Buy From China: How to Work With a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

16 minute read

Buy From China: How to Work With a China Clothing Manufacturer

Buy from China with a clear, apparel-specific plan and a China Clothing Manufacturer becomes a dependable engine for your outerwear line. Fashion brands in the US and EU reach predictable quality and margins when they lock specs early, vet factories for compliance, control sampling loops, align on Incoterms and duties, and run disciplined inspections from first cut to pre-shipment.

To buy from China apparel factories, finalize a complete tech pack, shortlist audited China clothing manufacturers, confirm compliance (REACH/UFLPA), sample and fit to PP sign-off, lock MOQs and Incoterms (FOB/CIF/DDP), plan AQL inspections, and model freight plus US/EU duties. Contract specs, timelines, penalties, and compliance documentation to reduce risk.

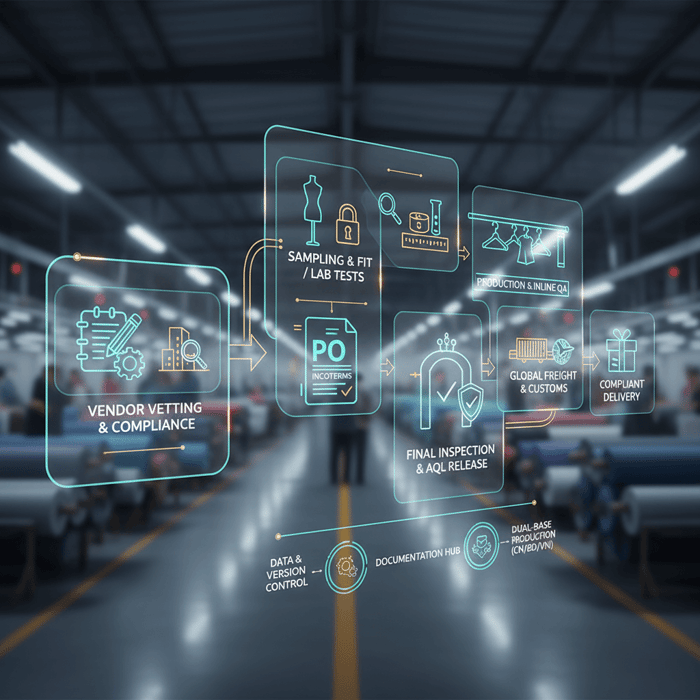

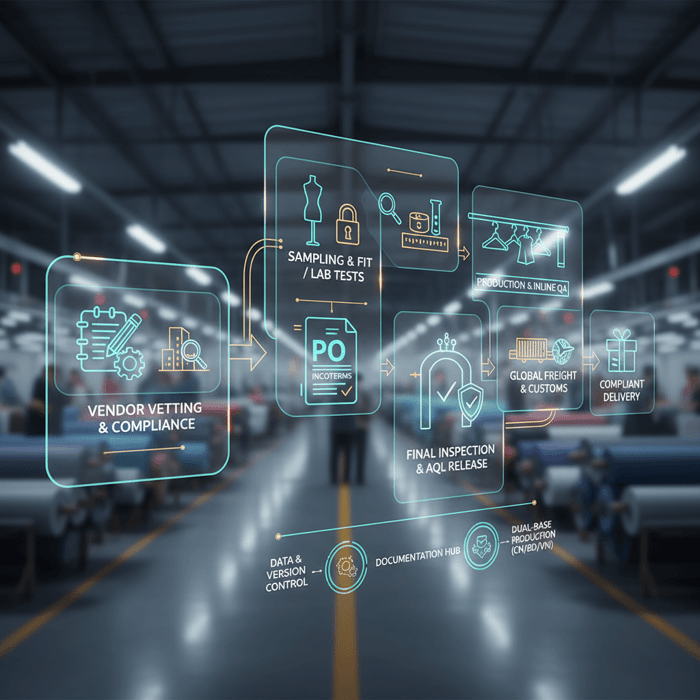

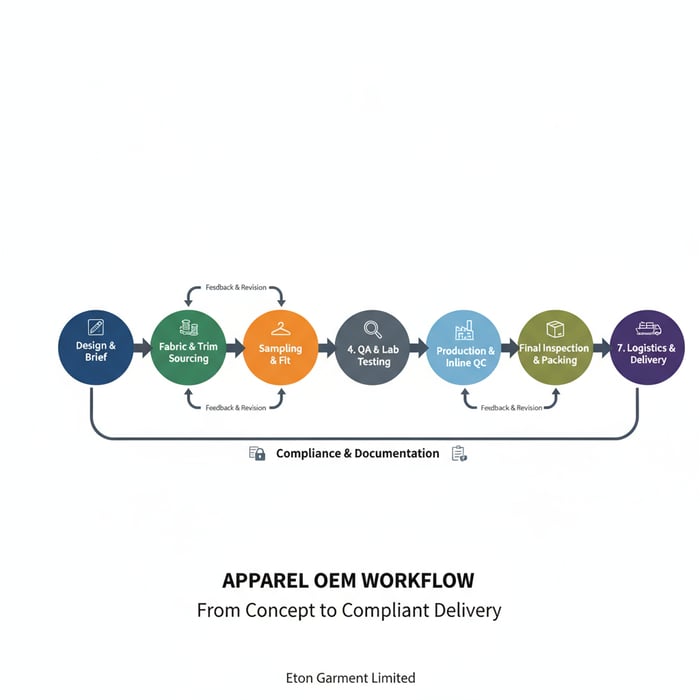

Success with a China clothing manufacturer hinges on precision—clear specs, vetted compliance, and a repeatable QA cadence. This guide delivers a step-by-step sourcing method for OEM/ODM apparel, outerwear-specific quality controls, transparent cost modeling with Incoterms, and a dual-country strategy across China and Bangladesh. Eton’s Clothing Manufacturing OEM Service connects design, fabric sourcing, development, inspections, and logistics into a single, compliant workflow for US/EU entry.

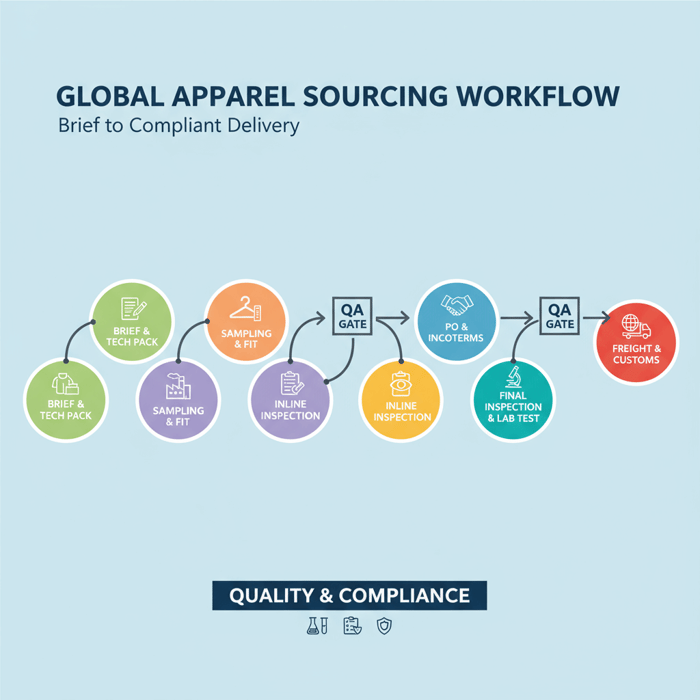

How to Buy From China Clothing Manufacturers (Step-by-Step)

Start with a complete tech pack, then shortlist audited factories, run sampling and fit to PP approval, set Incoterms and POs, and schedule inline and final inspections. Keep version control and documentation tight to prevent rework, detentions, and delays, and build buffers for fabric lead times and peak seasons.

- Brief and Tech Pack — Inputs: design brief, sketches, BOM, measurements, brand standards, compliance needs. Output: consolidated tech pack PDF and editable files with revision control. Time: 3–5 business days for consolidation after design assets exist. [CITE: Apparel product development lifecycle overview from a recognized fashion sourcing text]

- Vendor Shortlist and Vetting — Inputs: product scope, volume, target FOB, compliance checklist. Output: 3–5 China clothing manufacturers with relevant certifications, capacity, and references. Time: 5–10 business days, including calls and document review. [MENTION: QIMA], [MENTION: amfori BSCI]

- Sampling and Fit — Prototype (Proto), Fit, Sales, then Pre-Production (PP) samples with sealed specs. Outerwear typically requires lab tests on materials (e.g., DWR, seam tape adhesion) before PP sign-off. Time: 2–4 weeks per full cycle. [CITE: Lab testing protocols for apparel from a reputable testing body]

- PO and Incoterms — Confirm quoted prices, MOQs, trims, packaging, and Incoterms (FOB/CIF/DDP). Align payment terms with inspection gates (e.g., 30/70 or LC at sight). Time: 2–4 business days to finalize documents. [MENTION: ICC Incoterms 2020]

- Inline Inspection — Mid-production checks against AQL plan. Catch sizing, stitch, or sealing issues early to avoid mass defects. Time: scheduled at 20–50% completion. [MENTION: ISO 2859 sampling]

- Final Inspection and Testing — AQL-based final inspection plus any required third-party lab tests for US/EU entry (e.g., REACH, colorfastness). Release shipment only after pass. [CITE: EU REACH compliance overview from an official EU source]

- Freight and Customs — Book ocean or air; assemble commercial invoice, packing list, COO, test reports, and traceability docs for UFLPA risk management. Ocean: ~25–35 days port-to-port; Air: ~3–7 days. [MENTION: CBP for UFLPA]

| Incoterm | Buyer Controls | Pros | Trade-offs |

|---|---|---|---|

| FOB | Freight, insurance, customs | Transparent freight costs; forwarder choice; common for apparel | Buyer manages more risk; needs logistics expertise |

| CIF | Insurance included to named port | Simplifies marine insurance; fewer handoffs for small teams | Less control on routing; costs sometimes opaque |

| DDP | Minimal (seller delivers duty paid) | One-stop convenience; predictable delivery timeline | Limited visibility; embedded costs; compliance risks shift |

Before the PO: required documents — Final tech pack with tolerances, graded measurements, BOM, trim cards, approved lab dips/strike-offs, test plans, packaging specs, barcode/label specs, social/technical audit records, and factory declarations for REACH/UFLPA traceability. [INTERNAL LINK: Apparel tech pack checklist → /resources/apparel-tech-pack-checklist]

[CITE: OECD due diligence guidance on documentation standards] [MENTION: OECD Garment and Footwear Guidance] [INTERNAL LINK: Eton Garment Limited SOP overview — link to a process page]

Building a Complete Tech Pack

A complete tech pack anchors cost, quality, and lead time. Include a cover page with style codes and revision date; detailed measurements with tolerances; graded size specs; fabric codes with mill names; finish and coating specs; stitch types and SPI; seam sealing diagrams where relevant; BOM with trim part numbers; labeling and care instructions aligned to US/EU; packaging and folding specs; test plan (e.g., REACH, colorfastness, hydrostatic pressure); and fit notes. Lock color standards with approved lab dips/strike-offs, and attach PP sample photos on sign-off. Use file naming and version control so factory teams and inspectors work from the same source. [CITE: Apparel tech pack best practices from a recognized industry reference] [INTERNAL LINK: Download a tech pack template — /resources/apparel-tech-pack-checklist]

Vendor Vetting & Compliance Checks

Separate factories from trading companies by requesting business licenses, facility addresses, sewing line counts, and machinery lists. Verify social and technical audits (BSCI, SEDEX, WRAP), chemical management programs, and environmental permits. For outerwear, evaluate seam sealing rooms, down handling processes, and in-house testing capability. Request traceability for cotton or down to support UFLPA and brand claims. Ask for recent third-party inspection reports and references from US/EU brands. Run a pilot order with tight AQL to validate real performance. [MENTION: QIMA apparel audit programs] [CITE: CBP UFLPA enforcement guidance page] [INTERNAL LINK: Garment factory compliance checklist — /compliance/garment-factory-checklist]

Costs to Buy From China: Pricing, MOQs, Duties, Shipping

Landed cost equals unit price plus sampling, molds/trims, testing, inspections, freight, duties, and financing. MOQs influence unit cost. Incoterms shift cost and risk. Model ocean versus air and validate HS codes for duty rates, including any Section 301 tariffs in the US. Confirm figures with a licensed customs broker.

| Component | Typical Range | Notes |

|---|---|---|

| Unit Price (FOB) | $8–$35 per jacket | Fabric, fill, and construction drive variance; technical outerwear sits at the higher end. [CITE: Industry pricing benchmarks for outerwear] |

| Sampling | $150–$600 per style | Proto/Fit/Sales/PP samples; refundable policies vary by factory. |

| Testing | $150–$500 per panel | REACH chemical screens, colorfastness, hydrostatic pressure; rates vary by lab. [MENTION: Intertek], [MENTION: SGS] |

| QC Inspections | $200–$500 per day | Third-party inline/final AQL inspections in China. [CITE: Market rate overview from a QC provider] |

| Freight (Ocean) | $0.20–$1.50 per unit | Seasonal variation; LCL vs FCL; fuel and congestion affect rates. [CITE: Freight index from a credible logistics source] |

| Duties/Tariffs | US 10–20% / EU ~12% typical | Subject to HS code; US Section 301 may add surcharges for China origin. [CITE: USITC HTS database], [CITE: European Commission TARIC] |

| Financing | 0.5–2.0% of PO value | Depends on payment terms and tenor. |

- China remains a top apparel exporter by value — 2024 (Source: WTO) [CITE: WTO World Trade Statistical Review 2024]

- US/EU buyers face tariff and compliance pressure in 2024–2025 (Source: McKinsey) [CITE: McKinsey State of Fashion 2025]

How MOQs influence unit pricing — Higher MOQs improve fabric utilization, dye minimums, and line efficiency, which can lower FOB by 5–20% versus small runs. Split colors across a shared fabric lot or consolidate trim codes to reach dye and trim MOQs without bloating inventory. [INTERNAL LINK: Build a landed cost calculator — /tools/landed-cost-calculator]

Incoterms & Payment Terms

FOB remains standard in apparel: the factory delivers to the origin port, and you control routing, freight, and insurance. CIF bundles marine insurance and carriage to the named port, handy for smaller teams. DDP pushes delivery and duty payment to the seller, trading transparency for simplicity. Align payment gates with quality gates—e.g., 30% deposit at PO, 70% after final inspection pass; or LC at sight tied to clean documents and AQL pass. Write tolerance, penalties, and rework clauses into contracts to deter defects. [CITE: ICC Incoterms 2020] [CITE: Apparel sourcing contracts best practices] [MENTION: International Chamber of Commerce]

Freight Modes & Lead Times

Ocean FCL offers the best unit economics for steady programs; plan 25–35 days port-to-port plus drayage and customs. LCL adds consolidation time; buffer one extra week. Air (3–7 days) supports rush replenishment or late-stage color corrections, but margins shrink fast. Avoid peak-season rollovers by booking early and distributing volume across carriers. For the US, common routings from China include trans-Pacific to LA/LB, Oakland, Seattle/Tacoma, or East Coast via Panama. For the EU, Rotterdam, Hamburg, and Antwerp offer strong inland connections. [CITE: Ocean transit time benchmarks from a reputable freight forwarder] [MENTION: Maersk], [MENTION: Flexport]

Quality & Compliance When You Buy From China Apparel Factories

Define AQL levels, schedule inline and final inspections, and require material and product tests. For outerwear, validate down fill power, seam sealing integrity, waterproof/breathable performance, and colorfastness. Prepare compliance documentation for US/EU, including UFLPA traceability and labeling under fiber content and care standards.

- Down fill power certification and chain-of-custody

- Seam sealing integrity (hydrostatic pressure; tape adhesion)

- DWR and waterproof/breathability performance targets

- Colorfastness to wash/rub; dimensional stability

- Trim durability: zipper cycles, snap pull, tensile strength

| Compliance Area | US/EU Requirement | Documentation |

|---|---|---|

| Chemical Safety | EU REACH; restricted substances lists | Certified lab test reports; SDS from chemical suppliers [CITE: ECHA REACH guidance] |

| Forced Labor | US UFLPA enforcement | Traceability documents, supplier declarations, risk mapping [CITE: CBP UFLPA Updates 2024] |

| Labeling | Fiber content, country of origin, care symbols | Approved labels, spec sheets, COO evidence [CITE: EU textile labeling rules], [CITE: US FTC textile labeling] |

| Product Safety | General product safety regulations | Declarations of conformity; test results [MENTION: EU GPSR], [MENTION: US CPSC] |

Performance outerwear test plan — Mandate hydrostatic pressure (water column), seam tape adhesion, DWR spray rating, breathability (MVTR or RET), abrasion (e.g., Martindale), colorfastness to washing and rubbing, dimensional stability, zipper cycle tests, and down fill power with IDFB methods. [INTERNAL LINK: Compliance checklist — /compliance/garment-factory-checklist] [MENTION: IDFB] [CITE: Standard test methods from an accredited lab provider]

AQL & Inspection Strategy

Define AQL based on risk tolerance: many brands use AQL 2.5 for major and 4.0 for minor defects. Set sample sizes with ISO 2859 tables. Run incoming fabric inspections, inline checks at 20–50% completion, and a final inspection at 100% packed. Tie payments to pass results and rework timelines. Document corrective actions and track defect Pareto to prevent recurrence in future POs. [MENTION: ISO 2859] [CITE: Apparel inspection best practice whitepaper] [INTERNAL LINK: Eton’s QA SOP summary — process page]

Documentation & Traceability

Build chain-of-custody for cotton and down, including transaction certificates where relevant. Archive SDS for chemicals and finishes, mill certificates, test reports, and declarations. Store documents per PO with date stamps and versioning. For UFLPA, maintain upstream supplier lists, bills of material, and evidence of site locations. For EU REACH, maintain up-to-date restricted list checks, updated annually. [CITE: OECD due diligence for garment supply chains] [MENTION: Textile Exchange for material claims]

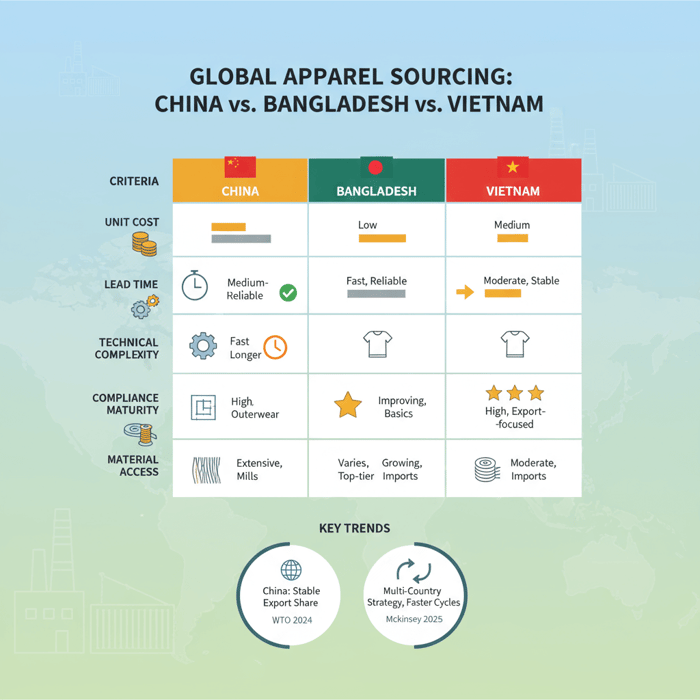

China vs Bangladesh vs Vietnam: Where to Source Apparel in 2025

China offers fast development, technical capability, and material access. Bangladesh excels on cost and large-volume basics. Vietnam provides balanced quality and trade access. For technical outerwear, China often delivers best execution; diversify to Bangladesh for volume and Vietnam for capacity hedging.

| Criteria | China | Bangladesh | Vietnam |

|---|---|---|---|

| Unit Cost | Medium–High | Low | Medium |

| Lead Time | Fast development; reliable calendars | Longer; plan early | Moderate; stable |

| Technical Complexity | Excellent (seam sealing, down, coatings) | Improving; best for padded basics | Strong; growing performance niche |

| Compliance Maturity | High with audited partners | Varies; strong in top-tier groups | High in export-focused clusters |

| Material Access | Extensive (mills, trims, tapes) | Growing; many imports | Moderate; imports common |

- China remains a leading apparel exporter — 2024 (Source: WTO) [CITE: WTO 2024 apparel export shares]

- Supply chains are rebalancing across Asia — 2024–2025 (Source: McKinsey) [CITE: McKinsey State of Fashion 2025]

Criteria Overview

Compare unit cost, development speed, technical execution, compliance history, and access to materials. Outerwear adds layers: seam sealing, membrane laminations, down handling, and specialized trims. Evaluate mills for coatings/DWR, tape compatibility, and test performance early. Consider import duties, trade actions, and logistics resilience for the US and EU destinations. [CITE: Country sourcing profiles from a recognized trade body] [MENTION: Eurostat for EU trade flows]

Decision Framework

Use China for higher-complexity outerwear and short-cycle development; allocate Bangladesh for cost-efficient padded volumes; add Vietnam for capacity diversification. Split styles within a capsule: keep taped shells and downproof seams in China; place quilted, non-taped jackets in Bangladesh; hold contingency SKUs in Vietnam. Reconfirm lab testing in each region before shifting styles. [INTERNAL LINK: Eton’s dual-base production overview — /garment-factory/] [CITE: Sourcing diversification best practices]

Supply Chain Trends: What US & EU Buyers Should Know

Tariff volatility, labor and chemical compliance scrutiny, and demand for traceable materials continue. Lead times compress as brands tighten calendars. PLM and AI-enabled fit/fabric tools shorten sampling cycles. Diversifying volume across China and South Asia remains a resilient posture for 2025.

- WTO 2024: Ongoing strength in China’s apparel exports with regional diversification [CITE: WTO 2024]

- McKinsey 2025: Sourcing shifts toward multi-country strategies and shorter development cycles [CITE: McKinsey State of Fashion 2025]

Key Trend 1 — Compliance Intensification

US enforcement under UFLPA has increased document scrutiny for cotton and upstream tiers; EU chemical controls under REACH and evolving due diligence laws raise testing and traceability expectations. Build a living compliance file per style and PO to protect margins from detentions and relabeling. [CITE: CBP UFLPA updates 2024] [CITE: EU due diligence/REACH communications] [MENTION: ECHA], [MENTION: CBP]

Key Trend 2 — Speed & Diversification

Brands compress calendars with digital protos and tighter fit cycles. Regional hedging across China, Bangladesh, and Vietnam cushions port congestion or policy shocks. Hold a short-list of backup factories per product tier and pre-qualify trims and fabrics to pivot quickly without re-specifying. [CITE: PLM adoption trends in apparel from a credible industry analyst] [MENTION: McKinsey], [MENTION: Gartner]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service links design, fabric sourcing, sampling, QA, and compliant production across China and Bangladesh. Brands gain outerwear expertise, predictable inspections, and documentation aligned to US/EU entry, compressing development cycles and reducing rework.

| Buyer Need | OEM Feature | Outcome |

|---|---|---|

| Rapid Sampling | Dedicated proto rooms; 2–3 week proto lead | Fewer rounds and faster line reviews |

| Compliance Assurance | Certified labs; traceability documentation | US/EU-ready files and lower detention risk |

| Outerwear Quality | Down QC, seam sealing, DWR tests | Performance that withstands returns |

| Cost & Capacity | China + Bangladesh dual-base production | Balanced margins and resilient calendars |

Learn how our Clothing Manufacturing OEM Service supports both fast fashion and premium outerwear with audited facilities, disciplined AQL inspections, and documentation aligned to REACH and UFLPA expectations. [INTERNAL LINK: Start OEM apparel production — /garment-factory/]

Use Case 1: Seasonal Outerwear Drop

A US retailer targets a Q4 parka capsule with taped shells and down fill. Eton runs parallel proto and fabric testing, aligns taping and DWR specs, and seals PP samples by week 6. Inline checks at 30% reveal a zipper issue; trims are corrected within two days. Final AQL pass triggers FOB shipment that meets retailer’s floor set. [CITE: Case study format guidance; anonymized buyer outcomes]

Use Case 2: Private Label Expansion

An EU brand expands private label with padded basics. Eton places taped shells in China and quilted jackets in Bangladesh, sharing fabrics to hit dye MOQs. A shared test matrix and unified labeling avoid duplication. The buyer cuts landed cost by 9% while meeting fit and color consistency goals. [CITE: Internal benchmarking methodology note]

Risks, Compliance & Localization

Mitigate risk with contracts that fix specs, tolerances, and penalties; stage payments on inspection gates; and build compliance files for UFLPA/REACH. Localize labeling and care instructions for US/EU markets. Diversify capacity and add calendar buffers around peak seasons.

- Pros of staged payments: Aligns cash with quality milestones; improves leverage.

- Cons: Requires tighter document control; longer payment cycles for factories.

- Pros of dual-region production: Risk hedge; better MOQs; flexible loading.

- Cons: More coordination; revalidation of tests in each region.

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Quality variance | Medium | High | PP sign-off; AQL inline/final; rework clauses |

| Compliance gaps | Low–Medium | Very High | Lab testing; traceability documentation; supplier training |

| Logistics delays | Medium | Medium–High | Freight buffers; split shipments; alternative ports |

| Currency swings | Medium | Medium | Multi-currency pricing; FX hedging clauses |

Regulatory Notes for US & EU

US: Confirm HTS codes and Section 301 applicability with a licensed broker; maintain UFLPA evidence for cotton/down; follow FTC labeling rules. EU: Validate REACH compliance, align fiber labeling, and prepare Declarations of Conformity where applicable. Policies update frequently—review quarterly. [CITE: USITC HTS; USTR Sec. 301 updates] [CITE: Eurostat/EU REACH and labeling guidance] [MENTION: USTR], [MENTION: European Commission]

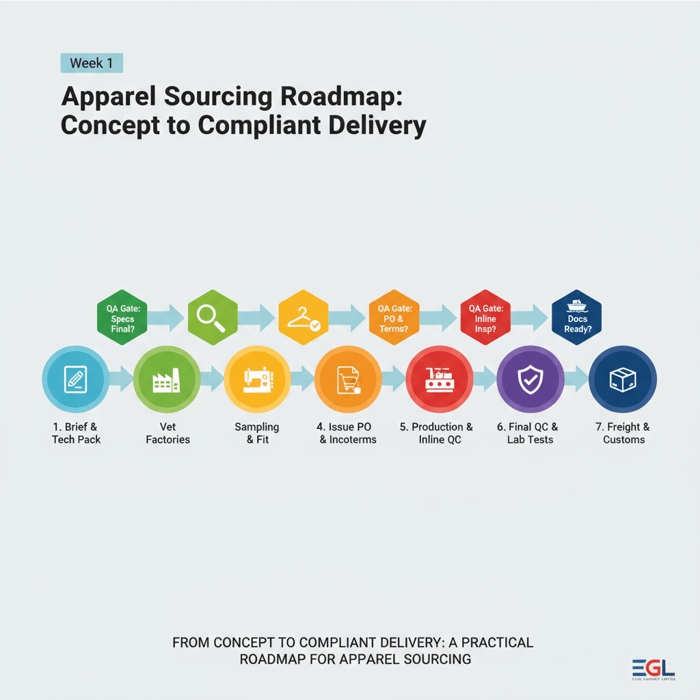

Conclusion & Next Steps

Buying apparel from China succeeds when brands enforce a disciplined, apparel-specific process: precise tech packs, audited factories, documented compliance, aligned Incoterms, and staged inspections. Diversify capacity where it helps, model landed costs, and protect calendars with buffers. When ready, use an OEM partner with proven outerwear depth and dual-region capacity.

- Week 1: Finalize tech pack and test plan

- Week 2–3: Shortlist and vet factories

- Week 4–7: Sampling, fit sessions, PP sign-off

- Week 8: PO issue, Incoterms, payment terms

- Week 9–12+: Production, inspections, lab tests, freight

[INTERNAL LINK: Explore our apparel sourcing hub — /resources/apparel-sourcing-hub] [INTERNAL LINK: Company/Author bio page: Eton Yip — Founder & CEO — {{author_bio_url}}]

Author & Review Notes (E-E-A-T)

Author: Eton Yip, Founder, Eton Garment Limited. 30+ years in outerwear OEM/ODM. Reviewer: Compliance Lead, Eton Garment Limited, specializing in REACH and UFLPA documentation. Methodology: Eton SOPs plus third-party sources (WTO, McKinsey, QIMA, USITC/CBP, Eurostat, ICC, OECD). Limitations: Duties depend on HS codes and policy changes; logistics costs fluctuate; confirm with licensed brokers and accredited labs. Disclosure: Eton provides OEM/ODM services; recommendations reflect in-house best practices. Last Updated: 2025-10-28.

References & Sources

- World Trade Organization — World Trade Statistical Review (2024). https://www.wto.org

- McKinsey & Company — The State of Fashion (2024/2025). https://www.mckinsey.com

- Office of the U.S. Trade Representative / USITC — Section 301 China Tariffs & HTS Database (2024). https://ustr.gov; https://www.usitc.gov

- Eurostat — EU International Trade in Textiles and Clothing (2024). https://ec.europa.eu/eurostat

- QIMA — Supply Chain and Quality Compliance Reports (2024/2025). https://www.qima.com

- U.S. Customs and Border Protection — UFLPA Enforcement Updates (2024). https://www.cbp.gov

- International Chamber of Commerce — Incoterms 2020. https://iccwbo.org

- OECD — Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector (2024). https://www.oecd.org

- ECHA — REACH Guidance for Substances in Articles (Accessed 2025). https://echa.europa.eu

- FTC — Textile, Wool, and Fur Acts and Rules (Accessed 2025). https://www.ftc.gov

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »