Boutique Wholesale Vendors: How a China Clothing Manufacturer Helps You Scale Profitably

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

17 minute read

Boutique Wholesale Vendors: How a China Clothing Manufacturer Helps You Scale Profitably

Boutique wholesale vendors give boutiques fast access to ready-made product, while a China Clothing Manufacturer offers OEM/ODM for margin, control, and brand identity. This field guide maps when to use each, how to vet vendors, how to plan QA and compliance, and where Eton’s Clothing Manufacturing OEM Service fits for outerwear and technical apparel.

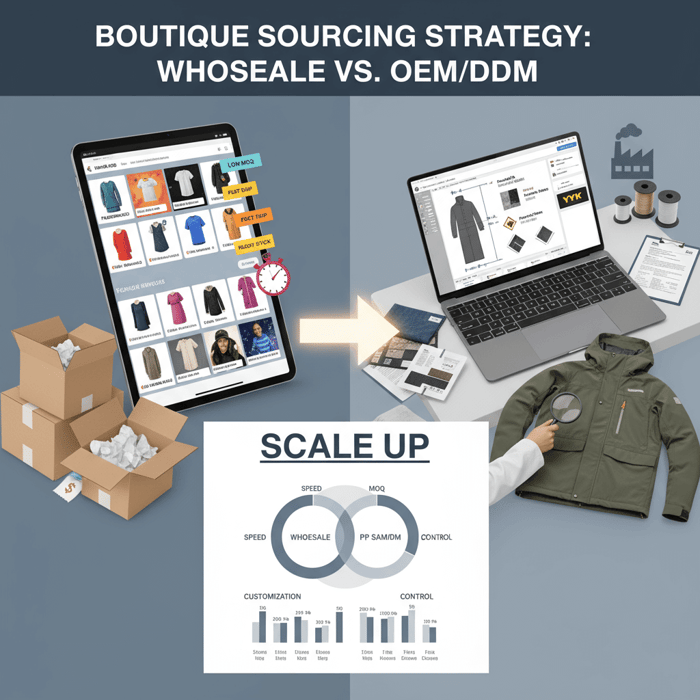

Boutique wholesale vendors sell ready-made goods in bulk for quick assortment and low MOQs. They suit fast tests and small budgets, but margins, uniqueness, and quality control can plateau. A China Clothing Manufacturer offering OEM/ODM unlocks custom fits, repeatable quality, and better unit economics once demand is proven.

Boutique wholesale vendors help boutiques move fast with low-risk buys and wide category choice. Yet brands often hit a ceiling on margin, repeatable quality, and distinct product. Direct OEM/ODM with an experienced China Clothing Manufacturer complements wholesale by delivering custom designs, technical development, and capacity at scale. This blueprint gives definitions, a vendor evaluation checklist, a decision matrix, landed cost logic, QA/AQL basics, compliance guidance for US/EU (UFLPA, REACH), and a step-by-step workflow from shortlist to first shipment. Eton’s Clothing Manufacturing OEM Service sits where outerwear and technical apparel demand higher performance and compliance. The result: boutique teams can keep wholesale velocity for breadth while piloting OEM/ODM on signature styles that build brand equity and better long-term margins.

What Are Boutique Wholesale Vendors? Definitions, Models, and Where They Fit

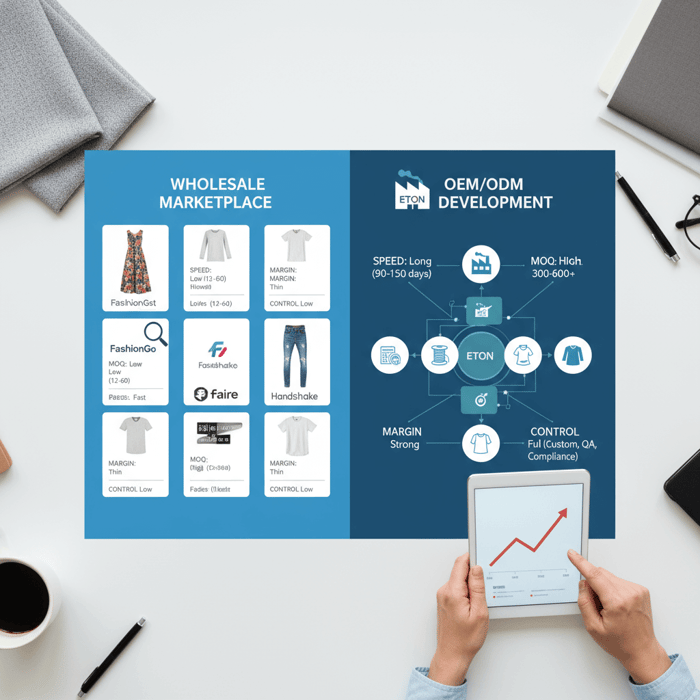

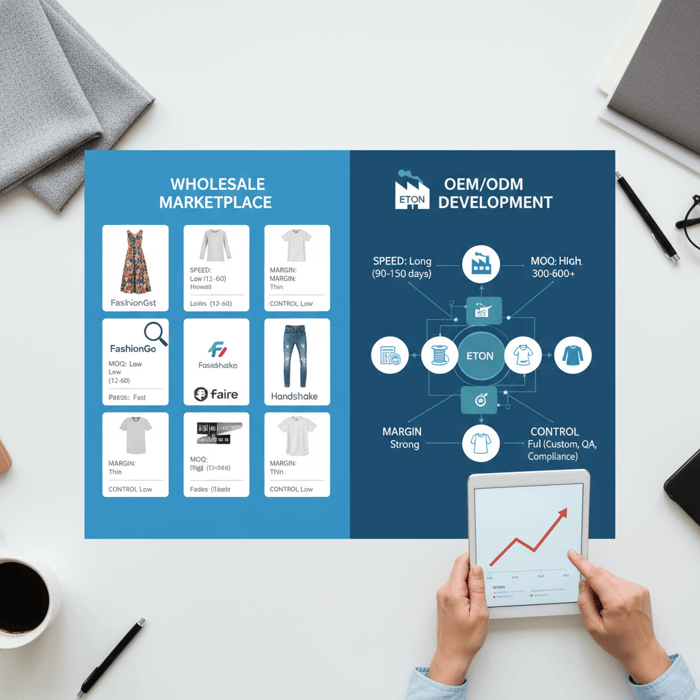

Boutique wholesale vendors supply ready-made goods in case packs or small bulk quantities. Marketplaces like FashionGo, Faire, and Handshake aggregate vendors; independent brand wholesalers sell direct. Wholesale excels at speed and risk control but limits uniqueness and margin compared with OEM/ODM manufacturing.

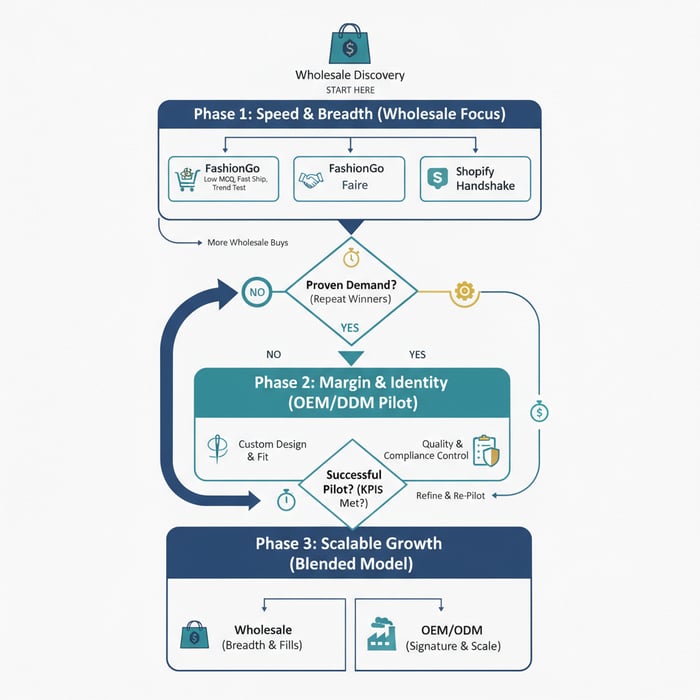

Wholesale slots into a growth path. Early on, boutiques need breadth, fast ship, and low MOQs. Over time, repeat winners and brand goals call for custom fits, controlled materials, and stronger economics—where OEM/ODM enters.

Wholesale Vendor Types and When to Use Each

- Marketplace aggregators (e.g., FashionGo, Faire, Handshake)

- Pros: breadth and discovery; integrated order/returns; reviews help screening.

- Cons: product sameness; fees; variable QC and policies across vendors.

- Best for: quick seasonal fills, trend tests, new category trials.

- Direct brand wholesalers

- Pros: stable lines; predictable replenishment; direct support.

- Cons: less assortment; set MOQs; limited customization.

- Best for: core basics, reliable reorders, steady flow styles.

- Distributors/importers

- Pros: domestic stock; faster ship; single invoice across labels.

- Cons: extra margin layer; mixed QC; thinner selection per label.

- Best for: emergency backfills, small stores with limited cash cycles.

- Closeout and liquidators

- Pros: lowest buy cost; immediate ship; opportunistic margin.

- Cons: no continuity; size/color breaks; quality variance.

- Best for: outlet events, price-point promotions, off-season buys.

[MENTION: FashionGo], [MENTION: Faire], and [MENTION: Shopify Handshake] provide reach and convenience, while independent wholesalers can trade better terms for continuity. These models are distinct from private label OEM/ODM, where the product is made for your brand from a tech pack or an adapted design.

PAA micro-answer: Private label suppliers build to your label and spec under OEM/ODM; boutique wholesale vendors sell pre-made goods. Some vendors offer both, but terms, MOQs, and timelines differ.

Why Wholesale Wins Early—and Where It Hits Limits

Wholesale wins on speed, breadth, and cash safety. You can place small orders, hold low inventory risk, and respond to trends. Over time, limits show up:

- Margin pressure: The vendor’s margin layer caps your markup. Landed cost creep (fees, freight) narrows room to price for growth. [CITE: “Retail margin benchmarks for independent boutiques in 2024–2025”]

- Product sameness: The same styles appear across nearby stores and online marketplaces—eroding differentiation and repeat traffic.

- Quality consistency: Inconsistent fits and finishing increase returns and hurt repeat purchase rate. [CITE: “Return rate drivers in apparel retail”]

- Compliance opacity: You inherit upstream risks (UFLPA, REACH) without full visibility or documentation.

- Lead time variance: Replenishment timing can slip during season peaks, breaking launch calendars.

[INTERNAL LINK: Our wholesale outerwear sourcing guide — pillar page placeholder]

How to Evaluate Boutique Wholesale Vendors: A Practical Checklist

Use a structured path: request product data and policies, review samples, validate with AQL-based inspections, and decide with a weighted scorecard. Focus on quality, MOQs, lead times, pricing clarity, after-sales terms, compliance documentation, and references.

- Request: Line sheets, spec sheets, size charts, MOQs, price tiers, lead times, policies, compliance docs (fiber origin, RSL, social audits).

- Review: Fit assessment, fabric handfeel, trims/hardware quality, construction (seams, bartacks), color consistency, packaging.

- Validate: Order samples; perform fit/wash tests; run small pilot; schedule AQL inspection for pilot or first replenishment.

- Decide: Score against weighted criteria; negotiate terms; set reorder triggers and inspection plan.

| Criterion (Weight) | Evidence | Score (1–5) | Weighted | Notes |

|---|---|---|---|---|

| Quality & Fit (25%) | Sample review, fit try-ons, wash tests | Seam strength; colorfastness; grading | ||

| MOQ & Lead Time (15%) | MOQ per style; replenishment days; stock level | Peak season variance | ||

| Pricing & Landed Cost (20%) | FOB/ex-works; freight; duty; fees | Marketplace commission impact | ||

| Compliance & Traceability (15%) | Fiber origin, RSL, test reports, social audits | UFLPA evidence pack | ||

| After-sales Policies (10%) | Defect allowance, returns, rework, chargebacks | Turnaround SLA | ||

| Communication & References (10%) | Responsiveness; buyer references | Escalation path | ||

| Sustainability & Ethics (5%) | Certifications (e.g., OEKO-TEX), initiatives | Scope validity dates |

PAA micro-answer: A reasonable MOQ for outerwear wholesale ranges from 12–60 units per style/color from marketplaces, and 60–200 units from direct brand wholesalers. For OEM/ODM outerwear, MOQs often start at 300–600 units per style depending on fabric/insulation. [CITE: “MOQ ranges by apparel category — marketplace vs OEM/ODM”]

[MENTION: OEKO-TEX], [MENTION: amfori BSCI], and [MENTION: Sedex] audits can inform screening but do not replace your own product tests. Ask for current scope certificates and confirm facility addresses against paperwork.

Quality, Fit, and AQL Basics for Apparel

Lock fit and workmanship before scale. Eton’s teams run staged sampling for outerwear and technical apparel across China and Bangladesh facilities:

- Development sample (Proto): Confirms design concept and base fabric/trim direction.

- Fit sample: Checks grade rules, movement, sleeve articulation, and hood ergonomics for jackets.

- Pre-production (PP) sample: Confirms bulk materials, trims, labeling, and construction details on actual machines.

- TOP (Top of Production) sample: Pulled from the first bulk run to validate production consistency.

Apply AQL (Acceptable Quality Limit) on inline and final inspections. Common apparel AQL settings: 2.5 for major defects and 4.0 for minor defects, with a defined sampling plan per lot. Inline checks spot stitch density, seam allowances, sealing/taping for technical shells, and down-proofing for insulated styles. Final checks verify size sets, measurements, labeling, and packaging integrity. [CITE: “AQL sampling tables and apparel defect classification reference”] [INTERNAL LINK: Apparel quality control checklist — cluster page placeholder]

Commercial Terms That Protect You

- MOQs and breaks: Document MOQs per style/color/size range and price breaks by quantity.

- Payment milestones: For wholesale, common terms are prepay or Net 30–60 for qualified buyers. For OEM/ODM, 30% deposit at PO/70% at ship is common.

- Defect allowance: Agree on a percent allowance or rework/credit process with turnaround SLAs.

- Exclusivity: Define by zip code, radius, or channel for a set period, tied to minimum purchase commitments.

- Returns & chargebacks: Specify conditions, timelines, and documentation (photos, inspection reports).

- Compliance warranties: Vendors warrant materials and origin; buyers reserve audit and documentation rights (UFLPA, REACH).

Boutique Wholesale Vendors vs. China Clothing Manufacturer (OEM/ODM): Which Model When?

Wholesale is fastest for variety and trend tests. OEM/ODM with a seasoned China Clothing Manufacturer improves margin structure, customization, and repeatable quality once demand proves out. Many boutiques mix models: wholesale for breadth, OEM/ODM for signature products.

| Dimension | Marketplace Wholesale | Direct Wholesaler | China OEM/ODM |

|---|---|---|---|

| Speed to shelf | Fastest (in-stock/quick ship) | Fast to moderate | Longest (dev + bulk) |

| MOQ | Low (12–60) | Moderate (60–200) | Higher (300–600+ by style) |

| Unit cost & margin | Highest unit cost; thin margins | Moderate; better than marketplace | Lowest unit cost at scale; strongest margin |

| Customization | Minimal | Limited | Full (fabric/trim/fit/branding) |

| Quality control | Vendor-defined | Some control | Full QA/AQL program |

| Compliance control | Opaque; document gaps | Better but uneven | Traceable with lab tests/docs |

| Differentiation | Low; sameness risk | Moderate | High; ownable product |

| Working capital | Lowest per order | Moderate | Higher deposit; longer cycle |

- Assortment proliferation and margin pressure are top retail themes — 2024 (Source: [CITE: “McKinsey State of Fashion 2024”]).

- Compliance scrutiny under UFLPA increased detentions for opaque supply chains — 2024 (Source: [CITE: “CBP UFLPA enforcement updates 2024”]).

- Brands report stronger repeat rates on unique products vs. shared wholesale styles — 2023–2024 (Source: [CITE: “Retail cohort retention by product uniqueness”]).

Cost and Margin Architecture by Model

Know your landed cost and target margins:

- Wholesale buy: Unit wholesale price + marketplace fees + inbound freight + duty/taxes + handling.

- OEM/ODM (FOB): FOB factory price + international freight (air/sea) + insurance + duty/taxes + domestic drayage and handling + testing/compliance costs.

Outerwear margin bands tighten under wholesale because fill-power down, functional membranes, seam taping, and trims carry higher base costs. OEM/ODM lets you engineer the BOM (fabric, insulation, tape, zips) to hit target cost without compromising performance. [CITE: “Outerwear BOM cost drivers and trade-offs”] [MENTION: YKK zippers], [MENTION: PrimaLoft], and [MENTION: Gore-Tex] decisions impact both performance and cost tiers.

Signals It’s Time to Add OEM/ODM

- Repeat winners: A jacket or fleece style sells through on multiple buys; size curve stabilizes.

- Margin squeeze: Landed costs limit MSRP or undermine profitability at current price points.

- Quality variance: Inconsistent fits or finishing from wholesale supply raise returns and hurt reviews.

- Brand identity goals: You need signature details, trims, and fits not available off-the-shelf.

- Capacity planning: You plan seasonal drops and require bookable capacity and timeline control.

Data & Trends: Boutique Wholesale and OEM in 2024–2025

Boutiques balance speed and uniqueness. Marketplaces expand choice but amplify sameness. OEM/ODM gains share in assortments where brand identity matters. Compliance expectations in the US/EU push buyers toward suppliers with clear documentation and test programs.

- Retailers cite speed-to-market and differentiation as top priorities — 2024 (McKinsey (2024)).

- OECD due diligence guidance emphasizes traceability and risk-based controls — 2023 (OECD (2023)).

- UFLPA enforcement raises documentation standards for fiber origin — 2024 (CBP (2024)).

Marketplace Breadth vs. Product Sameness

Marketplaces deliver unmatched selection and fast fulfillment, yet the same SKUs surface across many boutiques and DTC sellers. Unique trims, proprietary fabrics, and custom fits shift the conversation from price to value. Boutiques that blend stock styles with OEM/ODM capsules tend to report stronger repeat purchase and community engagement. [CITE: “Impact of product uniqueness on repeat purchase in apparel”]

Compliance-Driven Supplier Consolidation

US/EU importers face heightened expectations on origin evidence, chemical safety, and social standards. Buyers consolidate to fewer, better-documented suppliers to reduce detention and returns risk. Expect more pre-shipment testing, clear RSLs, and digital document trails tied to each PO. [MENTION: ECHA REACH], [MENTION: CSDDD] updates drive process rigor. [CITE: “REACH apparel enforcement updates 2024–2025”] [CITE: “CSDDD scope and timeline brief”]

How to Source from Boutique Wholesale Vendors and China Manufacturers (Step-by-Step)

Run a parallel pipeline: keep wholesale flowing for breadth and cash turns while piloting OEM/ODM on 1–2 hero styles. Use gated QA, AQL inspections, and pre-booked capacity. Track landed cost and contribution margin per SKU to scale the mix that wins.

- Discovery: Build a shortlist from marketplaces and trusted wholesalers; identify 1–2 OEM/ODM candidates for outerwear. Inputs: line sheets, price tiers, MOQs, compliance docs.

- Sampling: Order wholesale samples and OEM/ODM protos. Outputs: fit notes, material preferences, construction comments.

- Pilot order: Place a small wholesale order for immediate sell-through and an OEM/ODM pilot (e.g., 300–600 units). Define success metrics.

- QA/AQL: Run inline/final inspections; test critical components (e.g., colorfastness, seam taping, down fill power).

- Logistics: Align shipping mode to launch date and margin goals; prepare customs and compliance packs.

- Scale: Expand the winning path; book capacity for the next season; tune MOQs and materials for margin and quality.

Limitations to plan for: MOQs vary by fabric/insulation; lead times shift with season peaks; compliance testing adds time and cost. Build buffers into calendars and margins.

Preparation: Budget, Assortment, and Calendar

- Budget: Allocate separate pools for wholesale quick-turn and OEM/ODM development (samples, PP tests, deposits).

- Assortment: Map SKUs by role—core, trend, signature. Place OEM/ODM bets on signature roles with repeat potential.

- Calendar: Wholesale leads can be 2–6 weeks; OEM/ODM outerwear can be 90–150 days (dev + bulk), depending on materials. Book earlier for peak months.

Execution: Samples, Orders, Inspections, and Ship

- Wholesale: Confirm size runs and pack ratios; align ship window with floor sets; define returns/defect process.

- OEM/ODM: Approve PP/TOP samples; lock BOM; schedule inline and final AQL inspections. For technical shells, validate seam taping and hydrostatic head. For down, verify fill power, down-proof fabrics, and no-feather leak standards.

- Freight: Choose air for near-term drops or sea for planned builds. Map duty codes (HTS) and estimate landed cost per unit in USD/EUR.

Quality Assurance: AQL and Continuous Improvement

- Defect taxonomy: Major vs. minor defects; define measurement tolerances per point-of-measure.

- Sampling plan: Use AQL 2.5/4.0 with clear acceptance numbers tied to lot sizes.

- Feedback loop: Tie returns data and review notes to corrective actions on the next PO; update spec packs and workmanship guides.

[INTERNAL LINK: Eton outerwear development process — pillar page placeholder]

Product/Service Integration: Clothing Manufacturing OEM Service by Eton

Eton’s OEM/ODM outerwear manufacturing helps boutiques move from wholesale to ownable product. Capabilities include design support, fabric/trim sourcing, technical development, scalable production in China and Bangladesh, and rigorous QA aligned to US/EU compliance. Focus: parkas, down jackets, padded coats, softshells, and technical sportswear.

| Boutique Need | Eton Capability | Expected Outcome |

|---|---|---|

| Scale a hero parka with consistent fit and lower unit cost | Pattern refinement, down/insulation sourcing, seam-sealed construction, AQL program | Stable fit, improved margin, repeatable quality; lead time 90–130 days |

| Launch a softshell capsule with branded trims | Fabric mills network, branded hardware (e.g., YKK), color lab dips, PP/TOP control | Ownable details; on-time delivery; lead time 75–110 days |

| Meet US/EU compliance requirements | UFLPA documentation trail, RSL testing with accredited labs, labeling compliance | Lower customs risk; smoother clearances |

Start an OEM/ODM project here: Clothing Manufacturing OEM Service. Eton Garment Limited has delivered outerwear since 1993 for global retailers including Liverpool F.C., Forever 21, Babyshop, Max, Gloria Jeans, Jeep Apparel, and TFG Group—built on modern factories, strict QA, and international compliance.

Use Case 1: Scale a Hero Parka from 100 to 5,000 Units

Situation: A boutique parka outperformed at 100 units via wholesale. Goal: stronger margin and consistent fit at 1,000–5,000 units.

- Approach: Migrate to OEM with refined grading; choose down or synthetic insulation; specify down-proof fabrics; confirm seam taping where needed.

- QA: Inline checks for fill weight uniformity; final AQL 2.5/4.0; needle sharing controls to prevent down leakage.

- Outcome: Net landed cost reduction; repeatable quality; room to price for value. [CITE: “Down garment quality control best practices”]

Use Case 2: Technical Softshell Capsule with Branded Details

Situation: The boutique wants a distinct identity in transitional weather pieces.

- Approach: Source performance softshell with the right stretch and handfeel; add branded zipper pulls, reflective transfers, and custom labels; verify bonding/lamination stability with wash tests.

- QA: PP/TOP samples; lab tests for colorfastness, pilling, and seam strength; final AQL with measurement tolerances tuned for stretch textiles.

- Outcome: Signature details, higher perceived value, greater repeat purchase.

Risks, Compliance & Localization (US & EU)

Reduce quality, delivery, and compliance risks with documented QA, AQL plans, and due diligence. For the US/EU, prepare UFLPA evidence of origin, chemical safety testing under REACH, and correct labeling. Maintain a risk register and an evidence trail per PO.

- Wholesale compliance control: Pros—faster buys; existing vendor docs. Cons—opaque origin, uneven RSL testing, limited traceability.

- OEM/ODM compliance control: Pros—traceability, tailored testing, lab report alignment to your RSL. Cons—requires planning, budget, and documentation management.

| Risk | Likelihood | Impact | Mitigation & Evidence |

|---|---|---|---|

| Origin documentation gaps (UFLPA) | Medium–High | High | Maintain fiber/yarn/fabric origin docs; supplier affidavits; production records; shipping docs; retain for 5+ years. (CBP (2024)) |

| Chemical non-compliance (REACH) | Medium | High | RSL program; accredited lab tests; maintain COAs; track SVHC updates. (ECHA (2024)) |

| Late deliveries during seasonal peaks | Medium | Medium | Book capacity early; milestone tracking; split shipments; buffer weeks in calendar. |

| Quality variance on bulk | Medium | Medium | Inline/final AQL; PP/TOP sign-offs; factory SOPs; learning loop from returns data. |

| Labeling errors (US/EU) | Low–Medium | Medium | Labeling checklist; pre-shipment label review; sample carton audit; correct fiber content and care symbols. |

Risk Matrix and Evidence You Need

- Supplier traceability: Factory list, subcontractor approvals, production records, capacity sheets.

- Fiber origin: Cotton/wool origin statements; yarn/fabric invoices; mill declarations.

- Lab tests: RSL, colorfastness, pilling, seam strength, hydrostatic head (where relevant), down fill power.

- RSL: Your chemical restrictions with test methods and limits; update twice yearly.

- Social compliance: Audits (BSCI/Sedex), corrective action plans, follow-ups.

- C-TPAT/Customs: Security questionnaires; chain-of-custody documents; HTS classification reviews.

Regulatory Notes for US/EU

- United States: UFLPA operational guidance; country-of-origin marking; FTC care labeling; flammability where applicable; CPSIA for children’s wear. (CBP) [CITE: “FTC apparel labeling guidance”]

- European Union: REACH chemical compliance; ECHA SVHC monitoring; product safety obligations; labeling in local language; emerging CSDDD due diligence expectations. (European Commission)

[INTERNAL LINK: Compliance documentation pack — cluster page placeholder]

Conclusion & Next Steps

Start with wholesale for speed, layer OEM/ODM for margin and identity. Use the evaluation checklist, decision matrix, and risk controls to decide the right mix. Pilot one or two styles with Eton’s OEM/ODM to validate fit, quality, and margin before scaling.

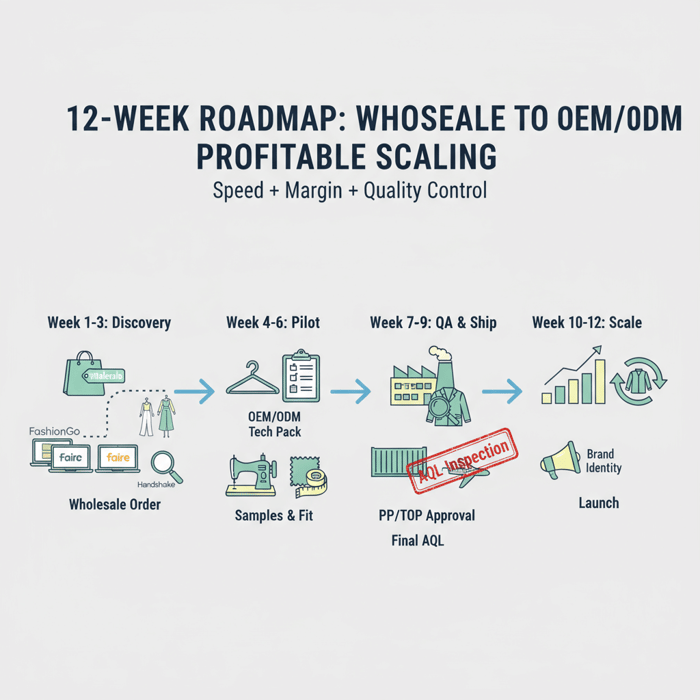

- Week 1–2: Build shortlist; request documents and samples; set QA criteria.

- Week 3–4: Fit and wash tests; landed cost modeling; pick candidates.

- Week 5–6: Place wholesale orders; issue OEM/ODM tech packs; schedule PP.

- Week 7–9: PP/TOP approvals; inline AQL; book freight; prepare compliance docs.

- Week 10–12: Final AQL; ship; receive; floor set launch; review KPIs; plan scale.

When you’re ready to turn a proven style into a signature product, explore Eton’s Clothing Manufacturing OEM Service.

Author: Senior Apparel Sourcing Strategist, 12+ years in OEM/ODM outerwear and QA. [INTERNAL LINK: Author bio placeholder]

Reviewer: Eton Production Director, 20+ years in technical outerwear manufacturing.

Methodology: Synthesized first-hand manufacturing practices from Eton with recognized industry guidance. Vendor marketplace details to be verified prior to publication.

Limitations: MOQs, costs, and lead times vary by product, season, and supplier. Statistics marked [Verification Needed] require final citation checks. Disclosure: Eton provides OEM/ODM services referenced in this guide.

Last Updated: 2025-10-28

- McKinsey & Company — The State of Fashion 2024 (2024). https://www.mckinsey.com

- OECD — Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector (2023). https://mneguidelines.oecd.org

- U.S. Customs and Border Protection — UFLPA Operational Guidance (2024). https://www.cbp.gov

- European Commission — Corporate Sustainability Due Diligence Directive (2024–2025). https://commission.europa.eu

- European Chemicals Agency — REACH Regulation Overview for Apparel (2024). https://echa.europa.eu

- OEKO-TEX — Standard Updates (2024). https://www.oeko-tex.com

- [Placeholder] FTC — Care Labeling and Fiber Content Rules (Year). [CITE: “FTC apparel labeling guidance”]

- [Placeholder] Apparel return drivers report — Consumer behavior in fashion retail (Year). [CITE: “Return rate drivers in apparel retail”]

- [Placeholder] Outerwear BOM cost drivers — Technical report (Year). [CITE: “Outerwear BOM cost drivers and trade-offs”]

- [Placeholder] Product uniqueness and repeat purchase — Retail study (Year). [CITE: “Impact of product uniqueness on repeat purchase in apparel”]

- [Placeholder] AQL in apparel — Sampling and defect classification (Year). [CITE: “AQL sampling tables and apparel defect classification reference”]

FAQs

Related Articles

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »