Private Label Screen Printing for Fashion Brands: A China Clothing Manufacturer’s Guide

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

19 minute read

Private Label Screen Printing for Fashion Brands: A China Clothing Manufacturer’s Guide

Private label screen printing gives brands direct control over how labels, care content, and identity live on the garment, and the right China Clothing Manufacturer can embed that branding into an OEM flow that meets US/EU compliance, passes QA, and ships on time. This guide turns goals into a clear, compliant production plan.

Private label screen printing places brand, size, care, and fiber info directly on garments. Choose method-to-fabric fit, meet US/EU labeling laws, lock Pantone and curing parameters, and validate with wash/crock tests. Partner with an OEM China Clothing Manufacturer that integrates screens, sampling, QA, finishing, and export packaging into a single schedule.

What Is Private Label Screen Printing? Use Cases, Benefits, and Essentials

Private label screen printing applies a brand’s identity and required product information directly to apparel. It works best when the content, inks, and fabric are matched correctly, compliance is embedded early, and quality controls verify legibility and durability before bulk production.

Use cases for fashion brands in the US and EU:

- Inside neck labels: brand name/logo, size, care symbols, fiber content, country of origin, manufacturer/RN/ID where required.

- Screen printed care labels: replace or supplement sewn care labels when legal and legible, especially on tees, fleece, and sportswear.

- Hem hits and sleeve marks: subtle logo prints for cohesion across capsules and line extensions.

- Packaging alignment: printed identity that matches hang tags, branded polybags, and carton labels for a consistent shelf presence.

Benefits:

- Brand cohesion at scale: repeatable identity across SKUs without added seam operations.

- Speed and cost control: fewer trim purchases and sewing steps than woven labels for certain programs.

- Comfort: no scratchy label edges; print sits flush with the fabric.

Watchouts:

- Ink-to-fabric mismatch: cracking or poor adhesion on stretch or coated shells if inks and curing are not tuned.

- Color fidelity: Pantone drift without standardized mixing and cured drawdowns.

- Compliance blind spots: missing country of origin, fiber content, or manufacturer/RN/ID details on items exported to the US/EU.

PAA micro-question: Can I screen print care and fiber content to replace sewn labels? Yes—if the print is durable and legible through the product’s useful life and the required fields are present for the destination market. Some retailers still require a physical care label; confirm early in tech pack notes. [CITE: “Retailer packaging and labeling manuals for US big-box chains”]

OEM garment factory finishing services – inside labels and export packaging

[MENTION: ScreenPrinting.com (Ryonet) production tips] [MENTION: SanMar guidance on tear-away labels and relabeling]

Core Components of a Private Label Neck Print

Build a compliant, legible neck print using this checklist for US/EU shipments:

- Brand name or logo: high-contrast, clear at a glance.

- Size: consistent system (e.g., S–XXL) aligned to region; maintain minimum font height for legibility.

- Care instructions: use GINETEX/ISO 3758 symbols or clear text; match fabric and trims. [MENTION: GINETEX/ISO 3758 care symbols]

- Fiber content: percentages total 100% and use legal fiber names per jurisdiction (e.g., EU 1007/2011). [CITE: “EU 1007/2011 guidance page”]

- Country of origin (COO): permanent, accurate marking (e.g., “Made in Bangladesh”). For the US, COO must be conspicuous and durable. [CITE: “FTC textile labeling basics for COO”]

- Manufacturer/RN/ID (US): either the company name or a registered RN number; keep records for audits. [CITE: “FTC RN database”]

- Tracking code or lot: optional but helpful for recalls, returns, or post-bulk QA.

- Date code/QC mark: small internal code for factory traceability.

Design notes: line thickness, font size, and contrast matter. Keep smallest type ≥1.8–2.2 mm x-height for cotton jersey; increase for textured knits. Place above the back neck seam, centered, with a consistent baseline grid. Keep artwork linework clean to prevent fill-in during curing.

Fabric and Ink Compatibility Basics

Match ink chemistry to fabric and finish before scaling:

- Plastisol inks: strong opacity and durability on cotton and blends; flexible on darker garments with low hand feel when flashed correctly. Use stretch additives for elastane blends.

- Water-based inks: softer hand and breathable prints; great on lighter colors and ringspun cotton. Requires tighter control of humidity and cure temperature.

- Discharge inks: bleach-activate to remove dye and re-pigment; yields soft prints on 100% cotton with reactive dyes. Not suitable for many blends and certain dye types.

- High-stretch synthetics: consider low-cure inks, migration blockers for polyester, and longer flash to prevent dye bleed (sublimation risk on bright poly). [CITE: “Technical bulletin on polyester dye migration control”]

Operational notes: Record mesh count, squeegee hardness, stroke count, flash temp/time, and final cure profile (e.g., 320°F / 160°C for plastisol; confirm with thermoprobe). For outerwear liners or coated shells, run adhesion and flex testing under expected conditions. [MENTION: AATCC test methods for wash and colorfastness]

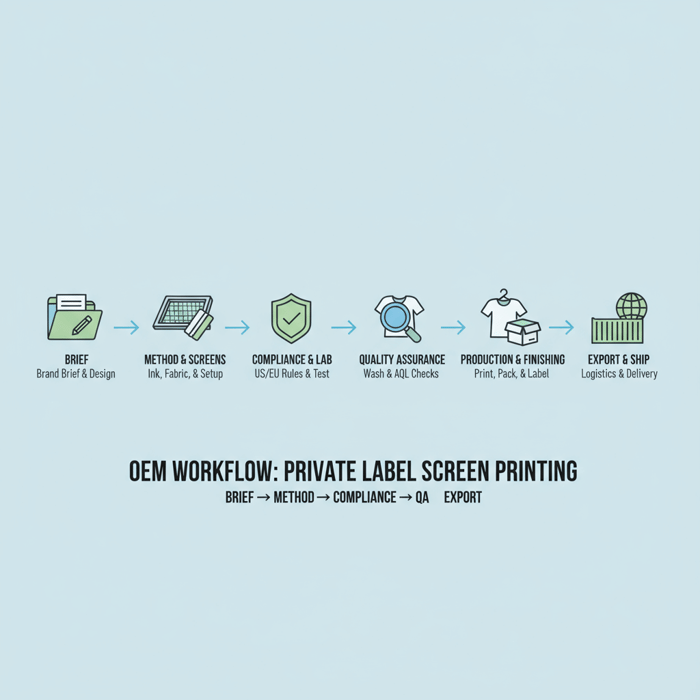

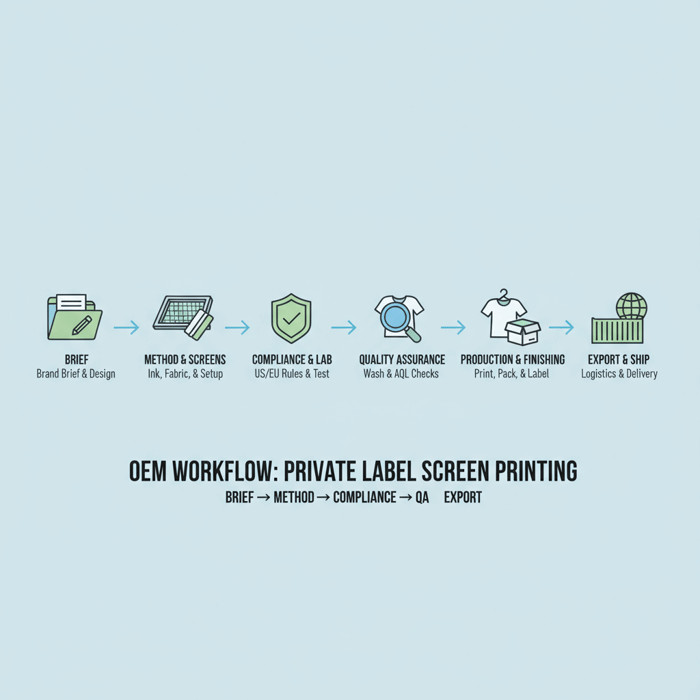

How to Set Up Private Label Screen Printing: From Brief to Approved Sample

A clean setup starts with a brand/label brief and compliance pack, then flows through artwork prep, screen making, test prints, lab validation, and PPS approval. Lock Pantone references, curing temperatures, and QA checkpoints in the tech pack so bulk production repeats the approved result.

Preparation: Brand Brief + Compliance Pack

Inputs that help avoid rework and delays:

- Brand identity kit: logo vector (AI/SVG), clear-space rules, tone on dark/light fabrics, and Pantone references.

- Label matrix by market: US vs. EU content fields, language requirements, and any retailer-specific rules on care/warnings. [CITE: “Major US retailer labeling manual excerpts”]

- Artwork spec for neck prints: target size, minimum type size, placement (mm from center-back), and allowed color swaps per SKU.

- Fabric deck: fabric codes, fiber composition, finishing/coatings, and any dye migration risks (noted from previous runs).

- Testing plan: required wash cycles (e.g., 5–10), crocking (dry/wet), and colorfastness grades per program. [MENTION: AATCC 61, AATCC 8/116]

Outputs to capture in the tech pack:

- Compliant neck label template(s) by destination market, with placeholders for fiber content, size, RN/ID, and COO.

- Pantone codes for each color; if no Pantone, retain approved physical drawdowns signed by buyer and factory.

- File handoff: vector artwork at 1:1 scale, spot colors named, and overprint settings verified.

US apparel labeling requirements and RN lookup [MENTION: FTC Care Labeling Rule guidance]

Execution Steps: Artwork → Screens → Test Prints → PPS

- Preflight artwork: verify line weights, reverse type legibility, and color naming (Pantone vs. custom mix).

- Screen making: choose mesh count based on detail and ink; burn screens with correct exposure and tension.

- Press setup: align registration, set off-contact, and validate flood/print strokes for consistency.

- Test prints: run on all relevant fabrics and colors; record flash/cure profiles and note hand feel.

- Lab checks: wash and crocking tests against agreed standards; assess cracking, lift, and color shift. [CITE: “ISO colorfastness grading reference”]

- Corrections: adjust ink modifiers (soft hand, stretch), tweak screen mesh, or revise exposure/angle to sharpen detail.

- PPS build: produce a pre-production sample set with finalized settings, labeled by SKU and size.

- Buyer approval: confirm color, legibility, compliance fields, and placement. Sign off with date and version.

- Press run SOP: freeze parameters in a one-page run card attached to the production order.

Tip: For multi-size runs, test the smallest and largest sizes to catch legibility issues and placement drift.

Quality Assurance: Wash/Crocking Tests + AQL

Build a simple, reliable QA backbone:

- Wash tests: define temperature, cycle count, and detergent profile; require no cracking, lifting, or severe fading beyond the agreed grade.

- Crocking tests: validate dry/wet rub for color transfer on light fabrics and white liners.

- Inline checks: verify placement tolerance (e.g., ±5 mm), color target (delta E threshold for Pantone), and legibility of smallest type.

- AQL sampling: set inspection levels (e.g., General II, AQL 2.5 for major defects; 4.0 for minor); include print defects in the defect list.

Documentation: retain swatches from test prints and signed PPS in production files for traceability. [CITE: “ISO/AATCC references for wash and colorfastness test methods”]

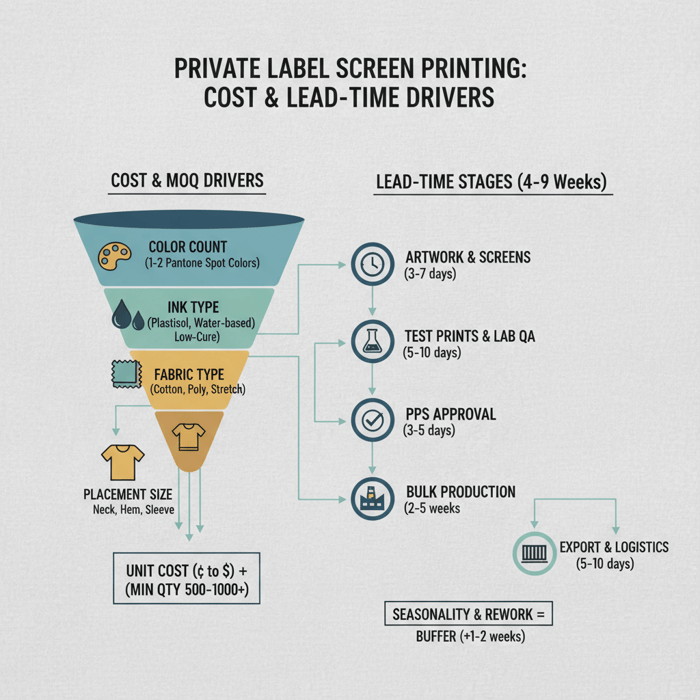

Costs, MOQs, and Timelines for Private Label Screen Printing

Cost is driven by color count, ink chemistry, fabric type, and volume; MOQ stems from screen setup and batching efficiency in China and Bangladesh. Timelines expand with multi-color art, seasonal peaks, and added testing. Early consolidation and a tight PPS help keep budgets and dates intact.

Key Cost Drivers and How to Optimize

- Color count: each color adds a screen and press time; aim for 1–2 colors for neck prints.

- Ink type: plastisol is economical and durable; water-based may add handling time; low-cure and migration-blocker systems raise cost on synthetics.

- Fabric and finish: coated shells and high-stretch blends often require extra testing and slower press speeds.

- Placement and size: smaller neck prints cost less than large hem logos; avoid oversized art where not needed.

- Batching and changeovers: group SKUs by ink color and fabric to cut cleans and resets.

Indicative ranges for planning (to be confirmed during quotation):

- Screen setup: low to mid double-digit USD per color per screen; amortize across units.

- Unit print cost (neck, 1 color): cents to low tens of cents at volume; higher for specialty inks or low MOQs. [CITE: “Factory cost benchmarking for screen-printed labels, 2024–2025”]

- Testing: wash/crocking panels and lab fees vary by scope; include in sampling budget.

MOQ Reality: Screens, Colors, and Consolidation

MOQ depends on how efficiently a factory can run your batch:

- Single-color neck prints: lower MOQ thresholds are possible, especially when grouped by body color and fabric.

- Multi-color or large placements: MOQs climb with added setup and slower run speeds.

- China vs. Bangladesh: Bangladesh can be sharp on large orders with stable artwork; China often suits multi-style launches and faster sampling. [CITE: “Country-level apparel capacity and lead-time report”]

Consolidation tips: standardize the neck template across multiple SKUs; vary only size and fiber content lines. Lock a master artwork set per season to reduce resets.

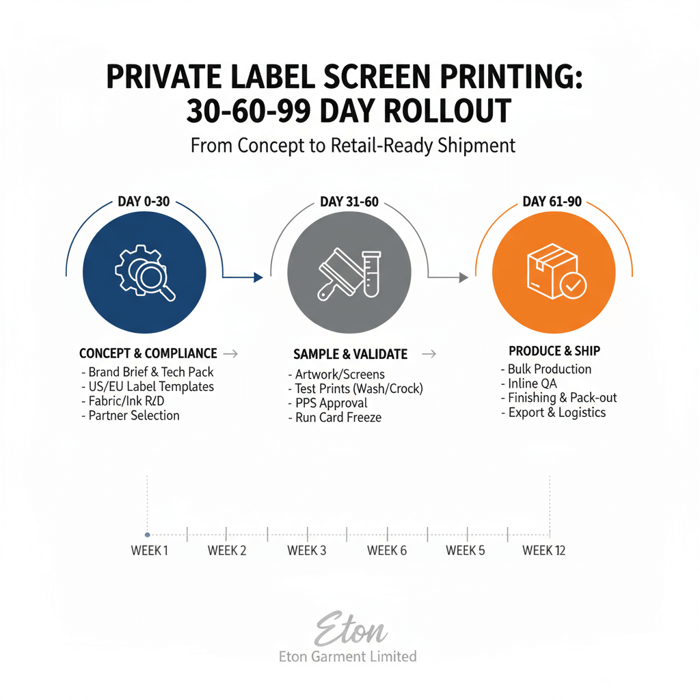

Timeline Planning: From Sample to Ship

- Artwork and screens: 3–7 days after final files.

- Test prints and lab checks: 5–10 days, depending on wash cycles and lab queue.

- PPS approval: 3–5 days for courier, review, and signoff.

- Bulk production: 2–5 weeks, influenced by seasonality, color changes, and order size.

- Export packaging and booking: 5–10 days to finalize packing lists, carton labels, and freight bookings.

Plan buffers around peak factory seasons and client-side review windows. Confirm buyer availability for PPS signoff to avoid idle time. [CITE: “Sourcing calendars for US/EU retail seasons”]

| Factor | Impact | Notes |

|---|---|---|

| Color count | High | Each color adds screen setup and time; keep neck prints to 1–2 colors. |

| Ink type | Medium–High | Water-based/low-cure systems and blockers cost more but solve migration or hand-feel goals. |

| Fabric category | Medium | Stretch, coatings, and deep dyes add testing and slowdowns. |

| Placement area | Medium | Larger or multi-location prints raise unit time. |

| Artwork complexity | Medium | Fine detail requires higher mesh and more rejects if not tuned. |

| Region (China/Bangladesh) | Medium | China for speed/mixed styles; Bangladesh for scale on stable art. |

| Seasonality | Medium | Peak months extend queue times; lock PPS early. |

- Press setup accounts for a sizable share of unit cost at low MOQs — 2025 [CITE: “Apparel factory costing guide for finishing services”]

- Seasonal peaks extend approvals and lab queues by 3–7 days — 2025 [CITE: “Sourcing planning calendars, industry associations”]

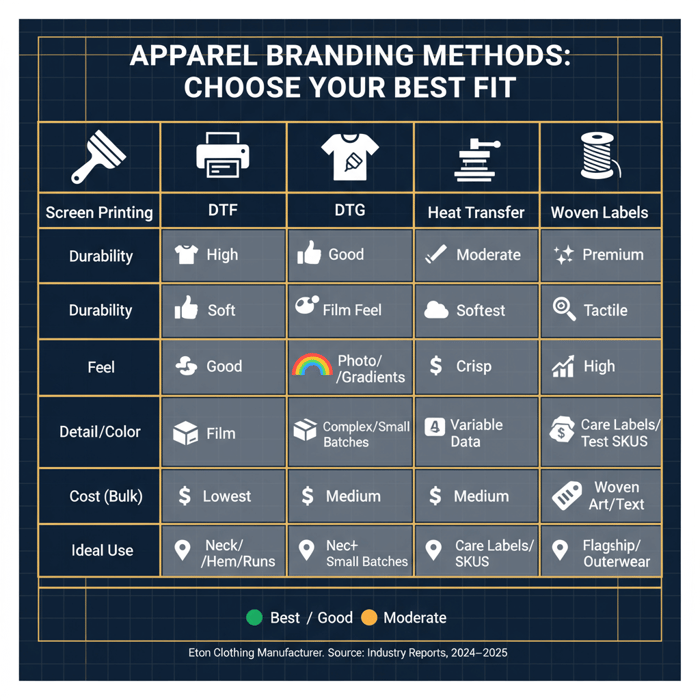

Screen Printing vs. Alternatives (DTF, DTG, Heat Transfer, Woven Labels)

Screen printing wins on durability and unit cost at scale; DTF and DTG support gradients and short runs; heat transfer suits fine detail and variable data; woven labels add a premium tactile cue. Choose based on look, hand feel, compliance, unit volume, and testing outcomes.

Criteria Overview

Score methods against brand goals:

- Durability: repeated washes without cracks or lift.

- Look and feel: matte vs. glossy, soft hand, or raised definition.

- Compliance: permanent COO and required fields, symbol clarity.

- Volume economics: screens pay off at volume; transfers support flexible SKUs.

- Color fidelity: Pantone matches vs. photo-real gradients.

[MENTION: Printful branding notes on method options] [MENTION: Threadbird finishing services overview]

| Method | Strengths | Limitations | Best Use |

|---|---|---|---|

| Screen printing | Durable, economical at volume, Pantone control | Setup cost per color; migration risk on poly without blockers | Neck prints, simple hem logos, large runs |

| DTF | Fine detail, gradients, small batches, good on varied fabrics | Feel of transfer film; heat press workflow adds time | Short runs, multi-color neck art, complex capsules |

| DTG | Photo-real prints, fast iteration, no screens | Unit cost higher, pre-treat needed on darks, neck legibility varies | On-demand, art-heavy graphics on tees and fleece |

| Heat transfer | Crisp small type, variable data, low setup | Durability varies by film and process; sheen on some films | Care labels with small type, test market SKUs |

| Woven labels | Premium tactile identity, no curing | Extra sewing step, lead time for label production | Flagship lines, outerwear branding cues |

Decision Framework

- Define volume bands: pilot vs. replenishment; consolidate art where possible.

- Set look and hand targets: matte/soft vs. glossy/raised; choose inks or transfer films accordingly.

- Map compliance fields: confirm print permanence for COO and fiber content or use a woven/sewn label when required.

- Run durability checks: wash/crock standards, migration tests for polyester.

- Freeze the method per SKU: record parameters in the tech pack and the run card.

- Private label demand rising amid value seeking, 2024–2025 [CITE: “McKinsey State of Fashion 2024”] [MENTION: McKinsey & Company]

Data & Trends: Private Label Apparel Momentum in US/EU

Private label apparel continues to expand as retailers and brands pursue margin resilience, faster reaction times, and tighter control over identity and compliance. Align method choices with consumers’ expectations for comfort, clarity, and sustainability claims.

Signals shaping 2024–2025 plans:

- Value re-tiering: shoppers trade across price points but still expect consistent quality and clear care info. [CITE: “US/EU apparel consumer studies, 2024–2025”]

- Speed and flexibility: capsule testing with small-batch methods (DTF/heat transfer), then moving to screens for volume.

- Sustainability framing: claims must match substantiated inputs (inks, trims, recycled content), and care symbols should be accurate to support garment longevity. [CITE: “Guidance on environmental claims in apparel, EU/US”]

Key Trend 1: Value & Speed

Brands run pilots with faster, lower-setup methods, validate demand, and shift to screen printing once SKUs stabilize. This play reduces sunk setup costs while preserving the path to better unit economics at scale. Packaging and labeling data flow in PLM/ERP systems shortens changeovers. [CITE: “Apparel PLM case studies on time-to-market”]

Key Trend 2: Compliance & Trust

Retail partners now expect audit-ready label packs: COO accuracy, fiber content naming per region, and care symbols that match fabric performance. Missing fields or non-permanent marking stalls inbound checks and raises chargeback risk. Build templates once and reuse across styles, with country and fiber fields pulled from BOM data. [MENTION: GINETEX; ISO 3758]

- Private label share expanded across categories by multiple points since 2020 — 2024 [CITE: “Retail panel data for US/EU, 2024”]

- Retailers elevated compliance checks on COO and fiber content in inbound QC — 2025 [CITE: “Third-party inspection reports, 2025”]

Operations & Finishing: Inside Labels, Hang Tags, Polybagging, Carton Labels

Build a retail-ready finishing stack that pairs private label screen printing with hang tags, polybagging, barcode management, and carton labels. Lock SKU granularity and data integrity early to prevent rework, chargebacks, or delays at inbound DCs.

Retail-Ready Sequencing

- Confirm neck print content: brand, size, fiber, COO, RN/ID (US), care symbols.

- Hang tags: logo, story, price label format; assign GS1-compliant barcodes per SKU/size. [CITE: “GS1 barcode guidance for apparel”]

- Polybagging: follow retailer specs on suffocation warnings, thickness, recycle marks, and size stickers.

- Carton labels: include PO, style, color, size run, and destination; use scannable labels aligned to retailer routing guides.

- Packing list and ASN: tie quantities, barcodes, and carton IDs; test a pilot EDI if required.

PAA micro-question: Do I need polybagging for major US retailers? Many do require it, including specific warning placement and language; check the routing guide and confirm exceptions for eco programs. [CITE: “Retailer routing guide excerpts on polybagging”]

Packaging & Label Data Integrity

- Single source of truth: lock SKU attributes (size, color, fiber, COO) in the BOM and push to labels and barcodes.

- Barcode validation: print verification reports (ANSI/ISO grades) before bulk to avoid scan failures.

- Carton QC: randomize checks to ensure correct sizes and counts per carton; record photos at pack-out.

OEM finishing services & export packaging

Risks, Compliance & Localization for US & EU

Private label prints must include required fields (e.g., fiber content, manufacturer/RN/ID, country of origin) and present care instructions aligned to the fabric. Use standardized symbols (GINETEX/ISO 3758) and maintain an audit-ready label pack with templates, proofs, and PPS signoff records.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Missing COO or RN/ID (US) | Medium | High | Use templates with required fields; pre-ship compliance check. [CITE: “FTC labeling guidance”] |

| Illegible care/fiber print | Medium | Medium–High | Increase type size; verify ink contrast; wash-test legibility after cycles. |

| Dye migration on polyester | Medium | Medium | Use blockers and low-cure inks; run migration test panels. |

| Cracking on stretch fabrics | Medium | Medium | Add stretch additives; tune mesh and squeegee; flex test post-cure. |

| Retailer-specific labeling variance | Medium | High | Load routing guide specs into the tech pack; pilot one DC before full rollout. [CITE: “Retailer routing guide”] |

Regulatory Notes for US & EU

| Requirement | United States (FTC) | European Union (EU 1007/2011) |

|---|---|---|

| Fiber content | Percentages and legal fiber names; total 100%. | Legal fiber names; percentages; multilingual where applicable. |

| COO | Conspicuous, accurate country of origin marking. | Required; format varies; align with customs marking rules. |

| Manufacturer ID | Company name or RN number. | Company name/address; RN not used; importer details as needed. |

| Care instructions | Care Labeling Rule; symbols or text; permanence required. | GINETEX/ISO symbols widely used; clarity and durability expected. |

| Language | English for US market. | Local language(s) as required by member state. |

Disclaimer: This overview is informational, not legal advice. Confirm retailer and country requirements with counsel and current government sources. [CITE: “FTC Care Labeling Rule”] [CITE: “EU 1007/2011 official text”]

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton’s Clothing Manufacturing OEM Service integrates private label screen printing with US/EU compliance content, Pantone-controlled color, wash/crock tests, and retail-ready finishing. One workflow covers design, sampling, printing, packaging, and export—across China and Bangladesh—so brands scale with fewer handoffs.

| Your Need | OEM Solution | Outcome |

|---|---|---|

| Compliant neck labels | Templates aligned to FTC/EU rules; RN/ID management and symbol set library | Audit-ready neck prints; fewer inbound issues |

| Pantone fidelity | Color drawdowns, controlled mixing, delta E thresholds | Consistent brand color across runs and regions |

| Durability | AATCC wash/crock tests and migration panels for polyester | Labels that remain legible through the garment life |

| Volume + speed | Screen consolidation by artwork; regional batching plans | Sharpened unit cost and predictable lead times |

| Retail-ready pack | Hang tags, polybags, barcode labels, and carton labels in one flow | Smoother inbound checks, fewer chargebacks |

Use Case 1: Start-Up Brand, Low MOQ → Scalable Program

Challenge: Launch three tees and two fleece styles across five sizes with custom neck prints, while preserving cash and optionality.

Approach:

- Round 1: Use 1-color neck art with a shared template. Test DTF for two complex logo placements; screen print the neck labels.

- Validation: Wash/crock tests and migration checks on the fleece; PPS signoff within one week.

- Scale-up: After sell-through, move complex logos to screens for unit cost savings; keep the same neck template.

Results: Faster launch, fewer resets, and a clear path to better margins in replenishment. [CITE: “Case study pattern: start-up SKU ramp with hybrid methods”]

Use Case 2: Retailer Line Extension → Compliance-First Rollout

Challenge: Extend an outerwear line with printed neck labels and carton label changes across US and EU destinations, with strict routing guide compliance.

Approach:

- Matrix templates: two master neck print templates (US/EU) aligned to fiber content variations and COO by factory.

- QA layer: migration panels on dark poly shells; wash tests on quilted liners; PPS signoff.

- Finishing: harmonized barcodes and carton labels; retailer-specific polybag specs; staged shipments.

Results: On-time DC intake with fewer relabel requests and consistent brand presentation across markets. [MENTION: GINETEX/ISO references in tech pack]

Explore Eton’s Clothing Manufacturing OEM Service for private label printing, sampling, and retail pack integration: Clothing Manufacturing OEM Service. OEM private label screen printing workflow

Conclusion & Next Steps

Set goals for look, durability, and cost; choose the method per SKU; build a compliance-first neck template; test for wash durability and migration; and fix parameters in the tech pack. With an OEM partner aligning screens, QA, and finishing, private label screen printing becomes repeatable, audit-ready, and scalable.

- Week 1–2: Finalize brand/label brief, method choices, and compliance templates (US/EU).

- Week 2–3: Artwork preflight, screens, test prints, and lab checks.

- Week 3–4: PPS signoff and run card freeze.

- Week 4–8: Bulk production with inline QA and finishing.

- Week 8–9: Carton QC, documents, booking, and ship.

Start your compliant private label program today with integrated sampling, QA, and packaging: Clothing Manufacturing OEM Service. Brand resources hub and compliance templates. Pantone controls and wash testing for apparel labels

Author: Senior Apparel Manufacturing Strategist (12+ years factory-side; outerwear and technical apparel). Reviewer: Compliance & QA Manager, Eton Garment Limited. Methodology: Synthesis of factory workflows and recognized industry resources; compliance mapped to FTC and EU regulations. Limitations: Retailer requirements vary; confirm during production. Disclosure: Eton provides OEM private label screen printing.

Author bio page — Senior Apparel Manufacturing Strategist

- FTC — Care Labeling Rule and Textile/Wool/Fur Acts (2024–2025). [CITE: “FTC Care Labeling Rule; textile labeling guidance”]

- European Union — Regulation (EU) No 1007/2011 on textile fibre names and related labelling (Consolidated). [CITE: “EU 1007/2011 official text”]

- GINETEX / ISO 3758 — Care labelling system and symbols. [CITE: “GINETEX; ISO 3758 standard page”]

- AATCC — Test methods for wash durability and crocking. [CITE: “AATCC 61, 8/116 method pages”]

- Pantone — Color standards and mixing guides. [CITE: “Pantone color guides”]

- Printful — Branding Options Guide. [CITE: “Printful branding guide page”]

- Threadbird — Finishing Services. [CITE: “Threadbird finishing services page”]

- ScreenPrinting.com (Ryonet) — Private labeling and technique tips. [CITE: “ScreenPrinting.com how-to resources”]

- SanMar — Tear-away labels/relabeling guidance. [CITE: “SanMar education resources”]

- McKinsey & Company — The State of Fashion 2024. [CITE: “McKinsey State of Fashion 2024”]

- GS1 — Barcode standards for apparel. [CITE: “GS1 barcoding for retail apparel”]

- Country-level capacity and lead-time reports. [CITE: “Industry sourcing reports for China and Bangladesh”]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »