China Style Fashion: A Practical Guide to Trend-to-Production with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

15 minute read

China Style Fashion: A Practical Guide to Trend-to-Production with a China Clothing Manufacturer

China style fashion now shapes outerwear and streetwear globally, and partnering with a China Clothing Manufacturer turns inspiration into deliverable collections for US/EU markets. This guide shows how to translate trend boards into manufacturable capsules with tested workflows, responsible sourcing, and performance QA, while protecting timelines, compliance, and margins.

Fashion teams can move from awareness to decision with a clear, factory-proven path: define aesthetics, lock specs, book materials, iterate samples, test performance, and ship on schedule. Drawing on Eton Garment Limited’s 30+ years in OEM/ODM outerwear, it connects modern silhouettes and technical features to capacity, costs, and due diligence across China and Bangladesh—so collections land on time and pass US/EU compliance scrutiny.

China style fashion blends modern streetwear, technical outerwear, and selective cultural accents. The fastest path to market with a China Clothing Manufacturer is a disciplined workflow: trend validation, complete tech packs, early fabric/trim booking, proto → SMS → PP sampling, testing, AQL inspections, and compliance-ready documentation aligned to US/EU standards.

What “China Style Fashion” Means for US & EU Brands

China style fashion combines contemporary streetwear, technical function, and culturally nuanced details. Success hinges on translation: adapt silhouettes, materials, and features to market fit, price bands, and regulatory norms, so creative intent lands as manufacturable, compliant product with predictable timelines. [CITE: Recent industry overview on trend-to-sourcing alignment] [MENTION: Business of Fashion; McKinsey State of Fashion]

Core Aesthetics and Functions

Silhouettes skew oversized yet refined—boxy bombers, elongated parkas, cropped technical shells—balanced by clean lines and engineered pocketing. Materials prioritize recycled nylons/polyesters, laminated shells (2.5L–3L), and matte or peach-touch surfaces that photograph well yet withstand abrasion. Functional features include seam taping, waterproof ratings (e.g., 10K/10K), articulated sleeves, insulated baffles with controlled fill distribution, and premium closures.

- Silhouette: Structured volume, dropped shoulders, adjustable hems, ergonomic patterning.

- Materials: RPET, recycled nylon, stretch woven, ripstop; coatings and laminates with verified performance.

- Function: DWR, seam sealing, breathable membranes, thermal regulation via down or synthetic fills.

- Details: Laser-cut vents, bonded plackets, two-way zips, low-gloss hardware, reflective accents.

[CITE: Outerwear demand and performance feature adoption in 2024–2025] [MENTION: AATCC; ASTM International] [INTERNAL LINK: Technical outerwear QA pillar page]

Translating Cultural Accents Responsibly

Cultural references—calligraphy-inspired lines, knot closures, tonal embroidery, or color symbolism—require consultative reviews and context checks. Align motifs to narrative intent; verify IP, usage rights, and sensitivity with local advisors. For US/EU markets, restraint helps: echo forms and textures rather than literal copies, or use limited-edition patches and inner labels to preserve meaning without overstatement.

- Run provenance checks on graphics and patterns; document approvals.

- Use bilingual annotations across tech packs to reduce misinterpretation in sampling.

- Build a references file: source images, artist credits, cultural notes, and license summaries.

[CITE: Ethical design and IP guidance from industry bodies] [MENTION: amfori BSCI; WRAP] [INTERNAL LINK: Brand compliance and approvals page]

Category Focus: Outerwear and Technical Sportswear

Outerwear and technical sportswear anchor china style fashion, where performance features elevate street-led silhouettes. For jackets and parkas, budget impacts cluster around seam taping, laminates, branded zippers, and insulation choice. In technical sportswear, breathable stretch, bonded constructions, and durable trims add value but require early supplier reservation to hit fit windows and cost targets.

- Cost-impact bands: 3L laminate and full seam taping raise FOB substantially; DWR-only is budget-friendly.

- Performance acceptance: Hydrostatic head, breathability (RET), tear/seam strength, colorfastness, and pilling.

- Supplier ecosystem: YKK zips, Coats threads, Prym snaps, PrimaLoft insulations—lock availability by proto stage.

[CITE: Typical unit cost impacts by feature set] [MENTION: YKK; PrimaLoft] [INTERNAL LINK: Fabric & trims sourcing in China cluster]

China Style Fashion Trends: Materials, Colors, and Features to Watch

Oversized-tailored outerwear mixes recycled synthetics, matte finishes, and sleek bonding with elevated closures. Colorways lean earthy and protective with muted neons for pop. Early specification of trims and coatings controls both cost and lead time; include lab tests in the tech pack to avoid sampling rework and missed dates. [CITE: 2024–2025 trend analysis with sourcing impacts] [MENTION: Vogue Business; Jing Daily]

- Pros: Recycled nylon/poly delivers narrative and performance; matte shells photograph well; bonded seams offer clean aesthetics.

- Cons: Laminates and seam taping add unit cost; recycled content may extend development; premium hardware impacts MOQ and lead time.

- Outerwear resilience in 2024 (Source: [CITE: BoF x McKinsey State of Fashion 2024])

- China remains the top textile/clothing exporter in 2024 (Source: [CITE: WTO World Trade Statistical Review 2024])

Materials & Coatings

Prioritize recycled nylon (20D–70D) and RPET woven shells, with DWR and PU or TPU laminates. Specify film thickness, fabric weights, and finishing method; define lab tests early. For water protection, use Hydrostatic Head (AATCC 127) thresholds (e.g., ≥10,000 mm) and spray ratings (AATCC 22) that match your end-use claims. Bonded constructions reduce bulk but require skilled sewers and calibrated equipment.

- Shells: 2.5L for lighter weight; 3L for durable performance and cleaner inside aesthetics.

- Finishes: C6/C0 DWR with documented fluorine compliance; matte PU coatings for low-gloss appeal.

- Insulation: 700+ fill power down with traceability, or PrimaLoft/3M Thinsulate with targeted clo values.

[CITE: AATCC test method references; recycled content verification frameworks] [MENTION: AATCC; OEKO-TEX Standard 100] [INTERNAL LINK: Performance testing standards page]

Trims & Closures

Lock trim suppliers by proto stage: zips (two-way, water-resistant), snaps, toggles, and drawcord systems with low-friction ends. Map catalog SKUs (e.g., YKK Aquaguard) to colorways and quantity bands; include corrosion and pull tests. Threads, seam tapes, and interlinings must be compatible with coatings—a mismatch causes adhesion failures and seam leaks.

- Closures: Two-way front zips, laminated plackets, hidden snaps for a clean profile.

- Compatibility: Seam tape chemistry matched to shell coating; heat settings documented.

- Testing: Pull strength, fatigue cycles, salt spray/corrosion where relevant.

[CITE: Trim compatibility and failure mode benchmarks] [MENTION: Coats; Prym]

Palette & Surface Treatments

Palettes skew grounded: deep olives, charcoal, stone, and protective blacks with subdued neon accents—lime, magenta, optic orange—used sparingly. Surface treatments include micro-textures, embossed grids, reflective piping, and panel bonding that catches light without glossy finishes. Tie shades to dye-house capabilities; confirm lab dips by Week 3–4 to hold schedule.

- Batch MOQs: Set per dye-house and mill; consider off-shade contingency plans.

- Fastness: Crocking, perspiration, and lightfastness aligned to AATCC/ISO acceptance criteria.

- Reflectives: Balance visibility and wash durability; specify stitch-free bonding where feasible.

[CITE: Dye-house lead times and colorfastness standards] [MENTION: ISO 105 series; EN ISO 12947 Martindale] [INTERNAL LINK: Fabric & trims sourcing in China cluster]

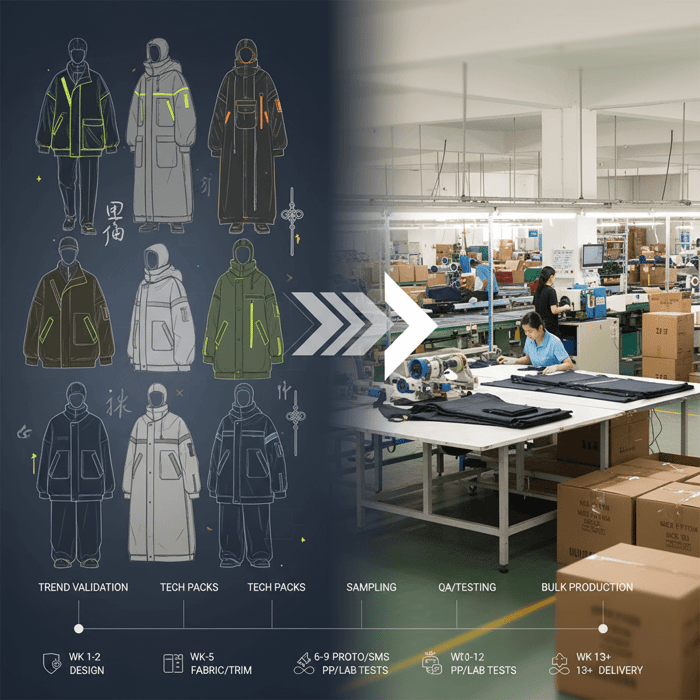

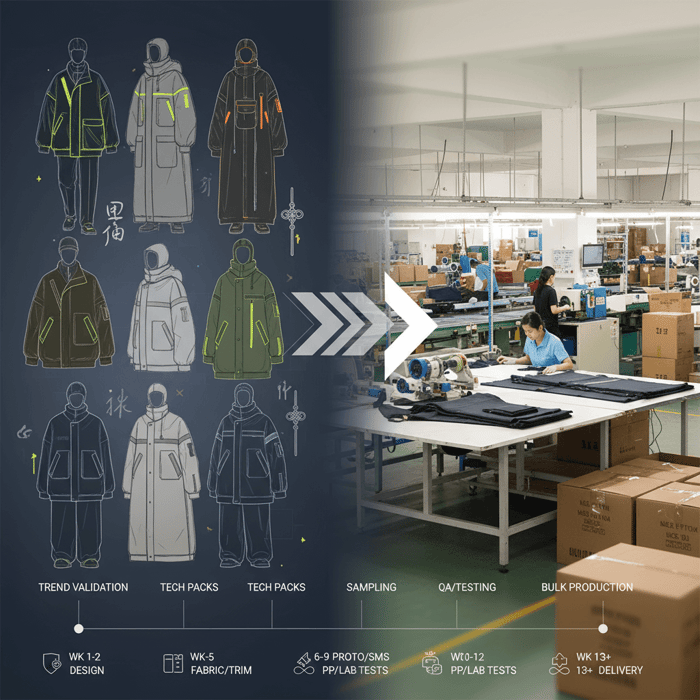

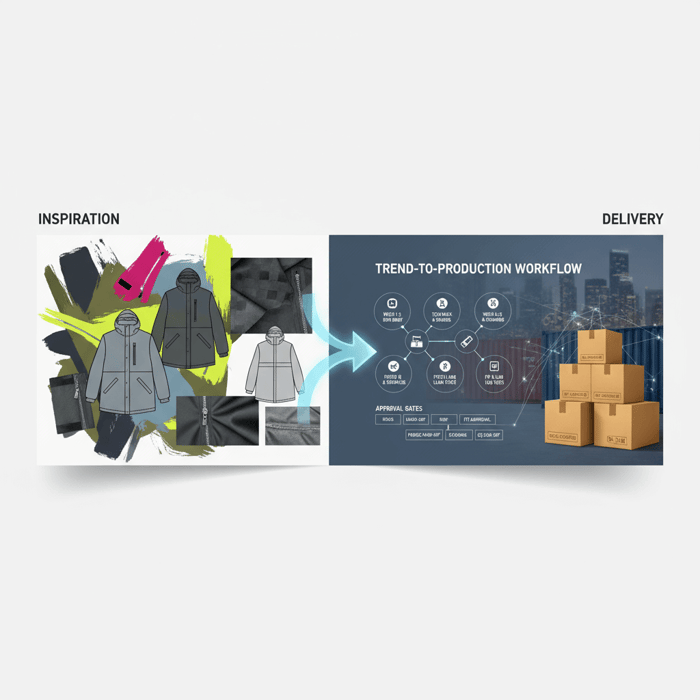

How China Style Fashion Moves from Trend to Production

A reliable path runs: trend validation, complete tech packs, early fabric/trim booking, sampling (proto → SMS → PP), performance testing, bulk production, and AQL inspections. Each stage needs documented specs, clear approvals, and risk checklists to prevent rework and delays for US/EU calendars. [CITE: Sourcing workflow benchmarks 2023–2025] [MENTION: McKinsey; World Bank]

Preparation

- Inputs: Trend boards, BOM pre-study, target FOB bands, season calendar, compliance (UFLPA/EU CSDDD), and size-range strategy.

- Outputs: Design brief with feasibility notes, cost-impact map, sourcing shortlist (mills, trims), and sampling timeline.

- Controls: Feature creep guardrails; bilingual annotations; IP approvals for cultural accents.

Set objective cost targets to protect margins. Align design ambition to category capabilities by region—China for technical outerwear and trims depth; Bangladesh for volume basics; Vietnam for balanced capacity. Document lab tests and approvals at the outset. [CITE: Category-region capability comparisons] [MENTION: WTO; amfori BSCI]

Execution Steps

- Tech Pack Completeness: Measurements, tolerances, grading rules, construction notes, labelling, packaging, and care content that meets US/EU requirements.

- Materials Booking: Reserve fabrics and trims; run lab dips and hand approvals; align lead times with proto windows.

- Proto → SMS: Build proto for silhouette and function; SMS for sales and fit validation; record changes with version control.

- PP Samples: Final fabrics and trims; sign-off on construction and QC gates before bulk cutting.

- Testing: Waterproofing (AATCC 127), spray (AATCC 22), seam strength (ASTM D1683), tear (ASTM D5587), colorfastness (AATCC 61/8), and insulation performance.

- Bulk Production: In-line QC, end-of-line AQL checkpoints, and production logs tied to traceability files.

- Delivery: Pre-shipment inspections, carton drop tests, booking confirmation, and incoterms clarity (FOB/CIF).

[CITE: Acceptance criteria and AQL standards for outerwear] [MENTION: ISO 9001; AQL ANSI/ASQ Z1.4] [INTERNAL LINK: Outerwear manufacturing standards pillar page]

Quality Assurance

Use in-line inspections for seam and bonding, end-of-line AQL sampling, and performance reports tied to each PP approval. Track deviations on a digital QA dashboard, flag root causes, and document corrective actions. Maintain traceability files: supplier lists, batch reports, certificates (WRAP, amfori BSCI, OEKO-TEX), recycled content claims, and UFLPA/CSDDD documentation ready for audits.

- Fit and grading checks across US/EU size runs; record tolerance variance by size.

- Down/insulation verification: fill power, baffle fill distribution, and clumping resistance.

- Shipment readiness: carton compression checks, barcodes/labels per retail requirements.

[CITE: Retail return reduction via QA gates] [MENTION: WRAP; OEKO-TEX] [INTERNAL LINK: QA & Compliance program overview]

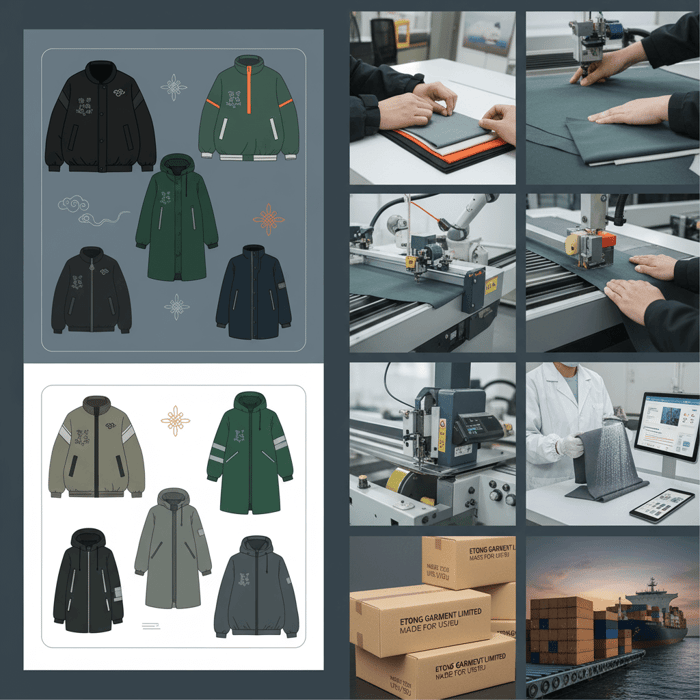

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service compresses sampling cycles and lowers risk through integrated design support, materials sourcing, technical testing, and compliance documentation. Focused on china style fashion outerwear, we deliver repeatable quality at scale for US/EU brands while balancing function, aesthetics, and unit economics. [CITE: Case study results on lead time compression] [MENTION: Eton sample room; QC lab]

| Brand Need | OEM Feature | Expected Timeframe | Risk Notes |

|---|---|---|---|

| Technical shell with waterproof rating | Laminate sourcing; seam taping capability; AATCC 127 testing | Proto: 2–3 weeks; PP: 5–7 weeks | Film/tape compatibility; heat parameters; seam integrity |

| Streetwear parka with recycled content | Verified mills; recycled certificates; finish durability tests | Proto: 3–4 weeks; PP: 6–8 weeks | Material availability; shade control; documentation completeness |

| Accelerated capsule for seasonal launch | Parallel sampling lanes; early trim booking; bilingual tech pack | Proto: 2 weeks; SMS: Week 4; PP: Week 8 | Supplier queues; change control to avoid rework |

Use Case 1: Trend Capsule → Technical Jacket Launch

A US brand needed a waterproof shell with protective aesthetic and a tight season deadline. Eton ran rapid protos, booked DWR fabric early, confirmed seam taping parameters, and stamped PP after lab validation. The style shipped on schedule with AQL acceptance; return rates stayed low through fit controls and documented QA gates.

- Outcome: On-time launch; measurable return reduction tied to fit QA.

- Lead time: Proto in 2–3 weeks; PP by Week 7–8.

- Compliance: Traceability file prepared for UFLPA review.

[CITE: Launch window adherence and returns data] [MENTION: U.S. Customs and Border Protection; AATCC] [INTERNAL LINK: Case notes from Eton’s QC lab]

Use Case 2: Streetwear Parka with Recycled Materials

A European retailer required recycled nylon with performance parity. Eton verified suppliers, collected recycled content certificates, and ran seam seal tests to protect waterproof claims. The parka maintained aesthetics and function while meeting documentation requirements for EU retail channels.

- Outcome: Compliance-ready materials and certificates; maintained waterproof rating.

- Lead time: Proto in 3–4 weeks; PP in 6–8 weeks.

- Risk control: Alternate mills prequalified to hedge supply delays.

Clothing Manufacturing OEM Service turns design intent into production-grade specs, sampling, and testing with auditable files. [CITE: Dual-base capacity utilization in China and Bangladesh] [MENTION: amfori BSCI; WRAP]

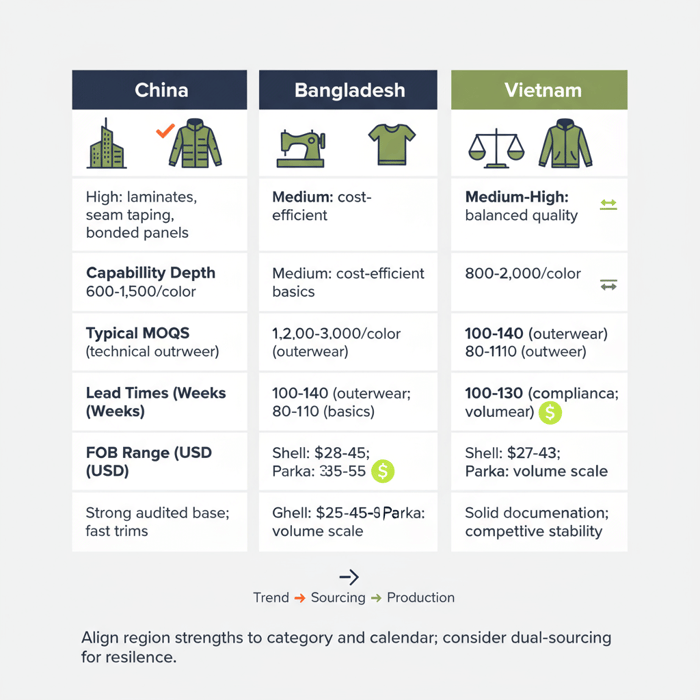

Comparison: China Style Fashion Manufacturing vs Other Regions

China excels in technical outerwear and trims availability with competitive lead times. Bangladesh offers cost advantages for volume basics; Vietnam balances quality and capacity. Choose by category capability, compliance maturity, logistics, and speed-to-market. Use dual-sourcing to hedge geopolitical and capacity risks. [CITE: 2023–2025 sourcing diversification analysis] [MENTION: WTO; World Bank]

| Region | Capability Depth | Typical MOQs | Lead Times (Weeks) | FOB Range (Indicative) | Compliance Maturity |

|---|---|---|---|---|---|

| China | High: laminates, seam taping, bonded panels, premium trims | 600–1,500/color | 90–120 for technical outerwear | Shell jacket: USD $28–$45; Parka: USD $35–$65 | Strong audited base; fast trims availability |

| Bangladesh | Medium: cost-efficient basics; improving technical features | 1,200–3,000/color | 100–140 for outerwear; 80–110 for basics | Shell jacket: USD $25–$40; Parka: USD $30–$55 | Growing compliance; volume scale |

| Vietnam | Medium-High: balanced quality and capacity | 800–2,000/color | 100–130 for outerwear | Shell jacket: USD $27–$43; Parka: USD $32–$60 | Solid documentation; competitive stability |

Figures are indicative and vary by fabric availability, trims, seasonality, and brand standards. [CITE: Regional cost and lead-time ranges; verification needed] [MENTION: McKinsey; WTO] [INTERNAL LINK: Region-by-category decision guide]

Criteria Overview

- Technical capability: seam taping, laminates, bonded constructions, waterproof ratings.

- Materials/trims ecosystem: mills, dye houses, zipper and thread suppliers, seam tapes.

- Lead times by category and season: peak bookings and factory calendar alignment.

- Compliance maturity: audits, traceability, recycled content verification, and UFLPA/EU CSDDD readiness.

- Logistics agility: transit lanes, port capacity, and replenishment service levels.

[CITE: Comparative capability scoring for category-region pairs] [MENTION: amfori; WRAP]

Decision Framework

Weight category complexity at 40%, trims/materials ecosystem at 25%, lead-time requirements at 20%, compliance maturity at 10%, and logistics agility at 5%. For technical outerwear with seam taping and laminates, China often wins on capability and speed; for volume fleece or basics, Bangladesh may deliver better economics; Vietnam is a balanced choice for mid-complexity lines.

- Risk mitigation: dual-source by component (shell in China, basics in Bangladesh), buffer lead times by +2–3 weeks, and pre-qualify alternates.

- Scenario planning: align US/EU retail windows with factory calendars; use PP approval gates to freeze changes.

- Incoterms: clarify FOB vs CIF responsibilities early to avoid logistics surprises.

[CITE: Dual-sourcing resilience outcomes in apparel] [MENTION: McKinsey Apparel sourcing at a pivot point]

Data & Sourcing Trends (2023–2025)

Macro indicators show resilient demand in outerwear and technical apparel, sourcing diversification, and rising compliance expectations. Brands seek traceability, audited facilities, and verified performance to protect margin and reputation across US/EU markets. [CITE: 2024–2025 macro trend synthesis] [MENTION: Business of Fashion; WTO]

- US/EU compliance and traceability requirements rising into 2025 (Source: [CITE: CBP UFLPA guidance; EU CSDDD communications])

- Sourcing diversification momentum in 2023–2025 (Source: [CITE: McKinsey sourcing reports])

Key Trend 1: Resilient Outerwear Consumption

Outerwear remains resilient in capsules and seasonal drops, driven by performance narratives and weather variability. Consumers reward functional claims backed by credible testing, while retail buyers lean into matte, subdued palettes with occasional neon accents. Align category mix to these patterns and hold QA thresholds that match stated claims for waterproofing and insulation.

- Mix: Technical shells, insulated parkas, and light mid-layers.

- Claims: Waterproof ratings with lab reports; fill power documentation for down.

- Pricing: Clear tiering by feature sets to protect FOB bands.

[CITE: Outerwear category performance in 2024] [MENTION: BoF x McKinsey]

Key Trend 2: Elevated Compliance & Traceability

US UFLPA enforcement pushes deeper documentation and supplier verification; EU CSDDD rolls out due diligence obligations. Brands request supply chain maps, audit reports, recycled content certificates, and lab testing records. This elevates factory readiness and compresses launch risk where documentation is standardized and accessible at gate reviews.

- Traceability: Tier-1 and tier-2 supplier lists, batch records, and chain-of-custody claims.

- Certifications: WRAP, amfori BSCI, ISO 9001, OEKO-TEX Standard 100.

- Tools: Digital QA dashboards, document repositories, and audit scheduling.

[CITE: Enforcement updates 2024–2025] [MENTION: CBP; European Commission]

Risks, Compliance & Localization

Top risks include forced labor exposure, materials delays, technical spec inconsistency, and logistics volatility. US/EU compliance requires proactive traceability, supplier audits, and verified documentation. Localization aligns fits and seasonality to cut returns and deliver market-ready china style fashion. Guidance is general; seek legal counsel for specific obligations. [CITE: Compliance frameworks and enforcement notices] [MENTION: CBP; EU Commission]

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Forced labor exposure | Medium | High | Traceability files, audits, verified supplier tiers, documented due diligence |

| Material scarcity or delays | Medium | Medium | Early booking, alternate mills, trims contingency, parallel sampling lanes |

| Spec misinterpretation | Medium | High | Complete tech packs, PP sample stamps, bilingual annotations, change control |

| Logistics disruptions | Medium | Medium–High | Buffer timelines, dual lanes, incoterms clarity, priority bookings |

[CITE: Apparel risk registers and mitigation outcomes] [MENTION: ISO 31000 risk management; major freight indices]

Regulatory Notes for US & EU

- UFLPA (US): Maintain supplier lists, chain-of-custody records, and audit reports; prepare for potential detention reviews with documentation packets.

- EU CSDDD: Ramp due diligence obligations; standardize process documentation and supplier verification workflows to meet anticipated requirements.

- Certifications: WRAP, amfori BSCI, ISO 9001, OEKO-TEX Standard 100; recycled content/traceability (e.g., GRS) where applicable.

[CITE: Official guidance pages and directive texts] [MENTION: WRAP; amfori BSCI] [INTERNAL LINK: Compliance & Traceability toolkit]

Conclusion & Next Steps

China style fashion can ship on time with performance and polish when design ambition meets manufacturability, compliance, and QA. Choose the right region for your category, lock specs early, and use an OEM partner with proven outerwear workflows to protect lead times and margins. Eton’s ethos is simple: Textile From Day One.

- Week 1–2: Trend validation, design brief, FOB targets, compliance scoping.

- Week 3–5: Tech pack finalization, sourcing shortlist, proto booking and lab dips.

- Week 6–9: Proto → SMS; fit approvals; change control and QA checkpoints.

- Week 10–12: PP sample stamps; performance tests; finalize documentation.

- Week 13+: Bulk production; in-line and AQL; shipment planning per incoterms.

Visit our garment factory (OEM/ODM) to align trend intent with factory-proven execution for US/EU calendars. [INTERNAL LINK: Author bio page] [INTERNAL LINK: Outerwear QA standards pillar]

- Business of Fashion — The State of Fashion 2024 (2024). [CITE: URL]

- WTO — World Trade Statistical Review 2024 (2024). [CITE: URL]

- U.S. Customs and Border Protection — UFLPA Guidance (2024). [CITE: URL]

- European Commission — Corporate Sustainability Due Diligence Directive Communications (2024). [CITE: URL]

- WRAP — Worldwide Responsible Accredited Production Guidance (2023–2024). [CITE: URL]

- McKinsey — Apparel Sourcing at a Pivot Point (2023). [CITE: URL]

- World Bank — Bangladesh Ready-Made Garments Overview (2023). [CITE: URL]

- AATCC — Standard Test Methods for Textiles (2023). [CITE: URL]

- ISO — ISO 9001:2015 Quality Management Systems (2015; reaffirmed). [CITE: URL]

- OEKO-TEX — Standard 100 (2024). [CITE: URL]

- amfori BSCI — Code of Conduct and Implementation (2024). [CITE: URL]

- ASTM International — Textile Test Standards (2023). [CITE: URL]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »