Clothing Brand Website Maker: A US/EU Buyer’s Guide Aligned with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

15 minute read

Clothing Brand Website Maker: A US/EU Buyer’s Guide Aligned with a China Clothing Manufacturer

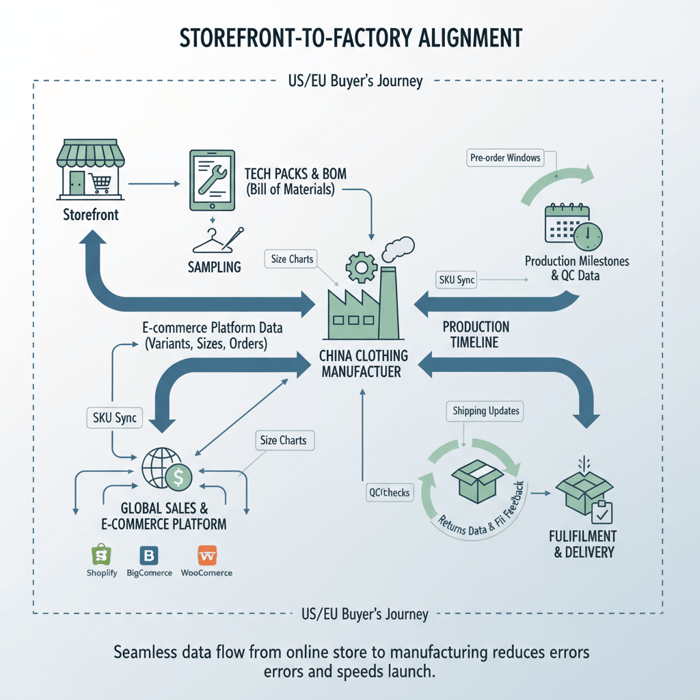

Clothing brand website maker choices shape launch speed, conversion, and margin. To win in the US and EU, pick a fashion website builder that supports apparel variants, size charts, returns, and performance—and align it with a China Clothing Manufacturer so product data, tech packs, and timelines stay in sync from design to delivery.

A clothing brand website maker is an eCommerce platform for fashion labels to launch and run online stores with apparel-first features. Select one that handles variants, size guides, returns, fast page speed, and integrations with OEM/ODM. This keeps launch dates, pre-orders, and compliance aligned with your China Clothing Manufacturer partner.

This guide helps US/EU brands choose a clothing brand website maker and pair it with manufacturing reality. You get an apparel feature checklist, a platform comparison with scalability and integrations, performance and compliance guardrails, and an OEM/ODM integration roadmap. The goal: cut rework, reduce returns, and ship collections on time with accurate data linked to factory deliverables and milestones.

What a Clothing Brand Website Maker Must Do for Fashion Brands

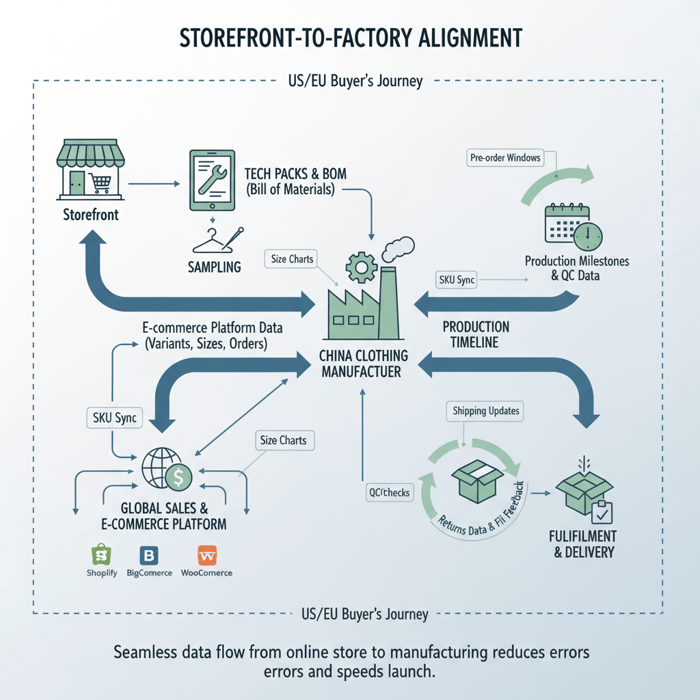

A clothing brand website maker for fashion must support variant-rich catalogs, size guides, visual merchandising, returns workflows, global payments, shipping and duties, fast performance, and integrations with PLM/PIM/ERP. Map each feature to factory data and timelines so listings match approved specs and size labeling, preventing returns and complaints.

[MENTION: Shopify themes and app ecosystem]

[MENTION: BigCommerce enterprise catalog features]

[CITE: Baymard checkout UX benchmarks for apparel stores]

[INTERNAL LINK: Our foundational guide on ‘Outerwear OEM & Digital Merchandising’]

- Variants and options: sizes, colors, fits, fabric/trim options, and bundles. Match option names and codes with factory BOM and tech pack identifiers.

- Size guides by region: US/EU sizing, body measurements, garment measurements, and fit notes. Tie charts to graded specs approved by the factory.

- Lookbooks and collections: capsules, seasons, drops, and evergreen lines. Power editorial content and shoppable galleries.

- Pre-orders and reservations: set windows based on MOQs and lead times; display clear delivery windows and cutoffs.

- Returns workflows: RMA portal, reason codes, exchange vs refund logic, and policy pages aligned with US/EU rules.

- Global payments and tax/VAT: multi-currency, region pricing, EU VAT rules, and US sales tax; reliable fraud tools.

- Shipping and cross-border: live rates, duties and taxes at checkout (DDP/DDU), returns labels, and warehouse routing.

- Performance and SEO: Core Web Vitals targets, image compression, clean theme code, structured data, and canonical rules.

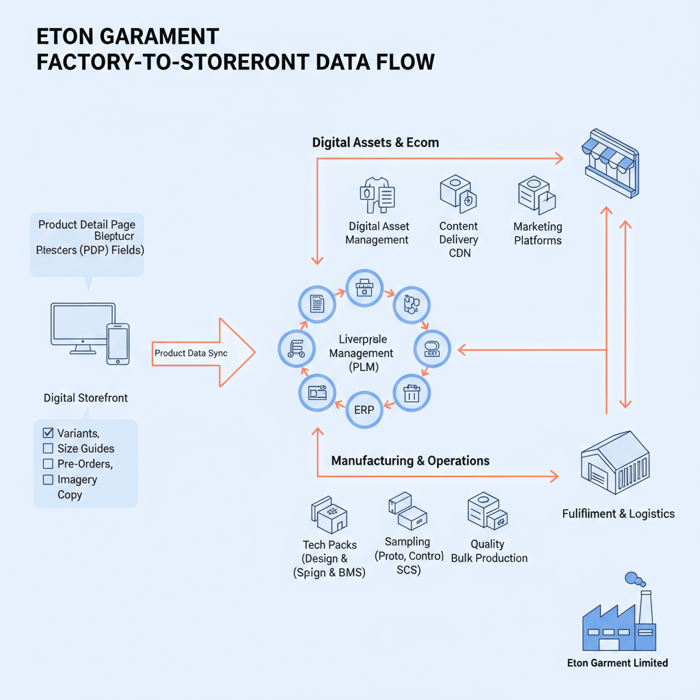

- PLM/PIM/ERP sync: consistent product IDs, variant SKUs, materials, care labels, and barcode/GTIN logic.

- Sustainability claims and labeling: traceable materials, care instructions, and claim substantiation.

Variants, Size Charts, and Returns

Start with the tech pack. Use factory measurements, graded rules, and fit notes to build variant trees and size charts. Document unit conversions for US/EU size parity and sync them with PLM/PIM. In your return portal, require reason codes (fit too small, color mismatch, fabric feel, defect). Feed those codes back into the chart and content. Over time, tighten tolerance notes and add “fits small/large” badges based on actual return ratios. Surface garment measurements for outerwear and denim where layering and shrinkage matter. Keep a single source of truth for SKUs and barcodes, matching factory packing lists and carton labels to avoid mis-picks and inbound errors. [CITE: A study correlating fit data with reduced returns in fashion]

[MENTION: GS1 GTIN standards]

Visual Merchandising: Lookbooks & Collections

Plan product images and videos from your photo sample plan. Shoot looks by capsule and season, flag colorways that differ materially in fabric or sheen, and tag imagery with consistent naming. Build shoppable lookbooks and bundle offers that mirror merchandising plans. Compress images and use next-gen formats. Lazy-load below-the-fold blocks and defer non-critical scripts to protect LCP and CLS. Set hero copy and badges for pre-order windows, fabric stories, and limited runs. [CITE: Image performance guidance aligned with Core Web Vitals]

[MENTION: Google Lighthouse diagnostics]

Performance & SEO Guardrails

Target Core Web Vitals. Keep LCP fast with lean hero images and server-side rendering where supported. Limit app bloat and duplicate tracking scripts. Add structured data for products, offers, and reviews. Write product titles with fabric, fit, and use-case; keep meta descriptions under character limits; add canonical tags for color variants to control crawl. Link size guides from PDPs and returns policy from the cart. [CITE: Core Web Vitals thresholds from web.dev]

[MENTION: Google Web.dev Core Web Vitals]

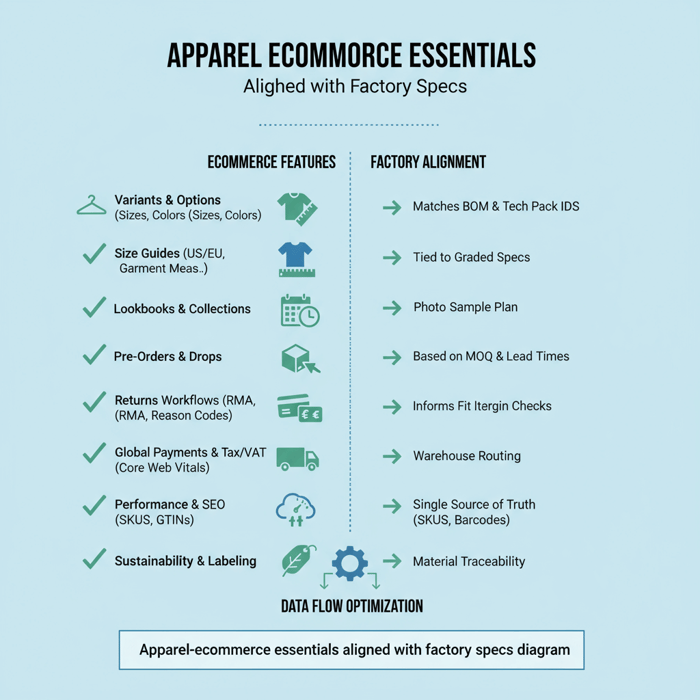

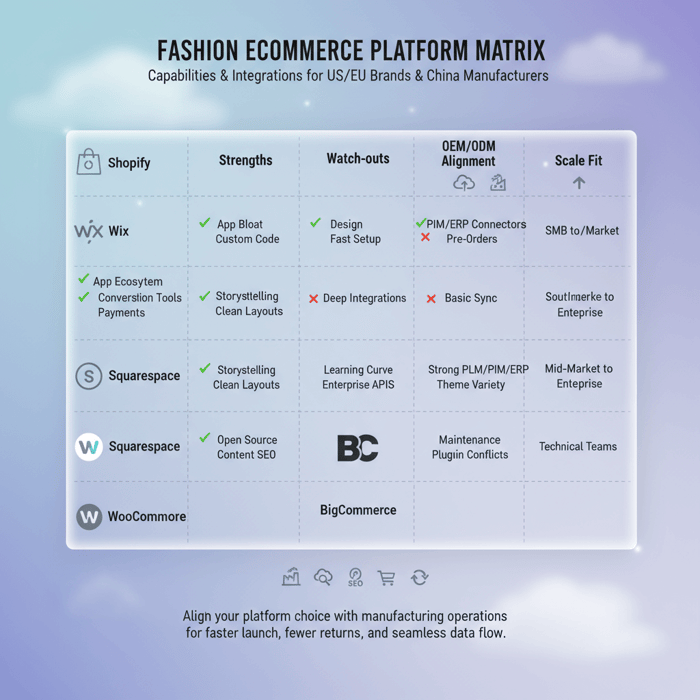

How to Choose the Best Clothing Brand Website Maker (US/EU)

Compare hosted vs self-hosted platforms on scalability, variant depth, integration maturity, performance, and regional compliance. Select a platform that fits your team skills, budget, and OEM/ODM roadmap. Include pre-order handling, PIM/PLM connectors, and multi-store needs for US/EU expansion.

| Platform | Strengths | Watch-outs | OEM/ODM Alignment | Scale Fit |

|---|---|---|---|---|

| Shopify | Large app market, conversion tooling, strong payments | App bloat risk, advanced apparel ops need apps | Works with PIM/ERP connectors; pre-order apps available | SMB to mid-market; can reach enterprise with add-ons |

| Wix | Design-forward templates, fast onboarding | Fewer deep ERP/PLM integrations | Limited factory data sync; lightweight drops okay | Startup and small brands |

| Squarespace | Brand storytelling, clean layouts | Variant complexity and fewer commerce apps | Manual sync or basic connectors; content-led commerce | Design-led boutiques, capsules |

| BigCommerce | Native variant breadth, enterprise integrations | Template variety smaller; learning curve | Strong ERP/PIM connectors; better for large catalogs | Mid-market to enterprise |

| WooCommerce | Flexibility, content SEO strength | Maintenance burden, plugin conflicts risk | Custom PIM/ERP pipelines possible; needs engineering | Technical teams; content-led brands |

- Cart abandonment benchmarks guide checkout choices — 2023 (Source: [CITE: Baymard Institute report page])

- Core Web Vitals thresholds steer theme and app decisions — 2024 (Source: [CITE: web.dev guidance])

- Apparel eCommerce growth in US/EU — 2024/2025 [Verification Needed] (Source: [CITE: Statista category pages])

[MENTION: Shopify App Store]

[MENTION: BigCommerce B2B Edition]

See our China clothing manufacturer guide — https://china-clothing-manufacturer.com/

Criteria Overview

- Catalog and variants: native options and SKUs, limits per product, and ability to map factory option codes.

- Pre-orders and drops: scheduled releases, deposit support, clear delivery windows, and split fulfillment.

- Integrations: native and third-party connectors for PLM, PIM, ERP, WMS, and finance.

- Performance: theme code quality, CDN reach, image handling, and app/script control.

- Global readiness: multi-currency, duties, EU VAT, US sales tax, and language support.

- Governance: staging environments, version control, roles/permissions, audit logs.

- Costs: subscription, apps, payments, and maintenance; TCO over 24 months.

Decision Framework

- Define catalog scale, variant depth, and required integrations for year one and year two.

- Map your OEM/ODM calendar: design freeze, proto fit, SMS, and production dates with pre-order windows.

- Score platforms on integration effort for PIM/ERP, returns/RMA, and shipping/duties.

- Run a performance proof with your largest PDP: images, 3D, reviews, and scripts.

- Validate compliance: GDPR consent flows, EU returns rules, US labeling, and tax setup.

- Model TCO for 24 months and include app and developer time.

- Test content workflows for capsules, lookbooks, and size guide updates tied to factory changes.

Clothing Brand Website Maker vs Custom Development

Website builders speed launch and reduce maintenance, while custom stacks grant full control and higher engineering effort. Most fashion startups pick hosted platforms with selective custom apps and a PIM/ERP bridge. That balance covers UX, scale, and factory alignment without runaway costs.

- Hosted builders — Pros: fast setup, managed hosting, vetted apps, predictable updates. Cons: platform limits, app fees, code constraints.

- Custom stacks — Pros: control, unique UX, deep ops integration. Cons: higher cost, maintenance, security and performance risk.

| Cost Area | Hosted Builder | Custom Stack |

|---|---|---|

| Platform/Hosting | Monthly subscription | Cloud hosting + CDN + security suite |

| Apps/Plugins | Multiple paid apps (returns, PIM sync, reviews) | Fewer paid plugins; more custom builds |

| Development | Theme tweaks and app integration | Front-end, back-end, integration engineering |

| Maintenance | Low; vendor-managed | High; patches, upgrades, regression testing |

| Performance Budget | Theme + app governance | Custom profiling and CI checks |

| Integration Budget | Adapter or iPaaS fees | Custom APIs, data pipelines, mapping |

[CITE: Platform TCO benchmarks from reputable commerce consultancies]

Hosted Builders: Fast Launch

Hosted stacks ship faster, which suits pre-orders and small batches. Build on a stable theme, cap your app count, and standardize PDP modules for new capsules. Use an iPaaS or native connectors for PIM/ERP and returns. Keep a performance budget with image constraints and code reviews at each content drop. [MENTION: Segment or similar CDP for data flows]

Custom Builds: Control & Complexity

Go custom for complex catalogs and bespoke UX. Plan an engineering roadmap for storefront, PIM/ERP integration, shipping, and returns. Add CI checks for performance. Write clear mapping for tech pack IDs, BOM references, and SKU logic. Assign SRE coverage for peaks and drops. [MENTION: Vercel or Netlify for front-end hosting]

Data & Trends for Apparel eCommerce (US/EU 2024–2025)

Apparel eCommerce holds steady, with stricter scrutiny on returns and sustainability claims. Mobile dominates traffic and revenue. Teams that improve speed and fit guidance lower return rates and protect margin. Validate market figures before publishing and align marketing with regional rules.

- US/EU apparel eCommerce growth estimates — 2024–2025 [Verification Needed] (Source: [CITE: Statista topic pages])

- Average cart abandonment benchmark — 2023 (Source: [CITE: Baymard])

- Core Web Vitals thresholds — 2024 (Source: [CITE: Google Web.dev])

- State of Fashion insights — 2024/2025 (Source: [CITE: McKinsey report])

[MENTION: McKinsey State of Fashion]

[MENTION: Statista eCommerce apparel category]

Key Trend 1: Mobile-First Conversion

Most browsing time sits on mobile. Keep pages fast, images compressed, and CTAs clear. Use sticky size guide access and visible returns info on PDP. Align checkout with local wallets, SCA for EU, and tax rules. Track mobile funnel drop-offs and pare down scripts. [CITE: Mobile conversion trends in apparel retail reports]

Key Trend 2: Returns & Sustainability Claims

Returns continue to strain margins, pushing teams to improve fit content and post-purchase support. Sustainability claims face higher scrutiny. Require substantiation for materials and impact statements. Mirror care labels and fiber content on PDPs. Keep traceability records and be ready to share sources. [CITE: EU guidance on green claims; US FTC Green Guides updates if applicable]

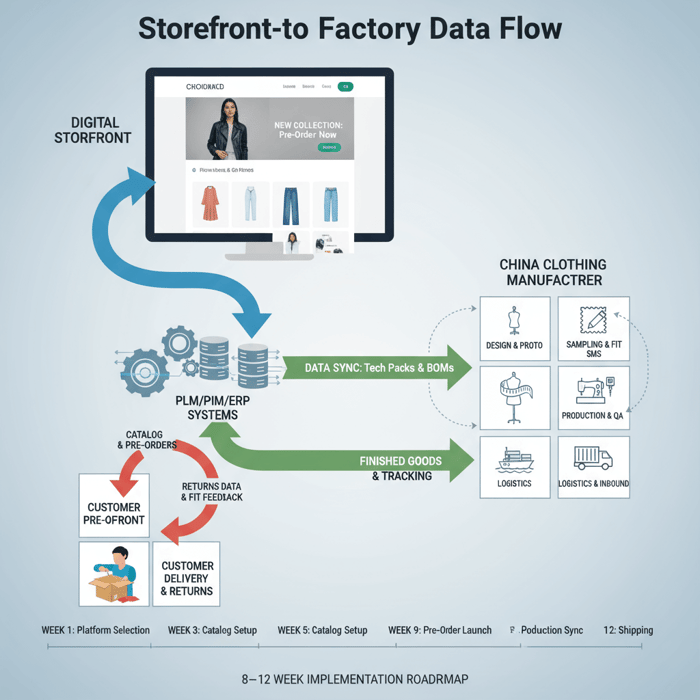

How-To: Build Your Site and Sync with OEM/ODM Production

Follow a 10-step plan from platform selection and catalog setup to performance tuning and factory sync. Use checkpoints tied to tech packs, BOMs, graded specs, and sampling to keep web content and production aligned. Update size guides and PDP content when measurements or materials change.

Preparation

- Define assortment: styles, colorways, and sizes; include MOQs, target margins, and ship windows.

- Create a data dictionary: product IDs, variant codes, sizing units, care labels, and barcode rules.

- Set the calendar: design freeze, proto fit, SMS approval, bulk handoff, and inbound dates.

- Pick your platform using the criteria above; confirm PIM/ERP and returns integrations.

- Draft content standards: copy blocks, imagery specs, and size guide templates linked to graded specs.

Execution Steps

- Catalog modeling: build product types, attributes, options, and SKU logic; align with PLM/PIM fields.

- Sample and content pipeline: photo samples scheduled against shoot dates; lock image formats and naming.

- Pre-order and release planning: set windows, deposits if needed, and delivery ranges matching lead times.

- Checkout and payments: enable wallets, region pricing, and duties collection; add tax/VAT setup.

- Shipping and returns: connect carriers, show reliable delivery estimates, and configure an RMA portal with reason codes.

- Size and fit: publish charts per region, garment measurements for outerwear and denim, and fit notes; link on every PDP.

- Performance and SEO: run audits on image weight, scripts, and theme code; add structured data for products and offers.

- Governance: stage changes, version control themes, and document app approvals; schedule performance checks for each drop.

- Factory sync: share PDP spec snapshots with your manufacturer at proto fit and SMS; flag any measurement or materials changes.

- Launch and iterate: monitor returns reasons, PDP engagement, and pre-order fulfillment; refine size guidance each cycle.

Quality Assurance

- Data QA: confirm SKU and barcode alignment with factory cartons; check variant-to-image mapping.

- Content QA: verify care labels, fiber content, and compliance notes for US/EU.

- Performance QA: test LCP/CLS/INP on mobile and desktop; cap third-party scripts.

- Compliance QA: verify consent flows, privacy notices, return windows, and disclosures.

[INTERNAL LINK: Our ‘Design & Tech Packs’ resource — alignment guide]

[CITE: Checkout UX patterns from Baymard; performance targets from web.dev]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service aligns your digital catalog with factory deliverables. From tech packs and material sourcing to samples and bulk production, we tie your site’s variants, size charts, and pre-order windows to real timelines and MOQs. That lowers returns, protects margins, and keeps launches on schedule.

[MENTION: Eton Garment Limited manufacturing footprint in China and Bangladesh]

Clothing Manufacturing OEM Service — https://china-clothing-manufacturer.com/garment-factory/

| Brand Need | Eton OEM Feature | Outcome |

|---|---|---|

| Accurate size and fit | Graded spec review, fit sessions, and measurement sign-off | Size charts tied to approved specs; returns drop |

| Pre-order capsules | Lead time and MOQ planning; SMS-to-bulk checkpoints | Clear delivery windows; customer trust rises |

| Variant-rich catalogs | Variant coding aligned to BOM and color/trim | PDP accuracy; fewer mis-picks and inbound errors |

| Sustainability claims | Material traceability docs and labeling guidance | Claims supported; lower legal and reputational risk |

Use Case 1: Pre-Order Capsule → Sample to Production

Set a pre-order window tied to proto and SMS gates. Publish delivery ranges tied to production slotting. As SMS passes, switch estimated to firm ship dates. Use deposits if needed and send order data to Eton for material reservations. Lock size charts post fit approval. [CITE: Case examples from fashion DTC brands with pre-order models]

Use Case 2: Evergreen Collection → Demand-Driven Replenishment

Run a PIM/ERP bridge for stock updates and forecast signals. Route low-stock alerts to production for planned replenishment. Keep PDP badges for restock dates. Match returns reason analysis with rolling spec checks to refine fit for high-volume sizes. [CITE: Inventory and replenishment best practices from enterprise commerce]

Risks, Compliance & Localization for US/EU Fashion eCommerce

Reduce risk with transparent policies, accurate size guides, and validated claims. Meet EU consumer rights and GDPR rules, and cover US labeling and returns policies. Use clear disclosures for pre-orders and delivery ranges. Review updates with counsel before go-live.

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Inaccurate size charts | Medium | High | Link charts to graded specs; monitor returns codes |

| Slow mobile performance | High | High | Compress images; reduce scripts; test Core Web Vitals |

| Mislabeling or claim issues | Low–Medium | High | Substantiate claims; mirror care labels and fiber content |

| Returns policy non-compliance | Low–Medium | High | Align with EU consumer rights and US rules; display clearly |

| Data privacy gaps | Medium | High | GDPR-compliant consent, DSR handling, and data retention |

Regulatory Notes for US & EU

- EU — Consumer rights on returns, delivery, and clear pricing; GDPR consent and privacy notices. [CITE: EU consumer rights portal] [CITE: GDPR resources]

- US — Fiber content and care labeling; shipping and returns policy clarity; state sales tax where applicable. [CITE: Official US labeling guidance]

- Green claims — Avoid vague terms; cite sources and keep documentation ready. [CITE: EU Green Claims guidance; FTC Green Guides updates where applicable]

Legal content is jurisdiction-specific and evolves. Seek counsel for policy wording and disclosures. [MENTION: EU Consumer Law Ready] [MENTION: GDPR.eu]

Conclusion & Next Steps

Pick a clothing brand website maker that fits your catalog, region needs, and integration depth. Anchor variant data, size charts, and pre-order windows to OEM/ODM milestones with your China Clothing Manufacturer. Keep performance and compliance in check, and improve fit content with each season’s returns data.

- Week 1–2: Select platform; confirm PIM/ERP and returns integration scope.

- Week 3–4: Model catalog; draft data dictionary; create size guide templates from graded specs.

- Week 5–6: Shoot imagery; configure payments, tax/VAT, shipping, and duties; set returns portal.

- Week 7–8: Run performance and compliance QA; align pre-order windows with production slots.

- Week 9: Launch; monitor returns reasons, mobile metrics, and PDP engagement; iterate.

[INTERNAL LINK: Sustainability & Compliance hub — policy templates and claim guidance]

[INTERNAL LINK: Outerwear OEM Hub — factory capabilities and sampling process]

Author & Review Notes (E-E-A-T)

Author: Eton Garment Editorial Team — apparel manufacturing and eCommerce advisors with 30+ years of factory-side experience in outerwear and technical apparel.

Reviewer: OEM/ODM Operations Lead — outerwear production and compliance specialist.

Methodology: Platform comparison synthesized from known capabilities; manufacturing guidance based on Eton operations; performance and compliance aligned with referenced authorities.

Limitations: No live SERP crawl; statistics must be re-validated before publication. Costs and timelines vary by product, market, and supplier capacity. Disclose platform and service relationships where relevant.

Disclosure: Eton provides OEM/ODM services; recommendations are platform-agnostic with manufacturer alignment focus.

Last Updated: 2025-10-28

References & Sources

- Baymard Institute — Cart Abandonment Rate Benchmarks (2023). [CITE: Baymard cart abandonment benchmark page]

- Google Web.dev — Core Web Vitals Overview (2024). [CITE: https://web.dev/vitals/]

- Statista — Online Apparel Retail/Ecommerce Topic Pages, US/EU (2024–2025) [Verification Needed]. [CITE: Statista category pages]

- McKinsey — The State of Fashion 2024/2025. [CITE: McKinsey State of Fashion page]

- BigCommerce Blog — eCommerce Strategy and Platform Features (2024–2025). [CITE: BigCommerce blog articles]

- Shopify Blog — How to Start a Clothing Brand; Online Clothing Store Guides (2024–2025). [CITE: Shopify blog]

- EU Consumer Law Ready — Consumer Rights; GDPR.eu — Data Protection (2024–2025). [CITE: consumerlawready.eu] [CITE: gdpr.eu]

- US Labeling Guidance — Fiber Content and Care Labels (FTC/CPSC) (2024) [Verification Needed]. [CITE: Official US labeling pages]

- GS1 — GTIN and barcode standards (2024). [CITE: GS1 organization]

- Google Lighthouse — Performance diagnostics (2024). [CITE: Lighthouse documentation]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »