Manufacturer Clothing: How to Choose a China Clothing Manufacturer That Delivers

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

18 minute read

Manufacturer Clothing: How to Choose a China Clothing Manufacturer That Delivers

Manufacturer clothing decisions define margin, speed, and risk when choosing a China clothing manufacturer for outerwear. Brands in the US and EU weigh OEM vs ODM scope, MOQs, lead times, compliance, and region trade-offs. This guide turns complex choices into a practical roadmap grounded in three decades of garment factory experience at Eton Garment Limited.

A manufacturer clothing partner builds apparel at scale under OEM/ODM models. To choose a reliable China clothing manufacturer, validate certifications, sampling quality, QA, MOQs, and lead times; request traceability for UFLPA and chemical testing for REACH; compare China, Bangladesh, Vietnam, and domestic options; and run a pilot before bulk production for outerwear.

Strong outcomes flow from aligning SKU complexity with a factory’s technical depth, capacity, and compliance maturity. Use a six‑step vetting process, quantify cost/MOQ/lead-time ranges, and pressure‑test QA and traceability before purchase orders. China remains the hub for complex outerwear; Bangladesh excels at volumes and cost; Vietnam balances quality with competitive pricing; domestic offers speed at a premium. Eton’s dual‑base OEM/ODM model in China and Bangladesh integrates design, sourcing, and QA for outerwear, helping US/EU brands meet UFLPA and REACH obligations with predictable schedules and repeatable quality.

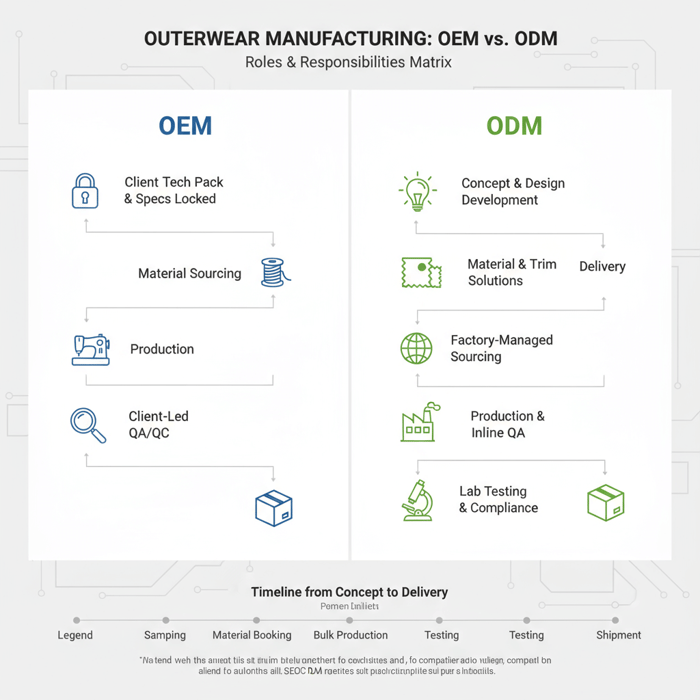

“Manufacturer Clothing” Explained: OEM vs ODM for Outerwear

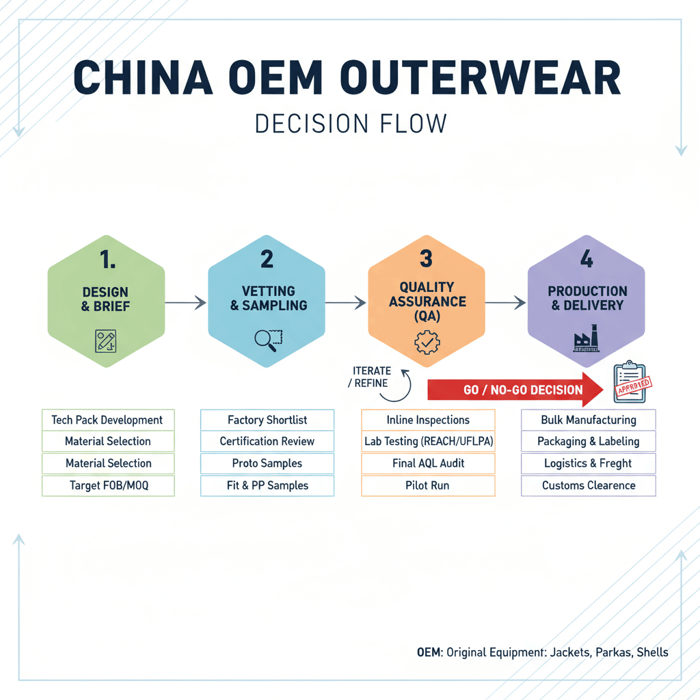

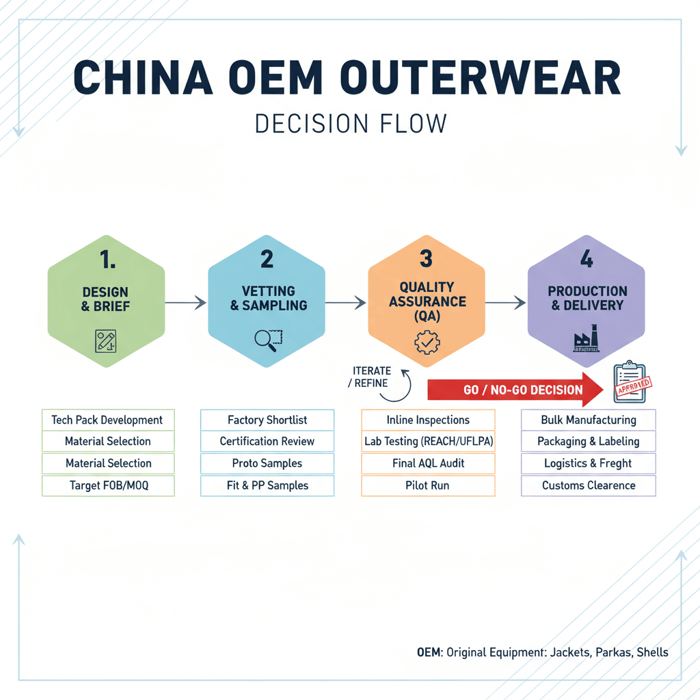

Manufacturer clothing typically means OEM or ODM apparel production. OEM executes your tech pack to spec; ODM adds design development and material solutions. For outerwear, factor insulation, seam sealing, laminations, and lab testing. Choose OEM when specs are locked; choose ODM when you need concept-to-spec support and faster iteration.

Manufacturer Types and Where They Fit

Choosing the right factory type accelerates development and lowers risk:

- Cut-and-Sew Specialist: Focused on assembly with limited sourcing. Fit: brands supplying fabrics/trims and tight tech packs. Risk: higher coordination load, fragmented accountability.

- Full-Package Manufacturer (FPP): Sources fabrics/trims, manages sampling, production, QA, and logistics. Fit: brands seeking end-to-end execution. Benefit: single accountable owner from lab dips to AQL.

- Outerwear-Only Factory: Expertise in insulation, seam sealing, taped constructions, waterproof zippers, and thermal mapping. Fit: down jackets, parkas, ski/snow, commute shells. Benefit: lower rework risk and fewer field failures.

- OEM vs ODM Partner: OEM suits locked specs and experienced teams. ODM suits lean teams or new lines needing patterning, construction choices, and testing plans to hit performance targets.

[MENTION: Patagonia’s technical garment approach], [MENTION: The North Face’s material innovation] reinforce why specialized partners matter for high-stakes outerwear. Complex builds need the right needles, tapes, machines, and an experienced QA playbook to avoid late-stage defects.

[INTERNAL LINK: Our foundational guide on ‘Outerwear OEM & ODM’]

Outerwear Complexity: Materials, Construction, Testing

Outerwear combines textiles, insulation science, and mechanical hardware. Plan for performance, durability, and compliance from sample one:

- Materials: 2–3 layer laminates, DWR-treated shells, ripstop, recycled synthetics, RDS-certified down, synthetic insulation (e.g., PrimaLoft).

- Construction: Seam sealing, bartacks at stress points, ultrasonic welding (select builds), storm flaps, snow skirts, adjustable cuffs and hoods.

- Hardware: Waterproof zippers, auto-lock sliders, snaps, toggles, cord locks, heat-transfer labels.

- Lab Testing: Hydrostatic pressure/water column, breathability (RET/MVTR), down fill power and turbidity, seam strength, abrasion/pilling, colorfastness, anti-migration of down, REACH chemical screening.

- QA & AQL: Inline and final inspections, AQL sampling plans, pilot runs to tune line balance and PP (pre-production) approvals.

Eton’s BOM control covers shell/lining/insulation, seam tape specs, zipper models, and testing matrices for down and synthetics based on end-use (commute vs alpine). [CITE: A standards body summary for hydrostatic testing], [CITE: An industry guide on down testing criteria].

