Portuguese Apparel vs China Clothing Manufacturer: How Fashion Brands Should Source in 2025

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

22 minute read

Portuguese Apparel vs China Clothing Manufacturer: How Fashion Brands Should Source in 2025

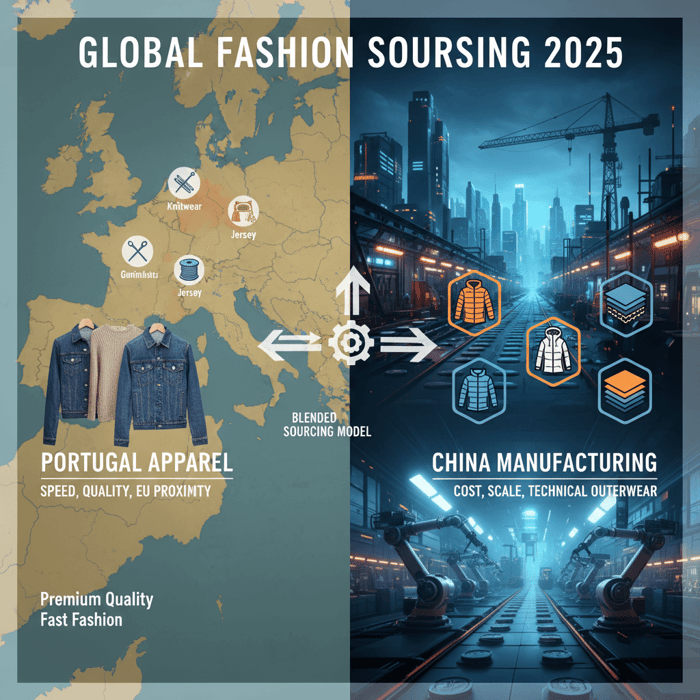

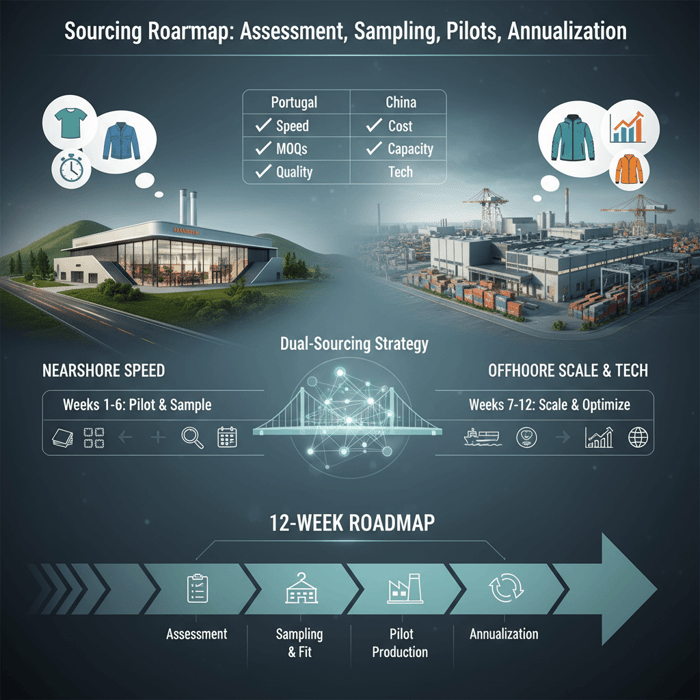

Portuguese apparel sits back on US and EU buyers’ shortlists while a China Clothing Manufacturer still carries the weight for cost and technical outerwear. Brands want faster drops, reliable margins, and fewer compliance risks. The smartest play is a blended model: launch nearshore for speed and precision, then scale offshore where capacity and advanced construction deliver cost control and breadth.

Sourcing leaders face shrinking calendars and fuller compliance checklists. Portugal brings proximity, lower MOQs, and tight control in knitwear, jersey, denim, and light outerwear. China and Bangladesh bring production scale, specialized machinery, and multi-plant load balancing for jackets, padded coats, seam-sealed shells, and down-proof constructions. Eton has run that scale side since 1993 and pairs it with a practical decision framework that fits modern buying and QA cadence.

This article maps definitions, trade-offs, landed cost inputs, and a dual-sourcing playbook. It shows how to build a working portfolio split, how to harmonize BOMs across regions, and how to keep testing and audits coherent. It weighs Portuguese apparel against a China Clothing Manufacturer on cost, speed, capacity, ESG, and technical capability. It also lays out compliance notes for REACH, CPSIA, and PFAS restrictions that affect outerwear and performance fabrics.

Nearshore speed is real when calendars compress or when replenishment matters. Offshore scale is unbeatable in high-volume runs or complex jackets with bonding, taping, and multi-component linings. Use the seven-step framework to set goals, segment SKUs, run samples, pilot PO splits, and lock your annual distribution. The plan centers on measurable KPIs: OTIF, AQL, return rates, and carbon proxies aligned with buyer priorities.

Portuguese apparel wins for fast, lower-MOQ capsules with strong ESG and EU proximity. A China Clothing Manufacturer wins for unit cost, capacity, and technical outerwear. Most brands benefit from dual-sourcing: launch nearshore to de-risk calendars and polish fits, then scale offshore for margin, category breadth, and advanced construction [S1][S4].

Portuguese apparel today: strengths, categories, and when it wins

Portuguese apparel excels in premium knits, jersey, denim, and light outerwear with small-to-mid MOQs and quick turnarounds. It fits drops, capsules, replenishment, and EU-localized programs. It brings tight QC, integrated clusters, and washing/finishing depth in denim. Use Portugal when speed and proximity trump unit-cost savings, or when ESG signals matter to your brand narrative [S1][S2].

Portugal’s apparel ecosystem clusters around knitwear in Barcelos and Guimarães, with strong vertical integration. Mills, dye houses, laundries, and stitching facilities sit within short drives. That geography removes friction in lab dips, washing trials, and fit rounds. It also simplifies vendor day trips for EU teams and field-ready QC during critical weeks.

- Speed: 4–8 weeks post-PP sample for simpler knits and jersey; denim and light outerwear vary by wash, fabric, and trim readiness [CITE: “Industry averages for Portugal lead times by category; AICEP or ATP brief”].

- Lower MOQs: Small-to-mid orders that fit drops or brand pilots; frequent in jersey and knit programs [CITE: “Portugal apparel MOQ ranges; trade association survey”].

- Quality: Consistent stitching and finishing; denim washing and laser finishing capabilities are strong in specialist hubs.

- Proximity: EU logistics with road or short sea; customs simplicity within EU markets; faster fit rounds.

- ESG: European compliance alignment and transparent audits; strong adoption within clusters [CITE: “Portugal sustainability initiatives; ATP or AICEP sector note”].

- Category fit: Knits, jersey, denim, tees, sweats, polos, and light outerwear with limited bonded layers.

- Nearshoring pilots rose across EU brands in 2024 — Year (Source: [S4]).

- Portugal positions on quality and sustainability in EU apparel — Year (Source: [S1][S2]).

[MENTION: AICEP Portugal Global], [MENTION: ATP – Textile and Clothing Association of Portugal], and [MENTION: Eurostat] show consistent interest in European proximity sourcing. US and EU buyers report fewer calendar misses when sample approvals and lab tests occur within short haul of design teams. This plays best for collections where fit refinement or washing trials are part of the brand’s signature look.

[INTERNAL LINK: EU nearshore manufacturing guide → Resource hub page idea] can house the full vendor shortlisting checklist. Keep in mind that Portugal’s strength narrows for complex seam-sealed shells or down-proof cluster programs; those reach deeper into specialized machinery setups more common in China and Bangladesh. Eton’s outerwear expertise covers those needs across factories with bonding, taping, and multi-layer BOM control, which we detail later.

Category fit: knits, jersey, denim, light outerwear

Knits and jersey form the backbone of “made in Portugal apparel.” Tee and fleece programs get fast proto cycles and reliable stitching. Polo bodies with collar and cuff detail sit well in clusters that run consistent quality on repeat bodies. Denim programs leverage washing, laser finishing, and abrasion treatments. Light outerwear with minimal bonding or taping can fit Portugal when trim readiness and fabric lead times align.

Premium capsules often start with Portuguese apparel for fit confidence and speed. EU multi-country retail groups use local replenishment in knits and sweats to respond to sell-through signals. Denim nearshore pilots can validate wash recipes and hand feel faster than cross-continental shipping allows. Technical shells or down jackets with multiple taped seams and layered linings are better staged offshore for specialized machinery and process control.

Operational profile: MOQs, lead times, sampling cadence

MOQs in Portugal trend lower relative to offshore mass production. Brands can place graduated orders, test sell-through, and adjust color or wash between drops. Lead times sit in the 4–8 week window post-PP approval for simple jersey or knit bodies. Denim adds lab dips, wash recipe development, and testing. Light outerwear can hold the same cadence if the construction is straightforward.

Sampling cadence benefits from EU proximity. Fit and PP rounds can close faster. Lab dips and washing approvals finish in days rather than weeks. EU buyers gain oversight without long flights and timezone friction. That tight feedback loop keeps capsule calendars intact when marketing plans aim for seasonal events or football club collaborations. Eton’s teams often coordinate PP/TOP samples across nearshore pilots and offshore scale, keeping measurements and BOMs aligned while brands move into volume runs.

Portuguese apparel vs China Clothing Manufacturer: cost, speed, quality, and scale

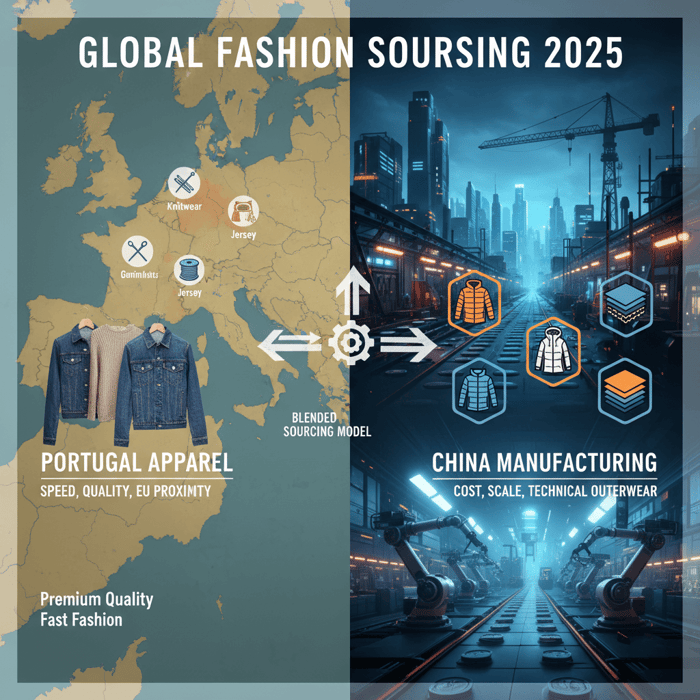

Portugal wins on speed, lower MOQs, and EU-localization. A China Clothing Manufacturer wins on unit cost, capacity, and complex technical outerwear. The choice hinges on SKU complexity, margin targets, and delivery windows. Global buyers diversify to reduce single-country dependence and to rebalance risk, cost, and speed [S3][S4][S5].

| Criteria | Portugal | China | Notes |

|---|---|---|---|

| MOQs | Lower; suited to capsules and replenishment | Higher; economical at volume | Portugal fits tests and drops; China fits planned volumes. |

| Lead time | 4–8 weeks post-PP (simple knits/jersey) | 8–12+ weeks post-PP | Category complexity and fabric sourcing change these ranges. |

| Unit cost | Higher at small-to-mid volumes | Lower at scale | Landed cost modeling must include duty and freight [S6][S7]. |

| Category fit | Knits, jersey, denim, light outerwear | Technical outerwear, down jackets, seam-sealed shells | Machinery depth matters for taped seams and bonding. |

| Fabric access | EU mills; short-haul sourcing | Global mill network; breadth of technical fabrics | Functional fabrics and laminates often align with China supply. |

| Lab/testing | EU standards alignment; local labs | Extensive labs; full suite of performance tests | Map REACH/CPSIA/PFAS testing across both. |

| ESG maturity | Strong EU alignment | Variable by factory; verify audits | Run standardized audits and documentation mapping. |

| Capacity/scale | Moderate; cluster strengths | High; multi-factory networks | Load balancing supports multi-country retail calendars. |

| Risk exposure | Lower geopolitical/logistics uncertainty in EU | More exposure; offset via diversification | Dual-sourcing reduces single-point risk. |

- Portugal pros: speed, lower MOQs, EU proximity, denim finishing depth.

- Portugal cons: higher unit cost at scale, limited capacity for complex shells.

- China pros: unit cost at volume, technical outerwear capability, broad mill access.

- China cons: longer ship times, higher MOQs, more complex compliance logistics.

- Buyers rebalanced portfolios in 2024 to reduce single-country exposure — Year (Source: [S4][S5]).

For technical outerwear, China remains the best fit when multi-layer BOMs, seam sealing, bonding, and advanced insulation come into play. Eton’s factories run taped-seam shells, down-proof baffle constructions, and bonded panels with strict QA gates. Global brands expect consistent AQL, documented TOP samples, and lab-backed performance results that match US and EU requirements. Program detail lives here: Outerwear OEM/ODM expertise.

[MENTION: McKinsey – State of Fashion], [MENTION: WTO – trade review], and [MENTION: Eurostat] support the portfolio balancing trend. For US/EU retailers, the practical decision often lands on a blended approach. Run Portuguese apparel for speed and smaller runs. Use a China Clothing Manufacturer for cost and complex categories. Revisit distribution quarterly against OTIF performance and return metrics.

Criteria overview: order size, margin, calendar, complexity

Start with order size. Small-to-mid runs favor Portuguese apparel. Larger runs favor China on landed margins. Margin targets put weight on unit cost and duty. Calendars shift the score toward nearshore for fast capsules. Complexity lifts China when seam sealing, bonding, and down-proof constructions enter the design. Fabric strategy matters as well; technical laminates often sit within Asia’s mill networks.

Add vendor dependencies. Some Portugal vendors carry deeper denim finishing and knit expertise. Some China vendors excel in taped-shell construction lines. Testing capability and documentation cadence matter in both regions. A blended portfolio places lightweight knits nearshore and complex down jackets offshore. Then monitor results across seasons to tune the split.

Decision scoring: how to assign weights

Set weights on speed, cost, complexity, and ESG. A fast fashion capsule might weight speed at 40%, cost at 25%, complexity at 15%, ESG at 20%. A winter outerwear program might weight complexity at 40%, cost at 30%, speed at 15%, ESG at 15%. Build a simple scorecard. Rate Portugal and China per criterion. Multiply by weights. Choose the top performer or split SKUs by criterion strength.

Refine the model as actuals arrive. If Portuguese apparel hits OTIF targets and keeps returns low, raise its share for similar SKUs. If technical shells from China pass lab tests and improve margins, expand that category’s offshore run. Keep BOMs aligned across both vendors to avoid drift in trims, fabrics, and measurement tolerances.

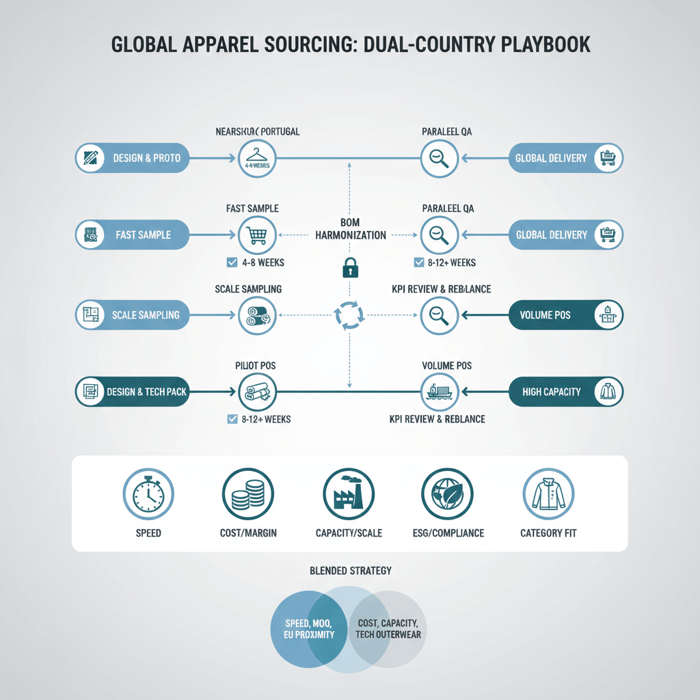

How to choose between Portuguese apparel and a China Clothing Manufacturer: a 7-step framework

Use a structured sequence to pick the right path and build the split. Define margin and speed goals. Segment SKUs by complexity and volume. Build shortlists. Model landed costs by destination market. Sample to validate fits and lab results. Pilot POs. Review KPIs and finalize the annual distribution.

- Define margin and speed goals: set target gross margin and calendar windows by drop and season.

- Segment SKUs: cluster by complexity, volume, and category (knits, denim, technical outerwear).

- Build shortlists: select Portugal vendors for smaller runs; China vendors for scale and technical needs.

- Model landed costs: include duties, brokerage, freight, insurance, testing, labeling, packaging.

- Sample and validate BOM parity: align fabrics, trims, measurements, and lab standards across vendors.

- Run pilot POs: split orders; measure speed, quality, returns, and cost actuals.

- Review KPIs and lock annual splits: set quarterly reviews; adjust distribution based on performance.

Question: what MOQ level makes China more cost-effective? The break-even shifts by category and duty. Knits and jersey usually flip at mid-thousands. Technical jackets flip earlier when complexity and machinery time drive higher local costs. Model with your own FOBs, duties, and freight to see the threshold by SKU group [CITE: “Case-based landed cost modeling study”].

[INTERNAL LINK: Quality control and lab testing checklist → Page idea] should detail PP, TOP, and AQL steps. Eton’s experience points to BOM drift and fit inconsistencies as common pitfalls when brands run nearshore pilots and offshore production in parallel. Strict measurement tolerances and trim confirmations cut risk across the split.

Preparation: inputs, templates, sourcing brief

Build a sourcing brief with margin targets, calendar dates, SKU counts, size runs, and testing protocols. Include labeling, fiber content, PFAS stance, and special compliance notes by market. Prepare a calculator with FOB prices, duties by HS code, freight mode options, and testing costs. Draft a vendor RFI that covers capacity, MOQs, audited certifications, and lab capability. Keep a shared tech pack template across vendors to reduce divergence.

This upfront work saves calendar time later. Vendors move faster when specs are clean and materials are available. Eton’s teams often help brands standardize BOMs to avoid last-minute trim substitutions that compromise fit or lab outcomes.

Execution steps and timing by season

Map proto, fit, PP, and TOP rounds against delivery dates. Run parallel sampling in Portugal and China to compare fits and handle. Use quick EU trips for nearshore fit approvals. Use video or posted samples for offshore checks while lab tests run. Place pilot POs with tight AQLs. Ship early capsules by road or short sea to EU stores. Stage offshore production for broader release and price points in US and EU.

For winter outerwear, line up insulation, down-proof shells, seam sealing tapes, and bonding adhesives early. These inputs have longer lead times and testing cycles. Pair that with a clear defect taxonomy and accept/reject rules that hold across both nearshore and offshore vendors.

Quality assurance gates: PP, TOP, AQL, lab tests

Lock QA gates before PO issue. PP sample approval triggers production. TOP samples verify production batch quality before shipment. Maintain AQL sampling plans for incoming goods inspections. Run lab tests for fiber content, colorfastness, seam integrity, and water resistance or repellency as needed. Add PFAS testing for US state compliance where required. Keep documents filed by SKU and factory and ready for audits.

Eton’s QA model includes factory-level measurement checks and lab tests on scheduled cadence. Multi-factory networks follow the same playbook. This keeps technical shells consistent across production cycles and seasons.

Total landed cost and trade logistics for US & EU buyers

Landed cost for Portuguese apparel and China production changes with duty rates, freight mode, packaging, testing, and compliance. Use official tools for tariffs and rules of origin. Account for seasonality and mode shifts. Air improves speed but raises cost. Sea reduces cost but stretches calendars. Road works inside the EU for nearshore programs [S6][S7].

- EU Access2Markets and US HTS list duties by HS code; verify with official tools — Year (Source: [S6][S7]).

Build a calculator with FOB/EXW prices, duties, brokerage, freight, insurance, testing, labeling, packaging, and compliance costs. RoO rules can alter duty outcomes on finished garments; check fabric origin and processing steps with customs brokers. Train teams to request HS classification support. A 1–3% swing in duty changes margin on volume runs [CITE: “USITC HTS classification case example”].

Small capsules from Portugal often ship by road for EU markets or air for US. Volume runs from China move by sea to hit margin targets. When calendars tighten, brands fly initial sizes to set floors and fixtures, then follow with sea for the balance. Packaging changes also affect landed cost. Optimize carton cube, inner packs, and hanger use by program and channel.

Inputs for a reliable landed-cost model

Use FOB prices per style and size run. Add duty by HS code and destination. Include port fees and brokerage. Select freight mode and lane. Add insurance. Include lab test cost per style. Add labeling and packaging. Sum per unit. Maintain version control and store assumptions. Link each input to a source or vendor quote. Keep a note on seasonality, fuel surcharges, and capacity constraints.

For Portuguese apparel, road and short sea within EU reduce complexity. For US-bound loads, air or sea choices drive the biggest swing. For China loads, sea lanes beat air on cost unless speed trumps margin. Test both scenarios with current freight quotes and live duty tables.

Logistics choices: when to use air, sea, road

Use air for capsules with tight calendar dates or high-value styles that must land on time. Use sea for bulk runs. Use EU road for frequent replenishment from Portugal. Route planning reduces risk; split shipments by mode when calendars and margin targets conflict. Track transit times with buffer. Align ship dates with in-store sets and marketing drops.

Logistics providers should share weekly updates on capacity and rates. Demand spikes raise air rates. Port congestion adds transit days. Keep a fallback plan and flexible booking paths. That flexibility keeps nearshore and offshore programs aligned with store-level needs.

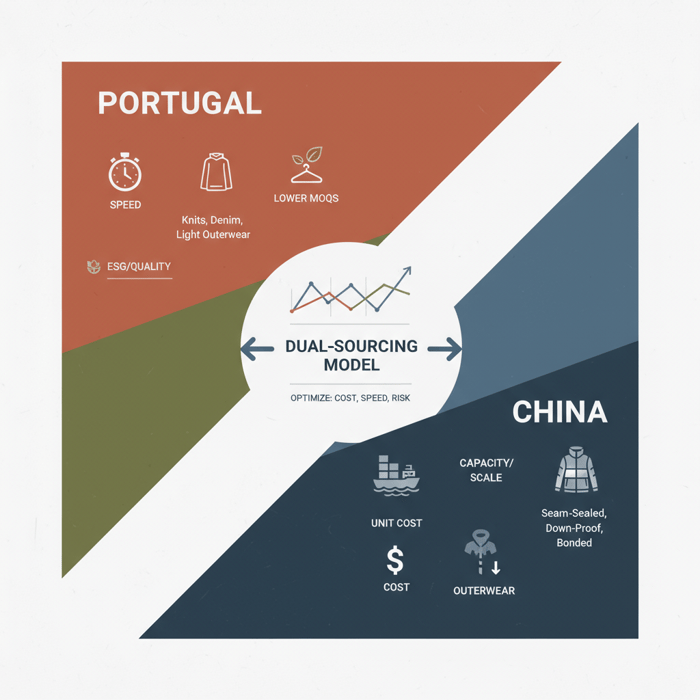

Implementation playbook: dual-sourcing with Portugal (nearshore) + China (scale)

Split your line by volume and complexity. Synchronize sampling and keep BOMs harmonized. Standardize QA and lab standards across vendors. Create a rolling capacity plan that balances risk, margin, and speed. Use quarterly reviews to adjust shares across Portuguese apparel and offshore production.

- Vendor audits and compliance mapping: verify certifications, audits, and testing capability in both regions.

- BOM harmonization: lock fabrics, trims, measurement tolerances, and test standards across vendors.

- Parallel sampling calendar: run PP samples from Portugal and China to compare fit and construction details.

- MOQ and capacity pooling: place smaller runs nearshore; move volumes offshore; keep contingency capacity.

- KPI governance: track OTIF, AQL, return rates, and carbon proxies; set thresholds for shifts.

- Quarterly rebalancing: adjust distribution based on performance; protect top SKUs from single-source risk.

- Documentation control: centralize test reports, PP/TOP approvals, and audit files for both vendors.

[MENTION: Eurostat], [MENTION: McKinsey], and [MENTION: WTO] report buyers moving away from single-country sourcing. This playbook supports that shift with a practical cadence. It requires disciplined calendar management and clean tech packs. Seasonal volatility and supply disruptions still occur. Strict BOM discipline and testing parity reduce mismatch across vendors.

Common pitfalls include BOM drift, fit divergence, washing inconsistencies, and rules-of-origin traps. Eton’s teams document trims and fabrics for each SKU and track measurement tolerances across factories. Welding, bonding, and taped seam rules live in shared SOPs to guard construction integrity. RoO and duty mapping sit in the same folder as lab results and PP/TOP approvals.

Playbook steps and RACI

Assign roles for tech pack creation, BOM approval, vendor communication, lab testing, QC inspections, logistics planning, and KPI tracking. Document who approves PP and TOP samples. Define who owns duty checks and RoO decisions. Give sourcing leads the authority to shift shares between Portugal and China when KPIs cross thresholds. Keep RACI visible to vendors to reduce delays.

This structure speeds decisions on fit and testing and cuts back-and-forth during production peaks. It also helps during seasonal reviews when sell-through data changes the plan.

KPI dashboard and quarterly review

Build a dashboard for OTIF, AQL pass rates, return percentages, lab test pass/fail, and carbon proxies per shipment. Track by region and vendor. Review quarterly. If Portuguese apparel hits strong sell-through and returns stay low, increase its share for similar styles. If offshore technical shells raise margins and meet QA targets, expand that category. Keep contingency capacity ready for shifts.

Use the dashboard in vendor meetings. Celebrate strong performance. Document corrective actions for misses. Maintain the brand’s risk posture by enforcing maximum share per single vendor and by category.

Product/Service Integration: Clothing Manufacturing OEM Service by Eton

Eton delivers outerwear-focused OEM/ODM with China and Bangladesh capacity, deep technical capability, and disciplined QA. For brands building a Portugal+China model, Eton fills the scale side with seam sealing, down-proof constructions, bonded panels, and multi-lab testing. This suits high-volume outerwear and performance categories where precision and repeatability drive margin.

| Brand Need | Feature | Outcome |

|---|---|---|

| Technical outerwear | Seam sealing, bonded constructions, taped shells | Waterproof integrity and consistent lab results |

| Scale and margin | Multi-factory capacity in China/Bangladesh | Cost control at volume and load balancing |

| Rigorous QC | Standardized PP/TOP approvals, AQL inspections | Stable fits and controlled defect rates |

| Compliance | Lab testing aligned with REACH/CPSIA/PFAS stance | Clear documentation and audit-ready files |

| Rapid development | Sampling calendars synced with brand seasons | Momentum through proto, fit, and pre-production |

The program starts fast with tech pack reviews, BOM validation, and lab matrices tailored to US and EU. This reduces surprises at PP and TOP. Eton has built programs for global retailers and football club collaborations. A blended Portugal+China plan often sends early capsules nearshore, then runs volume in Eton’s offshore plants for margin and category breadth. Explore outerwear OEM/ODM details here: Clothing Manufacturing OEM Service.

Use Case 1: Premium capsule launches nearshore, scale offshore

A US brand plans a European drop with premium sweats and tees, plus a limited light jacket. Portuguese apparel delivers fast proto and fit, then replenishes based on sell-through. Eton runs the jacket’s scaled release with stable BOMs and tighter margins. Result: a fast EU launch backed by offshore capacity once the product-market signal hits.

This mix supports marketing moments without overcommitting to high MOQs early. It also uses road shipments inside the EU for short lead times and sea shipments for larger US-bound loads.

Use Case 2: Technical outerwear with strict QA and compliance

A multi-country retailer sets a winter outerwear target with taped shells, bonded panels, and down jackets. Eton’s teams build lab matrices, run PP and TOP controls, and align AQL sampling per shipment. Compliance documents map to REACH and CPSIA. Test results sit in shared folders for audits. The program scales across factories without losing fit integrity or construction quality.

Global brands use this approach for repeat winter shells and parkas where returns and failures cut margin in peak season. Eton’s QA cadence reduces those risks at scale.

Risks, compliance, and localization for US & EU

Build compliance into design and sourcing early. Track chemical restrictions, product safety, labeling, and due diligence obligations. Keep documentation aligned across vendors and regions. Use official portals for duty and rules of origin. Document lab results by SKU and factory [S6][S8][S9][S10].

- US: CPSIA requirements, state-level chemical restrictions, California AB 1817 PFAS phase-ins from 2025 [S8].

- EU: REACH and labeling rules; due diligence obligations under German LkSG and the CSDDD trajectory [S9][S10].

- Pros: Clear lab matrices and audit cadence reduce surprises and shipment holds.

- Cons: Ongoing updates; classification nuances; multi-country retailer requirements raise paperwork volume.

Eton’s compliance teams maintain lab standards for fiber content, colorfastness, seam integrity, waterproof ratings, and PFAS targets per the buyer’s stance. Audits follow common frameworks. Documentation sits in accessible folders for brand QA leads and auditors. This keeps Portuguese apparel pilots and offshore scale programs in sync on safety and labeling.

Risk matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Calendar slip | Medium | High | Parallel sampling; buffer lead times; mode splits |

| BOM drift | Medium | Medium | Shared BOMs; trim locks; approval workflows |

| Fit inconsistency | Medium | High | Measurement tolerances; PP/TOP checks; shared blocks |

| Lab test failures | Low–Medium | High | Pre-production lab runs; vendor SOP training |

| Duty misclassification | Low | Medium | Broker checks; HS codes; RoO documentation [S6][S7] |

| Vendor capacity shortfall | Medium | Medium | Load balancing; contingency vendors; quarterly reviews |

| Geopolitical disruption | Low–Medium | High | Diversified sourcing; inventory buffers; flexible lanes |

Regulatory notes for US & EU

US buyers should set CPSIA testing plans, track state PFAS rules, and monitor labeling norms. EU buyers should align with REACH and have due diligence documentation ready. German LkSG sets expectations for larger groups. The EU’s CSDDD path requires buyers to map risks, run audits, and maintain corrective actions. Keep a compliance calendar next to production calendars to avoid shipment holds.

Verify details with official portals or counsel. Duty tables change. RoO rules vary by agreement. Chemical lists update. Brands thrive when compliance sits inside the sourcing workflow rather than as an afterthought [CITE: “EU due diligence directive overview, 2024”].

Conclusion & next steps

Run Portuguese apparel for speed, lower MOQs, and EU proximity. Use a China Clothing Manufacturer for cost, capacity, and technical outerwear. Adopt a dual-sourcing model with strict QA and lab standards. Pilot, measure, and refine quarterly. Keep BOMs aligned across vendors and track KPIs that move margins and calendars.

- Weeks 1–2: Set criteria, margins, calendars; build shortlists for Portugal and China.

- Weeks 3–6: Run sampling, fit, and PP approvals; model landed cost by market.

- Weeks 7–12: Place pilot POs; measure OTIF, AQL, returns; monitor lab results.

- Week 12+: Lock annual split; stage replenishment; plan seasonal reviews.

Use Eton’s Clothing Manufacturing OEM Service to run the scale side with technical precision and documented QA. Pair it with nearshore pilots for speed and fit. Blend the two, and keep the review cadence tight. That mix delivers resilience, margin, and calendar confidence.

- [S1] AICEP Portugal Global — Textiles & Clothing Sector Profile (2024). https://www.portugalglobal.pt/EN/

- [S2] ATP — Textile and Clothing Association of Portugal (2024). https://www.atp.pt/en/

- [S3] Eurostat — International trade in textiles/clothing 2023–2024. https://ec.europa.eu/eurostat

- [S4] McKinsey & Company — The State of Fashion 2024/2025. https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion

- [S5] WTO — World Trade Statistical Review 2024. https://www.wto.org/english/res_e/statis_e/wts2024_e/wts2024_e.pdf

- [S6] EU Access2Markets — My Trade Assistant (2025). https://trade.ec.europa.eu/access-to-markets/

- [S7] USITC/HTSUS — Harmonized Tariff Schedule (2025). https://hts.usitc.gov/

- [S8] California AB 1817 — Safer Clothes and Textiles Act (PFAS) (2023–2025). https://leginfo.legislature.ca.gov/

- [S9] BAFA — German Supply Chain Due Diligence Act (LkSG) (2024–2025). https://www.bafa.de/

- [S10] European Council — Corporate Sustainability Due Diligence Directive (2024). https://www.consilium.europa.eu/

[INTERNAL LINK: Author — Senior Sourcing Strategist, 12+ years in outerwear OEM/ODM] [INTERNAL LINK: Reviewer — Head of Quality, Eton Garment Limited]

Methodology: synthesized Eton’s factory experience with sector sources; applied a criteria-based decision framework. Limitations: duty rates, PFAS lists, and freight pricing change; verify with official tools and service providers. Disclosure: Eton offers OEM/ODM services in China and Bangladesh and participates in outerwear programs for global retailers.

[CITE: “Recent freight rate movements; reputable logistics index”] [CITE: “PFAS restrictions update; state regulatory site 2025”] [MENTION: Major EU retail group case examples], [MENTION: Leading testing labs in apparel].

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »