Customs Charges from China to US: Fashion Brands’ Guide with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

20 minute read

Customs Charges from China to US: Fashion Brands’ Guide with a China Clothing Manufacturer

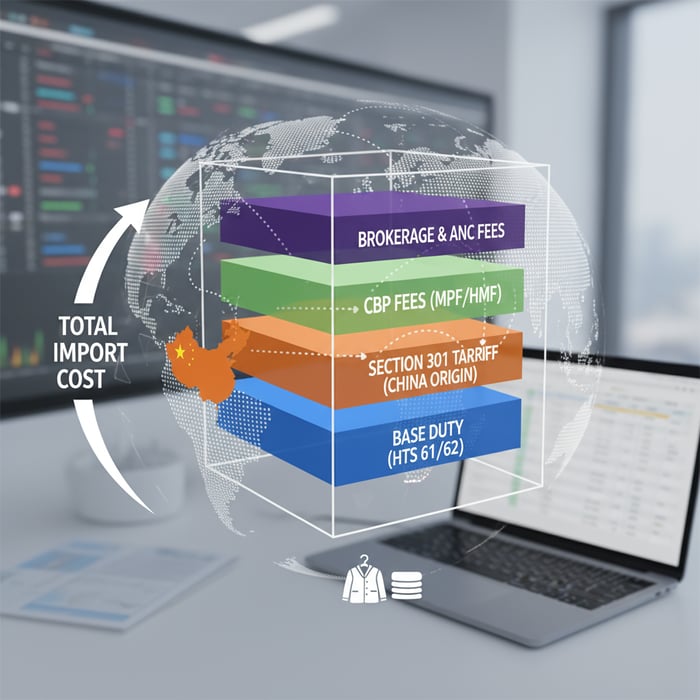

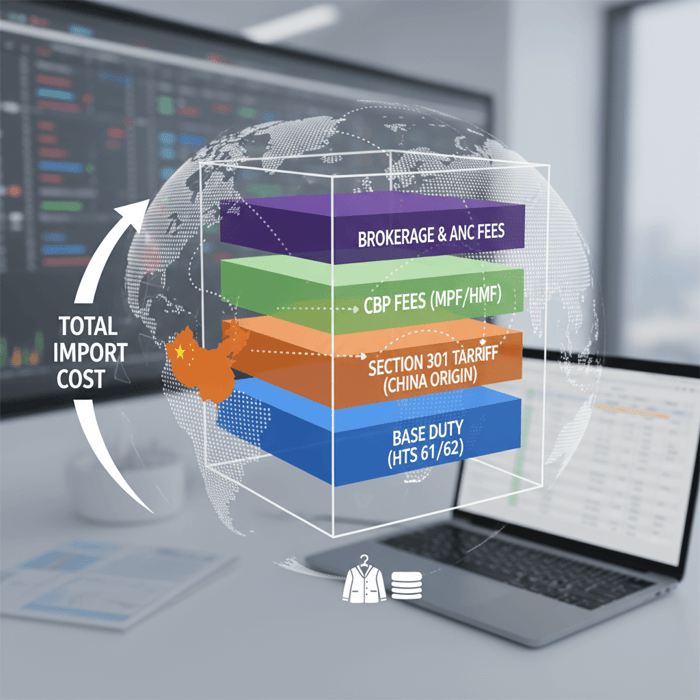

Customs charges from China to US can define margin, timing, and risk for any apparel import program. Working with a China Clothing Manufacturer like Eton, brands need a calculation-first playbook that covers HTS classification, Section 301 tariffs, MPF/HMF, brokerage, and compliant strategies to reduce cost without slowing launch windows or inviting CBP scrutiny.

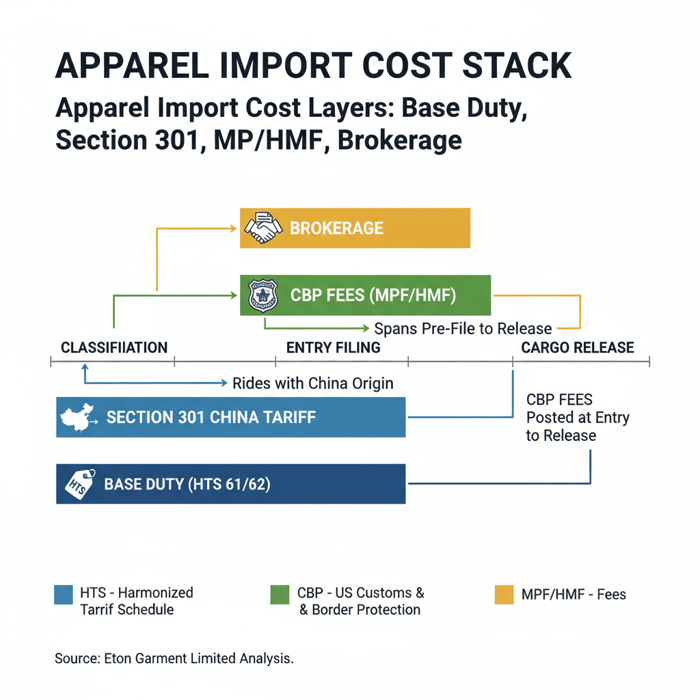

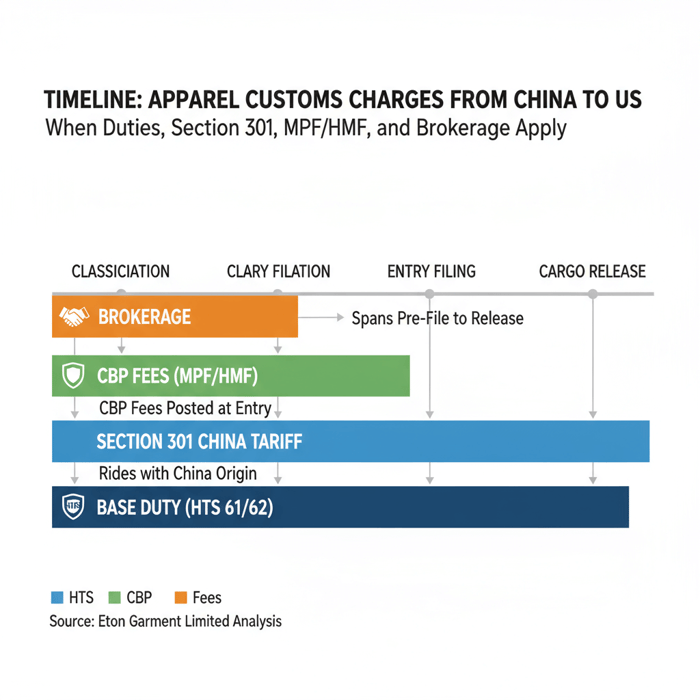

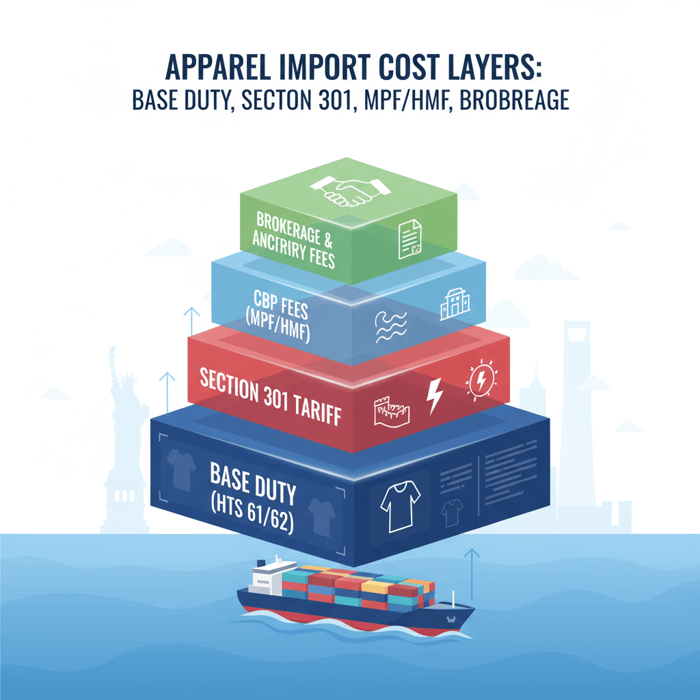

Customs charges from China to US for apparel include base duty (HTS Chapters 61/62), any Section 301 China tariff, CBP fees (MPF and HMF for ocean), and brokerage. De minimis ($800) can exempt eligible low-value parcels from duties and taxes. Accurate classification, valuation, and origin planning anchor cost control [CITE: CBP overview pages; USITC HTS; USTR Section 301].

Fashion brands sourcing jackets, parkas, and performance outerwear need a clear view of the full cost stack: duty from the correct HTS subheading, potential Section 301 charges on China-origin goods, CBP fees, and brokerage. This guide provides apparel-specific calculations, sample scenarios, documentation checklists, and cost-reduction strategies, including origin planning across China and Bangladesh. It aligns with US rules, emphasizes compliance, and reflects Eton’s 30+ years manufacturing and shipping outerwear to the US and EU.

What Are “Customs Charges from China to US” for Apparel?

Customs charges cover base duty from the HTS rate, any China Section 301 duty, CBP fees like MPF and HMF (for ocean), and brokerage. Sales/use tax typically falls outside CBP collection. De minimis at $800 can remove duties and taxes for eligible low-value parcels shipped direct to US recipients [CITE: CBP de minimis; USITC HTS; USTR 301; CBP MPF/HMF].

Apparel lands within HS Chapters 61 (knit) and 62 (woven). Duty rates vary by garment, fiber content, gender, and construction. Section 301 applies based on country of origin, not routing. MPF applies to nearly all entries; HMF applies to ocean freight value. Brokerage fees depend on service scope and entry type. Each element has rules that shape the final landed cost.

- Base duty (HTS Chapters 61/62) — derived from correct classification at the 10-digit HTS.

- Section 301 China tariff — additional duty for China-origin products when listed under an applicable subheading.

- MPF (Merchandise Processing Fee) — ad valorem with minimum and maximum caps for formal entries.

- HMF (Harbor Maintenance Fee) — 0.125% on ocean freight value; not charged on air.

- Brokerage — service fees for entry filing, bonds, and ancillary services.

[PAA] Are Section 301 tariffs applied to goods made in China but shipped via another country? Section 301 follows the country of origin under CBP rules. Transshipment through a third country does not remove 301 duties unless a qualifying substantial transformation creates a new origin [CITE: CBP origin rulings discussion; USTR 301 guidance].

HTS classification for apparel — foundational guide

[MENTION: U.S. Customs and Border Protection (CBP)] [MENTION: Office of the U.S. Trade Representative (USTR)]

Base Duties (HTS) and Apparel Chapters 61/62

HTS classification determines the base duty. Apparel splits between Chapter 61 (knit/crochet) and Chapter 62 (woven). Rates differ by garment type (e.g., coats vs. shirts), fiber (cotton, man‑made, wool), gender, and features (e.g., water resistant wording). The USITC HTS database holds the official rates and legal notes [CITE: USITC HTS landing page]. Precise specs in tech packs and fabric contents drive accurate classification.

For outerwear, a misread of “water resistant” language can swing rates. Fiber blends require correct percentage and predominance rules. Construction details like coating or quilting materially change headings or subheadings. A classification memo that cites chapter notes and GRIs helps align brokers, finance, and production. Keep HTS decisions traceable for audits.

HTS classification for apparel — foundational guide

Section 301 China Tariffs

The Section 301 tariff regime imposes additional duties on many China-origin products identified by HTS subheading. Coverage evolved through USTR actions and subsequent reviews. Whether a specific apparel subheading carries 301 depends on the current USTR lists and any product exclusions or reinstatements [CITE: USTR Section 301 pages with apparel examples]. Country of origin rules, not shipment routing, control 301 applicability.

Origin determination rests on substantial transformation. Cutting and sewing garments in Bangladesh from Chinese fabric typically confers Bangladesh origin; simple repacking in a third country does not. Maintain complete origin documentation: bills of materials, cutting/sewing records, and production site attestations to support origin claims if CBP requests evidence [CITE: CBP origin guidance].

[MENTION: National Customs Brokers & Forwarders Association of America (NCBFAA)] [MENTION: American Apparel & Footwear Association (AAFA)]

CBP Fees (MPF/HMF) and Brokerage

MPF applies to most formal entries as a small ad valorem fee with a minimum and maximum cap. HMF applies to ocean entries at 0.125% of the value of the cargo for import, foreign trade zone admissions, and other channels, but not to air shipments [CITE: CBP MPF/HMF pages]. Brokers charge their own service fees; line items can include entry filing, ISF filing (ocean), bonds, ACH setup, and exams handling.

Brokerage fee structures vary by provider and entry volume. Some offer bundled rates per entry; others apply itemized charges per HTS line. Request a tariff sheet and align it with your shipment profile. For recurring outerwear programs, supply the broker with pre‑vetted HTS matrices, brand-specific packing norms, and contact windows to cut clearance cycles.

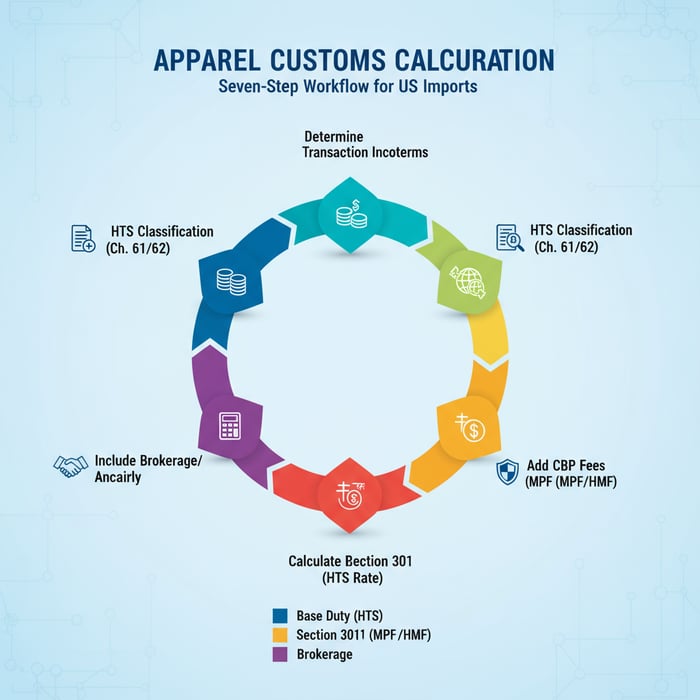

How to Calculate Customs Charges from China to US for Apparel

Calculate charges with the correct HTS code, transaction value, and Incoterms. Apply any Section 301 tariff if origin is China. Add MPF for formal entries and HMF for ocean. Include brokerage/ancillary fees from your provider. Verify each step against CBP valuation rules and live HTS rates before PO sign‑off [CITE: USITC HTS; USTR 301; CBP MPF/HMF; CBP Valuation].

- Identify the correct HTS code (Chapter 61/62). Confirm via garment specs, fiber content, and legal notes [CITE: USITC HTS].

- Determine transaction value under CBP rules. Start with the price paid or payable; check for assists, royalties, and packing [CITE: CBP valuation overview].

- Confirm Incoterms. Value for duty generally excludes international freight/insurance under FOB, includes them under CIF; disclose terms on the invoice.

- Calculate base duty: duty rate × customs value.

- Apply Section 301 (if origin is China and HTS subheading listed): 301 rate × customs value.

- Add CBP fees: MPF (ad valorem subject to min/max cap) and HMF for ocean shipments.

- Include brokerage fees and any ancillary charges. Sum all to reach total customs charges.

[PAA] Is freight and insurance included in customs value? Under transaction value, freight and insurance to the US generally are excluded if using FOB at the foreign port, included if selling on CIF terms. Disclose terms and amounts so the broker can derive the correct customs value [CITE: CBP valuation; Incoterms 2020 references].

Landed cost calculator (apparel) — tool concept

Sample Scenario: Woven Jacket (HS 62) via Ocean

Assume a men’s woven polyester jacket, China origin, ocean shipment.

- FOB unit price: $22.00

- Quantity: 2,000 pieces

- FOB shipment value: $44,000

- HTS subheading: 6201.93.xxxx [placeholder; confirm exact 10-digit]

- Base duty rate: [Verification Needed]% (check live HTS) [CITE: USITC HTS]

- Section 301 rate: [Verification Needed]% if the subheading is listed [CITE: USTR 301 lists]

- Ocean freight: $4,500; Insurance: $90 (may impact value if CIF)

Step-through:

- Customs value for FOB sale = $44,000.

- Base duty = customs value × base rate. Example: $44,000 × 7.1% = $3,124 [Verification Needed].

- Section 301 = customs value × 301 rate. Example: $44,000 × 7.5% = $3,300 [Verification Needed].

- MPF = ad valorem within min/max. Example: 0.3464% × $44,000 = $152.42, subject to current caps [CITE: CBP MPF; verify current cap].

- HMF = 0.125% × entered value for ocean entries. Example: 0.125% × $44,000 = $55.00 [CITE: CBP HMF].

- Brokerage = per agreement (e.g., $135 entry filing + $30 ISF + bond allocation, placeholders).

- Total customs charges ≈ base duty + 301 + MPF + HMF + brokerage. Example subtotal ≈ $3,124 + $3,300 + $152.42 + $55.00 + $165 = $6,796.42.

Swap origin to Bangladesh with equivalent construction and classification. Section 301 drops out; base duty remains. Recompute total, then divide by units for a landed cost delta per SKU. Confirm any preference programs or special claims before reliance [CITE: USTR 301 scope; country rules of origin].

Incoterms Impact (FOB/CIF/DDP/DAP) on Who Pays

FOB: Buyer pays international freight and insurance; customs value aligns with FOB price. CIF: Seller covers freight/insurance; customs value reflects these if invoiced that way. DAP: Seller ships to destination without import clearance or duties; importer of record remains the buyer. DDP: Seller acts as importer of record and pays duties, taxes, and fees.

Brands control compliance better under FOB or DAP with a contracted broker. DDP shifts filing obligations to the seller; many sellers use intermediaries or third-party IORs. Confirm who files ISF (ocean), who holds the continuous bond, and how post‑entry audits or protests are handled. Align Incoterms with your operations and risk tolerance [CITE: ICC Incoterms 2020 guide].

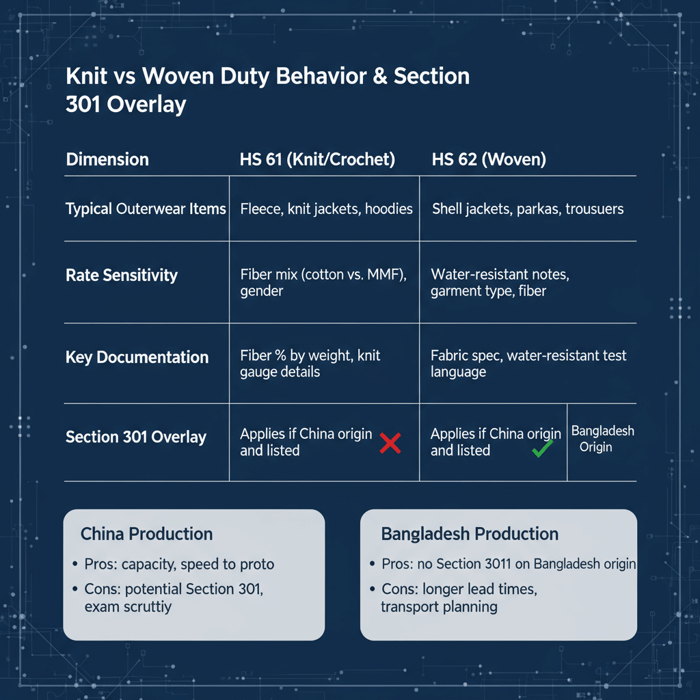

Apparel Duty Rates and Section 301: What Fashion Brands Should Expect

Apparel duty varies by fiber, garment type, and construction. Section 301 adds a second duty line for China-origin goods that appear on active lists. Always verify the exact HTS 10-digit subheading in the USITC database and the current USTR 301 coverage before final costing [CITE: USITC; USTR 301].

| Dimension | HS 61 (Knit/Crochet) | HS 62 (Woven) |

|---|---|---|

| Typical Outerwear Items | Fleece, knit jackets, hoodies | Shell jackets, parkas, trousers |

| Rate Sensitivity | Fiber mix (cotton vs. MMF), gender | Water-resistant notes, garment type, fiber |

| Common Rate Range | [Verification Needed]% reference ranges | [Verification Needed]% reference ranges |

| Key Documentation | Fiber % by weight, knit gauge details | Fabric spec, water-resistant test language |

| Section 301 Overlay | Applies if China origin and listed | Applies if China origin and listed |

- China production — Pros: capacity, speed to proto, materials ecosystem; Cons: potential Section 301, exam scrutiny if routing appears irregular.

- Bangladesh production — Pros: no Section 301 on Bangladesh origin, strong outerwear sewing base; Cons: longer lead times, transport planning, capacity cycles by season.

- De minimis threshold: $800 per person per day — 2025 [CITE: CBP de minimis]

- HMF: 0.125% on ocean entries — current reference [CITE: CBP HMF]

- MPF: ad valorem with min/max — verify current caps [CITE: CBP MPF]

HS 61 (Knit) vs HS 62 (Woven) Considerations

Knit garments lean on fiber content and garment category for rate behavior; blended man‑made fibers often differ from cotton lines. Woven outerwear often hinges on water-resistant terminology and coating notes in legal texts. Test reports and precise spec language strengthen classification and reduce post‑entry disputes [CITE: USITC HTS notes; testing language references].

For category planning, map your core silhouettes to their candidate headings with real samples. Maintain a rate card that pairs subheadings with documented logic and evidence. This gives sourcing, finance, and sales a single source of truth for landed cost modeling and promotional pricing.

Section 301 Overlay: China vs Bangladesh

When a subheading appears on the active 301 list, China-origin items carry an extra duty line. Moving production to Bangladesh usually removes 301, if cutting and sewing occur there, while base duty remains. Confirm whether any product exclusions apply to your exact HTS subheading and monitor USTR reviews for changes [CITE: USTR 301 lists and notices].

Run scenario comparisons before committing capacity: prototype speed, fabric access, peak-season freight constraints, and retailer delivery windows can offset duty gains. Document the origin rationale and keep production records aligned with the declared origin to support CBP inquiries.

Strategies to Reduce Customs Charges Without Compromising Compliance

Reduce customs charges with accurate classification, defensible valuation, packaging efficiency, and origin planning. Shift origin to Bangladesh where appropriate to avoid Section 301, maintain quality with robust QA, and choose Incoterms that preserve control over filings and bonds. Avoid misdeclaration under any pressure to shave cents [CITE: CBP valuation; USTR 301 scope].

- Classification QA: validate HTS with samples, tech packs, and testing language; store memos with citations.

- Valuation discipline: invoices align to terms; declare assists and royalties as required; maintain price trails.

- Packing and shipment size: optimize cartonization for de minimis parcels (DTC) and CBM per container for B2B.

- Origin decisions: balance duty/301 with throughput speed; consider dual-base models for resilience.

- Broker coordination: share HTS matrices early; set broker SOPs for ISF, bonds, and ACH duty payments.

[PAA] Can splitting shipments help use the $800 de minimis? Multiple same‑day parcels to the same recipient risk aggregation by CBP; structure DTC flows so each shipment stands alone on value and compliance. Avoid any pattern that looks like evasion [CITE: CBP de minimis guidance].

Eton garment factory — capabilities overview

[MENTION: International Chamber of Commerce (Incoterms)] [MENTION: U.S. Census Bureau (Schedule B/HTS cross-reference)]

Tariff Engineering vs Misclassification: Know the Line

Tariff engineering means designing legitimate product features that fall into a lower-rate provision. Misclassification means declaring an incorrect HTS. Examples: selecting a fabric that meets a tested water-resistant threshold can shift a jacket into a different line where the legal text supports the claim. Declaring “water resistant” without evidence invites penalties.

Actions that help: classify from approved samples; maintain lab test summaries that match the legal language; document why a subheading applies, not only the number itself. Avoid “HTS shopping” without evidence. Use advance rulings when uncertainty remains; build lead time for potential CBP questions [CITE: CBP binding ruling process].

Origin Planning and Dual-Base Production (China + Bangladesh)

A dual-base model uses China for speed, proto excellence, and materials, while staging production in Bangladesh to avoid Section 301 when duty impact outweighs lead‑time costs. Country of origin rests on where cutting and sewing occur. Keep production records, tickets, and origin statements consistent and auditable [CITE: CBP origin rules; USTR 301 coverage].

Execution tips: freeze specs and BOMs before cutting; align fiber labeling and COO labels with final origin; standardize document packs for each factory; and schedule third‑party inline QA for first shipments out of a new origin.

Documentation and Entry Procedures with CBP

Successful entries depend on complete paperwork and timely filings. Required documents include the commercial invoice, packing list, HTS codes, and COO statements. For ocean, file ISF 10+2 before loading. Choose the correct entry type, secure a bond for formal entries, and coordinate with your broker on ACH duty payments [CITE: CBP basic import; USITC HTS; CBP ISF 10+2].

- Pre‑shipment: final HTS classification memo, correct invoice terms, fiber/content and care labeling prep.

- At origin: ocean bookings with ISF details; air bookings with airway bill data; verify carton markings.

- At entry: broker files entry summary, pays duties/fees, and receives release. Respond rapidly to any document requests.

Entry Types, Bonds, and Broker Roles

Informal entries cover low-value shipments under a set threshold; formal entries require a bond and a fuller set of data. Many apparel shipments enter formally based on value. Continuous bonds simplify recurring entries. Brokers translate your documents into entry data, file to CBP, manage exams, and advise on post‑entry corrections [CITE: CBP basic import/export; bond requirements].

Align your bond amount with projected duty outlay. Enable ACH with periodic monthly statement to smooth cash flow. Provide your broker with a pre‑approved HTS matrix for styles to shorten classification cycles and reduce rework.

ISF 10+2: Avoid Costly Penalties

For ocean shipments, Importer Security Filing captures key data elements before vessel loading at the foreign port. Late or inaccurate ISF can trigger penalties and exams that add cost and time. Lock ISF timelines into your purchase order and booking process, and assign a named owner for completeness [CITE: CBP ISF 10+2].

ISF data includes supplier, manufacturer, ship-to, country of origin, and HTS codes. Align ISF codes with the entry codes to avoid mismatch flags. Treat ISF cadence like a production milestone and hold vendors to it.

Common Pitfalls and Audit Risks for Fashion Imports

Top risks include misclassification, origin errors, undervaluation, late ISF, and incorrect labels. Build a risk register specific to apparel and outerwear, score likelihood and impact, and assign mitigations with owners. A small set of preventive controls reduces chargebacks, exams, and penalties [CITE: USITC HTS; CBP ISF; CBP valuation].

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Misclassification | Medium | High | Classification memo with evidence; broker alignment; sample-based HTS |

| Origin Error | Low–Medium | High | Origin records; cutting/sewing documentation; COO labels check |

| Undervaluation | Low | High | Invoice controls; assist tracking; finance sign-off |

| Late ISF (ocean) | Low | Medium–High | ISF SOP with booking; milestone alerts; vendor training |

| Labeling Non‑Compliance | Medium | Medium | Fiber/care labels verified; QA audits; reference CFR text |

| Broker Data Mismatch | Medium | Medium | Pre‑approved HTS matrices; CSV templates; EDI testing |

| Exam Delays | Medium | Medium | Accurate docs; predictable packing; fast response protocol |

| Post‑Entry Claims | Low | Medium–High | Recordkeeping; internal audits; protest strategy with broker |

Risk Matrix

Score each risk by shipment lane and season. Outerwear peaks often coincide with port congestion; exams and storage charges rise during those windows. Flag high‑volume styles and ensure the HTS decision path is indisputable. Keep a one‑page “entry profile” per style with HTS, origin, labeling, and testing references for fast broker response.

Pre‑Clearance QA Checklist

- Invoice: correct Incoterms, buyer/seller addresses, price trails, style numbers.

- Packing list: carton counts, weights, dimensions; SKU mapping; scannable labels.

- HTS/COO: classification memo attached; COO statement; factory address matches ISF.

- Valuation: assists and royalties declared if applicable.

- ISF (ocean): filed on time; data matches entry; bond active.

- Bonds/Payments: continuous bond coverage; ACH/Periodic Monthly Statement enabled.

Data & Trends: De Minimis and Apparel Imports

The $800 de minimis threshold shapes DTC parcel strategies from Asia, while wholesale shipments enter formally. Track policy debates and carrier practices; keep DTC documentation complete even when duties are not collected at the border. Treat de minimis as a program, not an exception [CITE: CBP de minimis pages].

- De minimis: $800 per person per day — current reference year 2025 [CITE: CBP de minimis]

- Ocean share of apparel imports remains significant; HMF applies on those lanes [CITE: trade flow datasets].

De Minimis for B2C vs B2B

B2C parcels under $800 can enter duty‑ and tax‑free when meeting eligibility rules. Splitting orders to skirt limits invites aggregation. Maintain correct values, commercial invoices, and product descriptions even for low‑value shipments. For B2B, formal entries dominate; invest in bonds, ACH, and pre‑clearance workflows that scale during peak seasons [CITE: CBP de minimis; carrier guidance].

Monitoring Policy Changes

Duty rates, 301 coverage, and de minimis policy debates evolve. Assign an owner to check USITC HTS updates and USTR notices monthly. Subscribe to broker bulletins and industry associations like AAFA. Keep your rate cards versioned and time‑stamped; recost open POs if a mid‑season change lands [CITE: USITC changes; USTR notices; AAFA policy trackers].

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service pairs outerwear production with landed cost foresight. We model HTS outcomes, validate documentation, and plan origin across China and Bangladesh to manage duty and Section 301 exposure while protecting quality and ship windows. Results: smoother entries, tighter budgets, consistent labels.

| Brand Need | OEM Feature | Outcome |

|---|---|---|

| Lower 301 exposure | Dual-base China + Bangladesh production | Remove Section 301 where origin shifts; maintain quality |

| Faster clearance | Doc QA, broker SOPs, ISF discipline | Shorter release times; fewer mismatches |

| Accurate budgets | HTS classification support and rate cards | Reliable landed cost forecasts by SKU |

| DTC parcels at scale | Packing design and value documentation for de minimis | Clean low‑value flows with audit‑ready trails |

| Peak capacity | Calendar planning and factory allocation | On‑time launches across styles and sizes |

See our garment factory overview to understand equipment, sewing lines, and compliance certifications: Clothing Manufacturing OEM Service.

China Clothing Manufacturer — homepage

[MENTION: Liverpool F.C. apparel licensing] [MENTION: Forever 21 supplier programs]

Use Case 1: US Retail Launch with Ocean Shipments

A US retailer plans a fall outerwear launch. The style mix includes woven parkas and knit liners. Eton delivers classification memos per style, origin planning with Bangladesh capacity for high‑duty silhouettes, and a bond/ACH setup schedule with the retailer’s broker. Result: predictable entries, lower total duty, and stable on‑shelf dates.

Use Case 2: DTC Parcels Leveraging De Minimis

A DTC brand ships replenishment capsules under $800 per shipment. Eton standardizes micro‑packing, invoice clarity, and value documentation. The brand avoids duty on eligible parcels while keeping records that stand up under inspection. For styles crossing the threshold, entries switch to formal with pre‑cleared HTS lines.

Risks, Compliance & Localization for US/EU Brands

US-bound apparel must track HTS, Section 301, MPF/HMF, and ISF. EU-bound apparel centers on customs duty, VAT, and any preference programs; Section 301 does not apply in the EU. Align country labeling rules and fiber content declarations for each market [CITE: USITC HTS; USTR 301; EU TARIC and VAT rules].

- Single global spec — Pros: simplicity; Cons: risk of local non‑compliance if label or testing norms diverge.

- Market-specific packs — Pros: fewer relabels at DCs; Cons: higher complexity in production control.

Risk Matrix (US/EU Differences)

| Topic | United States | European Union |

|---|---|---|

| Tariff Surcharges | Section 301 on China origin (if listed) | No US Section 301; check EU measures as applicable |

| Taxes at Entry | No federal VAT; state taxes outside CBP | VAT collected; IOSS/OSS for DTC models |

| De Minimis | $800 threshold (DTC focus) | Different thresholds and VAT regimes |

| Labeling | Fiber/care; FTC/CFR guidance | EU textile labeling regulation |

| Security Filings | ISF 10+2 (ocean) | ICS2 advance data (phased) |

Regulatory Notes for US & EU

US: verify HTS and 301 lists before each season; keep valuation files and ISF calendars live. EU: confirm TARIC duty rates, VAT collection methods, and ICS2 requirements for air parcels. For both, maintain origin records and labeling compliance files linked to styles and factories [CITE: TARIC; ICS2 publications; USITC HTS].

Compliance and sustainability — certifications and social compliance

Conclusion & Next Steps

Customs charges from China to US depend on accurate HTS codes, origin rules, Section 301 coverage, and CBP fees. Fashion brands can lower duty outlay with compliant design, origin planning, and broker discipline. Start with style-level classification, run sample calculations, and align production with document-first execution.

- Week 1: Validate HTS per style; confirm origin; build rate cards; sample calculation per SKU.

- Week 2: Broker SOPs; bond/ACH setup; ISF templates; invoice and packing list formats.

- Weeks 3–4: Pilot container with pre‑clearance QA; post‑entry review; finalize seasonal playbook.

Plan your next production cycle with a manufacturing partner that aligns design, compliance, and speed. Eton’s OEM service integrates classification support, origin options, and documentation rigor so landed costs stay predictable. Explore Eton’s garment factory capabilities.

Author & Review Notes (E-E-A-T)

Author: Senior Trade Compliance Specialist, Eton Garment Limited (15+ years in apparel logistics and classification).

Reviewer: Head of Logistics, Eton Garment Limited.

Methodology: Combined CBP/USITC/USTR sources with Eton’s manufacturing and shipping experience; flagged any duty ranges as [Verification Needed]; emphasized step-by-step workflows and documentation discipline.

Limitations: Duty rates and Section 301 actions change; brokerage fees vary; always verify live HTS rates and official notices before committing prices or purchase orders.

Disclosure: Eton provides OEM/ODM clothing manufacturing services; examples align with Eton’s capabilities.

Last Updated: 2025-10-28

References & Sources

- CBP — Basic Importing and Exporting (De Minimis/Informal Entry Overview). https://www.cbp.gov/trade/basic-import-export [CITE: CBP de minimis overview]

- USITC — Harmonized Tariff Schedule Search. https://hts.usitc.gov/ [CITE: USITC HTS]

- USTR — Section 301 Tariff Actions (China). https://ustr.gov/issue-areas/enforcement/section-301-investigations/tariff-actions [CITE: USTR 301]

- CBP — Merchandise Processing Fee. https://www.cbp.gov/trade/entry-summary/merchandise-processing-fee [CITE: CBP MPF]

- CBP — Harbor Maintenance Fee. https://www.cbp.gov/trade/entry-summary/harbor-maintenance-fee [CITE: CBP HMF]

- CBP — Importer Security Filing (ISF 10+2). https://www.cbp.gov/bonds/requirements/importer-security-filing [CITE: CBP ISF]

- Easyship — US Import Duty and Taxes Guide. https://www.easyship.com/blog/us-import-duty-and-taxes [CITE: Easyship guide]

- Freightos — Customs Duty Guide. https://www.freightos.com/freight-resources/customs-duty-guide/ [CITE: Freightos guide]

- CBP — Valuation (Transaction Value). https://www.cbp.gov/trade/programs-administration/valuation [CITE: CBP valuation]

- USITC — HTS Chapter 61 and Chapter 62. https://hts.usitc.gov/current?chapter=61 and https://hts.usitc.gov/current?chapter=62 [CITE: HTS Chapters 61/62]

[MENTION: AAFA policy trackers] [MENTION: ICC Incoterms 2020]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »