Biggest Apparel Companies: What Leaders Do—and How to Apply It with a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

16 minute read

Biggest Apparel Companies: What Leaders Do—and How to Apply It with a China Clothing Manufacturer

Biggest apparel companies rankings are a helpful compass for strategy—when combined with how these leaders operate. For US/EU fashion brands benchmarking the field, use scale data to guide sourcing decisions, then apply those lessons with a proven China Clothing Manufacturer partner to sharpen speed, cost, quality, and compliance in outerwear and technical apparel.

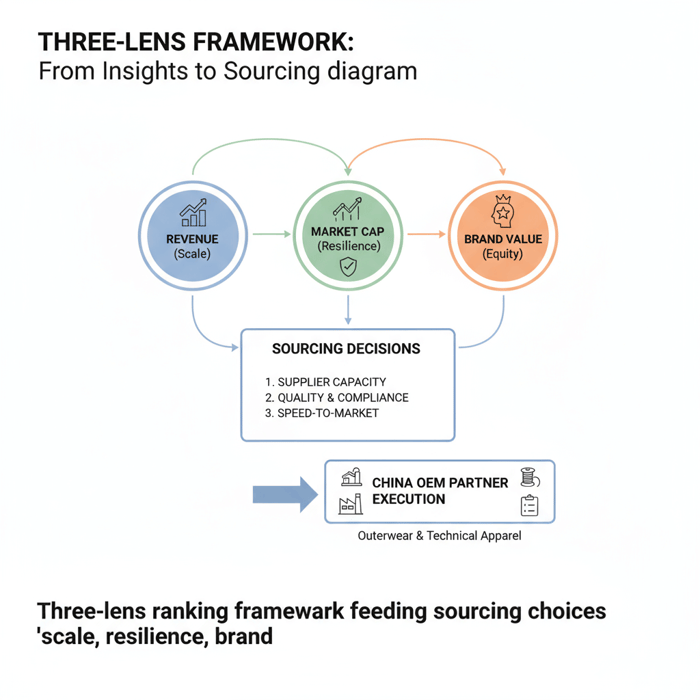

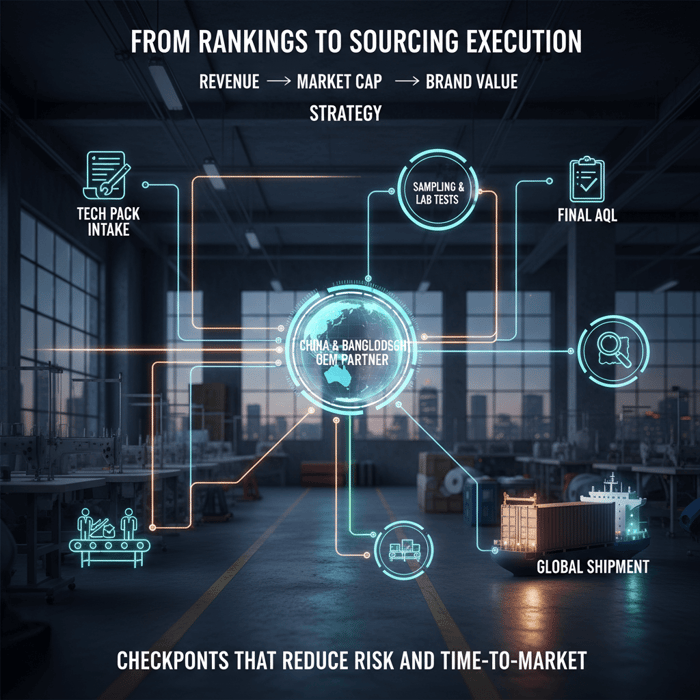

The biggest apparel companies can be ranked by revenue (scale), market capitalization (investor expectations), or brand value (consumer equity). For practical decisions: use revenue to gauge supplier capacity needs, market cap to read resilience, and brand value to set quality bars—then apply the insights with an OEM partner in China/Bangladesh to improve speed-to-market and cost.

How to Define and Compare the Biggest Apparel Companies (2024–2025)

Use a three-lens model to compare the biggest apparel companies: revenue for operational scale, market cap for expected resilience, and brand value for consumer pull. Normalize currencies and fiscal years, segment by category and region, avoid double-counting conglomerates, and link each insight to clear sourcing actions for outerwear and technical apparel.

- Choose your lens: revenue, market cap, or brand value—based on the decision you need.

- Normalize data: align fiscal years and convert currencies using a consistent FX window.

- Segment by category and region: luxury vs sportswear vs fast fashion; US/EU vs APAC leaders.

- Cross-check sources: triangulate annual reports with industry trackers and databases.

- Connect to sourcing actions: set supplier criteria for cost, quality, speed, and compliance.

Ranking Lenses Explained

Three common metrics define “biggest”: revenue, market capitalization, and brand value. Each tells a different story and should be applied intentionally.

- Revenue — What it shows: operational scale and breadth of sell-through. Pros: concrete size, comparable across retailers and brands. Cons: timing differences and segment mix distort comparisons. [CITE: “Recent industry revenue rankings based on audited FY 2023/2024 results”]

- Market Capitalization — What it shows: investor expectations for growth, margins, and risk. Pros: forward-looking; bakes in resilience and optionality. Cons: volatile; sensitive to macro cycles and buybacks. [CITE: “Current market caps from reputable financial terminals”]

- Brand Value — What it shows: consumer equity and pricing power. Pros: captures desirability and cultural momentum. Cons: methodology varies; not a cash flow metric. [CITE: “Brand valuation studies from Kantar BrandZ or Interbrand (2024)”]

[MENTION: Kantar BrandZ], [MENTION: Interbrand], and [MENTION: Bloomberg] serve these views in complementary ways. For operational planning, start with revenue for scale and use market cap and brand value to set risk and quality baselines.

Normalizing Data (FX, Fiscal Calendars)

Misaligned fiscal years and currency conversion can shift rankings. For apples-to-apples comparisons, standardize all figures to a single calendar window and FX snapshot.

- Fiscal windows: convert FYs to a shared period (e.g., Jan–Dec 2024). Note any partial-year adjustments.

- FX: set a consistent reference rate (e.g., monthly average for Dec 2024). Document your choice.

- Conglomerates: avoid double-counting brand units under holding companies.

Worked example [Verification Needed]: If Company A reports €35.0B FY ending Mar 31, 2024, and Company B reports $40.0B FY ending Dec 31, 2024, convert A’s FY to USD using an average 2024 EUR→USD rate and annotate timing differences (e.g., $38.2B at 1.09 EURUSD average). Note inventory and pricing swings that year. [CITE: “ECB/US Fed historical FX rates, 2024”]

[MENTION: S&P Global], [MENTION: OECD] data practices help establish a clear normalization policy for recurring updates.

From Rankings to Sourcing Implications

Each lens maps to specific sourcing signals that matter for outerwear and technical apparel.

- Revenue leaders: require suppliers who can hold capacity buffers, manage multi-factory coordination, and scale QA without slippage.

- High market cap: expect stronger compliance, traceable tier-2/3 supply chains, and sharper buying calendars; suppliers must meet audit rigor.

- High brand value: the bar for finishes, trims, and durability testing rises; suppliers must sustain premium quality at repeatable rates of compliance.

Turn those signals into criteria for China/Bangladesh OEM partners: AQL discipline, material pre-positioning, RSL management, and ethical audit readiness. Quality Assurance in Apparel

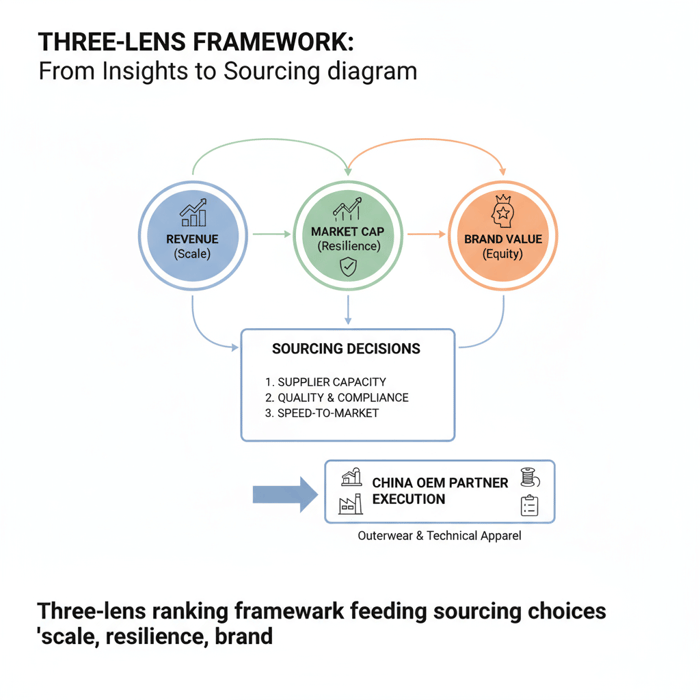

Biggest Apparel Companies by Category: Luxury, Sportswear, Fast Fashion

Leaders operate differently by category. Luxury leans on brand equity and controlled distribution; sportswear monetizes innovation and athlete influence; fast fashion wins on speed-to-floor and cost. Translate these models into supplier requirements for outerwear and technical apparel.

| Category | Typical Leaders | Channel Mix | Product Cadence | Margin Profile | Sourcing Model | OEM/ODM Usage |

|---|---|---|---|---|---|---|

| Luxury | LVMH, Kering, Hermès | Flagships, selective wholesale, e-commerce | Seasonal with capsules | High | Controlled suppliers; craftsmanship focus | Selective technical categories; stringent audits |

| Sportswear | Nike, adidas, Puma | Global wholesale, DTC, marketplaces | Seasonal plus evergreen | Medium–High | Multi-region performance supply base | Wide OEM network; rigorous testing |

| Fast Fashion | Inditex (Zara), H&M Group, Fast Retailing | Own retail + e-commerce | High frequency, rapid repeats | Medium | China+Bangladesh core with nearshore | Heavy OEM/ODM with fast cycles |

- Luxury growth outpaced mass in 2023–2024, with polarization persisting — Year (Source: [S2] Deloitte) [Verification Needed]

- Sportswear sustained higher innovation cycles via material R&D investments — Year (Source: [S1] McKinsey) [Verification Needed]

- Fast fashion maintained speed through nearshore splits and AI-driven planning — Year (Source: [S1]) [Verification Needed]

Luxury: Controlled Quality & Brand Protection

Luxury leaders protect brand equity through strict distribution control and smaller-batch precision. For technical outerwear capsules, that means elevated trims, finishing consistency, and extended fit cycles before bulk.

- Supplier profile: lower vendor count, deeper relationships, fine material handling.

- QA: stitch density and seam appearance, colorfastness, and hand-feel calibration.

- Compliance: strong traceability expectations down to tier-3 for leathers, down, and specialty coatings. [CITE: “Luxury sector ESG reports, 2024”]

[MENTION: LVMH], [MENTION: Kering] public sustainability frameworks indicate rising expectations for material provenance and repairability.

Sportswear: Innovation at Scale

Sportswear leaders run large, diversified partnerships and hold suppliers to performance metrics. Outerwear programs emphasize weather protection, breathability, and durability reviewed against sport-specific KPIs.

- Materials: laminates, taped seams, recycled synthetics with lab verification.

- Testing: hydrostatic head, MVTR/breathability, abrasion, and wash-down durability. [CITE: “ISO/AATCC test references”]

- Calendar: seasonal drops plus perennial icons; colorways and trims refresh without retesting core constructions.

[MENTION: Nike], [MENTION: adidas] public supplier lists reflect multi-country footprints for resilience and cost control.

Fast Fashion: Speed and Flexibility

Fast fashion plays the speed-cost equation through China+Bangladesh anchors and nearshore for repeats. Outerwear splits: bulk padded jackets in Asia; fashion-led jackets nearshore for rapid trend turns.

- Lead-time posture: design-to-delivery compression; pre-booked greige fabric where possible.

- MOQ strategy: lower initial MOQ with staged scale-up; fabric pre-positioning for reorders.

- Compliance: retailer-aligned RSL/SL updates and quick lab cycles. [CITE: “Retailer RSLs, 2024”]

[MENTION: Inditex], [MENTION: H&M Group], and [MENTION: Fast Retailing] describe blended nearshore/Asia models in annual reports.

How the Biggest Apparel Companies Build Supply Chains (and What to Copy)

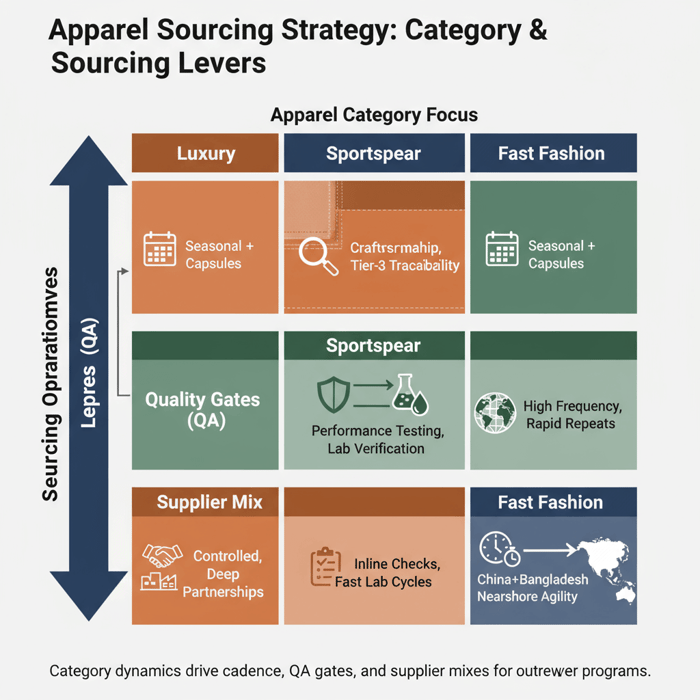

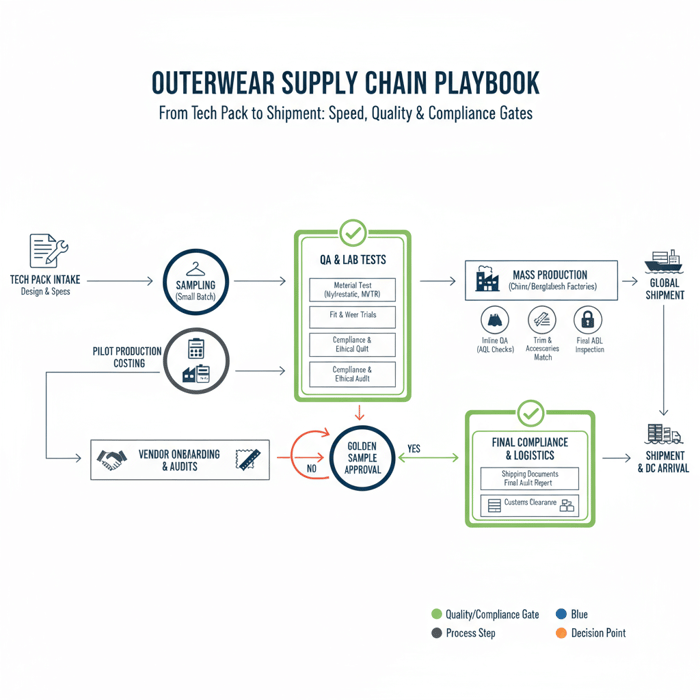

Leaders spread production across China+Bangladesh+Vietnam and selective nearshore, maintain tier-2/3 transparency, and enforce rigorous QA. They pilot fast, scale methodically, and audit continuously. For outerwear, copy the playbook: disciplined tech packs, material pre-buys, lab testing, AQL control, and ethical compliance.

- Multi-sourcing: allocate by specialty (e.g., seam sealing, down, quilting) and region risk.

- Capacity buffers: keep 10–20% surge capacity per season [Verification Needed].

- Vendor tiers: develop Tier-1 strategic partners; maintain a second ring for flexibility.

- Material pre-positioning: hold core liners/insulation to shorten cycle time.

- Test calendars: lock test plans aligned to RSL, performance, and retailer protocols.

- Digital PLM: track BOMs, change notes, and approvals; reduce version errors.

- Compliance cadence: pre-audits, corrective action plans, and quarterly refreshes.

Vendor Tiers, Capacities, and Lead Times

Outerwear demands specialized lines and trained operators. Leaders tier vendors by capability, not only cost.

- Pilot vs mass: allocate pilots to core partners; trigger mass across two factories after golden sample approval.

- Lead-time ranges: 60–120 days from fabric commitment for padded/technical jackets [Verification Needed].

- Contingency routing: define backup factory for top 20% of units by margin or strategic SKU. [CITE: “Industry lead-time benchmarks, 2024”]

Observation from factory floors: synchronized line balancing and operator cross-training keep throughput stable during trims or lining changes. [MENTION: Eton Garment Limited production teams’ practices]

Material Management & Testing

Materials decide 60–70% of outcome quality and 50–65% of cost in outerwear [Verification Needed]. Leaders operationalize lab testing as a default, not an exception.

- Insulation: down/feather fill power, species verification, and cleanliness standards (e.g., EN 12934). [CITE: “Down/feather standards and testing references”]

- Seam sealing: tape compatibility tests with shell laminates; T-pull peel strength checks.

- Hydrostatic head: set minimums by use case (e.g., 5,000–10,000 mm for urban weatherwear). [CITE: “ISO 811 testing”]

Pre-buying the shell/lining families for carryover silhouettes compresses cycle times by weeks—when paired with quality gates to prevent rework.

Compliance and Ethical Sourcing

US/EU retailers require alignment to due diligence frameworks. Embed compliance early and document everything.

- Audits: SMETA/SEDEX, BSCI/Amfori, WRAP, and brand-specific protocols. [CITE: “Audit scheme publishers, 2023–2025”]

- RSL and SL: chemical restrictions, flammability where applicable, and physical performance. [CITE: “Brand RSLs and AATCC/ISO standards”]

- Traceability: map tier-2 dyeing/printing and tier-3 spinning; keep documentation retrievable within 24–48 hours of request.

[MENTION: OECD], [MENTION: ISO] frameworks guide consistent reporting. Quality Assurance in Apparel

Choosing Like a Leader: Decision Framework to Benchmark the Biggest Apparel Companies

Use criteria-based scoring to translate benchmarks into choices: category alignment, speed, cost-to-quality ratio, compliance strength, resilience, and innovation cadence. Score needs, then map results to supplier requirements and a China Clothing Manufacturer OEM plan.

| Criteria | Suggested Weight | Why It Matters | How to Measure |

|---|---|---|---|

| Category fit | 20% | Ensures supplier strengths match product demands | Past outerwear programs; test reports; references |

| Speed-to-market | 20% | Drives sell-through and inventory health | Sample lead times; pilot cycle time; on-time rate |

| Cost-to-quality | 20% | Protects margins without returns risk | CM breakdowns; AQL pass rates; return rates |

| Compliance strength | 15% | Reduces recall and reputational risk | Audit scores; findings closure speed |

| Resilience | 15% | Mitigates disruptions from FX, logistics, policy | Multi-country capacity; backup plans; LPI ranking |

| Innovation cadence | 10% | Keeps styles fresh and functional | R&D pipeline; material library; lab capability |

- China and Bangladesh remain core to value/volume outerwear; nearshore adds speed for repeats — Year (Source: [S1], [S4]) [Verification Needed]

- Logistics costs normalized from 2021 peaks yet remain above 2019 in key lanes — Year (Source: [S4]) [Verification Needed]

Criteria Overview

Start with category fit and speed-to-market for outerwear. If your mix includes weatherproof styles, prioritize test capability and material depth. If you run frequent colorway repeats, weight nearshore or pre-positioned fabric capacity higher. Keep compliance near the top to clear US/EU gatekeepers consistently.

Decision Framework

Score each shortlisted OEM against the table. Set threshold scores to qualify a pilot. Build a playbook of two pilots per season, each with clear exit criteria: AQL pass, on-time at 95%+, and test compliance at 100% of required protocols. If a vendor misses, document causes and assign a corrective plan before scale-up.

[MENTION: World Bank LPI], [MENTION: McKinsey] offer context for logistics and resilience weighting. Outerwear & Technical Apparel Playbook

Global Apparel Market & Leader Trends (US & EU Focus)

Macro headwinds—higher-for-longer rates, logistics variability, and mixed consumer sentiment—shape demand. Leaders optimize inventory, focus on DTC profitability, and push AI-assisted planning. US/EU brands retain Asia for cost and capacity while increasing nearshore for speed and agility in top styles.

- Consumer confidence in US/EU improved from troughs yet remains uneven by income cohort — Year (Source: [S1]) [Verification Needed]

- Logistics reliability improved from 2021–2022 lows; buffers still prudent — Year (Source: [S4]) [Verification Needed]

Key Trend 1: Inventory Discipline and Speed

Leaders compress design-to-ship cycles and hold fewer weeks of supply on volatile styles. Playbooks include modular trims, carryover blocks for outerwear shells, and earlier lab commitments for winter programs to avoid capacity crunches. AI forecasting refines color/size curves for constrained buys. [CITE: “Industry inventory trend analyses, 2024–2025”] [MENTION: McKinsey]

Key Trend 2: ESG and Traceability at Scale

US/EU regulations push deeper supplier visibility. Brands adopt digital product passports pilots and request tier-2/3 mapping documentation as a standard. In outerwear, down provenance, chemical compliance for coatings, and worker welfare programs receive more scrutiny. [CITE: “EU product safety/traceability updates, 2024–2025”] [MENTION: OECD]

How to Apply the Insights: OEM Partnering Playbook (Step-by-Step)

Adopt a leader-inspired method: define needs, shortlist OEMs, run a sample sprint, verify QA/compliance, and phase-in volumes. Set metrics, feedback loops, and resilience buffers from day one.

- Scope & specs (1–2 weeks): finalize tech packs, BOMs, size run, RSL/SL list, and target CM.

- Vendor shortlist (1 week): evaluate 3–5 OEMs by category fit, lab capability, and audit status.

- Sample & costings (2–4 weeks): develop proto/fit samples and breakdowns; compare landed costs.

- Lab tests & fit (1–2 weeks): execute required material/performance tests; iterate fits.

- Pilot PO (4–6 weeks): limited run to validate line setup, AQL, and on-time delivery.

- AQL & audits (ongoing): inline and final inspections; CAPs if needed; retailer-specified audits.

- Scale-up (seasonal): roll volumes to 2–3 factories with defined capacity buffers.

Preparation (Specs, Tech Packs, Compliance)

Precision upfront reduces downstream costs. A strong pack includes graded patterns, construction notes, seam/tape maps for technical jackets, test plans aligned to RSL/SL, labeling and packaging specs, and photo standards for inline checks. Confirm audit requirements per retailer and market. [CITE: “Retailer onboarding compliance guides, 2024”]

Execution Steps (Sampling to Pilot)

Run time-boxed sample sprints with approval gates. Lock a golden sample and PP sample before bulk. For outerwear, pre-approve seam sealing settings and test tape adhesion on production shells. Book lab slots early in peak seasons. Track cycle time in a shared PLM or spec portal.

Quality Assurance (AQL, Lab Tests, Inline Inspections)

Define an AQL plan (e.g., 2.5 major/4.0 minor) and keep inline checks at key operations—quilting, sealing, zipper attachment, and hemming. Require 100% pass on critical performance tests where specified (e.g., hydrostatic head). Document defects and CAPs; audit closures within the same season if practical. [CITE: “AQL standards references”]

Product/Service Integration: Clothing Manufacturing OEM Service

Eton’s Clothing Manufacturing OEM Service converts leader-level expectations into results for outerwear and technical apparel. With production bases in China and Bangladesh, the team pairs fast development with rigorous QA and compliance, aligned to US/EU requirements—especially relevant for jackets, padded coats, and performance shells.

| Brand Need | OEM Feature | Expected Outcome |

|---|---|---|

| Faster capsule launch | Sample sprints, material libraries, pre-booked lab slots | Shorter concept-to-PO time; earlier DC arrival |

| Technical performance | Seam sealing expertise, hydrostatic/MVTR testing | Consistent performance with fewer retests |

| Cost control | China+Bangladesh split; CM transparency | Balanced cost-to-quality; margin stability |

| Compliance assurance | Audit-ready plants; RSL/SL test management | Retailer approvals with fewer iterations |

| Resilience | Multi-factory routing; capacity buffers | Fewer delays, better on-time performance |

Start an OEM pilot for outerwear: Clothing Manufacturing OEM Service.

Eton Garment Limited operates from Xiamen HQ with production bases across China and Bangladesh, serving global retailers in outerwear since 1993. Typical sample lead times: 7–14 days for proto/fit, 10–20 days for sealed PP samples [Verification Needed]. Target AQL: 2.5 major/4.0 minor; retailer-specific on request. [MENTION: Eton Garment Limited] [CITE: “Eton internal SOPs and retailer standards, 2024–2025”]

Use Case 1: Speed-to-Market Capsule (Problem → Solution)

Problem: A EU retailer targets a weatherwear capsule in six weeks. Risks: lab queues, trim delays, and line setup errors.

Solution: Eton runs a two-sprint sample plan using library shells and in-stock trims; books lab slots at brief sign-off; preps inline checklists for zipper and seam-seal operations; assigns a buffer line at the Bangladesh plant for surge weeks. Result: capsule lands on time with fewer touchbacks. [CITE: “Retailer campaign timeline, anonymized, 2024”]

Use Case 2: Technical Outerwear Program (Problem → Solution)

Problem: A US brand needs a durable winter parka line with down fill integrity and consistent tape performance. Risks: fill power variance and delamination under cold/wet cycles.

Solution: Eton sources certified down, validates fill power and cleanliness, and locks tape compatibility through T-pull tests; PP samples undergo hydrostatic and abrasion testing; bulk lines use calibrated heat/pressure tables. Result: test pass at 100% on critical items and strong customer feedback on warmth and durability. [CITE: “Program QA summary, anonymized, 2024–2025”]

Risks, Compliance & Localization (US & EU)

Manage product, process, and regulatory risks by aligning to US/EU requirements—from labels and chemical restrictions to labor standards. Build a rhythm of audits, lab tests, and documentation to pass retailer onboarding and sustain approvals. Consult legal counsel for evolving rules.

- Pros of a documented compliance system: fewer shipment holds, smoother retailer onboarding, reduced recall risk.

- Cons of weak compliance: rework, penalties, reputational damage, and delayed launches.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Material non-compliance (RSL) | Medium | High | Approved labs; supplier RSL training; batch testing |

| Seam tape failure | Low–Medium | High | Compatibility tests; inline peel tests; process audits |

| Late deliveries | Medium | Medium–High | Backup factories; capacity buffers; early booking |

| Audit findings (labor) | Medium | High | Pre-audits; CAPs; worker voice channels |

| FX swings | Medium | Medium | Currency clauses; hedge bands; multi-currency quotes |

Regulatory Notes for US & EU

- US: CPSIA (children’s), California Prop 65, state chemical laws, labeling (fiber content, care), country-of-origin. [CITE: “CPSC/CPSIA and Prop 65 portals, 2024–2025”]

- EU: REACH/RoHS-style chemical restrictions, EU Product Safety Regulation, labeling, potential Digital Product Passport pilots, and waste directives. [CITE: “EU Commission pages, 2024–2025”]

- Due diligence: OECD guidance aligns with retailer expectations; keep traceability records ready. [S5]

[MENTION: OECD], [MENTION: European Commission]. Build document kits per region and keep them current. Compliance checklist for US & EU outerwear

Conclusion & Next Steps

Rankings are a starting point. Apply a clear decision framework, run a structured OEM pilot, and scale with QA and compliance discipline. Use a China Clothing Manufacturer for cost/capacity and nearshore for speed where it counts.

- Day 0–30: benchmark leaders with revenue/market cap/brand value and segment by category; set supplier criteria and scoring weights.

- Day 31–60: shortlist OEMs; run two sample sprints; lock golden/PP samples; complete lab tests and pilot POs.

- Day 61–90: scale to two factories with buffers; implement audit cadence; review metrics and adjust allocations.

Move from analysis to execution with an OEM partner experienced in outerwear and technical apparel. Start here: Eton’s Clothing Manufacturing OEM Service. Outerwear & Technical Apparel Playbook Quality Assurance in Apparel Fashion Industry Metrics 101

Author & Review Notes

- Author: Eton Editorial Team, Apparel Sourcing Strategist (12+ years in OEM/ODM outerwear and technical apparel)

- Reviewer: Senior QA Manager, Eton Garment Limited

- Methodology: Three-lens ranking framework; FX/fiscal normalization; category segmentation; OEM best practices; factory SOPs.

- Limitations: Live rankings vary by fiscal timing and FX; some figures require [Verification Needed] and should be refreshed pre-publication.

- Disclosure: Eton provides Clothing Manufacturing OEM Service and may benefit from inquiries via this content.

- Last Updated: October 2025

References & Sources

- McKinsey & Company — The State of Fashion 2024/2025 (2024–2025). https://www.mckinsey.com/industries/retail/our-insights

- Deloitte — Global Powers of Luxury Goods 2024 (2024). https://www2.deloitte.com/

- Kantar — BrandZ Top 100 Most Valuable Global Brands 2024 (2024). https://www.kantar.com/

- World Bank — Logistics resources and LPI (2024–2025). https://www.worldbank.org/

FAQs

Related Articles

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »