compliant chinese: How to Choose a China Clothing Manufacturer That Meets US/EU Standards

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

15 minute read

compliant chinese: How to Choose a China Clothing Manufacturer That Meets US/EU Standards

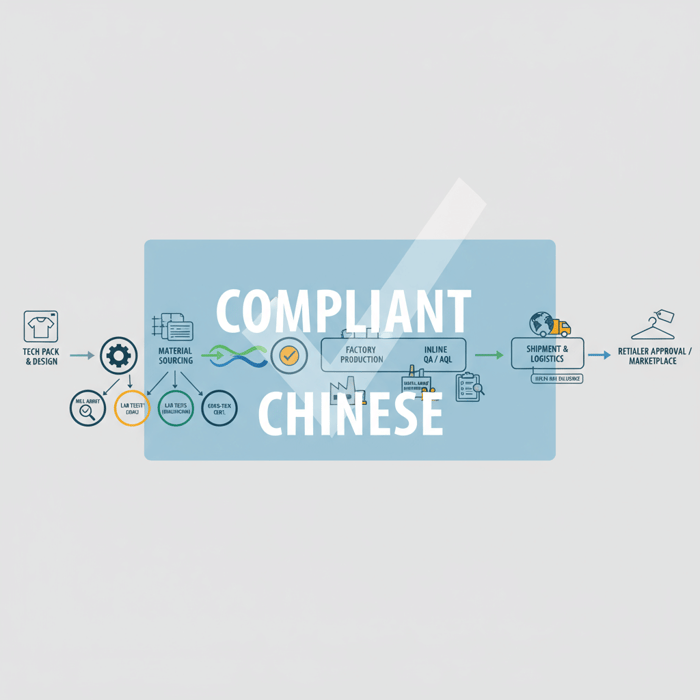

compliant chinese apparel sourcing starts with a China Clothing Manufacturer that can pass US/EU requirements and prove it with live, verifiable documentation. For fashion brands, “compliant” means current third‑party audits for social and environmental practices, chemical safety aligned to REACH/CPSIA, and a QA system that maps audits, lab tests, and AQL inspections to each purchase order.

“Compliant Chinese” describes a China Clothing Manufacturer able to prove social, environmental, and product safety compliance through valid third‑party audits (BSCI/SMETA/WRAP), chemical programs (REACH, CPSIA, OEKO‑TEX, ZDHC), and documented QA. Verify audit IDs, scope, validity, closed CAPs, and lab reports mapped to your PO, then cross‑check with the issuing bodies.

Executive Summary

In apparel sourcing, compliant chinese indicates a factory that meets recognized social, environmental, and product safety standards accepted by US/EU markets and major retailers. This guide defines compliance beyond certificates, compares audits (BSCI, SMETA, WRAP), outlines chemical requirements (REACH, CPSIA, OEKO‑TEX, ZDHC), and shows how to build a verification flow that stands up to retailer checks and UFLPA due diligence. You’ll see where costs and time accrue, how to weigh compliant vs non‑compliant options, and how to embed compliance into your critical path—tech pack to shipment.

Eton brings 30+ years in outerwear OEM/ODM across China and Bangladesh, combining audit‑ready supply chains, material traceability, and rigorous QA. The workflow presented here mirrors how Eton’s teams plan testing, manage CAPs, and tie documents to POs to prevent late‑stage failures, shipment holds, and listing bans.

What “compliant Chinese” means in apparel sourcing

A compliant chinese clothing manufacturer meets verifiable social, environmental, and product safety standards accepted by US/EU buyers. Proof rests on valid third‑party audits, chemical compliance, material traceability, and a QA system that links audits, lab tests, and AQL inspections to your purchase orders.

- Social and labor: Current audits against amfori BSCI, SMETA (Sedex), or WRAP; transparent working hours, wages, and health/safety; closed or progressing Corrective Action Plans (CAPs) with evidence.

- Environmental: ISO 14001 for environmental management, wastewater testing where relevant, and ZDHC alignment for chemical inputs and effluent in wet processes.

- Product/chemical: Material compliance to REACH for the EU and CPSIA for the US, supported by lab test reports; OEKO‑TEX Standard 100 where specified; PFAS/solvent controls for coated and functional fabrics.

- Quality systems: ISO 9001 or equivalent SOPs; inspection plans (AQL) set at quotation; inline and final inspections documented with sign‑offs and defect analytics.

- Traceability and forced labor due diligence: Supplier mapping for tiers, UFLPA‑ready documentation, and controls against unauthorized subcontracting.

- Outerwear specifics: Management of DWR finishes, laminations, seam tapes, down/insulation origins, and hardware (zips/snaps) for nickel and phthalate risks.

[CITE: An official amfori BSCI overview clarifying audit scopes and code of conduct] [CITE: Sedex SMETA methodology page on audit criteria and sharing model] [MENTION: Sedex] [MENTION: amfori]

[INTERNAL LINK: Garment Factory Compliance Hub – pillar page defining audits, chemicals, and QA evidence]

Social and labor compliance (BSCI, SMETA, WRAP)

BSCI is a code of conduct and audit program used by many EU‑focused retailers. SMETA is a common audit methodology under Sedex, with 2‑pillar (labor/health & safety) and 4‑pillar (adds environment/business ethics) options. WRAP certifies compliance with labor, safety, and environmental criteria in apparel facilities. Renewal cadence typically runs 12 months, with risk‑based intervals. A valid audit is not enough; buyers need CAPs closed or on track with dated evidence, responsible owners, and re‑audits scheduled when required.

Ask for the full audit report, not only a summary. Check site scope, legal entity, address, and subcontracting disclosures. Confirm the audit firm and report ID on the scheme’s portal when possible. Align the audit type to your risk: 4‑pillar SMETA if your retailer expects environmental and ethics coverage, or a WRAP certification if the brand mandates it.

[CITE: WRAP program description and certification directory] [CITE: Intertek WCA program summary for social assessments] [MENTION: Intertek] [MENTION: WRAP]

Product and chemical compliance (REACH, CPSIA, OEKO‑TEX)

Textiles entering the EU must meet REACH restrictions on substances like azo dyes, nickel release, PAHs, and the expanding SVHC list. US market access can involve CPSIA for children’s wear (lead, phthalates), flammability rules, and labeling. OEKO‑TEX Standard 100 offers product‑level chemical screening that aligns with many retailer policies and complements REACH/CPSIA, while ZDHC MRSL governs input chemicals at mills and laundries.

Outerwear carries higher risk: PU/PVC coatings, solvent residues, PFAS‑based DWR, seam tapes, reflective films, and ink systems. Build a test plan per material: shell/lining/fill, print/heat transfers, coatings, trims. Map each material to a lab report with sample photos and batch IDs. If your brand follows ZDHC, request MRSL conformance statements and wastewater test data from wet‑processing suppliers.

[CITE: ECHA REACH restrictions page for textiles and leather] [CITE: CPSC CPSIA guidance for apparel] [CITE: OEKO‑TEX Standard 100 criteria updates] [CITE: ZDHC MRSL v3.1 and Wastewater Guidelines] [MENTION: ECHA] [MENTION: CPSC]

How to verify a compliant Chinese clothing manufacturer: audits, certifications, evidence

Verification rests on authentic, current documents that match your products and timeline: audit certificates with IDs and scope, CAP status with evidence, lab test reports tied to materials, and QA SOPs aligned to your PO milestones. Cross‑check every document with the issuing body or lab.

- Request a document pack: audit reports, certificates, CAPs, ISO 9001/14001, SMETA/BSCI/WRAP details, OEKO‑TEX if applicable, lab reports, and QA SOPs.

- Validate authenticity: verify report IDs on scheme portals or directly with the auditor or lab; confirm legal entity, address, and validity dates.

- Match scope to product: confirm the audited site performs your production steps; check whether wet processes are external and audited.

- Check CAP closure: require dated evidence, responsible owners, root cause, and timelines; review proof for high‑risk findings first.

- Confirm test coverage: map every material and finish to a lab report; confirm batch or pre‑production sampling aligns with your orders.

- Run a pre‑production assessment: conduct a desktop review of SOPs, line layout, and material controls before cutting.

- Set cadence: plan inline and final AQL inspections, re‑tests after material changes, and audit refresh cycles in your calendar.

| Evidence | What to check | Where to verify | Renewal cadence |

|---|---|---|---|

| BSCI/SMETA/WRAP | Report ID, scope, date, findings, CAP status, site address | Scheme portal or auditor confirmation | 12 months (risk‑based) |

| ISO 9001/14001 | Accredited body, scope, multi‑site coverage | Certification body database | 3 years with surveillance |

| OEKO‑TEX S100 | Product class, certificate holder, validity | OEKO‑TEX certificate checker | 1 year |

| Lab test reports | Material IDs, photos, test methods, pass/fail, lab stamp | Lab contact or QR code validation | Per material batch or season |

| AQL inspection reports | Sample size, defects, photos, disposition | Independent inspector record | Per lot |

| Traceability pack | Tier mapping, PO‑to‑material links, transport docs | Internal checks; spot‑verify with suppliers | Per PO |

Quick fraud checks: mismatched fonts or logos, altered dates, missing surveillance audit entries, or labs not accredited for the methods listed. Contact the issuer when anything feels off.

[CITE: QIMA overview of social audit programs] [CITE: ISO accredited certifier directory] [MENTION: QIMA] [MENTION: SGS] [INTERNAL LINK: AQL and Inline Inspection for Outerwear – cluster page on inspection levels and defect control]

From Eton’s onboarding checklist: compliance and QA teams validate audit scope against the planned process flow, request missing CAP evidence, align testing plans to the bill of materials, and lock inspection levels before issuing the bulk PO. This sequence prevents overruns and late‑stage rework.

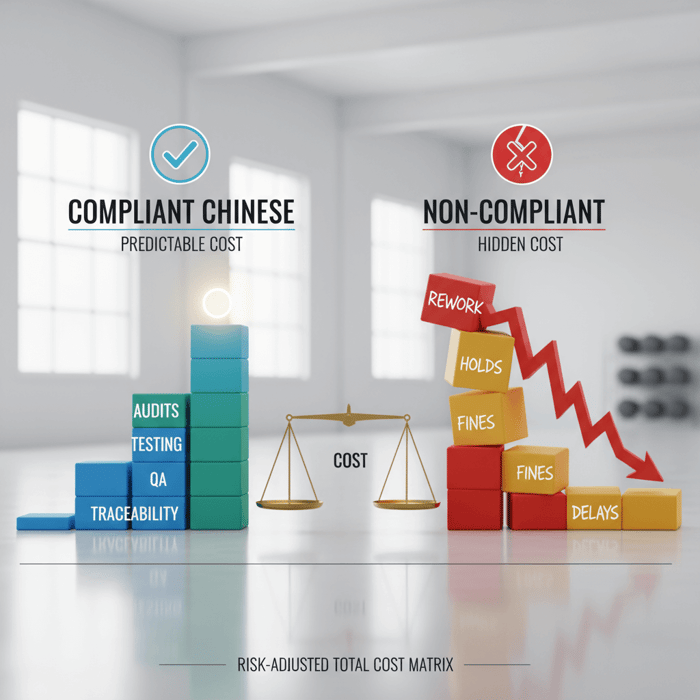

compliant chinese vs. non-compliant factories: trade-offs for US/EU brands

Compliant factories improve acceptance rates with retailers and marketplaces and reduce legal, reputational, and operational risk. Non‑compliant factories may quote lower prices, yet increase the chance of rework, port holds, chargebacks, and listing bans, which often outweigh headline savings.

| Dimension | Compliant Chinese factory | Non‑compliant factory |

|---|---|---|

| Retailer acceptance | High with valid audits; faster vendor onboarding | Low; repeated rejections, added audits |

| Regulatory exposure | Lower with REACH/CPSIA coverage and traceability | High; higher risk of detentions and recalls |

| Lead time | Slightly longer upfront, fewer delays later | Short early, longer from rework and holds |

| Total landed cost | Predictable; fewer chargebacks and airfreight rescues | Volatile; hidden costs from failures |

| Brand reputation | Positive with audit evidence and CAP follow‑through | Negative risk from press or platform bans |

- SMETA/BSCI audits are recognized by major retailers — 2023–2024 (Source: [S6]).

- UFLPA expects importer due diligence and traceability for US shipments — 2023 (Source: [S2]).

Criteria overview (what to weigh and why)

Weigh the following with clear scoring: audit validity and scope coverage; CAP status and closure evidence; product safety test coverage for all materials; QA SOPs and recent AQL performance; traceability depth across tiers; capacity that matches your calendar; and cost transparency, including testing and audits. For outerwear, add mill capability for coatings/laminations and down traceability where relevant.

[CITE: Retailer vendor manuals referencing SMETA/BSCI acceptance] [MENTION: Walmart Responsible Sourcing] [MENTION: Inditex Sustainability Standards]

Decision framework (weighted scoring example)

Set weights by business risk. Example: audit status 20%, CAP trend 15%, product testing 20%, QA/AQL performance 15%, traceability/UFLPA 15%, capacity/on‑time delivery 10%, price 5%. Target a threshold (e.g., 80/100) for awarding POs. Document evidence under each score, link to files, and time‑stamp approvals. Re‑score after pilot lots to reflect live performance.

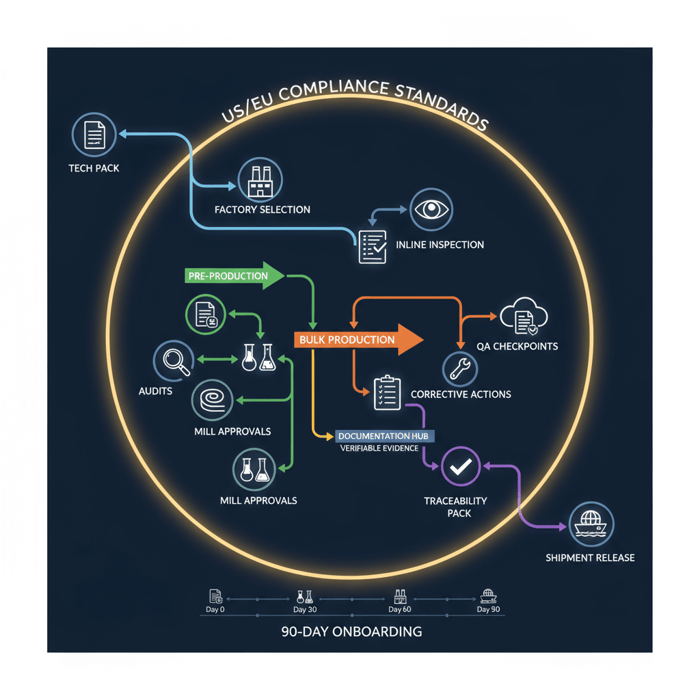

Implementing a compliant Chinese sourcing process (step-by-step)

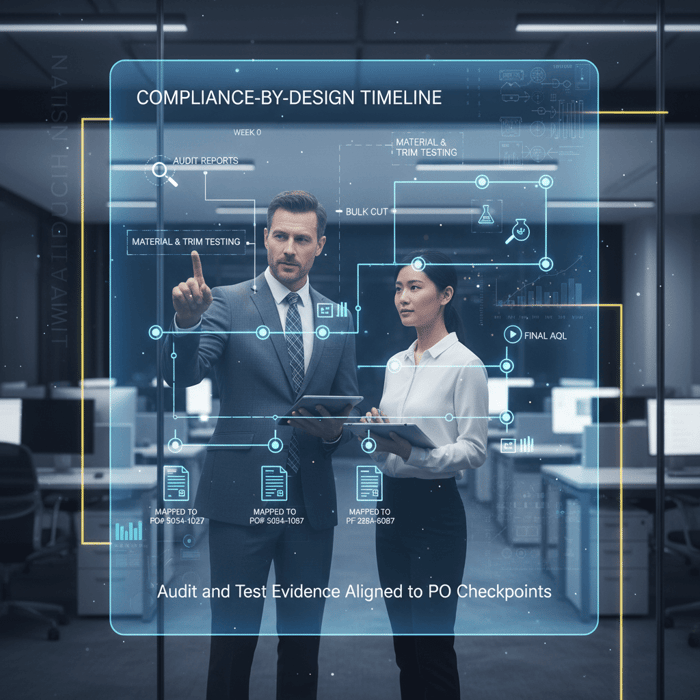

Use a compliance‑by‑design workflow: start with compliant materials, embed testing plans in tech packs, schedule audits and inspections at milestones, and maintain a traceable evidence trail for each PO.

- Define your RSL/MRSL and audit baseline by product and retailer expectations.

- Build the tech pack with material IDs, testing plan, and inspection levels.

- Pre‑qualify factories with audit reports, CAPs, and capacity checks.

- Lock mill list and map tests per material and finish.

- Run pilot lot; review inline defects and adjust controls.

- Approve bulk only after passing lab tests and CAP checkpoints.

- Track inline and final AQL; hold shipment release on pass results.

[INTERNAL LINK: AQL and Inline Inspection for Outerwear – practical sampling levels and defect taxonomy]

Preparation (RSL/MRSL, tech packs, supplier assessment)

Publish a brand RSL aligned to REACH/CPSIA and, if applicable, a ZDHC MRSL stance. In the tech pack, list each material with a unique ID, test method, and required standard. Ask the factory for a complete social audit report and ISO 9001 scope. For mills and wet processes, request ZDHC conformance or wastewater tests. Align timelines: testing slots, audit refresh, and contingency buffers. For US shipments, plan UFLPA traceability: bills of material, supplier declarations, and transport records.

[CITE: ZDHC MRSL policy guidance] [CITE: EU REACH SVHC communication duties] [MENTION: Hohenstein] [MENTION: Bureau Veritas]

Execution steps (pilot run → inline → final AQL)

Run a pilot on production lines to validate workmanship and process controls. Trigger inline inspections at 20–30% completion; use Pareto on defects, then apply targeted countermeasures. Hold final AQL on packed goods against agreed levels (e.g., II/2.5 for critical programs). Any material changes trigger re‑tests. Tie go/no‑go to evidence rather than dates. Keep an auditable trail: inspection reports, photos, and CAPs tied to specific lots.

[CITE: ANSI/ASQ Z1.4 AQL sampling reference] [MENTION: TUV Rheinland] [MENTION: SGS]

Quality assurance (AQL plans, lab re-tests, CAP tracking)

Set AQL levels during quotation, not post‑production. Use lab re‑tests for repeat materials each season or when mills change chemistries. Track CAPs with root‑cause analysis and due dates. Share dashboards with suppliers and close the loop with evidence. Archive per PO so retailer checks and customs reviews can be met fast.

Costs, lead times, and MOQs for compliant outerwear production

Compliance adds planned costs and time—lab tests, audits, and verification—but trims rework, detentions, and emergency freight. Budget these checkpoints into your critical path to protect launch dates.

| Cost driver | Typical impact | Mitigation |

|---|---|---|

| Lab testing | $200–$800 per material/test panel; 5–10 days | Batch materials, use accredited composite tests where valid |

| Social audits | $900–$2,500; 1–2 days on site + report time | Accept recognized audits; share across programs where policy allows |

| Inspection | $250–$500 per man‑day; 1–2 days | Risk‑tier SKUs; combine lots when feasible |

| Traceability | Admin time; courier and notarization for sensitive lanes | Standardize document packs and templates |

Do compliant factories always have higher MOQs? Usually MOQs stem from mills and dye houses, not audits. Compliant suppliers often offer similar or more flexible MOQs because they plan capacity and material commitments earlier.

[CITE: Lab pricing ranges from TIC providers] [MENTION: Intertek] [MENTION: Eurofins] [INTERNAL LINK: Outerwear Lead‑Time Calculator – planning tool for sampling, testing, and bulk]

Risks, forced labor due diligence, and regional compliance (US & EU)

For the US, align with UFLPA expectations on traceability and origin. For the EU, track REACH and retailer policies. Build a tiered control system that proves origin, materials, and labor practices across your chain.

Risk matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Unauthorized subcontracting | Medium | High | Declare process flow; surprise visits; PO‑site lock; GPS/time‑stamped photos |

| Forced labor exposure | Low‑Medium by region | High | UFLPA traceability pack; supplier declarations; tier mapping; third‑party screening |

| Chemical non‑conformance | Medium | High | RSL/MRSL with lab tests; pre‑approval of mills; re‑tests after changes |

| Document fraud | Low‑Medium | High | Issuer verification; watermark checks; portal lookups; trained review team |

| Capacity shortfalls | Medium | Medium | Load plans; dual‑facility options; pilot lots; early booking windows |

Regulatory notes for US & EU

- UFLPA due diligence: Build a traceability pack with supplier declarations, PO‑to‑material mapping, invoices, and logistics records. Prepare to present within short notice. [CITE: CBP UFLPA Operational Guidance] [MENTION: US CBP]

- REACH updates: Monitor new SVHCs and restriction entries for textiles; adjust test plans when lists change. [CITE: ECHA news on textile restrictions]

- OEKO‑TEX and ZDHC alignment: OEKO‑TEX supports product compliance; ZDHC reduces upstream chemical risk. Many retailers accept these as evidence layers. [CITE: OEKO‑TEX Standard 100] [CITE: ZDHC Wastewater Guidelines]

Regulatory lists evolve. Validate the latest versions and document the check date on your test plans.

How Eton’s Clothing Manufacturing OEM Service ensures compliance end-to-end

Eton ties compliance to operations from design to shipment: audited partners in China and Bangladesh, OEKO‑TEX‑aligned fabrics when specified, REACH/CPSIA test plans, CAP management, and AQL inspections. The workflow maps all evidence to each PO to speed retailer approvals.

| Your need | Eton workflow/capability | Outcome |

|---|---|---|

| Proof of social compliance | Accepted audits (BSCI/SMETA/WRAP) with CAP follow‑through | Vendor approvals with major retailers |

| Chemical compliance | Material‑level test plans; OEKO‑TEX when specified; ZDHC‑aware sourcing | Pass rates and fewer re‑tests |

| QA and inspections | Inline and final AQL; defect Pareto; corrective actions | Stable quality and predictable releases |

| Traceability | PO‑linked document packs; tier mapping | Fast responses to customs and retailer checks |

| Speed and scale | Dual‑region capacity with shared methods | Balanced lead times and risk |

Start a project with Eton’s Clothing Manufacturing OEM Service to align design intent, compliance, and production plans in one place.

Use Case 1: Fast-fashion outerwear capsule → on-time compliance

A US retailer requests a 6‑style capsule with tight windows. Eton locks a composite test plan for shared materials, runs a pilot on one style, triggers inline inspections at 30%, and batch‑books testing to cut time. Social audits are current; a minor finding closes with photo evidence before bulk cut. Result: on‑time approvals, no holds.

[MENTION: H&M Group chemical policy reference] [CITE: Lab guidance on composite testing rules]

Use Case 2: Premium technical jacket → deep testing and traceability

An EU premium brand specifies PFC‑free DWR, a 3‑layer lamination, and recycled insulation. Eton sources ZDHC‑aligned mills, runs PFAS targeted methods, seam‑tape adhesion tests, and nickel release on trims. A 4‑pillar SMETA covers the site; ISO 14001 supports environmental controls. The PO ships with a traceability pack ready for spot checks.

[CITE: PFAS restriction proposals in the EU] [MENTION: Bluesign] [MENTION: ToxServices]

Conclusion & Next Steps

Define compliance, verify with evidence, and embed checks into your production calendar. Choose partners with a proven OEM workflow that satisfies US/EU gatekeepers without derailing launches.

- Days 1–30: Set RSL/MRSL and audit baseline; shortlist factories; request full reports and CAPs; draft test plan per material.

- Days 31–60: Lock tech packs with testing and AQL; run pilot lots and first lab tests; close priority CAPs; schedule audit refresh if required.

- Days 61–90: Approve materials post‑test; run inline inspections; complete final AQL; compile traceability pack; ship only with pass results.

[INTERNAL LINK: Garment Factory Compliance Hub – reference library for standards and documents] [INTERNAL LINK: Outerwear Lead‑Time Calculator – timeline planning] [INTERNAL LINK: AQL and Inline Inspection for Outerwear – inspection playbook]

Author & Review Notes

Author: Senior Apparel Compliance Lead, 10+ years in OEM outerwear, audit and QA program design. Reviewer: Head of Quality, Eton Garment Limited (Asia‑based QA audits and AQL systems). Methodology: standards and regulatory sources cross‑referenced (BSCI/SMETA/WRAP, OEKO‑TEX, ZDHC, UFLPA/CBP, REACH/CPSIA) plus Eton’s operations playbooks. Limitations: standards and regulations update; verify per project, product, and market; timelines vary by season and capacity. Disclosure: Eton provides OEM/ODM services. Last updated: 2025‑10‑28.

[INTERNAL LINK: Author bio – {{author_name}} – {{author_title}} – {{author_bio_url}}]

References & Sources

- QIMA — Social Compliance Audits (2024). https://www.qima.com/social-compliance-audits

- U.S. Customs and Border Protection — UFLPA Operational Guidance for Importers (2023). https://www.cbp.gov

- ECHA — REACH Restrictions for Textiles (2024). https://echa.europa.eu

- OEKO‑TEX — STANDARD 100 Criteria and Updates (2024). https://www.oeko-tex.com

- ZDHC — MRSL and Wastewater Guidelines (2023–2024). https://www.roadmaptozdhc.com

- amfori — BSCI Code of Conduct and Resources (2023–2024). https://www.amfori.org

- Intertek — Workplace Conditions Assessment (WCA) (2024). https://www.intertek.com/auditing/wca/

- Sedex — SMETA Guidance/Methodology (2024). https://www.sedex.com/

- ISO — ISO 9001 and ISO 14001 Information (2024). https://www.iso.org

- CPSC — CPSIA Guidance for Apparel (2024). https://www.cpsc.gov

- WRAP — Certification Program Overview and Facility Directory (2024). https://wrapcompliance.org

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »