La Boutique Stores Sourcing Guide with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

17 minute read

La Boutique Stores Sourcing Guide with a China Clothing Manufacturer

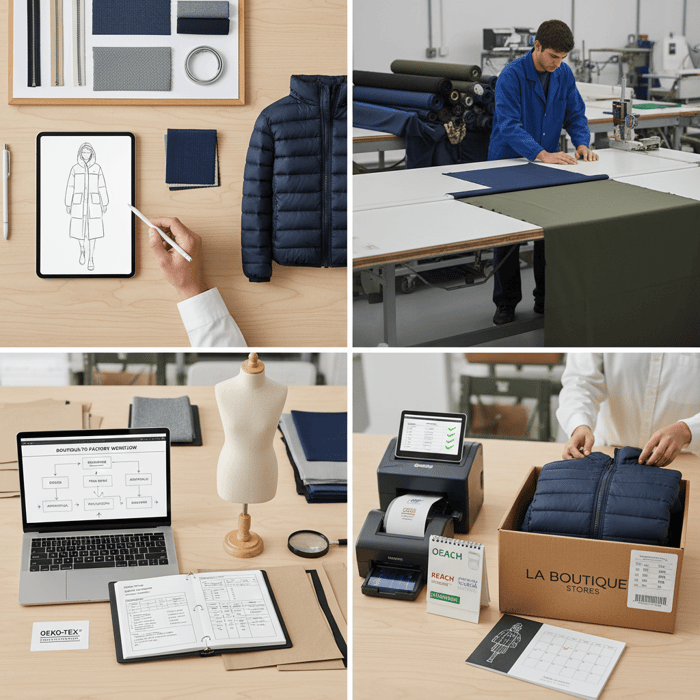

La boutique stores can build private-label outerwear with a proven China Clothing Manufacturer that understands boutique MOQs, capsule assortments, compliance, and repeatable quality. Eton brings 30+ years of OEM/ODM experience in jackets, padded coats, and technical apparel for US/EU boutiques and independent retailers seeking agility without sacrificing standards.

La boutique stores secure reliable private-label outerwear by aligning capsule size runs to manageable MOQs, locking tech packs early, staging QC from proto to pre-shipment, and meeting US/EU standards (REACH, CPSIA). Partner with an experienced China Clothing Manufacturer offering OEM/ODM, transparent costing, and realistic lead times.

What La Boutique Stores Need from a China Clothing Manufacturer

Boutique apparel programs benefit from small-batch MOQs, flexible size runs, outerwear engineering expertise, staged QC, and compliance-ready supply chains. Align on complete tech packs, clear sample calendars, price-break logic, and weekly updates to convert design intent into consistent delivery for US/EU markets.

- MOQs aligned to capsule size runs (XS–XL or 34–44; limited colorways; pre-pack options).

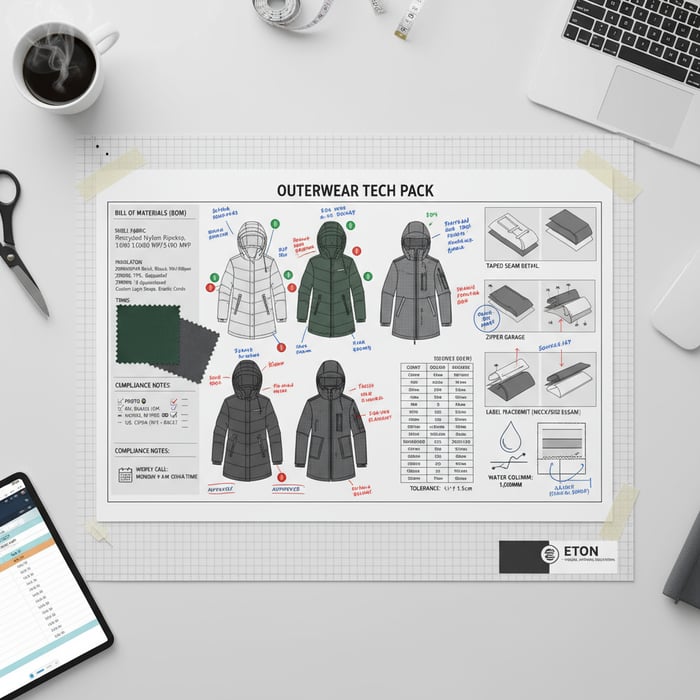

- Tech pack completeness: measurements, construction notes, bill of materials (BOM), tolerances, branding placement.

- Sampling cadence: proto, fit, pre-production sample (PPS), branded packaging sample if applicable.

- Outerwear engineering: insulation type and fill power, water column ratings, seam sealing approach, zipper brand/spec.

- QC checkpoints: incoming fabric inspection, in-line audits, final AQL aligned to boutique defect tolerance.

- Compliance protocols: REACH for EU and CPSIA for US; care labels, fiber content, traceable documentation.

- Communication cadence: weekly status, milestone sign-offs, change-control logs for BOM and construction.

- Costing transparency: fabric/trim/labor/overhead/freight breakdown; currency clarity (USD/EUR).

- Lead-time realism: fabric and trim procurement, sampling slots, lab testing, production throughput, freight choice.

[MENTION: ECHA for REACH] [MENTION: CPSC for CPSIA] [CITE: Boutique MOQs benchmark from a specialized outerwear sourcing study] [INTERNAL LINK: OEM tech pack checklist – pillar resource on creating outerwear tech packs]

Micro-scenario: boutique size runs often overstock mid sizes and understock edge sizes. Shift the curve by reviewing last season sell-through, reducing edge sizes by 10–15%, and setting reorder triggers after first two weeks. Document the curve in the tech pack to avoid surprises during PPS.

Capsule Planning & MOQs

Start with a capsule brief: two to four styles, each in one to two colorways, size curve XS–XL or 34–44. For outerwear, practical boutique MOQs per color often sit between 150–300 units for simpler blousons and 300–600 units for engineered parkas. Lower MOQs typically raise unit costs; use pre-packs (e.g., 1-2-2-2-1 for XS–S–M–L–XL) to manage sizing complexity and reduce picking errors.

Bundle related trims across styles to unlock price breaks. One zipper supplier, shared snap specs, and consistent seam tape width cut procurement noise. Plan one special color per capsule for storytelling and one core color for margin protection. Track color drops in merchandising tools and roll updates into PPS approvals, not after.

[CITE: Price-break behavior from a zipper brand’s trade brochure] [MENTION: YKK and Coats as trim suppliers] [INTERNAL LINK: Our foundational guide on boutique capsule planning]

Outerwear Engineering Basics

Technical decisions drive cost and calendar. Down and synthetic insulation need clear specs: fill power (e.g., 650FP), blend ratio, and quilting design. Waterproof claims require a water column target (e.g., 5,000–10,000 mm) backed by fabric and seam performance. Seam sealing needs compatible tape and controlled heat settings; mixing tape brands across lots increases failure risk.

Choose zipper brands by performance tier and available lead time. Confirm slider type and puller finish in the BOM and PPS. Add a test matrix covering hydrostatic head (ISO 811/AATCC 127), seam adhesion, colorfastness, nickel release for trims, and down composition purity. Group testing with accredited labs and plan for one re-test window to avoid shipment slips.

[MENTION: SGS and Bureau Veritas as accredited test providers] [CITE: ISO/AATCC water resistance standards overview] [INTERNAL LINK: Our lab testing matrix for boutique outerwear]

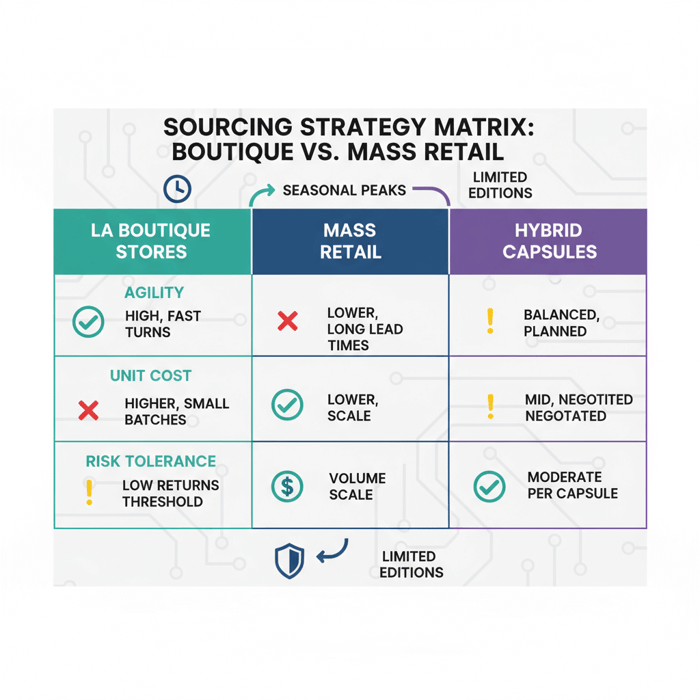

La Boutique Stores vs Mass Retail: Sourcing Differences

Boutique programs emphasize small-batch agility, faster concept-to-store cycles, and higher per-style flexibility. Mass retail optimizes scale with lower unit costs, longer horizons, and strict price breaks. Hybrid capsules mix both: curated styles with moderate MOQs and selective replenishment.

| Dimension | La Boutique Stores | Mass Retail | Hybrid Capsules |

|---|---|---|---|

| MOQ | 150–600 per color per style | 2,000–20,000+ per color per style | 500–3,000 per color per style |

| Unit Cost | Higher; boutique trims/short runs | Lower; scale efficiencies | Mid; negotiated bundles |

| Lead Time | 8–16 weeks; faster sampling | 16–30+ weeks; long fabric windows | 12–20 weeks; planned overlaps |

| Style Flexibility | High per style | Low; repeatability favored | Medium; curated change |

| Compliance Overhead | Focused; capsule-based | Wide; portfolio-wide | Moderate; targeted tests |

| Risk Tolerance | Low returns threshold | Inventory risk spread over volume | Balanced per capsule |

| Negotiation Levers | Trims consolidation, calendar discipline | Volume, long-term commitments | Seasonal bundles, multi-style deals |

- Boutique Pros: agility, uniqueness, premium positioning.

- Boutique Cons: higher unit cost, tighter cash flow.

- Mass Retail Pros: scale cost efficiencies, stable replenishment.

- Mass Retail Cons: long timelines, reduced uniqueness.

- US retail growth resilience — 2024 (Source: [CITE: NRF 2024 retail growth outlook])

- Agility as a competitive edge — 2024 (Source: [CITE: McKinsey State of Fashion 2024])

[MENTION: NRF, McKinsey & Company] [INTERNAL LINK: Boutique sourcing vs mass retail deep dive]

Criteria Overview

Score styles using five criteria: uniqueness (trend fit), technical complexity (engineering level), margin potential (target gross margin), lead-time sensitivity (season cut-offs), and compliance scope (EU/US test packages). Boutique programs prioritize uniqueness and lead-time sensitivity; mass retail favors margin potential and complexity reduction.

Apply a 1–5 scale per criterion and sum per style. Styles above 18 are boutique-friendly; 14–18 suit hybrid; below 14 lean mass retail. Revisit after proto feedback and fabric booking status.

[CITE: Assortment scoring framework references from retail operations literature] [INTERNAL LINK: Our assortment scoring template]

Decision Framework

Pick a model per capsule: Boutique if launch windows are tight and brand storytelling matters more than heavy price breaks. Mass retail when volume forecasts are robust and scale trims deliver margin. Hybrid for seasonal peaks, limited-edition drops, and higher marketing visibility without overcommitting inventory.

Run sensitivity tests: adjust MOQ by ±20%, shift colorways, and simulate freight choices. Document outcomes in the capsule brief before PPS scheduling.

[MENTION: Bain & Company retail assortment analysis] [CITE: Freight sensitivity modeling case study] [INTERNAL LINK: Freight & Incoterms guide – FOB vs CIF, air vs sea]

Costs, MOQs, and Lead Times for La Boutique Stores

Outerwear cost depends on fabric/trim choices, insulation level, construction complexity, and test scope. MOQs that match capsule size runs keep cash flow balanced. Lead time spans fabric, sampling, production, and freight. Air shortens weeks; sea protects unit cost.

| Component | What’s Included | Indicative Range (FOB) | Notes |

|---|---|---|---|

| Fabric | Shell, lining, membrane/laminate | USD/EUR 6–22 | Ripstop, softshell, recycled polyester increase cost |

| Trims | Zippers, snaps, seam tape, pullers | USD/EUR 2–8 | Brand-name trims carry premiums and lead-time constraints |

| Labor | Pattern, sewing, finishing | USD/EUR 5–18 | Complex quilting, taped seams, multi-panel designs add minutes |

| Overhead | Compliance, testing, admin | USD/EUR 1–4 | REACH/CPSIA tests vary per style and age group |

| Freight | Air vs sea; Incoterms impact | USD/EUR 0.7–5 per unit | Air narrows weeks; sea improves margin |

| Duties/Taxes | Market-specific, HS code dependent | Varies | Confirm classification in US/EU; plan landed cost |

- China as top apparel exporter enables material availability — 2024 (Source: [CITE: WTO World Trade Statistical Review 2024])

- Inflation and supply variability affect lead times — 2024 (Source: [CITE: McKinsey State of Fashion 2024])

[MENTION: WTO, McKinsey & Company] [INTERNAL LINK: Freight & Incoterms guide – clarify FOB vs CIF and modal choices]

MOQ Strategies & Price Breaks

MOQ strategies hinge on fabric minimums, trim pack sizes, and line balancing on the factory floor. For woven shells, mills often quote 800–1,200 meters per color; consolidate styles to hit yardage thresholds. Zippers come in carton packs; align cut plans to avoid partial cartons.

Price breaks typically appear at 500, 1,000, and 2,000 units per color per style. Boutique capsules can “bridge” breaks by sharing trims and booking fabrics for two styles under one dye lot. Negotiate surcharge caps for sub-break volumes to protect margin on test colors.

[CITE: Fabric MOQ norms from a mill’s technical datasheet] [MENTION: Leading zipper and snap suppliers] [INTERNAL LINK: Our costing framework for boutique outerwear]

Lead Times & Freight Choices

Indicative timeline: fabric/trim booking 3–6 weeks; proto 1–2 weeks; fit 1–2 weeks; PPS 1 week; production 3–6 weeks; freight 1–2 weeks by air or 4–6 weeks by sea to US/EU ports. Lock PPS before fabric cutting to avoid rework. If the launch window is tight, split shipments: early sizes or hero color by air; rest by sea.

FOB vs CIF carries control trade-offs. FOB keeps freight under buyer management and supports flexible routing. CIF bundles freight but may reduce visibility. Boutique programs often prefer FOB for agility; confirm insurance coverage and Incoterms obligations in POs.

[CITE: Incoterms 2020 reference from ICC] [MENTION: Maersk and DHL for modal choices] [INTERNAL LINK: Freight & Incoterms guide – routing and insurance notes]

How-To: Source OEM/ODM Outerwear from China

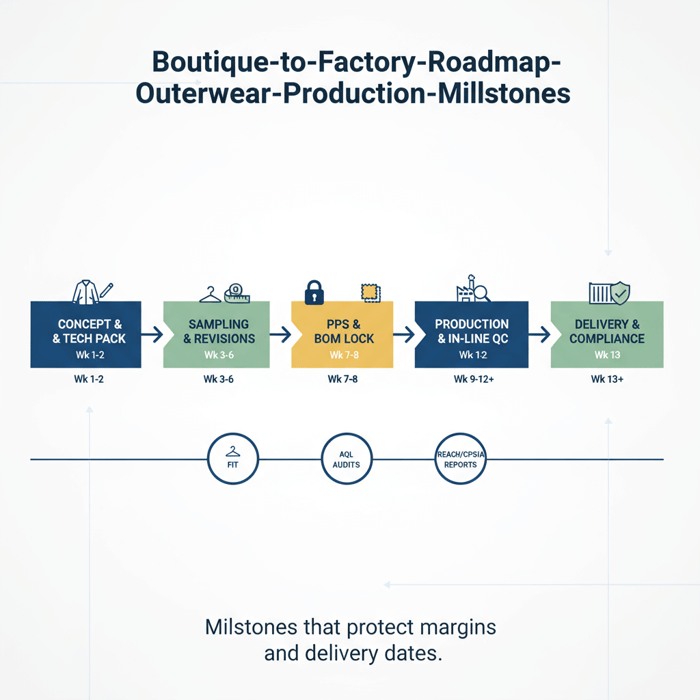

Follow an OEM/ODM workflow: define the capsule, build tech packs, stage sampling, lock BOM/trims, confirm compliance tests, plan production QC, and choose freight. Document decisions at each checkpoint to protect fit, finish, and delivery dates.

- Define capsule goals: styles, forecast volumes, size runs, margin targets. Output: capsule brief. Time: 1 week.

- Build tech packs: measurements, construction, BOM, tolerances. Output: final tech pack. Time: 1–2 weeks.

- Run proto: feasibility and major fit. Output: proto. Time: 1–2 weeks.

- Fit sample: refined fit, construction fixes. Output: fit approval. Time: 1–2 weeks.

- PPS: final specs, trims, branding applied. Output: PPS approval. Time: 1 week.

- Compliance checks: REACH/CPSIA per style. Output: reports, labels. Time: 1–2 weeks.

- Production & in-line QC: defect prevention based on AQL plan. Output: QC logs and corrective actions.

- Final inspection & shipment: pack and documentation; freight booking. Output: shipment.

- Post-mortem: lessons and reorder logic. Output: capsule improvement notes.

Methodology: OEM/ODM stages refined across Eton’s China and Bangladesh factories supporting boutiques and international retailers. Limitations: actual timelines vary with fabric complexity, lab capacity, and peak seasons.

[MENTION: WRAP and Sedex audits] [CITE: AQL standards reference from ANSI/ASQ] [INTERNAL LINK: Outerwear OEM resource center – templates and checklists]

- BOM changes after PPS approval increase defect risk and shipment delays.

- Zipper spec mismatches: slider/teeth choice not aligned with fabric and use case.

- Missing care labels or incorrect fiber content declarations at packing.

- Skipped water resistance tests on seam tape lead to returns for rainwear styles.

Checkpoints: lock BOM at PPS, confirm zipper brand/spec in writing, proof care labels prior to bulk cutting, and file test reports before production start. Keep a change log with sign-offs for any deviation.

Preparation

Pre-sourcing checklist: assortment brief, margin targets, size curves by market, branding guidelines, trim preferences, packaging standards, and target compliance scope. Vet vendors by requesting factory profiles, audited certifications, sample calendars, and lab partners.

Questions to ask a China Clothing Manufacturer: boutique MOQ flexibility, trim sourcing options, PPS scheduling capacity, test matrix management, audit history (e.g., WRAP, BSCI), and shipping documentation expertise for US/EU. Validate with one pilot style before committing the full capsule.

[CITE: Boutique vendor vetting framework from an apparel sourcing body] [MENTION: BSCI/Amfori] [INTERNAL LINK: Request a boutique sourcing consult – kickoff questionnaire]

Execution Steps

Set calendar gates: proto (week 3), fit (week 5), PPS (week 7), cutting (week 8+). Each gate requires sign-offs with photos, measurement sheets, and packaging mock-ups. Hold a PP meeting to align workmanship standards, seam sealing parameters, and tolerance handling. File compliance documents alongside PPS to remove late-stage surprises.

Plan change control: only accept updates with a clear reason code (fabric roll issue, test failure mitigation) and a written impact on cost/time. Tie changes to risk logs and update POs and tech packs accordingly.

[CITE: PP meeting best practices from industry training materials] [MENTION: ASTM standards for apparel performance] [INTERNAL LINK: Our PP meeting checklist]

Quality Assurance

Define AQL targets by style complexity and boutique tolerance for returns. Typical AQL 2.5 for major defects and 4.0 for minor works for jackets. Schedule in-line audits at 20–30% and 70–80% completion points. Enforce pilot lot checks on seam tape adhesion and zipper function before full run.

Set rework thresholds and corrective action response times. Require photo and measurement documentation for resolved issues. Capture lessons in a capsule closeout note to feed the next season.

[CITE: ANSI/ASQ Z1.4 AQL reference] [MENTION: Intertek as third-party inspectors] [INTERNAL LINK: Our AQL plan template for boutique outerwear]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service covers design support, tech pack refinement, sampling cadence, compliance, production, and QC across China and Bangladesh. Boutique programs gain small-batch agility, transparent costing, and delivery tuned for US/EU retailers.

| Boutique Need | OEM Service Feature | Outcome |

|---|---|---|

| Low MOQs for capsules | Small-batch lines with pre-pack size runs | Manageable commitments and faster turns |

| Tech pack rigor | Technical development support | Consistent sampling and bulk quality |

| Fast sampling | Proto/fit/PPS scheduling with a dedicated PM | Predictable approvals and launch timing |

| Compliance | REACH/CPSIA lab testing and documented labeling | Smoother customs and fewer returns |

| QC confidence | In-line audits + final AQL inspections | Lower defect rates |

| Reliable delivery | Freight planning (FOB/CIF; air/sea) + documentation | On-time drops and margin control |

Eton’s factory network supports cold-weather markets and technical rainwear, drawing on decades of outerwear programs for global retailers. Boutique partners receive weekly updates, clear BOM control, and compliance-first handling for US/EU shipments.

Request a boutique sourcing consult to align capsule goals and calendar. [INTERNAL LINK: Request a boutique sourcing consult]

[MENTION: Liverpool F.C. retail partners, Forever 21] [CITE: Case-style notes on defect rate reductions from in-line QC]

Use Case 1: Cold-Weather Capsule (Problem → Solution)

Problem: a boutique wants two insulated jackets for FW with city-fit silhouettes and recycled materials, but MOQs from mills feel heavy and sampling slots are tight. Solution: Eton aggregates recycled polyester shells across both styles under one dye lot, sets a single zipper brand with two puller variants, and schedules proto and fit in a 3-week window. PPS locks quilting patterns and fill power at 650FP. A shared test matrix covers down purity, colorfastness, and hydrostatic head for the shell.

Outcome: manageable MOQs per color at 300–450 units, unit cost within margin targets, compliance documentation ready for US/EU, and split freight—hero color by air, secondary by sea—meeting store dates.

[CITE: Recycled fiber market pricing reference] [MENTION: Global Recycled Standard (GRS)]

Use Case 2: Technical Rainwear Capsule (Problem → Solution)

Problem: a boutique plans a two-color rain parka with taped seams, targeting 10,000 mm water column. The risk: tape failure and zipper leakage under pressure. Solution: Eton standardizes membrane sourcing and verifies compatibility with seam tape brand. PPS includes a pressure test on seams and zipper garages. A pilot lot runs at 50 units per color to validate adhesion and workmanship before full cut.

Outcome: reduced defect risk, clear documentation, and a lead-time plan that fits a mid-season launch. The capsule lands with performance credibility and a tight returns profile.

[CITE: Hydrostatic head testing guidance] [MENTION: Oeko-Tex for chemical safety labeling]

Data & Trends: US/EU Boutique Retail and Apparel Sourcing

Boutique demand favors quality and uniqueness, with a steady shift toward technical materials and compliance-first manufacturing. China’s material ecosystem supports speed; Bangladesh offers labor advantages for volume styles. Capsules increasingly include performance narratives and recycled content.

- US retail outlook remains resilient — 2024 (Source: [CITE: NRF 2024])

- Agile assortments mitigate volatility — 2024 (Source: [CITE: McKinsey State of Fashion 2024])

- China leads apparel exports — 2024 (Source: [CITE: WTO 2024])

[MENTION: National Retail Federation, McKinsey & Company, WTO] [INTERNAL LINK: Boutique trend tracker – quarterly updates]

Key Trend 1: Technical Performance & Sustainability

Performance stories linked to waterproof ratings, breathability, and insulation efficiency resonate for boutique outerwear. Recycled polyester, bluesign-approved materials, and traceable down gain traction. Capsules move from “fashion-first” to “function-plus-fashion,” with cleaner labelling and repair-friendly construction adding longevity value.

Plan recycled and performance content where it serves the silhouette and price target. Coordinate with suppliers to confirm certification paperwork and batch-level traceability before PPS.

[CITE: Consumer preference data on performance wear in specialty retail] [MENTION: bluesign, Responsible Down Standard (RDS)]

Key Trend 2: Compliance & Documentation as Differentiators

Boutiques selling in US/EU increasingly spotlight compliance as part of brand trust. Clear fiber content, care labels, and accessible test documentation reduce returns and smooth customs. Programs with clean audit trails and accredited lab reports gain retailer confidence and better shelf positioning.

Include a simple QR or URL on packaging linking to test summaries and care guides. Track reports in a central vault and attach to each shipment’s paperwork.

[CITE: Specialty retail survey on compliance signals] [MENTION: Oeko-Tex Standard 100 labeling, Eurofins testing]

Risks, Compliance & Localization for US & EU Boutiques

Mitigate risk by locking BOM at PPS, enforcing lab tests, and aligning labels/documentation with US/EU rules. REACH governs chemical safety in the EU; CPSIA covers labeling/testing in the US—especially for children’s apparel. Keep audit trails, lab certificates, and supplier credentials organized.

- Pros: fewer returns, stronger trust, smoother customs.

- Cons: added test cost/time; stricter documentation.

- EU: REACH chemical compliance and restricted substances lists.

- US: CPSIA labeling/testing, tracking labels for children’s wear.

Compliance varies by product category and intended market. Confirm current regulations and use accredited labs. Document fiber content, care instructions, country of origin, and batch-level traceability across the supply chain.

[MENTION: ECHA, CPSC] [CITE: REACH guidance and CPSIA requirements] [INTERNAL LINK: Compliance checklist for boutique outerwear]

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Zipper spec mismatch | Medium | High returns | Brand-approved trim list; PPS confirmation with function tests |

| Missing care labels | Low | Medium | Label proof in PP meeting; pre-shipment checks |

| Seam tape failure | Low | High | Lab tests, pilot lot verification, heat setting controls |

| Late test reports | Medium | Medium–High | Test scheduling after fit approval; buffer week for re-tests |

| Unplanned BOM changes | Low–Medium | High | Strict change-control with written impact on cost/time |

Regulatory Notes for US & EU

EU: REACH compliance focuses on restricted substances (e.g., azo dyes, nickel release), with documentation supporting material safety. US: CPSIA requires children’s product safety certificates, tracking labels, and flammability compliance for relevant categories. For general outerwear, confirm labeling rules and fiber content accuracy.

Keep a regulatory log per style outlining applicable tests, standard references, and lab certificates. Attach this log to shipment paperwork and brand portals for easy retrieval.

[CITE: ECHA REACH portal] [CITE: CPSC CPSIA portal] [MENTION: AATCC standards for colorfastness]

Conclusion & Next Steps

La boutique stores achieve agility, compliance, and quality by partnering with an experienced China Clothing Manufacturer under a disciplined OEM/ODM workflow. Align capsules, lock tech packs, stage QC, and choose freight wisely to protect margins and on-time delivery.

- Week 1–2: Capsule brief + tech pack build.

- Week 3–6: Proto/fit samples + revisions.

- Week 7–8: PPS approval + BOM lock.

- Week 9–12+: Production + in-line QC.

- Week 13+: Final inspection + freight booking.

[INTERNAL LINK: Outerwear OEM resource center – knowledge hub for boutique sourcing] Schedule a consult to scope the capsule and calendar, and to map REACH/CPSIA test plans to your styles.

- World Trade Organization — World Trade Statistical Review (2024). [CITE: WTO apparel exports 2024]

- McKinsey & Company — The State of Fashion (2024). [CITE: McKinsey State of Fashion 2024]

- National Retail Federation — NRF Expects Retail Sales to Grow in 2024 (2024). [CITE: NRF 2024]

- European Chemicals Agency — Understanding REACH (Accessed 2025). [CITE: ECHA REACH portal]

- US Consumer Product Safety Commission — CPSIA Requirements (Accessed 2025). [CITE: CPSC CPSIA portal]

- International Chamber of Commerce — Incoterms 2020 (2020). [CITE: ICC Incoterms 2020]

- ANSI/ASQ Z1.4 — Sampling Procedures and Tables for Inspection by Attributes (Standard). [CITE: AQL reference]

- AATCC/ISO — Water Resistance and Hydrostatic Pressure Methods (Standards). [CITE: AATCC 127 / ISO 811]

- Oeko-Tex — Standard 100 (Labeling and chemical safety). [CITE: Oeko-Tex Standard 100]

- Responsible Down Standard — RDS (Traceability and animal welfare). [CITE: RDS standard]

- bluesign — Input Stream Management (Chemical management). [CITE: bluesign system]

- Sedex/Amfori BSCI — Ethical sourcing audit frameworks. [CITE: Amfori BSCI guidance]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »