Mens Wholesale Clothing Distributors USA vs OEM/ODM Manufacturing: A 2025 Sourcing Playbook for Fashion Brands

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

10 minute read

Mens Wholesale Clothing Distributors USA vs OEM/ODM Manufacturing: A 2025 Sourcing Playbook for Fashion Brands

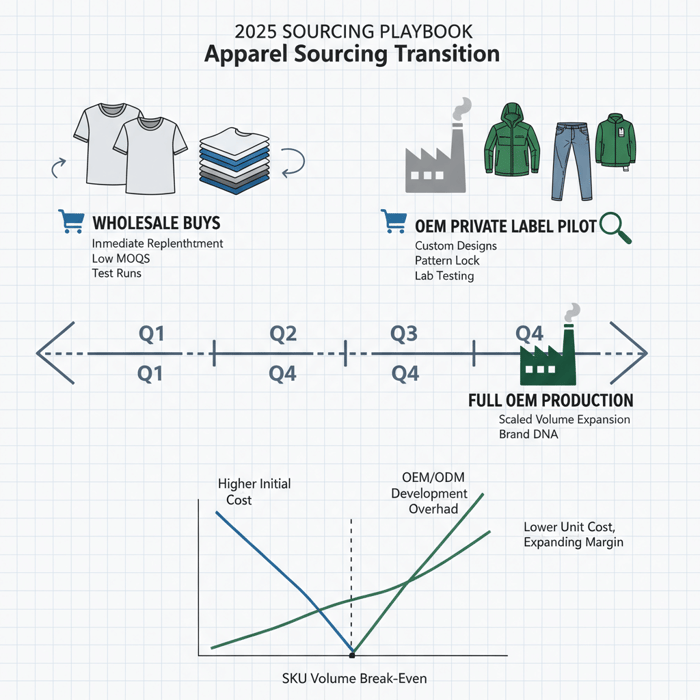

Mens wholesale clothing distributors USA give brands fast access to in‑stock apparel, while a China Clothing Manufacturer unlocks private label scale, deeper customization, and long‑term cost control. This guide maps the trade‑offs with concrete numbers, compliance checkpoints, and a category‑by‑category sourcing playbook for US/EU merchandising teams balancing speed, margin, and reliability.

Wholesale vs OEM/ODM: Where Each Model Wins for Menswear Sourcing

USA wholesale distributors excel on speed and replenishment with ready-made inventory; OEM/ODM in China leads on customization, cost per unit at scale, and brand differentiation. The practical split: use wholesale for immediate fill rates and season continuity; shift core items to OEM once demand signals repeat with predictable volumes.

For US/EU fashion brands, wholesale distributors serve as a quick-response engine across basics and selected mens outerwear. OEM/ODM manufacturing becomes the growth engine when your forecast stabilizes and you need signature fits, proprietary fabrics, and label control. Both paths can coexist inside a layered sourcing strategy that protects margins and buyer experience.

- Wholesale distributors — Immediate availability, domestic compliance familiarity, simple onboarding; narrower customization, higher per-unit costs, variable replenishment risk.

- OEM/ODM — Custom design, fabric options, scalable cost curves, brand DNA; longer lead times, technical development needed, vendor vetting essential.

| Dimension | USA Wholesale Distributors | China OEM/ODM Manufacturers |

|---|---|---|

| Speed | Immediate ship/replenishment | Design + production lead time (60–120 days) |

| MOQ | Low/no MOQ | MOQs by fabric/trim, often 300–1,000 units per style |

| Customization | Limited colors, fits, trims | Full private label, exclusive fabrics, performance features |

| Unit Cost | Higher; margin constrained | Lower at scale; margin expands |

| Compliance | US labeling familiarity | Global standards; requires governance |

| Risk | Inventory gaps, brand sameness | Lead-time exposure, development cycles |

[CITE: “State of Fashion” report analyzing wholesale vs manufacturing margins]

[MENTION: McKinsey State of Fashion; BOF (Business of Fashion)]

[INTERNAL LINK: Our foundational guide on 'China OEM vs Wholesale']

Understanding USA Mens Wholesale Distributors: Speed, MOQs, and Assortment

USA mens wholesale clothing distributors deliver fast turns, low MOQs, and consistent basics. The strongest operators pair wide size runs with reliable fill rates and WMS-driven inventory transparency, making them ideal for replenishment and test buys before scaling to OEM.

Common categories include tees, fleece, polos, denim basics, off-the-rack outerwear, and athleisure separates. Leading platforms and distributors emphasize stock visibility and EDI/API integrations for smooth order flow. Watch service levels—fill rate, on-time ship, and defect returns—over three consecutive cycles to qualify vendor reliability.

- [MENTION: SanMar; AlphaBroder — national basics distributors with strong size runs]

- [MENTION: FashionGo; Faire — curated B2B marketplaces for brand discovery]

- Fill rate targets ≥ 95% — 2024 (Source: [CITE: industry operations benchmark])

- Return rates ≤ 3% for basics — 2023–2024 (Source: [CITE: apparel returns study])

- EDI-enabled reorders reduce cycle time 12–18% — 2024 (Source: [CITE: logistics tech report])

[CITE: “US wholesale distributor capabilities” market scan]

[INTERNAL LINK: Eton blog on “Vendor Scorecards for Apparel”]

Landed Cost Modeling: Wholesale vs OEM/ODM for Mens Apparel

Landed cost runs higher with USA wholesale but carries minimal development overhead; OEM/ODM narrows unit cost and lifts gross margin once volume stabilizes. Model both paths using total landed cost by style, then compare gross margin and cash cycle timing to decide the mix.

Align your SKU-level forecast to a three-bucket view: replenishment basics, seasonal capsules, and signature hero products. Use wholesale for immediate basics; pivot capsules and heroes to OEM once trend proof points repeat. Update the cost model quarterly with real freight, duty, and return data.

| Cost Component | USA Wholesale | China OEM/ODM |

|---|---|---|

| Base Unit Cost | $42.00 | $24.00 |

| Freight & Handling | $2.00 | $3.50 (ocean), $7.50 (air) |

| Duty & Tariffs | $0.00–$1.50 (domestic) | $3.00–$5.00 (HTS dependent) |

| Development Overhead | $0.00 | $0.80 (samples/tech packs amortized) |

| Total Landed | $44.00–$45.50 | $31.30–$37.30 |

[CITE: US HTS duty ranges for man-made fiber outerwear]

[CITE: Freightos Baltic Index for current ocean/air rates]

[MENTION: U.S. International Trade Commission HTS; Freightos]

Compliance & Labeling: FTC, CPSIA, Prop 65, and EU REACH

Compliance precision protects sell-through and brand trust. USA wholesale often arrives pre-labeled, while OEM/ODM requires strict governance: fiber content (TFPIA), care symbols, RN/ID, country of origin, and specific product safety triggers (CPSIA for children’s wear, Prop 65 for California, REACH for EU).

Build a labeling checklist tied to style type and destination markets. For mens outerwear, focus on fiber identification, down/feather claims, and performance finishes. Store compliance evidence centrally—test reports, certificates, and supplier declarations—to speed audits and retail onboarding.

- FTC Care Labeling & TFPIA — fiber, care, origin [CITE: FTC guidance]

- CPSIA — children’s apparel testing and tracking labels [CITE: CPSC]

- California Prop 65 — chemicals list and warnings [CITE: OEHHA]

- EU REACH — restricted substances and registration [CITE: ECHA]

- OEKO-TEX, GRS, WRAP — voluntary certifications [CITE: program standards]

[MENTION: FTC; CPSC; OEHHA; ECHA]

[INTERNAL LINK: Eton compliance & certifications overview]

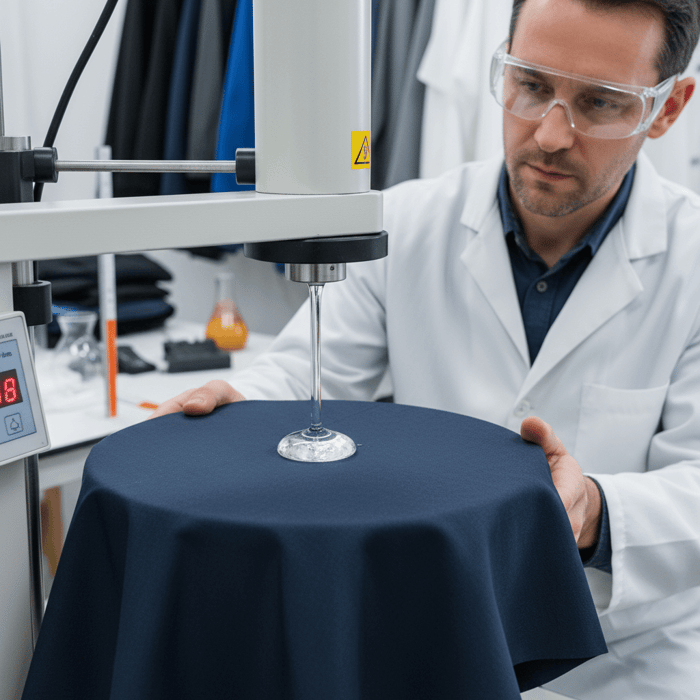

Quality Systems: AQL, Performance Testing, and Supplier Scorecards

Quality discipline sustains margin. USA wholesale relies on distributor QC; OEM/ODM runs on structured AQL inspection, lab testing for fabrics and finishes, and supplier scorecards tracking defect rates, OTIF, and CAPA cycles. The goal is predictable fit, function, and finish.

Adopt ANSI/ASQ Z1.4 (ISO 2859-1) for sampling. For outerwear, test hydrostatic head, seam sealing, abrasion, and colorfastness. Request third-party labs when needed and tie corrective actions to trend data. Keep thresholds realistic and update seasonally.

- AQL levels — common apparel practice: 2.5 major, 4.0 minor [CITE: ISO 2859-1]

- Performance tests — hydrostatic, breathability, abrasion [CITE: SGS/Bureau Veritas protocols]

- Scorecard KPIs — OTIF ≥ 95%, defect ≤ 2%, CAPA closure < 30 days [CITE: apparel QA benchmarks]

[MENTION: SGS; Bureau Veritas]

[INTERNAL LINK: Eton’s approach to AQL and technical development]

Private Label Roadmap: When to Move from Wholesale to OEM/ODM

Shift from mens wholesale clothing distributors USA to OEM/ODM when sales stabilize on repeat fits, the brand needs exclusive features, and volume meets MOQ thresholds. Profit expands where customization drives ASP and the cost curve benefits from scale.

Watch category signals—repeat sellers in fleece, parkas, and performance outerwear often hit the OEM break-even first. Keep wholesale as a flex valve for new colorways or size gaps while OEM absorbs core demand. Build a quarterly roadmap and align it with retail calendars.

- Identify top-velocity SKUs with 3+ consecutive sell-through wins.

- Confirm forecast volumes meet MOQ and fabric minimums.

- Lock tech packs, fit blocks, and lab test plans.

- Run pilot production with AQL and pre-shipment checks.

- Phase wholesale to backup for replenishment and gaps.

[CITE: Private label profitability case studies]

[MENTION: Retail Economics; NRF]

Category Sourcing Playbook: Mens Outerwear, Basics, Denim, and Activewear

Source basics from USA wholesale for speed and size breadth; move technical outerwear, performance knits, and signature denim to OEM/ODM for fit blocks and fabric innovation. Each category has different break-even dynamics, driven by complexity, MOQ, and branding needs.

Outerwear: Parkas, Padded Jackets, Technical Shells

OEM/ODM shines where insulation, seam sealing, and fabric engineering matter. Brands gain proprietary warmth indexes, unique pocketing, and finish durability. Wholesale fills immediate seasonal needs but is less brand-differentiating. Eton’s development pipeline focuses on down jackets, parkas, and functional sportswear engineered for cold-weather markets. [INTERNAL LINK: Eton outerwear capabilities]

Basics: Tees, Fleece, Polos

Wholesale distributors deliver velocity and low-risk replenishment with consistent basics. Once colorways and fits become signature, OEM moves in to reduce unit cost and add proprietary fabric hand, collar construction, or print techniques.

Denim & Casual Bottoms

OEM brings pattern control, wash libraries, and branded hardware. Wholesale supports trend trials in smaller runs. Watch wash development lead times and shrinkage performance; lab test tolerances before scaling.

Activewear & Performance Knits

OEM unlocks yarn-level performance, moisture management, and compression mapping. Wholesale covers quick seasonal drops. Validate stretch recovery and pilling with controlled testing early.

[CITE: “Performance fabric trends 2024–2025” industry report]

[MENTION: Textile Exchange; Hohenstein Institute]

Risk, Contracts, and Inventory: Reliability in a Two-Track Strategy

Mitigate risk by pairing domestic wholesale replenishment with OEM-based core programs. Lock SLAs for wholesale; codify Incoterms, payment terms, and inspection plans for OEM. Use rolling forecasts and buffer stock to smooth seasonality and shipping variability.

For OEM work, confirm Incoterms 2020 (FOB/CIF/DDP), letter of credit terms (UCP 600), and penalties tied to OTIF and quality thresholds. For wholesale, track lead-time adherence and substitution policies. Keep inventory governance tight across WMS/ERP, and test EDI/API integrations before peak season.

- Vendor reliability — monitor fill rate, OTIF, defect, and dispute cycle time.

- Contracts — SLA clauses for quality, delivery, and remedies.

- Inventory — safety stock for heroes; dynamic replenishment rules.

[MENTION: ICC Incoterms 2020; UCP 600]

[CITE: “Supply chain resilience 2024” logistics study]

[INTERNAL LINK: Eton vendor onboarding playbook]

Where Eton Fits: OEM/ODM Outerwear and Technical Apparel at Scale

Eton Garment Limited supports brands ready to elevate from wholesale into private label. With bases in China and Bangladesh, Eton specializes in mens outerwear—down jackets, parkas, padded shells—and functional sportswear, backed by rigorous development, compliance, and QA systems built for US/EU retail.

Teams gain end-to-end support: trend-aware design, fabric sourcing, lab testing, AQL inspections, and scalable production across certified facilities. Eton’s track record with Liverpool F.C., Forever 21, Babyshop, Max, Gloria Jeans, Jeep Apparel, and TFG Group reflects depth across lifestyle and performance segments. [CITE: Brand collaborations and case references]

For brands comparing mens wholesale clothing distributors USA to OEM pathways, Eton’s Clothing Manufacturing OEM Service compresses development cycles, builds signature fits, and protects margin at scale with disciplined compliance and quality frameworks.

[INTERNAL LINK: Eton sustainability & certifications]

[MENTION: OEKO-TEX Standard 100; Global Recycled Standard]

Putting It Together: A Practical Sourcing Mix for 2025

Run a two-track model: wholesale for fast replenishment and test buys; OEM/ODM for core mens SKUs where customization and cost curves deliver margin and brand identity. Use quarterly reviews to migrate winning SKUs, enforce compliance rigor, and keep risk in check across supplier types.

Mens wholesale clothing distributors USA remain a strategic lever for speed. A China Clothing Manufacturer becomes the engine for signature products and long-term margin. With disciplined scorecards, clear labeling standards, and a roadmap that respects lead times and MOQs, US/EU brands can scale sustainably while meeting retail calendars with confidence.

- FTC — Care Labeling & Textile Fiber Products Identification Act (2024). https://www.ftc.gov/

- CPSC — CPSIA Guidance for Apparel (2024). https://www.cpsc.gov/

- OEHHA — California Proposition 65 Program (2024). https://oehha.ca.gov/proposition-65

- ECHA — REACH Regulation Overview (2024). https://echa.europa.eu/regulations/reach

- ICC — Incoterms 2020 (2020–2024). https://iccwbo.org/

- ICC — UCP 600 Documentary Credits (2024). https://iccwbo.org/

- USITC — Harmonized Tariff Schedule (2024). https://hts.usitc.gov/

- Freightos — Freightos Baltic Index (2025). https://fbx.freightos.com/

- ISO — ISO 2859-1 Sampling Procedures (2007; in use 2024). https://www.iso.org/

- OEKO-TEX — Standard 100 (2024). https://www.oeko-tex.com/

- Textile Exchange — Global Recycled Standard (2024). https://textileexchange.org/

- SGS — Textile Testing Services (2024). https://www.sgs.com/

- Bureau Veritas — Apparel Testing (2024). https://group.bureauveritas.com/

- NRF — Retail Trends and Private Label Insights (2024). https://nrf.com/

- Business of Fashion — State of Fashion (2024). https://www.businessoffashion.com/

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »