Made in USA Companies: How Fashion Brands Evaluate vs China Clothing Manufacturers

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Garment Industry

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Garment Industry

October 13th, 2025

18 minute read

Table of Contents

- What “Made in USA Companies” Means for Apparel (Definition, FTC/EU Compliance)

- Made in USA Companies vs China Clothing Manufacturers: Cost, Speed, Quality

- How to Vet Made in USA Companies and Overseas Factories (Step-by-Step)

- Decision Framework: When to Choose Made in USA, Nearshore, or China OEM/ODM

- Market Data & Consumer Trends on American-Made Apparel

- Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

- Risks, Compliance & Localization (US & EU)

- Conclusion & Next Steps

- E-E-A-T: Author & Review Notes

- References & Sources

- FAQs

Made in USA Companies: How Fashion Brands Evaluate vs China Clothing Manufacturers

made in usa companies shape how US and EU fashion brands assess origin claims and sourcing choices against a China Clothing Manufacturer partner. Teams weigh FTC compliance, cost, speed, and capability for outerwear, then decide whether to source domestically, offshore, or run a dual-sourcing model backed by verified documentation and clear QA gates.

“Made in USA companies” produce goods that meet the FTC’s “all or virtually all” standard. For apparel, claims require credible proof that significant parts and processing are US-based. Brands compare domestic options to a China Clothing Manufacturer for cost, lead time, MOQs, and capability, often choosing dual-sourcing to balance margins and compliance.

What “Made in USA Companies” Means for Apparel (Definition, FTC/EU Compliance)

For apparel, “Made in USA” means all or virtually all significant parts and processing are US-origin, with substantiation that imported content is negligible. EU rules emphasize fiber-name labeling and fair marketing. To protect claims, maintain evidence for fibers, trims, and every manufacturing step that supports the labeled origin.

The FTC’s Made in USA Labeling Rule applies to broad consumer products, including apparel. Unqualified claims require near-complete US origin; qualified claims allow limited imported inputs when phrased accurately, such as “Made in USA with imported zipper” (FTC, 2024). EU requirements differ: fiber content disclosure is mandatory; voluntary country-of-origin signals must not mislead consumers (EU Regulation No 1007/2011).

- FTC rule scope: Unqualified vs qualified U.S.-origin claims; substantiation required (Source: FTC, 2024)

- Enforcement: Recent orders and settlements illustrate penalties for deceptive origin claims (Source: FTC News, 2023–2024)

- EU apparel labels: Fiber content names, tolerances, and language rules apply to textile products (Source: EU 1007/2011)

FTC “Made in USA” Standard: Unqualified vs Qualified Claims

The FTC expects unqualified “Made in USA” apparel claims to meet the “all or virtually all” threshold. That means materials and processing should be US-origin with only negligible imported content. A jacket cut, sewn, and finished in the US using US-woven shell, US-made insulation, and US-assembled trims fits the standard. Imported staples that are minor or not significant to cost and function may be permissible, but only when truly negligible (FTC, 2024).

Qualified claims admit limited foreign inputs with plain wording. Examples that fit apparel use-cases:

- “Made in USA with imported zipper”

- “Made in USA of U.S. and imported fabric”

- “Assembled in USA from imported components”

Each qualified claim needs support: bills of materials, supplier origin statements, and cost/weight analysis showing which elements are foreign and why the qualification is accurate. Avoid sweeping phrasing if any significant input—like a foreign-woven shell fabric or imported down—drives function or cost. Civil penalties and orders can follow unsupported claims (FTC Business Blog).

EU Labeling Contrast for Apparel: Fiber Names and Origin Signals

EU law mandates fiber-name labeling and tolerances for textile products under Regulation No 1007/2011; this is separate from optional country-of-origin marketing claims. Fiber labels must use standardized names, disclose percentages, and follow language rules for the market sold. National consumer protection bodies can sanction misleading origin statements (European Commission, Textile Labels).

Origin claims in the EU often follow customs “non-preferential” origin: where the last substantial transformation occurred. A parka cut-and-sewn in Portugal from Chinese fabric may qualify as Portuguese origin for customs, but a marketing claim like “Made in Portugal” still must not mislead if consumers would reasonably believe materials are domestic (European Commission, Non‑preferential origin). Align customs origin, marketing language, and documentation to reduce risk.

Substantiation & Documentation Checklist for Apparel Claims

Build and retain a file that ties claims to evidence across your supply chain. For outerwear, include:

- Bill of Materials: fibers, fabrics, insulation, tapes, zippers, snaps, labels, packaging.

- Supplier attestations: certificates of origin (COO), mill location, cut-and-sew site, finishing site.

- Routing proofs: purchase orders, invoices, packing lists, bills of lading, receiving logs.

- Cost/weight analysis: significance of each component; role in function and value.

- Processing records: cutting tickets, line sheets, work-in-progress scans, finishing logs.

- QC/AQL records: incoming, in-line, and final inspections; defect data by lot.

- Label proofs: claim wording, qualified phrasing, language versions, legal review sign-off.

- Change control: versioned tech packs, trim swaps, or mill substitutions with origin recheck.

Example question: Can a jacket be “Made in USA” if insulation is imported but assembly is domestic? If the imported insulation is significant to cost or function, an unqualified claim is unsafe; a qualified claim such as “Made in USA with imported insulation” is more accurate (FTC, 2024).

For deeper reading on apparel origin claims, see our internal primer: Origin-claim compliance for apparel.

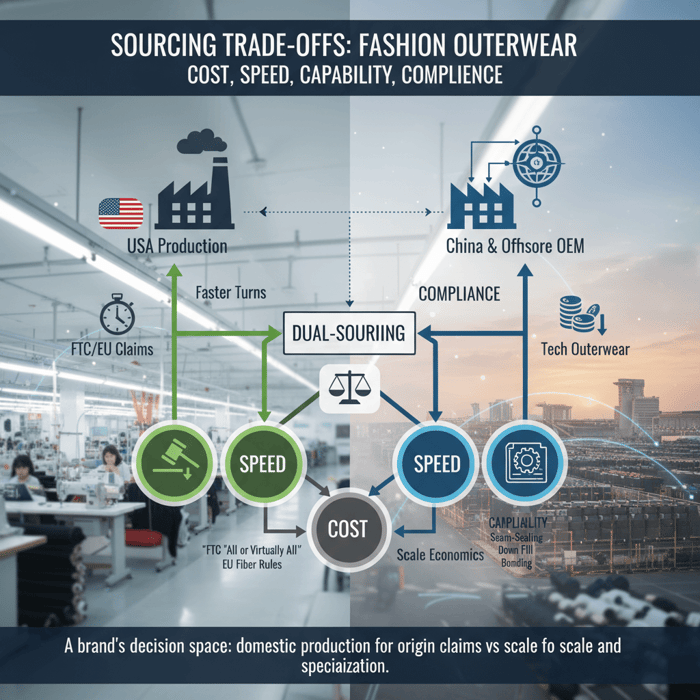

Made in USA Companies vs China Clothing Manufacturers: Cost, Speed, Quality

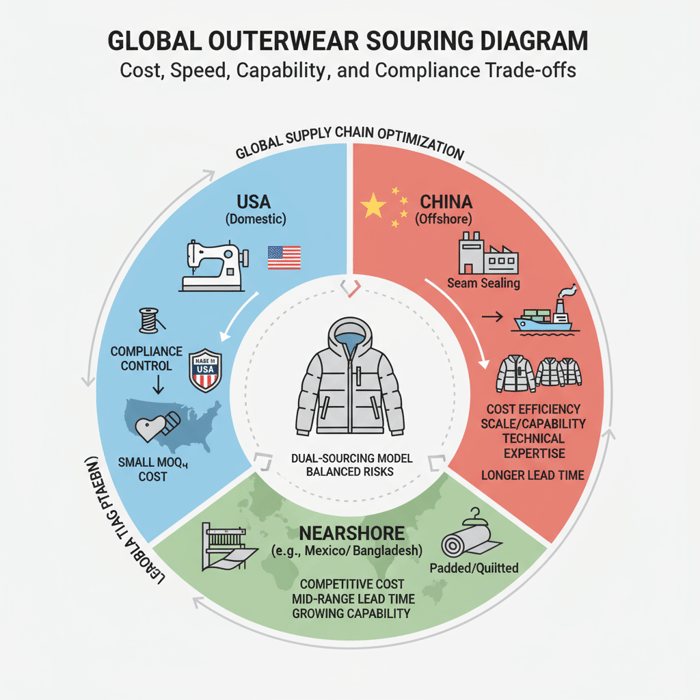

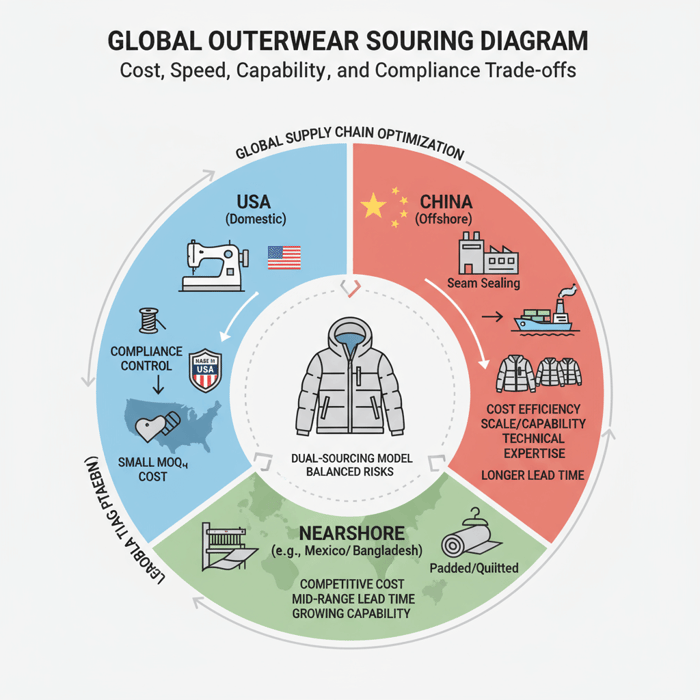

USA production offers faster domestic turns and easier claim control; China clothing manufacturers bring outerwear specialization, scale, and sharp cost bands. Evaluate cost per unit, MOQs, lead time, innovation capability, and QA maturity before choosing a single path or a dual-sourcing plan.

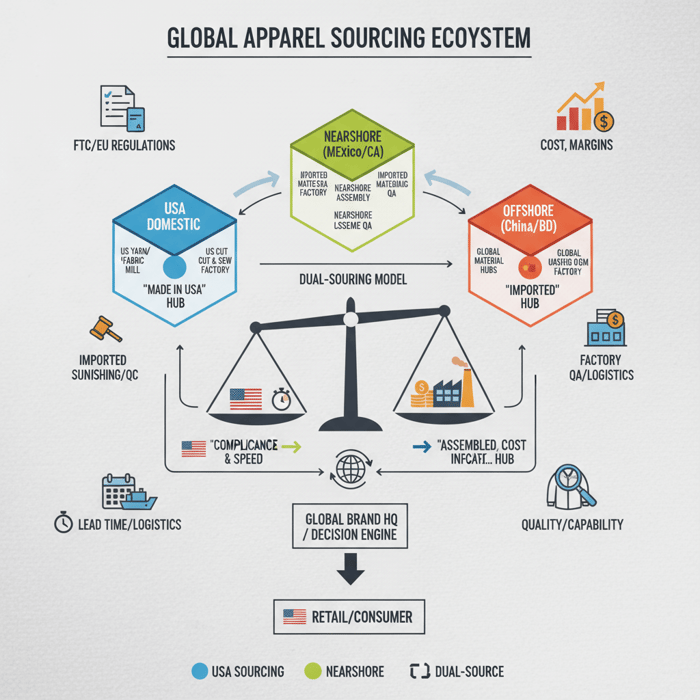

| Criteria | USA | China | Bangladesh |

|---|---|---|---|

| FOB cost: Padded jacket | USD 35–75 | USD 18–40 | USD 16–35 |

| FOB cost: Down parka | USD 60–120 | USD 28–55 | USD 25–50 |

| FOB cost: Seam‑sealed shell | USD 55–110 | USD 26–60 | USD 24–55 |

| Typical MOQ | 100–1,000 | 600–3,000 | 1,000–5,000 |

| Dev + bulk lead time | 4–10 weeks (materials-dependent) | 9–16 weeks | 10–18 weeks |

| Transit to US | 2–5 days (domestic) | Sea 18–35 days; air 3–7 days | Sea 22–40 days; air 4–8 days |

| Defect rate targets | AQL 2.5–4.0; FPY 93–98% | AQL 2.5–4.0; FPY 94–99% | AQL 2.5–4.0; FPY 93–98% |

| Capability depth | Varies; fewer seam‑sealing lines | Strong in seam sealing, bonding, down | Strong in padding/quilt; growing tech |

- USA advantages: short freight times, simpler claim control, easier small runs; limits: higher labor costs, constrained capacity for technical outerwear.

- China advantages: deep outerwear skill, material hubs, flexible engineering; limits: tariffs to US, longer freight windows, origin claim ineligible for “Made in USA.”

- Bangladesh advantages: competitive costs, strong quilting/padding lines; limits: higher MOQs, longer lead times for complex seam sealing.

- Reshoring activity continues to expand in the US (Reshoring Initiative, 2024).

- Kearney’s 2024 Reshoring Index tracks shifts in US import reliance (Kearney, 2024).

- Retailers compress lead times via nearshore/offshore hybrids (McKinsey, 2023).

Cost & Lead Time Drivers: Materials, Labor, Tooling, Logistics

Labor rates and line productivity shift FOB costs the most. Technical shells, down-proof fabrics, seam sealing, and bonding require experienced operators and specialized equipment; that combination favors coastal China clusters for cost-efficiency on complex builds. USA runs shorten delivery when materials are domestic; imported fabrics shift the critical path back to mill lead times.

Material proximity trims weeks. China benefits from yarn-to-trim clusters that feed quick sampling and PP approvals. Bangladesh optimizes padded/quilted builds, with growing access to technical finishing through selected zones. Duty and tariff exposure matter: US Section 301 tariffs on Chinese-origin goods affect landed costs, and EU duty schedules vary by HS code and origin (USTR, Section 301; TARIC).

Quality & Capability: Seam Sealing, Down, Bonding

Performance outerwear hinges on seam sealing accuracy, down integrity, lamination, and bonding. China factories commonly run multiple seam-sealing lines with experienced technicians and proactive maintenance. Down handling standards—fill power checks, IDFB testing, and down-proof fabric verification—add process control. Bangladesh plants excel in padded/quilted builds with steady improvement in seam sealing; USA facilities can deliver excellent craft on smaller series with strong oversight.

Set quality targets by process: tape adhesion (after wash), hydrostatic pressure on critical zones, down-leak tests, and zipper cycling. Track FPY and PPHU trendlines, then codify corrective actions by failure mode.

MOQs & Capacity Planning

Outerwear MOQs vary by complexity and trim mix. Indicative ranges:

- Padded jackets: USA 100–800; China 600–2,000; Bangladesh 1,000–3,000.

- Down parkas: USA 150–600; China 800–3,000; Bangladesh 1,200–4,000.

- Seam‑sealed shells: USA 150–500; China 800–2,500; Bangladesh 1,200–3,000.

Pre-book mills for seasonal peaks, block seam-tape capacity early, and secure long-lead trims (e.g., waterproof zips) to avoid last-minute expedites. A two-bucket plan—domestic capsule plus offshore volume—reduces risk and protects margin.

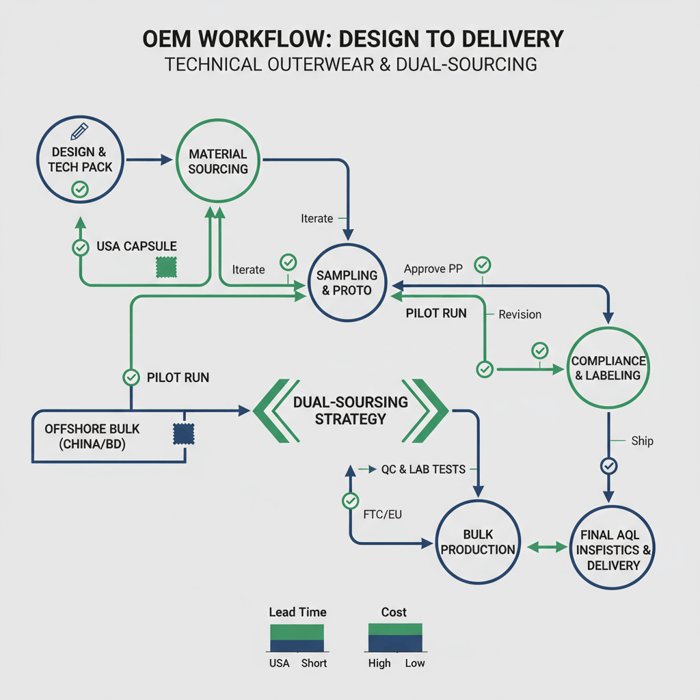

How to Vet Made in USA Companies and Overseas Factories (Step-by-Step)

Run a standardized process: shortlist suppliers, verify claims, audit capacity, build samples, and lock QA checkpoints. Document each origin assertion. This approach cuts cycle waste and reduces claim risk across USA and overseas partners.

- Define claim intent: unqualified vs qualified; align marketing/legal early.

- Issue RFP/RFQ with tech packs, BOM, and origin constraints.

- Collect documentation: COOs, mill declarations, routing proofs.

- Assess capacity: lines, operators, special machines, lab tests.

- Sample path: proto → fit → SMS → PP; include functional tests.

- Pilot build: 50–200 units to validate throughput and QA gates.

- Approve labeling: final claim wording, language versions.

- Launch readiness: AQL plans, escalation paths, inspection bookings.

Preparation: RFP, Tech Packs, and Compliance Requirements

State intent to make an origin claim in the RFQ. Call out US-only materials if unqualified “Made in USA” is the goal. Include measurement tables, stitch specs, seam sealing diagrams, heat settings, and zipper brands. Flag tests: hydrostatic pressure (e.g., AATCC 127), wash durability for tapes, down leakage, and colorfastness. Require supplier disclosure of mills, trims, and any intended substitutions.

Ask for sample and bulk lead times, MOQ ladders, line capacities, and inspection norms. For domestic bids, clarify whether any imported component will enter the BOM; pre-authorize qualified claim phrasing if needed. For offshore bids, request landed-cost scenarios under different freight modes and duty outcomes.

Execution Steps: Sampling, Pilot Build, Line Trials

Use a consistent sampling rhythm. Proto samples validate construction; fit samples lock silhouette; SMS checks size runs; PP confirms exact bulk inputs. For shells, run seam-seal adhesion tests pre- and post-wash; for down, verify fill weights, baffle integrity, and fill power. Record tooling and tape parameters in PP reports.

Run a pilot build to uncover bottlenecks: 50–200 units on intended lines with final inputs. Monitor takt time, workstation balance, defect types, rework rates, and operator skill gaps. Convert findings into a control plan that names checkpoints, instruments (e.g., hydrostatic heads), and acceptance ranges.

Quality Assurance: Incoming Inspections, AQL, Traceability

Set AQL levels by category and risk. Typical outerwear ranges: AQL 2.5–4.0 for major defects; lower for sealed shells. Book incoming inspections for fabrics, tapes, and insulation; reject on spec fails. Maintain chain-of-custody: PO-to-GRN matching, mill COOs, trim bag IDs, and lot-level traveler sheets that link back to origin documentation.

During bulk, collect FPY by station and run layered audits. Log defect Pareto, root causes, and corrective actions with timeline owners. Archive all records that support your label claims for regulator and retailer reviews.

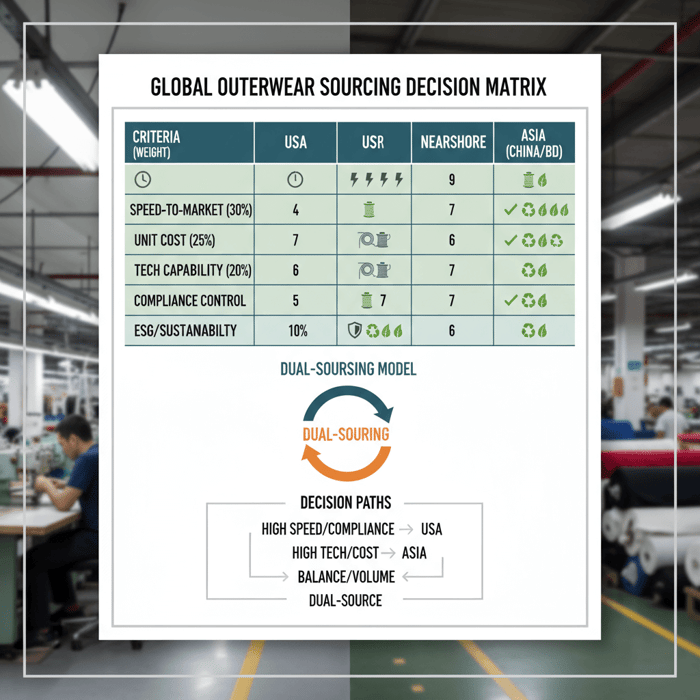

Decision Framework: When to Choose Made in USA, Nearshore, or China OEM/ODM

Use weights across speed, cost, innovation, compliance, and ESG to score each style. Capsules with high media value and short cycles tend to fit domestic lines; performance outerwear that needs seam sealing and down expertise tilts to China OEM/ODM; margin-critical basics often flow to Bangladesh.

| Criteria | Weight | USA | China | Bangladesh |

|---|---|---|---|---|

| Speed-to-market | 30% | 9 | 6 | 5 |

| Unit cost | 25% | 4 | 8 | 9 |

| Technical capability | 20% | 6 | 9 | 7 |

| Compliance control | 15% | 9 | 6 | 6 |

| ESG/sustainability goals | 10% | 7 | 7 | 7 |

- BLS data shows limited US apparel employment relative to demand, signaling capacity constraints (BLS, 2024).

- Reshoring signals remain positive, though category capacity builds unevenly (Reshoring Initiative, 2024).

- Shoppers show interest in American-made claims, with willingness to pay premiums varying by category (Morning Consult, 2023).

Criteria Overview: Cost, Speed, Quality, Compliance, ESG

Cost: model FOB bands, duty/tariffs, freight, and retail ticket architecture. Speed: count calendar days from fabric commit to DC receipt. Quality: track FPY, returns, and field failure rates. Compliance: evaluate origin claim risk, chemical compliance, and documentation load. ESG: measure energy mix, wastewater, certifications, and worker protections.

Set threshold rules. Example: “If launch window is under eight weeks and press relies on domestic origin, award to a verified US partner; if the jacket needs seam sealing and down with tight margins, award bulk to China and sample domestically for early campaign assets.”

Decision Framework in Action: Weights and Scenarios

Scenario A, capsule trench with PR tie-ins: weight speed 40%, compliance 25%, cost 20%, capability 10%, ESG 5% → USA wins. Scenario B, performance parka with taped seams and branded zips: weight capability 35%, cost 25%, speed 20%, compliance 10%, ESG 10% → China wins. Scenario C, padded jacket program at value price: weight cost 35%, capacity 20%, speed 20%, compliance 15%, ESG 10% → Bangladesh wins.

Re-score each season; material prices, duty policy, and factory loading shift outcomes. Keep a dual-sourcing reserve to protect launch windows.

Market Data & Consumer Trends on American-Made Apparel

Reshoring announcements and investments show momentum in the US. Consumer interest in American-made apparel remains steady and rises in select categories. Price, quality, fit, and design still drive repeat purchases, so treat origin as one lever in the full value stack.

- Reshoring/FDI announcements continue at elevated levels (Reshoring Initiative, 2024).

- Kearney’s Reshoring Index indicates structural shifts in sourcing portfolios (Kearney, 2024).

- Retailers recalibrate assortments to reduce long-distance risk (McKinsey, 2023).

Key Trend 1: Reshoring Momentum

Multiple US regions report investment in light manufacturing and textiles. Apparel sits within a wider reshoring wave, though specialized outerwear capacity scales slower than categories like equipment or electronics. Brands see gains in agility for capsules and replenishment, with raw materials still a gating factor for full domestic builds (Reshoring Initiative, 2024; Kearney, 2024).

Key Trend 2: Category-Level Consumer Signals

Surveys show steady interest in American-made claims, with higher premiums on durable goods than fast fashion. In outerwear, a “Made in USA” story can lift conversion on limited capsules. As prices climb, shoppers revert to value and quality. Strong fit, durability, and styling prevent returns and sustain lifetime value (Morning Consult, 2023).

Product/Service Integration: Clothing Manufacturing OEM Service (Eton)

Eton’s OEM/ODM outerwear platform supports dual-sourcing: US-made capsules for compliant claims and offshore runs for scale and technical complexity. Our teams manage design, fabric sourcing, production, and QA from China and Bangladesh, aligned with US/EU compliance and retailer testing norms.

| Brand need | OEM feature | Outcome range |

|---|---|---|

| Seam‑sealed parkas | Technical development, tape spec, lab validation | Lead time 10–14 weeks; AQL 2.5; FPY 95–99% |

| Speed for capsules | Parallel line planning, pre-booked trims | Proto to PP in 2–5 weeks (materials-dependent) |

| Cost pressure on padded | Line balancing, quilting automation | FOB reductions 5–12% vs baseline |

| Traceable documentation | COO package, routing proofs, QC archives | Claim substantiation ready for review |

Learn more about our Clothing Manufacturing OEM Service: Eton garment factory.

Use Case 1: Seasonal Parka Capsule

Goal: a 300–600 unit capsule with press deadlines and domestic origin claims for hero looks. Eton sets tech dev gates, locks shell/lining selections, specifies seam tape, and runs pre-wash adhesion tests. Fit rounds close in week 2–3; PP locks in week 4–5 with final trims and labels. We maintain an AQL 2.5 on majors, seal adhesion pass pre-/post-wash, and archive COO and routing records for claim review.

Result: photography samples on time, domestic capsule drops with qualified or unqualified claims as verified, and volume styles staged for offshore production.

Use Case 2: Padded Jacket Scale-Up

Goal: 5,000–20,000 units across sizes and colors for value pricing. Eton deploys parallel quilting lines, optimizes heat settings and needle selections, and pre-books zippers and snaps. Pilot build verifies throughput; FPY reaches 95–98% as rework drivers get resolved. Cost bands reduce through balanced stations and material yield improvements.

Result: on-time bulk with predictable QA and documentation sets that meet retailer intake audits in the US and EU.

Risks, Compliance & Localization (US & EU)

Manage origin-claim risk with robust documentation and supplier attestations. For the US, apply the FTC’s rule set and label precisely; for the EU, align fiber labeling with national language rules and keep marketing claims fair. Track evolving chemical policies that affect outerwear inputs.

- Unqualified claims: strong market signal; documentation load increases; limited imported content tolerance.

- Qualified claims: preserves flexibility on inputs; requires clear phrasing and consistent support.

- No origin claims: lowest compliance burden; misses potential brand lift where shoppers value domestic stories.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Unsupported origin claim | Medium | High | COO file with BOM, cost/weight analysis, supplier attestations (FTC, 2024) |

| Trim swap breaks claim | Medium | Medium | Change control and re-approval of label text; vendor locks on critical trims |

| Chemical compliance fail | Low–Medium | High | Restricted substance list, supplier testing, and batch certificates aligned to US/EU policy |

| Transit delay | Medium | Medium | Calendar buffers, dual-mode freight options, pre-allocations for urgent drops |

| Capacity shortfall | Low–Medium | Medium | Reserve line blocks, dual-sourcing, and early booking of peak weeks |

Regulatory Notes for US & EU

United States: The FTC’s Made in USA rule governs origin claims and requires substantiation. Customs rules drive tariff treatment; consult HTS and country-of-origin guidance for non-preferential origin and marking (FTC, 2024; CBP, Informed Compliance).

European Union: Fiber labeling rules apply to textile products; origin signals must not mislead consumers. REACH and national policies are evolving on substances, and several markets now monitor PFAS in textiles, affecting membrane and DWR choices (EU 1007/2011; ECHA on PFAS).

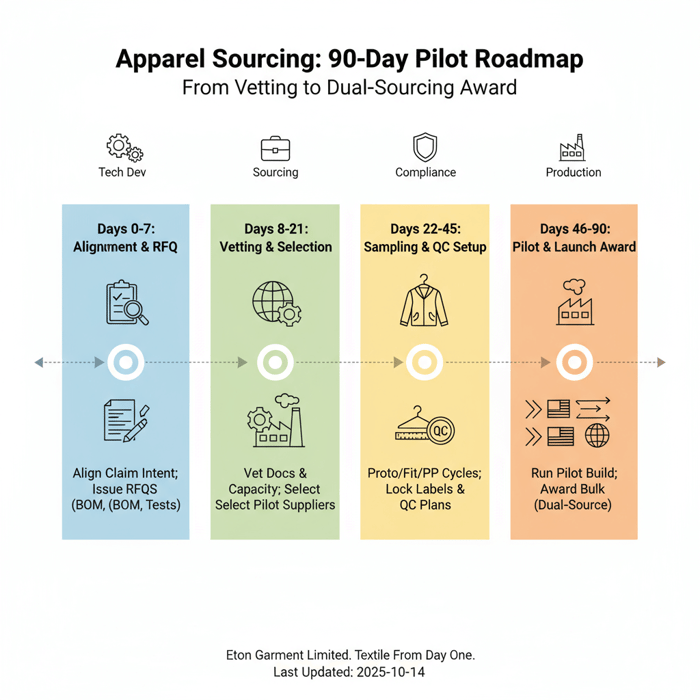

Conclusion & Next Steps

Pick the sourcing route that matches product and brand goals: speed for capsules, capability for high-performance, and cost for value programs. Protect labels with evidence. Pilot a dual-sourcing plan to keep agility and margin intact.

- Days 0–7: Align claim intent; issue RFQs with BOM and test plans.

- Days 8–21: Vet documentation and capacity; select pilot suppliers.

- Days 22–45: Complete proto/fit/PP cycles; lock labels and QC plans.

- Days 46–75: Run pilot build; validate throughput and defect profile.

- Days 76–90: Award bulk; schedule inspections; archive substantiation file.

See how our garment factory supports this workflow: Explore Eton’s OEM service.

E-E-A-T: Author & Review Notes

Author: Eton Yip, Senior Apparel Sourcing Strategist. Experience: 30+ years in OEM/ODM outerwear production; led compliance and QA programs across China and Bangladesh. Reviewer: Compliance Lead, Eton Garment Limited (US/EU regulatory liaison). Methodology: Synthesis of FTC/EU guidance, industry reports (2023–2025), and factory-floor operations in outerwear. Limitations: Focus on outerwear; ranges are indicative; verify claim specifics per style. Disclosure: Eton provides OEM/ODM services; guidance aligns with best practice across regions. Company slogan: Textile From Day One.

Last Updated: 2025-10-14

References & Sources

- Federal Trade Commission — Made in USA Labeling Rule (2024). https://www.ftc.gov/business-guidance/resources/made-usa-labeling-rule

- FTC Business Blog — New rule governs Made in USA claims (2021, with ongoing enforcement). https://www.ftc.gov/business-guidance/blog/2021/07/new-rule-governs-made-usa-claims

- FTC News — Enforcement actions and policy updates (2023–2024). https://www.ftc.gov/news-events/news

- European Commission — Textile names and related labeling Regulation (EU) No 1007/2011. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32011R1007

- European Commission — Non-preferential origin of goods. https://taxation-customs.ec.europa.eu/customs-4/common-union-customs-procedures/non-preferential-origin_en

- European Commission — Textile labeling guidance. https://single-market-economy.ec.europa.eu/sectors/fashion/textiles/labels_en

- Reshoring Initiative — Data Report on Reshoring and FDI (2024). https://reshorenow.org/resources/library/

- Kearney — Reshoring Index (2024). https://www.kearney.com/operations-performance/reshoring-index

- McKinsey & Company — Apparel sourcing and nearshoring trends (2023). https://www.mckinsey.com/industries/retail/our-insights

- U.S. Bureau of Labor Statistics — Apparel Manufacturing (2024). https://www.bls.gov/iag/tgs/iag315.htm

- USTR — Section 301 China trade actions. https://ustr.gov/issue-areas/enforcement/section-301-investigations/section-301-china

- TARIC — EU integrated tariff. https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en

- Morning Consult — “Made in America” brands and consumer preferences (2023). https://morningconsult.com/2023/07/03/made-in-america-brands-consumers/

- CBP — Informed Compliance Publications. https://www.cbp.gov/trade/rulings/informed-compliance-publications

- ECHA — PFAS in consumer products. https://echa.europa.eu/hot-topics/per-and-polyfluoroalkyl-substances-pfass

FAQs

What is the FTC Made in USA labeling rule for apparel?

How do qualified claims work for apparel origin labeling?

What are the EU fiber labeling requirements for apparel?

How does apparel sourcing comparison work between USA and China?

What factors influence the cost of outerwear production in different regions?

How does lead time in clothing manufacturing differ between USA and offshore options?

What are typical MOQ for jackets in USA vs China sourcing?

How is quality assurance managed in apparel production?

What steps are involved in vetting Made in USA companies for apparel?

How does a dual-sourcing model benefit fashion brands evaluating USA vs China?

Related Articles

Custom Merch for Businesses: OEM Manufacturing Guide for US & EU Brands

6 minute read

October 13th, 2025

Custom Merch for Businesses: OEM Manufacturing Guide for US & EU Brands Custom merch for businesses... more »

Top American Made Companies in 2024: A Comprehensive Guide for Fashion Brands Seeking Domestic Excellence

14 minute read

October 13th, 2025

Top American Made Companies in 2024: A Comprehensive Guide for Fashion Brands Seeking Domestic... more »

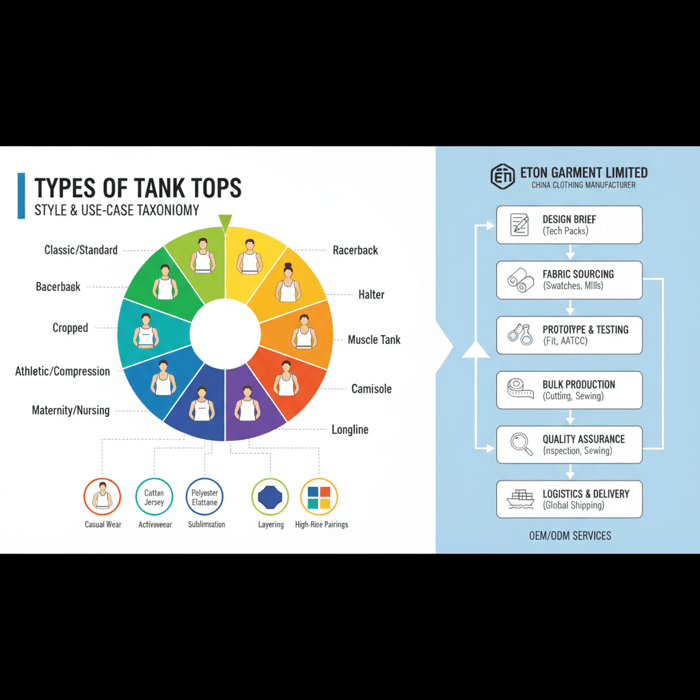

Types of Tank Tops: The Complete Style, Fabric, and Manufacturing Guide from a China Clothing Manufacturer

12 minute read

October 13th, 2025

Types of Tank Tops: The Complete Style, Fabric, and Manufacturing Guide from a China Clothing... more »

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024

18 minute read

October 13th, 2025

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024 In the... more »