, unit costs and freight-to-value ratios often favor OEM/ODM with factory-direct terms [CITE: apparel cost structure breakdown from a recognized sourcing report].

Stock depth becomes a constraint in peak seasons; a viral campaign can wipe core sizes in days. Lead times for replenishment from upstream mills are outside distributor control, creating uncertainty. Compliance granularity is mixed: distributors provide basic labeling and country-of-origin, but detailed supply-chain traceability and UFLPA documentation packs vary. Enterprise EDI quality ranges from robust mappings to brittle custom fields; this affects ASN accuracy and chargebacks in retail programs [MENTION: SPS Commerce and TrueCommerce as EDI ecosystems].

T-Shirt Distribution Companies vs China Clothing Manufacturer vs Wholesaler vs POD

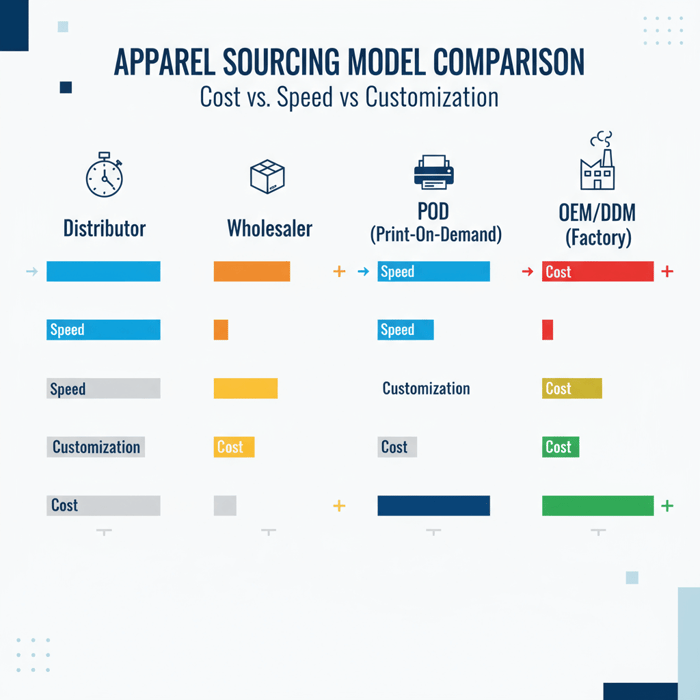

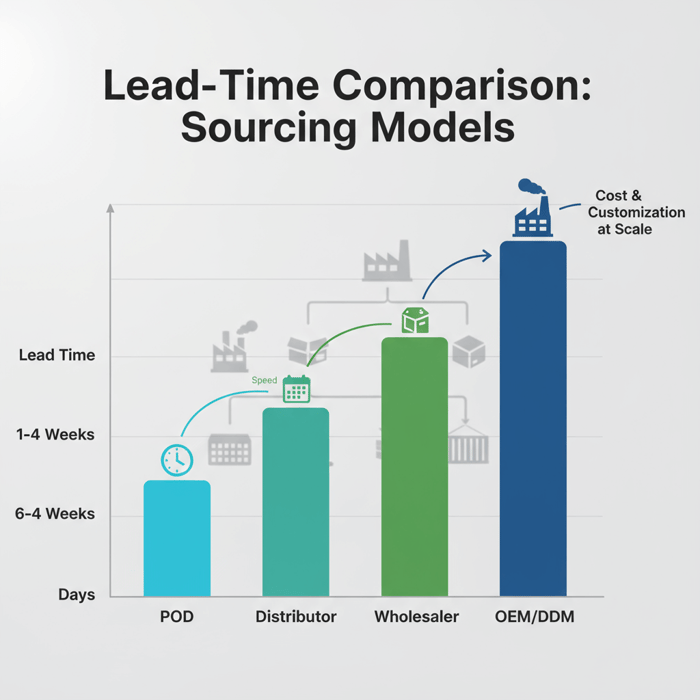

Distributors win on speed and simple fulfillment. A China Clothing Manufacturer wins on unit cost and customization at scale. Traditional wholesalers sit between, and POD removes inventory but carries higher unit costs. The correct model depends on volume, lead time, customization, and compliance posture.

| Model | Speed | Typical MOQ | Unit Cost Trend | Customization | Lead Time (Typical) | Compliance Depth | Best Use |

|---|---|---|---|---|---|---|---|

| Distributor | Fast | 1 case/size-color | Higher at volume | Limited | 1–7 days | Basic to moderate | Drops, restocks, decorators |

| Wholesaler (direct brand) | Moderate | Carton to pallet | Improves with volume | Limited | 1–4 weeks | Moderate | Program buys on known blanks |

| POD | Immediate | Per unit | Highest | Print-focused | 1–7 days | Platform-defined | Testing designs, micro-runs |

| OEM/ODM (Factory) | Planned | 2k–10k+ per style | Lowest at scale | Full | 6–14 weeks+ | Deep, documentable | Custom specs, scale programs |

- US enforcement of UFLPA intensified in 2023–2025—importers face higher documentation expectations (Source: CBP UFLPA) [CITE: CBP UFLPA enforcement guidance, 2024–2025].

- EU chemicals rules under REACH impact dye/finish choices in apparel (Source: ECHA) [CITE: ECHA REACH textiles guidance, latest revision].

- Sourcing strategies show growing dual-sourcing and nearshoring interest for speed [CITE: McKinsey State of Fashion 2024/2025].

Criteria Overview

Use a consistent lens across models: unit economics (FOB, duties, freight, warehousing), lead time windows and variability, MOQ and capacity, customization depth (fabrics, dyes, trims, care labels), compliance documentation (UFLPA traceability, REACH chemical declarations, labeling), data integrations (EDI/API and ERP), and service reliability (OTIF, ASN accuracy). For brands shipping to US and EU, local tax IDs (resale permit, VAT/EORI) and labeling rules matter [CITE: EU textile labeling regulation; US FTC textile labeling rules].

Cost & Lead-Time Signals

Total cost of ownership combines unit price plus logistics, duties, handling, and risk buffers. At small runs, distributors and POD minimize exposure; at seasonal programs, OEM’s lower FOB offsets freight and duties. Plan for peak-season uplift on transit time and rates. Lead-time bands shift by model: distributors are days; wholesalers run weeks; OEM runs weeks to a few months based on fabric and trims.

| Component | Distributor | Wholesaler | POD | OEM/ODM |

|---|---|---|---|---|

| Unit Price | $$–$$$ | $$ | $$$+ | $ at scale |

| Freight | Domestic parcel/LTL | Domestic pallet | Parcel | International + last mile |

| Duties/VAT | Domestic sales tax | Domestic/EU cross-border | Platform-defined | HTS-based duties + VAT/EORI |

| Inventory Risk | Low | Low–medium | None | Medium–high |

| Customization | Low | Low | Print only | High |

| Compliance Pack | Basic | Moderate | Platform | Deep (traceability, labs) |

How to Choose T-Shirt Distribution Companies: Criteria and Checklist

Start with weighted criteria aligned to margin and service goals, score vendors against data, and pilot with tight QC before scaling. The outcome is a defensible shortlist and a low-risk validation path that prevents stockouts and brand quality erosion.

The Weighted Criteria

Use weights that reflect strategy. Example weights below skew toward speed and systems maturity; adjust for deeper brand standards if needed. Target tangible metrics: stock depth in core sizes, OTIF, ASN accuracy, return rates, integration robustness, and compliance documentation quality.

| Criterion | Weight | Signals to Verify |

|---|---|---|

| Inventory depth & reliability | 25% | Fill rate in peak weeks; backorder policies; forecast collaboration |

| Unit cost & price breaks | 15% | Tiered discounts; substitution SKUs; freight programs |

| Integrations (EDI/API/ERP) | 15% | Supported ERPs; webhook stability; uptime SLA |

| Lead time & OTIF | 15% | Cut-off adherence; late order variance; carrier performance |

| Compliance & documentation | 15% | UFLPA traceability, REACH statements, labeling accuracy |

| Brand/fabric fit | 10% | Body blocks, handfeel, printer feedback (DTG/screen) |

| Credit/terms & service | 5% | Net terms; RMA speed; support responsiveness |

Check legal prerequisites early: reseller permits in US states, VAT registration and EORI for EU trade lanes, and any restricted substance declarations needed for distribution into specific markets [CITE: EU EORI and VAT guidance]. Interview print partners for feedback on shrinkage and colorfastness across the distributor’s main SKU families [MENTION: Bella+Canvas and Gildan as commonly referenced tee brands].

The Pilot Plan

- Define scope: 2–3 SKUs, 3 colors, 2 size curves; 300–600 units total.

- Lock specs: fiber content, fabric weight, finish expectations; confirm care labels.

- Run inbound QC: measure body specs, shrinkage (home-wash and lab), colorfastness to washing and crocking [CITE: AATCC test method reference].

- Print tests: DTG and screen on light/dark; record handfeel and cracking after 5 washes.

- Systems test: place one EDI and one API order; validate ASN and invoice accuracy; measure pick/pack errors.

- Service test: simulate a shortage; request substitutions; evaluate response time and documentation.

- Acceptance gates: ≥98% ASN accuracy; ≤2% QC fails; ≤1 shade step delta E for core colors; stock-out resolution ≤48 hours.

- Scale decision: award share across 1–2 distributors; document escalation paths and quarterly reviews.

[INTERNAL LINK: Textile QA & Lab Testing Essentials] [INTERNAL LINK: OEM & ODM Apparel Development—how we build from tech packs]

Data & Trends: T-Shirt Sourcing in 2024–2025 (US & EU)

Brands spread demand across distributors for speed, while building OEM lines for margin and control. Compliance expectations rise in the US and EU, pulling more documentation and traceability upstream. Dual-sourcing buffers shock risk and stabilizes availability in peak periods.

- UFLPA enforcement expanded detentions for high-risk textile inputs in 2024–2025 (CBP, 2025) [CITE: CBP dashboard/update page].

- REACH guidance on restricted substances impacts dyes/finishes used in tees (ECHA, 2024) [CITE: ECHA textiles guidance].

- Brands report greater adoption of nearshoring and dual-sourcing for core styles (McKinsey) [CITE: State of Fashion 2024/2025].

- OECD Due Diligence reinforces risk-based mapping for garment supply chains (OECD, 2023) [CITE: OECD Garment & Footwear Guidance].

Key Trend 1: Compliance & Traceability

US-bound shipments require supplier attestations and documentary trails to navigate UFLPA. EU programs expect chemical compliance declarations, labeling accuracy, and emerging digital product passport pilots [CITE: EU Digital Product Passport pilot references]. Working with t shirt distribution companies that can furnish chain-of-custody documents and testing reports reduces detention risks at the border and return risks at retail. OEM partners should align lab test plans (colorfastness, pilling, dimensional change) with market-specific claims and care instructions [MENTION: Oeko-Tex Standard 100 and GRS for recycled claims].

Key Trend 2: Dual-Sourcing & Nearshoring Mix

US/EU teams increasingly split programs: distributors or nearshore blanks for fast drops, OEM/ODM for margin-critical, custom trims, or wholesale channels. This model reduces lead-time volatility and balances freight exposure. Seasonal calendars lock OEM buys 12–20 weeks ahead for custom fabrics, with distributors covering upside or color extensions. Data integration across both lanes—inventory feeds from distributors and WIP visibility from factories—improves DC planning and cash flow [CITE: supply chain visibility platform case studies].

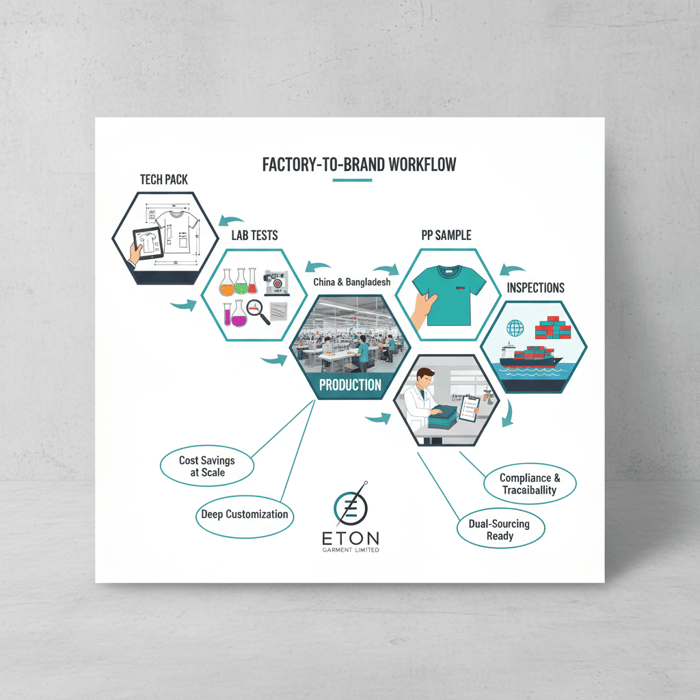

How to Switch from a Distributor to a China Clothing Manufacturer

Build a bridge, not a cliff: stabilize distributor supply, then pilot OEM SKUs with explicit specs, labs, and inspections. Migrate styles in phases to protect service levels and cash. The outcome is lower unit cost, deeper brand control, and reliable compliance documentation.

Preparation

- Tech packs: body measurements, tolerances, stitch specs, fabric targets, trims, packaging, labeling.

- Volume plan: seasonal demand curve, size curve, color mix, DC calendar, re-order logic.

- Compliance pack: fiber content and origin records, UFLPA traceability, REACH chemical declarations, labeling artwork for US/EU [CITE: FTC Textile, Wool, and Fur labeling rules].

- Laboratory plan: shrinkage, colorfastness to wash and rubbing, spirality, pilling, print durability (after 5–10 washes) [MENTION: AATCC and ISO test methods].

- Quality targets: AQL levels (e.g., 2.5), shade band approvals, carton testing, barcode and GS1 label formats.

Execution Steps

- Shortlist and NDA: select 1–2 OEMs with matching vertical capability in China/Bangladesh and relevant certifications (WRAP, BSCI, ISO 9001/14001).

- Sampling: fit sample → PP sample → size set; lock measurements and shrinkage allowances after wash tests.

- Costing & TCO: compare FOB vs distributor landed; model duties by HTS code; include freight and handling.

- Pilot PO: 2–5k units per style; set inline and final inspections; approve TOP samples against sealed specs.

- Compliance & labels: finalize care labels, fiber content, origin; confirm any recycled claims via GRS chain of custody if applicable.

- Inline control: fabric and trim incoming checks; shade approvals; print handfeel and color checks; carton drop tests.

- FRI & shipment: final inspection against AQL; carton qc; load plan; photo/video documentation for records.

- Phase migration: move 20–40% of volume initially; keep distributor as surge/back-up; scale after two successful cycles and CAPA closure.

Quality Assurance

Define a closed loop: lab tests pre-bulk; inline audits against critical points; final inspections with statistically sound sampling; CAPA for each defect exceeding thresholds. For color-heavy programs, manage shade bands and retain panels for replenishment matching. Keep a shrinkage library by fabric mill and finishing line to refine patterns and overfeed settings for consistent post-wash fit [CITE: textile finishing process references].

Product/Service Integration: Clothing Manufacturing OEM Service

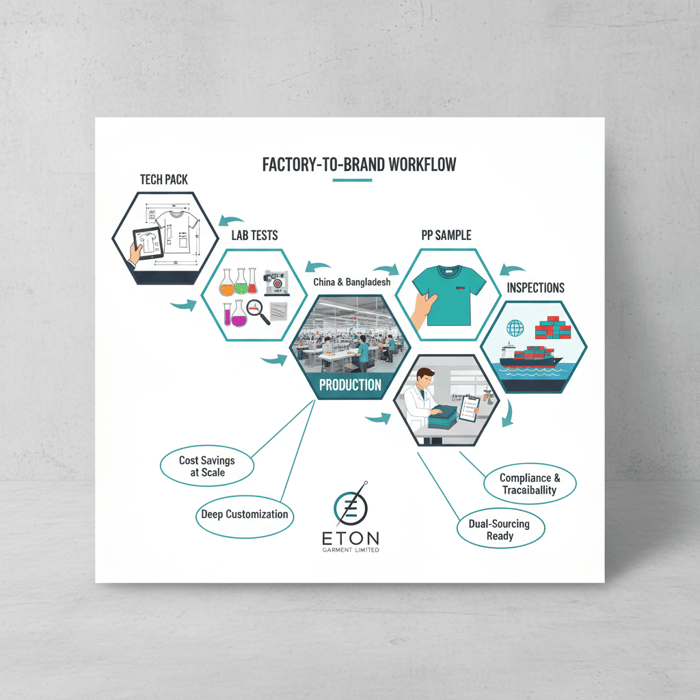

Eton Garment Limited brings 30+ years of factory execution to brands that are ready to move beyond distributors. With development hubs in Xiamen and production in China and Bangladesh, Eton builds from tech packs and trend briefs across tees, outerwear-adjacent knits, and program basics. The team supports design-for-production, lab testing, inline/FRI inspections, and compliance documentation for US and EU buyers.

- OEM/ODM coverage: fabrics, dyes, trims, branded care labels, packaging, and carton standards.

- Compliance: documentation aligned to UFLPA traceability, REACH chemical rules, and labeling; certifications available on request (WRAP, BSCI, ISO 9001/14001).

- Lead times: development-to-bulk plans that align with seasonal calendars; risk buffers for peak freight periods.

- Integrations: PO/ASN/invoice data flows; production milestone visibility; portal or EDI/API arrangements on scope.

- Dual-sourcing play: run OEM pilots while distributors cover surge demand; phase migration by style and color.

Review the service scope and request a pilot through Clothing Manufacturing OEM Service. Eton’s motto—Textile From Day One.—reflects factory-first discipline backed by a track record with global retailers. [INTERNAL LINK: Case studies—how we scaled cold-weather programs] [INTERNAL LINK: About our founder and team]

Next Steps to Lock Your Plan

Pick two t shirt distribution companies and run a four-week pilot while scoping one OEM pilot with a China Clothing Manufacturer. Model TCO across a season, include compliance and lab costs, and set acceptance gates. Use distributors for speed and volatility; move stable, margin-critical styles into OEM with documented specs and QC.

When you are ready, align scope with Clothing Manufacturing OEM Service and request a development calendar. [INTERNAL LINK: Contact Eton—OEM inquiries] [INTERNAL LINK: OEM & ODM Apparel Development—start here]

- U.S. Customs and Border Protection — Uyghur Forced Labor Prevention Act (UFLPA) Operational Guidance (2024–2025). https://www.cbp.gov

- European Chemicals Agency — REACH Guidance for the Textile Sector (2024). https://echa.europa.eu

- OECD — Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector (2023 update). https://oecd.org

- McKinsey & Company — The State of Fashion 2024/2025. https://www.mckinsey.com [CITE: McKinsey SoF 2024/2025]

- Federal Trade Commission — Textile, Wool, and Fur Labeling Rules (2024). https://www.ftc.gov

- European Commission — VAT, IOSS, and EORI Information for Businesses (2024). https://taxation-customs.ec.europa.eu

- Thomasnet — Top T-Shirt Manufacturers and Suppliers in the USA (Year). https://www.thomasnet.com [CITE: directory overview]

- Shopify — How to Find a Clothing Manufacturer/Supplier (Year). https://www.shopify.com/blog [CITE: sourcing framework]

- Printify Blog — Best Wholesale T-Shirt Vendors for Your Store (Year). https://printify.com/blog [CITE: POD/wholesale context]

- Fit Small Business — Best Wholesale T-Shirt Suppliers (Year). https://fitsmallbusiness.com [CITE: SMB vendor comparisons]

- ShirtSpace/Industry Blogs — Wholesale T-Shirt Distributors Overview (Year). [Verification Needed] [CITE: vendor SKU insights]

- AATCC/ISO — Textile Test Methods: Colorfastness, Dimensional Stability, Pilling (Year). https://www.aatcc.org | https://www.iso.org

[CITE: Provide links to CBP UFLPA guidance, ECHA REACH textiles page, OECD garment guidance, FTC labeling rules, McKinsey State of Fashion, EU VAT/EORI portal, AATCC/ISO methods.]

[MENTION: WRAP and amfori BSCI as audit frameworks; Oeko-Tex Standard 100 and GRS for material claims; SPS Commerce and TrueCommerce for EDI ecosystems; Bella+Canvas and Gildan as common tee brands.]

[INTERNAL LINK: Our foundational guide on OEM & ODM Apparel Development] [INTERNAL LINK: Textile QA & Lab Testing Essentials] [INTERNAL LINK: Eton author bio—Head of Sourcing]

FAQs

Related Articles

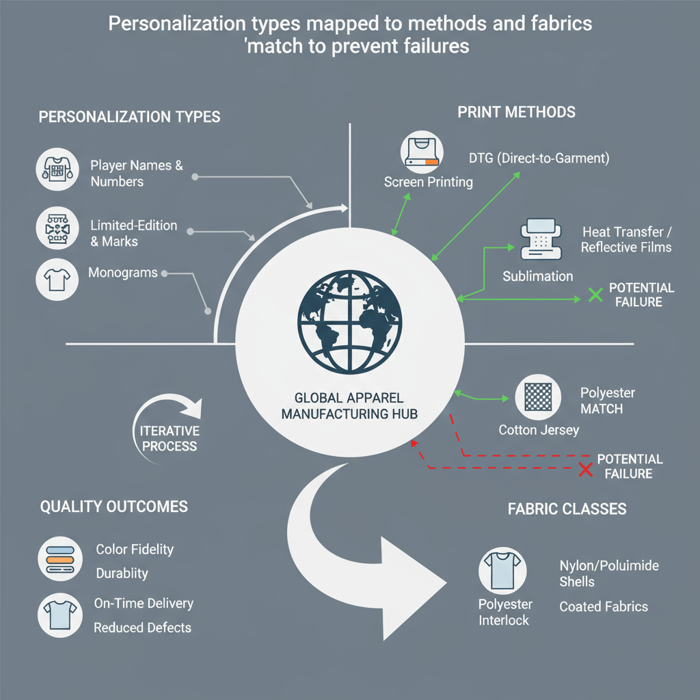

Personalized Printed Apparel with a China Clothing Manufacturer: A Complete Guide for Fashion Brands

15 minute read

October 16th, 2025

Personalized Printed Apparel with a China Clothing Manufacturer: A Complete Guide for Fashion BrandsPersonalized... more »

Empowering Your Brand: The Ultimate Guide to Sourcing Company Logo Clothing as a Leading Clothing Manufacturer

15 minute read

October 15th, 2025

Empowering Your Brand: The Ultimate Guide to Sourcing Company Logo Clothing as a Leading Clothing Manufacturer... more »

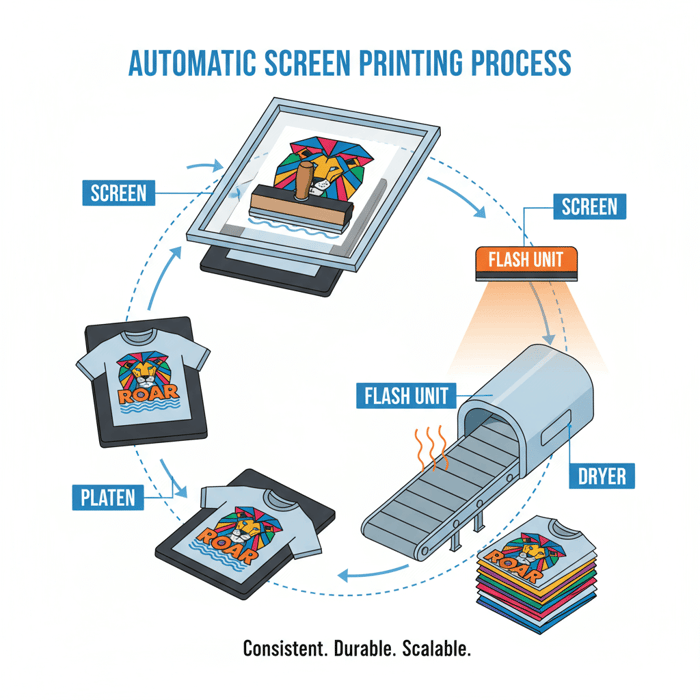

Screenprint T Shirts: A Fashion Brand’s Guide to Sourcing at Scale with a China Clothing Manufacturer

19 minute read

October 15th, 2025

Screenprint T Shirts: A Fashion Brand’s Guide to Sourcing at Scale with a China Clothing... more »

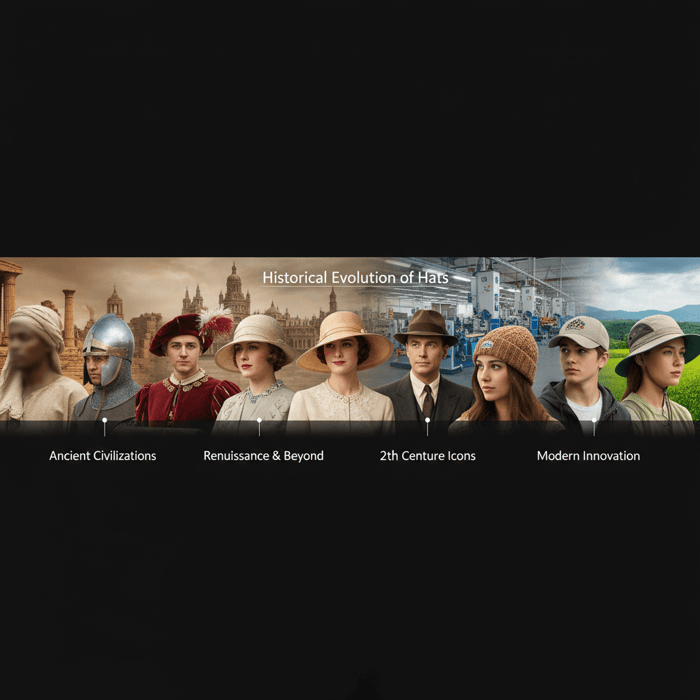

Discover the World of Kinds of Hats: Essential Insights for Fashion Sourcing Managers Seeking Innovation and Excellence

8 minute read

October 15th, 2025

Discover the World of Kinds of Hats: Essential Insights for Fashion Sourcing Managers Seeking Innovation and... more »