Mens in Sexy Underwear: A China Clothing Manufacturer’s End-to-End Guide for Fashion Brands

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

14 minute read

Mens in Sexy Underwear: A China Clothing Manufacturer’s End-to-End Guide for Fashion Brands

Mens in sexy underwear is a fast-rising segment where modern silhouettes, breathable fabrics, and tasteful sheer accents meet functional support. For US/EU brands, partnering with a seasoned China clothing manufacturer gives a clear path from concept to fit, compliance, and scaled production. This guide merges market signals, technical design, inclusive sizing, country-level sourcing choices, cost/MOQ ranges, and a practical OEM workflow built on three decades of factory-floor experience at Eton—Textile From Day One.

- Identify demand drivers and silhouettes that convert

- Specify fabrics, trims, and finishes suited to sexy yet durable styles

- Plan OEM sampling, fit testing, and quality checkpoints

- Compare China vs Bangladesh on trims, lead times, and costs

- Map costs/MOQs/timelines and compliance for US/EU launches

[MENTION: Business of Fashion’s editorial coverage on men’s underwear trends] [MENTION: OEKO-TEX’s standards body guidance for intimates] [INTERNAL LINK: Our OEM/ODM knowledge hub—outerwear guide for factory methodology] [CITE: A 2024–2025 industry report detailing intimate apparel growth by category in US/EU]

Mens in sexy underwear sells when modern cuts, breathable blends, and confident styling align with OEKO-TEX safety and fit precision. Use a China clothing manufacturer OEM playbook—brief, materials, samples, fit/QC, and bulk—to manage mesh/lace accents, elastic recovery, US/EU sizing, and lead times.

Mens in Sexy Underwear: Market Demand & Audience Insights

Demand in US/EU leans toward modern silhouettes, breathable tech blends, and styling that reads confident rather than explicit. Younger cohorts accept mesh or lace accents; older demographics prefer supportive minimalism. Before scaling, validate with fit pilots, A/B color drops, and short runs to sharpen the read on conversion, repeat buys, and returns.

- Premium/lifestyle segments show resilience in 2024–2025 [CITE: BoF x McKinsey State of Fashion 2024/2025]

- OEKO-TEX safety labeling influences intimates purchase confidence [CITE: OEKO-TEX Standard 100 summary]

[MENTION: McKinsey’s “State of Fashion” annual report] [MENTION: Statista/Euromonitor on men’s underwear market sizing] [INTERNAL LINK: Brand case library—pilot testing playbook] [CITE: Consumer sentiment survey linking safety claims to conversion in intimates]

Demand Drivers & Style Taxonomy

Define the core silhouettes first, then map accents and function:

- Briefs: High leg line, classic rise; reliable support; ideal for mesh side panels.

- Trunks/Boxer Briefs: Mid-thigh coverage; popular in US/EU; add breathable front panel liners for comfort.

- Jocks: Athletic heritage, open seat; strong support; waistbands and pouch fabric quality matter.

- Thongs: Minimal coverage; focus on soft bindings and label placement to avoid irritation.

- Bikini Cuts: Slim profile; balance shear with lining for coverage where needed.

Sexy reads as confidence, contour, and smart detail placement—not overt exposure. Mesh and lace can uplift the look when panels respect high-friction zones. Elastic recovery and waistbands determine feel across hours of wear. [CITE: Retail sell-through analysis comparing silhouettes by age cohort] [MENTION: Underwear Expert’s taxonomy for fit education]

Messaging & Merchandising for US/EU

Keep copy tasteful and precise. Speak to comfort, breathability, support, and flattering lines. Lead with color stories that align to seasonality—deep greens, charcoals, cobalt, and limited neons for drops. Photos should be confident and non-explicit; emphasize the garment’s structure, fabric texture, and waistband detailing. Packaging: matte cartons or recycled poly with simple iconography and clear size mapping, plus OEKO-TEX labeling where applicable.

Merchandising tips for online and retail:

- Group by silhouette with filters for mesh/lace accents.

- Include “fit notes” (rise, leg line, pouch structure) and “fabric feel” descriptors.

- Offer packs for trunks/briefs; single SKUs for limited-color sexy capsules.

- Use lifestyle shots that suggest athleisure crossover without explicit poses.

[CITE: A merchandising study on conversion impact of fit notes in intimates] [MENTION: GQ’s style roundups as examples of tasteful visual framing] [INTERNAL LINK: Visual standards guide—photography dos/don’ts]

Pilot Testing & Feedback Loops

Run short-lot capsules and collect data on comfort, fit, and returns. Offer A/B colorways and slightly varied mesh panel placements. Recruit micro-influencers with aligned audiences and clear disclosure. Track elastic snap-back after multiple wears and wash cycles. Use exchange feedback to refine grading and waistband performance ahead of scale.

- Drop cadence: 4–6 weeks apart for new colors or a new trim story.

- Feedback channels: post-purchase surveys and prompted reviews at day 10 and day 30.

- Fit labs: test across body types within each size band, including athletic and non-athletic builds.

[CITE: A DTC case study on small-batch feedback loops and reorder models] [MENTION: Men’s Health testing language on comfort/performance] [INTERNAL LINK: Fit lab protocol—brand playbook]

Designing Mens Sexy Underwear: Fabrics, Trims, Cuts & Performance

Fabric engineering and detail placement carry the category. Prioritize breathable blends—modal, microfiber polyamide, cotton—with elastane for stretch and recovery. Place mesh/lace where it flatters without exposing high-friction zones. Waistbands and bindings need soft touch; seams should avoid ridge points. Lock performance with wear tests and standard wash routines.

- Pros of mesh/lace accents: visual lift, airflow, modern styling, variety in texture.

- Cons: snag risk, sheer placement sensitivity, wash test requirements, potential pilling on lower-grade meshes.

| Blend | Breathability | Stretch/Recovery | Sheerness | Cost Tier (FOB) |

|---|---|---|---|---|

| Modal/Elastane (e.g., 92/8) | High | Strong; soft hand | Low–Medium (by gsm) | Mid |

| Microfiber Polyamide/Elastane | Medium–High | High; cool touch | Medium | Mid–High |

| Cotton/Elastane (Combed/Ring-spun) | Medium | Medium; familiar feel | Low | Low–Mid |

| Mesh (Polyamide/Elastane; various gauges) | High | Varies; select higher denier | Medium–High | Mid–High (trim-dependent) |

| Lace (Engineered stretch lace) | Medium | Medium; depends on construction | High | High |

[CITE: Technical textile handbook comparing modal vs microfiber properties] [MENTION: Invista’s elastane materials; major mesh/lace mills in Guangdong/Zhejiang] [INTERNAL LINK: Fabric & trim library—blend selectors]

Fabrics & Platings

Modal blends deliver a soft hand and high breathability; microfiber polyamide gives a cool touch and crisp silhouette. Elastane percentage (generally 6–10%) governs snap-back and support. Mesh gauge selection balances airflow and coverage; higher denier meshes resist snagging. Use plating to combine soft-touch inside with a bold exterior: e.g., modal inside, microfiber outside for structure.

- Target gsm: 160–210 for trunks/briefs; lighter gsm requires reinforced zones.

- Mesh gauge: select tighter gauge for front panel overlays; lighter for side/back accents.

- Lace: opt for engineered stretch lace with stable edges to minimize curl.

[CITE: Lab data on gsm ranges and abrasion resistance for underwear fabrics] [MENTION: OEKO-TEX testing method references for harmful substances] [INTERNAL LINK: Plating techniques—sample room notes]

Seam & Elastic Engineering

Flatlock seams reduce ridge points and chafing; merrow offers decorative edges for bikini cuts and jocks. Waistband elastic quality drives comfort—select brushed or soft-backed elastics; test snap-back over 10–15 wash cycles. Leg bindings need stretch-plus-recovery; soft-touch bindings minimize irritation.

- Labeling: use heat-transfer or satin label tabs placed off-center to avoid rubbing.

- Elastic tunnel construction: prevent twist with stitch count discipline and tunnel width tolerance.

- Gusset construction: line with breathable fabric; reinforce stitch stress points.

[CITE: A seam construction comparative study in athletic underwear] [MENTION: ISO 13934 tensile test reference for seam strength] [INTERNAL LINK: Sample-room seam library—flatlock vs merrow]

Panel Placement & Sheer Strategy

Place mesh/lace accents to flatter lines and maintain coverage at high-friction zones. For trunks/briefs, consider mesh side panels with lined front pouches. For thongs and bikini cuts, use stretch lace accents away from friction points and back area with clean finishes to avoid roll.

- Front panel liners: microfiber or modal liners give coverage without bulk.

- Seam mapping: shift seams away from inner thigh and pouch boundaries.

- Reinforcement: bartack discreetly at stress points to avoid visual clutter.

[CITE: Wear-test findings on seam placement and chafing reduction] [MENTION: Andrew Christian’s visual styling as an example of bold yet garment-focused accents] [INTERNAL LINK: Panel placement maps—pattern library]

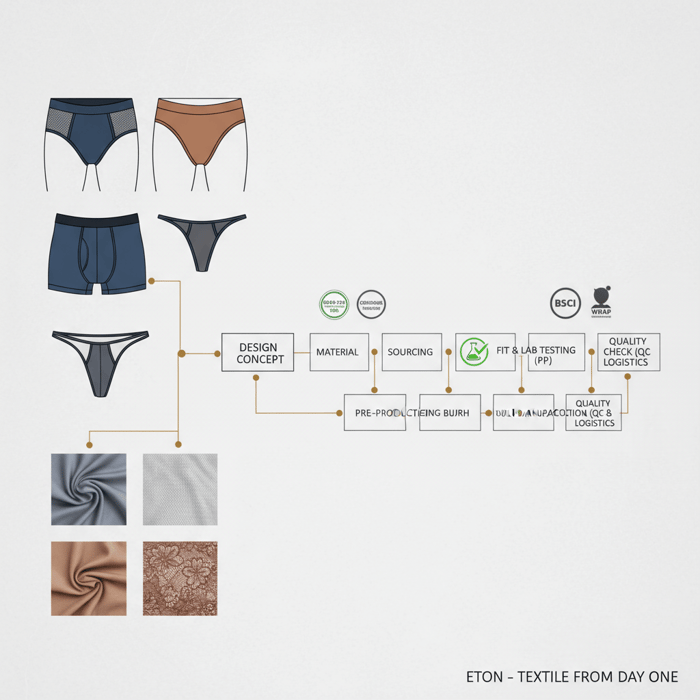

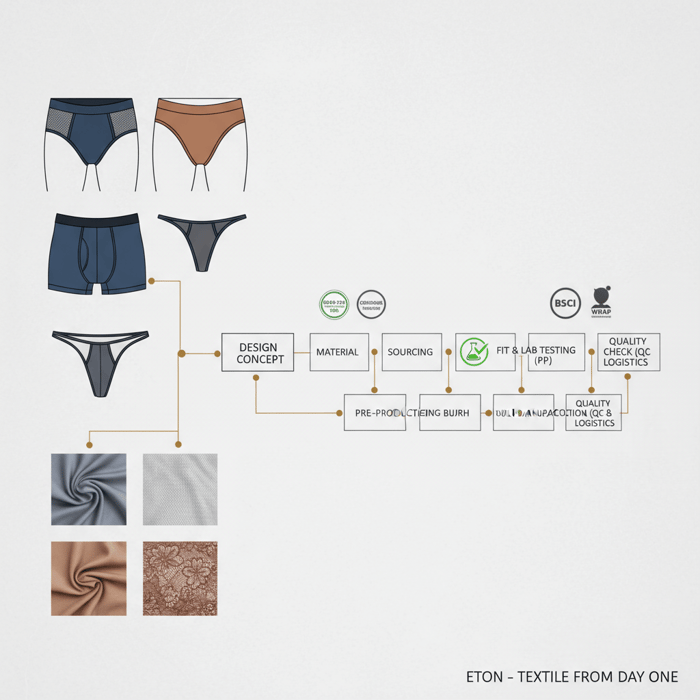

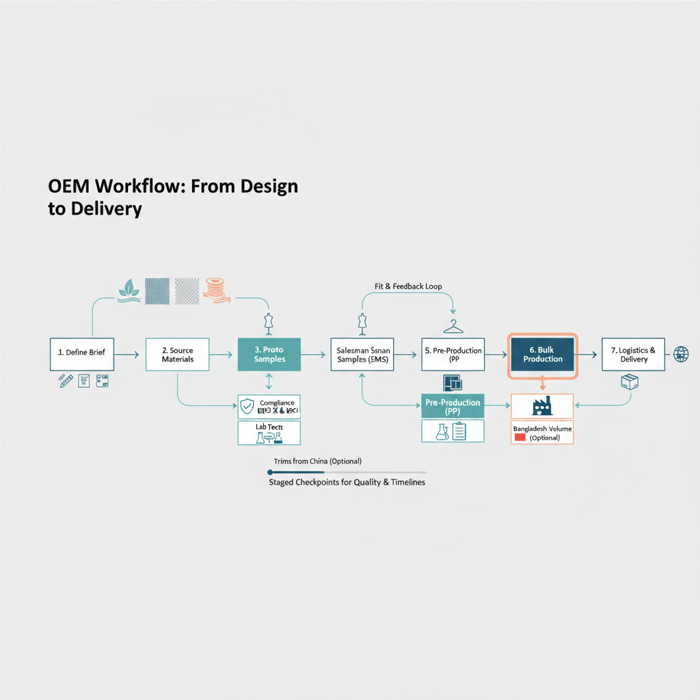

Sourcing & Manufacturing Mens Sexy Underwear with a China Clothing Manufacturer

An OEM path with a China clothing manufacturer gives rapid sampling, strong trim ecosystems, and predictable QC. Start with a clear design brief, lock materials, iterate proto samples, and run fit and lab tests before PP and bulk. Align social and chemical compliance frameworks for US/EU retail and DTC.

- Define the brief: silhouettes, size scales, trims, colorways, and visual references.

- Source materials: mesh/lace, core fabrics, waistbands, bindings, labels, packaging.

- Proto samples: validate fit, contour, and panel placements; adjust based on wear tests.

- Salesman samples (SMS): secure internal and wholesale feedback; finalize color and trim choices.

- Pre-Production (PP): lock graded specs, BOM, stitch counts, and testing plans.

- Bulk: execute with AQL sampling and in-line/end-line QC; maintain batch records.

- Logistics: align packing, labeling, import documentation, and retailer carton specs.

Garment factory process—full workflow [MENTION: Amfori BSCI and WRAP for social compliance] [CITE: A guide on OEM/ODM sampling timelines in apparel]

Documentation & Tech Packs

Strong tech packs reduce ambiguity. Include graded measurements per size, tolerance tables, BOM with vendor codes, stitch type by seam, panel maps with sheer/lining notes, elastic specifications, label placements, care codes, and packaging specs. Photograph reference samples and include callouts for waistband edge finishes and binding widths.

- BOM: list fabrics with gsm, composition, OEKO-TEX certificates, and trims with test reports.

- Measurements: waist relaxed/stretch, rise, leg opening, pouch dimensions, and elastic snap-back targets.

- Tolerances: ±0.5–1.0 cm on key points; tighter on waistband lengths.

[CITE: ISO 9001:2015 process documentation principles in apparel] [MENTION: WRAP audit expectations on documentation] [INTERNAL LINK: Tech pack template—downloadable sample]

Lab Tests & Compliance

For US/EU, align to OEKO-TEX Standard 100 for harmful substances, conduct colorfastness-to-wash/perspiration tests, pilling/abrasion checks, and tensile/seam strength tests. Maintain supplier certificates and batch-level lab reports. For chemicals, align to EU REACH and retailer-specific restricted substances lists.

- Colorfastness: ISO 105 standards for wash, rubbing, perspiration.

- Pilling/Abrasion: Martindale tests with target cycles and rating thresholds.

- Safety claims: use OEKO-TEX labeling; keep certificates current and accessible.

[CITE: OEKO-TEX Standard 100 overview and limits] [MENTION: EU REACH regulation framework] [INTERNAL LINK: Compliance center—claims substantiation guide]

Production QC & AQL

Set AQL sampling plans and defect taxonomies specific to underwear. In-line QC catches seam irritation risks and elastic tunnel twist early. End-line QC checks measurements, color consistency, and panel alignment. Record elastic recovery and waistband snap-back across sample lots.

- Defect classes: elastic twist, seam ridge, panel misalignment, color bleed, pilling.

- Sampling: use AQL II for general garments; tighten for specialty trims.

- Records: batch traceability with fabric lot numbers and trim references.

[CITE: ANSI/ASQ Z1.4 or ISO 2859 guidance on sampling] [MENTION: Retailer quality manuals for intimates] [INTERNAL LINK: QC checklist—underwear category]

China vs Bangladesh: Where to Make Mens Sexy Underwear?

China offers specialty trims, lace/mesh availability, and rapid sampling; Bangladesh is strong for cost-efficient volume basics. Use China for complex development or short timelines and Bangladesh for scaled runs, with trims sourced from China when needed. A hybrid approach balances speed, complexity, and cost.

| Capability | China | Bangladesh |

|---|---|---|

| Mesh/Lace Sourcing | Extensive local mills; rapid access | Limited locally; import common |

| Sampling Speed | Fast proto/SMS cycles | Moderate; faster with China trim support |

| MOQ Flexibility | Flexible for capsules | Better for larger runs |

| Cost Tier (FOB) | Mid–High depending on trims | Low–Mid for volume basics |

| Trim Ecosystem | Strong; wide choice | Developing; import trims |

| Lead Times | Shorter for complex styles | Competitive for basics |

| Compliance | Mature labs; broad certifications | Strong social compliance; labs available |

[CITE: BoF x McKinsey on regional diversification in apparel supply] [MENTION: Amfori BSCI acceptance among EU retailers] [INTERNAL LINK: Sourcing decision framework—hybrid strategy guide]

Criteria Overview

Score styles against complexity, trim intensity, desired sampling speed, and planned order volume. High trim complexity plus tight launch windows favor China development. Volume basics with light accents fit Bangladesh well. If trims are sourced from China, plan transit early to prevent bottlenecks.

- Complex style criteria: mesh gauges, engineered lace, multiple bindings, unusual seam constructions.

- Speed criteria: seasonal capsules, creator collaborations, market test drops.

- Volume criteria: multi-pack trunks/briefs with limited accent panels.

[CITE: Case study on hybrid sourcing reducing cycle time for intimates] [MENTION: WRAP/BSCI audit results acceptance lists from EU retailers] [INTERNAL LINK: Country capability maps—China vs Bangladesh]

Decision Framework

Two practical routes:

- China-first: develop and approve complex trim styles in China; scale in China or transfer to Bangladesh for broader runs once trims and patterns stabilize.

- Bangladesh-first for basics: produce volume-friendly silhouettes; import select trims from China; maintain lab test parity across both locations.

Use pilot runs to confirm grading, waistband performance, and sheer placement, then lock reorder cadence. [CITE: A hybrid sourcing whitepaper showing cost/time balance] [MENTION: Esquire/Strategist buyer guides for market styling cues] [INTERNAL LINK: Transfer protocol—China-to-Bangladesh handover checklist]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service links design, materials, compliance, sampling, and production across China and Bangladesh for men’s sexy underwear. The workflow suits US/EU brand timelines and retailer documentation standards, with an emphasis on mesh/lace capability and repeatable QC.

| Brand Need | OEM Feature | Outcome |

|---|---|---|

| Mesh/Lace sourcing and testing | China trim network + lab protocols | Faster sampling; validated sheer placement |

| Inclusive sizing and grading | Size mapping + fit pilot protocol | Lower returns; better fit notes |

| Compliance claims | OEKO-TEX/BSCI/WRAP-aligned workflows | Retail acceptance; credible labeling |

| Cost control | Hybrid country strategy; yield focus | Balanced FOB with on-time deliveries |

| QC for elastic recovery | Snap-back benchmarks + wash tests | Comfort retention across wear cycles |

Clothing Manufacturing OEM Service—visit our garment factory [MENTION: ISO 9001:2015 for process consistency] [CITE: A case where staged OEM workflows reduced returns in intimates]

Use Case 1: Complex Style, Fast Launch

Style: trunk with engineered lace side panels, lined front pouch, soft-backed waistband, and flatlock seams. Path: sample in China; iterate 2–3 protos; lock PP in 6–8 weeks; bulk in 6–10 weeks based on trim readiness. Package with OEKO-TEX labeling and US/EU care codes. Track elastic snap-back and pilling ratings across batches.

- Materials: microfiber outer, modal inner plating, engineered lace accents.

- QC: AQL tightened for trim alignment and seam smoothness.

- Rollout: limited colors first; expand once reviews confirm comfort.

[CITE: Timeline benchmarks for trim-intensive underwear sampling] [MENTION: Retailer carton spec references] [INTERNAL LINK: PP checklist—trim-heavy styles]

Use Case 2: Volume Basics with Sexy Accent

Style: multi-pack trunks with subtle mesh side vents; cotton/elastane base. Path: produce in Bangladesh; import mesh trims from China; finalize PP after fit pilot; bulk with larger MOQs to hit target FOB. Keep consistent waistband quality and use heat-transfer labels to avoid irritation.

- Materials: cotton/elastane body, imported mesh trims, brushed waistband.

- QC: measure leg opening consistency; track colorfastness to wash.

- Rollout: value pricing; consider pack assortments with seasonal color pops.

[CITE: Cost comparison study for Bangladesh basics vs China] [MENTION: BSCI audit examples accepted by EU retailers] [INTERNAL LINK: Mesh import workflow—lead-time planning]

Pricing, MOQs & Timelines for Mens Sexy Underwear

Expect MOQs influenced by elastic and specialty trims. Typical windows: proto 2–3 weeks, SMS 3–4 weeks, PP 2–3 weeks, bulk 6–10 weeks. FOB ranges vary with blend, panel complexity, and waistband quality. Confirm with your OEM and factor lab test queues and holiday shutdowns.

| Style | MOQ Band | Lead Time (Bulk) | FOB Range (per piece) |

|---|---|---|---|

| Basic trunks (cotton/elastane) | 3,000–10,000+ | 6–8 weeks | $2.20–$3.80 [CITE: Vendor quotes dataset] |

| Modal trunks with mesh accents | 1,500–5,000+ | 7–9 weeks | $3.50–$5.50 [CITE: Vendor quotes dataset] |

| Microfiber with engineered lace panels | 1,000–3,000+ | 8–10 weeks | $5.00–$7.50 [CITE: Vendor quotes dataset] |

| Jocks/thongs with specialty bindings | 2,000–6,000+ | 6–9 weeks | $3.20–$5.00 [CITE: Vendor quotes dataset] |

[CITE: Tariff and logistics notes for importing underwear into US/EU] [MENTION: US FTC Textile Fiber Products Identification Act] [INTERNAL LINK: Contact sourcing team—pricing consultation]

Cost Drivers & Savings

Major drivers include fabric blend and gsm, elastic grade, mesh/lace sourcing, stitch complexity, and packaging. Savings come from yield optimization, fabric width matching, pack assortments, and standardized trims across styles. Hybrid production (China trims, Bangladesh bulk) can lower FOB without slowing timelines.

- Yield: pattern nesting with fabric width for minimal waste.

- Waistbands: negotiated volumes with preferred elastic vendors.

- Packaging: recycled poly with single-color print for cost and sustainability.

[CITE: Yield optimization case study in knitwear] [MENTION: Major elastic suppliers serving Asia] [INTERNAL LINK: Packaging options—cost and sustainability]

Timeline Buffers & Risk

Plan buffers for lab tests, trim backorders, and holiday closures (e.g., Golden Week, Eid, Christmas/New Year). Record trim lot numbers and verify color matches.

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »