i love t shirts custom: How Fashion Brands Source at Scale with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

17 minute read

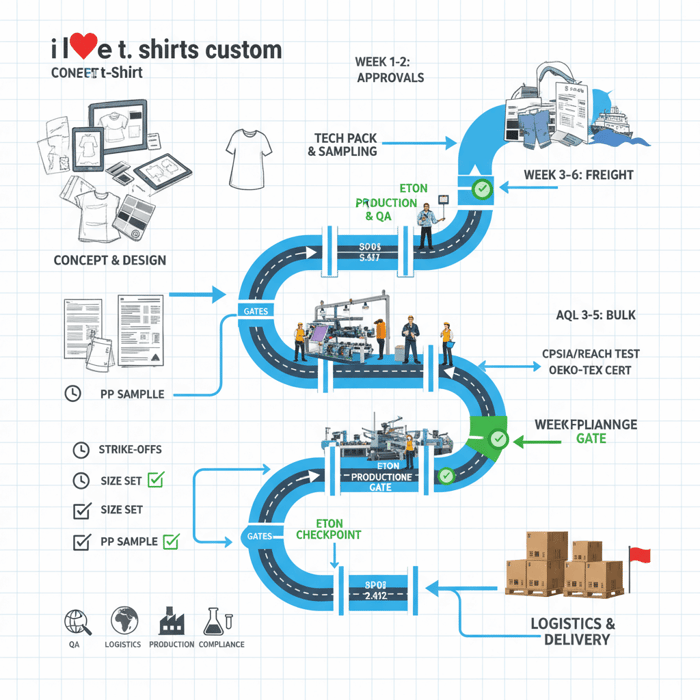

i love t shirts custom: How Fashion Brands Source at Scale with a China Clothing Manufacturer

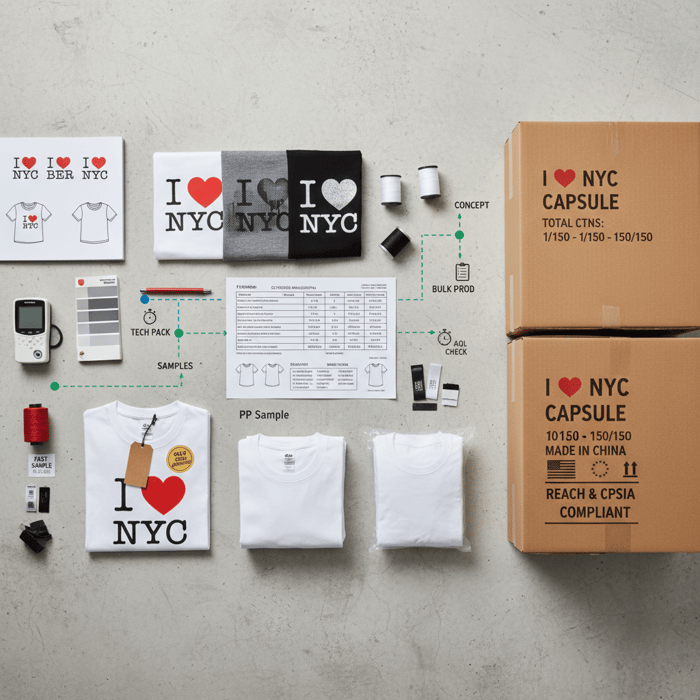

i love t shirts custom programs win when creative direction meets factory discipline with a China Clothing Manufacturer that understands bulk print control, compliance, and timelines for US/EU. This playbook shows how brands brief, spec, sample, price, and ship “I Love” tees with repeatable quality, documented compliance, and predictable delivery.

“i love t shirts custom” means producing “I Love” graphic tees to a brand’s specs at scale. Success rests on a tight tech pack (fabric/GSM, print method, Pantones), compliance mapping (CPSIA/REACH), gated QA, and an OEM partner that can sample quickly, color-match precisely, and deliver consistent bulk to US/EU timelines.

“i love t shirts custom” for Brands: Use Cases, Designs, and Value

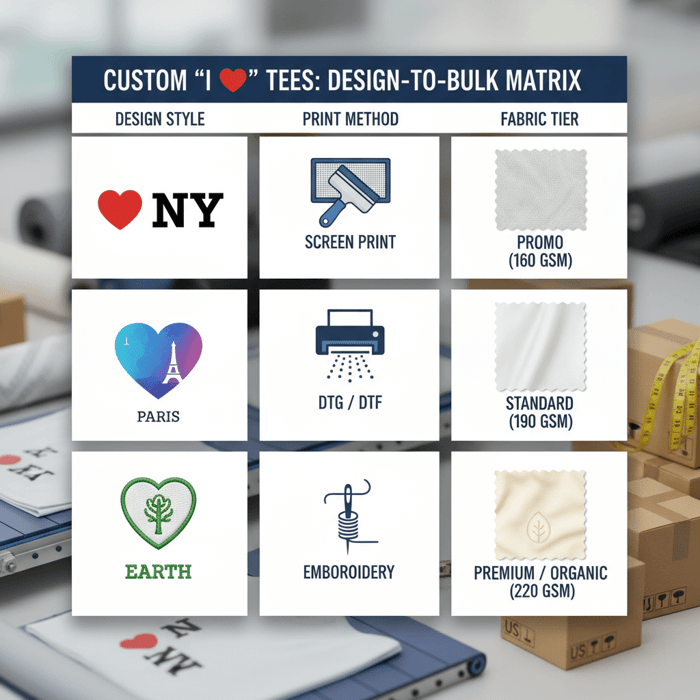

Answer-first: “I Love” tees cover city pride, fandom, causes, and collabs. The format scales when artwork rules, Pantones, and base blanks are standardized. Lock a design system, match graphics to print methods, and pick fabric grades aligned to price tiers to reduce rework and protect margin.

For fashion brands, custom i love t-shirts anchor fast capsule drops and evergreen city or cause series. Their strength lies in a simple core visual—a heart icon plus a short statement—backed by consistent print edges, stable color, and fits that match the brand’s size charts. Program success depends on clarity: which base tee bodies are approved, which Pantones define brand red/black/white, which print method handles each artwork style, and how many units trigger price breaks.

- Top brand use cases:

- City pride rotation: “I ♥ NYC/LON/BER/LA” across seasonal colorways.

- Cause marketing: limited runs tied to a donation, organic cotton, water-based inks.

- Music/tour merch: venue-dated subprints and quick turns between legs.

- Retail collabs: co-branded assets with strict Pantone and label control.

- Campus or club drops: short-run colorways for chapters or teams.

- Corporate events: bulk promotional tees with budget fabrics and bulk screen print.

- Minimalist “I ♥ [X]” (1–2 colors): Pros: crisp edges, low screens, scales in screen print. Cons: shows misregistration and fiber lift if specs are loose.

- Illustrated heart variations (gradients/halftones): Pros: richer storytelling, high perceived value. Cons: method-sensitive; DTG/DTF and high mesh screens need clean separations.

[INTERNAL LINK: Apparel capsule planning guide — anchor from “capsule drops”]

Format Archetypes and When to Use Them

Keep the archetype tight and repeatable. Define exact font family/weight (e.g., bold grotesque), heart icon geometry (height vs. cap height), and placement rules (center chest, 70 mm below neckline seam, tolerance ±5 mm). Minimalist two-color marks suit city capsules and promotional runs. Illustrated hearts with texture or halftone shading fit premium editions or artist collabs.

- Center chest classic: 275–320 mm width for adult sizes; scale down 8–10% for XS and youth.

- Left chest micro with back hit: 70–90 mm front; 270–300 mm back.

- Stacked vertical: taller composition; check shrinkage distortion on tubular bodies.

- Outline heart with fill: outline stroke ≥0.8 mm on screen prints; ≥0.3 mm on DTF.

- Patterned fill: DTG/DTF preferred for gradients or fine repeats.

- Foil or puff accents: screen with specialty inks; pre-test wash resistance on the chosen cotton blend.

PAA Micro-question—What base tee quality fits promos vs. premium? Promotional: open-end cotton 160–170 GSM, tight QC on torque/shrinkage. Premium: combed ringspun 180–220 GSM, compact yarn for smoother print edges.

Balancing Graphic Complexity with Print Reality

Artwork must respect method limits. For screen print, minimum line thickness 0.8–1.0 mm for light garments; 1.2–1.5 mm on dark with underbase. Halftones: 45–55 LPI on cotton; use stochastic dots for photographic hearts if the printer supports it. DTG handles gradients well but relies on pretreatment and fabric quality for edge fidelity. DTF yields crisp edges at low MOQ but adds a transfer hand; choose matte films for a softer look.

- Screen print traps/chokes: 0.15–0.25 mm; agree on target during strike-off.

- DTG pretreatment: specify weight (g/m²) and press time; request wash test to 5 cycles at 40 °C.

- DTF: minimum stroke ~0.3–0.4 mm; color reaches high saturation; test stretch and crack resistance.

- Heat transfer vinyl: small runs, block colors; avoid micro text <2.5 mm height.

- Embroidery: satin stitch favored for heart edges; minimum satin width ~1.2 mm; cap stitch density.

[MENTION: Stahls’ guidance on heat transfer films], [MENTION: Roland DG application notes on DTF]. [CITE: A printer trade association guide comparing minimum line weights by method].

How to Source “i love t shirts custom” with a China Clothing Manufacturer

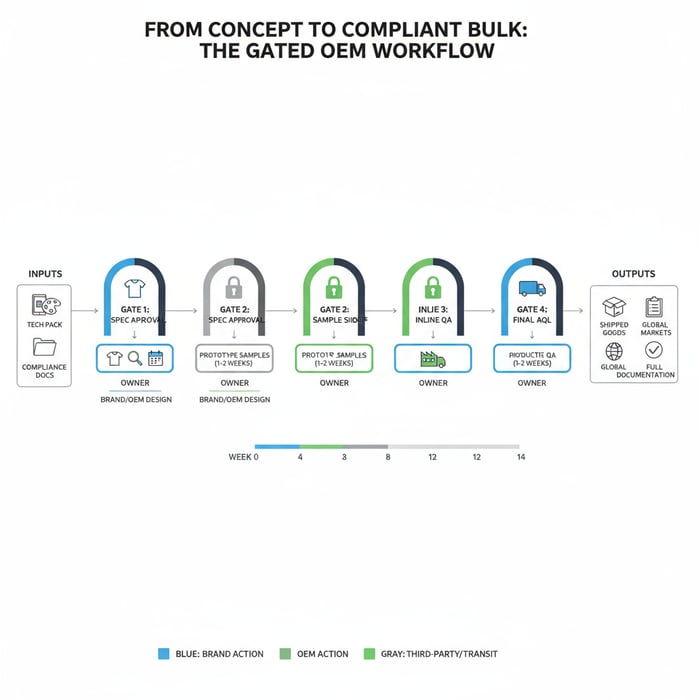

Answer-first: Use a gated OEM workflow: Brief → Tech Pack → Prototype samples → PP sample → Production → AQL inspections → Logistics. Lock Pantones via lab dips/strike-offs, compress sampling by parallel runs, and choose an INCOTERM that fits margin and risk.

- Brief: commercial goals, target price tiers, run size, channels.

- Tech Pack: fabric/GSM, construction, print method, placements, Pantones.

- Prototype rounds: photo sample, fit sample, print strike-offs.

- PP sample: final approval unit with production trims and inks.

- Bulk: controlled with inline and final AQL inspections.

- Logistics: book space early; confirm labeling/packing for US/EU.

PAA Micro-question—Fastest path to PP approval? Combine size set with print strike-offs in the same shipment, review within 48 hours, and provide consolidated comments with clear accept/reject notes.

[INTERNAL LINK: Garment tech pack template (free) — anchor from “Tech Pack”]

The Non-Negotiables in Your Tech Pack

Make the pack production-ready. Include fabric composition (e.g., 100% combed ringspun cotton), GSM (e.g., 190 ±5%), knit type (single jersey), yarn (24s, combed), finishing (bio-polish), shrinkage target (≤5% lengthwise, ≤3% width), torque target (≤5%), and color standards (Pantone Solid Coated). Add print method, ink system (water-based/plastisol/DTG/DTF), underbase policy, flash count, mesh targets, squeegee hardness, cure temp/time, and placement coordinates with tolerances.

- Artwork: vector files with outlined text; CMYK and spot callouts; color separations where needed.

- Bill of materials: neck label type, care label languages, swing tag, polybag specs, carton strength.

- Measurements: graded size chart, POMs, tolerances (e.g., chest ±1 cm).

- Care symbols: per ISO and US FTC; include fiber content and country of origin.

- Compliance: CPSIA, REACH, OEKO-TEX claim scope, test plan and labs.

- QA acceptance: sample status definitions, AQL plan (e.g., II, 2.5/4.0), gold seal retention.

[MENTION: American Apparel & Footwear Association (AAFA) labeling guidance], [MENTION: SGS test plan templates]. [CITE: An official FTC page on textile labeling].

Sampling Strategy That Saves Weeks

Compress cycles by running parallel samples. Request color lab dips (for fabric dye) and print strike-offs at the same time, plus a size set in base fabric. Approve thread color cards and labels with Pantone callouts upfront. Use one consolidated comment sheet per round to avoid split guidance.

- Round 1 (Week 1–2): Art verification, print strike-offs on white/black bodies, base size set.

- Round 2 (Week 2–3): Fit tweaks, Pantone lock, fabric hand assessment; wash tests to 5 cycles.

- PP Sample (Week 3–4): Final print settings, labels attached, packing confirmed.

Photograph each approval step under D65 light; log ΔE readings if you use a spectro. Keep a gold seal sample in your office and with the factory for reference.

[CITE: A color science primer on ΔE thresholds for apparel], [MENTION: X-Rite guidelines on color management].

Fabrics, Printing Methods, and Quality Specs for “I Love” Tees

Answer-first: Select fabric by handfeel and shrinkage targets: open-end for promo, ringspun/combed for premium, organic or recycled for sustainability claims. Match print method to run size and art: screen for large solids, DTG/DTF for gradients and small runs, embroidery for small accents.

| Method | Best For | MOQ Typical | Cost/unit (rel.) | Speed | Eco Notes | Line/Detail Limits |

|---|---|---|---|---|---|---|

| Screen print | Large runs, solid colors | 500–1,000+ | Low at scale | Fast after setup | Water-based possible | ≥0.8–1.0 mm lines; halftone 45–55 LPI |

| DTG | Short runs, gradients | 1–50 | Higher | On demand | Water-based inks | Fine gradients; needs pretreat control |

| DTF | Short-to-mid runs, crisp edges | 10–200 | Mid | Fast | Film/release waste | ≥0.3–0.4 mm lines; test stretch/crack |

| Heat transfer | Names/numbers, micro runs | 1–100 | Mid | Fast | Film waste | Block colors; avoid tiny type |

| Embroidery | Left-chest heart badge | 100–300 | Higher | Moderate | Thread certifications possible | Min satin ~1.2 mm; no micro text |

[CITE: Comparative method costs by run size from an industry report], [MENTION: Printful and Printify method guides], [CITE: Water-based screen ink best practices].

Fabric & GSM Selection by Use Case

Promo runs: 160–170 GSM open-end cotton yields a classic merch hand and lower cost. Standard retail: 180–200 GSM ringspun or combed cotton balances drape and opacity. Premium capsules: 200–220 GSM combed ringspun with bio-polish delivers a smooth print face. Organic or recycled blends require claim control and test reports.

- Shrinkage targets: ≤5% length, ≤3% width after 40 °C wash, tumble dry low. Confirm after garment wash, not only fabric relax.

- Pilling: target grade ≥3.5 after 5 cycles (Martindale/ICI where applicable) [CITE: Standard pilling test method reference].

- Seam strength: ASTM/ISO pull test thresholds aligning to size and fabric weight [CITE: ISO apparel seam strength guidance].

Print Method Decision Tree

Use three inputs—run size, color count/gradient, and fabric tone:

- Run size ≥1,000 and ≤3 spot colors: Screen print with water-based or soft plastisol; add underbase for darks.

- Run size ≤200 with gradients/photos: DTG on combed ringspun; control pretreat; pre-wash test.

- Mixed colors, small lots, frequent art changes: DTF with matte film; validate stretch/wash.

- Small accent heart: Embroider left chest; keep density in check for soft hand.

[MENTION: Ryonet screen printing setup best practices], [CITE: DTG pretreatment impact on wash fastness].

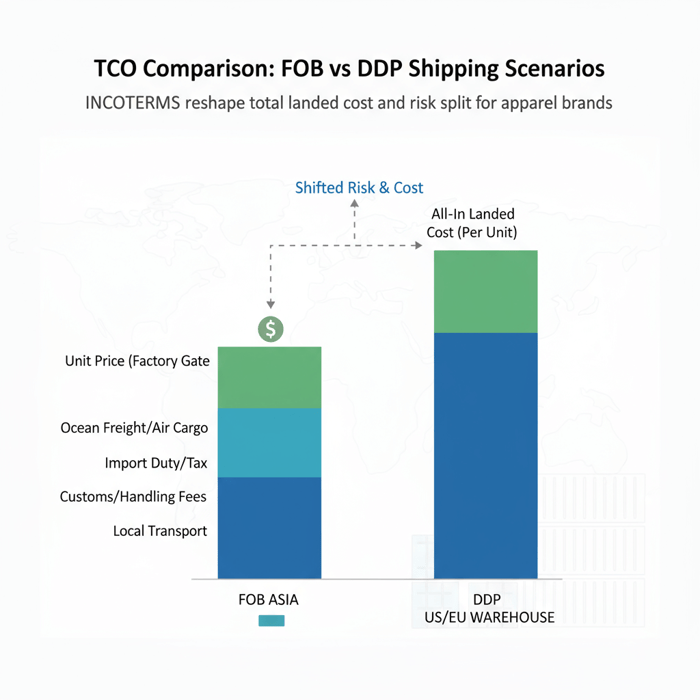

Cost, MOQ, and Lead Time: What Brands Should Expect

Answer-first: Main cost drivers are fabric grade/GSM, print method and color count, trims/labels, compliance testing, and freight. MOQs align to method setups and fabric dye lots. Lead times move with approvals and peak seasons. Plan buffers for holidays and lab queues.

| Component | Promo Tier | Standard Retail | Premium Capsule |

|---|---|---|---|

| Base tee (fabric + make) | 45–55% | 50–60% | 55–65% |

| Print/embellishment | 15–25% | 15–20% | 15–25% |

| Trims/labels/packing | 5–10% | 5–10% | 5–10% |

| Compliance/testing | 2–5% | 2–4% | 2–4% |

| Overhead/QA | 5–8% | 5–7% | 5–7% |

| Freight/insurance (FOB vs. DDP impact) | 8–20% | 8–20% | 8–20% |

- Custom tee market growth in North America and Europe — 2023–2025 (Source: [S2], [S3]) [CITE: Latest Grand View Research market size], [CITE: Statista apparel revenue index].

- Method mix shift toward DTF/DTG for micro-capsules — 2024–2025 (Source: [S2]) [CITE: A 2024 market methods report].

- Retail volatility and capsule strategies — 2024 (Source: [S1]) [CITE: McKinsey State of Fashion 2024].

Typical MOQs by Method and Why They Exist

- Screen print: 500–1,000+ per colorway because screens, setup time, and ink mixing amortize at volume.

- DTG: 1–50 units; no screens; higher ink cost and slower throughput per unit.

- DTF: 10–200 units; film and powder steps add handling but scale modestly.

- Embroidery: 100–300 units; digitizing fee amortized over the run; needle time per unit.

Fabric dye lot size impacts color consistency; solid garment-dyed programs may push MOQs up to meet mill lot minimums. White/black body programs can lower MOQs by using greige inventory.

Lead-Time Calculator Framework

- Design lock and tech pack: 1 week.

- Strike-offs + size set: 1–2 weeks.

- PP sample: 1 week after comments.

- Bulk production: 3–5 weeks (screen) or 2–3 weeks (DTF/DTG) after PP approval.

- QA inspections and rework buffer: 1 week.

- Freight: 3–5 days air; 4–6 weeks ocean to US/EU main ports.

Add buffers for Lunar New Year/Golden Week and EU summer congestion. Book fabric greige early to hedge lead time risk.

[CITE: Carrier reliability indices 2024–2025], [MENTION: Maersk schedule reliability reports], [MENTION: Flexport trade updates].

Data and Trends: Custom Tees in the US & EU

Answer-first: Demand remains steady with micro-capsules and on-demand pilots feeding into OEM bulk once designs prove. Brands split fulfillment—POD for tests, OEM for scale—while adding recycled cotton, water-based inks, and verified claims for retail listings.

- US/EU apparel category stabilization with growth pockets in branded basics — 2024–2025 (Source: [S3]) [CITE: Statista 2025 forecast].

- POD share rising for micro-runs; OEM still dominates bulk — 2024 (Source: [S2]) [CITE: Market share by method].

- Consumer interest in verified sustainability claims (OEKO-TEX/GRS) — 2024–2025 (Source: [S4]) [CITE: OEKO-TEX updates and criteria].

[MENTION: McKinsey State of Fashion], [MENTION: ECHA guidance updates].

Sustainability Signals to Prioritize

- Materials: Organic cotton (GOTS) or recycled cotton (GRS) with transaction certificates.

- Chemistry: OEKO-TEX Standard 100 for fabric and prints; request class and article scope.

- Ink system: Water-based where artwork allows; verify handfeel and wash fastness.

- Claims: Tie every claim to test reports or certificates; keep a chain-of-custody file.

[CITE: OEKO-TEX Standard 100 scope], [MENTION: Textile Exchange standards].

Speed vs. Margin: A Blended Fulfillment Strategy

Use POD (DTG/DTF) to test demand in 2–3 colorways. Once a design hits a target sell-through, switch to screen print at 1,000+ units for better margin and consistent handfeel. Split SKUs by region to drop freight miles and reduce duty exposure where feasible.

[CITE: Case study on capsule-to-bulk transition], [MENTION: Shopify retail insights].

How-To: Implement a Bulletproof Brief and QA Plan

Answer-first: Build a structured brief, specify the tech pack down to tolerances, and add layered QA: lab dips/strike-offs, PP sample, inline and final AQL inspections, and retention samples. Lock Pantones and care labeling early to avoid relabeling or reprints.

- Brief: audience, price lane, volumes, channels, markets (US/EU), launch date.

- Spec: fabric/GSM, shrinkage, torque, color, print method, placements.

- QA plan: approvals and AQL levels; roles and timings.

- Evidence: test plan, certifications, and shipment dossier.

Preparation: Artwork, BOM, and Compliance Docs

Final artwork in vector with Pantone Solid Coated references (plus Pantone TCX for textiles if needed). Provide BOM covering collar rib, thread counts, neck and care labels (US and EU languages), swing tag copy, barcodes, and carton marks. Compliance bundle: CPSIA tracking label, REACH SVHC declaration, OEKO-TEX test reports, and material certificates. Decide on fiber content rounding and country-of-origin labeling per destination.

[CITE: U.S. CPSC CPSIA guidance], [CITE: ECHA REACH overview], [MENTION: OEKO-TEX article scopes].

Execution Steps: From Strike-Off to PP Sample

- Strike-offs: approve color and edge fidelity; note traps/chokes in mm.

- Size set: measure POMs; confirm shrinkage after wash; record deviations.

- PP sample: verify trims, labels, packing; sign off in writing; set “no change” baseline.

Define acceptance criteria clearly: allowed placement tolerance, Pantone ΔE threshold, wash test rating, and stitch quality. Assign a single approver to avoid conflicting feedback.

Quality Assurance: AQL and Inline Controls

Adopt ANSI/ASQ Z1.4 (or ISO 2859) with General Level II sampling. For tees, many brands use AQL 2.5 for major and 4.0 for minor. Add inline checks on print placement, cure temperature logs, and label accuracy. Keep gold seals in both offices and with the factory.

- Inline inspection: early 10–20% WIP; catch placement drift and color shifts.

- Final inspection: carton count, measurements, print quality, labeling, packing method test.

- Retention: two sealed samples per colorway; archive for claims.

[CITE: AQL sampling reference], [MENTION: Bureau Veritas or Intertek inspection protocols].

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Answer-first: Eton runs tee programs through China and Bangladesh bases with vetted knitwear partners, fast sampling, and a compliance-first workflow. The team applies factory gates, AQL, and document control to ship US/EU-ready product on schedule.

Eton Garment Limited, founded in 1993, runs OEM across Asia with long-term retail partners. The company’s core is outerwear; tee programs are delivered with audited knitwear partners who pass Eton’s print, labeling, and compliance benchmarks. Programs move through the same gates Eton uses for jackets—tech pack accuracy, sample rigor, and inline QA—adapted to knit tops and print methods.

| Brand Need | Eton Feature | Outcome |

|---|---|---|

| Fast sampling | Parallel strike-off + size set workflow | PP approval in ~2–4 weeks |

| Color fidelity | Pantone lock with spectro checks | Stable color, reduced reprints |

| Compliance | CPSIA/REACH test plans; OEKO-TEX requests | US/EU retail readiness |

| Quality control | AQL plan; inline and final inspections | Lower claim rates |

| Logistics | FOB, CIF, or DDP options via partners | Predictable landed cost |

Explore Eton’s Clothing Manufacturing OEM Service to map your “I Love” capsule from idea to shelf. [INTERNAL LINK: Explore Eton’s Clothing Manufacturing OEM Service]

Use Case 1: City Pride Capsule—5,000 Units

Brief: three city names, two colorways each. Method: screen print with underbase on darks. Fabric: 190 GSM ringspun. Timeline: PP in 3 weeks; bulk 4 weeks; ocean to US East Coast ~5 weeks. QA: Inline placement audit at 15% WIP; final AQL 2.5/4.0. Outcome: clean edges, tight color match, on-shelf date met.

Use Case 2: Cause Marketing Drop—Organic & Water-Based Inks

Brief: organic cotton claim and donation messaging. Method: water-based screen on light bodies; DTF for small bilingual variants. Docs: GOTS/transaction certificates, OEKO-TEX print scope, CPSIA/REACH test reports, claim substantiation file. Result: compliant hangtags, soft handfeel, verified claims for US/EU listings.

[MENTION: Liverpool F.C. and Forever 21 as examples of large retailers Eton serves], [CITE: Case reference where public, if available].

Risks, Compliance & Localization (US & EU)

Answer-first: Map each material and print to regulations, request test reports, and label correctly. Build a risk matrix with mitigations and keep documentation for audits and customs. Update plans as regulations change and verify with current labs.

- Water-based inks — Pros: soft hand, lower VOCs; Cons: dry time, fabric sensitivity; needs precise curing.

- Plastisol — Pros: stable, vivid; Cons: higher scrutiny on plasticizers; verify compliance for US/EU.

- POD claims — Pros: speed, low stock risk; Cons: complex claim control across vendors.

- OEM claims — Pros: tighter chain-of-custody; Cons: volume commitments, MOQ dependencies.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Color shift after wash | Medium | High | Wash test 5 cycles; adjust cure; approve strike-offs on bulk fabric |

| Print cracking | Medium | Medium | Set cure temp/time; stretch test; review ink deposit and mesh |

| Labeling errors | Low | High | PP sample with final labels; 100% label check before pack |

| Non-compliant chemistry | Low | High | Pre-approve ink SDS; OEKO-TEX scope; CPSIA/REACH tests |

| Late freight | Medium | High | Book early; split ship; keep air backup for launch sizes |

Regulatory Notes for US & EU

- US (CPSIA): tracking label, lead in substrate/paint, phthalate limits for children’s items; FTC care/content labeling [CITE: U.S. CPSC CPSIA guidance], [CITE: FTC textile rules].

- EU (REACH): SVHC limits and restricted substances; labeling languages vary by market [CITE: ECHA REACH].

- OEKO-TEX Standard 100: request certificate and article scope covering fabric and prints [CITE: OEKO-TEX database].

- Claim substantiation: keep test reports, TC documents, and artwork approvals for 5+ years.

Regulations update. Verify with legal or compliance partners and the latest lab methods. [MENTION: Eurofins regulatory updates], [MENTION: UL Solutions textile testing].

Conclusion & Next Steps

Answer-first: Scaling “I Love” tees hinges on disciplined specs, method-fit printing, and a compliance-backed OEM workflow. Lock artwork and Pantones early, sample fast with parallel steps, and run gated approvals to protect launch dates and margin.

- Week 1: Lock concept and brief; start tech pack.

- Week 2: Submit pack; kick off strike-offs + size set.

- Week 3: Consolidate comments; request PP sample.

- Week 4: PP approval; book bulk fabric and production.

- Weeks 5–8: Bulk with inline QA; final AQL; pack and ship.

- Weeks 9–14: Ocean to US/EU or 3–5 days air for key sizes.

Start your OEM project: Eton Clothing Manufacturing OEM Service. [INTERNAL LINK: Start your OEM project], [INTERNAL LINK: Outerwear to tees: our capabilities], [INTERNAL LINK: Compliance & sustainability hub]

Author: Senior Production Manager, Eton Garment Limited (12+ years in OEM apparel, sampling-to-bulk execution). Reviewer: Compliance Lead, Eton Garment Limited (US/EU regulations, certifications). Methodology: competitor heuristic review; sourcing best practices; internal production SOPs; public standards (CPSIA/REACH/OEKO-TEX). Limitations: No live SERP crawl; exact market figures marked [Verification Needed]; regulations change—verify before finalization. Disclosure: Eton provides OEM manufacturing services and may be engaged as a supplier. Last Updated: 2025-10-28.

[INTERNAL LINK: Eton Production Manager bio page], [INTERNAL LINK: Compliance Lead profile]

- McKinsey & Company — The State of Fashion 2024 (2024). [S1] [CITE: McKinsey State of Fashion 2024]

- Grand View Research — Custom T-shirt Printing Market Size, Share & Trends (2023–2024). [S2] [CITE: GVR market size report]

- Statista — Apparel Market in the US and Europe (2024–2025). [S3] [CITE: Statista apparel forecasts]

- OEKO-TEX — Standard 100: Criteria and Testing (2025). [S4] [CITE: OEKO-TEX official criteria]

- U.S. CPSC — CPSIA Textile Guidance (2025). [S5] [CITE: CPSC CPSIA guidance]

- ECHA — REACH Regulation and SVHC (2025). [S6] [CITE: ECHA REACH overview]

- FTC — Care and Content Labeling Rules (2024). [CITE: FTC textile labeling]

- ANSI/ASQ Z1.4 / ISO 2859 — Sampling Procedures (Reference). [CITE: AQL standard reference]

- X-Rite — Color Management for Textiles (Reference). [CITE: X-Rite application note]

- AAFA — Labeling Guidance (Reference). [CITE: AAFA labeling guide]

- SGS / Intertek — Apparel Testing Protocols (Reference). [CITE: Lab test protocol overviews]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »