Cheapest White Fabric: How Fashion Brands Source It with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

16 minute read

Cheapest White Fabric: How Fashion Brands Source It with a China Clothing Manufacturer

Cheapest white fabric is not the lowest number in a quote; it is the lowest total cost that still clears opacity, whiteness, and compliance when sourced with a China Clothing Manufacturer. Brands in the US and EU that set clear GSM, width, whiteness targets, and test methods lock value while avoiding rework and returns.

The cheapest white fabric for production runs is usually polyester or polycotton poplin/twill in 58–60 inch width, PFD/PFP finish, and calibrated GSM for opacity. Compare EXW/FOB with freight, yield, and defect risk. Require CIE whiteness, OBAs disclosure, and AATCC/ISO tests to secure low cost without quality loss.

Why “cheapest” is a strategy, not a number

Answer-first summary: Lowest cost sticks when teams define performance thresholds and price the full journey, not only EXW. An aligned spec (use, GSM/opacity, finish, whiteness, compliance) plus TCO thinking protects margin and time-to-market for US/EU programs.

In production, a cheap white that fails opacity or yellows in storage becomes expensive fast. Brands that frame the decision as total cost of ownership (TCO) choose fabrics that pass lab tests, run cleanly on lines, and land at target. Eton Garment Limited’s OEM teams in China and Bangladesh pair mill-direct pricing with front-loaded validation to hit both speed and cost for outerwear, linings, and printable bases. [MENTION: Textile Exchange fiber market data] [MENTION: ICAC cotton outlook]

- Unit price: EXW/FOB/CIF by finish (PFD/PFP), weave, GSM, and width.

- Yield and waste: fabric width vs marker efficiency; shade bands and roll variation.

- Freight and FX: ocean, air for rush, surcharges; currency volatility.

- Testing and compliance: lab fees, certification, and re-test contingencies.

- Rework and returns: opacity complaints, yellowing, pilling, and lightfastness fails.

- Lead time: capacity windows; buffer for lab and pilot lots.

[CITE: A current overview of freight rate indices] [CITE: A 2024–2025 analysis of cotton and polyester feedstock trends] [INTERNAL LINK: Fabric Sourcing & Lab Testing page — create foundational landing tailored to white fabric procurement]

What “cheapest white fabric” means in production

Answer-first summary: The cheapest workable fabric meets use-case specs for opacity, handfeel, whiteness index, and colorfastness at the lowest TCO. Define targets first, then source quotes that match finish, GSM, width, and test methods so comparisons stay valid.

Start with the garment role. Linings, shells, and printable blanks demand different balances of GSM, weave, and finish. A PFP/PFD white with stable CIE Whiteness and disclosed optical brighteners (OBAs) delivers consistency for branding and care labels. Brands should put numbers on targets and lock methods for testing early. [CITE: AATCC/ISO method listings and updates] [MENTION: AATCC committee work on colorfastness]

- Define intended use: lining, shell, printable base, interlining, or disposable/nonwoven.

- Set opacity/GSM target by weave and fiber, plus desired handfeel and drape.

- Select finish: PFP/PFD white for printing; calendared or brushed where needed.

- Set whiteness metrics: CIE WI target, ΔWI tolerance, and OBAs disclosure.

- Map tests: colorfastness (wash/light), pilling, dimensional change, yellowing resistance.

- Confirm MOQ, roll width, roll length, and lead time by mill and region.

Opacity relates to GSM, fiber refractive index, yarn count, and weave structure. A 58/60 inch width can improve marker yield, lowering garment cost even with a slightly higher EXW. Include shade band acceptance to manage roll-to-roll variance and avoid chargebacks. [INTERNAL LINK: Our garment factory QA process — https://china-clothing-manufacturer.com/garment-factory/]

Whiteness and optical brighteners

CIE Whiteness Index (WI) expresses perceived whiteness under a defined illuminant, with higher values indicating a “brighter” white. OBAs absorb UV and re-emit blue light, shifting visual whiteness. OBAs can improve apparent whiteness without aggressive bleaching, yet stability varies by detergent, light exposure, and storage. [CITE: An applied textile chemistry explainer on OBAs and CIE WI] [MENTION: ZDHC program guidance on OBAs and MRSL]

- Typical targets: CIE WI 120–150 for apparel whites; tighter for premium branding.

- Specify measurement: D65 illuminant, 10° observer, and agreed instrument settings.

- Set tolerance: ΔWI ±3 to ±5 between bulk and approved standard.

- Require OBAs disclosure: product trade name, dosage range, and MSDS for compliance.

- Storage controls: avoid prolonged UV; use opaque or UV-inhibiting packaging to curb yellowing.

OBAs do not replace colorfastness and yellowing tests. Include accelerated laundering (AATCC 61 or ISO equivalents), lightfastness (AATCC 16/ISO 105-B02), and phenolic yellowing checks. [CITE: OEKO-TEX Standard 100 updates] [MENTION: OEKO-TEX association]

Opacity, GSM, and weave

Opacity improves with GSM, tighter constructions, and filament choice. Poplin and twill tend to hide darker underlayers better than open-structure plains at the same GSM. For linings, 60–80 gsm polyester taffeta can be serviceable; for shells, 110–160 gsm options provide structure and coverage without weight spikes. Numbers vary by yarn denier, weave, and finishing density. [CITE: A mill technical note correlating GSM and opacity] [MENTION: Mill brands known for lining fabrics]

- Linings: 60–85 gsm 63D/75D polyester taffeta or pongee; calendar as needed for slip.

- Printable base: 120–160 gsm cotton or polycotton poplin/interlock; pre-shrunk and PFP.

- Shells: 110–160 gsm twill/poplin; for technical shells, consider micro-twill with C6-free repellency.

- Interlinings and disposables: spunbond nonwovens (12–40 gsm) for non-aesthetic roles.

Target opacity by sample testing over black/striped underlays and by using standardized panels. Record visual grades with photo logs under D65 lighting. [INTERNAL LINK: Visual evaluation SOP — create page with D65 lightbox guidance]

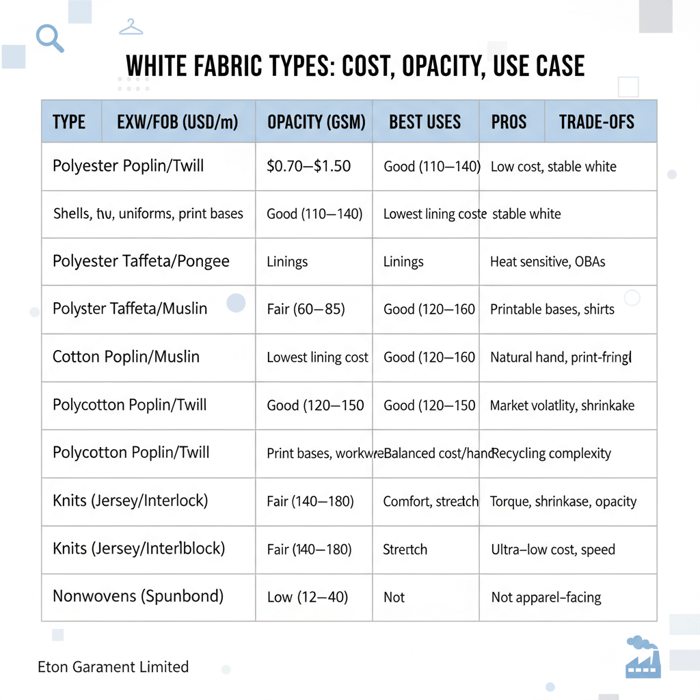

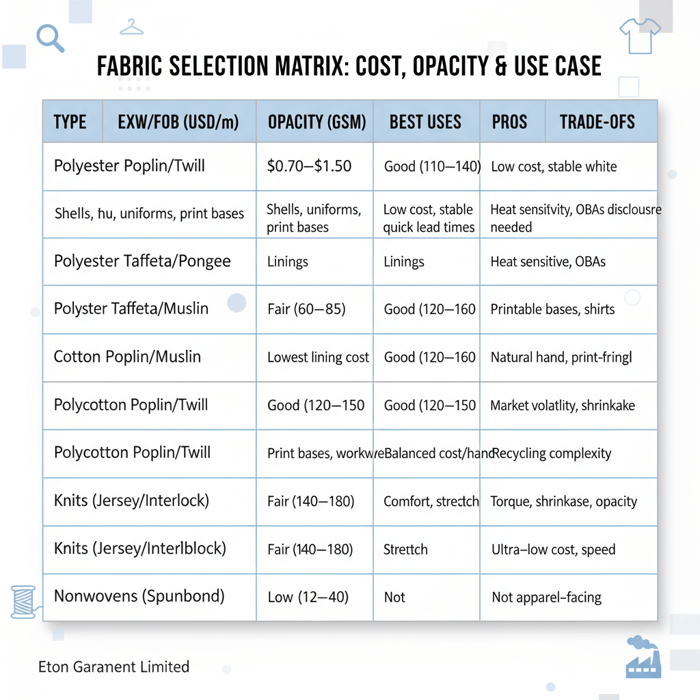

Cheapest white fabric: budget options compared

Answer-first summary: Polyester and polycotton poplin/twill usually deliver the most affordable, stable white for linings and blanks. Cotton can win during soft markets. Nonwovens suit interlinings or disposables. Match fabric to role, opacity need, and print method to protect margin.

- Polyester dominance in fiber share — 2023–2024 (Source: Textile Exchange) [CITE: Textile Exchange Material Change Insights 2023–2024]

- Cotton price volatility — 2024–2025 (Source: ICAC) [CITE: ICAC market updates 2024–2025]

- Ocean freight fluctuation impacts — 2024–2025 (Source: Drewry WCI) [CITE: Drewry World Container Index]

| Type | Indicative EXW/FOB (USD/m) | Opacity at Typical GSM | Best Uses | Pros | Trade-offs |

|---|---|---|---|---|---|

| Polyester Poplin/Twill (58–60") | $0.70–$1.50 | Good at 110–140 gsm | Shells, uniforms, print bases | Low cost, stable whiteness, quick lead times | Heat sensitivity, OBAs disclosure needed |

| Polyester Taffeta/Pongee (58–60") | $0.45–$0.95 | Fair to good at 60–85 gsm | Linings | Lowest lining cost, smooth hand | Lower breathability, slippery to sew |

| Cotton Poplin/Muslin (57–63") | $1.40–$2.80 | Good at 120–160 gsm | Printable bases, shirts | Natural hand, print-friendly | Market volatility, shrinkage control |

| Polycotton Poplin/Twill (58–60") | $1.10–$2.10 | Good at 120–150 gsm | Print bases, workwear, schoolwear | Balanced cost/hand, shrinkage moderation | Fiber blend may complicate recycling claims |

| Knits (Jersey/Interlock, 66–72") | $1.80–$3.80 | Fair to good at 140–180 gsm | Print tees, athleisure | Comfort, stretch options | Torque, shrinkage, opacity at lower GSM |

| Nonwovens (Spunbond) | $0.15–$0.45 | Low to moderate (12–40 gsm) | Interlinings, disposables | Ultra-low cost, speed | Not apparel-facing; limited durability |

Price ranges reflect historical context, region, and order size. Always verify live quotes. [CITE: A buyer’s market report for fabric pricing bands, updated 2024–2025]

Woven basics: poplin, twill, satin, muslin

- Poplin: tight plain weave suits prints and flat surfaces. Good opacity per GSM. Cost drivers: yarn count, finishing, and OBAs package. PFP for graphics.

- Twill: diagonal texture with drape and coverage. Useful for shells and uniform applications. Slightly higher GSM for structure.

- Satin: lustrous face; higher filament counts. Often over-spec for cost-down unless a premium look is mandatory.

- Muslin: economical cotton with lower thread counts. Works for sampling and some basics; opacity varies widely.

For white shells that must hide dark trims or down, twill beats muslin and low-GSM poplins. For printing, poplin with stable whiteness and low hairiness prints cleaner and reduces ink usage. [CITE: Printing yield and hairiness relationship study] [MENTION: A leading rotary/DTF ink supplier’s technical brief]

Knits and nonwovens

- Jersey and interlock: softness and printability for tees and kidswear. Test torque, shrinkage, and pilling. Opacity requires higher GSM or double-knit constructions.

- Spunbond nonwovens: interlining and packaging roles; not for apparel exteriors. Ultra-low cost and fast availability.

Knits require careful dimensional stability planning. Preshrink with compacting for cotton or blends. For bright whites in knits, manage OBA selection and sweat/lightfastness with AATCC 15/16 testing to avoid complaints. [CITE: AATCC knit shrinkage and torque standards] [MENTION: A major mill known for interlock programs]

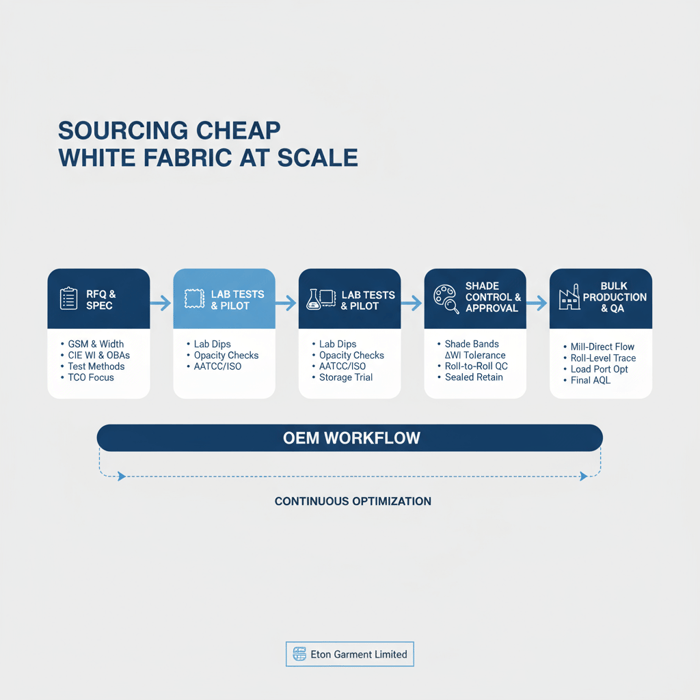

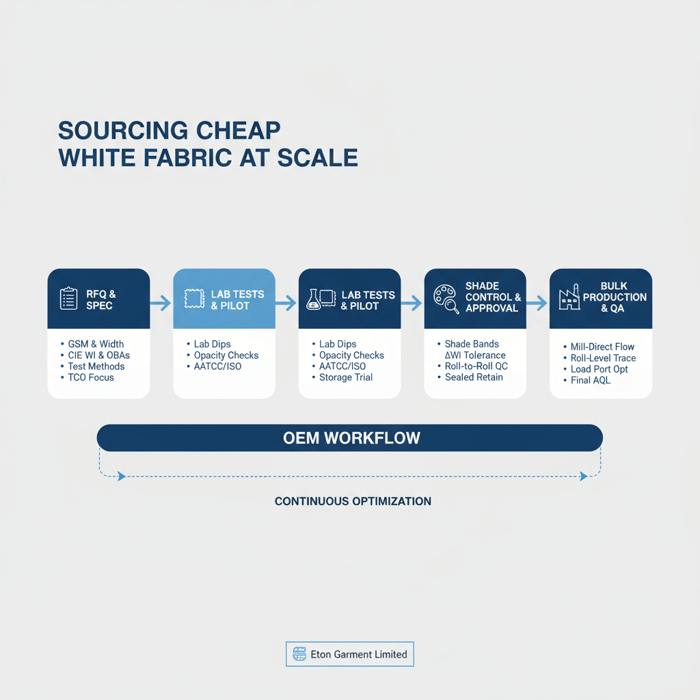

How to source the cheapest white fabric from a China Clothing Manufacturer

Answer-first summary: Write a tight RFQ with use, GSM, width, finish, CIE WI, OBAs disclosure, and lab tests. Request lab dips and pilot lots. Compare quotes on TCO. Align MOQ, roll width, and packing to protect yield and reduce shade variation risk.

Eton Garment Limited’s OEM teams standardize RFQs to avoid mismatched quotes. By locking measurement conditions and tolerances, buyers compare like for like and negotiate on drivers that matter. The process below prevents surprises and can compress onboarding by weeks. [INTERNAL LINK: Supplier Onboarding & Compliance — create page with RFQ templates and checklists] [MENTION: ZDHC MRSL v3.x]

RFQ essentials for white

- Role and finish: lining/shell/print base; PFD/PFP; calendared/brushed if required.

- Fiber and construction: 100% polyester, 65/35 polycotton, 100% cotton; weave/knit; yarn count/denier.

- GSM, width, and yield target: target marker efficiency; acceptable roll width tolerances.

- Whiteness: CIE WI target and ΔWI tolerance; instrument and illuminant; OBAs disclosure.

- Colorfastness and stability: specify AATCC/ISO methods for wash, light, perspiration, pilling, shrinkage.

- Compliance: REACH Annex XVII, California Prop 65, OEKO-TEX Standard 100 target class, ZDHC MRSL alignment.

- MOQ and lead time: greige and finished; lab dip timing; bulk capacity windows.

- Packing and storage: roll length, core size, UV-protective packaging; anti-yellowing storage SOPs.

- Incoterms and logistics: EXW/FOB/CIF preference; expected load port; carton specs for cube efficiency.

Include a request for shade bands and a small sealed retain to benchmark bulk. This supports disciplined approvals and reduces disputes. [CITE: An apparel sourcing guide on RFQ best practices]

Pilot lot and lab testing

- Lab dips and swatches: measure CIE WI under D65; photograph against standard under controlled lighting.

- Pilot lot (pre-production): run 500–2,000 meters to test opacity over “worst-case” underlays and confirm sewing behavior.

- Tests: AATCC 61/135/16, ISO 105 series, phenolic yellowing, and OBAs compatibility with detergents used in target markets.

- Storage trial: retain sealed and shelf-exposed controls; re-measure WI after 2–4 weeks to catch early yellowing.

- QC plan: AQL, roll-by-roll documentation, and a hold/release process for outliers.

Batch-level QC with roll IDs and test retention creates traceability, which helps contain any field complaints. [CITE: AQL best practice document] [INTERNAL LINK: Our garment factory QA process — https://china-clothing-manufacturer.com/garment-factory/]

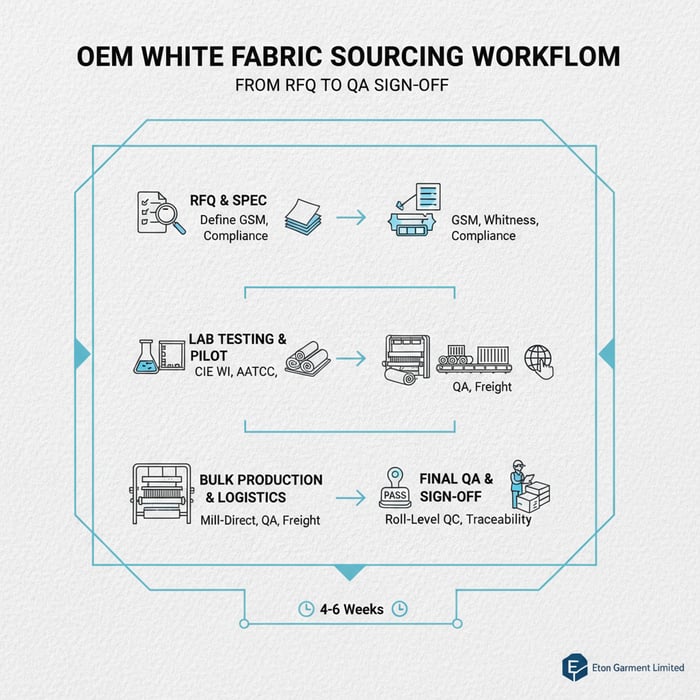

Step-by-step: lowest total cost without quality loss

Answer-first summary: Calibrate GSM for opacity, pick the right Incoterm, schedule freight, and confirm early lab tests. Track defect rates and yield. Use a TCO worksheet so a higher EXW can still win when freight and yield favor the offer.

- Preparation (1–2 weeks): finalize use-case specs, calendar, and budget bands. Draft the RFQ with test methods and compliance notes.

- RFQ and shortlist (1–2 weeks): send to mills/OEM partners in China and Bangladesh; collect tech sheets, OBAs disclosure, CIE WI data, MOQ, and capacity windows.

- Sampling and pilot (2–3 weeks): lab dips, handfeel assessment, and pilot lot. Run opacity checks over standardized black/striped panels. Lock approvals with shade bands.

- Price lock and terms (1 week): select EXW/FOB/CIF; set payment terms and QC checkpoints. Record packaging and roll specs to stabilize inbound QA.

- Bulk and monitoring (4–6 weeks typical): roll-level inspection, random lab verification, and transport booked to protect transit times.

- Checkpoints: CIE WI match; opacity on worst-case underlay; AATCC/ISO pass marks; MRSL conformance; roll width consistency.

- Common pitfalls: comparing quotes with different finishes; ignoring roll width and yield; skipping pilot; no storage trial; OBAs undisclosed.

Use a TCO calculator to weigh EXW/FOB against cube, yield, expected defect rates, and returns exposure. A 2–3% shift in marker efficiency frequently offsets a small unit price gap. [CITE: A procurement whitepaper on yield-driven TCO]

Product integration: Eton’s Clothing Manufacturing OEM Service

Answer-first summary: Eton Garment Limited combines mill-direct sourcing in China and Bangladesh with testing, QA, and compliant production. Brands secure competitive FOB and consistent whites for linings, shells, and print bases at scale.

Eton’s Clothing Manufacturing OEM Service coordinates fabric development, lab testing, and bulk production under one plan. Longstanding mill relationships help lock slots, align specs, and resolve variance. Outerwear, padded programs, and technical apparel benefit from a team fluent in opacity, whiteness control, and global compliance. [MENTION: ZDHC and OEKO-TEX certification ecosystems] [CITE: Public compliance frameworks for textiles]

| Buyer Need | OEM Feature | Outcome |

|---|---|---|

| Low-cost lining that doesn’t show through | Polyester taffeta/pongee library; pilot opacity checks | Clean silhouettes with minimal unit cost |

| Printable white base with stable whiteness | PFP whites with CIE WI targets; OBAs disclosure; AATCC colorfastness | Consistent print results, lower reprint risk |

| FOB leverage in China/Bangladesh | Mill-direct negotiation; load-port options | Competitive landed costs and faster slots |

| US/EU compliance confidence | REACH/Prop 65 mapping; OEKO-TEX Standard 100 target; ZDHC alignment | Lower recall and claim exposure |

| Shade/roll consistency | Shade bands, AQL, roll-by-roll traceability | Fewer disputes and smoother inbound QA |

Use case 1: lining program cost-down

A retailer needs 300,000 units of quilted outerwear with bright white linings. The team tests 63D/75D polyester taffeta at 70–80 gsm, calendar finish for slip, and checks opacity over black quilt lines. Eton’s pilot lot passes ΔWI and AATCC 61 wash testing. A wider 60 inch roll improves marker yield by 1.8%, offsetting a $0.05/m higher quote. Total savings land at scale through better yield and fewer re-cuts. [CITE: Case-style sourcing note on yield impact] [INTERNAL LINK: MOQ, Lead Time & Logistics page — create explainer on FOB ports and cube]

Use case 2: printable white base for graphics

A brand needs a white poplin for screen and DTG with a crisp surface and stable whiteness. Eton sources PFP polycotton at 140–150 gsm, sets CIE WI with ΔWI ±3, and confirms dimensional stability and pilling limits. OBAs disclosures align to ZDHC MRSL with lab verification. Print teams report lower ink laydown and reduced rejects. The order scales across seasons with the same standard retained. [CITE: ZDHC MRSL overview] [MENTION: A DTG machinery provider’s printing guide]

Market data and price drivers for white fabrics in 2024–2025

Answer-first summary: Fiber costs, finishing inputs, freight, and FX shape price. Polyester remains the most available, cotton faces cyclical swings, and ocean rates affect landed costs. Time RFQs against softer freight and confirm capacity for peak seasons.

Key trend 1: Fiber and finishing inputs

Polyester typically anchors the cheapest white fabric programs, supported by large-scale production and consistent availability. Recycled polyester commands a premium and may present whiteness and yellowing sensitivity that requires careful selection and testing. Cotton pricing reflects weather, policy, and global trade flows; peaks and troughs alter the cotton vs polycotton calculus. OBAs, resins, and softeners affect cost and performance, so transparency on finishing chemistry reduces re-test cycles. [CITE: Textile Exchange on recycled polyester shares and premium ranges] [CITE: ICAC cotton updates 2024–2025] [MENTION: Brands publishing recycled fiber roadmaps]

Key trend 2: Logistics, FX, and seasonality

Ocean freight swings move landed costs in both directions. Cube efficiency from roll width and packing matters more when rates rise. FX moves between USD/CNY and USD/BDT alter FOB competitiveness. Peak season demand tightens lead times; aligning RFQs with mill downtime secures better slots and pricing. [CITE: Drewry WCI freight trend analysis] [MENTION: Logistics consultancies commenting on Asia–US and Asia–EU spot rates]

Risks, compliance, and localization for US and EU buyers

Answer-first summary: White fabric programs carry risks tied to chemistry, light, and storage. Pre-specify test methods, MRSL alignment, and packaging. Map regulations for US/EU and use recognized labels, keeping documents current to cut exposure.

Risk matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Yellowing in storage | Medium | High | UV-blocking packing; phenolic yellowing test; climate-controlled storage |

| Whiteness shift (ΔWI) | Medium | Medium | ΔWI tolerance; instrument alignment; roll-level checks |

| Opacity complaints | Medium | High | GSM and weave calibration; underlay test panel; pilot lot |

| Non-compliant chemistry | Low–Medium | High | MRSL alignment; OEKO-TEX Standard 100; supplier declarations with SDS |

| Pilling and abrasion | Medium | Medium | AATCC/ISO tests; yarn selection; finishing tweaks |

Regulatory notes for US and EU

- EU REACH Annex XVII: restrictions on azo dyes and other substances; white programs still require screening for auxiliaries and residues. [CITE: ECHA Annex XVII text and guidance] [MENTION: ECHA]

- California Proposition 65: list-based warnings framework; maintain SDS and testing relevance for OBAs and finishing chemicals. [CITE: OEHHA Prop 65 resources] [MENTION: OEHHA]

- ZDHC MRSL v3.x: manufacturing-restricted chemicals for wet processing; require mill conformance and documentation. [CITE: ZDHC MRSL v3.x link]

- OEKO-TEX Standard 100: label supports consumer safety claims and retailer onboarding. [CITE: OEKO-TEX Standard 100 updates]

Keep a document pack: test reports, supplier declarations, MRSL conformance letters, and any OEKO-TEX certificates. Refresh annually or with chemistry changes. [INTERNAL LINK: Compliance (REACH, ZDHC, OEKO-TEX) page — create with mapping and doc checklist]

Conclusion and next steps

Answer-first summary: Define specs, compare polyester, cotton, and polycotton whites by TCO, and lock compliance early. Use disciplined RFQs, pilot lots, and a China Clothing Manufacturer partner to scale with confidence and speed.

- One to two weeks: finalize specs and testing; issue RFQs with whiteness targets and OBAs disclosure.

- Two to three weeks: lab dips and pilot lots; lock shade bands and approvals.

- Four to six weeks: bulk production with roll-level QC and logistics plan.

Ready to set up a program that balances cost and integrity? Start with Eton’s Clothing Manufacturing OEM Service to secure mill access, testing, and reliable production in China and Bangladesh. [INTERNAL LINK: Fabric Sourcing & Lab Testing page — create for intake and calculators]

- Textile Exchange — Material Change Insights (2023–2024). https://textileexchange.org [CITE: Textile Exchange 2023–2024]

- International Cotton Advisory Committee — Market Updates (2024–2025). https://icac.org [CITE: ICAC 2024–2025]

- Drewry — World Container Index (2024–2025). https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index [CITE: Drewry WCI 2024–2025]

- ECHA — REACH Annex XVII and Azo Dyes Guidance (Accessed 2024–2025). https://echa.europa.eu [CITE: ECHA 2025]

- OEHHA — California Proposition 65 Textiles Guidance (Accessed 2024–2025). https://oehha.ca.gov [CITE: OEHHA 2025]

- ZDHC — MRSL v3.x (2023–2024). https://www.zdhc.org [CITE: ZDHC MRSL v3.x]

- OEKO-TEX — Standard 100 (2024 updates). https://www.oeko-tex.com [CITE: OEKO-TEX Standard 100 2024]

- AATCC — Test Methods (AATCC 61, 16, 135). https://www.aatcc.org [CITE: AATCC Test Methods]

- ISO — ISO 105 Colorfastness Series. https://www.iso.org [CITE: ISO 105 series]

- [CITE: A credible textile chemistry source on OBAs and whiteness index]

- [CITE: A buyer-focused study on yield and TCO in garment manufacturing]

- [CITE: A current printing technology brief on white base fabrics and ink usage]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »