Leather Jacket Factory Outlet: How to Source from a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

11 minute read

Leather Jacket Factory Outlet: How to Source from a China Clothing Manufacturer

Leather jacket factory outlet queries usually surface consumer sale pages; brands need a B2B path. As a China Clothing Manufacturer with OEM/ODM capacity in China and Bangladesh, Eton aligns outlet stock, custom production, and US/EU compliance into a practical sourcing playbook for leather outerwear.

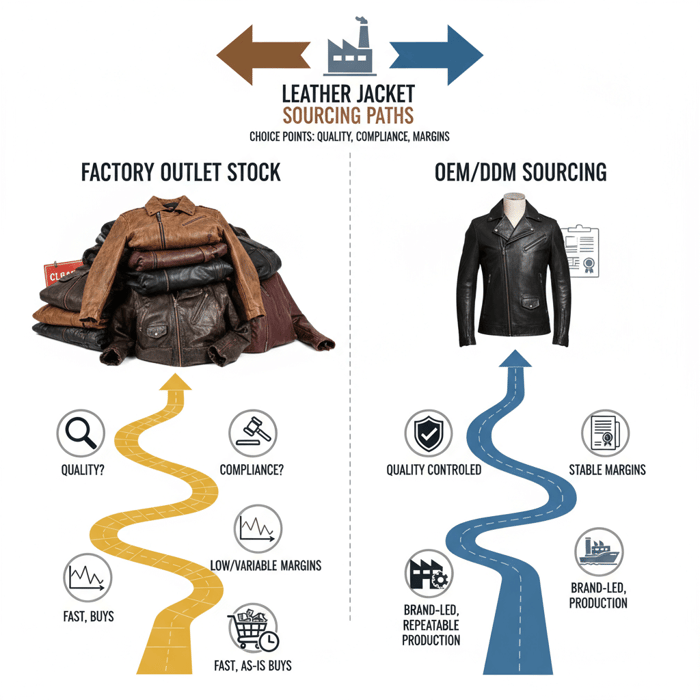

A leather jacket factory outlet means factory-held stock or clearance sold below wholesale. Use it for short-notice buys and budget programs. For brand-led design, quality control, and US/EU compliance, OEM/ODM with a China Clothing Manufacturer is the safer, margin-stable route.

“Leather jacket factory outlet” explained for Fashion Brands

Factory outlet stock is pre-made inventory offered at discounted prices by a manufacturer; OEM/ODM is custom production to a brand’s specifications. Outlet stock suits urgent needs and price-sensitive lines. OEM/ODM serves design control, repeatability, and regulatory alignment for US/EU markets.

What “factory outlet” means in apparel sourcing

In B2B apparel, a factory outlet usually refers to factory-owned channels selling finished goods at reduced prices. That can include excess inventory from prior seasons, overproduction, canceled POs, returns, or sample runs. These goods are typically “as is” and vary by style, size splits, leather type, finish, and hardware. A true factory outlet is operated by the manufacturer or its controlled entity; reseller outlets buy from multiple sources and resell—often with less traceability back to the tannery, finish chemistry, or original test data.

For leather jackets, brands should distinguish between:

- Factory-origin stock with traceable tannery documentation and prior test reports.

- Mixed reseller stock with limited provenance and inconsistent specs.

- “Outlet production” runs using leftover materials; pricing can be appealing, but color/finish consistency and testing history may be thin.

[MENTION: Leather Working Group’s role in supply-chain traceability] [CITE: A current LWG guidance overview describing audit scopes and ratings]

When outlet stock works—and when it doesn’t

Outlet stock works for immediate replenishments, promotional capsules, and test markets where speed and price outweigh full spec control. It suits off-price partners or e-commerce drops with flexible size curves. It doesn’t suit regulated markets without updated test coverage, seasons requiring strict color/finish matching, or long-life programs that demand fit consistency, warranty support, and recurring buys.

- Pros: faster ship dates; lower buy prices; ready styles; low sampling costs.

- Cons: inconsistent specs; limited documentation; size/finish gaps; constrained warranty and repeatability.

[INTERNAL LINK: Sourcing pillar — “Factory-direct vs OEM/ODM: which model fits your brand?”]

How to evaluate a leather jacket factory outlet supplier in China/Bangladesh

Confirm identity, ownership, and the leather source; verify LWG status at the tannery, ZDHC MRSL compliance, and test reports aligned to US/EU norms. Assess material and hardware quality, sample performance, finishing consistency, and production/logistics capability through documents, audits, and pre-shipment checks.

Supplier identity and transparency checks

- Request legal registration, factory address, and production scope; ask for owned lines vs subcontracting details.

- Validate factory outlet ownership; seek photos/videos of stock rooms and labeling showing PO history.

- Map the leather supply chain: raw hide origin, tannery name and location, finishing house, and dye/finish chemical lists.

- Cross-check business licenses, tax records, and trade references for China and Bangladesh.

[CITE: Government business registry portals in CN/BD that allow company verification] [MENTION: SGS or Bureau Veritas for third-party factory audits]

Quality & material standards (leather, lining, hardware)

Leather: define species (cow, buffalo, lamb, goat), grade, thickness, tanning method (chrome, vegetable, combination), and finish (aniline, semi-aniline, pigment, nubuck). Align with performance targets: tear strength, abrasion resistance, colorfastness to rubbing, odor, and finish adhesion. Lining: specify fiber content, breathability, seam strength, and colorfastness. Hardware: confirm metal composition, plating standard (nickel release compliance for EU), zipper brand and size, puller reinforcement, and corrosion resistance.

- Common tests: ISO/EN colorfastness to rubbing, tensile/tear, seam slippage, dimensional stability, finish adhesion.

- Hardware tests: nickel release (EN 1811), salt spray resistance, sharp edge checks, puller fatigue.

[CITE: EN/ISO standards for leather testing] [MENTION: YKK for zipper performance benchmarks]

Compliance: LWG, ZDHC MRSL, REACH, US rules

LWG audits tanneries on environmental performance, traceability, and chemical management. ZDHC MRSL restricts harmful substances in manufacturing; finishing chemicals must align to the latest list. EU REACH regulates substances in articles, including chromium VI in leather, azo dyes, and nickel release from hardware. US requirements include state-level Prop 65 notices, CPSIA for children’s apparel, and FTC labeling rules.

- Ask for LWG certificate or audit status; verify on LWG’s public database.

- Request ZDHC MRSL conformance statements and chemical supplier attestations.

- Obtain recent test reports for REACH Annex XVII restricted substances and nickel release.

[CITE: ZDHC MRSL documentation; EU REACH Annex XVII] [MENTION: European Chemicals Agency (ECHA)]

Sampling and performance verification

- Buy a production sample or cut swatches from outlet stock for lab tests.

- Run rub tests on dark finishes and check for crocking on light garments.

- Stress hardware: cycle zippers/poppers; inspect plating wear.

- Measure leather thickness; compare against spec for fit/weight expectations.

[CITE: Accredited lab test protocols from Intertek or TÜV SÜD] [MENTION: Intertek, TÜV SÜD]

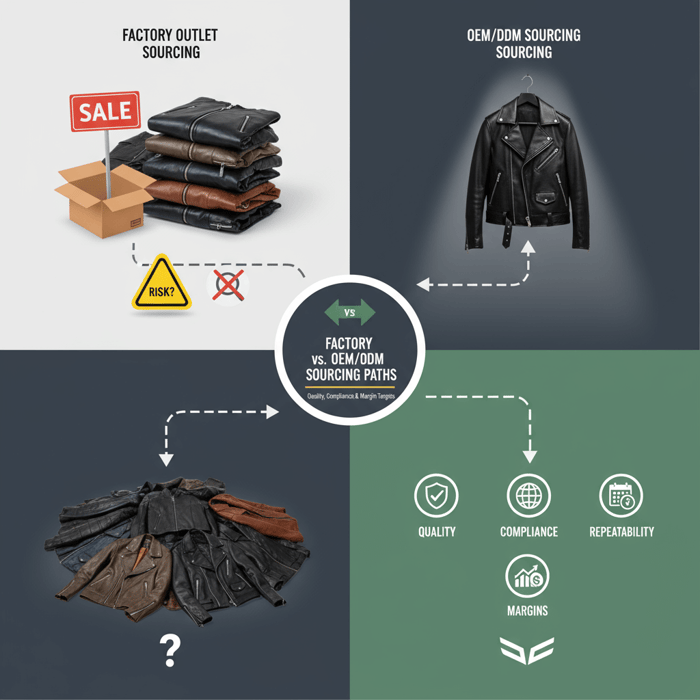

Outlet stock vs OEM/ODM with a China Clothing Manufacturer

Outlet stock offers speed and price with limited spec control. OEM/ODM delivers repeatability, testing coverage, and brand-right design. Choose OEM/ODM when compliance, margin planning, and future replenishment matter; choose outlet stock when timing and opportunistic buys drive the decision.

Decision framework: criteria and scoring

| Criteria | Factory Outlet | OEM/ODM | Scoring Guidance |

|---|---|---|---|

| Lead time | Immediate to 2–4 weeks | 10–16 weeks typical | Urgent launch favors outlet; planned season favors OEM |

| Spec control | Limited; “as is” | Full; tech pack/BOM | Design-led programs favor OEM |

| Compliance | Varies by lot | Built into workflow | US/EU distribution favors OEM |

| Repeatability | Uncertain | High | Seasonal carryover favors OEM |

| Buy price | Lower per unit | Higher per unit | Promo capsules favor outlet |

| Margin stability | Variable | Plannable | Retail margin targets favor OEM |

[INTERNAL LINK: “Garment factory capabilities” — linked to Eton’s production page] [MENTION: Brands with replenishment models in leather outerwear] [CITE: A retail margin study comparing custom vs opportunistic buys]

How to source: preparation, execution, and QA gates

Start with a clear brief: target retail, margin, silhouette, leather grade, hardware, and compliance scope. Execute sampling with fit and PP gates. Lock BOMs, test plans, and logistics early. Use independent inspections and carton-level checks for finish consistency and hardware performance.

Preparation: tech pack, BOM, size sets

- Tech pack with graded specs, seam types, stitch counts, pocket bag materials, and hardware details.

- BOM including leather grade/thickness, lining composition, zipper/popper brand and plating, thread type, and labels.

- Compliance brief: LWG preference, ZDHC MRSL alignment, REACH Annex XVII scope, US Prop 65 and nickel release if applicable.

- Sample plan: prototype, fit sample, size set, and PP sample timelines.

[MENTION: Techpacker’s role in tech pack workflows] [CITE: A process guide on sampling gates used by apparel brands]

Execution: sampling to production handover

- Prototype: confirm silhouette and leather hand; adjust patterns.

- Fit sample: confirm grading; document fit notes across sizes.

- Lab tests: run on production-intent materials; align with REACH and MRSL.

- PP sample: locking BOM and trims; sign off on workmanship.

- Production: start with pilot line; scale after first-article inspection.

[CITE: First-article inspection best practices] [MENTION: AQL standards commonly used in pre-shipment inspections]

QA gates and lab testing

- Leather: colorfastness to dry/wet rubbing, finish adhesion, chromium VI, formaldehyde.

- Hardware: nickel release, plating thickness, puller fatigue tests, corrosion checks.

- Garment: seam slippage, tear strength, dimensional stability, odor assessment.

- Packaging: moisture control, anti-tarnish measures for hardware, carton crush tests.

[CITE: ECHA nickel release guidance; ISO test method references] [INTERNAL LINK: “Quality management at Eton — process overview”]

Costs, MOQs, and margin planning

Costs move with leather grade/thickness, finish type, hardware brand/plating, workmanship, compliance testing, and logistics. MOQs depend on leather batch sizes, dye lot minimums, and hardware lead times. Outlet stock undercuts OEM unit costs but limits margin control; OEM supports consistent pricing and replenishment.

Cost drivers and MOQ signals

- Leather: species and grade; aniline finishes cost more, pigment finishes lower unit cost.

- Hardware: branded zippers/poppers add cost; EU-compliant plating raises price.

- Workmanship: complex paneling, quilting, and bindings increase labor minutes.

- Compliance: LWG preference and MRSL compliance add process costs; lab tests add per-style fees.

- Logistics: air vs ocean, duty, and carton optimization impact landed cost.

[CITE: Industry cost modeling for leather apparel] [MENTION: Freight rate trackers and duty calculators for US/EU apparel]

| Style/Finish | MOQ (pcs) | Ex-Factory (USD) | Notes |

|---|---|---|---|

| Cowhide, pigment finish, basic biker | 300–600 | $65–$95 | Lower rub risk; stable color |

| Lamb, semi-aniline, tailored | 250–500 | $95–$140 | Softer hand; higher rub sensitivity |

| Buffalo, waxed finish, rugged | 300–700 | $80–$120 | Thicker; durable; heavier cartons |

| Outlet stock (mixed) | 100–300 | $45–$80 | Varied spec; “as is” |

[CITE: Regional lead time averages for leather apparel] [MENTION: Port congestion indexes affecting transit times]

Risk and compliance roadmap for US/EU markets

Map regulations at the start: EU REACH Annex XVII for chromium VI, azo dyes, and nickel release; US Prop 65 notices for certain chemicals; CPSIA rules for children’s apparel; and labeling. Combine LWG-preferred tanneries, ZDHC MRSL conformance, and UFLPA risk controls to protect distribution.

Regulatory mapping and test coverage

- EU: REACH Annex XVII restricted substances; nickel release (EN 1811) for hardware; General Product Safety Regulation.

- US: Prop 65 listings, FTC labeling, CPSIA if a children’s size range is included.

- Documentation: test reports less than 12 months old; material safety data; supplier declarations.

[CITE: ECHA guidance on nickel release and chromium VI] [MENTION: California OEHHA for Prop 65 updates]

UFLPA and forced-labor risk mitigation

- Supply-chain mapping to raw hides and chemical origins; maintain traceability files.

- Signed supplier codes of conduct; audit trails; independent social audits.

- Transaction documentation: POs, invoices, packing lists, and factory process records.

- Third-party verification when materials cross sensitive regions.

[CITE: US CBP UFLPA guidance and enforcement updates] [MENTION: Sedex/SMETA for social audit frameworks]

Integrating outlet and OEM with Eton’s Clothing Manufacturing OEM Service

Eton balances opportunistic outlet buys and OEM/ODM production. For rapid programs, Eton screens factory-held stock against target specs and provides available test data. For OEM/ODM, Eton builds leather BOMs, manages sampling gates, and aligns test plans to US/EU distribution.

What Eton delivers for leather programs

- Design and technical development for biker, bomber, and tailored silhouettes.

- Leather sourcing with LWG-preferred tanneries; MRSL alignment with finishing houses.

- Sampling milestones: prototype, fit, PP; lab testing; pilot lines; first-article inspection.

- Production in China and Bangladesh; logistics planning; carton and moisture control protocols.

Explore Eton’s garment factory capabilities and the Clothing Manufacturing OEM Service to plan your next leather capsule. Clothing Manufacturing OEM Service

[INTERNAL LINK: “Garment factory capabilities” — https://china-clothing-manufacturer.com/garment-factory/] [MENTION: Eton Garment Limited — 30+ years in outerwear] [CITE: Case study references from Eton’s outerwear programs]

Next steps for brand teams

Define whether the program is time-driven or compliance-driven. If speed and price dominate, request documented outlet lots; test critical risks quickly. If the season plan is margin-led with replenishment, lock OEM/ODM with a China Clothing Manufacturer and build the sampling and testing calendar.

- Set targets: silhouette, retail, margin, grade, compliance scope.

- Choose model: outlet vs OEM/ODM using the decision framework.

- Run supplier checks: identity, tannery docs, MRSL, LWG status, test reports.

- Plan sampling and lab tests; confirm logistics and carton specs.

- Book production and inspections; maintain traceability dossiers.

- Leather Working Group — Audit Protocols and Certification (2024). [CITE: LWG official site]

- ZDHC — MRSL v3.1 Guidance (2024). [CITE: ZDHC official portal]

- ECHA — REACH Annex XVII and Nickel Release (2023–2024). [CITE: ECHA.europa.eu]

- OEHHA — Prop 65 Listings and Notices (2024). [CITE: oehha.ca.gov]

- US CBP — UFLPA Operational Guidance (2024). [CITE: cbp.gov]

- ISO/EN — Leather testing standards, colorfastness and performance (2022–2024). [CITE: ISO.org]

- Intertek, TÜV SÜD — Leather garment testing protocols (2023–2024). [CITE: Intertek/TÜV official pages]

- SGS, Bureau Veritas — Factory audits and inspections (2023–2024). [CITE: SGS/Bureau Veritas]

- Freightos — Freight rate indexes and transit time trends (2024). [CITE: freightos.com]

- Port Authorities — Congestion and lead-time advisories (2024). [CITE: Relevant port authority sites]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »