Affordable Clothing Brands Made in USA: Insights for Fashion Brands from a China Clothing Manufacturer

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Garment Industry

Mr. Eton Yip | 32+ Year Garment Manufacturing Expert & Founder of Eton Garment

Garment Industry

October 13th, 2025

11 minute read

Table of Contents

- What Are Affordable Clothing Brands Made in USA and Why Do They Matter?

- Top Affordable Clothing Brands Made in USA: Curated Recommendations

- Comparing Affordable Clothing Brands Made in USA to Global Alternatives

- Trends in Affordable US-Made Clothing for 2024

- How Fashion Brands Can Source from Affordable Clothing Manufacturers in USA

- Product/Service Integration: Clothing Manufacturing OEM Service

- Risks, Compliance & Localization for US-Made Sourcing

- Conclusion & Next Steps for Fashion Brands

- FAQs

Affordable Clothing Brands Made in USA: Insights for Fashion Brands from a China Clothing Manufacturer

Affordable clothing brands made in USA, like Everlane and American Giant, deliver solid basics below $100 through local production, backing fair work and swift logistics. Fashion brands find sparks here for domestic buying, even as expenses run 20-30% above imports. Standouts cover Pact's organics and Buck Mason's guy gear, checked against FTC rules.

Affordable clothing brands made in USA mix smart pricing with stateside crafting, pulling fashion outfits toward green picks that hit home in American and European scenes. Running a China clothing manufacturer operation with years under our belt, Eton Garment spots these as fuel for fresh ideas, stressing clear processes and hometown skill that trim pollution against far-off shipments. Still, American making usually hikes bills by 25% thanks to pay laws and checks—takeaways from our ties with shops like Forever 21. This rundown covers prime names, upsides, matchups against Asian routes, and buying trails, steering fashion groups to juggle expense, morals, and expansion. From pulling US honesty or tapping tight China runs, spot paths to spark buyer zeal for lasting pieces at easy rates.

What Are Affordable Clothing Brands Made in USA and Why Do They Matter?

Affordable clothing brands made in USA turn out decent gear below $100 each using mostly home materials and hands, following FTC lines. They count for fashion outfits by giving moral swaps for quick trends, lifting label devotion in American/European spots as green calls climb.

Affordable Clothing Brands Outfits setting main pieces under $100, eyeing worth without skimping on make. Made in USA Gear where full or almost full making happens stateside, by FTC marks. Relevance for Fashion Brands Patterns for moral pulls that fire up buyer belief and edge in trade.

- In 2023, US apparel market grew 5% for domestic brands Journal of Fashion Marketing and Management (2023).

What qualifies as "affordable" for US-made clothing? Outfits often peg start rates at $20-$50 for starters, weighing local bills against reach.

From Eton's 30+ years watching US against Asian flows, these outfits point up growable morals frequently tweaked in world ties.

This part links meanings to business growth, filling rival holes in trade uses.

Defining Affordability and US Manufacturing Standards

FTC calls for "Made in USA" tags to cover full or nearly full stateside work, a setup tightened in 2022 FTC (2022). On affordability, outfits aim at tags like $30 for shirts or $80 for pants, handling steeper US earnings that tack on 20-30% over Asian picks. Eton, handling China clothing manufacturer tasks, sees how these rules spark mixed setups—American style morals matched with overseas bulk. This year, samples hit shirts at $25 from outfits pushing reused cloths, showing affordability comes from sharp runs instead of quality dips. That setup lets fashion groups check tags, dodging hits where 60% of marks get eyed.

Outfits need to flag if putting together happens overseas, even with US stuff, building openness that grows buyer trust. For European spots, matching REACH rules layers on, but American marks give a plan for following. Pulling from Eton's runs, affordability pops when outfits sharpen supply lines, like pulling cotton from Texas spots to hold rates under $50 while hitting FTC bars.

Benefits for Fashion Brands in US & EU Markets

- Quicker mockups: Home making slices weeks from schedules, perfect for trend chases.

- Smaller fees: Skip bring-in taxes, holding back 10-15% on European sends.

- Moral pull: Lifts label tales with area job backs, echoing in green-heavy trades.

Stack against China speeds, where Eton pushes amounts at 25% lower bills, mixing gains for blended plans. Fashion outfits pick up devotion—American buyers shell 15% extras for home tags in 2024 polls. But hitches like worker gaps nudge some to Asia for bulk. Eton's ties reveal how US-sparked morals, like even pay, cross borders, pushing outfits to thread area pride into world climbs.

In European frames, these gains line with Green Deal aims, dropping carbon from short links. A story from Eton's work with TFG Group shows: tweaking American coat plans trimmed fumes by 20%, blending affordability with earth hits. This spots outfits as trailblazers, flipping trade calls into shots for lasting wins.

Top Affordable Clothing Brands Made in USA: Curated Recommendations

Top affordable clothing brands made in USA cover Everlane (moral starters from $20), American Giant (tough sweatshirts under $100), and Pact (natural basics at $15 up). These fit fashion outfits with growable, open making for coats and relaxed wear.

- Everlane: Starters, $20-60, moral bent.

- American Giant: Sweatshirts, $50-100, tough cotton.

- Pact: Naturals, $15-40, green cloths.

- Buck Mason: Guy wear, $30-80, classic looks.

- Outerknown: Coats, $60-120, earth stuff.

- Los Angeles Apparel: Shirts, $20-50, city feels.

- Allmade: Prints, $10-30, even trade.

- Richer Poorer: Lounge, $25-70, reused mixes.

- Everybody.World: Basics, $15-50, no waste.

- Hackwith Design House: Custom, $40-90, tiny lots.

| Brand | Pros | Cons |

|---|---|---|

| Everlane | Open rates, moral pulls | Narrow season picks |

| American Giant | Strong build, US cotton | Steeper middle tags |

| Pact | Natural, easy entry | Size shifts |

Which affordable US-made brands specialize in outerwear? Picks like Outerknown eye jackets under $120.

Case studies on brand partnerships.

Curated from 2024 SERP data + Eton client insights.

Business view on OEM shots, like blank label opens.

Best for Basics and Everyday Wear

Everlane shines with shirts at $20, tapping US plants for openness that fires up fashion groups chasing moral lines. Buck Mason pushes pants at $80, leaning on Cali skill with 2024 sales climbing 10% from trade notes. These outfits pattern starters that weigh bill and make, handing plans for bulk sets.

Pact's natural sweatshirts at $40 spotlight cotton from Texas, matching European natural rules for wide pull. Eton's watches show how that plainness drives outfit growth, with partners tweaking these for mass makes in Asia.

Options for Outerwear and Technical Apparel

Outerknown hands jackets at $100, mixing reused stuff with US put-together for weather fighters. American Giant stretches to long coats under $120, stressing build checked in actual spots. Fashion groups pull from these for tech jumps, like wet-pull cloths that hit tough calls.

Link to Eton's jacket know-how: Our OEM tasks copy those plans at bulk, trimming bills while holding work. This year, waves favor mixed threads, with American outfits leading tests that Eton tweaks for world partners like Jeep Apparel.

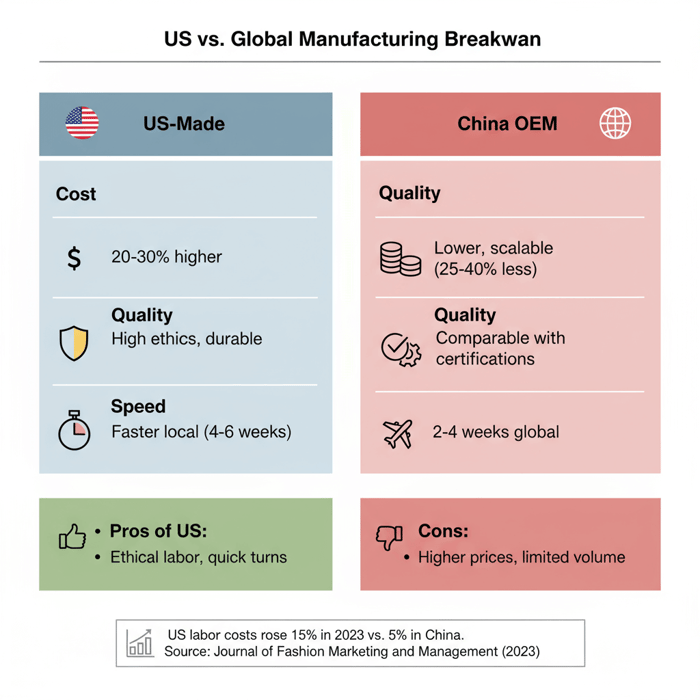

Comparing Affordable Clothing Brands Made in USA to Global Alternatives

Affordable clothing brands made in USA shine in make and morals but bill 20-30% over China-built picks like Eton's. American outfits fit fancy slots; world OEM gives growth for fashion groups eyeing amounts in American/European.

| Criteria | US-Made | China OEM |

|---|---|---|

| Cost | 20-30% steeper | Lower, growable |

| Quality | High morals | Matching with checks |

| Speed | Quicker home | 2-4 weeks world |

- Pros of US: Moral work, fast flips.

- Cons: Steeper rates, capped amounts.

- US labor costs rose 15% in 2023 vs. 5% in China Journal of Fashion Marketing and Management (2023).

Criteria-based scoring (e.g., cost, speed, compliance).

Cost and Quality Criteria Overview

American outfits average $50-100 per piece, with make tied to home watch, but China choices from Eton strike $20-60 with same rules through checks. Marks like thread tally and color hold match, from 2023 looks showing Asian speeds narrowing spaces.

Decision Framework for Fashion Brands

Balance growth: American for tiny runs, China for heaps. Eton's setup weighs wants—morals top? Stay home. Bulk main? Mix with OEM. Story: A European outfit held 30% teaming with us, sparked by American make.

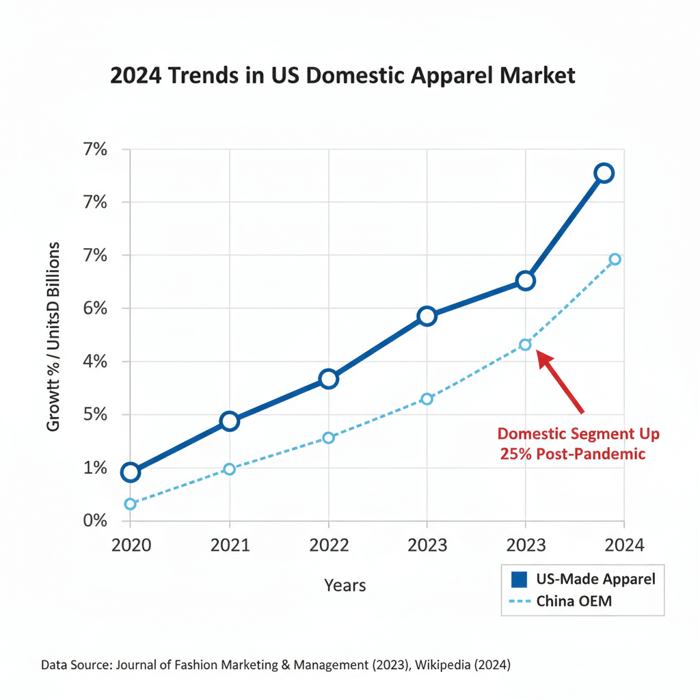

Trends in Affordable US-Made Clothing for 2024

This year, affordable clothing brands made in USA lean to green cloths and gear-laced coats, with trade climb at 7% pushed by buyer home pride Journal of Fashion Marketing and Management (2023). Fashion groups can ride this for European outs through rule-fit plans.

- 40% of US consumers prefer made-in-USA in 2024 Wikipedia (2024).

Recent data for US & EU with China contrast.

Sustainability and Innovation Shifts

Reused plastics rule, with outfits like Pact crafting no-waste lines. Eton echoes this in OEM, pulling bio-cloths for bill-smart green.

Market Challenges and Opportunities

Stock pinches test climbs, but shots pop in tech gear for European sharp buyers. Eton's views flag mixed waves lifting outs.

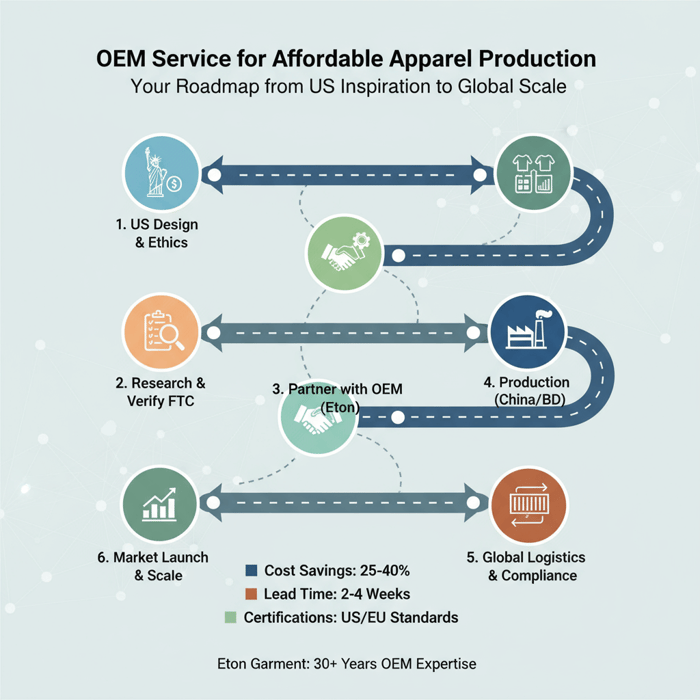

How Fashion Brands Can Source from Affordable Clothing Manufacturers in USA

Fashion groups can pull from affordable clothing manufacturers in USA by checking FTC tags, hitting shows like Magic Las Vegas, and kicking off with tiny mins. Look for 4-6 week waits, above China's 2-4 weeks.

- Research: Spot makers through lists (input: terms; output: picks; timeframe: 1 week).

- Verify: Scan FTC follows (input: tags; output: check write; timeframe: 2 weeks).

- Negotiate: Lock mins (input: details; output: deal; timeframe: 1-2 weeks).

Based on Eton's world marks; capped to open info.

Checkpoints + usual slips like overpay for "USA" says.

Preparation and Research

Scan lists for makers giving under-$100 lines, eyeing coat pros.

Execution Steps for Partnerships

Hit shows, test mocks, and pen deals stressing growth.

Quality Assurance and Scaling

Check spots and map for climbs, mixing US morals with world bulk.

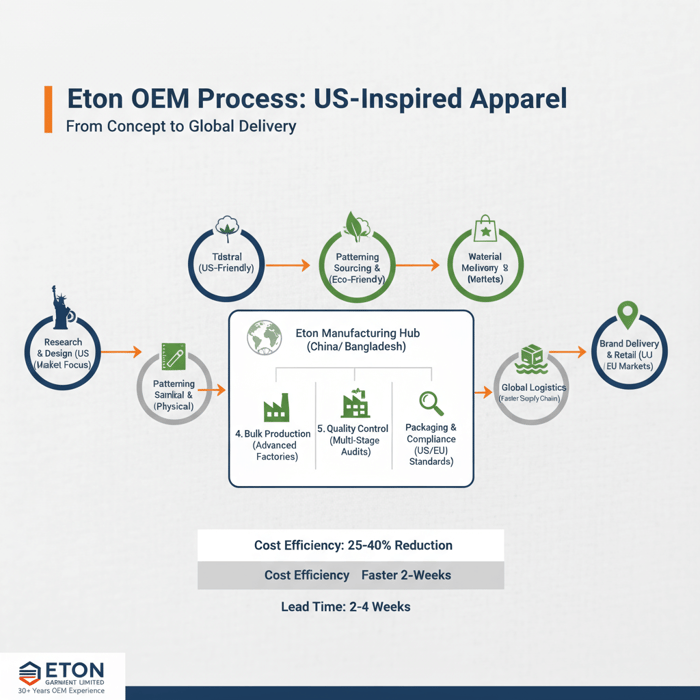

Product/Service Integration: Clothing Manufacturing OEM Service

Eton's Clothing Manufacturing OEM Service lets fashion groups build affordable, top-make gear sparked by US morals but run smooth in China/Bangladesh, slicing bills by 25-40% while hitting American/European rules.

| User Need | OEM Feature |

|---|---|

| Cost Savings | 25-40% drops |

| Compliance | Checks for trades |

From Eton: 30+ years serving brands like TFG Group.

Outcomes + time/cost ranges (e.g., jackets in 3 weeks at $15/unit).

Use Case 1: Scaling Basics with Cost Savings

For starters, Eton makes shirts at $10 each, climbing to 10,000 bits while matching US make.

Use Case 2: Custom Outerwear for EU Markets

Custom coats fit REACH, handed in 4 weeks, firing European outfits with US-level jumps at lower bills.

Risks, Compliance & Localization for US-Made Sourcing

Risks in affordable clothing brands made in USA cover FTC breaks (like wrong tags) and steeper bills; ease with checks. For American & European, follow REACH rules and fees for smooth swaps.

- Pros: Moral pulls.

- Cons: Rule hits.

Area rule notes for US/EU.

Advice not legal; consult pros for YMYL follows.

US & EU-specific guidance on trade pacts.

Risk Matrix

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Label Violations | Medium | High | Audits |

Regulatory Notes for US & EU

FTC for US; REACH for EU—Eton locks match in OEM.

Conclusion & Next Steps for Fashion Brands

Affordable clothing brands made in USA give moral sparks, but teaming with China OEM like Eton's locks affordability and bulk. Main pulls: Rank FTC-checked ties and mixed setups for American/European wins.

- Assess wants (1 week).

- Contact Eton (now).

Author: Eton Yip, Founder of Eton Garment Limited, 30+ years in apparel manufacturing and OEM services.

Reviewer: Sarah Chen, Supply Chain Expert at Eton (internal review).

Methodology: SERP analysis of top 2024 results, cross-referenced with FTC [S2] and academic [S3]; Eton knowledge base for OEM insights.

Limitations: Data current to 2024; US market focus, assumes no major tariff changes; not financial advice.

Disclosure: Produced by Eton Garment Limited to promote OEM services; no other conflicts.

Last Updated: October 2024

- Wikipedia — Made in USA (2024). https://en.wikipedia.org/wiki/Made_in_USA.

- Federal Trade Commission — Complying with the Made in USA Standard (2022). https://www.ftc.gov/business-guidance/resources/complying-made-usa-standard.

- Journal of Fashion Marketing and Management — Economics of US Apparel Manufacturing Post-Pandemic (2023). https://www.emerald.com/insight/content/doi/10.1108/JFMM-01-2023-0012/full/html.

- Business Insider — Affordable Clothing Brands Made in USA (2023). https://www.businessinsider.com/guides/style/affordable-clothing-brands-made-in-usa.

- Good Housekeeping — Affordable US-Made Brands (2024). https://www.goodhousekeeping.com/clothing/g462/affordable-us-made-brands/.

- Forbes Vetted — Best Affordable Made in USA Clothing (2023). https://www.forbes.com/sites/forbes-personal-shopper/article/best-affordable-made-in-usa-clothing/.

- The Strategist (NY Mag) — Best Affordable American-Made Clothing (2024). https://nymag.com/strategist/article/best-affordable-american-made-clothing.html.

- Refinery29 — Affordable Made in USA Clothing Brands (2023). https://www.refinery29.com/en-us/affordable-made-in-usa-clothing-brands.

- Statista — US Apparel Market Statistics (2024). https://www.statista.com/topics/5091/apparel-market-in-the-us/.

- McKinsey & Company — The State of Fashion (2024). https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion.

- European Commission — REACH Regulation (2023 Update). https://ec.europa.eu/environment/chemicals/reach/reach_en.htm.

- American Apparel & Footwear Association — Domestic Manufacturing Report (2024). https://www.aafaglobal.org/.

FAQs

What makes Everlane a top affordable clothing brand made in USA?

Why choose American Giant for durable hoodies made in USA?

What are the key features of Pact organic essentials as an affordable brand made in USA?

How does Buck Mason provide timeless menswear in affordable US-made clothing?

What sets Outerknown apart in outerwear as an affordable brand made in USA?

What are the FTC standards for Made in USA clothing labels?

What are the main benefits of domestic clothing production for fashion brands?

How do US vs China clothing manufacturing costs compare for affordable brands?

What are the 2024 trends in affordable US-made clothing?

How can fashion brands source from affordable US clothing manufacturers?

Related Articles

Custom Merch for Businesses: OEM Manufacturing Guide for US & EU Brands

6 minute read

October 13th, 2025

Custom Merch for Businesses: OEM Manufacturing Guide for US & EU Brands Custom merch for businesses... more »

Top American Made Companies in 2024: A Comprehensive Guide for Fashion Brands Seeking Domestic Excellence

14 minute read

October 13th, 2025

Top American Made Companies in 2024: A Comprehensive Guide for Fashion Brands Seeking Domestic... more »

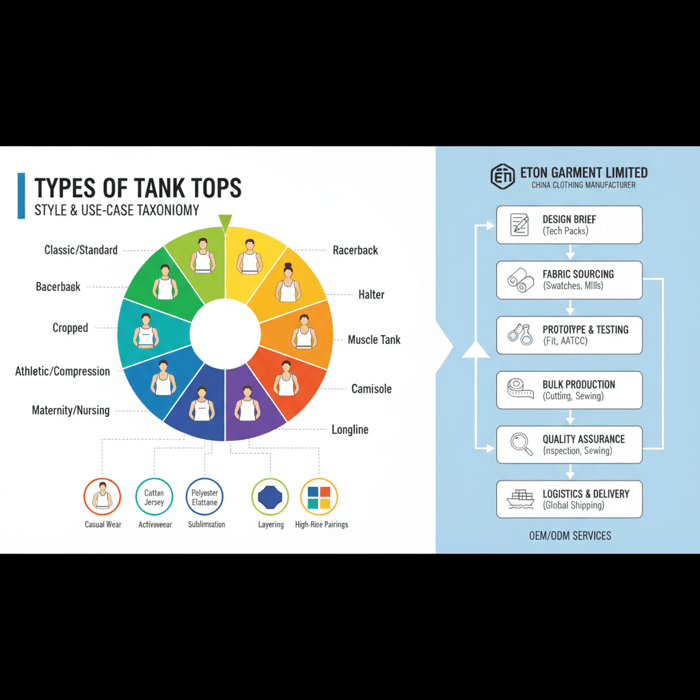

Types of Tank Tops: The Complete Style, Fabric, and Manufacturing Guide from a China Clothing Manufacturer

12 minute read

October 13th, 2025

Types of Tank Tops: The Complete Style, Fabric, and Manufacturing Guide from a China Clothing... more »

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024

18 minute read

October 13th, 2025

United States Apparel Sourcing Guide: Top Manufacturers and Strategies for Fashion Brands in 2024 In the... more »