How to Find and Vet a China Clothing Manufacturer

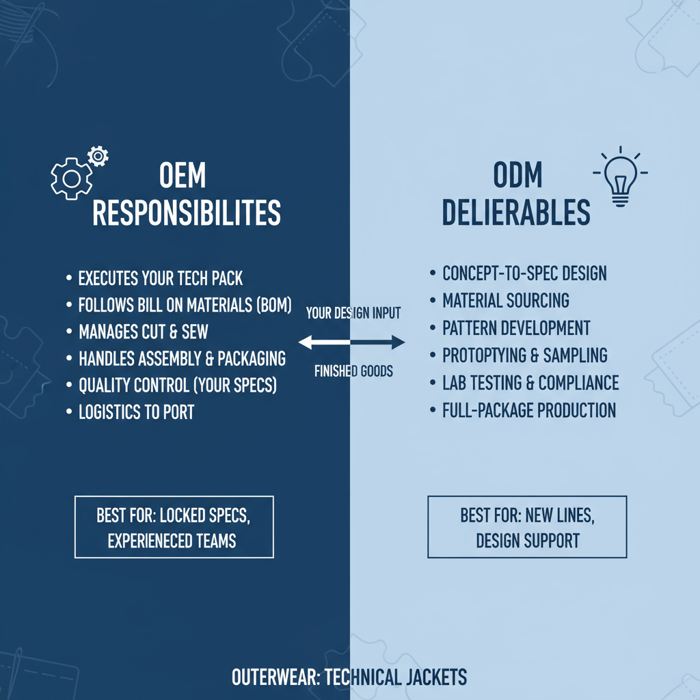

Shortlist capable garment factories, request documentation and samples, conduct an audit, run a pilot, and lock terms in a precise contract. Confirm certifications, QA control, MOQs, lead times, and responsiveness. Press for traceability and subcontracting rules to align with UFLPA and buyer codes of conduct.

The Six-Step Vetting Checklist

- Define Scope and Targets

- Inputs: Tech pack or design brief, target FOB, MOQ range, delivery window, compliance obligations (UFLPA/REACH).

- Outputs: Vendor profile you seek (outerwear specialist/FPP, China vs Bangladesh vs Vietnam), RFP package.

- Time: 3–5 working days.

- Shortlist and Documentation Review

- Inputs: Certifications (WRAP, ISO 9001, BSCI/SMETA), lab capabilities, capacity by product line, buyer references.

- Outputs: Scorecard by capability, communication speed, transparency.

- Time: 1–2 weeks.

- Sampling and Feasibility Check

- Inputs: Tech pack/BOM or concept brief; request fabric/trim proposals if ODM.

- Outputs: Proto 1/2, fit sample, PP sample; test results for critical properties.

- Time: 2–6 weeks based on complexity [Verification Needed].

- Factory Audit (Onsite or Virtual)

- Inputs: Audit checklist covering line setup, QC checkpoints, needle controls, tape machines, finishing and packing.

- Outputs: Audit report, CAP (Corrective Action Plan) if gaps exist, subcontracting disclosure.

- Time: 1–3 days plus report time.

- Pilot Run

- Inputs: Approved PP sample, graded markers, booked materials.

- Outputs: 30–200 units pilot to validate workmanship, shrinkage, and throughput; AQL results.

- Time: 1–2 weeks [Verification Needed].

- Commercial Terms and Subcontracting Controls

- Inputs: Incoterms (FOB/CIF/DDP), payment terms, penalties/bonuses, IP clauses, green- and red-line items.

- Outputs: Master supply agreement, PO template, labeling/packaging SOPs, testing schedule, traceability documentation plan.

- Time: 1–2 weeks.

[INTERNAL LINK: Garment factory overview → https://china-clothing-manufacturer.com/garment-factory/]

Red Flags and How to Address Them

- Inconsistent Samples: If fit/spec shifts between rounds, request build notes, line photos, and pilot validation before bulk.

- Opaque Subcontracting: Require pre-approval and full disclosure of any subcontractors; include contract penalties for unauthorized use to align with UFLPA risk controls.

- Weak Lab Testing: If only ad-hoc tests appear, schedule a protocol tied to REACH and brand RSL (Restricted Substances List).

- Capacity Mismatch: Production promises not backed by line availability; ask for a capacity plan and line allocation letters.

- Poor Communication Cadence: Missed update windows and vague replies—set weekly cadence, shared trackers, and escalation paths.

For US importers, insist on documented supply chain mapping and chain-of-custody evidence to pass UFLPA scrutiny. [CITE: U.S. CBP UFLPA guidance with documentation examples], [MENTION: American Apparel & Footwear Association policy resources]. For EU importers, align lab testing and SDS with REACH. [CITE: EU REACH official portal].

Clothing Manufacturer Costs, MOQs, and Lead Times (Outerwear Focus)

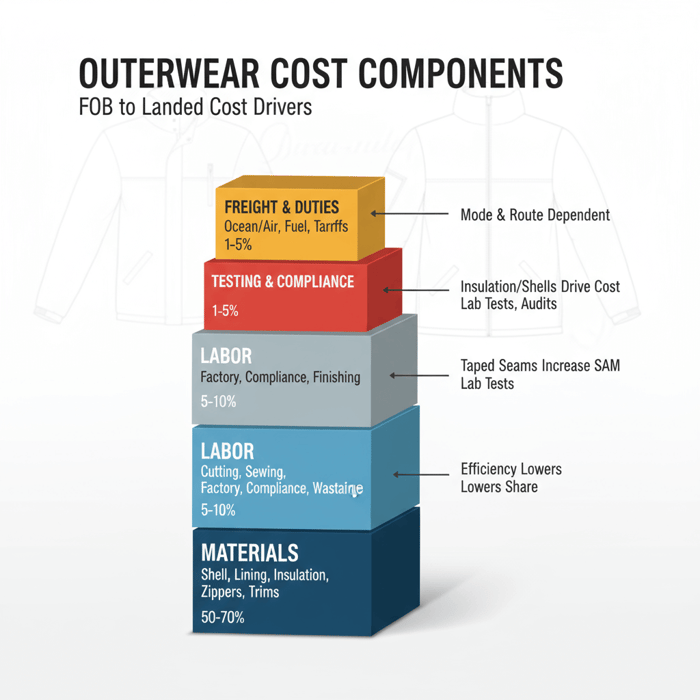

Budget using a cost stack: materials, labor, overhead, compliance, and logistics. MOQs hinge on fabric mill minima, dye lots, insulation pack sizes, and trims. Lead times span sampling, material booking, cut/sew, testing, and final QA. Validate ranges per season and SKU complexity.

| Component | What It Covers | Typical Impact on FOB | Notes |

|---|---|---|---|

| Materials | Shell, lining, insulation, seam tapes, zippers, trims, labels, packaging | 50%–70% [Verification Needed] | Insulation and technical shells are major drivers; recycled content may carry premiums. |

| Labor | Cutting, sewing, taping, finishing, packing | 10%–20% [Verification Needed] | Complexity (e.g., taped seams) extends SAM (standard allowed minutes). |

| Overhead | Factory overhead, compliance admin, wastage allowance | 5%–10% [Verification Needed] | Efficiency improves with stable repeats and size runs. |

| Testing & Compliance | Lab tests (REACH/RSL), down tests, performance tests, audits | 1%–5% [Verification Needed] | Program size and retailer protocols determine depth and cost. |

| Freight & Duties | FOB to landed costs: ocean/air, fuel, insurance, duty, brokerage | Variable | Route, mode, and HTS codes impact landed cost. [CITE: OTEXA/USITC tariff references] |

Cost Stack and Hidden Drivers

- Insulation Choice: RDS down vs recycled synthetic shifts both cost and testing. Higher fill power down cuts weight but can raise FOB.

- Fabric Commitments: Mill MOQs and dye lot sizes can push excess inventory; consider color consolidation and shared greige strategies.

- Hardware Specs: Waterproof zippers and branded components (e.g., YKK AquaGuard) add cost but reduce warranty claims.

- Seam Tape Footage: Designs with many seams require more taping and labor time; pattern optimization can save minutes and tape.

- Yield and Marker Efficiency: Tighter markers lower material waste; work with factories on width tolerance and shrinkage assumptions.

- Testing Program Depth: Early screening avoids late-fail costs; align REACH/RSL upfront and plan pilot-run testing.

MOQ and Lead-Time Ranges

- MOQs

- Padded/Down Jackets: 600–1,200 units per color depending on fabric and insulation pack sizes [Verification Needed].

- Lightweight Shells: 800–1,500 units per color; seam tapes and fabric MOQ dominate [Verification Needed].

- Trims/Hardware: Zippers/snaps often have color or size MOQs; consider cross-style consolidation.

- Lead Times

- Sampling: 2–6 weeks (Proto to PP) by complexity and capacity [Verification Needed].

- Materials: Greige/dyeing/lamination 3–8 weeks depending on mills and season [Verification Needed].

- Bulk Production: 6–10 weeks for outerwear; taped builds trend longer [Verification Needed].

- Freight: Ocean 3–5 weeks China–US West Coast; air 3–7 days plus handling [Verification Needed].

- Global apparel trade volumes shifted by region in 2024 (Source: [S2] WTO 2024) [CITE: WTO World Trade Statistical Review 2024].

- Brands emphasize speed-to-market and resilience in 2024–2025 (Source: [S1] McKinsey SoF 2024/2025) [CITE: McKinsey State of Fashion 2024/2025].

- US apparel import patterns by country updated in 2024 (Source: [S5] OTEXA) [CITE: OTEXA apparel import data 2024].

Plan buffers around holiday peaks, Lunar New Year, and mill maintenance schedules. Confirm all timelines at quotation and re-validate before POs.

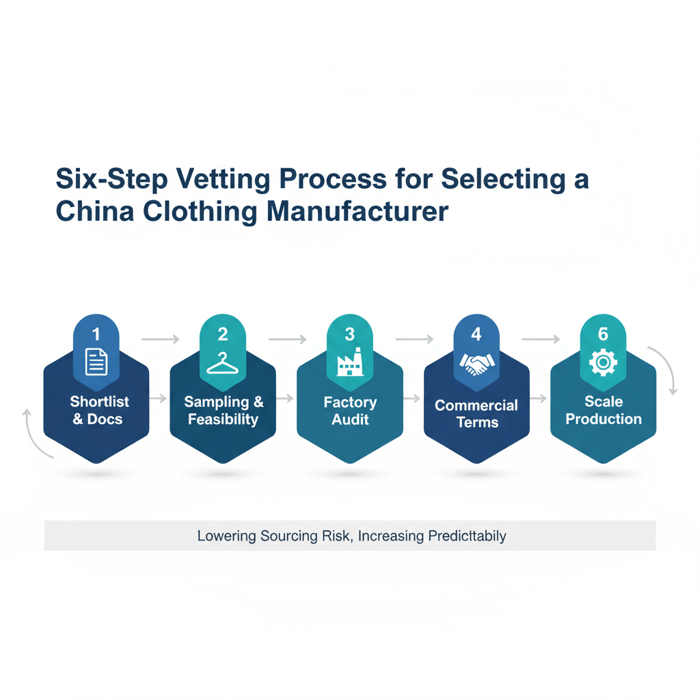

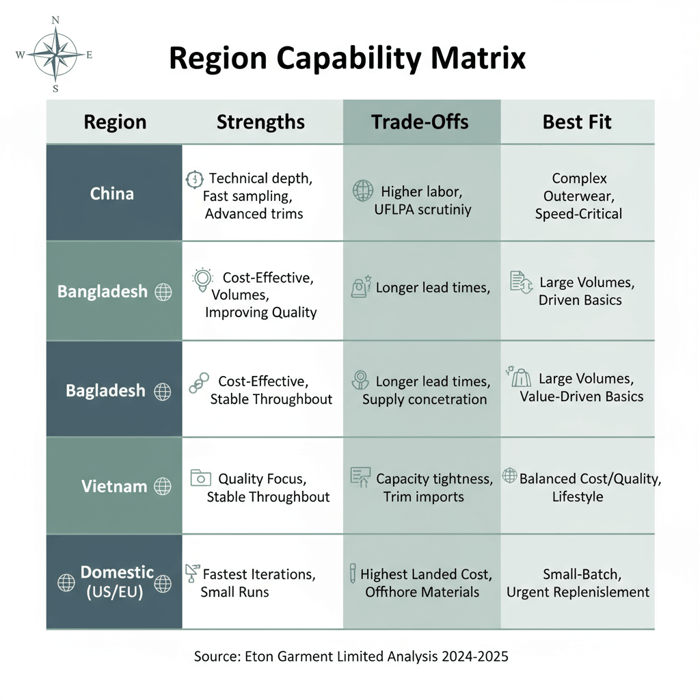

China Clothing Manufacturer vs Bangladesh, Vietnam, and Domestic (US/EU)

China offers unrivaled breadth and technical capability for outerwear; Bangladesh drives value for volumes; Vietnam balances quality and cost in multiple categories; domestic production delivers speed and flexibility at higher landed costs. Match region to SKU complexity, volumes, and compliance posture.

| Region | Strengths | Trade-Offs | Best Fit |

|---|---|---|---|

| China | Technical depth, fast sampling, broad supply base, advanced trims | Higher labor vs Bangladesh, compliance documentation scrutiny (UFLPA) | Complex outerwear, multi-style capsules, speed-critical drops |

| Bangladesh | Cost-effective for volumes, improving quality systems, knit/woven scale | Longer lead times on technical builds; supply base concentration | Large volumes, stable carryovers, basics and value-driven outerwear |

| Vietnam | Quality focus, stable throughput, growing outerwear capability | Capacity tightness on peaks; certain trims may be imported | Balanced cost/quality programs, lifestyle outerwear |

| Domestic (US/EU) | Fastest iterations, small runs, proximity to market | Highest landed cost, material sourcing sometimes offshore | Small-batch capsules, urgent replenishment, premium DTC |

Criteria Overview

- Speed to Proto/PP: China’s sampling ecosystems shorten early cycles.

- Technical Complexity: Taped seams, down handling, and specialized machines favor mature China facilities; select Vietnam lines also strong.

- Total Landed Cost: Bangladesh best for high-volume price points; trade compliance and freight shape the final calculus.

- Compliance Ecosystem: Documentation rigor and traceability readiness are improving across all three Asian hubs; domestic simplifies oversight.

- Share shifts across China/Bangladesh/Vietnam in US/EU imports in 2024 (Source: [S5] OTEXA) [CITE: OTEXA 2024 apparel imports by country].

- Supplier consolidation and nearshoring discussions persist in 2025 (Source: [S1] McKinsey) [CITE: McKinsey State of Fashion 2025 update].

Decision Framework

- Classify SKUs by complexity (simple padded vs fully taped technical).

- Assign target FOB, MOQ flexibility, and speed windows.

- Score regions on capability, capacity, compliance confidence, and logistics corridor strength.

- Run a pilot in the top region; keep a secondary region warm for risk diversification.

[MENTION: WTO regional trade analysis], [MENTION: World Bank logistics indicators] can inform macro feasibility while factory audits validate micro execution. [CITE: WTO/WB sources post-2023].

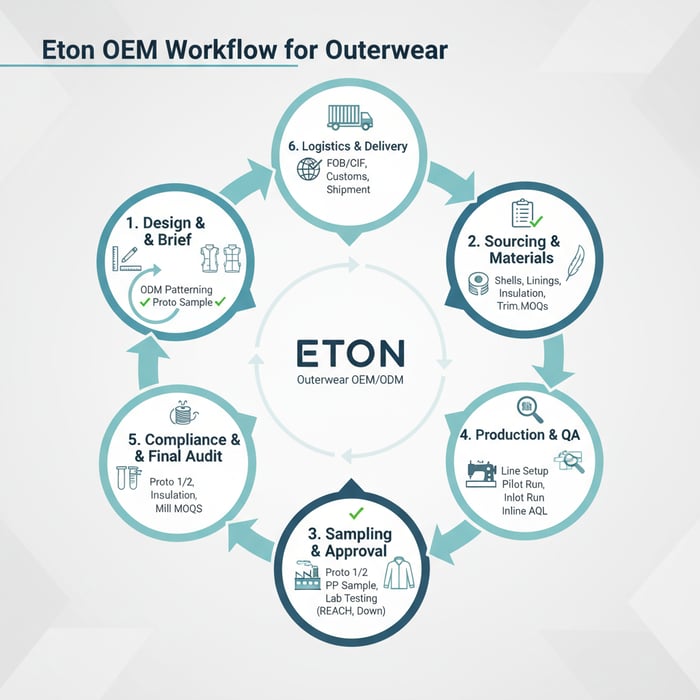

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton’s OEM clothing manufacturer service spans design support, technical development, fabric and trim sourcing, sampling, production, and QA across China and Bangladesh. Outerwear specialization covers down, parkas, and technical apparel with test‑backed validation for US/EU market requirements.

| Brand Need | Eton OEM Feature | Expected Outcome |

|---|---|---|

| Faster Concept to PP | ODM patterning and proto room linked to mills | Shorter sample cycles; earlier cost certainty |

| Complex Outerwear QA | Seam sealing expertise, down/insulation testing matrix | Lower defect rates; consistent performance reports |

| Compliance Confidence | Traceability documentation, RSL/REACH testing plans | Fewer customs holds; retailer-standard compliance |

| Scalable Production | Dual-base capacity (China + Bangladesh) | Risk-balanced allocation; dependable throughput |

Explore Eton’s garment factory capabilities and request a pilot through our Clothing Manufacturing OEM Service page: Clothing Manufacturing OEM Service. “Textile From Day One.”

Use Case 1: Fast Track Capsule (Problem → Solution)

A European retailer needed a 6-style lightweight outerwear capsule in 16 weeks for a seasonal drop. Problem: design not fully frozen; mill MOQs risked overbuy; fit blocks needed tuning. Eton’s ODM team stabilized blocks in two proto rounds, consolidated colors to hit mill minima, and used shared zippers across styles. A pilot of 100 units per style exposed a cuff stitch migration that was corrected before bulk. Result: on-time delivery, 1.8% defect rate at final AQL, and within target FOB [Verification Needed].

Use Case 2: Technical Parka Program (Problem → Solution)

A US brand planned a 3-layer parka with full seam sealing and high-fill down for winter. Problem: complex BOM and long material lead times. Eton pre-booked greige with an approved mill, validated hydrostatic pressure in lab screening, and ran a line pilot for taped seams. The down testing matrix (fill power, turbidity, oxygen number) was completed pre-PP. Result: 4-week sampling phase, 9-week bulk, zero major defects at final AQL, and clean customs clearance with complete UFLPA documentation set [Verification Needed].

[INTERNAL LINK: Our foundational guide on ‘Outerwear QA & Testing’]

Data & Trends: Global Apparel Sourcing 2024–2025

Brands balance speed-to-market, resilience, and compliance. China retains leadership in technical execution; Bangladesh and Vietnam grow share in value and quality-focused segments. Documentation rigor rises for US/EU importers, especially for UFLPA and REACH conformity.

- Resilience over single-source reliance cited by global brands in 2024/2025 (McKinsey (2024/2025)).

- World apparel trade volumes shifted across Asia in 2024 (WTO (2024)).

- US import patterns by country updated through 2024 (OTEXA (2024)).

Trend 1: Speed vs Resilience

Fast calendars reward integrated OEM partners. Yet more brands keep a secondary region active to hedge logistics or policy shocks. Capsules and repeats run in China for speed and technical depth; volume programs split across China and Bangladesh to blend cost and resilience. [MENTION: Li & Fung sourcing playbooks], [CITE: McKinsey’s multi-sourcing insights 2024/2025].

Trend 2: Compliance Documentation Rigor

US UFLPA enforcement expects granular supply chain mapping; EU REACH keeps chemical management front-and-center. Brands now request evidence packs—transaction certificates, mill lists, batch records, and test reports—before POs. Compliance readiness influences vendor selection as much as price. [CITE: U.S. CBP UFLPA guidance], [CITE: EU REACH portal 2024].

Risks, Compliance & Localization (US/EU)

Reduce risk by demanding traceability, audit trails, and chemical compliance before committing volume. US importers need UFLPA-ready documentation; EU importers must align with REACH and, where relevant, product safety directives. Sync QA, testing, and documentation at sampling and PP stages—not post‑production.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| UFLPA Detention | Medium | High | Chain-of-custody docs, supplier mapping, transaction certificates, third-party audits [CITE: CBP UFLPA]. |

| REACH Chemical Fail | Low–Medium | High | RSL-based testing plan, SDS from mills, restricted chemical substitution, pre-bulk lab tests [CITE: EU REACH]. |

| Late Material Arrival | Medium | Medium–High | Greige pre-booking, color consolidation, safety stocks for repeated trims, weekly WIP tracking. |

| Workmanship Defects | Medium | Medium | Pilot run, PP approvals, inline AQL, operator training on taped seams and down handling. |

| Unauthorized Subcontracting | Low–Medium | High | Pre-approval clauses, penalties, site audits, production GPS/photo logs, serialized packaging. |

Regulatory Notes for US/EU

- UFLPA (US): Importers bear the burden of proof. Prepare supplier lists, purchase records, production logs, and logistic documents that trace materials back to origin. [CITE: CBP UFLPA guidance 2024/2025].

- REACH (EU): Ensure chemical compliance; keep SDS, test reports, and supplier declarations. Plan periodic screening for high‑risk materials and finishes. [CITE: EU REACH overview].

[INTERNAL LINK: Our foundational guide on ‘Compliance & Audits’]

Conclusion & Next Steps

Match SKU complexity to factory capability, lock cost/MOQ/lead-time targets, and run a pilot before scale. Validate traceability and testing early to pass customs and retailer checks. Use the region matrix to place the right work in the right hub.

- Define your program: styles, target FOB, MOQ, delivery windows, compliance scope.

- Shortlist 2–3 outerwear‑capable partners in China—and a secondary region for resilience.

- Run two sampling rounds, approve PP, and schedule a pilot to validate throughput and AQL.

- Finalize terms: Incoterms, payment, IP, subcontracting controls, testing calendar.

- Scale with tracked KPIs: on-time cut-in, first-pass yield, AQL pass rate, and detention-free clearance.

When you are ready to move, Eton’s OEM team in China and Bangladesh can quote, sample, and schedule pilots with full documentation. Start here: Clothing Manufacturing OEM Service.

[INTERNAL LINK: Our foundational guide on ‘Fabric & Trim Sourcing’]

Author: Eton Yip, Founder & CEO, Eton Garment Limited, 30+ years in apparel manufacturing and outerwear OEM/ODM. [INTERNAL LINK: Eton Yip - Founder & CEO {{author_bio_url}}]

Reviewer: Head of QA, Eton Garment Limited (factory audits, AQL program).

Methodology: Eton factory practices + recent industry sources [S1–S5]. Ranges marked [Verification Needed] must be confirmed during program scoping.

Limitations: Costs/lead times vary by season, mills, and complexity. Regulations can update—verify on official sites.

Disclosure: Eton is an OEM/ODM provider and may have a commercial interest in presenting its services.

Last Updated: October 2025

- McKinsey & Company — The State of Fashion 2024/2025. https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion

- World Trade Organization — World Trade Statistical Review 2024. https://www.wto.org/english/res_e/statis_e/wts2024_e/wts2024_e.htm

- U.S. Customs and Border Protection — Uyghur Forced Labor Prevention Act (UFLPA) Guidance. https://www.cbp.gov/trade/forced-labor/uflpa

- European Commission — REACH Regulation Overview. https://ec.europa.eu/environment/chemicals/reach/reach_en.htm

- Office of Textiles and Apparel (OTEXA), U.S. Dept. of Commerce — Trade Data & Reports (Apparel Imports 2024). https://www.trade.gov/otexa

- [CITE: ISO 9001 standard overview, 2023–2025]

- [CITE: WRAP certification program overview, 2023–2025]

- [CITE: Higg Facility Environmental Module (FEM) background, 2023–2025]

- [CITE: Down testing protocols summary from a recognized lab, 2023–2025]

- [CITE: Hydrostatic pressure testing standard reference, 2023–2025]

Manufacturer Clothing: Humanized Narrative Version

Manufacturer clothing choices decide whether your outerwear line lands on time, meets spec, and clears customs. The right China clothing manufacturer gives you fast samples, clean QA, and proper documentation. The wrong one adds weeks and rework. This field guide lays out what to check, in what order, and why it matters.

A manufacturer clothing partner builds your styles as OEM or ODM. Pick a China clothing manufacturer that proves sampling quality, QA checkpoints, and traceability. Compare China, Bangladesh, Vietnam, and domestic options. Before bulk, run a pilot to confirm seams, insulation, and test results.

Short version: match SKU complexity to factory capability. Outerwear needs insulation controls, seam sealing know‑how, and a real testing plan. Eton runs dual bases in China and Bangladesh, so we can quote, sample, and scale while meeting UFLPA and REACH. The steps below mirror what our production teams do daily.

OEM vs ODM for Outerwear

OEM follows your tech pack. ODM helps create it. If your team has finished specs, OEM fits. If you need help turning sketches into patterns, fabrics, and tests, ODM saves cycles. For jackets with down or taped seams, an outerwear-first factory lowers defect risk by controlling BOM, taping, and lab work.

Vetting That Works

Run six moves: define scope, check documents, sample twice, audit the plant, do a pilot, sign a contract that bans unauthorized subcontracting. Keep a weekly update rhythm. Ask for capacity plans and line allocations in writing. Put the testing schedule next to the production plan so no one learns about a lab fail when cartons are packed.

Budget, MOQs, Lead Times

Most of the FOB sits in materials. Insulation and technical shells swing it most. MOQs ride on mill minima and insulation pack sizes. Lead time lives in sampling and materials. Plan a buffer around Lunar New Year and peak seasons. Mark anything marked [Verification Needed] for confirmation when you quote.

Region Picks

China wins on complex outerwear and fast sampling. Bangladesh wins price at volume. Vietnam splits the difference with stable quality. Domestic builds small runs fast but costs more. Many teams run capsules in China and larger repeats in Bangladesh, keeping Vietnam as a quality anchor on multi-season programs.

Eton OEM in Practice

Two snapshots. A fast capsule in Europe: six styles, 16 weeks. We tightened fit blocks in two protos, shared trims, and ran a 100‑piece pilot. The bulk landed on time with a clean AQL. A technical parka in the US: 3‑layer with down. We pre‑booked greige, tested hydrostatic pressure before PP, and piloted taped seams. The shipment cleared with full UFLPA docs.

What’s Changing in 2024–2025

Brands now weigh speed against resilience. Documentation is the new currency—UFLPA asks for proof; REACH asks for clean chemistry. Build that evidence while you sample, not after you ship.

Risk Control

Write subcontracting rules into your contract. Ask for supplier maps. Set the test list before PP. Pilot the line so taped seams and down handling are proven before the PO volume. Keep a second region warm for hedging.

Move Next

- Set targets: FOB, MOQ, dates, compliance.

- Shortlist 2–3 outerwear-capable plants.

- Approve PP and run a pilot.

- Lock terms and traceability.

- Scale with weekly WIP and AQL gates.

When you need a start point, Eton’s team can quote, sample, and sequence a pilot from China or Bangladesh: Clothing Manufacturing OEM Service.

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »