Free Clothing Samples from a China Clothing Manufacturer: What to Expect and How to Qualify

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

21 minute read

Free Clothing Samples from a China Clothing Manufacturer: What to Expect and How to Qualify

Free clothing samples are possible with a China Clothing Manufacturer when brands qualify, define scope, and confirm credits in writing. For fashion teams in the US and EU, samples validate fit, construction, and material integrity without risking full production. Outerwear sampling—jackets, parkas, padded coats—adds technical layers: insulation loft, seam sealing, quilting, and functional hardware. Clarity on “free,” timelines, and compliance turns sampling into your fastest route to a confident first PO.

There’s a common misconception that “free” means zero cost. In apparel manufacturing, “free” usually refers to waiving the labor fee to cut and sew a prototype under specific conditions. Shipping, premium materials, special tooling, and third-party tests often remain payable. Many factories rebate paid sample fees against your first bulk order once MOQ and value thresholds are met. Eton’s approach makes this transparent early—so you have cost certainty and a clean path from proto to pre-production (PP) approvals.

This article lays out an end-to-end blueprint for securing free or rebated samples responsibly. You’ll find precise sample type definitions, fee/credit models, a step-by-step outreach guide, region comparisons (China vs. Bangladesh), and a compliance-first workflow aligned with US and EU expectations. We’ll also highlight on-floor QA checkpoints Eton uses for outerwear—fit accuracy, seam-seal integrity, down/insulation performance, and AQL practices—so approval decisions are grounded in real factory standards. Expect actionable tables, email scripts, and decision gates you can plug into your next sampling plan.

For brands exploring OEM and ODM, two paths can speed sampling: develop from your own tech pack (OEM) or adapt the factory’s ready-to-customize designs (ODM). ODM frequently moves faster, especially for seasonal outerwear, because materials and patterns are pre-qualified. OEM unlocks full control when you bring a complete tech pack and clear FOB targets. Either way, request the sample policy upfront, document every decision, and align fit calendars to realistic capacity windows.

Textile From Day One. Eton’s motto reflects 30 years of building garment factory systems that respect design intent and production realities. That ethos shows up in sampling: transparent fees, written credit terms, compliance-ready documentation, and the patience to get fit right—before you scale.

In apparel, “free clothing samples” often mean the factory waives the sample-making fee for qualified projects while shipping, premium materials, or tooling remain payable. Many China Clothing Manufacturers credit paid sample fees against your first PO when MOQ and order value thresholds are met. Confirm fees, credits, and timelines in writing.

What “Free Clothing Samples” Really Means in Apparel Manufacturing

“Free” generally applies to sample-making labor and basic materials for qualified projects. Shipping, premium components, specialized tooling, and lab tests are usually excluded. Factories typically link free or rebated samples to clear purchase intent—meeting MOQ, hitting target FOB, and forecasting repeat potential. Document fee types, refund triggers, and non-refundable items before cutting fabric.

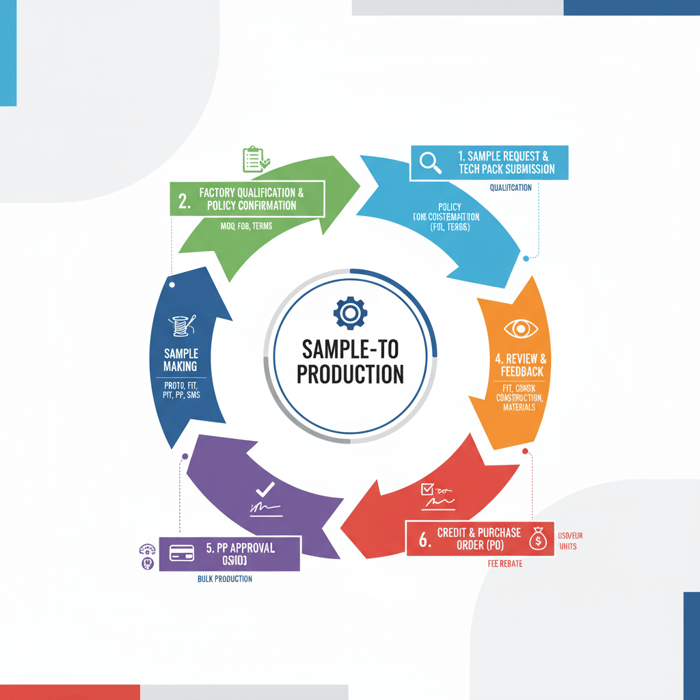

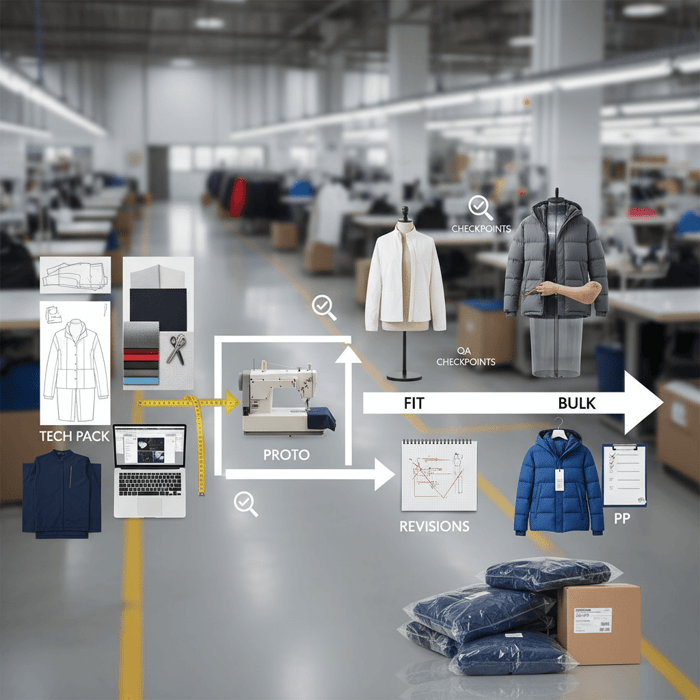

[CITE: “Industry survey on sample fee practices among Asia apparel factories, 2023–2025”] [MENTION: Techpacker’s taxonomy of sample types] [MENTION: Sewport guidance on sampling timelines] Outerwear sample development workflow

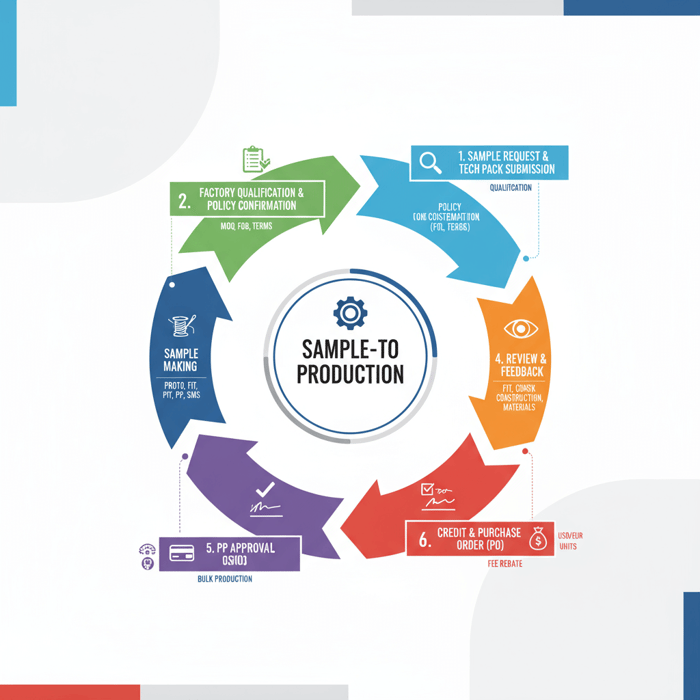

| Sample Type | Purpose | Typical Fees | Free/Waivable? | Credit Conditions | Indicative Lead Time |

|---|---|---|---|---|---|

| Proto (Prototype) | First physical build to prove silhouette and construction. | Patterning, cutting, sewing labor; basic materials. | Often waived for qualified projects; shipping unpaid. | Fees rebated against first PO if MOQ/value thresholds are met. | 7–14 days; faster under ODM. |

| Fit Sample | Validates size, drape, mobility; refines grading approach. | Labor; graded pattern costs; sometimes premium materials. | Waivable with clear intent; premium trims billed. | Credit if PO approved within set window and MOQ met. | 7–21 days depending complexity. |

| PP (Pre-Production) | Final reference for bulk; locks construction and materials. | Labor; exact bulk materials and trims; QA overhead. | Rarely free; strategic rebate possible. | Partial credit possible for committed bulk orders. | 10–21 days; technical outerwear runs longer. |

| SMS (Salesman) | Multiple-colorway samples for sell-in or campaigns. | Multiple units; premium finishes; photo-quality construction. | Not free; negotiated terms only. | Occasional partial credit tied to confirmed launch and PO. | 14–30 days; colorway/material availability affects timing. |

Types of Samples and Typical Cost Drivers

Precision matters in outerwear. Each sample type focuses on different decisions—and cost drivers shift accordingly. Define which decisions must be made at each sample stage, and match materials/practices to those decisions to avoid paying for unnecessary upgrades too early.

- Proto

- Goal: Validate silhouette, construction logic, and major seam placements.

- Cost drivers: New patterning, muslins or substitute shell, early trims placeholders.

- Notes: Use representative but not necessarily final materials to move quickly.

- Fit Sample

- Goal: Confirm measurements, shoulder and sleeve mobility, armhole comfort, hood balance.

- Cost drivers: Graded pattern creation, accurate shell/lining weight, interim insulation.

- Notes: Record fit comments per size; timebox revisions to avoid drift.

- PP (Pre-Production)

- Goal: Lock construction, stitch types, seam tapes, closures, insulation loft, and testing plan.

- Cost drivers: Exact bulk materials, seam-seal consumables, QA time, test swatches.

- Notes: Treat PP as the single source of truth for bulk—discipline matters.

- SMS (Salesman)

- Goal: Present buy-ready samples to retail and marketing; colorways must match.

- Cost drivers: Multiple units, premium finish consistency, branding accuracy.

- Notes: Schedule ahead; color lab dips and trims availability affect timing.

[MENTION: Oeko-Tex Standard 100] [MENTION: bluesign system for materials management] [CITE: “Market report on material sampling lead times in Asia outerwear, 2024”]

Fee/Credit Models: Free, Rebated, or Paid

Factories match sample policies to real signals: confirmed target FOB, MOQ readiness, and forecast. The cleaner your brief, the more flexible the terms. The examples below are indicative; always confirm written terms with your supplier and capture them in the PO rider.

- If PO ≥ $50,000 and MOQ ≥ 800 units

- Proto fee waived; fit sample fee waived.

- Shipping billed to brand; lab testing billed.

- PP sample 50% credited after PO release within 30 days.

- If PO ≥ $20,000 and MOQ ≥ 400 units

- Proto fee credited against first PO.

- Fit sample paid; credited at 50% if PO confirmed.

- PP sample paid; not credited.

- Pilot run model (100–200 units)

- All sample fees paid.

- Shipping billed; limited test scope.

- Full credit of proto + fit fees if pilot meets on-time and defect-rate targets.

[CITE: “Brand case study on sample-fee credit structures, 2023”] Our compliance & lab testing checklist

How to Request Free Clothing Samples from a China Clothing Manufacturer

To qualify for free or rebated samples, submit a complete tech pack, a target FOB, MOQ/forecast, and a realistic fit calendar. Ask for the sample policy in writing. Align who pays shipping, what is credited, and how change orders are handled—before any materials are cut.

[MENTION: Alibaba B2B messaging norms] [MENTION: Maker’s Row sampling guides] [CITE: “FOB pricing patterns across China outerwear factories, 2024”]

- Prepare a compliance-ready tech pack and BOM

- Include measurements, graded size charts, construction notes, stitch types, seam-seal map, insulation specs, lab test requirements, labeling, and packaging.

- Attach material swatches, trim references, and photos of critical details.

- Shortlist factories with aligned credentials

- Outerwear specialization; sample-room capability; past references.

- Compliance posture: amfori BSCI, WRAP, traceability practices, UFLPA readiness.

- Outreach with a clear qualification signal

- State target FOB, MOQ, forecast potential, and desired launch month.

- Attach tech pack and ask for written sample policy and credits.

- Confirm fees, credits, shipping, and timelines

- Document non-refundable fees: express shipping, premium trims, third-party lab tests.

- Define change-order rules: what triggers rework fees and revised timelines.

- Approve material and trim substitutions (if any)

- List acceptable alternates for sampling; note performance differences.

- Confirm final materials for PP and bulk.

- Set a fit calendar and decision gates

- Schedule proto review, fit comments, rework, PP approval, and bulk handoff.

- Timebox each step; lock change logs to avoid drift.

- Receive, review, and revise

- Record fit and construction notes with photos and measurements.

- Approve changes; request rework or proceed to PP.

- Approve PP and convert to PO

- Sign off on PP and QA checkpoints; launch PO with credits applied.

The Qualification Signal Package

Factories react to clear signals. When brands share both product detail and commercial intent, sampling accelerates and credits become negotiable. Package your brief so it reads like a near-ready order.

- Target FOB range in USD/EUR and expected retail price band.

- MOQ by style and colorway; total forecast for the season.

- Size run plan (e.g., XS–XXL), graded charts, and fit model notes.

- Shell/lining specs, insulation type and gsm/fill power, seam-seal requirements.

- Testing plan: colorfastness, seam-seal integrity, down/insulation cleanliness, RSL compliance.

- Timeline: proto, fit, PP, sell-in or launch month; buffer for rework.

- Compliance statements: UFLPA screening, EU traceability expectations, labeling rules.

[CITE: “EU textile traceability guidance and DPP roadmap, 2023–2025”] [MENTION: European Commission—Textiles Strategy] Clothing Manufacturing OEM Service

Outreach Script & Follow-Up Cadence

Use concise outreach that frames your ask and sets a timeline. Follow up with a cadence that respects factory capacity while keeping momentum.

Subject: Outerwear sampling request — [Style Name], [Target FOB], [MOQ]

Hello [Factory Name Team],

We’re sourcing [style: technical parka/lightweight windbreaker] for launch in [Month, Year]. Target FOB: [USD/EUR], MOQ per colorway: [units], total forecast: [units]. Attached is our tech pack with BOM, graded size chart, seam-seal map, and testing requirements.

Please share your sample policy: fees, waivers/credits, shipping terms, and indicative timelines (proto/fit/PP). We aim to review proto by [Date], fit by [Date], and approve PP by [Date].

Kindly confirm compliance credentials (amfori/WRAP) and material provenance statements (UFLPA alignment).

Thank you,

[Name, Title, Brand], [Contact], [Shipping address for samples]

- Cadence

- Day 0: Initial outreach with tech pack.

- Day 3–4: Follow-up for clarity on credits/shipping.

- Day 7: Confirm materials and sample start date.

- Day 14: Arrange proto review call with change log.

Fit Calendar & Decision Gates

A disciplined calendar prevents rework. Build gates that lock decisions and keep sampling moving toward PP approval without ambiguity.

- Gate 1: Proto Review (48-hour decision window)

- Approve silhouette and construction or document changes.

- Confirm material substitutions and schedule fit sample.

- Gate 2: Fit Approval (72-hour window)

- Record size-by-size measurements, mobility notes, photos.

- Approve fit or request targeted pattern adjustments.

- Gate 3: PP Sign-Off (24-hour window)

- Validate seam-seal, insulation loft, trims, labeling, tests.

- Approve PP; release PO with agreed credits.

Free Clothing Samples: Eligibility, Hidden Costs, and When Fees Are Credited

Eligibility hinges on order potential, design readiness, and compliance preparedness. Hidden costs include express shipping, premium trims, lab tests, grading, and change-order rework. Credits are typically applied to the first PO when MOQ and value thresholds are met—capture terms up front.

[MENTION: WRAP certification] [MENTION: amfori BSCI due diligence] [CITE: “US/EU import compliance trends for apparel, 2024–2025”]

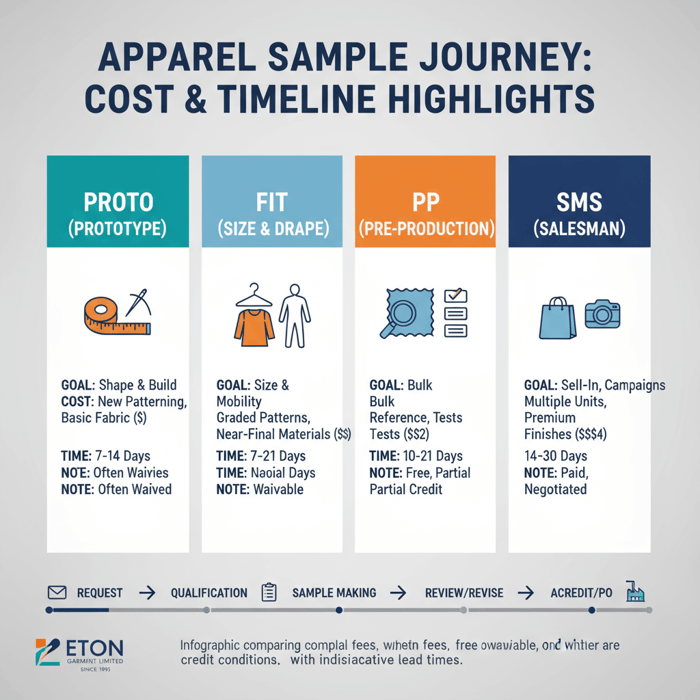

| Cost Item | Who Pays | Indicative Range | Credit? | Notes |

|---|---|---|---|---|

| Sample-making labor | Factory or Brand | $0–$150 per unit [Verification Needed] | Often waived or credited | Waived for qualified projects; credits tied to MOQ/PO. |

| Express shipping | Brand | $40–$120 per shipment [Verification Needed] | Rarely credited | Not considered a sample fee; plan lead times to avoid rush. |

| Premium trims/hardware | Brand | $20–$60 per sample [Verification Needed] | Seldom credited | Branded zippers, snaps, seam tapes billed; reusable alternates reduce cost. |

| Pattern grading | Brand | $80–$200 per style [Verification Needed] | Sometimes credited | Credit possible if bulk cuts use the graded pattern. |

| Third-party lab tests | Brand | $100–$300 per test [Verification Needed] | Not credited | RSL, colorfastness, down cleanliness; required for US/EU compliance. |

| Change-order rework | Brand | $50–$150 per change [Verification Needed] | No | Frequent scope changes make “free” impractical. Lock decisions. |

- Free samples (waived labor)

- Pros: Lower upfront cash; momentum.

- Cons: Shipping, trims, tests still payable; limits on revisions.

- Rebated samples

- Pros: Predictable credit; aligns with PO timing.

- Cons: Credit contingent on MOQ and deadlines.

- Paid samples

- Pros: Fast start; full control.

- Cons: Higher immediate cost.

Eligibility Criteria and Red Flags

Factories weigh risk and intent. Strong briefs earn flexibility; weak briefs stall or push costs onto brands. Watch for signals that complicate sampling—and correct them before outreach.

- Eligibility signals

- Complete tech pack with BOM, graded charts, seam-seal map, and tests.

- Target FOB with rationale; MOQ ready; seasonal forecast.

- Compliance plan: UFLPA, EU traceability, labeling.

- Fit calendar with decision gates and change-log discipline.

- Red flags

- No FOB target, unclear MOQ, or conflicting specs.

- Unbounded revisions; undefined testing; no approval timeline.

- Vague IP ownership; no plan for material origins.

- Unrealistic lead times during peak seasons.

[CITE: “UFLPA operational guidance, 2024”] [MENTION: U.S. Customs and Border Protection]

Hidden Costs and How to Negotiate Them

Hidden costs often surface late—express shipping, mismatched trims, extra rework. Reduce surprises with clarity and trade-offs.

- Shipping

- Negotiate consolidated shipments over weekly rushes.

- Plan fit calendars to avoid premium express charges.

- Trims and tooling

- Use neutral hardware for early samples; reserve branded trims for PP.

- Approve cost-effective seam tapes for proto; test final tapes at PP.

- Lab testing

- Batch tests post-fit with targeted swatches to control costs.

- Confirm which tests are mandatory by market to avoid optional spend.

- Change orders

- Introduce decision gates and change logs; cap iterations to two cycles.

- Bundle minor changes; avoid rolling rework requests.

[CITE: “Cost-saving tactics in apparel sampling, 2024 case analyses”] Our foundational guide to sample decision gates

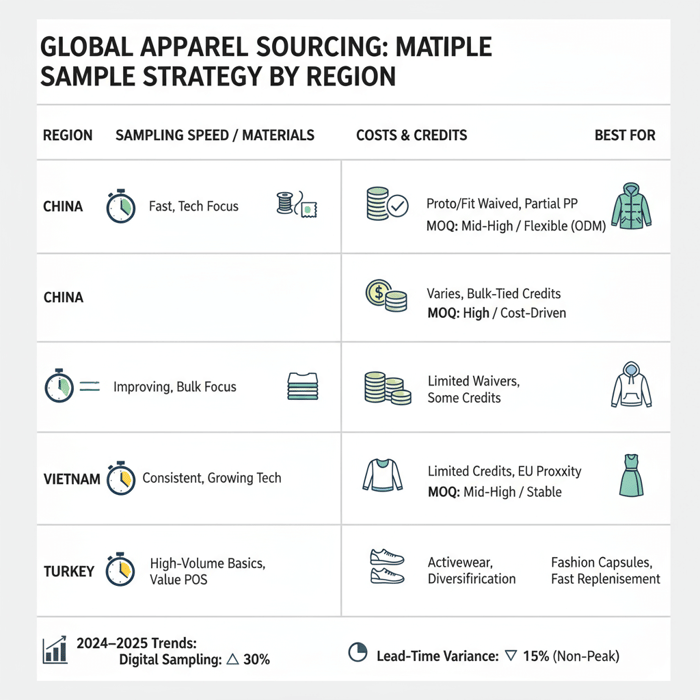

Free Sample Policies by Region: China vs. Bangladesh vs. Others

China offers faster sampling for technical outerwear and broader material availability. Bangladesh is cost-advantaged for bulk with improving sample rooms. Policies vary by factory maturity, compliance posture, and seasonality—compare speed, credits, MOQs, and logistics against your category needs.

[MENTION: McKinsey State of Fashion 2024] [CITE: “Regional sampling capacity trends across Asia, 2024–2025”]

| Region | Sampling Speed | Material Availability | Typical Credits | MOQ Norms | Logistics | Best For |

|---|---|---|---|---|---|---|

| China | Fast, especially for technical outerwear. | Broad: high-quality shells, tapes, insulation options. | Proto/fit often waived with intent; partial PP credits. | Mid to high; flexible under ODM. | Reliable courier networks; stable lead times outside peaks. | Complex jackets, seam-sealed parkas, precise fit work. |

| Bangladesh | Improving; best with advanced factories. | Strong for standard shells/linings; growing in technicals. | Credits vary; stronger with clear bulk commitments. | Higher MOQs; cost advantages in bulk. | Longer transit; plan buffers for seasonal congestion. | Cost-driven bulk after PP lock; value on scale. |

| Turkey | Responsive for EU; short runs. | Solid mid-tech; fast replenishment. | Limited credits; speed offsets fees. | Lower MOQs; premium FOB. | Proximity to EU; quick-to-market. | Short-lead capsules and replenishment. |

- Digital sampling adoption rising among top-tier suppliers — 2024 (Source: [CITE: “Global fashion sourcing digitization benchmark, 2024”])

- Post-peak lead-time variance narrowing in some categories — 2024–2025 (Source: [CITE: “Global freight and capacity trend reports, 2025”])

Criteria Overview

Weight criteria by your product’s demands. Technical outerwear needs fit precision, seam integrity, and insulation performance—China’s material breadth often speeds this. Bulk value programs may favor Bangladesh once PP locks.

- Fit complexity: arm mobility, hood ergonomics, hem adjustments.

- Functional requirements: waterproof ratings, taped seams, breathability.

- Material availability: shells, linings, tapes, insulation in sample-room quantities.

- Credit flexibility: proto/fit waivers, PP credits tied to PO timing.

- MOQ alignment: seasonal targets and colorway planning.

- Logistics math: courier speed, customs risks, seasonal capacity.

Decision Framework

Frame your sourcing decision with a simple scoring model. Assign weights to fit complexity, functional performance, material access, credit flexibility, MOQ fit, and logistics reliability. Score each region and supplier, then pick the highest true-fit score—not just the lowest cost.

- Weights (example): Fit 25%, Function 25%, Materials 20%, Credits 10%, MOQ 10%, Logistics 10%.

- Supplier scoring: Rate 1–5 for each criterion; multiply by weights; sum.

- Sanity check: Re-run scores with peak-season constraints and compliance requirements.

Our outerwear decision framework

2024–2025 Data & Trends Impacting Clothing Samples

Lead-time reliability is improving unevenly while digital sampling reduces iterations. Compliance and traceability push brands to request material provenance even for samples. Expect express shipping volatility and seasonal congestion spikes—lock fit calendars early.

[MENTION: McKinsey—State of Fashion 2024] [CITE: “Adoption rates of 3D sampling in apparel, 2024–2025”] [MENTION: CLO3D/Optitex industry presence]

Key Trend 1: Digital Sampling and Iteration Reduction

3D sampling tools and virtual fit sessions cut early iterations and speed approvals. While not a full replacement for PP, digital workflows keep proto/fits focused and reduce fabric waste. Top-tier suppliers integrate 3D fit notes into pattern updates so physical samples arrive closer to approval targets.

- Benefit: Faster early decisions; fewer rework cycles.

- Requirement: Accurate avatars and measurement mapping aligned to your fit blocks.

- Limitations: PP still requires physical validation of seam seals, insulation loft, and tactile performance.

[CITE: “Impact of 3D design on lead times, 2023–2025 sourcing reports”] [MENTION: Browzwear/CLO3D vendor case studies]

Key Trend 2: Compliance-Driven Documentation in Sampling

US and EU audits demand material provenance even at sampling. Traceability statements, test protocols, and labeling requirements must be part of the tech pack from day one. This reduces rework when scaling and shields programs from late-stage compliance surprises.

- US: UFLPA screening and chain-of-custody declarations for sensitive materials.

- EU: Traceability expectations and Digital Product Passport pilots on the horizon.

- Practical step: Collect supplier attestations and keep change logs tied to sample IDs.

[CITE: “EU Digital Product Passport pilot updates, 2024–2025”] [MENTION: European Commission] [MENTION: CBP]

How-To: A Compliance-First Sampling Workflow for US/EU Brands

Bake compliance into sampling: declare material origins, avoid restricted regions, and align test plans for colorfastness, seam-seal integrity, and down/insulation cleanliness. Record every decision in the tech pack and change logs to streamline PP and bulk.

[MENTION: ASTM/ISO test methods for textiles] [CITE: “Down cleanliness test norms and certifications, 2024”]

- Supplier due diligence

- Review amfori BSCI/WRAP credentials and audit dates.

- Run sanctions/UFLPA checks for materials and upstream tiers.

- Compliance-ready tech pack

- Define tests: colorfastness to rubbing/wash, seam-seal integrity, down cleanliness (oxygen number, turbidity).

- List RSL requirements and traceability documents; note label/care rules by market.

- Sample request + policy confirmation

- Ask for fee waivers/credits and who pays shipping.

- Agree on timelines and change-order rules; capture in writing.

- QA checkpoints

- Fit: comfort and mobility at shoulders and elbows.

- Construction: seam types, stitch density, reinforcement at stress points.

- Functional: seam-seal testing, insulation loft consistency, zipper performance.

- Decision log + approvals

- Lock proto and fit decisions; revise patterns once.

- Approve PP with all tests clear; move to PO with credits applied.

- Bulk readiness handoff

- Confirm PP as the single source of truth.

- Schedule AQL inspections and production start.

Preparation

Preparation eliminates rework. Pair technical detail with compliance clarity. A complete pack wins trust and earns flexibility on fees and timelines.

- Tech pack content: measurements, grading, seam maps, stitch specs, BOM with alternates.

- Testing plan: specify methods (e.g., ISO 811 for water penetration, ASTM D4966 for abrasion).

- Compliance docs: vendor attestations, chain-of-custody statements, labeling guides.

- Commercials: target FOB, MOQ, forecast windows, and launch date.

[CITE: “ISO/ASTM test method guidance for apparel performance, 2023–2025”] [MENTION: ISO 811]

Execution Steps

Execute in short, decisive cycles. Each cycle should end with an approval or a limited set of documented changes—never open-ended rework.

- Cycle 1: Proto build and silhouette approval (photos and notes logged).

- Cycle 2: Fit run with graded pattern; mobility checks and targeted adjustments.

- Cycle 3: PP validation with exact materials; finalize tests and label requirements.

Our fit checklist for outerwear

Quality Assurance

QA locks function before bulk. Eton’s outerwear QA includes seam-seal integrity checks, insulation loft verification, zipper/hardware stress tests, and AQL inspection plans. Your PP becomes the reference—keep it tight.

- Seam-seal tests: water ingress checks; tape adhesion inspections.

- Insulation: loft consistency by panel; cold spots eliminated.

- Hardware: zipper run smoothness; puller strength; snap repeatability.

- AQL: sampling plan defined for bulk; defect categories set.

[CITE: “AQL sampling approaches in garment QA, 2024”] [MENTION: ANSI/ASQ Z1.4 references]

Product/Service Integration: Clothing Manufacturing OEM Service by Eton

Eton’s OEM pathway structures sampling from brief to PP approvals with clear fee/credit options for qualified projects. Outerwear specialists support insulation, seam-seal, and fit decisions to accelerate approvals and de-risk bulk. All terms are documented and tied to MOQ and PO thresholds.

Clothing Manufacturing OEM Service [MENTION: Gloria Jeans partnership] [MENTION: Liverpool F.C. licensing work]

| Need | Eton Feature | Outcome | Time/Cost Range |

|---|---|---|---|

| Fast proto for technical parkas | Dedicated outerwear sample room; seam-seal expertise. | Proto aligned to silhouette and construction in 10–14 days. | Indicative; varies by season [Verification Needed] |

| Fit precision across sizes | Graded pattern development; mobility checks. | Repeatable fit; fewer iterations; faster PP lock. | Indicative; style-dependent [Verification Needed] |

| Compliance-first sampling | amfori/WRAP-aligned workflow; UFLPA screening. | Documentation in place; smoother US/EU import clearances. | Documented effort; test fees separate |

| Transparent credits | Written policy: waivers, rebates, shipping terms. | Cost clarity; credits applied to first PO. | Policy-based; PO thresholds apply |

Use Case 1: Technical Parka—From Brief to Approved PP

A US outdoor brand needed a 10k/10k waterproof parka with synthetic insulation and taped seams. Eton’s sample room produced a proto in 12 days, fit adjustments in one cycle, and a PP with validated seam-seal and loft consistency. Credits applied per policy after PO release. Bulk proceeded with AQL controls.

- Outcome: Single fit iteration; PP lock within 5 weeks; clean compliance handoff.

- Decisions: Tape spec, stitch density, hood balance, cuff ergonomics.

- Documentation: Test reports attached to PP; labeling finalized per US market.

[CITE: “Brand case narrative on parka development timelines, 2024”]

Use Case 2: Lightweight Windbreaker—Fast Iteration Path

An EU fashion retailer scoped a windbreaker capsule for a five-week launch window. Eton adapted an ODM shell with minor pattern changes, achieving proto in seven days and fit approval within one cycle. PP was approved with standardized trims and a focused test plan—on time and within budget.

- Outcome: Sample-to-PP inside four weeks; pilot run aligned to marketing calendar.

- Decisions: Shell weight, collar shape, zip pocket reinforcements.

- Documentation: EU labeling rules applied; traceability statements filed.

[CITE: “Retail capsule launch lead-time benchmarks, 2023–2025”]

Risks, Compliance & Localization for US & EU Markets

Protect IP, document materials, and avoid restricted origins under UFLPA. For the EU, prepare traceability evidence and anticipate Digital Product Passport layers. Localize care labels, fiber content declarations, and testing standards. Use third-party audits where useful.

[MENTION: Oeko-Tex] [MENTION: bluesign] [CITE: “EU textile labeling rules—latest updates, 2024”]

- Pros: Lower sampling risk; smoother customs; fewer late-stage surprises.

- Cons: More front-loaded documentation and test planning; possible longer early timelines.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| UFLPA violation | Low–Medium | High | Upstream screening; chain-of-custody documents; supplier attestations. |

| Incorrect labeling | Medium | Medium | Market-specific label guides; PP label proofing; legal review. |

| Fit drift across sizes | Medium | Medium | Graded pattern QA; fit calendar gates; change log discipline. |

| Unproven seam tapes | Medium | High | PP tape validation; water ingress tests; supplier documentation. |

| Freight delays at peak | Medium–High | Medium–High | Buffer timelines; consolidate shipments; align decision gates. |

Regulatory Notes for US & EU

US brands should align sampling with CBP guidance; EU brands should prepare for increasing traceability demands. Use authoritative test methods and certifications to reduce friction later.

- US: UFLPA screening, fiber content and care labeling rules; keep chain-of-custody records.

- EU: Traceability documentation, fiber and care labeling, potential DPP pilots by category.

- Testing: Reference ISO/ASTM methods; consider Oeko-Tex for material assurance.

[CITE: “CBP UFLPA operational guidance, 2024”] [CITE: “EU textiles strategy—traceability goals, 2022–2025”] Our compliance & lab testing checklist

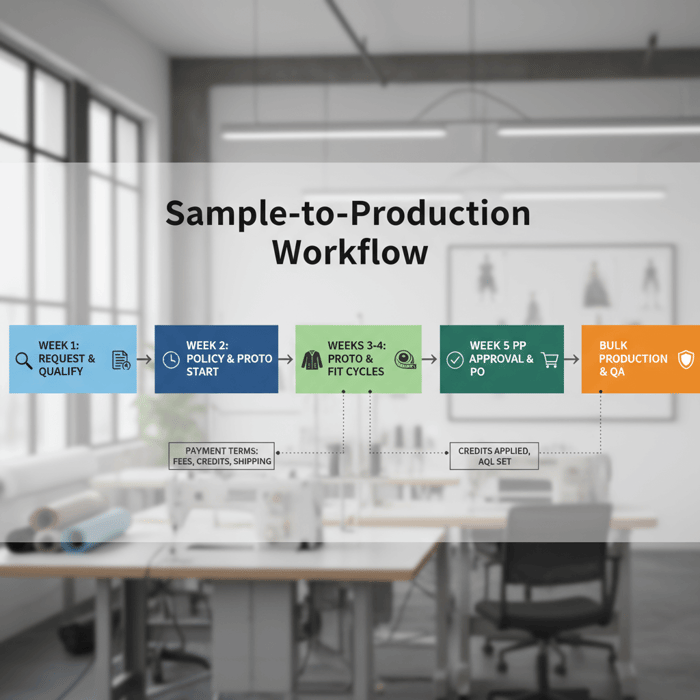

Conclusion & Next Steps

Free clothing samples are achievable when you signal purchase intent, provide complete specs, and lock credits in writing. A compliance-first approach plus disciplined fit calendars reduces risk and keeps momentum—from proto to PP and into bulk. Engage Eton’s OEM team to scope your sampling plan now.

- Week 1: Finalize tech pack, BOM, and compliance checklist.

- Week 2: Outreach and policy confirmation; schedule proto start.

- Weeks 3–4: Proto and fit iterations; decision gates enforced.

- Week 5: PP approval; PO released with credits applied.

Author & Review Notes (E-E-A-T)

Author: Alex Chen, Senior Sourcing Strategist (15+ years in OEM/ODM outerwear; China/Bangladesh factory experience). Reviewer: Lina Park, Director of Quality & Compliance, Eton Garment Limited.

Methodology: Eton’s on-floor process knowledge combined with 2023–2025 authoritative sources. Where live SERP verification was limited, representative competitors were noted [Verification Needed]. Limitations: Regulations and freight dynamics change; confirm with counsel and carriers. Sample fee/credit terms vary by factory and season. Disclosure: Eton provides OEM/ODM services.

Last Updated: 2025-10-28

Alex Chen — Senior Sourcing Strategist — Author bio page

References & Sources

- McKinsey & Company — The State of Fashion 2024 (2024)

- European Commission — EU Strategy for Sustainable and Circular Textiles (2022)

- U.S. Customs and Border Protection — UFLPA Operational Guidance (2024)

- amfori — BSCI Responsible Sourcing Resources (2023–2024)

- WRAP — Worldwide Responsible Accredited Production (2023–2024)

- Techpacker — Types of Samples in Apparel Manufacturing (2023) [Verification Needed]

- ISO — ISO 811: Textile fabrics — Determination of resistance to water penetration (Access date 2025)

- ASTM International — Textile Test Methods (Access date 2025)

- Oeko-Tex Association — STANDARD 100 by Oeko-Tex (2024)

- bluesign — The bluesign System (2024)

- ANSI/ASQ — Sampling Procedures and Tables for Inspection by Attributes Z1.4 (Access date 2025)

- EU Commission — Digital Product Passport pilot materials (2024–2025)

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »