Portugal Fashion Brands: How Leading Labels Partner with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

16 minute read

Portugal Fashion Brands: How Leading Labels Partner with a China Clothing Manufacturer

Portugal fashion brands anchor a creative scene shaped by Lisbon and Porto studios, heritage craftsmanship, and emerging technical outerwear. Many labels now benchmark nearshore production in Portugal against partnering with a China Clothing Manufacturer to scale outerwear, padded coats, and performance apparel for US and EU markets. This article provides a segment map, brand comparisons, a decision framework, compliance guidance, and an OEM playbook grounded in factory experience.

From luxury ateliers to streetwear collectives, Portuguese fashion labels thrive on distinctive design and European sensibility. Yet translating design into consistent production across seasons, sizes, and markets requires breadth in fabric sourcing, process control, and certification-ready supply chains. For cold-weather and performance categories, a specialist China Clothing Manufacturer can deliver technical capabilities at scale—quilted constructions, seam sealing, lamination, down handling—while meeting US/EU regulatory expectations when managed with rigorous QC and documentation.

Portugal fashion brands span luxury ateliers, contemporary designers, and sustainability-focused labels in Lisbon and Porto. To scale outerwear and technical apparel, many evaluate Portugal nearshoring versus China OEM partners. A China clothing manufacturer adds fabric breadth, process expertise, and capacity—if compliance, quality, and timelines are tightly controlled.

Portugal’s creative labels compete globally through distinct aesthetics and rising technical capability. When expanding into padded outerwear and performance apparel, brands compare local production advantages (proximity, smaller MOQs, faster communication) with offshore benefits (fabric libraries, specialist processes, capacity, and unit economics). This guide delivers a practical matrix to choose nearshore or offshore, a sampling-to-production OEM workflow, compliance mapping for US/EU, and data-backed trends. It also shows how Eton’s Clothing Manufacturing OEM Service integrates with Portugal-based brands seeking speed, quality, and certification-ready production.

[MENTION: McKinsey State of Fashion authors] [MENTION: ATP leadership names] [INTERNAL LINK: Our foundational guide on 'Outerwear OEM for EU brands'] [INTERNAL LINK: Alex Chen - Sourcing & OEM Specialist {{author_bio_url}}]

Portugal Fashion Brands: Market Overview and Segment Map

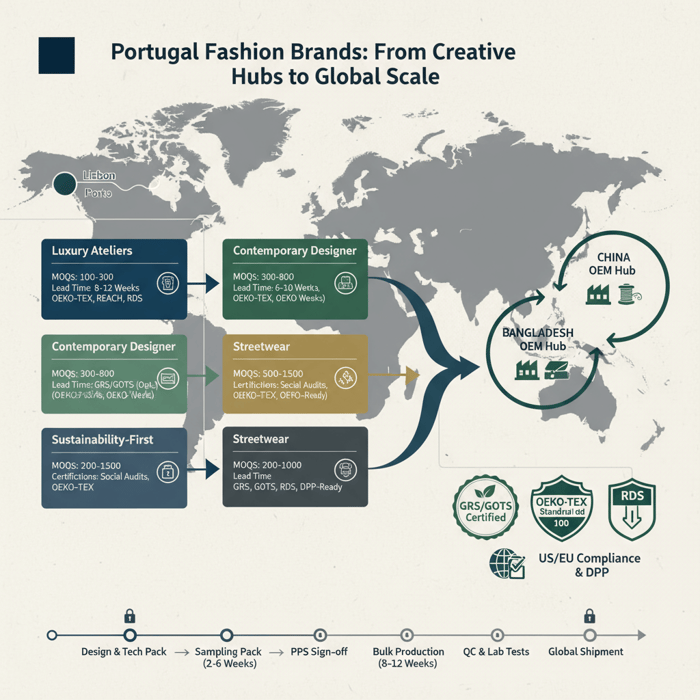

Portugal’s brand scene is concentrated in Lisbon and Porto, with strengths in craftsmanship, knitwear, footwear, denim, accessories, and emerging technical outerwear. Segments include heritage luxury, contemporary designer, streetwear, and sustainability-led labels; each segment brings distinct production needs, MOQs, and certification expectations that shape sourcing decisions.

Portugal Fashion (the official platform and event series) elevates local designers and helps international buyers track emerging talent. Labels engage Portugal’s domestic apparel cluster for sampling and small batches while evaluating offshore partners for volume, technical processes, and unit economics. City ecosystems provide access to pattern cutting, small-run manufacturing, and creative networks—crucial during early product testing and capsule drops.

Segment Profiles: Luxury, Contemporary, Streetwear, Sustainable

- Luxury heritage

- Traits: Atelier-level craftsmanship, tailored outerwear, premium fabrics, limited editions.

- Requirements: Low-to-medium MOQs; meticulous fit; hand-finished trims; reliable small-batch QC; brand-protective social audits.

- Certifications: OEKO-TEX Standard 100 for fabrics; REACH compliance on chemicals; traceable down (RDS) for padded pieces; leather standards where applicable.

- Fit for offshore: Targeted pilot runs with tight sampling control; specialist processes like seam sealing or bonded constructions where needed.

- Contemporary designer

- Traits: Directional silhouettes, mixed materials, fabric innovation; runway-to-retail transitions.

- Requirements: Agile sampling; robust BOM management; access to technical laminates, coated fabrics, recycled fibers; PPS discipline.

- Certifications: GRS/GOTS on request; OEKO-TEX for fabrics; lab testing for colorfastness, seam strength, and water repellency.

- Fit for offshore: Strong alignment—fabric libraries, process breadth, and capacity for commercial drops after showings.

- Streetwear

- Traits: Graphic-led capsules; utility outerwear; collaborations; fast design cycles.

- Requirements: Moderate MOQs; dependable repeatability across drops; flexible lead times; scale-up capacity after sell-through.

- Certifications: Social audit transparency; OEKO-TEX for basics; REACH compliance; footwear/add-ons where relevant.

- Fit for offshore: Excellent for padded coats, parkas, and functional pieces; nearshore for rapid sampling; offshore for price-capacity balance.

- Sustainability-first

- Traits: Material stewardship, circularity pilots, transparency; recycled down, organic cotton, bio-based trims.

- Requirements: GRS/GOTS scope handling; supplier traceability; documented lab testing; DPP-ready data flows.

- Certifications: OEKO-TEX, GRS, GOTS, RDS/BSCI/SMETA where applicable; retailer protocols for EU/US entries.

- Fit for offshore: Viable with certified mills and audited factories; mandates rigorous documentation for US/EU compliance.

City Clusters: Lisbon & Porto Ecosystem

Lisbon: Contemporary designers and street-led labels cluster around studios and concept stores; proximity to Portugal Fashion activations and creative agencies speeds sampling feedback. Porto: Strong ties to textile mills, knitwear specialists, denim expertise, and outerwear know-how. The runway and trade-show pipeline builds visibility for brand launches and niche categories. [CITE: AICEP overview on regional apparel hubs] [MENTION: Portugal Fashion organizers] [INTERNAL LINK: Portugal brand ecosystem explainer]

Top Portugal Fashion Brands by Segment: Comparison & Differentiators

Leading Portuguese labels vary across aesthetics, category focus, and sustainability posture. Use the comparison below to benchmark collaboration fit and understand which segments align best with technical outerwear and performance manufacturing capabilities while sustaining compliance maturity.

Notable examples often cited include Marques’Almeida (Portuguese founders operating internationally), Alexandra Moura, Nuno Gama, Luís Buchinho, Salsa Jeans, Lion of Porches, Parfois (accessories), and emerging eco-led SMEs showcased through Portugal Fashion. Final brand selection requires up-to-date verification of category focus, production partners, and certification status. [CITE: Portugal Fashion designer directory] [CITE: FashionUnited brand profiles] [MENTION: Vogue Portugal editorial team]

| Segment | Design Complexity | Fabric Tech Readiness | Compliance Maturity | Production Fit (Outerwear) | Notes |

|---|---|---|---|---|---|

| Luxury | High | Medium–High | High | Selective specialist runs | Prioritize craftsmanship with specialist process add-ons. |

| Contemporary | Medium–High | High | Medium–High | Strong alignment for padded/functional | Access to laminates, seam sealing, recycled fibers. |

| Streetwear | Medium | Medium–High | Medium | Excellent for parkas, puffers | Balance unit economics and drop cadence. |

| Sustainable | Medium | Medium–High | High | Viable with certified supply chain | Mandate GRS/GOTS scopes and traceability. |

Criteria Overview

- Design complexity: pattern innovation, paneling, insulation control, trim intricacy, fit blocks.

- Fabric tech readiness: ability to source and process laminates, membranes, coatings, DWR, recycled fibers.

- Compliance maturity: documentation readiness, audit history, lab test cadence, retailer protocol familiarity.

- Production fit: capacity to hit MOQs, keep PP meetings disciplined, and maintain AQL standards for outerwear.

Decision Framework

Score each candidate partner on cost structure, lead time reliability, process capability (e.g., seam sealing, down processing), compliance posture, and communication cadence. Pilot a style in small runs, then scale with PPS sign-off and inline inspections. Document lab tests and keep traceability records DPP-ready. [CITE: EU DPP program brief] [MENTION: Eurostat apparel trade insights] [INTERNAL LINK: OEM decision matrix download]

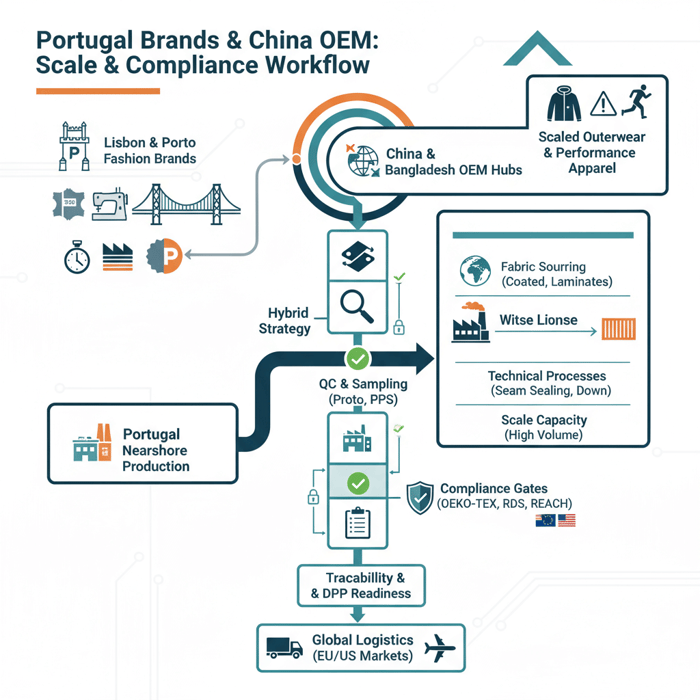

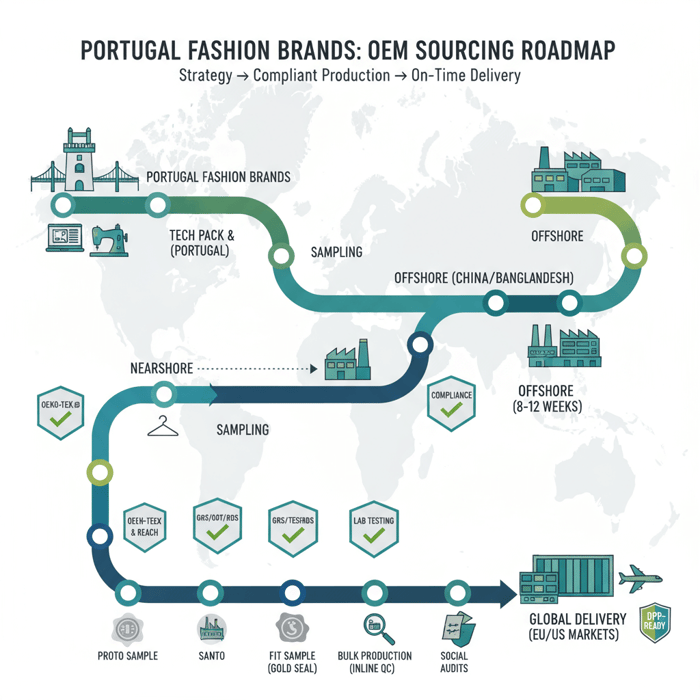

How Portugal Fashion Brands Choose Manufacturing Partners (Nearshore vs Offshore)

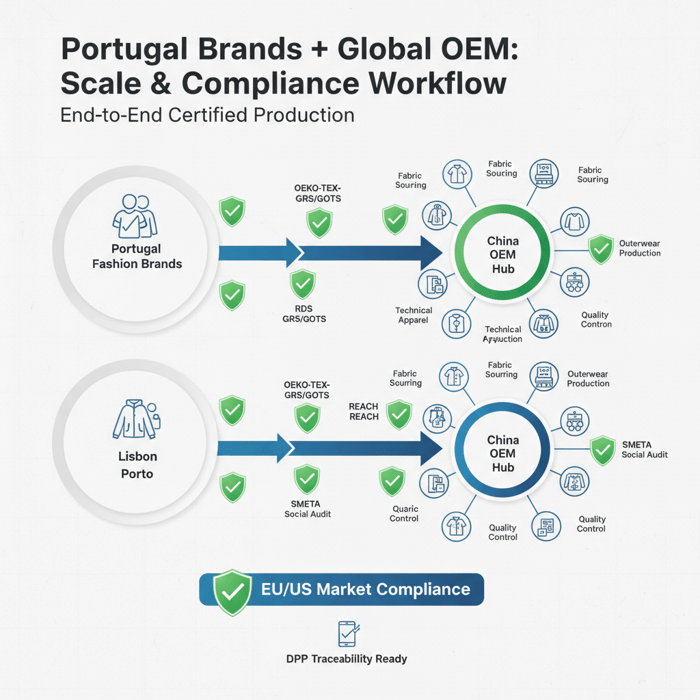

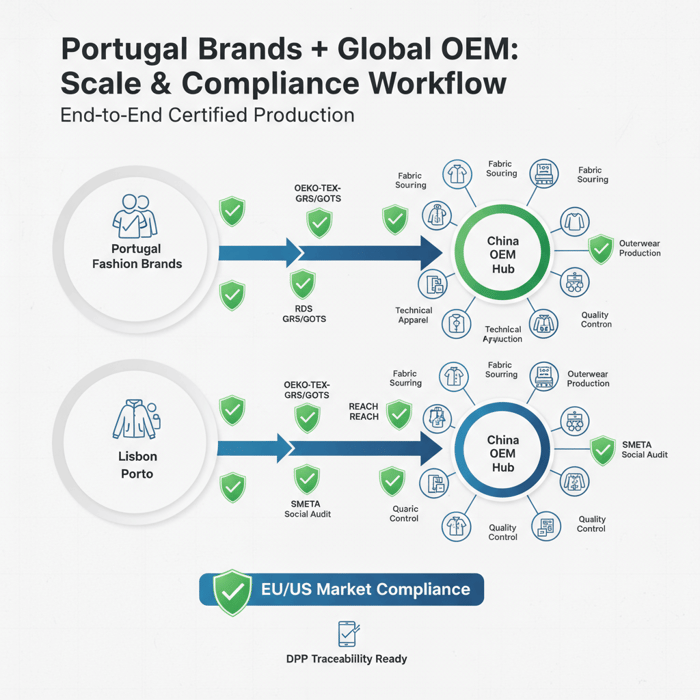

Use a structured framework to compare nearshoring in Portugal and offshoring in China/Bangladesh. Focus on cost, lead times, capacity, technical expertise, certifications, and risk controls. Follow the step-by-step OEM workflow to minimize sampling errors, avoid fit drift, and de-risk bulk production.

Portugal nearshore

- Strengths: proximity; rapid sampling feedback; lower MOQs; cultural alignment; EU compliance familiarity.

- Constraints: fabric breadth limitations; higher unit costs on technicals; capacity bottlenecks during peak seasons.

China/Bangladesh offshore

- Strengths: fabric library scale; specialist outerwear processes; unit economics for volume; flexible capacity.

- Constraints: logistics time; structured communication; strict compliance management; longer sampling if specs drift.

Preparation: Tech Pack, BOM, Fit Blocks

- Tech pack: pattern breakdown, measurements, seam types, SPI, stitch drawings, trimming instructions, graphic placements.

- BOM: fabric composition with finishing notes (e.g., DWR), liner, insulation spec (e.g., 90/10 down, synthetic fill GSM), zipper/toggle spec, label pack.

- Fit blocks: size run fit baseline; tolerance table; graded measurements; comments on mobility and thermal performance goals.

- Compliance pre-check: EU REACH substance restrictions; OEKO-TEX Standard 100 or equivalent lab test plan; RDS for down; GRS/GOTS scope handling as needed.

- Seasonality planning: avoid overlapping Chinese New Year/Lunar New Year bottlenecks; map EU holiday peaks; align freight booking windows.

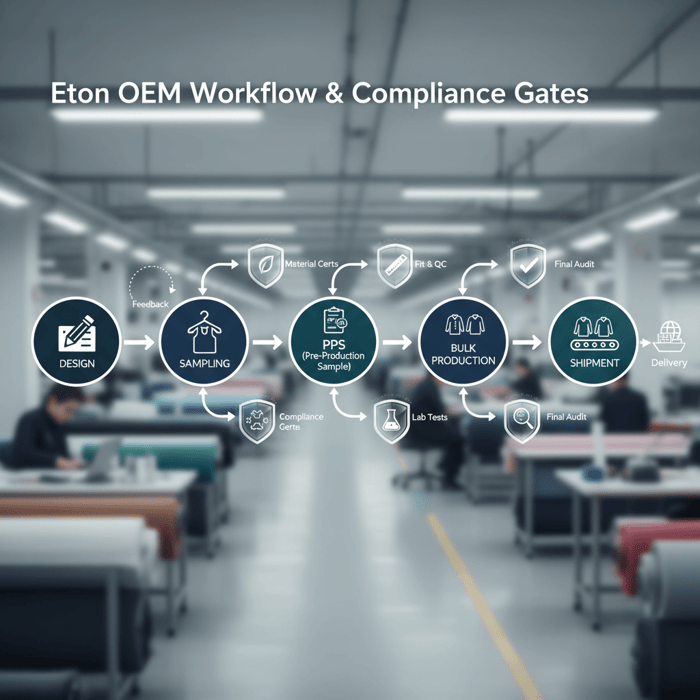

Execution Steps: Sampling → Gold Seal → Bulk

- Proto sample: validate silhouette, major seams, rough materials; record measurement deviations.

- Fit sample: conduct try-on; note mobility and articulation; update tolerance tables.

- Sales/sample set: confirm trim colorways, graphic accuracy; prep for lookbook/trade show.

- Pre-production sample (PPS): final fabric/trim, construction, and finishing; freeze spec; sign off.

- Gold seal: production-ready specimen sealed for QC reference; distribute to factory QA, brand QA, and merch teams.

- Bulk production: cut–make–trim with inline QC; tracking via AQL 2.5/4.0; lab tests per retailer protocol; carton and labeling compliance.

- Final inspection: random sample by size/color; lab test report collation; book freight; compile shipment documentation (packing list, invoice, test certificates, audit summaries).

Quality Assurance: Inline QC, AQL, Lab Tests

- Inline QC: stitch density checks; seam sealing validation; lamination bonding tests; down migration control; snap/puller pull tests.

- AQL: target 2.5 for major defects; 4.0 for minor; adjust for retailer policies; record failure modes and corrective actions.

- Lab testing: colorfastness to rubbing/washing; hydrostatic head/water repellency; seam strength; chemical compliance (REACH); thermal insulation for cold-weather ranges.

- Documentation: PPS sign-off sheets, lab reports, audit certificates, traceability records; maintain DPP-ready data fields.

- Typical nearshore MOQs (outerwear): 100–300 units/style — 2024 [CITE: ATP guidance or buyer interviews]

- Typical offshore MOQs (outerwear): 600–1,500 units/style — 2024 [CITE: OEM factory disclosures]

- Sampling lead time (nearshore): 2–4 weeks; offshore: 3–6 weeks — 2024 [CITE: Sourcing manager surveys]

- Bulk lead time (nearshore): 6–8 weeks; offshore: 8–12 weeks — 2024 [CITE: Eurostat supply chain cadence or industry reports]

[INTERNAL LINK: OEM sampling-to-production workflow] [MENTION: FashionUnited industry roundups]

Partnering with a China Clothing Manufacturer: Opportunities & Trade-Offs for Portugal Fashion Brands

China OEMs deliver breadth in fabrics, trims, technical know-how, and scalable capacity. Trade-offs include longer logistics windows, structured communication rhythms, and stricter compliance management. Outerwear and performance labels benefit from quilting precision, lamination, seam sealing, and down processing when QC and certification protocols are enforced.

- Pros:

- Fabric libraries: coated, laminated, membrane-based, recycled synthetics; dyeing/finishing breadth.

- Technical processes: seam sealing, ultrasonic bonding, baffle construction, down injection, laser cutting.

- Capacity: scalable lines for volume drops; consistent repeatability across seasons; competitive unit economics.

- Compliance familiarity: OEKO-TEX, GRS/GOTS scopes on request; retailer protocols; traceability tooling.

- Trade-offs:

- Logistics: sea freight adds 30–40 days EU/US; air freight raises costs; booking discipline needed.

- Communication: strict spec adherence; timezone planning; clear escalation paths for PPS and QC checkpoints.

- Lead times: sampling may extend if fit or BOM drifts; bulk timelines hinge on fabric readiness.

- Risk: compliance failures and lab test delays unless program-managed.

| Dimension | Portugal Nearshore | China/Bangladesh Offshore |

|---|---|---|

| Sampling speed | Fast (2–4 weeks) | Moderate (3–6 weeks) |

| Fabric breadth | Limited specialty | Extensive libraries |

| Technical processes | Variable availability | Specialist capabilities |

| MOQs | Lower (100–300) | Higher (600–1,500) |

| Unit economics | Higher costs | Competitive at scale |

| Compliance | Strong EU familiarity | Strong with program management |

| Logistics | Short | Longer; plan freight |

Pros & Cons by Category (Outerwear, Technical Apparel)

- Padded outerwear: Offshore excels in down handling, baffle engineering, lightweight shell sourcing; nearshore wins in rapid sampling and small MOQs for early capsules.

- Technical rainwear: Offshore offers seam sealing, laminated membranes, bonded seams; nearshore suitable for low-volume or simpler constructions.

- Performance sportswear: Offshore access to moisture-wicking knits, reflective trims, laser-cut ventilation; nearshore efficient for small-batch pilot runs.

Risk Mitigation Playbook

- Pilot runs: Start with 1–2 styles; lock PPS; run inline inspections at 30% and 80% completion.

- Fit clinics: Conduct live fit sessions via video; document corrective actions; update tolerance tables.

- Compliance checkpoints: Pre-book lab tests; confirm OEKO-TEX certificates; validate GRS/GOTS scopes; secure RDS for down.

- Freight planning: Reserve vessel space early; compare air vs rail options; align EU/US customs documentation.

[CITE: McKinsey State of Fashion 2024 on sourcing shifts] [MENTION: AICEP sector brief authors] [INTERNAL LINK: Comparison tool: Portugal vs China for outerwear]

Data & Trends: Portugal’s Apparel Exports, Sustainability, and Performance Categories

Portugal’s apparel exports remain resilient, with a rising sustainability posture that aligns with EU buyer expectations. Performance materials and technical outerwear continue to grow globally as consumers demand weather protection and utility. Use current EU/Portugal data to plan categories and compliance investments.

- Portugal apparel export value, 2020–2024: modest growth overall — [CITE: Eurostat dataset link]

- Certification uptake: OEKO-TEX, GRS/GOTS registrations increasing among Portugal mills/factories — [CITE: ATP association updates]

- Outerwear/performance category momentum across EU retailers — [CITE: FashionUnited market coverage]

- DPP pilots: EU preparing digital product passport frameworks — [CITE: Official EU Commission brief]

Key Trend 1: Sustainability & Certifications

Brands increasingly request certified recycled fibers (GRS) and organic inputs (GOTS), while OEKO-TEX Standard 100 and MADE IN GREEN labels support material safety narratives. RDS ensures responsible down sourcing in cold-weather lines. Documentation integrity and traceability options—backed by mill/factory certificates and lab testing—now shape retailer onboarding and DPP preparation. [CITE: OEKO-TEX annual report] [MENTION: GOTS program leadership]

Key Trend 2: Technical Outerwear Momentum

Functional outerwear—lightweight shells, insulated puffers, seam-sealed rainwear—continues to post strong sell-through, supported by travel, urban commuting, and outdoor lifestyles. Fabric tech and finishing (DWR, laminates, bonded seams) differentiate performance while meeting EU/US chemical compliance expectations. Repeatability and QC discipline drive lower returns on fit and function. [CITE: Retail sell-through analysis or McKinsey category trend] [MENTION: Eurostat sector analysts]

[INTERNAL LINK: Technical outerwear material guide]

Product/Service Integration: Clothing Manufacturing OEM Service by Eton

Eton’s OEM service specializes in padded outerwear, parkas, and technical apparel. Portugal fashion brands gain fast sampling, fabric sourcing breadth, and compliance-ready production—OEKO-TEX, GRS/GOTS on request—plus end-to-end QC aligned with US/EU market needs. The workflow aligns creative specs to scalable outcomes.

| Need | OEM Feature | Outcome |

|---|---|---|

| Padded outerwear with RDS down | Down processing, baffle engineering, RDS chain handling | Consistent loft; certified traceability; thermal performance meets spec |

| Seam-sealed rainwear | Laminate sourcing, seam sealing, bonded seams | Verified hydrostatic head; durable water protection; lower defect rate |

| Sustainability claims | OEKO-TEX, GRS/GOTS scope support; lab test program | Retailer onboarding readiness; documented compliance |

| Speed to market | Agile sampling lanes; PPS discipline; inline inspections | Shorter cycle; fewer reworks; stable fit across sizes |

Use Case 1: Padded Outerwear (Problem → Solution)

Problem: A Lisbon-based label plans a winter drop with multiple puffers, each requiring balanced loft, clean baffles, and certified down. MOQs must suit mid-volume demand without overstock risk.

Solution: Eton sets a down handling protocol with RDS documentation, locks fabric/trim in PPS, runs inline QC at stitch and baffle checks, and collates lab reports. Result: consistent insulation performance, low returns for fit/loft issues, timely EU delivery. Clothing Manufacturing OEM Service.

Use Case 2: Technical Sportswear (Problem → Solution)

Problem: A Porto streetwear brand expands into commuter rain shells with breathable laminates, seam sealing, and reflective trims. Season timing and compliance are critical.

Solution: Eton sources laminate options, validates seam sealing via PPS, executes inline pull tests on trims, and books lab tests per retailer protocol. Result: verified waterproof ratings, consistent construction, and dependable ship dates for EU and US markets. Clothing Manufacturing OEM Service.

[MENTION: RDS program managers] [INTERNAL LINK: Get a compliant OEM partner — Eton Garment Limited]

Risks, Compliance & Localization for US & EU Markets

Risk mitigation depends on structured testing, certification validation, and disciplined documentation. Address EU REACH, product safety, labeling, social audits, and traceability. Prepare for digital product passport developments and retailer-specific protocols; maintain version-controlled files across sampling and bulk.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Fabric non-compliance (REACH) | Medium | High | Pre-book lab tests; OEKO-TEX cert validation; supplier declarations |

| Seam sealing failure | Low–Medium | High | PPS water test; inline checks; post-wash validation |

| Down traceability gaps | Low | High | RDS certificate chain; batch-level logs; audit readiness |

| Labeling inaccuracies | Medium | Medium | Retailer-specific label packs; checklists; carton audits |

| Freight delays | Medium | Medium–High | Early bookings; buffer; multi-modal options; customs doc readiness |

Regulatory Notes for US & EU

- EU: REACH substance restrictions; product safety and labeling; DPP horizon—structure traceability fields from sampling onward.

- US: CPSIA where applicable; state-specific chemical rules for apparel; care labeling compliance; documentation for customs.

- Social audits: BSCI, SMETA, WRAP or equivalent; align with retailer onboarding checklists.

- Traceability: certificate chain for OEKO-TEX, GRS/GOTS, RDS; lot-level mapping for materials; retain lab test reports by style/color.

[CITE: EU REACH official portal] [CITE: US labeling regulations (FTC/CPSC)] [MENTION: SMETA program coordinators] [INTERNAL LINK: Compliance checklist download]

Conclusion & Next Steps

Portugal fashion brands can grow technical outerwear and performance apparel by pairing creative strength with an OEM partner that delivers fabric breadth, process expertise, and certification-ready production. Use the decision framework, sampling workflow, and compliance mapping to accelerate launches while protecting quality and brand reputation.

- Define category scope and compliance requirements (OEKO-TEX, GRS/GOTS, RDS, REACH).

- Build tech packs, BOMs, and fit blocks; set tolerance tables and lab test plans.

- Pilot with nearshore and offshore candidates; lock PPS and gold seals; run inline QC.

- Document certificates, audits, and lab reports; prepare DPP-ready traceability fields.

- Plan freight early; align EU/US customs documentation; finalize ship windows.

- Scale successful styles; maintain QA cadence; iterate materials with season updates.

To integrate with a certified OEM partner for outerwear and performance apparel, explore Eton’s Clothing Manufacturing OEM Service. [INTERNAL LINK: Portugal brand landscape resource hub] [INTERNAL LINK: OEM playbook] [INTERNAL LINK: Compliance checklist]

Author: Alex Chen, Sourcing & OEM Specialist (12+ years in outerwear manufacturing). Reviewer: Mei Lin, QA & Compliance Lead (OEKO-TEX/GRS program oversight). Methodology: Synthesized Eton’s factory experience with industry data (Eurostat, AICEP, ATP, McKinsey, FashionUnited). Limitations: Some brand examples and data points require updated verification; market conditions vary by season/category. Disclosure: Eton Garment Limited provides OEM services and may benefit commercially from this content. Last Updated: 2025-10-28.

[INTERNAL LINK: Alex Chen - Sourcing & OEM Specialist {{author_bio_url}}]

- McKinsey & Company — The State of Fashion (2024). [CITE: McKinsey State of Fashion 2024 landing page]

- Eurostat — EU Textile and Apparel Trade Statistics (2024). [CITE: Eurostat apparel trade dataset]

- AICEP Portugal Global — Industry Overviews (2023–2024). [CITE: AICEP apparel sector brief]

- ATP — Associação Têxtil e Vestuário de Portugal — Sector Updates (2023–2024). [CITE: ATP publications]

- FashionUnited — Portuguese Brands & Industry News (2024–2025). [CITE: FashionUnited articles]

- Portugal Fashion (Official) — Designers & Events. [CITE: PortugalFashion.com]

- OEKO-TEX — Annual Reports and Standard 100 Guidance (2023–2024). [CITE: OEKO-TEX site]

- GOTS — Program and Standards Overview (2023–2024). [CITE: GOTS official site]

- RDS — Responsible Down Standard (2023–2024). [CITE: Textile Exchange RDS resources]

- EU Commission — Digital Product Passport (DPP) Updates (2024). [CITE: EU official brief]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »