Mens Wear Wholesale: Sourcing from a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

13 minute read

Mens Wear Wholesale: Sourcing from a China Clothing Manufacturer

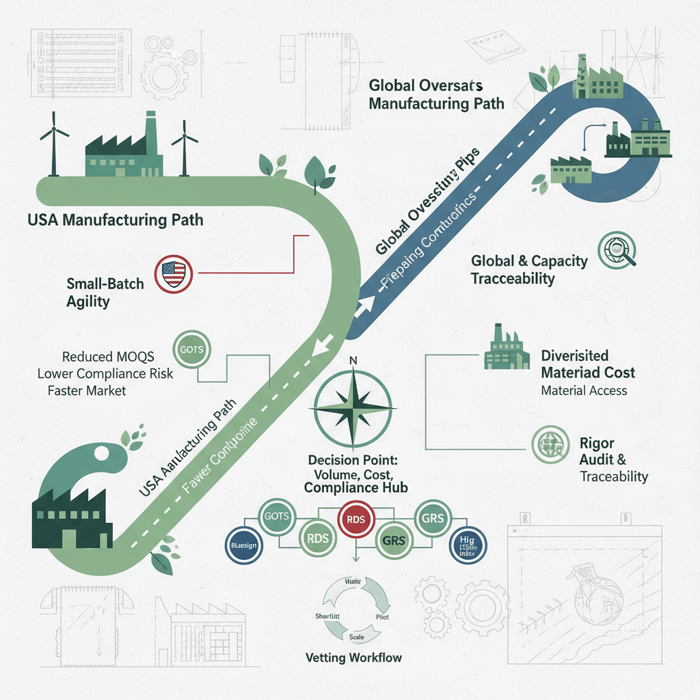

Mens wear wholesale decisions shape margin, quality, and delivery windows for US/EU brands. Working directly with a China Clothing Manufacturer like Eton connects you to OEM/ODM capabilities, deeper compliance control, and scalable production for jackets, padded coats, and technical apparel. This guide distills factory-floor methods into a practical sourcing playbook you can apply immediately.

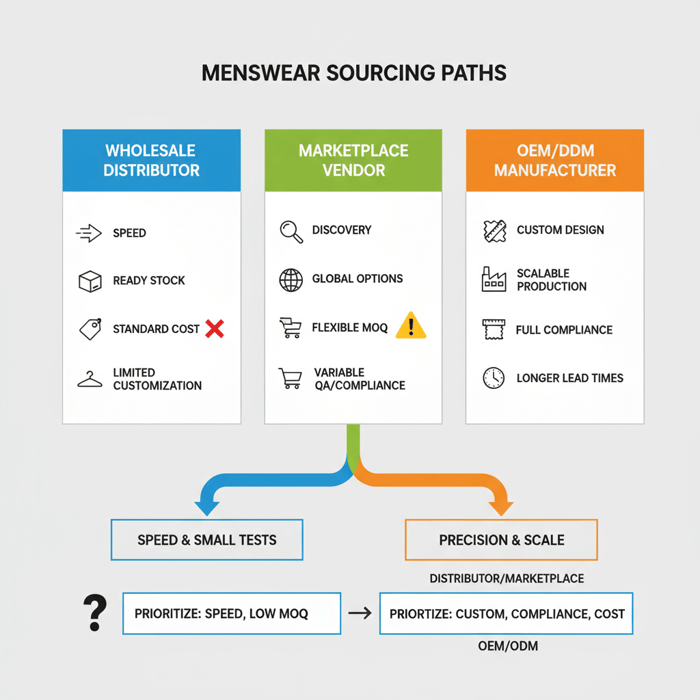

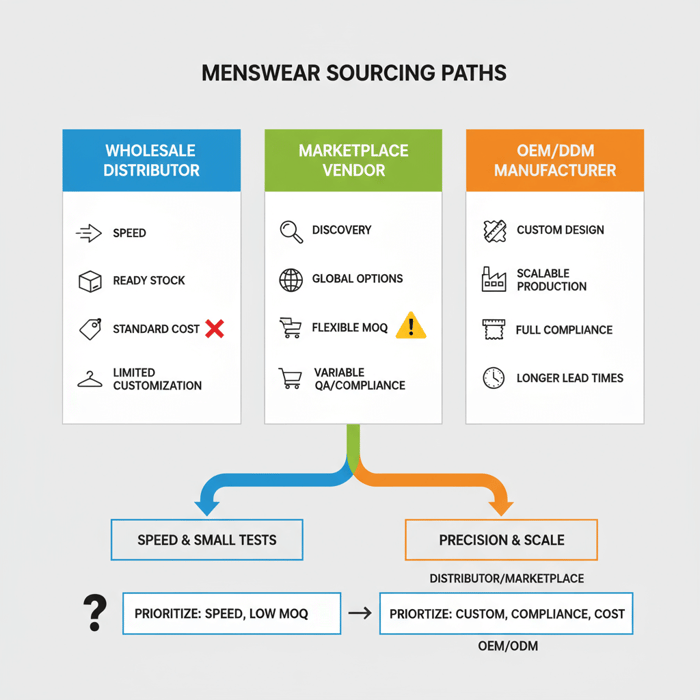

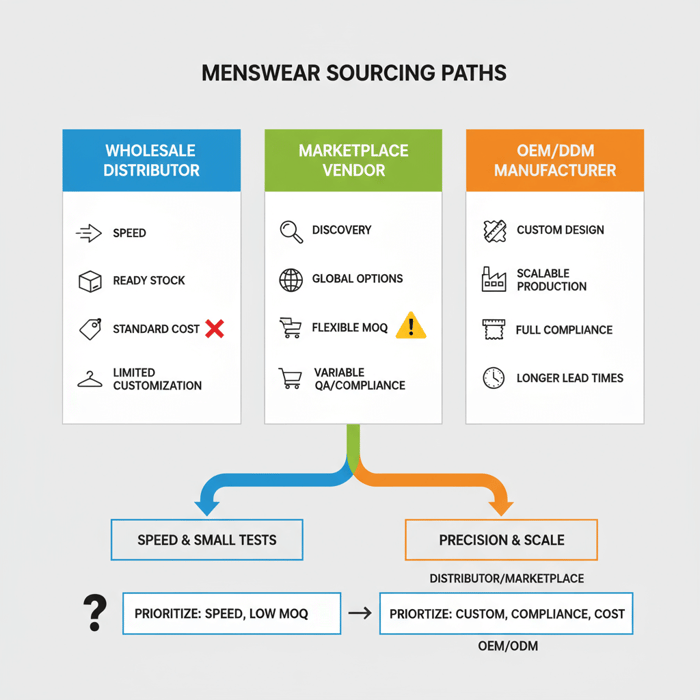

Mens wear wholesale means bulk buying men’s apparel from distributors, marketplaces, or an OEM/ODM China Clothing Manufacturer. For brands, OEM/ODM secures custom fit, materials, QA, and US/EU compliance—often at lower unit cost once MOQs and lead times align with your forecast. Distributors suit speed; OEM suits precision and scale.

Mens Wear Wholesale Models Explained (Distributor, Marketplace, OEM/ODM)

Wholesale models vary by control, speed, and customization. Distributors offer immediate assortment, marketplaces enable vendor discovery and small tests, and OEM/ODM manufacturers deliver custom fit, QA, and compliance control at scale. For menswear quality and reliability, OEM/ODM usually wins once MOQs and timelines fit your calendar.

| Supplier Type | Strengths | Constraints | Best Use |

|---|---|---|---|

| Distributor | Speed, ready-made assortments, low development overhead | Limited customization, variable compliance documentation, narrower size/fit control | Urgent replenishment, test buys under time pressure |

| Marketplace Vendor | Discovery across regions, competitive pricing, flexible MOQs | Opaque QA, mixed certification standards, fragmented communication | Pilot runs, small-batch exploration, category scouting |

| OEM/ODM Manufacturer | Custom fit, fabric selection, end-to-end QA, compliance-first workflows | Higher MOQs, structured lead times, more upfront preparation | Seasonal programs, technical outerwear, long-term brand development |

Distributor & Marketplace Wholesale

Distributor models supply finished menswear with little development prep. You gain speed, a defined assortment, and standardized pricing tiers. The trade-off: limited control over fits, fabrics, and trims. Compliance documentation may be uneven, with labeling and test reports ranging from strong to minimal. Marketplace vendors unlock global options—China, Bangladesh, Turkey, Vietnam—and often offer low or negotiable MOQs, but vendor vetting becomes critical. Profile reviews, sampling, and factory audits reduce risk. Marketplace buying fits short runs, trials, and opportunistic buys, yet brands carry higher QA oversight and potential performance variance across styles. [CITE: Summary of marketplace vetting effectiveness in apparel sourcing, 2024] [MENTION: Alibaba.com Guides] [MENTION: Shopify wholesale sourcing articles] [INTERNAL LINK: Our foundational guide on wholesale vs OEM/ODM apparel]

OEM/ODM Menswear Manufacturing

OEM/ODM manufacturers build to your tech pack. You set measurements, fabric, fill, trims, stitch density, seam sealing, and finish standards. QA becomes structured: pre-production sampling, lab testing, and AQL plans by lot size. You also secure compliance pathways for US CPSIA and EU REACH—labels, fiber content, flammability for applicable items, and restricted substances. MOQs are higher but unlock lower unit costs, consistent fit blocks, and season-to-season stability. Eton’s outerwear specialization—down jackets, parkas, and performance sportswear—aligns with technical requirements, thermal targets, and breathable membranes. [CITE: Technical apparel development benchmarks in Asia, 2023–2024] [MENTION: WRAP and BSCI certifications] [INTERNAL LINK: Our OEM/ODM resource hub]

Decision Criteria & Scoring

Rank your needs against five criteria—cost control, customization, compliance, speed, and scalability. Score each supplier type from 1–5. If the sum for OEM/ODM exceeds the distributor or marketplace route, proceed with development. If speed dominates and compliance risk is low, a distributor may suit. A marketplace route fits tests when compliance is checked via sample testing and vendor certifications.

| Criteria | Distributor | Marketplace Vendor | OEM/ODM Manufacturer |

|---|---|---|---|

| Cost Control | 3 (standard tiers) | 3 (varies by vendor) | 4–5 (defined BOM, negotiation) |

| Customization | 2 (limited) | 3 (moderate) | 5 (full tech pack) |

| Compliance | 3 (varies by brand) | 2–3 (uneven) | 5 (planned tests, documentation) |

| Speed | 5 (fast) | 4 (moderate) | 3–4 (lead-time windows) |

| Scalability | 3 (limited design control) | 3 (fragmented capacity) | 5 (program-level scale) |

Mens Wear Wholesale Costs, MOQs, and Lead Times (US & EU Context)

Menswear unit cost hinges on fabric, fill, trims, workmanship, finishing, compliance tests, and freight. OEM MOQs typically range 300–1,000+ units per style; technical outerwear lead times sit around 60–120 days. US/EU compliance, seasonality, and port conditions inform buffers and negotiation windows.

- Outerwear demand growth in US/EU: +X% — 2024 ([CITE: Regional retail index, 2024])

- Average Asia–US ocean transit: 22–35 days — 2024 ([CITE: Freight benchmark report, 2024])

- EU REACH SVHC list updates — ongoing ([CITE: ECHA guidance])

- US CPSIA labeling compliance — 2024 ([CITE: CPSC compliance overview])

Pricing Inputs & Cost Drivers

- Fabric and Fill: Nylon, polyester, cotton, wool blends, and performance membranes (PU, TPU, ePTFE); down-fill power and synthetic insulation weights affect warmth-to-weight and price. [CITE: Fabric and insulation cost benchmarks, 2024] [MENTION: Toray, Polartec]

- Trims and Hardware: Zippers (reverse coil, vislon), snaps, toggles, seam tapes, branded labels; corrosion resistance and finish add cents per unit that scale at volume.

- Workmanship and Construction: Stitch density, seam sealing, bartack reinforcement, panel count; higher complexity raises labor minutes and defect risk.

- Finishing and Treatments: DWR, anti-pilling, antimicrobial, garment washes; REACH-compliant chemistries may carry premiums and testing costs.

- Testing and Compliance: Fiber content verification, RSL screening, flammability (where applicable), nickel release; lab fees vary by test scope and country. [CITE: EU REACH textile guidance] [MENTION: ECHA]

- Freight and Incoterms: FOB, CIF, DDP shift cost allocation; ocean vs air freight impacts landed cost and speed. [CITE: Ocean spot rate averages, 2024]

MOQs by Category

| Category | MOQ Range (units/style) | Notes |

|---|---|---|

| T-shirts | 300–600 | Lower MOQs with solid colors; prints or specialty fabrics may raise MOQs. |

| Woven Shirts | 400–800 | Yarn-dyes and special finishes increase MOQs and lead times. |

| Knits/Sweatshirts | 400–800 | Fleece weights and rib trims influence MOQ and price. |

| Jackets/Anoraks | 600–1,200 | Multiple panels, lining, and seam sealing add complexity. |

| Parkas/Padded Coats | 800–1,500 | Down or synthetic fill; baffle design drives production time. |

| Technical Outerwear | 800–1,800 | Membrane bonding, taped seams, and performance tests require higher MOQs. |

Lead-Time Planning & Calendars

Lead times reflect a chain: fabric booking, trims procurement, sample rounds, approvals, bulk production, and testing. Technical outerwear spans 60–120 days. Align calendars to US/EU retail drops. Add buffers for REACH/CPSIA lab queues, port congestion, and holiday closures. Air freight accelerates at a higher cost; DDP simplifies customs at premium. [CITE: Seasonal lead-time impacts in apparel, 2024] [MENTION: World Trade Organization trade review] [INTERNAL LINK: Mens outerwear manufacturing costs pillar]

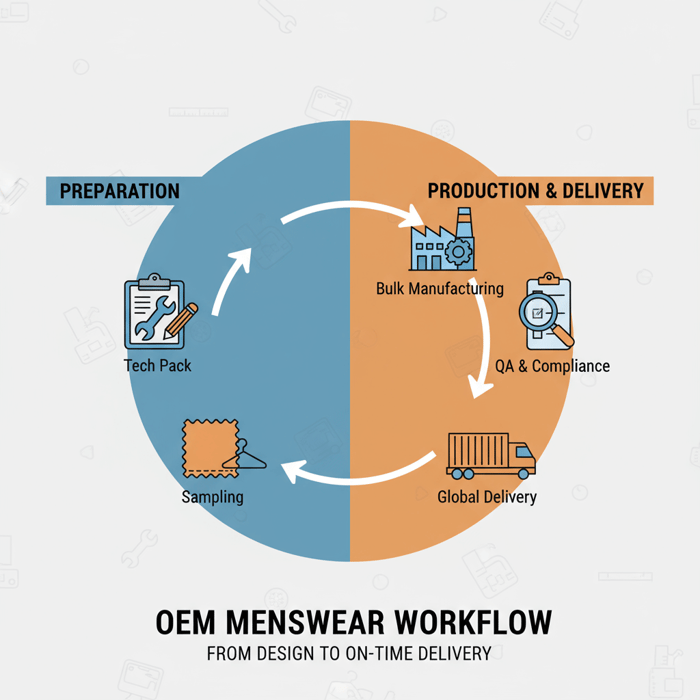

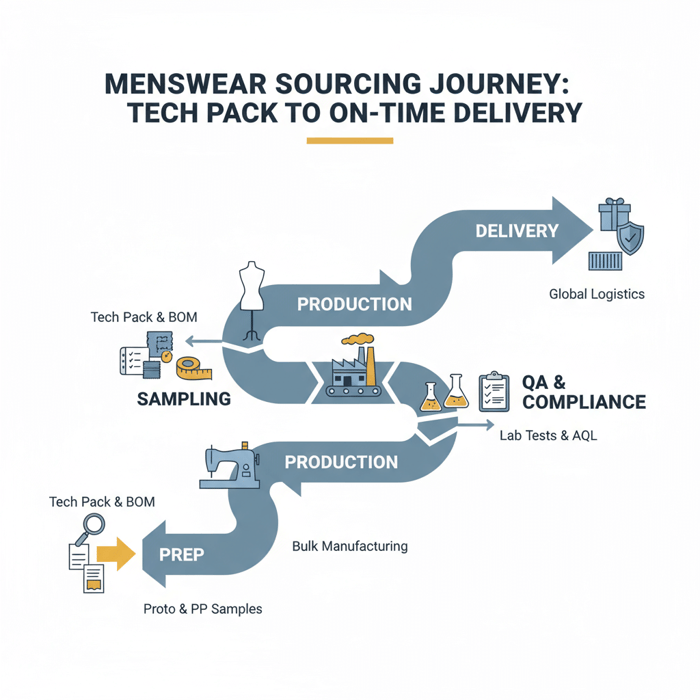

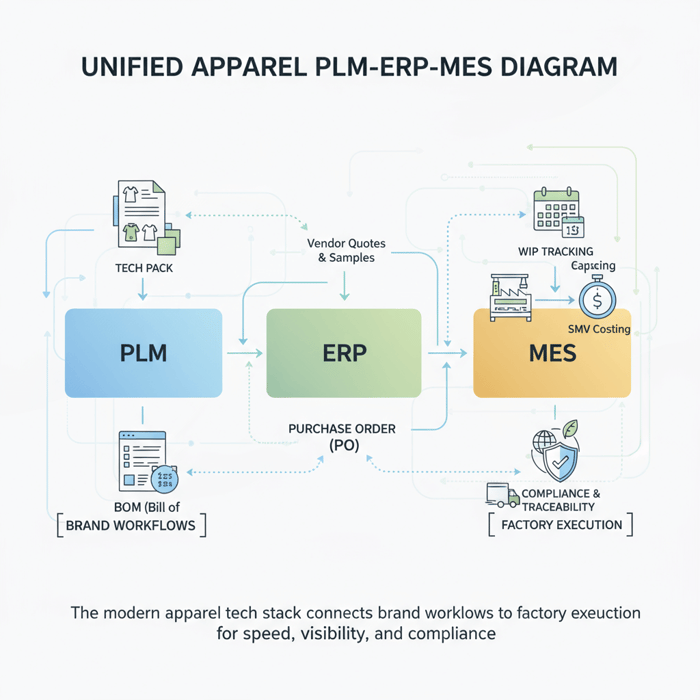

How to Source Mens Wear Wholesale from a China Clothing Manufacturer

Follow a structured OEM/ODM workflow: define requirements, build a tech pack, sample, confirm BOM, negotiate MOQs/pricing/incoterms, plan QA and testing, place POs, monitor production, and inspect before shipment. Clear checkpoints cut rework, secure compliance, and protect margins.

Preparation (Requirements, Tech Pack, BOM)

- Define Range: Style count, colorways, size runs, and target landed cost by market.

- Tech Pack Build: Measurement charts, grading rules, stitching diagrams, seam types, trims spec, label art, care instructions, packaging, and carton details. [CITE: Apparel tech pack standard references]

- Materials and BOM: Fabric codes, fill details (down power or gram weights of insulation), membranes, tapes, zippers, snaps; nominate approved mills if needed.

- Standards and Tests: RSL, REACH scope, CPSIA labeling, flammability where applicable, nickle release, fiber content; select labs and test timelines. [MENTION: CPSC] [MENTION: ECHA]

- Forecast and MOQ Strategy: Aggregate demand across sizes and colorways to hit tiered pricing breaks; consider carryover fits to reuse blocks.

Execution Steps (Sampling → Bulk → Inspection)

- Fit Sample: Validate silhouette, mobility, and comfort across sizes; note panel alignment and stitch consistency.

- Proto Sample: Confirm fabric/trim feasibility; adjust BOM for performance and cost targets.

- Pre-Production (PP) Sample: Finalize measurements, construction, and trims for bulk; lock tolerances.

- TOP Sample: Pull from bulk line for last-mile checks—labels, packaging, and barcode validation.

- Production Monitoring: Track line loading, daily output, first-article inspections, and defect trend logs.

- Pre-Shipment Inspection: Book AQL-based inspections; verify carton markings and sealing integrity.

- Shipping Prep: Confirm Incoterms (FOB/CIF/DDP), insurance, and routing; align with customs clearance requirements.

Quality Assurance (AQL, Lab Tests, Compliance)

Choose AQL levels by risk and price point (e.g., AQL 2.5 for major defects, 4.0 for minor). Build sampling plans proportionate to lot size. Lab tests should map to your product risk profile: fiber content, RSL screening, colorfastness, dimensional stability, seam strength, waterproofness, breathability, flammability when applicable, nickel release, and labeling accuracy. Document traceability through fabric lots and production lines. [CITE: AQL methodology in apparel QA] [MENTION: ISO standards for textiles] [INTERNAL LINK: Our guide to compliance-first sourcing]

Mens Wear Wholesale: Supplier Types Compared for Brands

Compare distributor, marketplace vendor, and OEM/ODM manufacturer across cost, control, compliance, speed, and scalability. OEM/ODM fits brands seeking consistent fit and long-term value. Distributors work for urgent fills; marketplaces help discovery and small tests.

| Attribute | Distributor | Marketplace Vendor | OEM/ODM Manufacturer |

|---|---|---|---|

| Unit Cost (long-term) | Moderate | Variable | Lower at scale |

| Customization | Minimal | Moderate | Full control |

| Compliance Control | Mixed | Mixed | Structured |

| Lead Time | Fast | Moderate | Planned windows |

| Scalability | Limited | Fragmented | Program-level |

Criteria Overview (Cost, Control, Compliance, Speed, Scale)

Cost tracks over seasons, not single buys. Control covers fit, BOM, and process transparency. Compliance requires structured testing and documentation to match US/EU rules. Speed relates to sampling rounds and supply chain readiness. Scale reflects multi-style drops and continuity across seasons. Prioritize what protects your margin and reputation.

Decision Framework (When to choose OEM vs Marketplace vs Distributor)

- Choose OEM/ODM when fit precision, fabric performance, and brand equity matter most over multiple seasons.

- Choose Marketplace vendors for exploratory runs, cost benchmarking, and short-cycle capsules with verified compliance.

- Choose Distributors for urgent replenishment, fill-in sizes, or promotional events where development time is limited.

[CITE: Retail calendar planning studies, 2023–2024] [MENTION: McKinsey — State of Fashion 2024] [INTERNAL LINK: Strategic sourcing decision models]

US & EU Menswear Wholesale Trends and Demand Signals (2023–2025)

US/EU menswear demand favors technical outerwear, sustainable materials, and seasonless staples. Brands seek resilient supply chains and stronger documentation. OEM partnerships grow where customization and compliance reporting are non-negotiable.

- Menswear global revenue trend — 2023–2025 ([CITE: Statista market data, 2024])

- US/EU preference for performance and sustainability — 2024 ([CITE: McKinsey State of Fashion])

- Trade resilience initiatives and freight normalization — 2024 ([CITE: WTO trade review])

Technical Outerwear & Performance

Demand for weather-ready menswear rose with urban commuting and outdoor leisure. Breathable membranes, seam sealing, and ergonomic patterning became standard for premium lines. Brands rely on factories with bonded fabric capabilities, taping accuracy, and moisture-management testing. Legacy fit blocks evolve into performance fits with mobility allowances in the elbow and shoulder zones. [CITE: Performance apparel segment growth, 2024] [MENTION: Gore, Schoeller]

Sustainability & Seasonless Basics

Recycled polyester, organic cotton, and verified down sourcing support sustainability claims. Seasonless silhouettes—tees, sweats, overshirts—smooth demand across quarters. Compliance intersects with sustainability: RSL adherence, traceable raw materials, and factory audits. Brands document fiber content and chain-of-custody to align with retailer mandates. [CITE: Sustainability adoption rates in apparel, 2024] [MENTION: Textile Exchange]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s OEM Service covers menswear end-to-end: design input, fabric sourcing, sampling, bulk production, QA, and compliance documentation for US/EU. The focus is outerwear, padded coats, and technical apparel, with capacity across China and Bangladesh factories.

| Brand Need | Eton OEM Feature | Outcome | Time/Cost Range |

|---|---|---|---|

| Technical Jacket launch | Membrane bonding, seam taping, lab test planning | Verified performance metrics, durable construction | Sampling: 3–6 weeks; Bulk: 60–100 days |

| Padded coat program | Down/synthetic fill management, baffle design, warmth targets | Consistent thermal performance across sizes | Sampling: 3–5 weeks; Bulk: 70–120 days |

| Compliance-first rollout | US/EU documentation, RSL testing, labeling audits | Reduced customs risk, retailer-ready reporting | Testing: 7–14 days per batch |

| Seasonal scaling | Multi-factory capacity, calendar alignment | On-time deliveries across drops | Planned by program size |

Use Case: Technical Jacket—Problem → Solution

Problem: A US/EU brand needs a storm-proof commuter jacket with breathability, taped seams, and ergonomic motion. Solution: Eton defines the BOM with membrane selection, seam tapes, zipper spec, and reinforced stress points. Fit is proven through PP samples; lab checks confirm water column and MVTR. Result: Consistent performance across sizes, lower warranty returns, and documented compliance. [CITE: Breathability and waterproof test standards in apparel] [MENTION: ISO 11092]

Use Case: Padded Coat—Problem → Solution

Problem: A winter program requires stable warmth and minimal cold spots. Solution: Eton applies baffle mapping tuned to body zones, selects down fill power or synthetic gram weights, and locks sewing sequence for loft retention. Testing covers thermal retention, fiber content, and down integrity. Result: Reliable warmth ratings and repeatable quality across runs. [CITE: Down provenance and fill power testing references] [MENTION: Responsible Down Standard]

Start OEM menswear production with Eton’s Clothing Manufacturing OEM Service: China factory and Bangladesh capacity. [INTERNAL LINK: Start OEM menswear production → product page]

Risks, Compliance & Localization for US & EU Imports

Mitigate risk with factory audits, sampling discipline, AQL inspections, and documented REACH/CPSIA compliance. Plan labeling, fiber content verification, and chemical tests early. Align Incoterms with insurance, add buffers for customs and port conditions, and keep test records accessible.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Quality variance | Medium | High | AQL inspections, line audits, TOP sample checks |

| Compliance failure | Low–Medium | High | Pre-book tests, maintain RSL documentation, label audits |

| Late delivery | Medium | High | Calendar buffers, material bookings, alternative routing |

| Freight disruption | Medium | Medium | Carrier diversification, cargo insurance, DDP planning |

| Customs hold | Low | Medium–High | Complete documentation, pre-clearance checks, compliant labeling |

Regulatory Notes for US & EU

- US CPSIA: Labeling (tracking, fiber content), flammability where applicable, and children’s wear stipulations if relevant. [CITE: CPSC CPSIA guidance]

- EU REACH: RSL and SVHC screening, nickel release for metal trims, azo dyes restrictions, and packaging compliance. [CITE: ECHA REACH guidance]

- Ethical Sourcing: BSCI, WRAP, and ISO-aligned systems support retailer audits and public reporting. [CITE: Ethical sourcing certification frameworks]

- Incoterms: FOB shifts risk at port; CIF covers freight and insurance; DDP simplifies customs at higher landed cost. [CITE: ICC Incoterms overview]

Conclusion & Next Steps

Mens wear wholesale choices hinge on cost, control, and compliance. OEM/ODM with a China Clothing Manufacturer gives brands precision, performance, and scale. Next steps: finalize tech packs, move through sampling, lock QA and testing, and schedule production against your US/EU retail calendar.

- Scope styles and demand to set MOQs and tiered pricing.

- Build complete tech packs and confirm BOM for fabric, fill, trims.

- Plan lab tests for REACH/CPSIA and book inspection windows.

- Align Incoterms and freight routing to your launch dates.

- Place orders with calendar buffers and track line output.

[INTERNAL LINK: OEM/ODM resource hub] [INTERNAL LINK: Mens outerwear manufacturing costs] [INTERNAL LINK: Wholesale vs OEM/ODM apparel]

Author: Senior Apparel Sourcing Strategist, 12+ years factory-side and brand-side experience. Reviewer: Head of Quality & Compliance, Eton Garment Limited.

Methodology: Based on Eton’s factory operations in China and Bangladesh, OEM workflows, US/EU compliance guidelines, and recent industry reports; pricing ranges reflect typical specs and may vary. Limitations: Supplier examples are representative; timelines and costs depend on final specs, volume, and seasonality. Disclosure: Eton provides OEM/ODM manufacturing services; this guide integrates those capabilities. Last Updated: 2025-10-28.

- [CITE: McKinsey & Company — The State of Fashion 2024]

- [CITE: Statista — Menswear market revenue (2023–2024)]

- [CITE: European Chemicals Agency — REACH Regulation Guidance for Textiles]

- [CITE: U.S. Consumer Product Safety Commission — CPSIA Requirements for Apparel]

- [CITE: World Trade Organization — World Trade Statistical Review 2024]

- [CITE: Shopify Blog — Wholesale Clothing: How to Source for Your Boutique]

- [CITE: SaleHoo — Wholesale Men’s Clothing Suppliers: The Ultimate Guide]

- [CITE: Alibaba.com Blog — Sourcing Men’s Clothing Wholesale from China]

- [CITE: DSers Blog — Best Wholesale Clothing Suppliers (2024)]

- [CITE: ICC — Incoterms Overview]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »