Portugal Fashion Brands: Sourcing, Growth, and China Clothing Manufacturer Partnerships

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

13 minute read

Portugal Fashion Brands: Sourcing, Growth, and China Clothing Manufacturer Partnerships

Portugal fashion brands blend craftsmanship with modern scale, and many partner with a China Clothing Manufacturer to reach US and EU demand without losing quality. For leaders weighing Portugal versus Asia, this guide maps the ecosystem, brand examples, compliance, cost/lead-time bands, and a step-by-step OEM/ODM roadmap—centered on outerwear and technical apparel where precision and testing matter most.

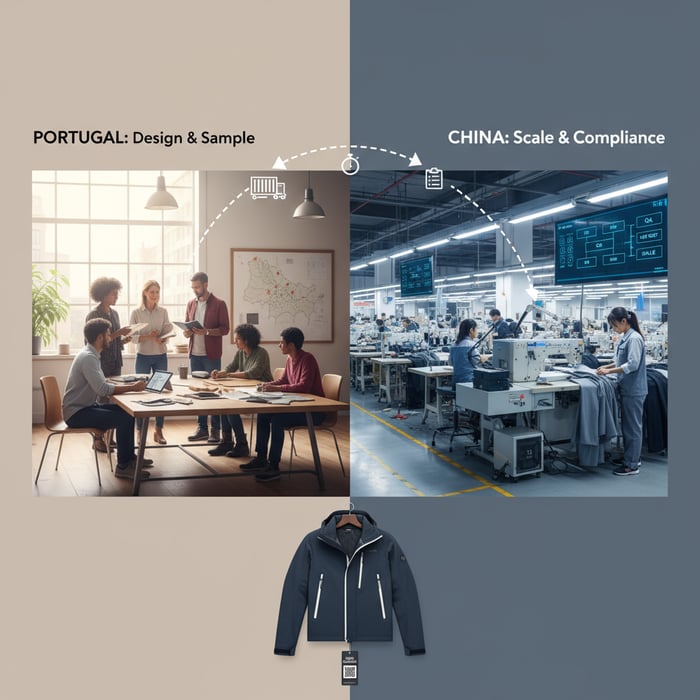

Portugal’s textile clusters consistently deliver fine finishing, agile short runs, and traceable supply chains grounded in EU standards. China’s mature OEM/ODM market brings breadth of materials, specialized machinery, and scalable capacity—especially for down jackets, parkas, and performance sportswear. A structured, two-region strategy increasingly wins: short-run design agility in Portugal paired with industrialized outerwear production in a trusted China Clothing Manufacturer ecosystem.

Portugal fashion brands excel in denim, footwear, and crafted outerwear. To scale, they combine nearshoring with a China Clothing Manufacturer for advanced materials, capacity, and cost control. For EU/US retail calendars, use Portugal for short runs and finishing; use China for technical outerwear, diversified sourcing, and compliant, repeatable scale.

The Portugal Fashion Ecosystem Today

Portugal’s fashion economy mixes heritage manufacturing with modern sustainability, concentrated in Northern clusters and powered by designer visibility through Portugal Fashion and ModaLisboa. Recognizable categories include denim, footwear, accessories, knitwear, and select outerwear, with strengths in finishing, short lead times, and EU compliance visibility. [CITE: Recent AICEP and ATP sector overview] [MENTION: AICEP; ATP]

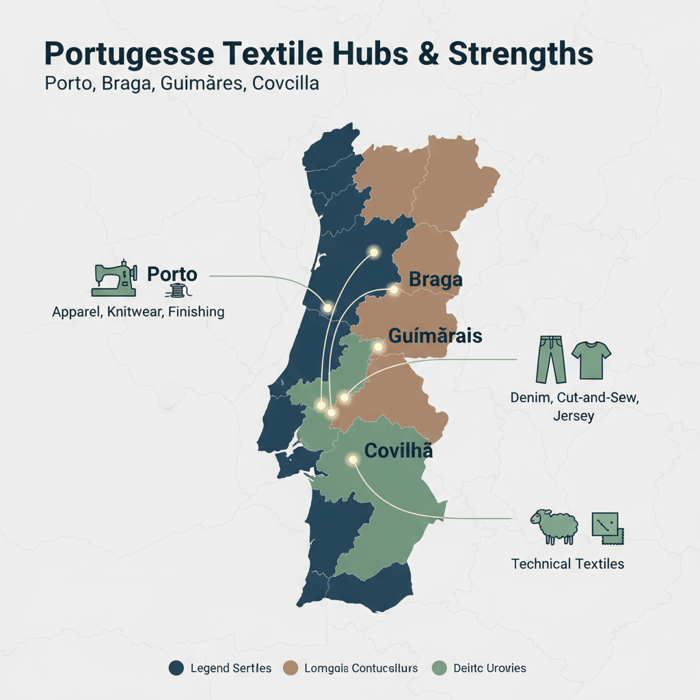

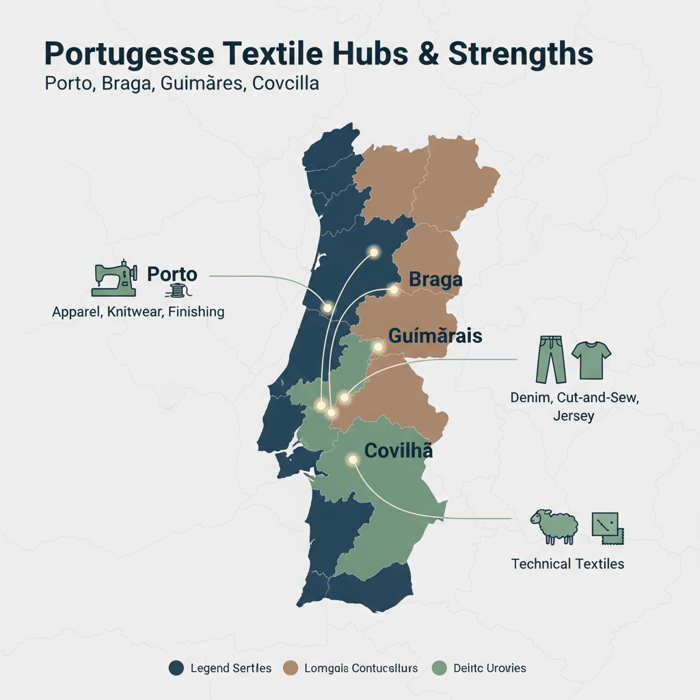

Key Regions & Capabilities

- Porto metro: Apparel assembly, knitwear, finishing, accessories, and showroom infrastructure. [CITE: Regional manufacturing profiles]

- Braga & Guimarães: Cut-and-sew clusters, denim, jersey, small-to-medium MOQs, and strong quality control culture. [MENTION: INE Portugal]

- Barcelos & Famalicão: Jersey knits, printing, embroidery, and agile sampling for D2C brands. [CITE: Local industry association data]

- Covilhã: Wool heritage and technical fabrics; niche capabilities in performance textiles. [MENTION: University of Beira Interior research]

- Aveiro & Leiria: Footwear and leather goods capacity; pattern development and finishing. [CITE: Footwear export data]

These clusters enable short lead times within the EU, greater transparency, and proximity to retail buyers. Brands tap these hubs for concept validation and premium finishing, then scale through OEM/ODM partnerships for larger drops or complex outerwear. [INTERNAL LINK: Our foundational guide on Portugal’s textile ecosystem]

Brand Categories & Notable Names

- Denim: Salsa Jeans; Tiffosi; [Verification Needed] Losan for casualwear. Strength: fit, wash, and finishing quality. [CITE: Trade press profiles]

- Footwear: Luís Onofre; Sanjo; Undandy (custom). Strength: design detail, lasts, and leather finishing. [MENTION: Vogue Portugal]

- Accessories & Leather: Parfois (accessories); Ideal & Co (leather) [Verification Needed]. Strength: fast design cycles and retail-ready QC. [CITE: Retail expansion data]

- Sustainable Basics & Knit: ISTO.; +351 [Verification Needed]. Strength: short runs, organic cotton, and EU compliance alignment. [MENTION: Time Out Lisbon]

- Outerwear & Technical Apparel: Lion of Porches; Decenio [Verification Needed]. Strength: styling and finishing; complex technical builds often nearshored/offshored. [CITE: Designer features]

Portugal Fashion Week & Designer Pipeline

Portugal Fashion (Porto) and ModaLisboa (Lisbon) showcase designers including Alexandra Moura, Nuno Gama, Miguel Vieira, and Diogo Miranda—giving retailers and media a clear view of Portugal’s style DNA and materials innovation. These platforms support international exposure, mentorship, and export readiness. [CITE: Portugal Fashion 2024 lineup] [MENTION: ModaLisboa]

For sourcing teams, runway concepts often translate into capsule runs with local factories, then scale through OEM/ODM partners for global rollouts—especially for categories requiring bonded seams, taped constructions, or down-proof fabrics. [INTERNAL LINK: Our analysis of Portugal Fashion Week → sourcing implications]

Portugal Fashion Brands: Who’s Leading and Why

Heritage and contemporary Portugal fashion brands have expanded across denim, footwear, leather goods, and sustainable basics—deploying short runs, controlled finishing, and proximity to EU buyers. Outerwear and technical apparel offer a growth vector; brands often blend local design sampling with OEM/ODM production for scale and materials diversity. [CITE: EURATEX on EU brand expansion]

| Brand | Category | Positioning | Strength |

|---|---|---|---|

| Salsa Jeans | Denim | Fit-focused, EU retail presence | Wash execution; finishing consistency [CITE: Retail case studies] |

| Tiffosi | Denim/Casualwear | Accessible fashion, Portugal heritage | Short-run agility; competitive pricing [MENTION: AICEP] |

| Luís Onofre | Footwear | Designer luxury | Craftsmanship; leather detailing [CITE: Designer profiles] |

| Undandy | Footwear | D2C customization | Digital-to-factory workflows; made-to-order [MENTION: D2C case features] |

| Parfois | Accessories | Fast-cycle retail | Design velocity; merchandising [CITE: Retail performance] |

| ISTO. | Sustainable Basics | Transparency-first | Material traceability; short runs [MENTION: Transparency reports] |

| Sanjo | Footwear | Heritage reboot | Brand story; local production partners [CITE: Heritage brand coverage] |

| Lion of Porches | Outerwear/Lifestyle | Modern classic | Finishing; style continuity [MENTION: Vogue Portugal] |

Heritage Strengths: Denim & Footwear

Portugal’s denim and footwear heritage shows up in stitch accuracy, panel symmetry, and finishing. Denim players deliver reliable fits and washes that scale across EU retail calendars. Footwear houses manage lasts, material selections, and leather finishing with precision—making Portugal a credible origin story for premium positioning. [CITE: INE export data; industry reports] [MENTION: EURATEX]

Contemporary & D2C Momentum [Verification Needed]

Contemporary labels and D2C brands use local sampling and short-run production to test new silhouettes, fabrications, and sustainable narratives. Transparent pricing, capsule drops, and seasonal edits fit EU demand for quality-led, traceable fashion. Many layer Asia OEM/ODM for volume seasons after testing domestically. [CITE: Consumer demand trends in EU] [MENTION: Statista; Time Out Lisbon]

Outerwear & Technical Apparel Opportunities

Down jackets, parkas, and taped-seam shells require specialized machinery, down-proof fabrics, seam sealing, and performance testing. Portugal offers design prototyping and finishing; advanced builds often move to a China Clothing Manufacturer for material breadth and industrialized processes. Brands that lock tech packs and run pilot batches gain repeatable quality over multiple seasons. [CITE: Technical testing standards] [MENTION: European Committee for Standardization (CEN)]

Portugal vs China Manufacturing for Fashion Brands

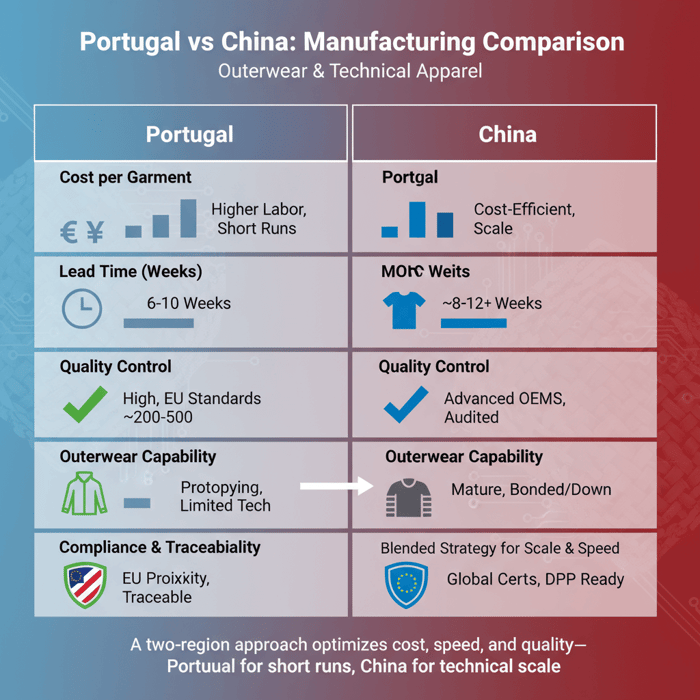

Use Portugal for EU proximity, short runs, and finishing; use China for scale, materials diversity, and mature OEM capabilities (especially outerwear). A blended model—sample in Portugal, scale with a China Clothing Manufacturer—improves total cost, coverage, and resilience under retail calendars. [CITE: WTO trade review; EURATEX export dynamics]

| Criteria | Portugal | China |

|---|---|---|

| Lead time (production) | 6–10 weeks for apparel; add 1–2 weeks for complex trims | 8–12 weeks for apparel; add freight transit; faster with air |

| MOQ by style | ~200–500; flexible for capsules | ~500–2,000; negotiable for pilot runs |

| Cost per garment | Higher labor; premiums for finishing and short runs | Cost-efficient at scale; material breadth lowers total cost |

| Outerwear capability | Strong prototyping; limited industrialized seam sealing/down | Mature for down-proof, taped seams, lab testing and scale |

| Compliance maturity | EU standards proximity; traceability practices | Advanced OEMs manage EU/US documentation and audits |

| Materials diversity | Reliable basics; specialty imports for technical | Extensive technical fabrics, trims, membranes, down |

Criteria Overview

- Quality: Stitch consistency, finishing, performance testing, and size set accuracy. [CITE: AQL and EU testing standards]

- Speed: Sampling and approvals; calendar alignment; freight transit. [MENTION: Logistics case studies]

- Cost: Unit cost, materials, trims, freight, duties, and compliance overhead.

- Compliance: REACH, labeling, traceability, and Digital Product Passport readiness. [CITE: European Commission, 2024]

- Scale: Capacity for outerwear; repeatability and yield over seasons.

Decision Framework

- Portugal pros: Nearshoring, short runs, EU buyer proximity, finishing quality.

- Portugal cons: Higher labor cost, limited industrial outerwear capacity.

- China pros: Scale, technical outerwear machinery, diversified materials, seasoned OEM/ODM.

- China cons: Freight transit, longer approval ladders without defined tech packs.

- EU sustainable textiles strategy active in 2022–2024 (Source: European Commission) [CITE: EC Sustainable Textiles Strategy]

- Portugal apparel revenue 2024—market estimate (Source: Statista) [CITE: Statista Portugal Apparel Market, 2024]

- EU textile/clothing export trends 2024 (Source: EURATEX) [CITE: EURATEX 2024 industry statistics]

- Global apparel trade context 2024 (Source: WTO) [CITE: WTO 2024 statistical review]

Data & Trends: Portugal Fashion Growth Signals

Portugal’s apparel sector maintains quality-led growth aligned with EU demand for traceable, sustainable fashion. Trade data shows steady recovery since 2020, with export momentum and hybrid sourcing models rising as brands balance nearshoring with offshore scale. [CITE: INE export indicators; EURATEX recovery analysis] [MENTION: AICEP]

EU Demand & Sustainability

US and EU retailers reward transparent, compliant supply chains—favoring brands that publish materials, audits, and performance testing while meeting REACH and labeling rules. Digital Product Passport initiatives are phasing in, raising expectations for data capture from yarn to finished goods. [CITE: European Commission Digital Product Passport timeline] [MENTION: EURATEX policy briefs]

Portugal Export Indicators

INE and AICEP data point to stable apparel exports, with denim, footwear, and knitwear as leading categories. The mix is moving toward higher-value segments, supported by finishing standards and proximity benefits. Brands increasingly trial outerwear domestically, then ramp volume with a China Clothing Manufacturer to hit multi-market drops on schedule. [CITE: INE 2023–2024 apparel export stats] [MENTION: AICEP Portugal Global]

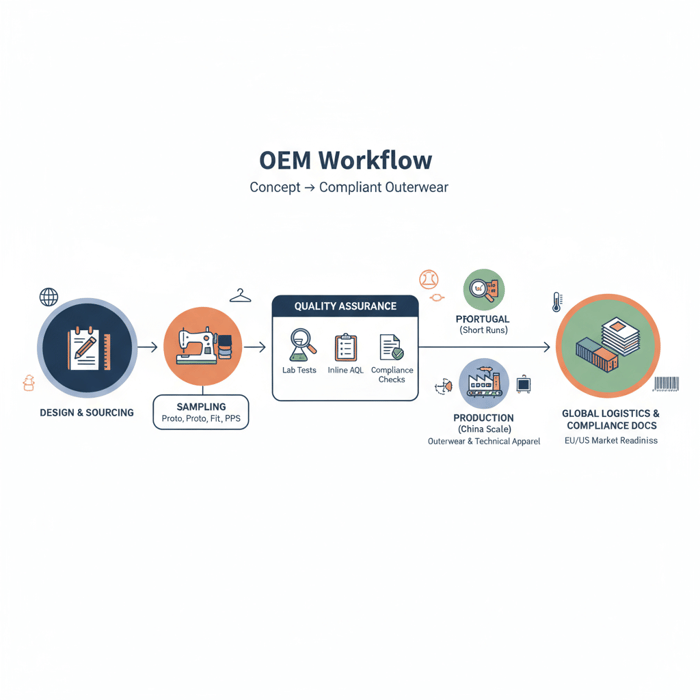

How to Partner with OEM/ODM for Outerwear and Technical Apparel

Success comes from clean specs, early material alignment, fit discipline, pilot runs, and compliance-first QA. Define tech packs, test materials, run PPS and pilots, then scale with structured inspections and lab validations. For performance apparel, lock seam sealing, down-proofing, and waterproof/breathability targets before volume. [CITE: AQL standards; ISO performance tests]

Preparation

- Inputs: Sketches, tech packs, graded size charts, BOM, tolerance tables, REACH and labeling requirements, DPP data fields. [MENTION: European Commission; CEN]

- Feasibility: Validate construction, materials, and target costs; confirm lab test protocols (down-proof, hydrostatic head, breathability). [CITE: ISO/EN test method references]

- Timeline: Define calendars for proto, fit, PPS, pilot, and production; include lab lead times and holiday calendars. [INTERNAL LINK: Outerwear tech pack standards]

Execution Steps

- Proto build: Confirm construction logic and materials.

- Fit sample: Adjust pattern; lock graded specs.

- Size set: Verify consistency across sizes; refine tolerances.

- PPS (pre-production sample): Approve final construction, trims, and labeling.

- Pilot run: Produce ~50–200 units to test yield and QA.

- Production: Scale after pilot metrics meet targets; schedule inline inspections.

Typical outerwear cycles run 10–16 weeks including lab tests and material lead times; align freight planning early to protect EU/US retail launch weeks. [CITE: Logistics transit benchmarks]

Quality Assurance

- Inspection: AQL sampling (e.g., 2.5), inline checks on seams, pockets, zips, bonding. [MENTION: ISO inspection guidance]

- Performance: Down-proof tests; hydrostatic head for waterproof shells; breathability ratings; taped seam audits.

- Documentation: Lab reports, material compliance declarations, labeling, and DPP-ready traceability. [CITE: EC DPP roadmap]

- Limitations: Seasonal material constraints; lab capacity; holiday calendars affecting approvals.

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service delivers end-to-end design, sourcing, sampling, QA, and scalable production for outerwear and technical apparel—bridging Portugal brand ambitions with proven China factory capability. Brands gain material diversity, structured testing, and EU/US compliance documentation under one workflow. [MENTION: Eton Garment Limited certifications] [CITE: Brand partner testimonials]

Explore Eton’s OEM/ODM capabilities for outerwear and technical apparel at Clothing Manufacturing OEM Service. [INTERNAL LINK: Eton Garment Limited – author bio] [INTERNAL LINK: Our outerwear compliance checklist]

Use Case 1: Seasonal Outerwear Line (Problem → Solution)

Problem: A Portugal brand needs a 12-SKU outerwear line for EU/US calendars with mixed fills (down/synthetic), consistent fit, and documented compliance under tight timelines. Solution: Rapid proto and PPS approvals; down/leak testing; inline AQL inspections; production in China with full lab reports and labeling packs; pilot run validates yield before volume. [CITE: AQL sampling standards] [MENTION: Retail calendar case studies]

Use Case 2: Technical Sports Jacket (Problem → Solution)

Problem: Required waterproof/breathability specs, taped seams, and lab-testing under budget constraints. Solution: Source membranes and seam tapes; lock construction with PPS; performance tests (hydrostatic head, breathability); pilot run; cost control through material alternatives; scale post-approval with repeatable QA steps. [CITE: ISO/EN test methods for waterproof/breathability] [MENTION: Material supplier benchmarks]

Risks, Compliance & Localization for US & EU Markets

Build compliance into specs and approvals—REACH chemicals, EU labeling, and DPP readiness—then audit materials and processes across pilot and production. For US-bound goods, plan CPSIA (children’s apparel), chemical lists, and customs documentation. Maintain traceability and lab reports to reduce customs delays. [CITE: EU and US regulatory references] [MENTION: European Commission; US CPSC]

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Material non-compliance | Medium | High | Supplier declarations; third-party lab tests; early REACH screening |

| Lead-time slippage | Medium | Medium–High | Frozen tech packs; pilot runs; parallel lab testing; freight buffers |

| Lab test failures | Low–Medium | High | Pre-tests on materials; alternative trims; retest window in calendar |

| Capacity constraints | Medium | Medium | Dual-sourcing plans; flexible MOQs; early booking |

Regulatory Notes for US & EU

- EU: REACH chemicals compliance; labeling; Digital Product Passport (2024–2026 roadmaps). [CITE: EC Sustainable Textiles Strategy]

- US: CPSIA for children’s apparel; state chemical lists (e.g., PFAS policies); strict customs documentation and HTS classification accuracy. [CITE: US CPSC guidance]

- Documentation: BOM, test reports, supplier declarations, traceability datasets, labels care instructions, and import records. [MENTION: EURATEX compliance guides]

Conclusion & Next Steps

Portugal’s craftsmanship pairs well with the scale and technical depth of a China Clothing Manufacturer. Define specs, compare region trade-offs with KPIs, and run pilots before volume. For outerwear, lock testing standards and seam constructions early, then scale with structured QA and compliance documentation for EU/US retail calendars. [INTERNAL LINK: Factory selection guide] [INTERNAL LINK: Outerwear tech pack templates]

- Scope the category: define silhouettes, materials, and budgets.

- Create tech packs with graded sizes, tolerances, BOM, and compliance notes.

- Sample in Portugal for fit and finishing; plan pilot with OEM/ODM partner.

- Approve PPS, run pilot, validate tests and yield, then scale.

- Finalize compliance documentation and freight plans for EU/US launches.

- EURATEX — European Textile and Clothing Industry Statistics (2024). https://euratex.eu/

- AICEP Portugal Global — Textile & Clothing Industry Overview (2023–2024). https://www.portugalglobal.pt/

- INE Portugal — International Trade Statistics: Textiles and Apparel (2023–2024). https://www.ine.pt/

- Portugal Fashion — Events and Designer Lineup (2024). https://portugalfashion.com/

- Time Out Lisbon — The Best Portuguese Fashion Brands (2023–2024). https://www.timeout.com/lisbon/shopping

- Vogue Portugal — Portuguese Designers & Brands Features (2023–2024). https://www.vogue.pt/

- European Commission — EU Strategy for Sustainable and Circular Textiles; DPP timeline (2022–2024). https://environment.ec.europa.eu/

- Statista — Portugal Apparel Market Revenue (2024). https://www.statista.com/

- WTO — World Trade Statistical Review (2024). https://www.wto.org/

[CITE: Add specific article URLs for brand profiles, export datasets, and testing standards] [MENTION: Include recognized testing bodies and industry auditors for outerwear]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »