Dress Manufacturer Guide: Selecting a China Clothing Manufacturer for OEM & ODM Success

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

7 minute read

Dress Manufacturer Guide: Selecting a China Clothing Manufacturer for OEM & ODM Success

Dress manufacturer selection with a China Clothing Manufacturer determines quality, speed, and margin for US/EU brands. This guide covers OEM/ODM services, vetting, costs, MOQs, lead times, compliance, AQL-based quality, and regional comparisons. It combines factory experience from Eton with authoritative standards to help apparel teams move from samples to confident bulk.

A dress manufacturer is a clothing factory that produces dresses at scale via OEM (your tech pack) or ODM (factory-led design). To choose a China Clothing Manufacturer, validate MOQs, lead times, fabric/trims sourcing, compliance (REACH/CPSIA/OEKO-TEX), and AQL inspection plans; demand clear pricing, sampling fidelity, and certifications.

Dress manufacturer decisions shape product fit, timelines, and margin. This article offers dress-specific benchmarks for unit costs, MOQs, and lead times; a compliance roadmap for US/EU (REACH, CPSIA, OEKO-TEX, SMETA/WRAP); region comparisons (China vs Bangladesh vs Vietnam); and a step-by-step workflow from tech pack to bulk. With Eton’s OEM/ODM capabilities and dual production bases in China and Bangladesh, brands can scale dresses with speed, repeatable quality, and predictable compliance.

References: McKinsey State of Fashion 2024; WTO apparel trade review; Global demand and sourcing trends, 2024–2025 industry outlook; Our foundational guide on ‘Outerwear to Dress Manufacturing’.

What a Dress Manufacturer Does (OEM vs ODM)

Dress manufacturing spans pattern making, grading, fabric/trims sourcing, sampling, bulk production, AQL inspections, and logistics. OEM builds to your tech pack; ODM provides factory-led design refined to a target price and quality level. Align early on compliance rules, fit standards, measurement tolerances, and inspection criteria to avoid rework.

Tools and references: Gerber AccuMark pattern systems; Lectra CAD solutions; market adoption of digital pattern/SaaS tools in apparel; Dress tech pack checklist — resource hub.

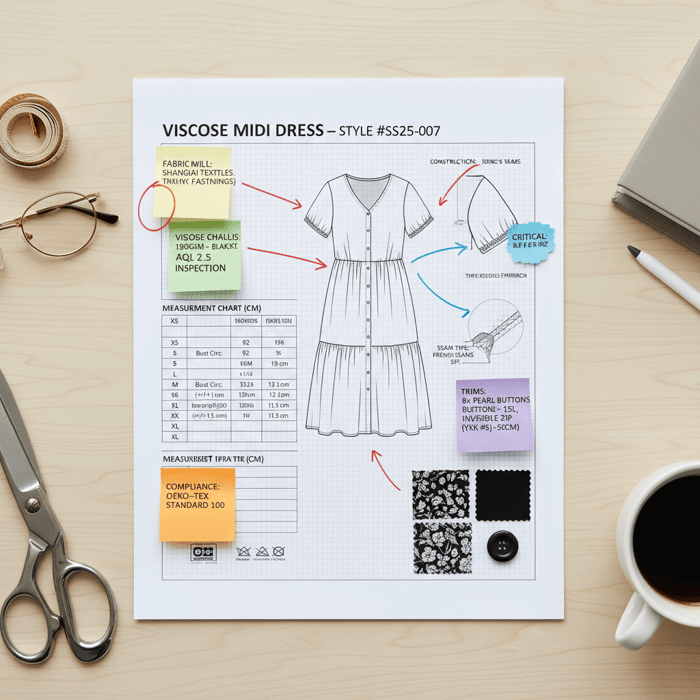

OEM: Build-to-spec Requirements

OEM dress manufacturer work starts with a complete tech pack and clear tolerances. Provide graded measurement charts, construction details, seam types (e.g., French seams, overlock), fabric composition and finishing notes, lining and interfacing specifications, artwork scale and placement, and trim standards. Include fit blocks, shrinkage allowances, and wash care standards aligned with your market.

- Measurements and grading: base size, size set, grade rules, tolerances.

- Pattern and construction: seam types, stitches per inch, seam allowances, reinforcement points.

- Fabrics and finishes: weave/knit type, GSM/oz, stretch %, pre-shrink, dye/print specs.

- Lining, interfacing, boning: coverage, weights, hand feel, fusing temperatures.

- Trims/hardware: zippers (YKK #3/#5), buttons, snaps, hooks/eyes, labels.

- BOM with suppliers: fabric mills, trim vendors, colorways, unit allocation.

- Artwork: placements, dimensions, color codes (Pantone), repeat sizes.

- Compliance: REACH/CPSIA requirements, OEKO-TEX materials, label content.

- Quality: AQL level, sample approval sequence, TOP standards, defect definitions.

Non-negotiables include accurate measurements with tolerances visible per seam and stress point, clear shrinkage targets after finishing and washing, and finalized fabric quality standards before PP (pre-production) sampling. Transparent fit targets and change-control logs cut sampling iterations and protect timelines.

ODM: Manufacturer-led Design

ODM suits brands that want speed and factory-driven design. Start with mood boards, silhouettes, functional must-haves, and target wholesale cost. Define fabric families (e.g., viscose challis, linen blends, poly crepe), trims hallmarks, and compliance constraints upfront. The dress manufacturer proposes patterns, materials, and construction tuned to your target price and quality tier.

Lock scope early: agreed range of styles, fabric baskets, and unit price corridors. Share fit blocks and grading rules where possible to preserve brand silhouette. The factory will iterate proto and fit samples against these guardrails and provide costed BOMs with alternates (e.g., invisible zip vs. lapped zip) to meet price points. Document approvals and deviations to keep ODM sampling aligned with production-ready specs.

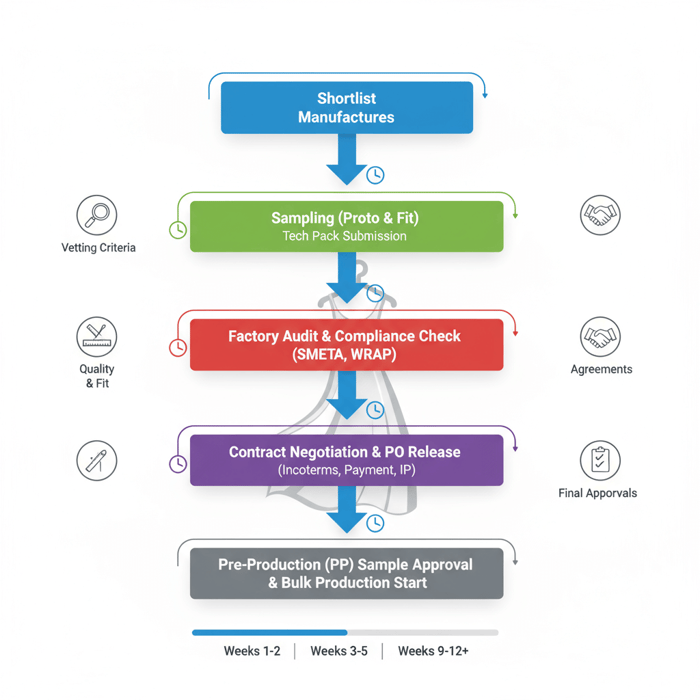

How to Choose a Dress Manufacturer in China

Shortlist China-based dress manufacturers by certifications, dress-specific experience, sample fidelity, fabric/trims access, capacity, MOQs, lead times, and communication cadence. Validate with factory audits, PP samples, and AQL inspection plans. Secure IP terms and negotiate Incoterms and payment structures aligned to your logistics and risk tolerance.

Compliance frameworks: Sedex SMETA; WRAP Certification; ethical audit adoption in Asia apparel; Factory audit checklist — compliance standards pillar.

Vetting Criteria & Certifications

- Category experience: proven dress lines—wovens/knits, structured bodices, drape-sensitive styles.

- Capacity and planning: line availability, daily output, peak season buffers, bottleneck analysis.

- Sample fidelity: proto-to-PP consistency, fit track record, repeatability metrics.

- Fabric/trims sourcing: mill network, booking windows, OEKO-TEX Standard 100 materials.

- Compliance: REACH for chemicals, CPSIA for children’s lines, SMETA/WRAP audits, ISO systems.

- Quality systems: AQL levels (ISO 2859-1), defect taxonomy, inline and pre-shipment inspection routines.

- Communication: weekly touchpoints, change-control, issue logs, bilingual merchandisers.

- References: US/EU retailer programs and shipment quality records.

Core certifications and frameworks: OEKO-TEX Standard 100 for harmful substances, WRAP for social compliance, Sedex SMETA audit reports, ISO 9001 quality systems, and ISO 14001 environmental management. Confirm recency, scope, and corrective actions in audit documentation.

Negotiation & Contracts

- Incoterms: FOB (factory), CIF (port), DDP (door). Align with your logistics preference and duty exposure.

- Payment terms: common structures—30% deposit, 70% against shipment docs; or LC for risk management.

- Sampling charges: cost-per-sample and credit treats upon PO; clarify courier responsibilities.

- IP protection: NDA + non-use/non-circumvention; define ownership of patterns, blocks, and artwork.

- Quality clauses: AQL levels, rework responsibilities, penalties for late delivery or failed inspections.

- Change control: document updates to patterns/BOM; cutoffs for cost impacts and timeline shifts.

Dress Manufacturer Costs, MOQs & Lead Times

Unit cost varies with fabric, lining, trims, construction complexity, finishing, order size, and region. MOQs stem from fabric mill minimums and factory line planning. Lead times include fabric booking, sampling windows, PP approvals, and bulk production. Plan buffers against seasonality and logistics constraints for US/EU calendars.

References: OEKO-TEX; ISO 2859-1; typical MOQs and booking windows by mills in China/Bangladesh; apparel lead time planner.

Cost Breakdown (Fabric, Trims, Labor, Overhead)

| Component | Summer Casual (Woven) | Occasion/Structured | Knit Jersey Dress | Notes |

|---|---|---|---|---|

| Fabric | $3.20–$5.80 | $6.50–$12.00 | $2.80–$4.80 | GSM, composition, dye/print; OEKO-TEX adds testing costs. |

| Lining/Interfacing | $0.60–$1.20 | $1.80–$3.50 | $0.20–$0.60 | Coverage, fusing quality, boning for structured bodices. |

| Trims/Hardware | $0.40–$0.90 | $0.80–$1.60 | $0.30–$0.70 | Zippers, buttons, labels, elastics, hangtags. |

| Labor (CM) | $2.20–$3.80 | $3.50–$6.50 | $1.80–$3.20 | Complexity, stitch counts, finishing time. |

| Overhead | $0.40–$0.80 | $0.60–$1.00 | $0.30–$0.60 | Admin, QA, compliance, energy. |

| Total (ex-factory) | $6.80–$12.50 | $13.20–$24.60 | $5.40–$10.00 | Shipping/duties not included. |

Example: A viscose challis midi with invisible zipper, partial lining, and two colorways at 5,000 units in China might price at $8.90 ex-factory under FOB. The same silhouette in Bangladesh could drop 5–12% with longer booking and longer lead times (Regional cost ranges, 2024 apparel production).

MOQs & Lead Times by Style Category

| Style | MOQ (units/style) | Sampling (weeks) | PP Approval (weeks) | Bulk Production (weeks) | Total to Ship (weeks) |

|---|---|---|---|---|---|

| Summer Woven | 500–2,000 | 2–4 | 1–2 | 4–6 | 8–12 |

| Occasion/Structured | 800–3,000 | 3–6 | 2–3 | 6–8 | 12–16 |

| Knit Jersey | 600–2,500 | 2–3 | 1–2 | 4–6 | 8–11 |

| Printed Woven | 1,000–5,000 | 3–5 | 1–2 | 5–7 | 10–14 |

- Global apparel demand outlook remains resilient — 2024 (Source: McKinsey State of Fashion 2024)

- China retains leading apparel export share — 2023–2024 (Source: WTO World Trade Statistical Review 2024)

Fastest realistic PP-to-ship windows for simple woven dresses under China Clothing Manufacturer programs are 6–8 weeks with booked greige and available trims. Add 2–3 weeks for custom prints or OEKO-TEX testing, and 1–2 weeks for peak-season congestion or DDP routing to the EU/US.

Comparing Dress Manufacturers: China vs Bangladesh vs Vietnam

China offers speed, deep fabric/trims ecosystems, and complex construction capability. Bangladesh excels for high-volume cost efficiency and basic-to-mid complexity. Vietnam balances quality, compliance maturity, and mid-to-high complexity with strong knit programs. Pick a region for your dress line based on complexity, volume, compliance, and lead-time needs.

References: Vietnam textile associations; BGMEA in Bangladesh; regional productivity and export data (WTO/OECD); regional sourcing strategy guide.

| Criteria | China | Bangladesh | Vietnam |

|---|---|---|---|

| Speed | Fastest; tight sourcing windows | Moderate; longer bookings | Moderate-fast; stable lead times |

| Cost | Mid; flexibility with volume | Low for volume | Mid-high; quality payoff |

| Complexity | High; structured/technical | Basic-to-mid | Mid-to-high (knits strong) |

| Compliance maturity | Broad certifications | Improving; volume focus | Strong; US/EU-focused |

| Fabric/trims access | Deep ecosystem | Relies on imports | Growing, imports common |

| MOQ flexibility | Flexible with networks | Higher for mills | Moderate |

Criteria Overview

Define the dress line’s complexity (e.g., structured bodice, boning), the volume per style, the retail calendar, and compliance needs. China excels for multi-fabric styles, fast sampling, and trims availability.

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »