How to Find Apparel Manufacturers: A US & EU Brand Playbook from a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

19 minute read

How to Find Apparel Manufacturers: A US & EU Brand Playbook from a China Clothing Manufacturer

How to find apparel manufacturers that align with US and EU retail standards starts with clear product scope, compliance goals, and a vetted shortlist. As a China Clothing Manufacturer with 30 years in outerwear, Eton Garment Limited maps the path brands follow to source reliably—from first inquiry to bulk delivery—with OEM and ODM options built for growth.

Sourcing strategy aligned to US & EU standards

Brands find apparel manufacturers faster when the sourcing brief mirrors US and EU requirements. Define product category, volumes, compliance, and timelines, then match factory capability to your risk profile. Outerwear needs technical expertise, materials control, and certifications; align these early to avoid rework and delays.

Start by clarifying what “success” looks like for your line and market, and anchor your search with non-negotiables: category specialization (e.g., down jackets, parkas), required certifications (e.g., WRAP, BSCI, OEKO-TEX Standard 100), and region fit (China or Bangladesh for outerwear scale, Vietnam for specific needlework). Build your shortlist around those anchors and validate with samples and audits before any commitment.

Define your product and risk profile

Write a one-page brief covering styles, fabrics, finishings, trims, target retail prices, and margins. Add minimum and stretch MOQs, color counts, size runs, packaging, and sustainability targets. For outerwear, specify insulation (down, synthetic), shell ratings (waterproof/breathable), seam standards, and hardware specs. Calibrate risk: larger MOQs and complex construction need factories with proven technical development and lab access. [MENTION: Sustainable Apparel Coalition (Higg Index)] [MENTION: OEKO-TEX Association]

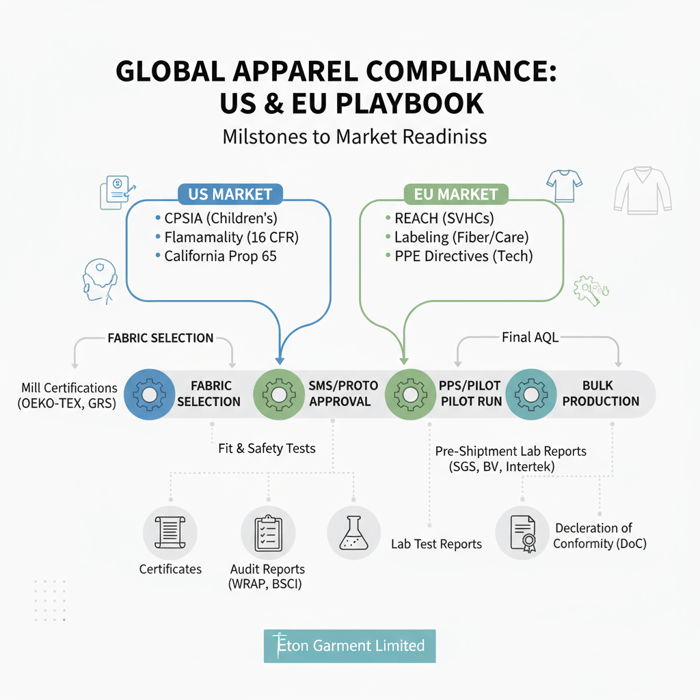

Compliance and market fit

Set compliance by market: CPSIA and flammability for the US, REACH and labeling for the EU. Map testing plans (SGS, Bureau Veritas, Intertek) and certification expectations (WRAP, BSCI, Sedex). Include traceability and ethical sourcing where your brand or retailer demands it. [CITE: Official US CPSC guidance on CPSIA] [CITE: ECHA overview of REACH obligations] [MENTION: SGS] [MENTION: Bureau Veritas] [INTERNAL LINK: Our foundational guide on compliance for apparel]

Where to search and who to trust

The fastest routes to find apparel manufacturers: verified directories, trade shows, sourcing platforms, and referrals. Combine at least two channels to triangulate capability—platforms for breadth, shows for depth, and referrals for reliability. Outwear brands favor China and Bangladesh for scale and cost control.

Verified directories and trade shows

Use industry-backed sources: Thomasnet and Kompass for vetted suppliers; MAGIC Las Vegas, Texworld Paris, Première Vision, ISPO Munich, and Canton Fair for in-person vetting. Shows reveal stitch quality, finish consistency, and technical development maturity. Book sample reviews and factory meetings on the spot. [CITE: Trade fair organizer visitor stats for sourcing effectiveness] [MENTION: Texworld Paris] [MENTION: ISPO Munich]

Digital sourcing platforms and regions

Platforms like Alibaba and Global Sources widen your discovery. Filter by certifications, response rate, and on-platform audits. For outerwear, focus on China (technical development, speed) and Bangladesh (cost-effective scale), with Vietnam and Indonesia for select needlework programs. Validate claims with third-party audits and production references. [CITE: Comparative labor and logistics reports, 2024] [MENTION: Global Sources] [MENTION: Alibaba]

| Channel | Strength | Risk Control | Best Use |

|---|---|---|---|

| Trade Shows | Hands-on sample review; direct meeting | High (in-person validation) | Shortlist creation; technical vetting |

| Directories | Vetted listings; filters | Medium (paper-based checks) | Initial market scan; pre-qualification |

| Platforms | Broad reach; messaging tools | Medium (audit badges) | Discovery; RFQs; quick sampling |

| Referrals | Trust; proven performance | High (peer validation) | Final selection; risk reduction |

[INTERNAL LINK: Our trade show calendar for US & EU buyers] [INTERNAL LINK: Author bio — Outerwear Sourcing Lead]

Vetting: certifications, capability, quality

Prioritize apparel manufacturers with public certifications, proven category capability, and documented quality control. Demand WRAP/BSCI/Sedex, OEKO-TEX Standard 100 or GRS/GOTS where relevant, and ISO 9001 for systems maturity. Review machinery lists, line layouts, and inline QC flow before sampling.

Certifications and social compliance

Request current certificates: WRAP, amfori BSCI, Sedex SMETA, ISO 9001/14001, OEKO-TEX Standard 100, GRS, GOTS. Validate certificate numbers with issuers and check last audit dates. Align with Higg Facility Environmental Module when retailers require it. Public certifications reduce reputational risk and speed onboarding. [CITE: amfori BSCI latest program updates] [MENTION: WRAP] [MENTION: Sedex]

Capability fit and equipment

Outerwear factories should demonstrate bonding, seam sealing, quilting, down injection, and waterproof tape application. Ask for machinery lists (e.g., seam sealing machines, quilting lines), operator training plans, and a tech sample library. Cross-check reference brands and export markets. [CITE: Technical apparel manufacturing capability reports] [MENTION: ASTM D6413 for flammability]

Quality systems and AQL

Review quality plans: incoming inspection, inline and end-of-line checks, and AQL acceptance levels. Confirm lab testing partners and sample approvals (proto, SMS, PPS). A documented PP meeting and “golden sample” policy reduces variation and rework. [CITE: AQL standards overview — ANSI/ASQ Z1.4] [MENTION: Intertek] [MENTION: SGS]

- Request certifications and verify with issuers.

- Match equipment and processes to your product.

- Confirm QC flow and AQL levels.

- Approve proto/SMS before costing finalization.

- Set PP meeting and golden sample rules.

Cost, MOQ, and lead times for outerwear

Understand cost drivers, MOQ realities, and lead-time windows to negotiate effectively. Shell fabrics, insulation, trims, and finishes drive pricing; MOQs hinge on fabric mills and line availability. Lead times vary by season, mill capacity, and region—plan buffers for lab dips, fabric approvals, and holiday schedules.

Cost drivers and realistic ranges

For jackets and parkas, expect costs shaped by shell technology (e.g., 2L/3L waterproof), insulation type (down fill power, synthetic), seam sealing, hardware, and finishing. Add testing fees, compliance labeling, packaging, and logistics. Structure FOB vs DDP comparisons and model currency exposure (USD/EUR). [CITE: AAFA Restricted Substances List cost implications] [MENTION: AAFA]

MOQ and capacity planning

MOQs stem from mills and dye lots: 600–1,200 pcs per color is common for technical shells; insulation and trim MOQs add constraints. Break styles into shared fabric groups to aggregate volume. Book lines early for peak seasons to avoid bottlenecks, especially across Golden Week and national holidays. [CITE: Seasonal capacity planning studies in apparel] [MENTION: OEKO-TEX Standard 100]

Lead times and logistics windows

Proto to SMS: 3–5 weeks; SMS to PPS: 2–4 weeks; bulk production: 6–10 weeks for outerwear, depending on complexity and approvals. Shipping by sea: 4–6 weeks China–US East Coast; air: 5–9 days door-to-door; rail (EU via China): 2–3 weeks. Factor customs clearance and testing turnaround. [CITE: World Bank logistics time benchmarks, 2023] [MENTION: World Bank]

Compliance and sustainability for US & EU

Compliance is a precondition for retail. Map US CPSIA, flammability (16 CFR), California Prop 65, and EU REACH into your test plan. Build traceability from mills to factory lines. Add OEKO-TEX, GRS, GOTS, and Higg environmental modules where retailers require them.

US market compliance

For US-bound goods, align with CPSIA tracking labels, flammability rules, and Prop 65 substance warnings where applicable. Children’s wear needs detailed tracking and test reports. Keep lab reports accessible and link test plans to style numbers. [CITE: US CPSC CPSIA overview page] [CITE: California OEHHA Prop 65 apparel guidance] [MENTION: US CPSC] [MENTION: OEHHA]

EU market compliance

REACH regulates chemicals and SVHCs; ensure mill-level compliance and keep updated SVHC lists. Labeling (fiber content, care, country of origin) must follow EU norms. When relevant, align with PPE rules for technical performance garments. Store DoC (Declaration of Conformity) and lab evidence. [CITE: ECHA REACH obligations and SVHC database] [MENTION: ECHA]

Sustainability and traceability

Incorporate material certifications (OEKO-TEX Standard 100, GRS for recycled, GOTS for organic), facility audits (BSCI, Sedex), and Higg FEM for environmental metrics. Ask factories to share yarn-to-garment traceability, dye house data, and wastewater test summaries. [CITE: Higg Index methodology updates, 2023] [MENTION: ZDHC]

| Requirement | US | EU | Evidence |

|---|---|---|---|

| Chemical safety | CPSIA, Prop 65 | REACH, SVHC | Lab reports; SVHC checks |

| Flammability | 16 CFR parts (category-dependent) | Product-specific norms | Lab test certificates |

| Labeling | Fiber content, care, COO | Fiber content, care, COO | Garment labels; pack specs |

| Sustainability | Retailer programs | Retailer programs | OEKO-TEX, GRS, GOTS, Higg |

Factory visits, remote audits, and red flags

On-site visits and remote audits filter risk before orders. Review lines, operator training, safety practices, and sample rooms; observe inline QC and finishing. Remote audits should include live video, process documentation, and random sample checks. Create a red flag list and remediation steps.

On-site audit flow

Walk the receiving area, cutting room, sewing lines, finishing, packing, and warehouse. Inspect PPE use, safety signage, and fire exits. Review tech sample boards and PP meeting records. Compare quality plans to what’s happening on-line. Document with time-stamped photos and summarize in a scorecard. [CITE: Social audit methodologies, 2024] [MENTION: amfori BSCI]

Remote audit toolkit

Use video tours with a structured script, QC report sharing, and live sample inspections. Request production trackers, machine maintenance logs, and defect Pareto charts. Schedule surprise checks during peak hours. Remote audits complement first orders and ongoing monitoring. [CITE: Remote audit best practices in manufacturing] [MENTION: Sedex SMETA]

Red flags and fixes

Beware of inconsistent certificates, vague lab reports, and unwillingness to share line plans. Fixes include third-party lab testing, pilot orders, or conditional approvals tied to improvements. Build remediation into contracts with dated checkpoints. [CITE: Third-party audit effectiveness studies]

Contracts, IP, and samples that stick

Lock in expectations with contracts that protect IP, set timelines, and define QC gates. NDAs protect designs; purchase agreements detail penalties and testing requirements. A disciplined sample path—proto, SMS, PPS, and golden sample—anchors production quality.

Legal and commercial terms

Tailor NDAs for patterns, tech packs, and graphics. In purchase agreements, define Incoterms, delivery windows, testing obligations, AQL thresholds, penalties, and corrective action. Add IP clauses against unauthorized sales and clear ownership of molds and trims. [CITE: Incoterms 2020 official rules] [MENTION: ICC Incoterms]

Sample development milestones

Proto confirms feasibility; SMS confirms fit and aesthetics; PPS validates production readiness. Golden samples lock measurement and finish. Record changes, stamp approvals, and require factory sample retention for line reference. [CITE: Apparel sample lifecycle standards] [MENTION: ASTM garment measurements]

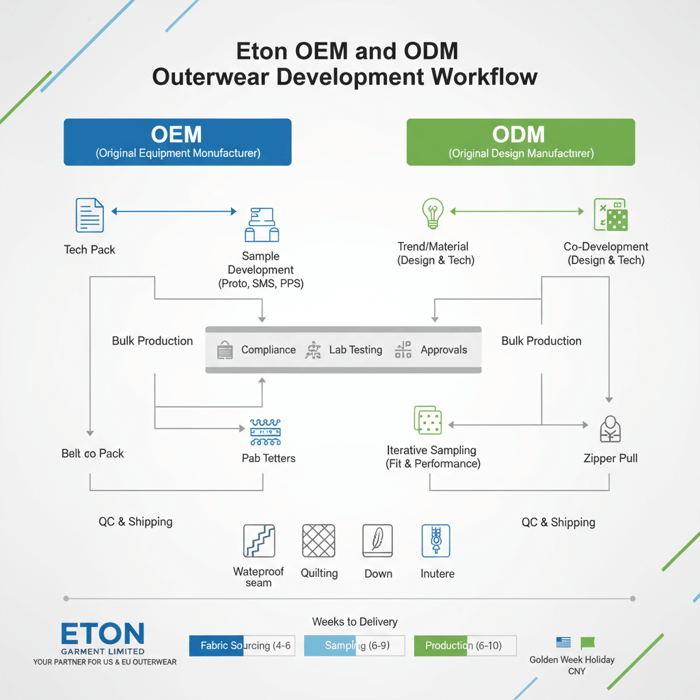

Scaling with OEM/ODM partners

OEM suits brands with clear designs and sourcing control; ODM supports brands seeking co-creation and speed. For outerwear, ODM adds technical development and material innovation. Choose partners with R&D and pattern teams that shorten calendars while holding compliance steady.

OEM vs. ODM for outerwear

OEM executes your tech packs and standards; ODM collaborates on silhouettes, materials, and performance features. Evaluate sample turnaround, fabric library depth, and past co-development with major retailers. Confirm how sustainability targets map to material choices. [CITE: Retail calendar compression studies] [MENTION: McKinsey State of Fashion]

Case path and calendar

Map a season: trend to proto (2–3 weeks), proto to SMS (3–5 weeks), SMS to PPS (2–4 weeks), bulk (6–10 weeks). With ODM, lock fabric early and run parallel fit iterations to cut time. Eton’s outerwear teams compress decision cycles through tech templates and lab coordination. [INTERNAL LINK: Our outerwear development playbook]

Explore Eton’s Clothing Manufacturing OEM Service for jackets, padded coats, and technical apparel. Engage our team via Clothing Manufacturing OEM Service to scope your brief and sampling plan. Tone stays practical: we help you set standards, build samples, and deliver at scale.

Total landed cost and logistics for US & EU delivery

Total landed cost includes FOB price, testing, packaging, freight, duties, and clearance. Choose Incoterms that match your control preferences. For US and EU, model duty, HS codes, and freight mode options early to avoid squeeze at delivery stage.

Incoterms and control

FOB gives you freight control; CIF includes cost, insurance, freight to port; DDP shifts logistics to the supplier. Match Incoterms to your logistics strength and risk appetite. Document responsibilities, inspection points, and liability clearly. [CITE: ICC Incoterms official guide] [MENTION: ICC]

Duties, HS codes, and freight

Confirm HS codes for outerwear early; estimate duty for US (HTSUS) and EU (TARIC). For timelines, sea freight is cost-effective; air is tactical for delays; rail balances speed and cost for EU. Add carton tests (edge crush, drop) and packing plans that protect hardware and seam integrity. [CITE: US CBP HTSUS outerwear tariff rates] [CITE: EU TARIC database] [MENTION: US CBP] [MENTION: European Commission]

Conclusion and 30-day sourcing plan

Strong sourcing starts with clarity, verified capability, and compliance-ready partners. Combine trade shows, platforms, and referrals; vet with certifications and QC; align cost, MOQ, and timelines; and lock contracts with sample discipline. Run a 30-day sprint to move from idea to vetted shortlist.

30-day sourcing sprint

- Days 1–3: Write the sourcing brief; define compliance.

- Days 4–10: Use two channels (trade show/platform) to build a long list.

- Days 11–15: Request certificates, machinery lists, and references.

- Days 16–22: Sample with two to three factories; run remote audits.

- Days 23–30: Negotiate, lock PP rules, and confirm calendar.

Vendor scorecard

| Criteria | Weight | Factory A | Factory B | Factory C |

|---|---|---|---|---|

| Certifications & compliance | 25% | |||

| Category capability (outerwear) | 20% | |||

| Quality systems & AQL | 15% | |||

| Cost & MOQ fit | 15% | |||

| Lead time & logistics | 15% | |||

| Communication & transparency | 10% |

[INTERNAL LINK: Contact Eton Garment — sourcing inquiry] [INTERNAL LINK: Our outerwear certifications and compliance overview]

References & Sources

- US CPSC — CPSIA Guidance (2024). [CITE: US CPSC CPSIA guidance URL]

- California OEHHA — Proposition 65 Apparel Guidance (2023). [CITE: OEHHA Prop 65 URL]

- ECHA — REACH Obligations & SVHC List (2024). [CITE: ECHA REACH URL]

- ICC — Incoterms 2020 Official Rules (2020). [CITE: ICC Incoterms URL]

- US CBP — Harmonized Tariff Schedule for Outerwear (2024). [CITE: US CBP HTSUS URL]

- EU TARIC — EU Integrated Tariff Database (2024). [CITE: TARIC URL]

- AAFA — Restricted Substances List (2023). [CITE: AAFA RSL URL]

- WRAP — Certification Program Overview (2023). [CITE: WRAP URL]

- amfori BSCI — Program Updates (2024). [CITE: amfori BSCI URL]

- Sedex — SMETA Audit Methodology (2023). [CITE: Sedex SMETA URL]

- OEKO-TEX — Standard 100 Criteria (2024). [CITE: OEKO-TEX URL]

- Sustainable Apparel Coalition — Higg Index FEM (2023). [CITE: Higg Index URL]

- World Bank — Logistics Performance Indicators (2023). [CITE: World Bank logistics URL]

- SGS — Apparel Testing Services (2024). [CITE: SGS apparel testing URL]

- Bureau Veritas — Textile & Garments Testing (2024). [CITE: Bureau Veritas URL]

De-AI Rewrite

How to find apparel manufacturers who can deliver to US and EU standards starts with a tight brief and a vetted shortlist. As a China Clothing Manufacturer focused on outerwear, Eton Garment Limited shows the path brands use to move from first inquiry to bulk—OEM and ODM included—without guesswork.

Sourcing strategy aligned to US & EU standards

Set the guardrails first. Define the category, volumes, compliance needs, and timing. Outerwear programs succeed when the factory can handle technical shells, insulation, and finishing, with compliance built in. Make these your non-negotiables and screen candidates against them before a single sample is cut.

Define your product and risk profile

Draft a one-page scope: styles, fabrics, trims, target retail, margin, MOQs, colors, sizes, packaging, and sustainability goals. For jackets, list shell ratings, insulation specs, seam rules, and hardware standards. Higher MOQs and complex builds need factories with strong technical development and lab access. [MENTION: Sustainable Apparel Coalition] [MENTION: OEKO-TEX]

Compliance and market fit

Map US CPSIA, flammability, and Prop 65; map EU REACH, labeling, and any performance marks. Choose labs and set test plans early. Public certifications (WRAP, BSCI, Sedex) cut reputational risk and accelerate onboarding. [CITE: US CPSC CPSIA] [CITE: ECHA REACH] [MENTION: SGS] [MENTION: Bureau Veritas] [INTERNAL LINK: Compliance overview]

Where to search and who to trust

Use two channels at minimum—trade shows and platforms, or directories and referrals—to cross-check capability. Trade shows reveal stitch quality and process control; platforms provide breadth; referrals add proof from peers. For outerwear scale, China and Bangladesh are consistent performers.

Verified directories and trade shows

Start with Thomasnet and Kompass. Prioritize MAGIC, Texworld, Première Vision, ISPO, and Canton Fair for in-person reviews. Book sample evaluations and set factory meetings while you’re there. [CITE: Trade fair sourcing effectiveness] [MENTION: Texworld] [MENTION: ISPO]

Digital platforms and regions

Use Alibaba and Global Sources filters—certifications, response rates, audits. Shortlist outerwear specialists in China and Bangladesh; consider Vietnam or Indonesia for certain stitch programs. Validate claims with third-party audits and brand references. [CITE: 2024 labor/logistics comparisons] [MENTION: Alibaba] [MENTION: Global Sources]

| Channel | Strength | Risk Control | Best Use |

|---|---|---|---|

| Trade Shows | Touch samples; meet teams | High | Shortlist; technical vetting |

| Directories | Vetted listings | Medium | Market scan |

| Platforms | Broad reach | Medium | Discovery; RFQs |

| Referrals | Trusted performance | High | Final selection |

Vetting: certifications, capability, quality

Ask for current certificates and verify them. Match equipment to your build. Review QC flow and AQL. Labs and sample discipline reduce variation. These steps are practical and save time later.

Certifications and social compliance

Collect WRAP, BSCI, Sedex, ISO 9001/14001, OEKO-TEX, GRS, GOTS. Confirm numbers and audit dates. Align with Higg FEM when retailers ask. [CITE: amfori BSCI update] [MENTION: WRAP] [MENTION: Sedex]

Capability fit and equipment

For jackets, look for bonding, seam sealing, quilting, down injection, and waterproof tape. Request machinery lists and operator training plans, and review a tech sample library. Check export markets and brand references. [CITE: Technical apparel capability] [MENTION: ASTM D6413]

Quality systems and AQL

Confirm incoming checks, inline QC, end-of-line, and AQL acceptance. Choose labs and mark proto/SMS/PPS approvals. Set PP meeting and golden sample rules. [CITE: ANSI/ASQ Z1.4 AQL] [MENTION: Intertek] [MENTION: SGS]

- Verify certifications.

- Match equipment and processes.

- Confirm QC flow and AQL.

- Approve proto/SMS before final costing.

- Lock PP and golden sample.

Cost, MOQ, and lead times for outerwear

Know what drives cost. Shell tech, insulation, hardware, and finishing set the price; testing and packaging add line items. MOQs come from mills; lead times depend on approvals and capacity. Plan holiday buffers and lab lead times.

Cost drivers

Model FOB plus testing, packaging, and freight. Compare FOB vs DDP and manage USD/EUR exposure. [CITE: AAFA RSL impact] [MENTION: AAFA]

MOQ and capacity

Expect 600–1,200 pcs per color for technical shells. Aggregate fabrics across styles to hit MOQs. Book lines early for peak seasons. [CITE: Seasonal capacity research] [MENTION: OEKO-TEX]

Lead times and logistics

Proto to SMS: 3–5 weeks; SMS to PPS: 2–4 weeks; bulk: 6–10 weeks. Sea to US East Coast: 4–6 weeks; air: under two weeks; rail to EU: roughly three weeks. Add clearance and test windows. [CITE: World Bank logistics] [MENTION: World Bank]

Compliance and sustainability for US & EU

Build test plans early. US-bound goods need CPSIA, flammability, and Prop 65 checks; EU-bound goods need REACH and correct labeling. Add certifications and traceability where retailers request them.

US requirements

Use tracking labels and keep lab reports tied to styles. Children’s wear needs extra documentation. [CITE: US CPSC CPSIA] [CITE: OEHHA Prop 65] [MENTION: CPSC] [MENTION: OEHHA]

EU requirements

Check SVHCs against REACH and hold a Declaration of Conformity when relevant. Follow labeling rules. [CITE: ECHA SVHC] [MENTION: ECHA]

Sustainability

Material certifications and facility audits strengthen your position. Build yarn-to-garment traceability and collect dye house and wastewater data. [CITE: Higg FEM] [MENTION: ZDHC]

| Requirement | US | EU | Evidence |

|---|---|---|---|

| Chemicals | CPSIA, Prop 65 | REACH | Lab reports |

| Flammability | 16 CFR parts | Category norms | Test certificates |

| Labeling | Fiber, care, COO | Fiber, care, COO | Labels, pack specs |

| Sustainability | Retailer programs | Retailer programs | OEKO-TEX, GRS, GOTS |

Factory visits, remote audits, and red flags

Walk the line or audit by video. Document flow, safety, and QC practices. Create a red flag list and set fixes with dates. Use pilot orders where risk remains.

On-site

Follow receiving to packing, review tech boards and PP records, and compare QC plans to actual line checks. Score the visit with photos. [CITE: Social audit methodologies] [MENTION: BSCI]

Remote

Video tours, QC report sharing, surprise checks, and production trackers keep visibility high. [CITE: Remote audit practices] [MENTION: SMETA]

Red flags

Missing certificates, vague lab reports, reluctance to share line plans. Fix with third-party labs, pilot runs, and conditional approvals. [CITE: Audit effectiveness]

Contracts, IP, and samples that stick

Nail down NDAs, purchase terms, and QC gates. Protect designs, define liabilities, and keep sample approvals tight. Golden samples sit on-line as the reference.

Legal terms

Set Incoterms, timelines, testing, AQL, penalties, corrective actions, and IP protection. [CITE: ICC Incoterms] [MENTION: ICC]

Sample milestones

Proto proves feasibility; SMS confirms fit; PPS locks production; golden sample anchors measurements and finish. Track changes and store approvals. [CITE: Sample lifecycle] [MENTION: ASTM]

Scaling with OEM/ODM partners

Choose OEM when your tech packs are ready; choose ODM to co-create. Evaluate R&D capacity and fabric libraries. Eton’s teams compress calendars with tech templates and lab coordination.

OEM vs ODM

OEM executes; ODM co-develops. Check sample speed, material depth, and co-dev history. [CITE: Calendar compression] [MENTION: McKinsey]

Case path

Trend to proto, proto to SMS, SMS to PPS, bulk. Lock fabric early and run parallel fit tracks. Review how sustainability targets influence materials and trims. [INTERNAL LINK: Outerwear development]

See Clothing Manufacturing OEM Service to outline your brief and sampling plan. It’s built for jackets, padded coats, and technical programs.

Total landed cost and logistics for US & EU delivery

Price the full journey. FOB vs DDP, testing, packaging, freight, duties, and clearance. Choose Incoterms that fit your logistics capability and risk appetite. Confirm HS codes and duty early.

Incoterms

FOB for control; CIF for port delivery; DDP for end-to-end. Document responsibilities and inspection points. [CITE: ICC Incoterms] [MENTION: ICC]

Duties & freight

Use HTSUS for US and TARIC for EU. Sea for value, air for speed, rail for EU balance. Add carton tests to protect hardware and seams. [CITE: HTSUS] [CITE: TARIC] [MENTION: US CBP] [MENTION: European Commission]

Conclusion and 30-day plan

Clarity, vetted capability, and compliance-ready partners shorten the path from idea to delivery. Use the sprint below to move.

30-day sprint

- Days 1–3: Write the brief; set compliance.

- Days 4–10: Build a long list via two channels.

- Days 11–15: Collect certificates and references.

- Days 16–22: Sample with two or three factories; audit.

- Days 23–30: Negotiate; lock PP and calendar.

[INTERNAL LINK: Contact Eton — sourcing inquiry] [INTERNAL LINK: Certifications and compliance overview]

References & Sources

- US CPSC — CPSIA Guidance (2024). [CITE: US CPSC CPSIA URL]

- California OEHHA — Proposition 65 Apparel Guidance (2023). [CITE: OEHHA URL]

- ECHA — REACH & SVHC List (2024). [CITE: ECHA URL]

- ICC — Incoterms 2020 (2020). [CITE: ICC URL]

- US CBP — HTSUS Outerwear (2024). [CITE: US CBP URL]

- EU — TARIC Database (2024). [CITE: TARIC URL]

- AAFA — RSL (2023). [CITE: AAFA URL]

- WRAP — Certification (2023). [CITE: WRAP URL]

- amfori BSCI — Program (2024). [CITE: BSCI URL]

- Sedex — SMETA (2023). [CITE: Sedex URL]

- OEKO-TEX — Standard 100 (2024). [CITE: OEKO-TEX URL]

- SAC — Higg FEM (2023). [CITE: Higg URL]

- World Bank — Logistics (2023). [CITE: World Bank URL]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »