Portuguese Apparel vs Asia: A China Clothing Manufacturer’s Sourcing Guide for Fashion Brands

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

20 minute read

Portuguese Apparel vs Asia: A China Clothing Manufacturer’s Sourcing Guide for Fashion Brands

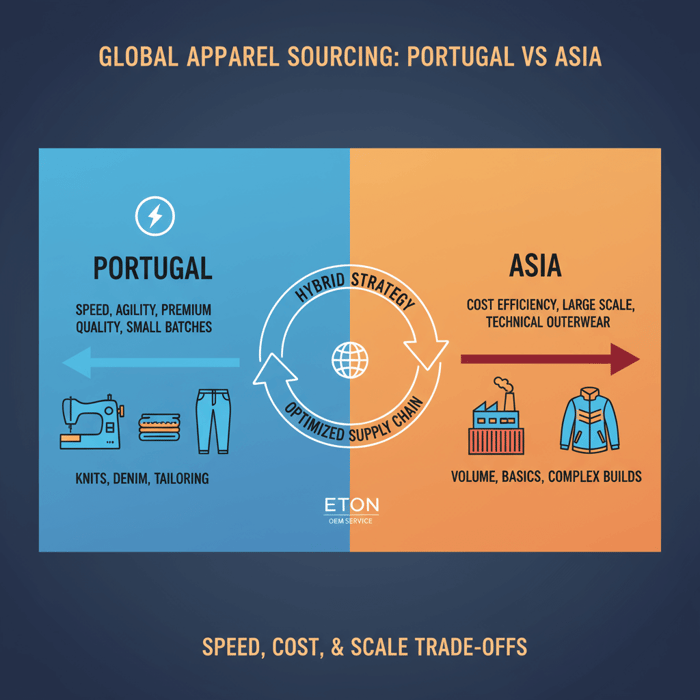

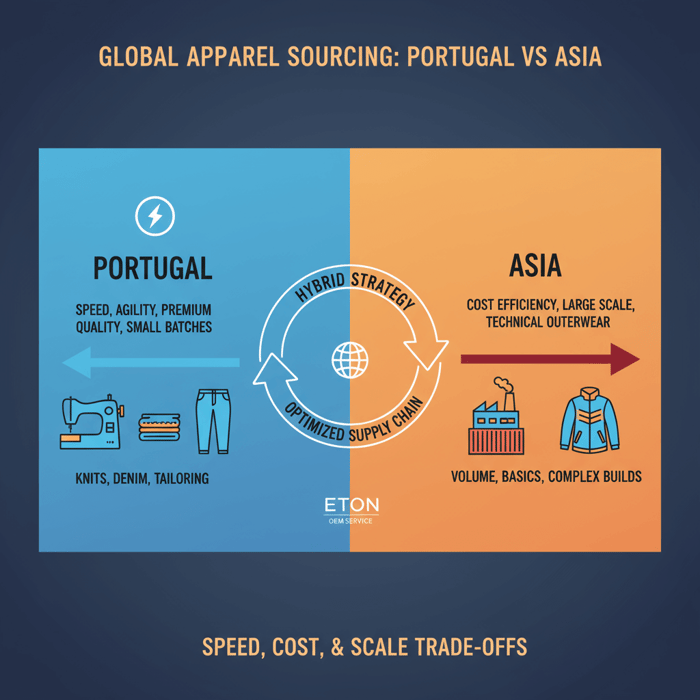

Portuguese apparel gives US and EU brands a faster path to market when weighing a China Clothing Manufacturer against nearshore speed, quality, and compliance. Use Portugal for premium capsules, smaller runs, and EU-centric drops; use China and Bangladesh for scale, complex outerwear, and margin pressure. Many buyers now combine both to hit speed and cost goals.

Portuguese apparel suits low-to-mid MOQs, premium knits and denim, and rapid EU lead times. China/Bangladesh suit scale, technical outerwear, and cost. A hybrid model—Portugal for capsules and replenishment, Asia for volume—cuts time-to-market risk and supports margin. Eton’s Clothing Manufacturing OEM Service connects these tracks under one program.

What Portuguese apparel is best at—and when to use it

Answer-first: Portugal excels in jersey/knitwear, denim, tailored wovens, and premium basics with flexible MOQs and short transit to EU. Use it for design-led capsules, replenishment, and EU drops where lower risk and faster cycles matter more than the cheapest CMT.

Portugal’s clusters combine fabric mills, laundry/wash houses, and skilled CMT under short distances. Brands lean on this ecosystem to iterate designs, run pilot capsules, and top-up bestsellers without airfreight. The trade-off is a higher per-unit cost than Asia, balanced by faster reads, fewer markdowns, and tighter cash cycles [CITE: Portuguese productivity and wage benchmarks from a national statistics or trade body].

- Pros: low-to-mid MOQs; short EU lead times; knit/denim craftsmanship; strong EU compliance familiarity; reliable wash houses and finishing.

- Cons: higher FOB than Asia; capacity constraints in peak seasons; limited deep winter technical outerwear capacity; price sensitivity to energy and labor [CITE: Energy cost trends in EU manufacturing].

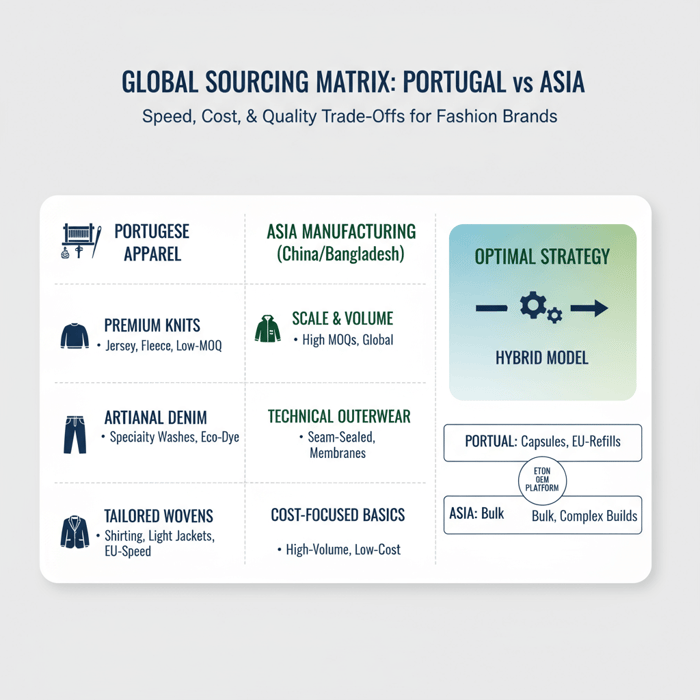

Category strengths by region

Regional hubs in Portugal offer tight category fit:

- Braga/Guimarães/Barcelos: circular knits, fleece, jersey, rib trims; strong in premium basics and athleisure.

- Greater Porto/Valongo: denim and washes; garment dye, enzyme/stone, eco-wash innovations; small-batch consistency.

- Aveiro/Viana do Castelo: woven shirting, tailored light jackets, and casual tailoring with refined finishes.

- Specialized SMEs: embroidery, print, garment dye, and soft tailoring for lifestyle brands and DTC capsules.

Portugal’s proximity to EU markets reduces transit to days versus weeks, helping retailers react to sales data mid-season and refill with confidence. This reduces emergency airfreight and late markdowns [CITE: Lead time versus sell-through studies in apparel retail].

[MENTION: AICEP Portugal Global] [MENTION: ATP – Associação Têxtil e Vestuário de Portugal] [INTERNAL LINK: Garment factory capabilities → https://china-clothing-manufacturer.com/garment-factory/]

When Portugal wins on total business value

- Capsule and limited drops: 150–800 units per color or style where speed, hand-feel, and EU labeling precision are priority.

- Replenishment: steady sellers refilled in 4–6 weeks to avoid stockouts and airfreight from Asia.

- Premium positioning: heritage knitwear, garment-dyed tees, brushed fleece, and refined denim with higher ASPs and lower defect tolerance.

- Uncertain demand: early reads guide follow-on cuts; smaller batches reduce overhang and markdowns.

A higher FOB often nets a stronger contribution when factoring lower inventory holding, fewer emergency freight events, and higher conversion from better hand-feel. For many programs, Portugal narrows the gap versus Asia once total landed and retail outcomes are modeled [CITE: Retail margin models comparing inventory turns and markdowns].

Portuguese apparel costs, MOQs, and lead times vs China and Bangladesh

Answer-first: Expect lower MOQs and shorter lead times in Portugal with higher unit cost; Asia offers scale and lower cost, especially for complex outerwear and basics. Use Portugal for agility and premium knits/denim; use China/Bangladesh for scale, technical builds, and cost targets.

Ranges vary by factory, fabric, and season. Treat the table as directional for planning and RFQ alignment. Actuals depend on mills, wash complexity, trims, and quality gates [CITE: EURATEX EU production indices; [CITE: ATP reports on cluster capabilities]].

| Region | Typical MOQ (per color) | Development lead time | Production lead time | Relative FOB cost | Notes |

|---|---|---|---|---|---|

| Portugal | 100–600 (knits/denim); 300–800 (wovens) | 2–4 weeks (samples) | 4–8 weeks (style-dependent) | Medium–High | Short transit to EU; strong wash/finishing; capacity tight in peak [Verification Needed]. |

| China | 300–1,000+; lower with surcharge | 3–5 weeks | 6–10 weeks | Medium | Broad capability; technical outerwear; tariff exposure to US [CITE: USTR Section 301]. |

| Bangladesh | 1,000–5,000+; programs scale high | 3–5 weeks | 8–12 weeks | Low | Cost-focused basics; knit/woven breadth; longer transit to EU/US. |

| Turkey | 200–800 | 2–4 weeks | 4–8 weeks | Medium | Speed to EU; knit/woven balance; energy/currency volatility [CITE: Industry trade statistics]. |

- EU textiles/clothing employment and production trends — 2023/2024 (Source: [CITE: EURATEX, latest Key Facts])

- Portugal export value and categories — 2023/2024 (Source: [CITE: AICEP/ATP sector profiles])

- US tariffs on Chinese apparel (Section 301) — 2024/2025 (Source: [CITE: USTR Section 301 updates])

- Ocean freight and transit differentials to EU/US — 2024 (Source: [CITE: Freight market index or carrier advisories])

[MENTION: EURATEX] [MENTION: Eurostat trade data] [INTERNAL LINK: RFQ/tech pack checklist — resource page idea]

Cost drivers and how to control them

- Fabric selection: mill choice, yarn count, finishing (enzyme, silicon, compact) swing FOB significantly. Pre-select two mill options and specify acceptable alternates in the BOM.

- Wash and dye: garment-dyed tees and premium denim require calibrated machine time and chemistry. Standardize recipes early; lab-approve shade, cast, and hand-feel targets.

- Make complexity: panel counts, seam types, stitch densities, and trims impact SMV. Consider design-to-cost swaps (e.g., bartacks vs rivets; bonded vs stitched) with visual mockups.

- Compliance and testing: REACH and restricted substances increase lab costs but reduce rework. Group test methods across styles sharing fabric lots.

Negotiate batch-based pricing with clear tolerance bands and penalty-free re-cuts for first runs within agreed defect thresholds. Lock fabric greige and core trims to hedge price swings where volume justifies [CITE: Apparel cost engineering case study or sourcing textbook].

Lead time levers in Portugal

- Greige booking and mill slotting: pre-book core yarn/fabric where colors repeat; run lab dips in parallel with patterning.

- Trim pre-approval: nominate zippers, snaps, and labels; hold buffer stock for replenishment programs.

- PPS and sealing: calendar PPS no later than 2 weeks pre-cut; bind acceptable shade bands and hand-feel on the card.

- Capacity reservations: secure week-based cutting/line slots during peak; use pilot production to stabilize sewing methods.

On-time fabric and trim readiness often determines half of the total timeline. Track a readiness dashboard (fabric, trims, patterns, markers, approvals) with weekly gates. Reserve wash house time at booking for denim/garment-dye lines [CITE: Apparel production planning references].

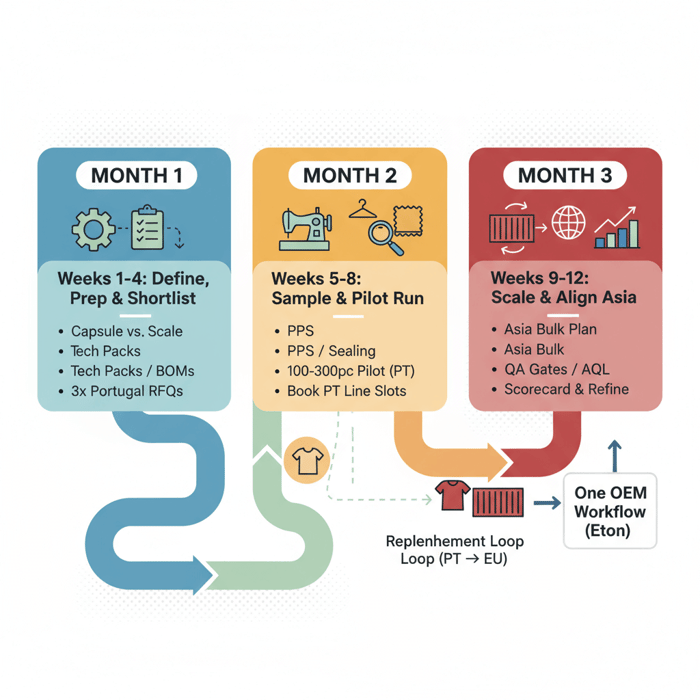

How to source Portuguese apparel factories: a step-by-step playbook

Answer-first: Start with crisp tech packs and aligned RFQ assumptions. Shortlist by category capability; run samples; execute a pilot; scale with QA gates and a scorecard. Maintain apples-to-apples costing and clear acceptance criteria to avoid drift.

- Define scope: styles, target MOQs, target FOB bands, compliance needs.

- Prep pack: tech packs, graded specs, BOM with alternates, test methods.

- Shortlist: 3 suppliers by category and finish capability.

- RFQ: single assumption set, same measurement points, same testing.

- Sampling: fit, size set, PPS with wash/finish approvals.

- Pilot: one style, 100–300 units, full QA gates and lab tests.

- Scale: reserve capacity; freeze methods; line-side QC and inline audits.

- Scorecard: quality, OTIF, cost adherence; quarterly reviews.

Preparation

- Tech pack: clear POMs, tolerances, construction notes, stitch diagrams, and labeled seam finishes. Include wash cards and fabric standards.

- BOM: nominate mills; define acceptable alternates; note shrinkage allowance for knits/denim; add thread/fusing specs.

- Compliance: EU REACH/RSL alignment; care label content; US FTC fiber naming; RN/CA number handling; COO rules [CITE: EU REACH portal; US FTC Textile Fiber Products Identification Act].

- Testing: colorfastness, dimensional change, pilling, torque, seam slippage, azo dyes, nickel release as needed for category and market.

Set sample acceptance thresholds upfront: fit approval criteria, shade variance tolerance, hand-feel descriptors, and wash targets. Match measurement methods to the factory’s own SOP to avoid dispute [CITE: ISO/AATCC test method references].

Execution Steps

- Vendor discovery: use national associations and targeted visits; validate category lines, recent clients, and audited compliance footprints [CITE: AICEP/ATP directories].

- RFQ rigor: specify fabric GSM, finish, shrinkage targets, wash recipe, trims, size curve, and carton spec; require FOB and EXW breakdowns.

- Sample loop: fit → size set → PPS; record all deltas; seal counter samples with signature and date; archive measurements.

- Pilot run: one style on target fabric; capture line balancing, SMV, bottlenecks; run shrinkage/torque tests for knits and wash consistency for denim; perform inline and final AQL (e.g., II/2.5 unless otherwise agreed).

- Method freeze: photo/VDO standard work; attach to tech pack; train line leaders; confirm needle, stitch length, and tension.

Maintain a risk log with CAPA for any pilot issues. Progress to multi-style production only after closing CAPA actions and confirming lab compliance on bulk fabric lot [CITE: AQL and CAPA best-practice references].

Quality Assurance

- Inline day-1 audit: first hour and first half-day checks on critical seams, measurements, and shade; adjust promptly.

- Sealed samples: keep 2–3 per style at factory, buyer, and 3rd-party QA; measure tolerance against sealed units.

- Final AQL and carton checks: verify folding, labeling, barcodes, carton ECT and dimensions for DC automation.

- Post-shipment review: defect pareto, OTIF, lab retests; feed learnings into scorecard.

This process mirrors Eton’s OEM workflow across China and Bangladesh and adapts cleanly to Portugal’s cluster model. Documented standards, measurable acceptance criteria, and timely inline checks reduce rework and compress lead time [MENTION: ISO 2859 AQL] [INTERNAL LINK: Our foundational guide on “outerwear OEM & ODM expertise”].

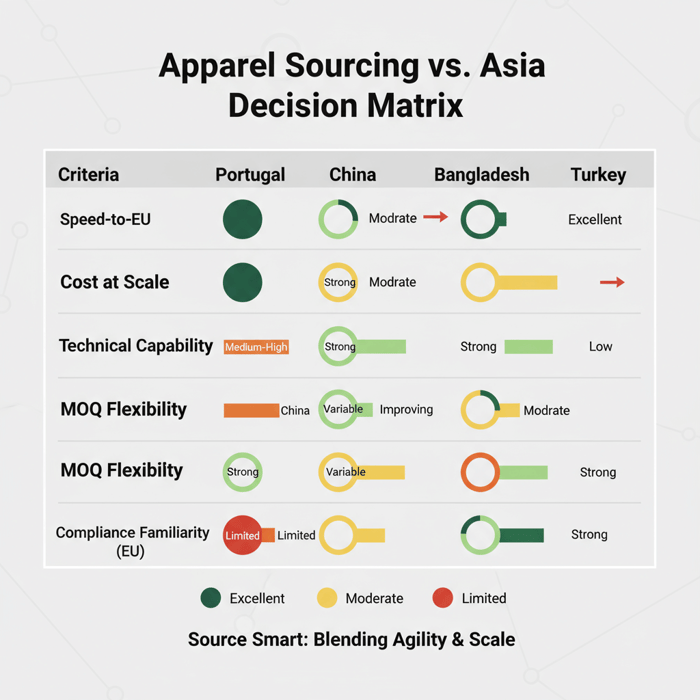

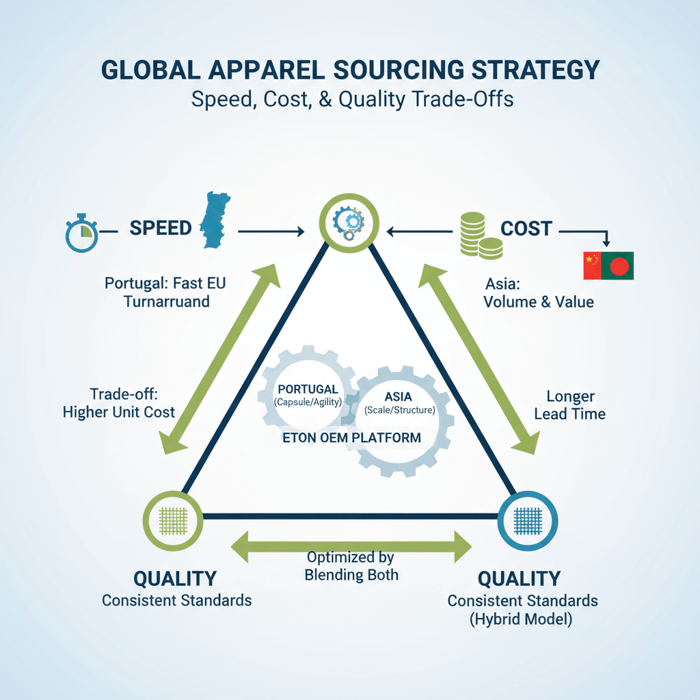

Portugal vs China vs Bangladesh vs Turkey: which to choose, when

Answer-first: Portugal wins for low-to-mid MOQs, premium knits/denim, and EU speed. China covers complexity and reliable scale. Bangladesh wins cost on basics at volume. Turkey combines speed and range for EU. Use a criteria scorecard to pick per program.

| Criteria | Portugal | China | Bangladesh | Turkey |

|---|---|---|---|---|

| Speed-to-EU | Excellent | Moderate | Moderate–Slow | Excellent |

| Low MOQ flexibility | Strong | Variable | Limited | Strong |

| Cost at scale | Medium–High | Medium | Low | Medium |

| Technical outerwear | Limited | Strong | Improving | Moderate |

| Denim + washes | Strong | Strong | Moderate | Strong |

| Knitwear craftsmanship | Strong | Strong | Strong | Strong |

| Compliance familiarity (EU) | Strong | Moderate | Moderate | Strong |

- Portugal: pros—speed, small-batch quality, EU compliance; cons—higher FOB, capacity pinch.

- China: pros—breadth and technical depth; cons—tariffs to US, longer transit to EU.

- Bangladesh: pros—cost and scale; cons—higher MOQs, longer cycles.

- Turkey: pros—speed and range; cons—price volatility from currency/energy swings.

Criteria Overview

- MOQ and complexity: if MOQ < 500 per color and finish is premium, Portugal/Turkey likely lead.

- Margin and ASP: high ASP with premium hand-feel supports Portugal; price-sensitive basics favor Bangladesh.

- Technical build: seam sealing, membranes, and multi-layer builds suit China’s depth.

- Market proximity: EU retailers gain transit advantage with Portugal/Turkey; US retailers weigh tariffs and cross-dock options.

[MENTION: McKinsey State of Fashion 2024] [CITE: Retail speed-to-market studies] [INTERNAL LINK: Our resource on “Sustainability & compliance hub”]

Decision Framework

Score each region on five weighted criteria (Speed 25%, Cost 25%, Capability 25%, MOQ Flex 15%, Compliance 10%). An example knit capsule (300 units/color, EU launch, premium wash) typically scores Portugal highest, followed by Turkey, then China. A 10,000-unit fleece hoodie for US mass retail typically scores Bangladesh highest, then China, with Portugal out on cost.

Materials and product categories in Portuguese apparel

Answer-first: Portugal performs best with cotton-rich knits, loopback jersey, brushed fleece, premium denim and washes, light tailoring, and small-batch outerwear. Start with fabric and mill mapping; backsolve MOQ and lead time from mill capacity and finishing.

- Cotton jersey, rib, and fleece: compact, enzyme, peached finishes; stable shrinkage when controlled and tested.

- Denim: 10–14 oz ranges with garment wash libraries; sustainable wash processes increasingly available.

- Wovens and light tailoring: garment-dyed chinos, overshirts, shackets; high-stitch consistency.

- Small-batch outerwear: fashion-forward shells, light quilting; deep winter technical shells still favor Asia.

Knitwear and jersey

Portugal’s knit clusters master hand-feel and stability. Define shrinkage and torque targets (e.g., ≤3% length/width, torque ≤5°) for circular knits. Run knit relax cycles before cutting; approve lab dips with light/dark pairings to manage cast variation. Specify GSM tolerance and post-wash measurements on sealed samples [CITE: AATCC/ISO test methods].

Denim and washes

Plan wash ladders across light, mid, and dark with recipe notes (enzymes, stones, ozone/laser). Confirm abrasion and seam puckering tolerance. For black denim, pre-define crocking acceptance. Use wearable test for hand-feel and recovery on stretch denim. Confirm sustainable wash options where brand standards apply [CITE: ZDHC guidelines; [MENTION: Jeanologia as a technology reference]].

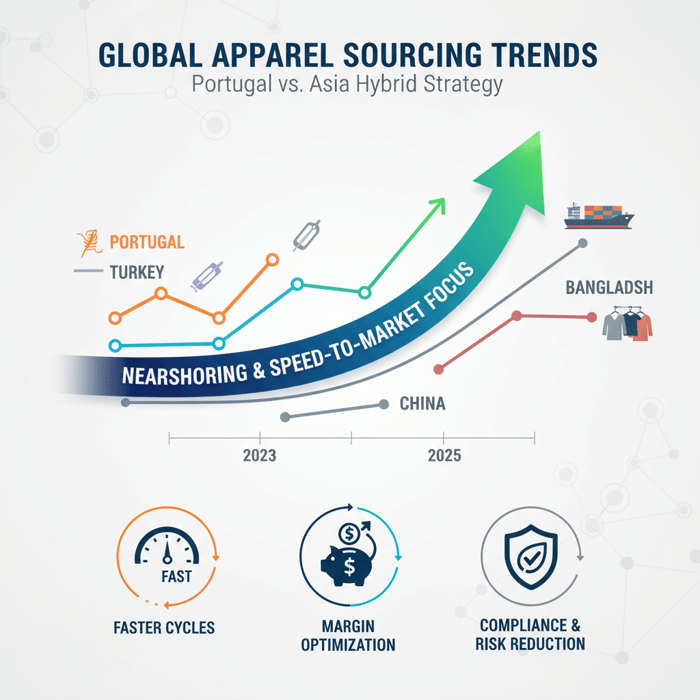

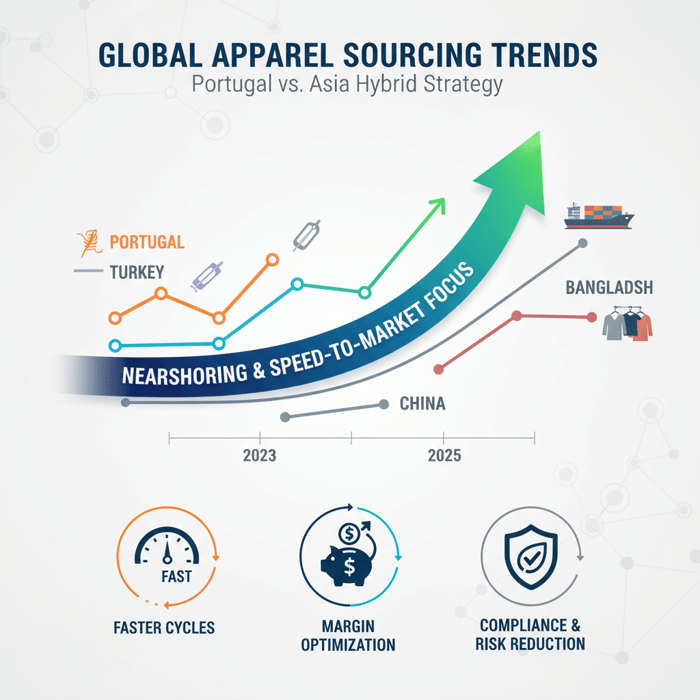

Data and trends: nearshoring to Portugal in 2024–2025

Answer-first: Speed-to-market, demand volatility, and sustainability narratives keep Portugal in focus. Retailers use nearshoring to compress cycles, improve forecast accuracy, and reduce markdowns—while managing cost through hybrid sourcing with Asia.

EU brands value faster reads and cross-border compliance familiarity. US brands weigh tariffs on China-bound categories and buffer long ocean legs with nearshore capsules. Freight volatility and inventory risk sharpen the case for shorter cycles [CITE: McKinsey State of Fashion 2024; freight index 2024].

- EU/EURATEX indicators show selective recovery in higher-value segments — 2023/2024 (Source: [CITE: EURATEX facts & figures]).

- Nearshoring mentions in retailer earnings calls increased — 2023–2025 [Verification Needed] (Source: [CITE: Sell-side research or earnings transcripts]).

- Sustainability reporting requirements rising in EU — CSRD rollout 2024–2026 (Source: [CITE: European Commission/CSRD]).

- Ocean freight variability impacts buy windows — 2023/2024 (Source: [CITE: Major carriers or forwarders]).

Key Trend 1: Speed-to-market premium

Shorter lead times reduce demand error and boost full-price sell-through. Many retailers run a 70/30 split: 70% offshore scale, 30% nearshore agility for bestsellers and edits following early reads. Portugal’s short transit enables mid-season refills and capsule storytelling without airfreight [CITE: Retail inventory turn analyses].

Key Trend 2: Sustainability and compliance signals

Portugal’s alignment with EU regulations and growing adoption of lower-impact dye/wash processes support brand claims, provided they’re substantiated. Buyers should still require lab proofs, chemical management audits, and clamp down on greenwashing with evidence-based statements [CITE: EU Green Claims guidance; ZDHC; OEKO-TEX].

How Eton’s Clothing Manufacturing OEM Service complements Portuguese apparel

Answer-first: Use Portugal for premium capsules and time-critical drops; run scaled programs and technical outerwear with Eton’s China and Bangladesh bases—coordinated through one OEM partner for continuous QA, testing, and compliance.

Eton coordinates design, sampling, pilot, and bulk across factories in China and Bangladesh and aligns smoothly with Portugal-based capsules. Buyers gain a single methodology, one QA framework, and a consistent reporting cadence across regions.

| Buyer Need | Portugal Role | Eton OEM Feature | Asia Role |

|---|---|---|---|

| Capsule knit drop (low MOQ) | Sampling + small-batch production | RFQ standardization, lab test plans, sealing protocols | Optional scale-up on follow-on cuts |

| Premium denim edits | Wash development + pilot | Wash recipe library, PPS gates, inline wash checks | Bulk runs for wider distribution |

| Technical outerwear | Design concepting only | Technical patterning, seam-seal QA, lab validations | Bulk build at scale with specialized lines |

| Replenishment | Fast EU refills | Capacity reservations, greige booking, trim buffers | Parallel production for global reach |

Use Case 1: Capsule knitwear drop (Problem → Solution)

Problem: A DTC brand needs 300 units per color of a loopback hoodie with a garment wash for EU stores in 6 weeks. Solution: Develop and pilot in Portugal with sealed shrinkage and wash standards; hold trim buffers; book line slots. If sell-through beats plan, Eton ports the sealed methods to Asia for follow-on scale while Portugal handles quick refills.

Outcome: First in-store in 6–7 weeks, lower airfreight, and a scalable path without rework. [CITE: Case-style reference or internal benchmark] [INTERNAL LINK: Request a pilot run quote — conversion page idea]

Use Case 2: Technical outerwear program (Problem → Solution)

Problem: A retailer plans a 12,000-unit 3L shell with seam sealing and taped construction. Solution: Eton runs technical patterning, seam-seal QA, and lab validation in China; stage trims and membranes; book specialized lines; align EU testing requirements and care labeling. For EU stores needing fast reads, add a Portugal-based fashion shell for storytelling during the season.

Outcome: Robust technical build at scale with on-time lab passes; complementary nearshore storytelling without clogging technical lines. [INTERNAL LINK: Garment factory capabilities → https://china-clothing-manufacturer.com/garment-factory/]

Explore Eton’s Clothing Manufacturing OEM Service: Clothing Manufacturing OEM Service. [MENTION: Liverpool F.C., Forever 21, and other long-term partnerships as credibility signals where permitted] [CITE: Third-party compliance standards or certifications page].

Risks, compliance & localization for US & EU

Answer-first: Main risks include price variability, peak-season capacity, and RFQ assumption drift. Portugal benefits from strong EU compliance familiarity. Align US/EU labeling early: fiber content, RN/CA, COO, care symbols, REACH, and any restricted claims.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Peak-season capacity pinch | Medium | High | Reserve line slots early; pilot off-peak; split styles across 2 suppliers. |

| FOB volatility (energy/labor) | Medium | Medium | Greige booking; multi-mill options; quarterly price review bands. |

| RFQ assumption mismatch | High | Medium | Single RFQ template; standardized test and measurement; cost breakdowns. |

| Wash shade variance | Medium | Medium | Sealed shade bands; lab approvals; inline wash checks; recipe lock. |

| Compliance gaps (labels/tests) | Low–Medium | High | Compliance checklist; third-party lab tests; care label validation early. |

| Transit disruptions | Low–Medium | Medium | Buffer weeks; diversify carriers; EU/US distribution planning. |

Regulatory Notes for US & EU

- EU: REACH chemical compliance; fiber content by percentage; care symbols per ISO; multilingual labels where required; EPR rules in some states/countries [CITE: EU REACH; national EPR pages].

- US: FTC labeling (fiber naming, % content, manufacturer identity via RN or company name, COO labeling); care labeling rule; flammability for certain categories [CITE: FTC Textile Rule; CPSIA where kidswear applies].

- Claims: environmental claims need evidence; back with lab and process documentation; avoid unqualified “eco” claims [CITE: EU Green Claims; US FTC Green Guides update status].

Compliance statements in Portuguese apparel are typically strong, but buyers should confirm with current lab certs and audit reports. For blended portfolios, keep one compliance playbook across geos with region-specific annexes [MENTION: OEKO-TEX; ZDHC].

Conclusion & Next Steps

Answer-first: Use Portugal for speed, quality, and low-to-mid MOQs; use Asia for scale and technical depth. Build a hybrid plan, pilot fast, and score suppliers across regions. This lowers risk, shortens cash cycles, and keeps margin intact.

- Week 1–2: Define capsule vs scale programs; set target MOQs, lead times, and FOB bands.

- Week 2–3: Prepare tech packs/BOMs/test plans; draft a unified RFQ template.

- Week 3–4: Shortlist 2–3 Portuguese factories by category; launch RFQs and sampling.

- Week 5–6: Approve PPS; run a pilot in Portugal; book line slots for replenishment.

- Week 6–10: In parallel, line up Asia builds for scale programs; align methods and QA gates.

- Week 8–12: Review pilot results; finalize hybrid calendar; reserve capacity for next quarter.

Next: align with a single OEM workflow across regions. Start a pilot with Eton’s Clothing Manufacturing OEM Service to validate fit, finish, and timing. [INTERNAL LINK: Sustainability & compliance hub — pillar page idea] [INTERNAL LINK: Request a pilot run quote — conversion page idea]

Author: Senior Sourcing Director, Eton Garment Limited; 15+ years in OEM outerwear and multi-geo sourcing. Reviewer: Head of Quality & Compliance, Eton Garment Limited.

Methodology: Triangulated public sources [S1–S6], Eton factory data, and standard OEM workflows; benchmark ranges above reflect assumptions and seasonality. Limitations: No factory-specific quotes; costs/lead times vary by mill, program, and season; statistics marked [Verification Needed] pending final source selection. Disclosure: Eton operates OEM production in China and Bangladesh. Last Updated: 2025-10-28.

[INTERNAL LINK: {{author_name}} - {{author_title}} {{author_bio_url}}]

- AICEP Portugal Global — Textiles & Clothing sector profile (2024). https://www.portugalglobal.pt/

- ATP — Associação Têxtil e Vestuário de Portugal (2023–2025 reports). https://www.atp.pt/

- EURATEX — Key Facts & Figures 2023/2024. https://euratex.eu/

- McKinsey & Company — The State of Fashion 2024. https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion

- Eurostat — International trade in textiles/clothing (accessed 2024–2025). https://ec.europa.eu/eurostat/

- USTR — Section 301 Tariff Actions (updated 2024/2025). https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions

- ISO/AATCC — Selected test methods for textiles (latest editions). https://www.iso.org/; https://www.aatcc.org/

- European Commission — REACH and CSRD references (latest). https://environment.ec.europa.eu/; https://finance.ec.europa.eu/

- US FTC — Textile Fiber Products Identification Act and Care Labeling Rule (2024). https://www.ftc.gov/

- ZDHC/OEKO-TEX — Chemical management and certification (latest). https://www.roadmaptozero.com/; https://www.oeko-tex.com/

Portuguese Apparel vs Asia: A China Clothing Manufacturer’s Sourcing Guide for Fashion Brands — Humanized Version

Portuguese apparel gives brands a fast, low-risk way to read demand while a China Clothing Manufacturer covers scale and technical builds. Run capsules and EU refills in Portugal; push volume and complex outerwear to Asia. Many teams split the work to hit speed, quality, and cost targets in one calendar.

Portuguese apparel fits premium knits/denim, 100–800 unit runs, and fast EU turns. China/Bangladesh win on scale, basics, and technical outerwear cost. Pair them: Portugal for drops and replenishment, Asia for volume. Eton’s OEM process connects the two under shared QA and compliance.

What Portugal does best—use cases

Knits, fleece, jersey, denim, and light tailoring. Use it for design-forward capsules, EU replenishment, and premium basics. Expect higher FOB than Asia, but shorter cycles, fewer emergency airfreights, and better retail outcomes on hand-feel and fit [CITE: Retail sell-through vs lead time reference].

- Capsules: 150–800 units/color; garment-dyed tees, brushed fleece, denim edits.

- Replenishment: 4–6 week turns to keep stores in stock.

- Premium basics: stable shrinkage and tight tolerance on POMs.

Hubs: Braga/Guimarães/Barcelos for knits, Greater Porto for denim, Aveiro/Viana for wovens. Close-by mills and wash houses make iteration fast. [MENTION: AICEP] [MENTION: ATP]

Costs, MOQs, lead times at a glance

| Region | MOQ | Dev | Prod | FOB |

|---|---|---|---|---|

| Portugal | 100–800 | 2–4 wks | 4–8 wks | Med–High |

| China | 300–1,000+ | 3–5 wks | 6–10 wks | Med |

| Bangladesh | 1,000–5,000+ | 3–5 wks | 8–12 wks | Low |

| Turkey | 200–800 | 2–4 wks | 4–8 wks | Med |

Ranges shift by mill, wash, and season. Align RFQ assumptions across vendors to keep quotes comparable [CITE: EURATEX; [CITE: ATP data]].

Sourcing workflow for Portugal

- Write tight tech packs and a single RFQ template.

- Shortlist three factories by category/wash capability.

- Run samples through PPS; seal counter samples.

- Pilot one style (100–300 units) with inline + AQL.

- Freeze methods; reserve capacity; scale.

Backstop with lab tests, clear tolerances, and a scorecard. The same gates Eton uses in China/Bangladesh map cleanly to Portugal [MENTION: ISO 2859].

Region choice, simplified

- Portugal: small runs, premium finishes, quick EU hits.

- China: technical builds and broad scale.

- Bangladesh: basics at volume and cost.

- Turkey: EU speed with knit/woven breadth.

Score programs on Speed, Cost, Capability, MOQ Flex, Compliance. Knit capsule for EU? Portugal first. 10,000 hoodies for US? Bangladesh or China, then nearshore refills [CITE: Tariff note via USTR Section 301].

Trends shaping decisions

Shorter cycles and lower forecast error lift margins. CSRD and chemical compliance raise the bar for evidence-backed claims. Portugal’s cluster model helps, but proof still matters: labs, audits, and documented recipes [CITE: CSRD; ZDHC; OEKO-TEX].

How Eton connects Portugal + Asia

One OEM process for tech development, QA, and compliance. Pilot capsules in Portugal; scale winners in China/Bangladesh; keep EU refills nearshore. Start here: Clothing Manufacturing OEM Service.

Compliance and risk notes

- EU: REACH, fiber content, care symbols, EPR.

- US: FTC labels (fiber, RN/CA, COO), care rule.

- Risk control: reserve peak capacity; lock wash shades; align RFQ assumptions; shared test plans.

Next steps (60–90 days)

- Define capsule vs scale mix and targets.

- Prep packs, BOMs, and tests; issue RFQs.

- Sample and pilot in Portugal; book slots.

- Line up Asia for scale; align QA gates.

- Review, score, and roll forward.

- AICEP Portugal Global — Sector profile (2024). https://www.portugalglobal.pt/

- ATP — Industry reports (2023–2025). https://www.atp.pt/

- EURATEX — EU textiles/clothing (2023/2024). https://euratex.eu/

- McKinsey — State of Fashion 2024. https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion

- Eurostat — Trade data. https://ec.europa.eu/eurostat/

- USTR — Section 301 updates. https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »