American Dress Companies: How a China Clothing Manufacturer Powers OEM for U.S. Brands

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

October 28th, 2025

16 minute read

American Dress Companies: How a China Clothing Manufacturer Powers OEM for U.S. Brands

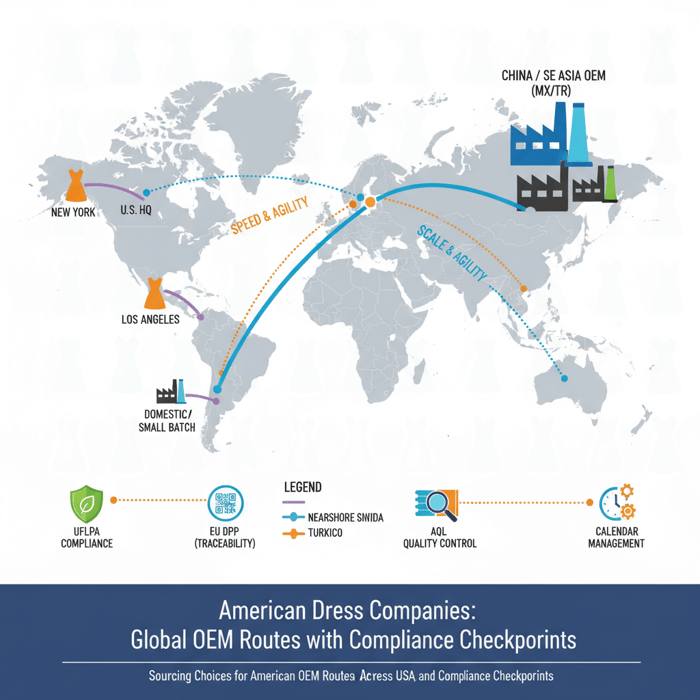

American dress companies design in the U.S. and sell across price tiers while production spans multiple regions. Using a China Clothing Manufacturer for OEM gives brands scale, technical range, and pricing leverage when paired with strong compliance, quality assurance, and calendar discipline. This guide shows how to compare domestic, nearshore, and China/Asia sourcing and execute with confidence.

American dress companies include U.S.-based brands and labels that sell dresses across tiers, with most production offshore. A qualified China clothing manufacturer can deliver competitive unit cost, capacity, and technical capability if you align early on compliance (UFLPA/EU due diligence), quality standards (AQL), and calendar gates from proto through TOP and ex‑factory.

The Landscape of American Dress Companies

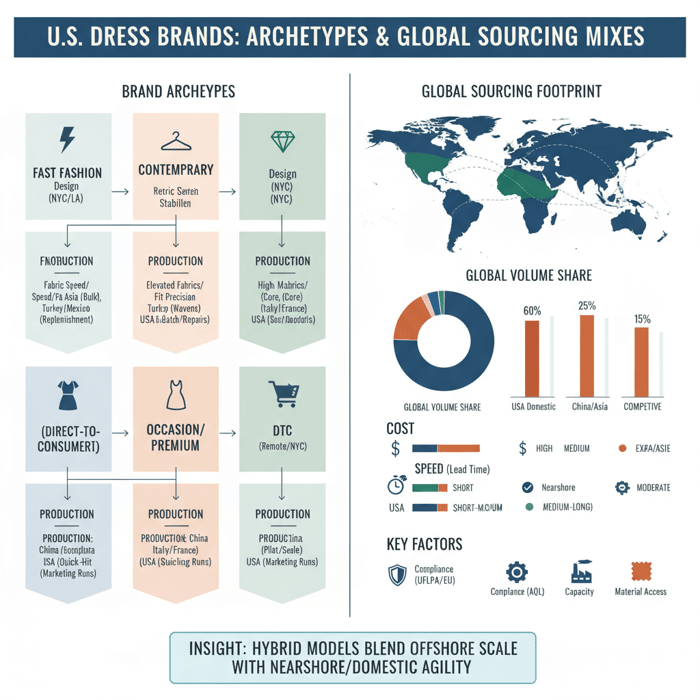

American dress companies span fast fashion to premium, with brand teams balancing trend, fit, cost, and compliance. Most design and merchandising sit in New York, Los Angeles, and other U.S. hubs, while manufacturing follows a multi‑region footprint. Teams weigh domestic speed and small-batch capability against the scale, fabric access, and pricing available through China/Asia OEMs and select nearshore partners.

Types of U.S. dress companies include fast-fashion labels that chase weekly trend pulses, contemporary brands with elevated fabrication and consistent fits, occasionwear and special-event players, and DTC brands that lean on distinctive storytelling and tight SKU counts. Many of these labels manufacture offshore to protect margin and access broader fabric libraries, even when the consumer positioning is “American brand.”

- Fast fashion: high refresh rates, lower ticket prices, strong demand for fabric speed and pattern stability.

- Contemporary: woven sets, knit dresses, and elevated trims; fit precision across sizes drives returns.

- Occasion/premium: lower volume per style, higher materials spend, sensitive to color fastness and handfeel.

- DTC: focused capsules, limited runs, preference for agile vendors with drop-by-drop planning.

PAA: Are most American dress brands manufacturing in the USA or overseas? Most volume is offshore, with China/SE Asia and select nearshore hubs providing the bulk of capacity, while domestic U.S. runs address small-batch needs, marketing stories, and quick repairs to missed reads. [CITE: OTEXA apparel import share for woven/knit dresses; 2023–2024] [MENTION: U.S. Dept. of Commerce OTEXA] [MENTION: World Trade Organization apparel trade review] Learn how OEM partners support dress programs.

What “American Dress Companies” Means Today (and Where They Produce)

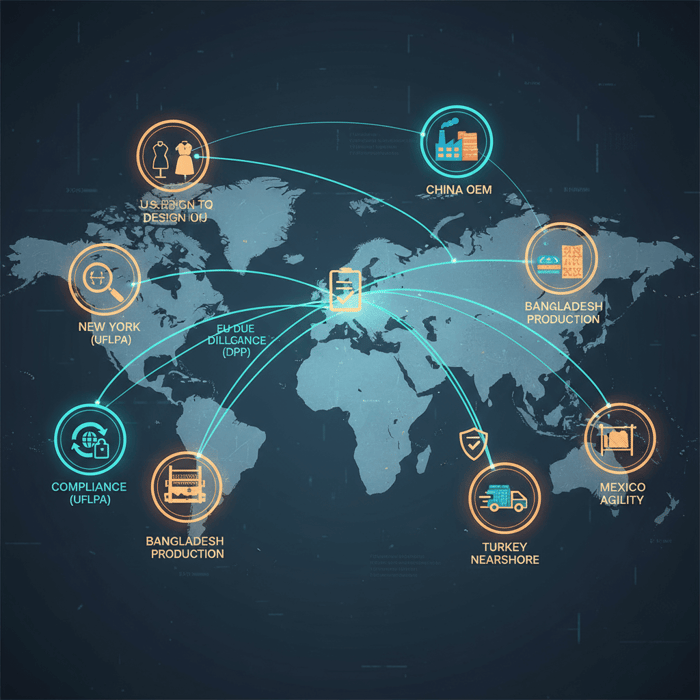

American dress companies usually design domestically and rely on a global factory network to balance unit cost, capability, capacity, and speed. A typical mix includes China/SE Asia for scale and technical complexity, nearshore for faster turns, and domestic for boutique runs or compliance-driven needs. Exact splits vary by strategy, price tier, and calendar.

Brand Archetypes & Assortment Focus

Fast-fashion dress brands prioritize speed-to-market across knit dresses, jersey day looks, and price-point woven styles. They often rely on fabric greige availability, pre-booked dye capacity, and vendor-managed libraries to compress development. Contemporary and premium players emphasize handfeel, drape, trims, and sewing quality on wovens and sweater-dress silhouettes. Occasionwear focuses on color accuracy, special finishes, and delicate handling from sample through TOP, with lower volumes per colorway. DTC players prioritize consistent fits, clear size grading, and storytelling trims, often piloting offshore with cautious MOQs while exploring nearshore for quick-hit capsules.

Sourcing patterns reflect the mix: core knit bodies at scale may sit in China/SE Asia; trend-sensitive runs or replenishment can shift to Turkey or Mexico; highly specialized domestic runs support marketing claims or specific compliance needs. [CITE: Brand case studies contrasting China/SE Asia vs nearshore unit economics; 2024–2025] [MENTION: BoF/McKinsey State of Fashion authors] [MENTION: Apparel sourcing executives from major U.S. retailers] [INTERNAL LINK: Our foundational guide on 'Clothing manufacturer in China — overview']

Typical Production Footprints

Why do core styles gravitate offshore? Lower unit cost, material access (e.g., chiffon, satin, twill, ponte), and mature quality systems. Why nearshore or domestic? Shorter lead times, easier collaboration, and tighter control for small volumes. Many U.S. dress companies end up with a hybrid: offshore for core seasonal bodies and big bets, nearshore for capsule drops or reads, domestic for micro-corrections and special runs.

PAA: What percent of U.S. dress production is offshore vs domestic? Most apparel volume imported to the U.S. is offshore with China/SE Asia leading by share; dress-specific splits require category-level analysis. [Verification Needed] [CITE: OTEXA HS codes for dresses by origin; 2023–2024] [MENTION: CBP trade statistics team] [INTERNAL LINK: Our foundational guide on 'China clothing manufacturer — overview']

American Dress Companies vs. Offshore OEM Partners (China/Asia): Cost, Speed, and Risk

Domestic production offers proximity, smaller MOQs, and fast iterations with higher unit costs. A China clothing manufacturer provides scale, materials access, technical capability, and competitive pricing with longer lead times and a higher documentation burden. Nearshore sits between: moderate cost and faster shipping, but constrained fabric options and variable capacity.

Criteria Overview

- Margin goals: Cost breakdown with fabric share, labor minutes (SMV), trims, and logistics.

- Speed needs: Calendar gates, fabric readiness, and sampling cycles.

- Complexity: Sewing difficulty, finishing, and trim handling.

- Compliance: UFLPA, EU due diligence/ESPR/DPP, RSL testing, traceability proofing.

- Volume profile: Core styles vs. capsules; replenishment vs. trend peaks.

Decision Framework

Score each route on unit cost, MOQ fit, lead time, complexity handling, and compliance comfort. Many teams route core woven dresses with repeatable BOMs to China/SE Asia for cost and consistency. Capsules and read/react drops move to Mexico or Turkey for speed. Domestic runs cover micro volumes, special claims, and last-minute color or length adjustments.

| Option | Unit Cost | MOQ | Lead Time (dev → ex‑factory) | Strengths | Watchouts |

|---|---|---|---|---|---|

| USA Domestic | High | Low–Medium | Short | Proximity, fast iterations, easy fit sessions | Cost, limited fabric libraries, capacity constraints |

| China/Asia OEM | Competitive | Medium–High | Medium–Long | Scale, technical capability, material access | Compliance diligence, freight variability, planning buffer |

| Nearshore (MX/Turkey) | Medium | Medium | Short–Medium | Speed, timezone, moderate costs | Fabric availability, price variance, limited peak capacity |

- Brands report tighter margins and resilience priorities in 2024–2025 (BoF/McKinsey (2025)). [CITE: The State of Fashion 2025]

- China remains a leading apparel sourcing hub by volume; nearshoring grows selectively in the Americas and EMEA (OTEXA (2024); WTO (2023)). [CITE: OTEXA, WTO apparel flows; 2023–2024]

PAA: Is China still competitive for dresses given freight and compliance pressure? Yes, for core styles and technical dresses, unit economics and material access often outweigh freight variability. The caveat: harden documentation (traceability, audits) and pad calendars to protect on-time delivery. [CITE: Freight index volatility and apparel landed-cost models; 2024–2025] [MENTION: Drewry World Container Index] [MENTION: OECD due diligence guidance]

The Cost, MOQ, and Lead-Time Reality for Dress Programs

Landed cost hinges on fabric, trims, labor minutes, overhead, and logistics. MOQs flex with mill dye lots, yarn minimums, and trim availability. Lead times depend on fabric readiness, sampling rounds, and QA. Use a BOM-first approach, visible calendars, and buffer gates to protect margin and delivery windows.

BOM-First Costing

- Build the BOM: fabric GSM/oz, width, yield, trims, labels, packaging.

- Add CMT: SMV by operation (e.g., darts, pleats, zipper installs, lining).

- Overheads: washing/finishing, pressing, folding, polybag, carton.

- Logistics: ex‑factory to DC; ocean vs. air sensitivity by launch window.

- Duties/compliance: HS code, duty rate, testing budget, audit amortization.

Where to negotiate: fabric substitution within handfeel/spec, consolidated trims, shared greige, and calendar-based price breaks. Track variance between proto and TOP yields. Time-and-motion analysis clarifies labor minutes on complex bodices or ruffle placements. [CITE: Apparel SMV benchmarks for dresses; 2024] [MENTION: WRAP training on productivity] [MENTION: ASTM sizing references]

MOQ Levers (Fabric, Dye Lot, Trims)

- Fabric MOQs: common polyester chiffon/satin can run 1,000–3,000m per color; cotton sateen or specialty jacquards trend higher. [CITE: Mill MOQ guidance; 2024]

- Dye lots: consolidate colorways; share greige across styles; use solution-dyed or stock colors when possible.

- Trims: standardize zipper lengths, buttons, and hook/eye specs across styles to reduce minimums.

- Factory MOQs: 300–800 units per color per style at a China OEM is common; premium fabrics or novelty may require higher. [CITE: OEM MOQ ranges for dresses; 2024–2025]

PAA: What’s a typical MOQ for woven dresses at China OEM partners? 500–1,200 units per color is a typical planning range, but shared bodies and multi-brand consolidation can lower or raise the floor. [CITE: Category-specific MOQ datasets; 2024] [MENTION: Textile Exchange material guidance]

Lead-Time Drivers (Fabric Readiness, Sampling, QA)

- Fabric readiness: lab dips/strike-offs add 2–3 weeks; greige stock cuts this substantially.

- Sampling gates: proto (1–2 rounds), fit/counter-sample, PP approvals, TOP timelines.

- QA/testing: RSL testing per fabric/color, dimensional stability, color fastness, AQL inspections.

- Logistics: booking windows and transit; airfreight contingency plans for launch-critical styles.

How American Dress Companies Source OEM Partners in China (Step-by-Step)

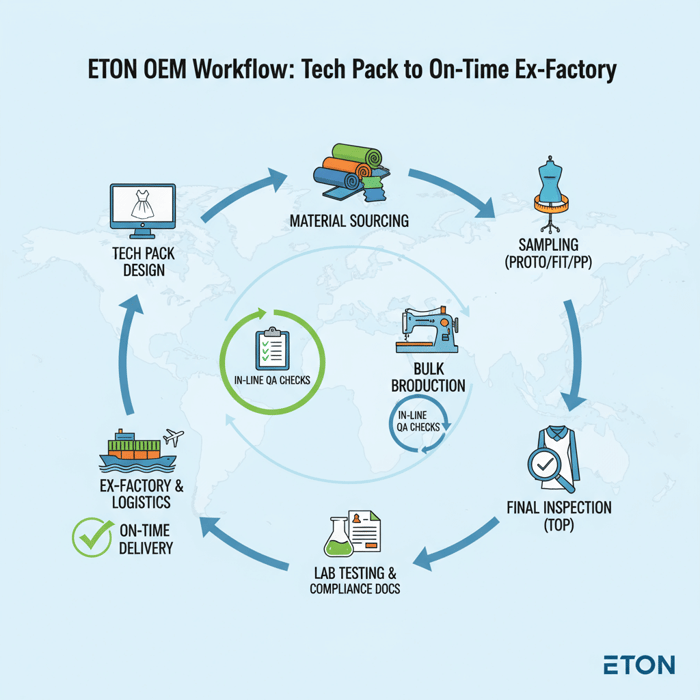

Shortlist for capability fit, compliance posture, and capacity. Share a complete tech pack, set clear sampling gates (proto/fit/PP/TOP), agree AQL and lab testing, and conduct supply chain due diligence aligned to UFLPA and EU rules. Pilot first, then scale with rolling forecasts and dual-sourcing for risk.

Preparation (Vendor Screening + Tech Pack)

- Screen vendors: category experience, stitch quality, equipment, and references. Request audit reports and product samples. [CITE: Audit frameworks e.g., SMETA, WRAP; 2024]

- Compliance review: forced-labor risk map, sub-tier transparency, materials origin plan.

- Tech pack: graded specs, tolerances, stitch diagrams, BOM, test methods, labeling, packaging.

- Calendar: milestone dates, approval gates, AQL plan, documentation deliverables.

Documents to request: factory licenses, social and technical audit summaries, chemical management policy, RSL testing plan, and a traceability schema for cotton or cellulosics. [MENTION: ZDHC MRSL] [MENTION: OEKO-TEX]

Execution Steps (Sampling → Approvals → Production)

- Proto and counter-sample: confirm silhouette and construction; record feedback in pack.

- Fit rounds: size-set checks and shrinkage controls; measure to tolerances and note variances.

- PP approvals: lock BOM, color, trims, size labels, care, and test status.

- Production: in-line audits, hourly QA checks on critical operations, and WIP tracking.

- TOP: test against sealed PP; approve only with passing lab tests and inspection report.

Pitfalls: late fabric approvals, unmanaged shrinkage, trim substitutions without sign-off, and missing lab reports prior to TOP approvals. [CITE: Case study on PP/TOP non-conformance and return rates; 2023–2024]

Quality Assurance (AQL, In‑line/Final, Lab Tests)

- AQL sampling: AQL 2.5 is common for apparel; specify measurement points and defect classifications.

- In-line controls: high-risk seams (e.g., invisible zippers, exposed seams on satins), print/embroidery checks.

- Lab tests: color fastness, dimensional stability, pilling/snags, needle detection if required.

- Records: maintain PP approvals, lab reports, inspection reports, and TOP approvals per style.

PAA: Which documents prove cotton origin for UFLPA compliance? Transaction and origin evidence such as gin bale IDs, spinner documentation, fabric mill batch records, and supplier affidavits tied to purchase orders. Maintain a CBP-ready file. [CITE: CBP UFLPA guidance and statistics; 2024–2025] [MENTION: U.S. CBP Forced Labor Division] [INTERNAL LINK: Garment factory compliance and audits — pillar page idea]

Trendlines Shaping American Dress Companies in 2024–2025

Demand is uneven, but event-driven buying and knit comfort hold steady. Sourcing strategies rebalance for resilience as compliance expectations rise in the U.S. and EU. Hybrid models grow: core offshore for margin protection, nearshore capsules for speed, with stronger documentation and digital product data readiness.

- Margin pressure and cautious consumer spend tracked through 2024–2025 (BoF/McKinsey (2025)). [CITE: State of Fashion 2025]

- U.S. apparel imports remain high with evolving country mix (OTEXA (2024)). [CITE: OTEXA trade data]

- EU ESPR and Digital Product Passport requirements are staging for phased apparel impacts (EU Commission (2024)). [CITE: ESPR/DPP updates]

- UFLPA detentions underscore the need for documented traceability (CBP (2025)). [CITE: UFLPA enforcement dashboard]

Key Trend 1: Compliance as a Growth Enabler

Compliance is now a commercial capability. Teams that build UFLPA-proof origin files, maintain EU-ready product data (material composition, recyclability indicators), and control RSL testing reduce detentions and rework, protect on-time launches, and earn retailer trust. Digital records tied to POs, color lots, and lab reports create traceability that withstands audits. [CITE: OECD garment sector due diligence updates; 2023] [MENTION: OECD Centre for Responsible Business Conduct] [MENTION: ZDHC Roadmap to Zero]

Key Trend 2: Hybrid Sourcing Models

Hybrid models align category economics with speed. Offshore handles core bodies with competitive cost and stable quality; nearshore covers quick-turn capsules and replenishment; domestic tackles micro-batch or special stories. Teams shift volume among routes by reading sell-through and using pre-approved fabrics to avoid lab-dip bottlenecks. [CITE: Retail inventory turns and lead time case studies; 2024] [MENTION: National Retail Federation] [MENTION: Alvarez & Marsal retail studies]

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton delivers OEM manufacturing with China and Bangladesh capacity, rooted in three decades of apparel production. Our strength is technical outerwear and allied woven workflows that support select dress programs requiring stable quality, rigorous QA, and disciplined compliance documentation—helping American dress companies hit launch dates and target margins. [MENTION: Eton Garment Limited production engineering lead] [INTERNAL LINK: Our foundational guide on 'Outerwear OEM case studies']

Use Case 1: Core Styles at Scale

Problem: A U.S. brand needs consistent fit and color control across repeatable woven dress bodies while holding margin in a competitive channel. Solution: Eton runs shared-body development, locks PP/TOP checklists, and uses dual-base capacity with calibrated AQL to stabilize output and pricing. Outcome: fewer fit rounds, predictable lead times, lower scrap. [CITE: Internal program KPIs; verification on request] [INTERNAL LINK: Contact our sourcing team — conversion page idea]

Use Case 2: Capsule Drops with Tight Calendars

Problem: Trend capsules require short lead times and tight color approvals. Solution: Parallel proto/trim approvals, pre-approved fabric pools, and milestone buffers; documented QA with accelerated lab testing. Outcome: higher on-time ex‑factory rate, controlled unit cost despite shorter cycles. [CITE: Launch punctuality improvement data; 2024–2025]

| Brand Need | Challenge | Eton OEM Feature | Expected Outcome |

|---|---|---|---|

| Repeatable Core | Margin + consistency | Dual-base capacity; QA/AQL discipline | Stable quality and pricing at scale |

| Technical Details | Complex trims/fabrics | Technical development + supplier network | Right-first-time sampling; fewer fit rounds |

| Compliance | UFLPA/EU due diligence | Chain-of-custody docs; audit support | Lower detention risk; smoother customs |

| Speed | Tight launches | Parallel workflows; calendar buffers | More on-time ex‑factory |

Start a scoped pilot through our Clothing Manufacturing OEM Service to test cost, fit, and calendar assumptions on a controlled style set. Start your OEM brief. [INTERNAL LINK: Resource hub for compliance templates — page idea]

Risks, Compliance & Localization (US & EU)

Mitigate forced-labor and chemical risks with supplier mapping, chain-of-custody records, and a lab-testing plan aligned to RSL/REACH/Prop 65. Build a living compliance file per style: material origins, audit summaries, lab reports, inspection reports, PP/TOP approvals, and DPP-ready product data for EU programs. This content is informational and not legal advice.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Fiber Origin (UFLPA) | Medium–High | High | Supplier mapping, origin docs, CBP-ready package linked to POs (CBP UFLPA Dashboard (2025)) |

| Chemicals (REACH/Prop 65) | Medium | Medium–High | Lab tests per fabric/color; RSL adherence; supplier chemical management program |

| Capacity/Delays | Medium | Medium | Calendar buffers; dual-sourcing on key bodies; priority booking windows |

| Quality Drift | Medium | Medium | In-line audits; PP/TOP rigor; AQL 2.5 sampling; measurement controls |

Regulatory Notes for US & EU

- UFLPA (US): Prepare origin evidence from farm/ginner to spinner to mill; keep purchase records and batch links. [CITE: CBP UFLPA guidance; 2024–2025] [MENTION: U.S. CBP Office of Trade]

- EU Due Diligence/ESPR/DPP: Build product passports with material composition, sourcing data, and safe-use instructions. [CITE: EU Commission ESPR/DPP materials; 2024]

- REACH/Prop 65: Maintain per-color lab tests; define hold-and-release gates for nonconformances. [CITE: ECHA, California OEHHA updates; 2024]

- OECD Guidance: Embed risk-based due diligence across suppliers and sub-tiers. [CITE: OECD (2023)]

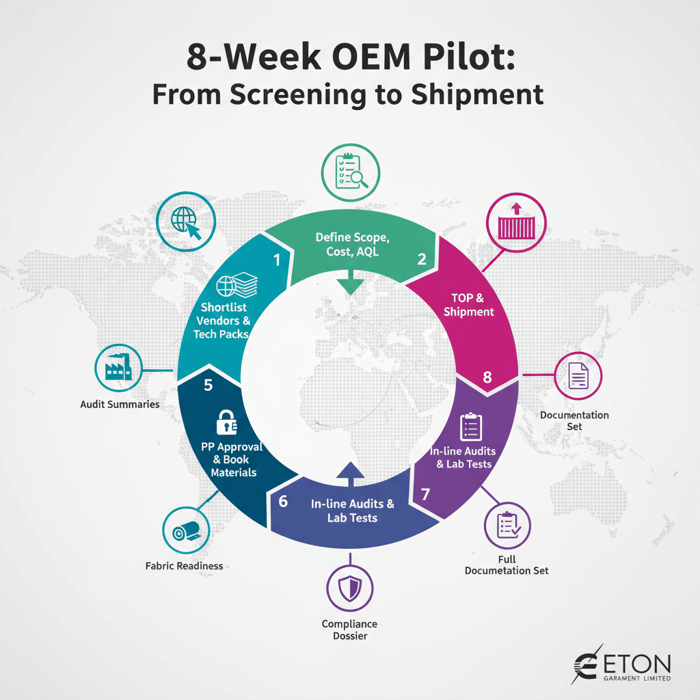

Conclusion & Next Steps

American dress companies win by pairing U.S. design with a smart manufacturing mix. Use the decision framework to compare domestic, China/Asia, and nearshore routes; set realistic cost, MOQ, and lead-time expectations; and operationalize compliance. Pilot with a focused style set to validate fit, cost, and calendar before scaling.

- Week 1: Define style scope, target cost, AQL, and compliance dossier template. [INTERNAL LINK: Resource hub for compliance templates — page idea]

- Week 2: Shortlist vendors; issue tech packs; request audit summaries and origin plans.

- Week 3–4: Proto and fit rounds; lab dips; set PP criteria and test plan.

- Week 5: PP approval; book materials; lock production calendar and inspection dates.

- Week 6–7: In-line audits; WIP monitoring; lab tests; corrective actions as needed.

- Week 8: Final inspection at agreed AQL; TOP sign-off; ship with complete documentation set.

When you’re ready to test a pilot with a China clothing manufacturer, align early on documentation and QA. For outerwear-adjacent workflows and select dress programs, scope your brief with Eton to validate your plan before peak seasons. Start your OEM brief. [INTERNAL LINK: Contact our sourcing team — conversion page idea]

- Pros of offshore OEM: scale, cost, and material access; strong for core bodies and complex sewing.

- Pros of nearshore: quicker turns, timezone alignment; ideal for capsules and replenishment.

- Pros of domestic: small-batch agility and rapid corrections.

- Cons: Each route carries distinct compliance, capacity, and cost trade-offs—use a hybrid model linked to assortment strategy.

References & Sources

- BoF & McKinsey — The State of Fashion 2024 (2023). https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion-2024

- BoF & McKinsey — The State of Fashion 2025 (2024). https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion-2025

- U.S. Dept. of Commerce, OTEXA — Trade Data (2023–2024). https://otexa.trade.gov/

- World Trade Organization — World Trade Statistical Review 2023/2024. https://www.wto.org/english/res_e/statis_e/wts2023_e/wts2023_e.htm

- OECD — Due Diligence Guidance for Responsible Supply Chains in the Garment & Footwear Sector (2023). https://mneguidelines.oecd.org/responsible-supply-chains-textile-garment-sector.htm

- European Commission — Ecodesign for Sustainable Products Regulation & Digital Product Passport (2024–). https://single-market-economy.ec.europa.eu

- U.S. CBP — UFLPA Enforcement Statistics Dashboard (2023–2025). https://www.cbp.gov/trade/forced-labor/UFLPA/statistics

FAQs

Related Articles

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands

20 minute read

October 28th, 2025

Custom Clothing Embroidery: A China Clothing Manufacturer’s Complete Guide for Fashion Brands Custom... more »

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer

16 minute read

October 28th, 2025

T Shirt Decal Maker: From DIY Designs to Scalable Production with a China Clothing Manufacturer A t... more »

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective

17 minute read

October 28th, 2025

Clothing production software: A fashion brand’s guide with a China Clothing Manufacturer’s perspective... more »

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer

17 minute read

October 28th, 2025

Sustainable clothing manufacturers USA: A practical guide to partnering with a China Clothing Manufacturer... more »