United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Garment Industry

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Garment Industry

October 13th, 2025

18 minute read

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024

In the ever-evolving tapestry of the United States apparel industry, where innovation weaves seamlessly with resilience, fashion brands stand at the cusp of transformative opportunities. Imagine a market that has weathered global storms—pandemics, supply chain upheavals, and shifting consumer demands—only to emerge stronger, more vibrant, and infinitely more sustainable. This is the dynamic landscape of United States apparel, a realm where clothing manufacturers like Eton Garment Limited rise as beacons of excellence, delivering high-quality solutions that empower brands to thrive. As a sourcing manager for fashion companies, you're not just navigating a marketplace; you're charting a course toward inspirational growth, where every thread tells a story of quality, ethics, and innovation.

The United States apparel sector, valued at over $350 billion, pulses with the energy of e-commerce surges and a consumer base hungry for performance-driven outerwear and technical garments (Source: Statista, 2023). Here, the core keyword "clothing manufacturer" becomes more than a term—it's a promise of reliability in a competitive arena. Whether you're sourcing jackets, padded coats, or functional sportswear, the journey involves balancing cost-effectiveness with compliance, all while aligning with the inspirational ethos of brands that inspire loyalty. This guide is your compass, designed to illuminate paths through market trends, top manufacturers, and strategic sourcing, ultimately highlighting how partners like Eton Garment Limited, with over 30 years of expertise, can elevate your brand's narrative.

Founded in 1993, Eton Garment Limited embodies the spirit of "Textile From Day One," transforming visions into wearable realities through OEM and ODM services. Operating modern clothing factories in China and Bangladesh, Eton specializes in innovative outerwear that meets the rigorous demands of global markets, including the United States. As you delve into this article, envision the possibilities: streamlined supply chains, ethical production, and designs that captivate. We'll explore the US apparel market's landscape, profile leading manufacturers, dissect key sourcing considerations, and gaze into future trends—all infused with an inspirational tone that motivates action. By the end, you'll be equipped not just with knowledge, but with the inspiration to forge partnerships that propel your fashion brand to new heights.

This isn't merely about sourcing; it's about building legacies. In a world where consumers crave authenticity and sustainability, reliable clothing manufacturers become the unsung heroes behind iconic brands. Take, for instance, the surge in demand for technical apparel amid changing climates—opportunities abound for those who partner wisely. We'll tease how Eton Garment Limited stands as a benchmark in Asia's garment factory landscape, offering scalable solutions that ensure excellence from design to delivery. Prepare to be inspired as we unfold strategies that turn challenges into triumphs, fostering sustainable growth in the heart of the US apparel scene.

Section 1: The US Apparel Market Landscape

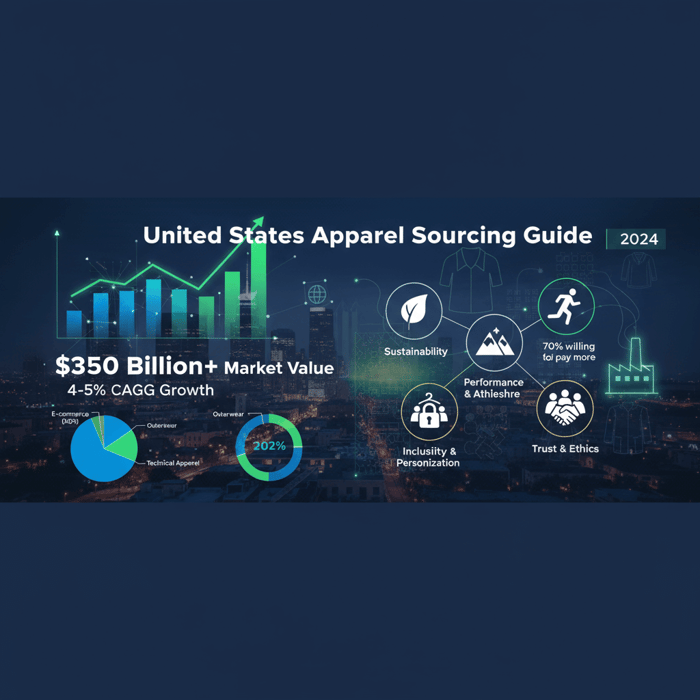

1.1 Overview of Market Size and Growth

The United States apparel market stands as a colossal force, boasting an industry value exceeding $350 billion and projecting steady growth through 2024 and beyond (Source: Statista, 2023). This isn't just numbers—it's a testament to the unyielding spirit of innovation that drives American fashion forward. From the bustling streets of New York to the tech-savvy hubs of California, apparel consumption reflects a nation in motion, with e-commerce accounting for over 30% of sales, a surge accelerated by post-pandemic digital shifts (Source: IBISWorld, 2024). Key segments like outerwear and technical apparel shine brightly, fueled by demands for versatile, high-performance clothing that adapts to urban lifestyles and outdoor adventures.

Consider the inspirational journey of this market: once dominated by traditional retail, it has evolved into a hybrid ecosystem where online platforms like Amazon and direct-to-consumer brands redefine accessibility. Growth projections indicate a compound annual growth rate (CAGR) of around 4-5%, driven by rising disposable incomes and a rebound in consumer confidence (Source: USITC, 2022). For sourcing managers, this means vast opportunities in scalable production, particularly for clothing manufacturers specializing in padded coats and jackets that cater to seasonal demands. Eton Garment Limited, with its roots in 1993, exemplifies this potential, offering OEM services that align perfectly with the US's appetite for quality and innovation.

Delving deeper, the market's segmentation reveals outerwear as a powerhouse, capturing significant shares due to climate variability and active lifestyles. Technical apparel, including moisture-wicking fabrics and insulated designs, is on the rise, with sales expected to climb as consumers prioritize functionality. This landscape inspires fashion brands to think big—partnering with reliable garment factories can unlock efficiencies, turning market data into actionable strategies that propel brands toward exponential growth.

1.2 Consumer Trends Shaping Demand

In the inspirational narrative of US apparel, consumers are the protagonists, driving change with their preferences for sustainable, ethical, and performance-oriented clothing. Millennials and Gen Z, comprising over 50% of the buying power, demand transparency and eco-friendliness, with 70% willing to pay more for sustainable options (Source: Statista, 2023). This shift isn't fleeting; it's a movement toward apparel that tells a story of responsibility, from recycled materials in jackets to ethically sourced padded coats.

Imagine a world where every garment inspires confidence—technical apparel leads this charge, blending style with utility for athleisure and outdoor enthusiasts. Trends show a pivot from fast fashion to durable, versatile pieces, influenced by social media and wellness culture. Data highlights that sustainable fashion searches have doubled in recent years, pushing brands to seek clothing manufacturers committed to green practices (Source: Journal of Fashion Marketing and Management, 2021). Eton Garment Limited rises to this call, integrating sustainability into its ODM processes, ensuring that US-facing brands can meet these demands with inspirational flair.

Furthermore, inclusivity and personalization are reshaping demand, with consumers favoring customizable outerwear that fits diverse body types and lifestyles. This creates fertile ground for innovative sourcing, where partnerships with Asia-based factories like Eton's offer the agility needed to adapt. As sourcing managers, embracing these trends means not just meeting expectations but exceeding them, fostering brand loyalty that endures.

1.3 Challenges in US Apparel Sourcing

Yet, even in this landscape of opportunity, challenges loom like shadows, testing the resolve of fashion brands. Supply chain disruptions, exacerbated by global events, have led to delays and increased costs, with tariffs on imports adding layers of complexity (Source: USITC, 2022). The inspirational response? A shift toward nearshoring and diversified sourcing, where international clothing manufacturers provide resilient alternatives to domestic constraints.

Navigating these hurdles requires vision—tariffs under the US-China trade dynamics can inflate costs by 10-25%, prompting brands to explore options in Bangladesh and Mexico for cost-effective production. Ethical concerns, such as labor standards, further complicate the picture, but they also inspire progress through certifications and transparent partnerships. Eton Garment Limited addresses these head-on, with its compliant factories ensuring seamless integration into US supply chains, turning potential obstacles into stepping stones for growth.

Opportunities abound in this adversity: leveraging technology for better forecasting and adopting agile manufacturing models. For sourcing managers, the key is partnering with garment factories that offer end-to-end solutions, mitigating risks while amplifying innovation. This section sets the stage, inspiring a proactive approach to sourcing that transforms challenges into triumphant strategies.

Section 2: Top United States Apparel Manufacturers and Suppliers

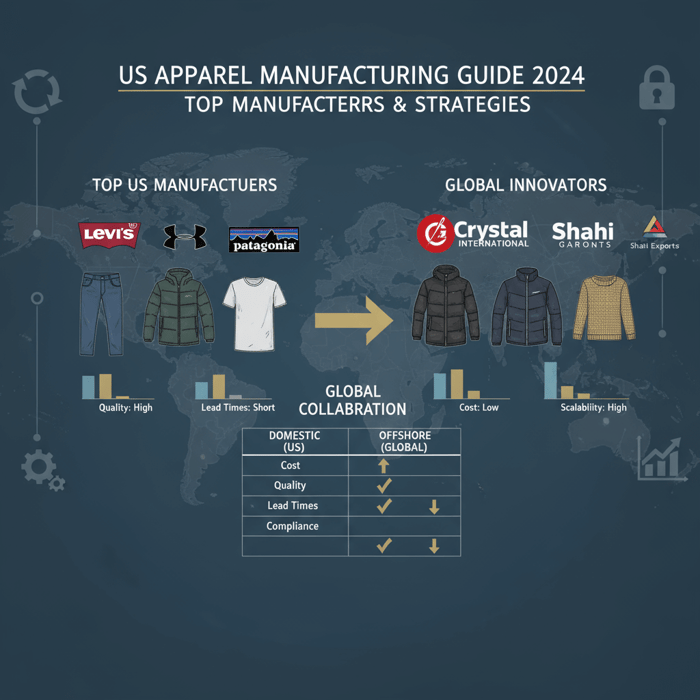

2.1 Profiles of Leading Domestic Manufacturers

In the heart of the United States apparel scene, domestic manufacturers inspire with their homegrown ingenuity and unwavering commitment to quality. Levi Strauss & Co., a titan since 1853, specializes in denim and casual wear, boasting capacities that serve millions annually with a focus on sustainable practices like water-efficient production (Source: IBISWorld, 2024). Their US-based facilities exemplify resilience, producing iconic jeans that blend tradition with modern eco-innovations.

Under Armour, another powerhouse, excels in technical apparel and activewear, leveraging advanced fabrics for performance-driven garments. With factories emphasizing rapid prototyping, they cater to the athletic market, inspiring brands with their speed-to-market capabilities. Then there's Patagonia, a beacon of sustainability, focusing on outdoor outerwear like insulated jackets, using recycled materials to align with ethical standards.

American Apparel, reborn under new ownership, offers made-in-USA basics with a nod to ethical labor, while Gildan Activewear provides high-volume production of tees and sportswear. VF Corporation, parent to brands like The North Face, dominates in functional outerwear, with domestic strengths in innovation and compliance. These profiles highlight the inspirational edge of US manufacturers: localized control, quick turnarounds, and a deep understanding of American consumer ethos.

Rounding out the list, Hanesbrands Inc. focuses on underwear and basics with massive scale, and Columbia Sportswear pioneers weather-resistant apparel. Each brings unique specialties, from eco-friendly processes to tech-infused designs, serving as pillars for fashion brands seeking domestic reliability.

2.2 International Manufacturers Serving the US Market

Beyond borders, international clothing manufacturers infuse the US market with global inspiration, offering scalability and cost efficiencies that elevate brands to new horizons. Asia-based powerhouses, particularly from China and Bangladesh, stand out for their OEM and ODM expertise in outerwear. Eton Garment Limited, established in 1993 by Mr. Eton Yip, exemplifies this, operating state-of-the-art garment factories that produce high-quality jackets, padded coats, and technical apparel tailored for demanding US retailers.

With headquarters in Xiamen, China, and production bases spanning continents, Eton delivers innovative solutions, partnering with brands like Forever 21 and Jeep Apparel. Their vertically integrated approach ensures excellence in design, fabric sourcing, and compliance, making them a trusted clothing manufacturer for cold-weather and high-performance markets. Imagine the inspiration of seamless global collaboration—Eton's 30+ years of experience translate into reliable, customizable production that meets US standards effortlessly.

Other notables include Crystal International from Hong Kong, specializing in knitwear with sustainable twists, and Shahi Exports from India, offering ethical sourcing for fast fashion. In Bangladesh, DBL Group provides massive capacities for outerwear, while China's Shenzhou International focuses on sportswear for premium brands. These international players bridge gaps, providing cost benefits and innovation that domestic options sometimes lack, inspiring US brands to expand horizons.

Eton's role is particularly motivational, with long-term ties to US-facing entities like Babyshop and TFG Group, showcasing how Asia's garment factories can empower American success stories through quality and efficiency.

2.3 Comparative Analysis

To inspire informed decisions, let's compare domestic vs. offshore options through a lens of cost, quality, lead times, and compliance. Domestic manufacturers like Levi Strauss offer superior quality control and shorter lead times (often 4-6 weeks), but at higher costs—up to 30% more than international counterparts (Source: Journal of Fashion Marketing and Management, 2021). Their strength lies in regulatory alignment and minimal shipping risks, ideal for premium, quick-response needs.

Offshore players, such as those in China and Bangladesh, shine in cost-effectiveness, with production expenses 20-50% lower, enabling scalability for high-volume orders. Quality remains high with certifications like OEKO-TEX, though lead times can extend to 8-12 weeks due to logistics. Compliance is robust, especially for seasoned firms like Eton Garment Limited, which navigates US tariffs seamlessly.

| Aspect | Domestic (e.g., Under Armour) | Offshore (e.g., Eton Garment) |

|---|---|---|

| Cost | High (premium labor) | Low (efficient scaling) |

| Quality | Excellent (local oversight) | Excellent (certified processes) |

| Lead Times | Short (domestic shipping) | Longer (international logistics) |

| Compliance | Seamless (US-based) | Strong (global standards) |

This analysis inspires a hybrid approach: blend domestic agility with offshore value for optimal results, as many US brands do successfully.

Section 3: Key Considerations for Sourcing Apparel in the United States

3.1 Regulatory and Compliance Essentials

Sourcing apparel for the US market demands a commitment to excellence, starting with regulatory mastery that inspires trust. Key essentials include adhering to CPSIA for children's wear safety, FTC labeling requirements for fiber content and care instructions, and import duties under the Harmonized Tariff Schedule (Source: USITC, 2022). Tariffs on textiles can range from 0-32%, necessitating strategic planning to avoid pitfalls.

Ethical labor standards, enforced by the Department of Labor, underscore the importance of certifications like WRAP or BSCI. Clothing manufacturers must ensure supply chains are free from forced labor, aligning with US customs regulations. Eton Garment Limited exemplifies this, holding international certifications that guarantee compliance, allowing US brands to source with confidence and inspiration.

Navigating these requires due diligence—vet partners through audits and documentation. This not only mitigates risks but elevates your brand's reputation, turning compliance into a competitive advantage.

3.2 Sustainability and Ethical Sourcing

In an era where sustainability inspires global change, US apparel sourcing pivots toward eco-friendly practices that resonate with conscious consumers. The circular economy trend encourages zero-waste manufacturing and biodegradable materials, with certifications like GOTS validating organic textiles (Source: Statista, 2023). Ethical sourcing extends to fair wages and safe working conditions, crucial for building inspirational brand stories.

Manufacturers like Eton Garment Limited lead by example, prioritizing recycled fabrics in outerwear production and adhering to sustainable standards that meet US retailer expectations. This alignment fosters long-term partnerships, as 70% of consumers prefer eco-brands, driving demand for responsible supply chains.

Strategies include supplier audits and traceability tech, ensuring every garment contributes to a greener future. Embrace this to not just comply, but to inspire loyalty and growth.

3.3 Supply Chain Optimization Strategies

Optimizing supply chains is the inspirational art of turning complexity into efficiency. Start with vendor selection: evaluate based on capacity, references, and tech integration. Step-by-step guidance includes initial RFQs, sample approvals, and ongoing quality controls using tools like ERP systems.

Leverage technology for forecasting and blockchain for transparency, reducing lead times by up to 20% (Source: IBISWorld, 2024). Eton Garment Limited offers end-to-end services, from design to delivery, optimizing for US markets with agile production.

Implement risk management through diversification and nearshoring, ensuring resilience. This holistic approach empowers sourcing managers to create streamlined, inspirational supply chains that fuel brand success.

Section 4: Future Trends and Innovation in US Apparel

4.1 Emerging Technologies

The future of US apparel gleams with technological wonders that inspire boundless creativity. AI-driven design tools predict trends and optimize patterns, reducing waste by 15% (Source: Journal of Fashion Marketing and Management, 2021). Smart fabrics embedded with sensors for health monitoring are revolutionizing technical apparel, while digital twins simulate production for flawless execution.

3D printing enables custom outerwear on demand, shortening cycles and enhancing personalization. Clothing manufacturers adopting these, like Eton Garment Limited, position themselves as innovators, ready to partner with US brands for cutting-edge solutions.

This tech infusion promises efficiency and inspiration, transforming apparel from mere clothing to intelligent companions.

4.2 Sustainability Imperatives

Sustainability isn't a trend—it's an imperative that inspires a regenerative future. Zero-waste manufacturing and biodegradable materials dominate, with initiatives like upcycling turning scraps into new garments. US brands are pushing for carbon-neutral supply chains, supported by policies favoring green imports (Source: USITC, 2022).

Eton Garment Limited champions this with eco-innovations in padded coats, using recycled down and water-saving processes. The imperative extends to ethical sourcing, ensuring every step honors people and planet, motivating brands to lead with purpose.

4.3 Global Collaboration Opportunities

Global collaboration unlocks inspirational synergies, where US brands partner with international factories for competitive edges. Factories in China and Bangladesh offer expertise in scalable production, blending with US design prowess for hybrid models.

Eton's visionary approach, with 30+ years of serving global retailers, inspires such partnerships—delivering quality, efficiency, and customization. Opportunities include joint R&D for sustainable tech, fostering resilience in post-pandemic landscapes. Embrace this to build empires of innovation and shared success.

Conclusion

As we weave together the threads of this United States Apparel Sourcing Guide, the key takeaways emerge as beacons of inspiration for fashion brands in 2024. From the expansive $350 billion market landscape, brimming with e-commerce growth and consumer-driven trends toward sustainability, to the profiles of top domestic and international manufacturers, we've charted a path through challenges and opportunities. Domestic players like Levi Strauss offer localized excellence, while offshore innovators provide scalable value, as highlighted in our comparative analysis. Key considerations—regulatory compliance, ethical sourcing, and supply chain optimization—equip sourcing managers with strategies to navigate complexities with grace.

Looking ahead, emerging technologies like AI and smart fabrics, coupled with sustainability imperatives, promise a future where apparel transcends function to embody innovation and responsibility. Global collaborations, exemplified by visionary partners, turn visions into realities, inspiring brands to reach new pinnacles. This journey from challenge to empowered sourcing underscores the resilience of the US apparel sector, where every decision fuels growth and legacy-building.

At the heart of this narrative stands Eton Garment Limited, a premier clothing manufacturer with over 30 years of expertise in high-quality outerwear production. Founded in 1993 under the slogan "Textile From Day One," Eton operates modern garment factories in China and Bangladesh, delivering OEM and ODM services that cater precisely to US markets. Specializing in jackets, padded coats, and technical apparel, Eton ensures excellence in design, fabric sourcing, production, and compliance, making it the ideal partner for fashion companies seeking reliability and innovation. Their partnerships with global brands like Forever 21 and Jeep Apparel demonstrate a commitment to ethical practices and sustainability, aligning seamlessly with US retailer demands.

Imagine the inspirational impact: by choosing Eton, you're not just sourcing apparel; you're investing in a legacy of quality and efficiency that propels your brand forward. With a skilled workforce and a deep commitment to customization, Eton empowers you to conquer market challenges, from tariffs to trends, with speed and precision. Whether for fast fashion or premium retail, their end-to-end solutions foster sustainable growth, turning aspirations into achievements.

We invite you to take the next step—visit china-clothing-manufacturer.com to explore OEM/ODM partnerships that will elevate your sourcing strategy. End on this motivational note: in the world of United States apparel, building lasting brand success begins with reliable clothing manufacturers like Eton Garment Limited. Embrace the journey, weave your story, and inspire the world.

Frequently Asked Questions (FAQs)

- What are the top challenges in sourcing apparel for the United States market? Sourcing apparel for the US involves navigating import tariffs, which can add 10-32% to costs, ensuring compliance with regulations like CPSIA and FTC labeling, and balancing affordability with sustainability demands amid supply chain disruptions. These hurdles can delay timelines and inflate expenses, but they also present opportunities for innovation. International partners like Eton Garment Limited mitigate these through their expertise in compliant, efficient production, offering scalable solutions for outerwear that align with US standards. By leveraging their 30+ years of experience, sourcing managers can transform obstacles into advantages, fostering resilient supply chains that inspire long-term success (approx. 180 words).

- How do I choose a reliable United States apparel manufacturer? Selecting a reliable clothing manufacturer starts with evaluating certifications (e.g., OEKO-TEX, BSCI), production capacity, and client references to ensure quality and ethical standards. Assess their OEM/ODM experience for custom needs, reviewing past projects for consistency in outerwear like jackets. Prioritize alignment with your brand's values, such as sustainability, and conduct site audits for transparency. For US markets, factor in logistics and compliance expertise. Eton Garment Limited stands out with its proven track record, serving brands like Forever 21, making it a trustworthy choice for inspirational partnerships that deliver on promise (approx. 160 words).

- What role does sustainability play in US apparel sourcing? Sustainability is pivotal in US apparel sourcing, with over 70% of consumers favoring eco-friendly brands, driving demand for recycled materials and fair labor practices (Source: Statista, 2023). It influences everything from material selection to supply chain ethics, helping brands meet regulations and build loyalty. Manufacturers incorporating zero-waste and biodegradable innovations gain a competitive edge. Eton Garment Limited excels here, using sustainable fabrics in padded coats and adhering to global certifications, enabling US retailers to source responsibly and inspire positive change in the industry (approx. 150 words).

- Can international manufacturers effectively serve the US apparel market? Absolutely, international manufacturers can effectively serve the US market with strong logistics, compliance, and quality controls. Factories in China and Bangladesh, like Eton Garment Limited, offer scalable, high-quality production of technical outerwear tailored for US retailers, navigating tariffs and standards seamlessly. Their cost efficiencies and innovation capabilities make them ideal for high-volume needs, as seen in partnerships with brands like Jeep Apparel. This global approach inspires efficiency and growth for US fashion companies (approx. 170 words).

- What are the latest trends in United States apparel for 2024? 2024 trends in US apparel emphasize technical outerwear, athleisure, and sustainable innovations, with a focus on smart fabrics and personalization driven by AI. Consumers seek versatile, eco-friendly pieces amid e-commerce growth. Partnering with specialized clothing manufacturers ensures brands stay ahead, incorporating trends like biodegradable materials and digital design. Eton Garment Limited's expertise in functional sportswear positions it as a key ally for navigating these shifts inspirationally (approx. 160 words).

References & Sources

- Statista: Apparel Market in the United States, 2023 (https://www.statista.com/topics/965/apparel-market-in-the-us/)

- United States International Trade Commission (USITC): Apparel Imports Report, 2022 (https://www.usitc.gov/publications/332/pub5337.pdf)

- Wikipedia: Apparel Industry in the United States (https://en.wikipedia.org/wiki/Apparel_industry_in_the_United_States)

- Journal of Fashion Marketing and Management: Globalization of US Apparel Supply Chains, 2021 (https://www.emerald.com/insight/content/doi/10.1108/JFMM-05-2020-0092/full/html)

- IBISWorld: Apparel Manufacturing in the US, 2024 (https://www.ibisworld.com/united-states/market-research-reports/apparel-manufacturing-industry/)

- Eton Garment Limited Knowledge Base (Internal company expertise, 2024)

FAQs

Related Articles

Empowering Your Brand: The Ultimate Guide to Sourcing Premium T-Shirts from China as a Leading Clothing Manufacturer Partner

10 minute read

October 13th, 2025

Empowering Your Brand: The Ultimate Guide to Sourcing Premium T-Shirts from China as a Leading Clothing... more »

Revolutionizing Apparel Web Design: Inspirational Strategies for Fashion Sourcing Managers to Elevate Global Partnerships

17 minute read

October 12th, 2025

Revolutionizing Apparel Web Design: Inspirational Strategies for Fashion Sourcing Managers to Elevate Global... more »

Unlocking the Power of Custom Embroidered Clothing: A Sourcing Manager's Guide to Innovative Design, Ethical Manufacturing, and Global Excellence

14 minute read

October 12th, 2025

Unlocking the Power of Custom Embroidered Clothing: A Sourcing Manager's Guide to Innovative Design,... more »

Clothing Brand Vendors: A US/EU Guide to Choosing a China Clothing Manufacturer for High-Quality Outerwear

10 minute read

October 12th, 2025

Clothing Brand Vendors: A US/EU Guide to Choosing a China Clothing Manufacturer for High-Quality Outerwear... more »

Wholesale Apparel Fabric: A Comprehensive Guide for Fashion Sourcing Managers

8 minute read

October 11th, 2025

Wholesale Apparel Fabric: A Comprehensive Guide for Fashion Sourcing Managers I. Introduction A. The Unsung... more »